|

|

市場調査レポート

商品コード

1336713

料理油の世界市場-2023年~2030年Global Cooking Oil Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 料理油の世界市場-2023年~2030年 |

|

出版日: 2023年08月22日

発行: DataM Intelligence

ページ情報: 英文 165 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

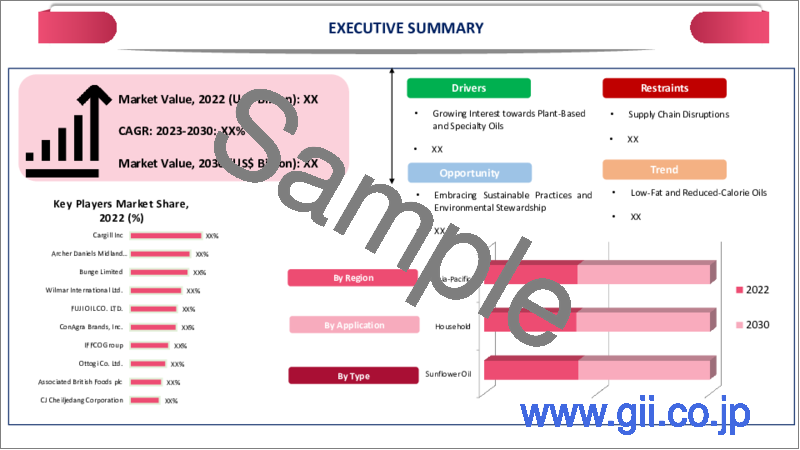

世界の料理油市場は、2022年に1,822億米ドルに達し、2023-2030年の予測期間中にCAGR 5.5%で成長し、2030年には2,796億米ドルに達すると予測されています。消費者の健康意識の高まりと、コーン油のような健康的な食用油への嗜好の高まりが、世界の料理油市場の成長を牽引しています。

人々は持続可能性に注目し、オーガニック、植物性、植物由来の料理油に嗜好を移しています。より健康的な料理油への需要が高まっています。植物性食品や菜食主義者の増加により、有機・非遺伝子組み換え料理油の需要が高まっています。料理油の品質に関する消費者の意識の高まりは、料理油セクターにおけるトレーサビリティと透明性に対する需要を高めています。

主要企業による様々な新しい買収や製品の発売は、料理油市場の範囲を拡大しています。都市化の進展は生活水準を向上させ、オリーブオイルのような高級料理油の需要を増加させ、市場の需要を高めています。メーカー各社は様々なフレーバーを市場に投入しており、その結果、フレーバーオイルやインフューズドオイルの人気が高まっています。例えば、2022年3月、EBRDとBungeはトルコで有機オリーブオイルを開発するために提携しました。

市場力学

料理油の強化が世界の料理油市場の成長を促進します。

人々の健康意識が高まり、より健康的な料理油の需要が増加しています。顧客の需要を満たすため、メーカーは料理油の強化に取り組んでおり、市場成長を牽引しています。料理油のビタミンや微量栄養素の強化は、新興国市場で順調に発展しています。ビタミンAやビタミンDのような脂溶性ビタミンは、栄養価を向上させるために料理油の強化に最も一般的に使用されています。

政府も料理油の栄養強化に乗り出しています。例えば、2021年にインド食品安全基準局(FSSAI)は、料理油にビタミンAとビタミンDを強化することを義務付ける草案を発表しました。FSSAIによると、料理油を強化することで、ビタミンAとビタミンDの推奨食事摂取量の25~30%を満たすことができます。

加工食品需要の増加が市場成長を牽引。

加工食品に対する需要の増加は、世界の料理油市場の成長にプラスの影響を与えています。多忙なライフスタイルと調理時間の短縮が、加工食品の需要を高めています。加工食品の最も重要な原材料の一つであるパーム油などの料理油の需要も急速に増加しています。このような需要の増加により、主要企業は市場での役割を維持するために様々な戦略を練っています。

主要企業間の様々な買収や提携は、業界で強力な発展を確立するために料理油の市場を牽引しています。例えば、2021年5月に米国の食品企業であるカーギルと米国のスマートオイル管理メーカーであるフロントライン・インターナショナルが提携しました。この提携により、彼らは油の濾過・廃棄・自動化を監視するNew Kitchen Controller油管理システムを立ち上げました。

料理油の過剰消費に関する健康問題が市場成長を抑制します。

油の過剰摂取は不健康なLDLコレステロールを増加させ、健康なHDLコレステロールを減少させる可能性があります。菜種油のような一部の油には有毒な脂肪酸が多く含まれている可能性があります。そのため、摂取量が多いと健康に悪影響を及ぼす可能性があります。大豆油の多量摂取は消化器系に影響を与える可能性があります。心臓発作、糖尿病、高血圧などの健康問題は、大豆油の大量消費によって引き起こされやすく、市場の成長を抑制します。

油の不純物は、料理油の成長を妨げる大きな要因のひとつです。人気のある高価な油と安価な油との不純物が増加しています。これは健康に大きな脅威をもたらす可能性があります。例えば2021年3月、フォーチュン・ブランドの不純大豆油が政府によって押収されました。汚染、不適切な保管、不純物は料理油市場の成長を妨げます。

COVID-19影響分析

COVID-19分析には、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格力学(COVID前シナリオと比較したパンデミック中およびパンデミック後の価格変動を含む)、需給スペクトラム(取引制限、封鎖、およびその後の問題による需給の変化)、政府の取り組み(政府機関による市場、セクター、産業を活性化させる取り組み)、メーカーの戦略的取り組み(COVID問題を緩和するためにメーカーが行ったことをここで取り上げる)が含まれます。

目次

第1章 調査手法と調査範囲

第2章 市場の定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場への影響要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 タイプ別

- 大豆油

- ひまわり油

- ピーナッツ油

- パーム油

- キャノーラ/菜種油

- コーン油

- ココナツ油

- その他

第8章 用途別

- 家庭用

- フードサービス店舗

- 食品加工

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- Cargill Inc.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Archer Daniels Midland Company

- Bunge Limited

- Wilmar International Ltd.

- FUJI OIL CO. LTD.

- ConAgra Brands, Inc.

- IFFCO Group

- Ottogi Co. Ltd.

- Associated British Foods plc

- CJ Cheiljedang Corporation

第12章 付録

Market Overview

Global Cooking Oil Market reached US$ 182.2 billion in 2022 and is expected to reach US$ 279.6 billion by 2030 growing with a CAGR of 5.5% during the forecast period 2023-2030. The increasing consumer health consciousness and rising preference for healthy edible oils such as corn oil are driving the global cooking oils market growth.

People are focussing on sustainability and shifting their preference towards organic, vegetable and plant-based cooking oils. There is an emerging demand for healthier cooking oils. A number of plant-based and vegan diets increased the demand for organic and non-GMO cooking oils. The rising consumer awareness regarding the quality of cooking oils is increasing the demand for traceability and transparency in the cooking oil sector.

The various new acquisitions and product launches by the key market players are increasing the scope of the cooking oil market. The growing urbanization improved living standards and increased the demand for premium quality cooking oils like olive oil, raising the market demand. The manufacturers are introducing various flavors resulting in the rising popularity of flavored and infused oils in the market. For instance, in March 2022, EBRD and Bunge partnered to develop organic olive oil in Turkey.

Market Dynamics

The Fortification of Cooking Oil Drives the Global Cooking Oil Market Growth.

There is an increased health consciousness among people leading to increased demand for healthier cooking oil. To meet the demand of the customers, the manufacturers are going for fortification of cooking oil, driving the market growth. Fortification of cooking oil with vitamins and micronutrients is developing well in the market. The fat-soluble vitamins such as vitamin A and vitamin D are most commonly used in the fortification of cooking oil to improve their nutritional value.

The government is also initiating cooking oil fortification. For instance, in 2021, the Food Safety and Standards Authority of India issued a draft for mandatory fortification of cooking oil with vitamins A and D. According to the FSSAI, fortified oil can help a person to meet 25-30% of the recommended dietary intake for vitamins A and D. Within the Food Fortification Initiative, 27 countries have already ordered oil fortification.

The Increasing Demand for Processed Food Drives the Market Growth.

The increased demand for processed food options has a positive influence on the growth of the global cooking oil market. The busy lifestyle and less cooking time are increasing the processed food demand. Being one of the most essential ingredients of processed food, the demand for cooking oil, such as palm oil, is also rising rapidly. This increased demand is making the key market players develop various strategies to maintain their role in the market.

The various acquisitions and partnerships among the critical players in the market are driving the market of cooking oil to establish powerful developments in the industry. For instance, the partnership between Cargill, an American food corporation, and Frontline International, a US-based smart oil management manufacturer, in May 2021. Through this collaboration, they launched a New Kitchen Controller oil management system, to monitor oil filtration, disposal, and automation.

The Health Issues Related to Excess Consumption of Cooking Oil Restrains Market Growth.

Excessive consumption of oil can increase unhealthy LDL cholesterol and decrease healthy HDL cholesterol. Some of the oil, such as rapeseed oil, may contain higher levels of toxic fatty acids. Thus, higher consumption may have negative health effects. The high consumption of soy oil can affect the digestive system. Health problems such as heart attack, diabetes, and hypertension can easily get attacked due to higher consumption of this oil, restraining the market growth.

Oil adulteration is one major hindering factor to the growth of cooking oil. The adulteration of popular and expensive oil with cheaper oil is increasing. This can cause a major threat to health. For instance, in March 2021, the adulterated soybean oil of Fortune brand was seized by the government. The contamination, improper storage, and adulteration hamper the cooking oil market growth.

COVID-19 Impact Analysis

The COVID-19 Analysis includes Pre-COVID Scenario, COVID Scenario and Post-COVID Scenario along with Pricing Dynamics (Including pricing change during and post-pandemic comparing it with pre-COVID scenarios), Demand-Supply Spectrum (Shift in demand and supply owing to trading restrictions, lockdown, and subsequent issues), Government Initiatives (Initiatives to revive market, sector or Industry by Government Bodies) and Manufacturers Strategic Initiatives (What manufacturers did to mitigate the COVID issues will be covered here).

Segment Analysis

The global cooking oil market is segmented based on type, application, and region.

In the Global Cooking Oil Market, the Household Segment Holds the Largest Market Share.

The global cooking oil market has been segmented by application into household, food service outlets, and food processing. The household segment held the largest cooking oil market share of 38.8% in 2022 in the cooking oil market analysis report. The increased use of cooking oil such as sunflower and coconut oils in the household sector is driving the expansion of the market in this segment.

The increased health concerns about outside food motivated people to cook food at home, driving the demand for the household segment of the market. Furthermore, the app development by key players in the market to improve customer convenience boost the market growth. For instance, in May 2021, Fortune Brand developed a mobile application to order their oil online to deliver at home.

Geographical Analysis

Asia-Pacific Region Held The Largest Share Of Cooking Oil Market.

The global cooking oil market is segmented into five parts based on geography: North America, South America, Europe, Asia-Pacific, the Middle East, and Africa. The Asia-Pacific cooking oil market held the largest market share of 38.6% in 2022 in the cooking oil market analysis. The growing health consciousness among people and increasing demand for healthy cooking oils is driving the market in this region.

The high production of cooking oils in this region with a high consumption rate is driving the growth. The launch of various fortified cooking oils with improved healthy benefits is expanding this region's market size. Urbanization, changing dietary patterns, and increased demand for processed foods are expected to boost market growth. The increased developments in distribution channels and e-commerce application fuel the market expansion.

Competitive Landscape

The major global players in the market include: Cargill Inc., Archer Daniels Midland Company, Bunge Limited, Wilmar International Ltd., FUJI OIL CO. LTD., ConAgra Brands, Inc., IFFCO Group, Ottogi Co. Ltd., Associated British Foods plc, and C J Cheiljedang Corporation.

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

COVID-19 Impact:

The unprecedented COVID-19 pandemic in 2020 moderately affected the cooking oil market. The shutdown of food service sectors, such as hotels and restaurants, decreased the cooking oil demand. On the other hand, the increased household segment of cooking oil increased the demand for cooking oil. The increased retail, and online purchasing of processed food and household cooking oil segment resulted in the growth of market sales.

Why Purchase the Report?

- To visualize the global cooking oil market segmentation based on type, application, and region and understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of cooking oil market-level with all segments.

- The PDF report includes a comprehensive market analysis after exhaustive qualitative interviews and an in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The Global Cooking Oil Market report would provide approximately 5O tables, 53 figures and 165 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Market Definition and Overview

3. Executive Summary

- 3.1. Market Snippet, by Type

- 3.2. Markey Snippet, by Application

- 3.3. Market Snippet, by Region

4. Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.2. Restraints

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Soy Oil

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Sunflower Oil

- 7.4. Peanut Oil

- 7.5. Palm Oil

- 7.6. Canola/Rapeseed Oil

- 7.7. Corn Oil

- 7.8. Coconut Oil

- 7.9. Others

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Household

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Food Services Outlets

- 8.4. Food Processing

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. U.K.

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Spain

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. Cargill Inc.

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Key Developments

- 11.2. Archer Daniels Midland Company

- 11.3. Bunge Limited

- 11.4. Wilmar International Ltd.

- 11.5. FUJI OIL CO. LTD.

- 11.6. ConAgra Brands, Inc.

- 11.7. IFFCO Group

- 11.8. Ottogi Co. Ltd.

- 11.9. Associated British Foods plc

- 11.10. CJ Cheiljedang Corporation

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us