|

|

市場調査レポート

商品コード

1360148

食品用アミノ酸の世界市場-2023年~2030年Global Food Amino Acids Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 食品用アミノ酸の世界市場-2023年~2030年 |

|

出版日: 2023年10月11日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要:

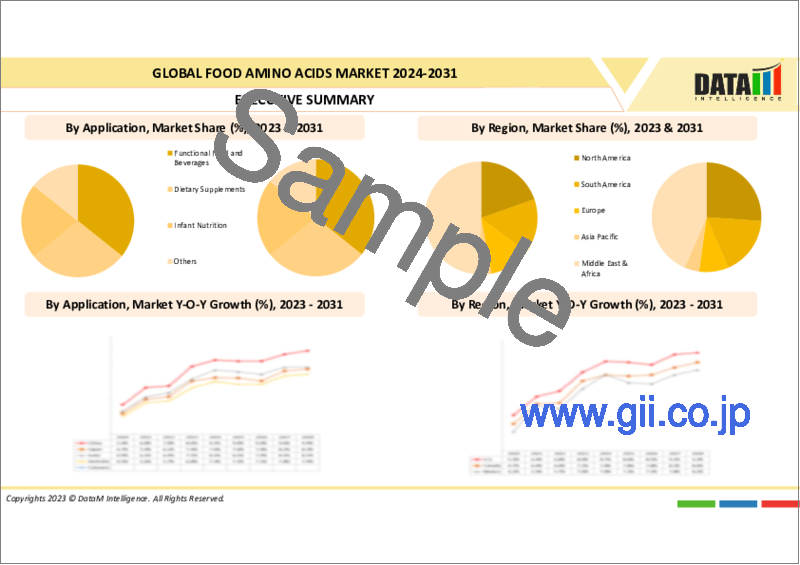

世界の食品用アミノ酸市場は2022年に65億米ドルに達し、2023-2030年の予測期間中にCAGR 7.2%で成長し、2030年には114億米ドルに達すると予測されています。

アミノ酸の健康上の利点に関する意識の高まりが、世界の食品用アミノ酸市場を後押ししています。アミノ酸はタンパク質の合成や健康全般に利用されます。消費者は、食品にクリーンラベルと天然成分を求めています。この動向はアミノ酸市場に影響を与えており、合成アミノ酸よりも天然由来のアミノ酸が好まれています。

同市場では、筋肉の回復、免疫サポート、認知機能の向上などを目的に配合された、アミノ酸を強化した機能性食品や飲食品が急増しています。分岐鎖アミノ酸のようなアミノ酸は、機能性食品・飲料分野で一般的に使用されています。新興国市場でも、発酵や酵素プロセスを利用した新製品の開拓が進んでいます。

例えば、2022年1月、米国のコカ・コーラのスポーツ飲料ブランドPoweradeは、分岐鎖アミノ酸を特徴とする便利なスポーツ飲料を発売しました。北米では、健康志向の水分補給オプションに対する需要が高まっています。この動向に対応するため、著名な飲料メーカーはアミノ酸を強化した栄養飲料などを開発し、健康飲料市場での存在感を強めています。

アジア太平洋地域は力強い経済成長と都市化を経験しており、食品に対する消費者の支出増につながっています。この成長は、同地域における食品用アミノ酸市場の拡大と活況につながっています。同地域では、消費者の健康意識が高まり、アミノ酸を強化した食品を含む機能性食品や強化食品への需要が高まるなど、健康とウェルネスへの大きなシフトが見られます。

ダイナミクス:

消費者意識の高まり

消費者の健康意識が高まるにつれて、栄養面でのメリットを提供する食品を求めるようになっています。アミノ酸はさまざまな身体機能に不可欠であり、消費者は健康維持におけるアミノ酸の重要性をより強く認識するようになっています。こうした意識は、アミノ酸を強化した食品に対する需要の高まりにつながり、市場の成長を牽引するものと思われます。

アミノ酸はタンパク質の構成要素であり、消費者は従来の動物性タンパク質に代わるものを探しています。植物性タンパク質には必須アミノ酸が含まれているため、菜食主義者の間で人気が高まり、アミノ酸を豊富に含む植物性食品市場が活性化しています。メーカーは、機能性食品や飲食品に対する消費者の需要を満たすために新製品を開発しています。この拡大の原動力となっているのは、さらなる健康上のメリットを提供する製品を積極的に求める消費者です。

例えば、2021年2月25日、ウルリック&ショートは新規のタンパク質を原料ラインナップに導入しました。このタンパク質は強化剤としての役割を果たすだけでなく、食品内で包括的なアミノ酸プロファイルを提供する上で重要な役割を果たします。「コンプレックス24」として知られるこの革新的な原料は、エンドウタンパク質と一緒に使用することで、植物性食品を含む最終製品にバランスのとれたアミノ酸組成を提供することができます。

都市化の進展

都市化が進むと食生活が変化することが多く、都市部の消費者は通常、アミノ酸を含む必須栄養素を欠いた、より簡便志向の加工食品を求めるようになります。メーカーは、都市部の人々の栄養ニーズを満たすために製品にアミノ酸を強化し、強化食品に対する需要の拡大を生み出し、食品用アミノ酸市場の成長を牽引しています。

都市部のライフスタイルは、多忙なスケジュールと、すぐに食べられて便利な食品への嗜好を特徴としています。加工食品は製造工程上、天然由来のアミノ酸含有量が低くなることが多いです。利便性と栄養の両方を求める都市部の消費者にアピールするため、食品会社は加工食品にアミノ酸を組み込んでおり、これがアミノ酸市場の成長を牽引しています。

都市部での生活は、健康意識の高まりと関連していることが多いです。都市住民の健康意識が高まるにつれて、特定の健康効果をもたらす飲食品を求めるようになります。アミノ酸は健康全般をサポートする役割が認められており、アミノ酸を強化した製品に対する需要は都市部の市場で高まる可能性が高いです。

健康志向の高まり

健康志向の消費者は、必須アミノ酸を供給する栄養密度の高い食品を求めています。アミノ酸は身体機能に不可欠であり、消費者は健康維持におけるアミノ酸の役割を認識し、アミノ酸を強化した食品やサプリメントの市場を牽引しています。体重や代謝を管理しようとする健康志向の消費者は、こうした目標をサポートするアミノ酸を含む製品に目を向け、アミノ酸市場の需要を煽っています。

健康志向の消費者は、健康に役立つ機能性食品を探しています。アミノ酸は、さまざまな食品に組み込んで栄養価を高めることができます。消費者が健康上の利点を付加した製品を求めているため、アミノ酸強化機能性食品市場は拡大しています。豆類や穀物に由来するような植物性タンパク質には必須アミノ酸が含まれており、アミノ酸市場全体に貢献しています。

生産コストの高さ

生産コストが高いため、アミノ酸強化製品が幅広い消費者層に行き渡るには限界があります。経営資源が限られた小規模企業は市場への参入に苦戦し、市場の成長を制限する可能性があります。各社は、製造コストを引き上げて、より競争力のある価格のアミノ酸強化製品を提供しています。高い製造コストは、一部のメーカーを不利な立場に追いやり、市場シェアと収益性に影響を及ぼす可能性があります。

新しいアミノ酸製剤や製品を生み出すための研究開発努力が、高い生産コストによって制約を受ける可能性があります。アミノ酸の新規用途を導入することで市場を拡大できるような技術革新も、製造コストが大きな障壁のままであれば、制限される可能性があります。高い製造コストに対応して、消費者や製造業者は、関連コストをかけずに同様の利点を提供する代替の解決策や原料を求める可能性もあります。これは代替製品との競合につながり、アミノ酸市場を制限する可能性があります。

限られた消費者の受容

消費者はアミノ酸強化食品になじみがなく、それを受け入れていないため、そうした製品に対する市場の需要は限られています。その結果、アミノ酸強化食品の市場の成長と普及が遅れる可能性があります。アミノ酸の中には、消費者に受け入れられにくい独特の味を持つものもあります。こうした官能特性は魅力的でないため、アミノ酸強化製品の消費者受容を妨げ、市場成長に影響を及ぼす可能性があります。

食生活におけるアミノ酸の利点に対する認識不足から、消費者の受容が限られています。アミノ酸強化食品の利点を消費者に伝えるには、効果的なマーケティング活動が不可欠です。消費者はアミノ酸強化製品の有効性と安全性に懐疑的であり、特にその背後にある科学については十分な情報を持っていないため、これを克服して市場での信頼を築くことは困難であり、市場成長の妨げとなります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 消費者意識の高まり

- 都市化の進展

- 健康志向の高まり

- 抑制要因

- 生産コストの高さ

- 限定的な消費者の受容

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- リジン

- グルタミン酸

- メチオニン

- トリプトファン

- その他

第8章 原料別

- 植物性

- 動物性

第9章 用途別

- 機能性食品・飲料

- 栄養補助食品

- 乳児栄養

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Ajinomoto Co. Inc.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- CJ CheilJedang Corp.

- Evonik Industries AG

- Kyowa Hakko Bio Co. Ltd.

- Angus Chemical Co.

- Kaneka Eurogentec SA

- Kemin Industries Inc.

- Molkem Chemicals Pvt. Ltd.

- Nagase and Co. Ltd.

- Novasep Holding SAS

第13章 付録

Overview:

The Global Food Amino Acids Market reached US$ 6.5 billion in 2022 and is expected to reach US$ 11.4 billion by 2030, growing with a CAGR of 7.2% during the forecast period 2023-2030.

The increasing awareness regarding the health benefits of amino acids is boosting the global food amino acids market. Amino acids are used in protein synthesis and overall well-being. Consumers are seeking clean labels and natural ingredients in their food products. This trend is influencing the amino acids market, with a preference for naturally derived amino acids over synthetic ones.

The market is witnessing a surge in functional foods and beverages fortified with amino acids which are formulated to offer muscle recovery, immune support, and improved cognitive function. Amino acids like Branched-Chain Amino Acids are commonly used in the functional food and beverage segment. Manufacturers are also developing new products using fermentation and enzymatic processes in the market.

For instance, in January 2022, Coca-Cola's Powerade sports drink brand in the United States introduced a convenient, sports beverage featuring branched-chain amino acids. The demand for health-focused hydration options is on the rise in North America. In response to this trend, prominent beverage manufacturers are developing nutrient beverages, including those enriched with amino acids, to strengthen their presence in the health beverage market.

Asia-Pacific region is experiencing robust economic growth and urbanization, leading to increased consumer spending on food products. This growth is translating into a larger and more dynamic food amino acids market in the region. The region is witnessing a significant shift toward health and wellness, with consumers becoming more health-conscious driving the demand for functional and fortified foods, including those enriched with amino acids.

Dynamics:

Growing Consumer Awareness

As consumers become increasingly health-conscious, they are seeking out food products that offer nutritional benefits. Amino acids are essential for various bodily functions, and consumers are becoming more aware of their importance in maintaining good health. This awareness is likely to lead to a higher demand for food products fortified with amino acids, driving growth in the market.

Amino acids are the building blocks of proteins, and consumers are looking for alternatives to traditional animal-based proteins. Plant-based proteins contain essential amino acids gaining popularity among vegans and boosting the market for amino acid-rich plant-based food products. Manufacturers are developing new products to meet the consumer demand for functional foods and beverages. This expansion is driven by consumers actively seeking products that offer additional health advantages.

For instance, on February 25, 2021, Ulrick & Short introduced a novel protein to its ingredient lineup. This protein not only serves as a fortifying agent but also plays a crucial role in delivering comprehensive amino acid profiles within food products. When utilized alongside pea protein, this innovative ingredient known as "complex 24" ensures that finished products, including plant-based options, offer a well-rounded amino acid composition.

Increasing Urbanization

Urbanization often leads to changes in dietary habits with urban consumers typically seeking more convenience-oriented and processed foods lacking essential nutrients, including amino acids. Manufacturers are fortifying products with amino acids to meet the nutritional needs of the urban population creating a growing demand for fortified foods and driving food amino acids market growth.

Urban lifestyles are characterized by busy schedules and a preference for ready-to-eat and convenience foods. Processed foods often contain lower levels of naturally occurring amino acids due to the manufacturing process. To appeal to urban consumers looking for both convenience and nutrition, food companies incorporate amino acids into processed foods, thus driving growth in the amino acids market.

Urban living is often associated with heightened health awareness. As urban populations become more health-conscious, they seek out foods and beverages that offer specific health benefits. Amino acids are recognized for their role in supporting overall health, and the demand for products enriched with amino acids is likely to rise in urban markets.

Rising Health Consciousness

Health-conscious consumers are seeking nutrient-dense foods that provide essential amino acids. Amino acids are critical for bodily functions, and consumers are recognizing their role in maintaining good health driving the market for food and supplements enriched with amino acids. Health-conscious consumers looking to manage their weight and metabolism turn to products containing amino acids that support these goals fueling demand for the amino acids market.

Health-conscious consumers are looking for functional foods offering health benefits. Amino acids can be incorporated into various food products to enhance their nutritional profile. The market for amino acid-fortified functional foods is expanding as consumers seek out products with added health benefits. Plant-based proteins, such as those derived from legumes and grains contain essential amino acids, contributing to the overall amino acids market.

High Cost of Production

High production costs limit the accessibility of amino acid-fortified products to a broader consumer base. Smaller companies with limited resources struggle to enter the market, leading to potentially limiting market growth. Companies offer more competitively priced amino acid-enriched products with increased production costs. High production costs put some manufacturers at a disadvantage, potentially affecting their market share and profitability.

Research and development efforts to create new amino acid formulations or products may be constrained by high production costs. Innovations that could expand the market by introducing novel amino acid applications may be limited if the cost of production remains a significant barrier. In response to high production costs, consumers and manufacturers may seek alternative solutions or ingredients that provide similar benefits without the associated cost. This can lead to competition from substitute products, potentially limiting the market for amino acids.

Limited Consumer Acceptance

Consumers are not familiar with and accepting of amino acid-fortified food products, so the market demand for such products is limited. This can result in slower growth and adoption of amino acid-fortified foods in the market. Some amino acids have distinct tastes that are not well-received by consumers. These sensory attributes are not appealing, it can hinder consumer acceptance of amino acid-enriched products, affecting their market growth.

Limited consumer acceptance from a lack of awareness of the benefits of amino acids in the diet. Effective marketing efforts are crucial to inform consumers about the advantages of amino acid-fortified foods consumers are skeptical about the efficacy and safety of amino acid-fortified products, especially since they are not well-informed about the science behind them overcoming this building trust in the market can be challenging and hinder market growth.

Segment Analysis:

The global food amino acids market is segmented based on type, source, application, and region.

Growing Consumer Preference for Plant-Based Food Amino Acids

The plant-based segment is dominating the global food amino acids market. The surge in consumer consciousness regarding health is precipitating a significant transition towards plant-based diets. There is a consistent upswing in the demand for plant-based food products enriched with amino acids, within the market. This expansion of the health and wellness product market is driven by consumers actively seeking food alternatives that are perceived as healthier.

Growing concerns about the environmental repercussions of animal agriculture, such as greenhouse gas emissions and land utilization, are steering numerous consumers towards adopting plant-based protein sources. This shift in dietary preferences is yielding a favorable impact on the market for plant-based amino acids. Manufacturers are also responding to consumer demand by developing new products.

For instance, on October 26, 2021, Ajinomoto's aminoVITAL introduced an innovative sports nutrition product. This advanced product relies on a unique blend of plant-based amino acids designed to optimize athletes' performance. aminoVITAL's specialized formulations are crafted to aid athletes in boosting their endurance, strength, and post-exercise recovery.

Geographical Penetration

Growing Population, Rising Disposable Income and Preference for Traditional Diets in Asia-Pacific

Asia-Pacific region is dominating the global food amino acids market. The region represents a significant consumer base for various food products with a growing population, including those fortified with amino acids. Consumers are willing to invest in premium food products with added nutritional benefits as disposable incomes are rising across countries in the region, further boosting the food amino acids market.

Various countries in the region have a strong culinary tradition that plant-based protein sources rich in amino acids, such as soy and legumes align with the increasing popularity of plant-based diets, contributing to the growth of the amino acids market. The region is witnessing substantial growth in food and beverage, leading to increased opportunities for incorporating amino acids into a wide range of products and driving market dominance.

COVID-19 Impact Analysis

The pandemic disrupted supply chains globally, affecting the availability of raw materials and causing logistical challenges that have led to production delays and fluctuations in the market. Lockdowns and restrictions on dining out led to a sharp decline in the demand for food service products, which are often fortified with amino acids. This demand reduction negatively impacted the market, particularly for products aimed at restaurants and catering services.

The economic downturn resulting from the pandemic has caused consumers to be more cost-conscious. This can lead to reduced spending on premium or specialty food products, including those fortified with amino acids, affecting market sales. COVID-19 has shifted consumer priorities toward essential items, such as staple foods and hygiene products. This shift may have temporarily reduced consumer interest in specialty products like amino acid-fortified foods and supplements.

However, the pandemic heightened consumer awareness of a healthy diet and a strong immune system. This increased emphasis on health and well-being drives demand for amino acid-fortified products marketed for their potential health benefits. E-commerce and online grocery shopping saw significant growth during the pandemic and potentially expanding the market growth.

Russia-Ukraine War Impact Analysis

The conflict has disrupted supply chains, particularly for key amino acid producers in the region. This has led to shortages and price fluctuations in the global market, impacting the availability of amino acids. Companies in the food industry have been exploring alternative sourcing strategies to reduce dependence on suppliers in the affected region. This has led to changes in market dynamics and supplier relationships.

Uncertainty and supply disruptions have caused significant price volatility in the food amino acids market. Buyers have had to adapt to rapidly changing prices. Some companies have diversified their amino acid sourcing by exploring suppliers from other regions, leading to a broader global market presence. Increased demand for amino acids from alternative suppliers has intensified market competition. This could lead to innovations and improvements in product quality.

By Type

- Lysine

- Glutamic Acid

- Methionine

- Tryptophan

- Others

By Source

- Plant-based

- Animal-based

By Application

- Functional Food and Beverages

- Dietary Supplements

- Infant Nutrition

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On July 18, 2022, CJ BIO, a prominent Korean amino acids provider, developed potent microbes and biostimulants as sustainable alternatives for plant protection and nutrition. These groundbreaking solutions are crafted exclusively from highly pure L-type amino acids, derived from microbial and plant-based sources.

- In October 2021, Arla Foods Ingredients introduced Lacprodan BLG-100, a pure beta-lactoglobulin (BLG) ingredient. This innovative product boasts 45% higher leucine content, the primary amino acid crucial for muscle development, compared to conventional whey protein isolates in the market.

- In July 2021, Ajinomoto launched a new amino acid supplement, backed by a clinical study and a randomized controlled trial (RCT), and aimed at reducing the risk of cognitive decline in middle-aged and older individuals who may be facing memory issues while maintaining good health.

Competitive Landscape

The major global players in the food amino acids market include: Ajinomoto Co. Inc., CJ CheilJedang Corp., Evonik Industries AG, Kyowa Hakko Bio Co. Ltd., Angus Chemical Co., Kaneka Eurogentec SA, Kemin Industries Inc., Molkem Chemicals Pvt. Ltd., Nagase and Co. Ltd., and Novasep Holding SAS.

Why Purchase the Report?

- To visualize the global food amino acids market segmentation based on type, source, application, and region, as well as understand critical commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous food amino acids market-level data points with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of critical products of all the major players.

The global food amino acids market report would provide approximately 61 tables, 59 figures and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Source

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Consumer Awareness

- 4.1.1.2. Increasing Urbanization

- 4.1.1.3. Rising Health Consciousness

- 4.1.2. Restraints

- 4.1.2.1. High Cost of Production

- 4.1.2.2. Limited Consumer Acceptance

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Lysine*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Glutamic Acid

- 7.4. Methionine

- 7.5. Tryptophan

- 7.6. Others

8. By Source

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 8.1.2. Market Attractiveness Index, By Source

- 8.2. Plant-based*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Animal-based

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Functional Food and Beverages*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Dietary Supplements

- 9.4. Infant Nutrition

- 9.5. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Ajinomoto Co. Inc.*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. CJ CheilJedang Corp.

- 12.3. Evonik Industries AG

- 12.4. Kyowa Hakko Bio Co. Ltd.

- 12.5. Angus Chemical Co.

- 12.6. Kaneka Eurogentec SA

- 12.7. Kemin Industries Inc.

- 12.8. Molkem Chemicals Pvt. Ltd.

- 12.9. Nagase and Co. Ltd.

- 12.10. Novasep Holding SAS

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us