|

|

市場調査レポート

商品コード

1360035

小売業向け人工知能の世界市場-2023年~2030年Global Artificial Intelligence In Retail Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 小売業向け人工知能の世界市場-2023年~2030年 |

|

出版日: 2023年10月11日

発行: DataM Intelligence

ページ情報: 英文 197 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

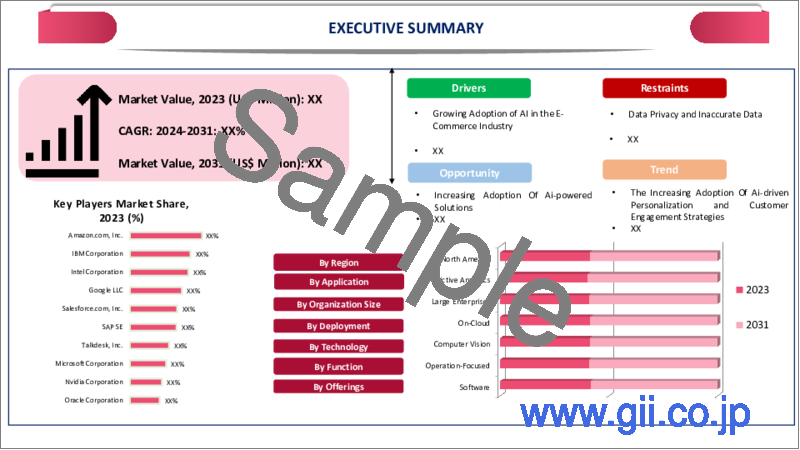

世界の小売業向け人工知能の市場は、2022年に55億米ドルに達し、2030年には554億米ドルに達すると予測され、予測期間2023-2030年のCAGRは34.2%で成長する見込みです。

AIによって小売業者は、商品の推奨、顧客サービスのためのチャットボット、バーチャル試着など、パーソナライズされたショッピング体験を提供できるようになり、顧客満足度とロイヤルティが向上します。AIを活用したシステムは、サプライチェーン管理、在庫管理、需要予測を最適化し、コスト削減と業務の効率化につながります。小売企業はAIの力を活用することで、膨大な量のデータを分析し、顧客行動、市場動向、競合情報についての考察を得ることができます。

例えば、2023年9月25日、アマゾンはAIスタートアップのAnthropicと提携し、40億米ドルを投じてジェネレーティブAIモデルを開発します。この提携は、アマゾンが特に消費者向けの機器やサービスにおいてAIに力を入れるようになったことと一致しています。当初、この提携は、アマゾンのクラウドサービスとマイクロチップを利用したAnthropicの生成的AIモデルの研究をサポートします。これらのモデルはアマゾン・ウェブ・サービスのアマゾン・ベッドロック・プラットフォームを通じて利用できるようになります。

アジア太平洋地域は、世界の小売業向け人工知能市場の3/5以上を占める成長地域の一つであり、この地域の特徴は、都市化の進展とともに人口が増加し、消費者基盤が拡大し、小売サービスに対する需要が高まっていることで、これらの需要に効率的に対応するためのAIを活用したソリューションの必要性が高まっています。この地域では、構造化・非構造化ともに膨大な量のデータが生成されます。AIはデータで成長し、アジア太平洋地域の小売業者はAIを活用して顧客の行動、嗜好、市場動向を分析し、データ主導の意思決定を行っています。

ダイナミクス

eコマース業界におけるAIの導入

AIアルゴリズムは顧客データを分析し、パーソナライズされた商品推奨やショッピング体験を提供することで、顧客満足度を高め、売上を増加させます。AIを活用したチャットボットやバーチャルアシスタントは、24時間365日のカスタマーサポートを提供し、応答時間と顧客エンゲージメントを向上させます。AIは、需要パターンを予測し、在庫過多や在庫不足の状況を減らし、在庫コストを最小限に抑えることで、小売業者の在庫最適化を支援します。

例えば、2023年7月31日、ビッグコマースはグーグル・クラウドとの提携により、同社のeコマース・プラットフォームにAIを搭載した新機能を発表しました。これらのAIツールは、企業の加盟店が業務効率を改善し、顧客体験を向上させ、売上を伸ばすのに役立ちます。主なAI機能には、AIを活用した商品説明、高度にパーソナライズされたストアフロント、ビジネスパフォーマンスをより深く洞察するためのAI主導のデータ分析などがあります。

顧客体験を向上させるAI搭載チャットボットの利用増加が市場を牽引

チャットボットは、顧客からの問い合わせに迅速かつ即座に対応することで、待ち時間を短縮し、全体的な顧客体験を向上させることができます。また、大量の顧客からの問い合わせを同時に処理することができるため、顧客とのインタラクション率が高い企業にとって拡張性があります。チャットボットは、すべての顧客に一貫した応答と情報を提供し、誰もが同じレベルのサービスを受けられるようにします。高度なチャットボットは、顧客データを使用して対話をパーソナライズし、カスタマイズされた推奨事項やソリューションを提供することができます。

例えば、2023年7月12日、スキーとスポーツ用品ブランドのEvoは、ホリデーシーズンに合わせてChatGPTを搭載した顧客サービスチャットボットを開始する予定であり、このAI駆動チャットボットは、軽いタッチの顧客サービス問い合わせを処理することができ、ブランドの繁忙期の冬の間にエージェントを追加雇用する必要性を減らすことができるかもしれません。Evoは通常、この時期にカスタマーサービス従業員を倍増させています。

AI活用型コラボレーションによる小売体験の変革

コラボレーションにより、小売企業は自社のデータとAI企業のデータ分析に関する専門知識を組み合わせることができるようになります。AIを活用した小売業とのコラボレーションは、高度にパーソナライズされたショッピング体験の創造を促進します。小売企業はAI企業と提携することで、個々の顧客プロファイルや過去のやり取りに基づいて商品を提案するレコメンデーション・エンジンを開発することができます。

例えば、ユニリーバは2022年4月6日、小売マーケティング・プラットフォームのPerchと提携し、ワシントンDC地域のジャイアント・フード・スーパーマーケットでインタラクティブな店舗内商品エンゲージメント・プラットフォームを開始しました。このプラットフォームは、QRコードや追加アプリ、画面タッチを必要とせず、買い物客の商品とのインタラクションに自動的に反応し、それらの商品に関するビデオや情報を提供するデジタル画面を備えています。

データプライバシーと不正確なデータ

AIは、パーソナライゼーションと洞察のために膨大な顧客データに依存しています。しかし、データ・プライバシーや、小売業者が機密性の高い顧客情報をどのように扱い、保護するかについての懸念が高まっています。GDPRなどのデータ保護規制の遵守は不可欠ですが、課題も多いです。インフラ、ソフトウェア、スタッフのトレーニングを含むAIテクノロジーの導入は、小売企業、特に中小企業にとって高額になる可能性があります。AIの導入に必要な初期投資が障壁となる可能性があります。

AIシステムは高品質なデータに依存します。不正確なデータや不完全なデータは、誤った予測や推奨につながる可能性があります。また、小売組織内のさまざまなソースからのデータを統合することも複雑な場合があります。AIの開発・保守には、熟練したデータサイエンティスト、機械学習エンジニア、AIの専門家が必要であり、AIの専門知識を持つ専門家が不足しているため、小売企業がAIチームを構築・管理するのは困難です。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- eコマース業界におけるAIの採用

- 顧客体験を向上させるAI搭載チャットボットの利用増加が市場を牽引

- AI活用型コラボレーションによる小売体験の変革

- 抑制要因

- データプライバシーと不正確なデータ

- 影響分析

- 促進要因

第5章 業界分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 提供別

- サービス

- ソリューション

第8章 機能別

- オペレーション中心

- 顧客志向

第9章 展開タイプ別

- クラウド

- オンプレミス

第10章 用途別

- 予測分析

- 店舗内映像監視・モニタリング

- 顧客関係管理

- 市場予測

- その他

第11章 技術別

- コンピュータビジョン

- 機械学習

- 自然言語処理

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Amazon.com, Inc.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- IBM Corporation

- Intel Corporation

- Google LLC

- Salesforce.com, Inc.

- SAP SE

- Talkdesk, Inc.

- Microsoft Corporation

- Nvidia Corporation

- Oracle Corporation

第15章 付録

Overview:

Global Artificial Intelligence In Retail Market reached US$ 5.5 billion in 2022 and is expected to reach US$ 55.4 billion by 2030, growing with a CAGR of 34.2% during the forecast period 2023-2030.

AI enables retailers to offer personalized shopping experiences, including product recommendations, chatbots for customer service and virtual try-ons and this enhances customer satisfaction and loyalty. AI-powered systems can optimize supply chain management, inventory control and demand forecasting, which leads to cost savings and more efficient operations. Retailers can harness the power of AI to analyze huge volumes of data, gaining insights into customer behavior, market trends and competitive intelligence.

For instance, on 25 September 2023, Amazon is partnering with AI startup Anthropic in a $4 billion investment to develop generative AI models. This partnership aligns with Amazon's growing focus on AI, particularly in its consumer-facing devices and services. Initially, the collaboration will support Anthropic's work on generative AI models using Amazon's cloud services and microchips. These models will be available through Amazon Web Services' Amazon Bedrock platform.

Asia-Pacific is among the growing regions in the global artificial intelligence in retail market covering more than 3/5th of the market and the region is characterized by a large and growing population, along with increasing urbanization and this results in a higher consumer base and greater demand for retail services, driving the need for AI-powered solutions to meet these demands efficiently. The region generates vast amounts of data, both structured and unstructured. AI thrives on data and retailers in Asia-Pacific leverage AI to analyze customer behavior, preferences and market trends to make data-driven decisions.

Dynamics:

Adoption of AI in E-Commerce Industry

AI algorithms analyze customer data to provide personalized product recommendations and shopping experiences and this enhances customer satisfaction and increases sales. Chatbots and virtual assistants powered by AI provide 24/7 customer support, improving response times and customer engagement. AI helps retailers optimize their inventory by predicting demand patterns, reducing overstock and understock situations and minimizing carrying costs.

For instance, on 31 July 2023, BigCommerce launched new AI-powered features on its e-commerce platform, due to its partnership with Google Cloud and these AI tools will help enterprise merchants improve operational efficiency, enhance customer experiences and boost sales. Some of the key AI features include AI-powered product descriptions, highly personalized storefronts and AI-driven data analytics to gain deeper insights into business performance.

Increasing Use of AI-Powered ChatBots that Improve Customer Experience Drives the Market

Chatbots can provide quick and instant responses to customer queries, reducing wait times and improving the overall customer experience and they can handle a large volume of customer inquiries simultaneously, making them scalable for businesses with high customer interaction rates. Chatbots provide consistent responses and information to all customers, ensuring that everyone receives the same level of service. Advanced chatbots can use customer data to personalize interactions, providing tailored recommendations and solutions.

For instance, on 12 July 2023 Ski and sporting goods brand Evo plans to launch a customer service chatbot, powered by ChatGPT, in time for the holiday season and this AI-driven chatbot can handle light-touch customer service inquiries and may reduce the brand's need to hire additional agents during the busy winter season. Evo typically doubles its customer service employees during this period.

AI-Powered Collaborations Revolutionize Retail Experiences

Collaborations allow retailers to combine their data with AI companies' expertise in data analysis and this enables retailers to gain deeper insights into customer behavior, preferences and trends, leading to more informed business decisions. AI-driven retail collaborations facilitate the creation of highly personalized shopping experiences. Retailers can partner with AI companies to develop recommendation engines that suggest products based on individual customer profiles and past interactions.

For instance, on 6 April 2022, Unilever partnered with Perch, a retail marketing platform, to launch an interactive in-store product engagement platform at Giant Food supermarkets in the Washington DC area and this platform features digital screens that automatically respond to shoppers' interactions with products by providing videos and information about those products, all without the need for QR codes, additional apps or screen touching.

Data Privacy and Inaccurate Data

AI relies on huge volumes of customer data for personalization and insights. However, there are growing concerns about data privacy and how retailers handle and protect sensitive customer information. Compliance with data protection regulations, such as GDPR, is essential but challenging. Implementing AI technologies, including infrastructure, software and staff training, can be expensive for retailers, especially smaller businesses. The initial investment required for AI adoption can be a barrier.

AI systems depend on high-quality data. Inaccurate or incomplete data can lead to erroneous predictions and recommendations. Integrating data from various sources within a retail organization can also be complex. AI requires skilled data scientists, machine learning engineers and AI specialists to develop and maintain systems and there is a shortage of professionals with AI expertise, making it challenging for retailers to build and manage AI teams.

Segment Analysis:

The global artificial intelligence in retail market is segmented based on offerings, function, deployment type, application, technology and region.

Services Provided to Customers Boost the Market

AI enables retailers to analyze huge volumes of customer data to create personalized shopping experiences and this personalization includes product recommendations, targeted marketing and customized promotions, all of which enhance the overall shopping experience and drive sales. AI helps retailers optimize inventory levels by predicting demand, reducing overstock and understock situations and improving supply chain efficiency, this leads to cost savings and ensures that products are available when customers want them.

For instance, on 10 November 2022, Amazon introduced Sparrow, an intelligent robotic system designed to enhance the fulfillment process by handling individual products before they are packaged. Over the past decade, Amazon has invested heavily in robotics and advanced technology to automate various aspects of its operations. Sparrow represents a critical advancement in the handling of individual products within Amazon's vast inventory.

Geographical Penetration:

Personalized Recommendation Enhance Customer Engagement Boosts the Market

North America is dominating the global artificial intelligence in retail market and retailers in the region are increasingly using AI to improve the customer shopping experience. AI-powered chatbots, virtual shopping assistants and personalized recommendations enhance customer engagement and satisfaction. North American consumers expect personalized experiences and AI helps retailers analyze vast amounts of customer data to provide tailored product recommendations, marketing messages and pricing strategies.

For instance, on 16 August 2023, a survey conducted by Honeywell revealed that around 60% of retailers plan to adopt artificial intelligence, machine learning and computer vision technologies in the next year to enhance the shopping experience, both in physical stores and online. The survey involved 1,000 retail directors globally and found that 48% of respondents believe AI, ML and Computer Vision(CV) will have a significant impact on the retail industry in the next three to five years.

Competitive Landscape

The major global players in the market include: Amazon.com, Inc., IBM Corporation, Intel Corporation, Google LLC, Salesforce.com, Inc., SAP SE, Talkdesk, Inc., Microsoft Corporation, Nvidia Corporation and Oracle Corporation.

COVID-19 Impact Analysis

Lockdowns and social distancing measures in place, there was a surge in online shopping. Retailers turned to AI-powered recommendation engines, chatbots and virtual shopping assistants to enhance the online shopping experience and manage increased website traffic. COVID-19 disrupted supply chains globally. AI-powered predictive analytics became crucial for retailers to predict and manage supply chain disruptions, optimize inventory levels and ensure products were available when and where customers needed them.

The pandemic caused fluctuations in demand and supply. AI was used to adjust pricing strategies in real-time, helping retailers avoid overstocking and maintain profitability. Retailers implemented AI-driven technologies like self-checkout kiosks and touchless payment options to minimize physical contact between customers and store employees. The unpredictable nature of the pandemic made demand forecasting more challenging. AI models were adapted to account for sudden shifts in consumer behavior and preferences.

AI analytics helped retailers understand changing customer behaviors during the pandemic and this information was used to tailor marketing campaigns, optimize product offerings and enhance customer engagement. AI-powered solutions, such as thermal imaging cameras and facial recognition systems, were deployed to enforce health and safety protocols in stores and distribution centers.

AI Impact

AI-powered recommendation systems analyze customer data to provide personalized product recommendations and this enhances the shopping experience and increases the likelihood of customers making purchases. AI algorithms can optimize inventory levels by predicting demand, reducing overstock and stockouts and this results in cost savings and improved customer satisfaction.

Retailers use AI-driven chatbots and virtual assistants to provide real-time customer support, answer queries and assist with product searches and this reduces the workload on human customer service agents. AI can analyze market conditions, competitor pricing and customer behavior to adjust product prices in real-time for maximum profitability. Also, AI-powered video analytics and image recognition systems boost the market.

For instance, on 13 September 2023, According to Amazon, amazon leveraged generative artificial intelligence to enhance the product listing creation and management process for sellers and these AI capabilities simplified the process of creating product titles, descriptions and listing details, making it faster and easier for sellers to create and enrich their product listings and this approach streamlines the listing creation process, reduces the need for manual data entry and ensures that customers receive more comprehensive, consistent and engaging product information.

Russia- Ukraine War Impact

The conflict has disrupted supply chain management, especially in the technology sector. Many AI-related components, such as semiconductors and hardware, are manufactured in various parts of the world. Disruptions in the supply chain can lead to shortages or increased costs for AI technology, impacting its adoption in retail. Geopolitical conflicts can contribute to economic uncertainty, which affects consumer behavior. Retailers may become more cautious in their investments, including AI initiatives, during uncertain times.

The ripple effects of geopolitical tensions can impact the global economy, leading to fluctuations in currency exchange rates, trade restrictions and changes in consumer spending patterns and these factors can influence the pace and scale of AI adoption in retail. Retailers rely on AI for customer data analysis, personalization and cybersecurity. Geopolitical tensions can lead to increased concerns about data security and privacy, prompting retailers to reassess their AI strategies and data handling practices.

By Offerings

- Services

- Solutions

By Function

- Operation-Focused

- Customer-Facing

By Deployment Type

- Cloud

- On-Premise

By Technology

- Computer Vision

- Machine Learning

- Natural Language Processing

- Others

By Application

- Predictive Analytics

- In-Store Visual Monitoring & Surveillance

- Customer Relationship Management

- Market Forecasting

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In October 2021, AT&T and H2O.ai collaborated together that resulted in the development of an AI feature store that allows the organization and recycle data and machine learning engineering skills. Data scientists and developers employ the same features that AI features used for storage and distribution when creating AI models.

- In January 2023, EY introduced the EY Retail Intelligence solution which leveraging the Microsoft Cloud and Cloud for Retail, that leads to enhance consumers' shopping experiences. As the retail landscape undergoes digital transformation, traditional retailers face challenges such as consumers searching for the best prices across various channels.

- In November 2022, Fractal, a global provider of AI and advanced analytics solutions, launched Asper.ai, an interconnected AI solution designed for consumer goods, manufacturing and retail. Asper.ai aims to address the fragmentation within the AI ecosystem in these sectors by offering an end-to-end AI product that unifies demand planning, inventory optimization, strategic pricing and promotion

Why Purchase the Report?

- To visualize the global artificial intelligence in retail market segmentation based on offerings, function, deployment type, application, technology and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of artificial intelligence in retail market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

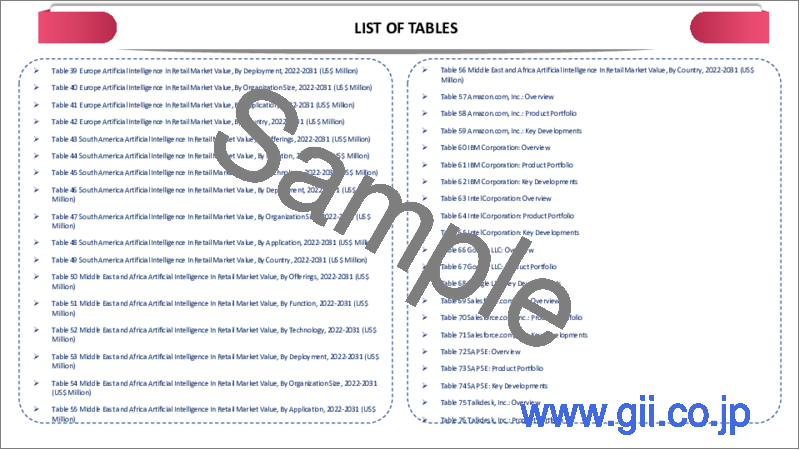

The global artificial intelligence in retail market report would provide approximately 77 tables, 77 figures and 197 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Offerings

- 3.2. Snippet by Function

- 3.3. Snippet By Deployment Type

- 3.4. Snippet by Application

- 3.5. Snippet by Technology

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Adoption of AI in E-Commerce Industry

- 4.1.1.2. Increasing Use of AI-Powered ChatBots that Improve Customer Experience Drives the Market

- 4.1.1.3. AI-Powered Collaborations Revolutionize Retail Experiences

- 4.1.2. Restraints

- 4.1.2.1. Data Privacy and Inaccurate Data

- 4.1.3. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Offerings

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offerings

- 7.1.2. Market Attractiveness Index, By Offerings

- 7.2. Services *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Solutions

8. By Function

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 8.1.2. Market Attractiveness Index, By Function

- 8.2. Operation-Focused*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Customer-Facing

9. By Deployment Type

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 9.1.2. Market Attractiveness Index, By Deployment Type

- 9.2. Cloud*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. On-Premise

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Predictive Analytics*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. In-Store Visual Monitoring & Surveillance

- 10.4. Customer Relationship Management

- 10.5. Market Forecasting

- 10.6. Others

11. By Technology

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.1.2. Market Attractiveness Index, By Technology

- 11.2. Computer Vision*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Machine Learning

- 11.4. Natural Language Processing

- 11.5. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offerings

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offerings

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Russia

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offerings

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offerings

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offerings

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. Amazon.com, Inc.*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. IBM Corporation

- 14.3. Intel Corporation

- 14.4. Google LLC

- 14.5. Salesforce.com, Inc.

- 14.6. SAP SE

- 14.7. Talkdesk, Inc.

- 14.8. Microsoft Corporation

- 14.9. Nvidia Corporation

- 14.10. Oracle Corporation

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us