|

|

市場調査レポート

商品コード

1319202

アロマ成分の世界市場-2023年~2030年Global Aroma Ingredients Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アロマ成分の世界市場-2023年~2030年 |

|

出版日: 2023年07月31日

発行: DataM Intelligence

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

アロマ成分の世界市場は、2022年に44億米ドルに達し、2030年には61億米ドルに達すると予測され、予測期間2023-2030年のCAGRは4.3%で成長する見込みです。消費者はフレグランス製品に透明性とクリーンな表示を求めるようになっています。例えば、コティのような大手フレグランス・ブランドは、製品に詳細な成分表を提供し始め、透明性へのコミットメントを強調し、消費者の懸念に対応しています。

アロマ成分市場は、様々な用途に使用される幅広い香料化合物や香気成分を包含する盛んな産業です。天然成分と合成成分の両方が含まれ、多様な消費者の嗜好に対応しています。市場を牽引しているのは、アロマセラピーやウェルネス製品に対する需要の高まり、飲食品業界における香料、香水におけるアロマ成分の重要性といった要因です。

アロマ成分市場の主な促進要因の1つは、天然で持続可能な香りの選択肢を求める消費者の需要の高まりです。例えば、多くの消費者は再生可能な資源に由来する植物由来のアロマ成分を使用した製品を積極的に求めています。ザ・ボディショップ(The Body Shop)のような企業は、クルーエルティフリー、ヴィーガン、持続可能な天然成分配合のフレグランス製品を提供することで、この動向を活用しています。

市場力学

アロマセラピーと天然香料がアロマ成分市場の成長を牽引

アロマセラピーと天然香料の人気の高まりにより、アロマ成分市場のシェアは大きく伸びています。アロマセラピーは、エッセンシャルオイルやその他の天然香料化合物を利用して、リラクゼーションを促進し、ストレスを緩和し、全体的な幸福感を向上させるホリスティックな手法として、絶大な支持を得ています。

消費者は、ラベンダー、ユーカリ、柑橘系オイルなどのアロマ成分を求め、個人空間に落ち着きと若返りの雰囲気を作り出しています。このようなアロマセラピーへの関心の高まりが、芳香剤への旺盛な需要を生み出し、芳香剤市場の拡大に寄与しています。

香水と合成香料がアロマ成分市場の成長を後押し

アロマ成分市場の動向は、香水、特に合成香料の分野における香料化合物の需要によっても後押しされています。香水、コロン、その他のパーソナルケア製品に魅惑的で長持ちする香りを作り出すために、香水メーカーは天然香料と合成香料の両方の多様なアロマ成分を利用しています。

合成香料は、費用対効果、一貫性、幅広い香りの選択肢といった利点があり、メーカーから高い人気を得ています。新しい合成香料化合物の継続的な技術革新と開拓は、ユニークで魅力的な香りを求める消費者の嗜好の進化に対応するため、アロマ成分市場の成長に拍車をかけています。

厳しい規制と天然成分の限られた入手可能性がアロマ成分市場規模に影響

アロマ成分市場は、アロマケミカル特有の課題を含むいくつかの抑制要因に直面しており、これが市場全体の成長と市場規模に影響を与えています。重要な阻害要因の1つは、消費者の安全性や環境への影響に関する懸念から、芳香族化学品に厳しい規制が課されていることです。これらの規制を遵守するには、広範な試験と文書化が必要となり、メーカーのコスト増につながり、製品イノベーションを制限する可能性があります。

さらに、天然芳香成分の入手可能性と信頼性が限られているため、市場における芳香成分の多様性と多様性に影響を及ぼす可能性があります。この制約は、原料価格の変動とともに、アロマ成分の市場シェアにさらに影響を与える可能性があります。さらに、アロマ成分の市場規模は、消費者の嗜好や動向に対する敏感さ、メーカー間の激しい競合、経済的な不安定さによって影響を受け、フレグランス製品などの非必需品に対する消費者の支出が減少する可能性があります。

COVID-19影響分析

COVID-19分析には、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格力学(COVID前シナリオと比較したパンデミック中およびパンデミック後の価格変動を含む)、需給スペクトラム(取引制限、封鎖、およびその後の問題による需給の変化)、政府の取り組み(政府機関による市場、セクター、産業を活性化させる取り組み)、メーカーの戦略的取り組み(COVID問題を緩和するためにメーカーが行ったことをここで取り上げる)が含まれます。

目次

第1章 調査手法と調査範囲

第2章 市場の定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場への影響要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 用途別

- 化粧品

- ファインフレグランス

- ホームケア製品

- 食品産業

第8章 タイプ別

- 天然成分

- 合成成分

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- BASF SE

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- International Flavors & Fragrances Inc.

- Robertet SA

- Takasago International Corporation

- Yingyang Aroma Chemical Group

- Firmenich SA

- Symrise

- Bel Flavors & Fragrances

- Kao Corporation

- Givaudan

第12章 付録

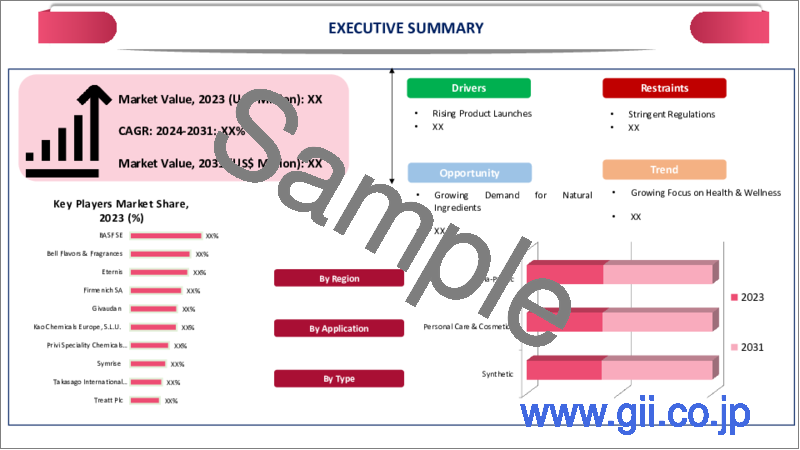

Market Overview

The Global Aroma Ingredients Market reached US$ 4.4 billion in 2022 and is expected to reach US$ 6.1 billion by 2030 and is expected to grow with a CAGR of 4.3% during the forecast period 2023-2030. Consumers are increasingly demanding transparency and clean labeling in fragrance products. For instance, major fragrance brands like Coty have started providing detailed ingredient lists on their products, highlighting their commitment to transparency and addressing consumer concerns.

The aroma ingredients market is a thriving industry encompassing a wide range of fragrance compounds and odorants used in various applications. It includes both natural and synthetic ingredients, catering to diverse consumer preferences. The market is driven by factors such as the growing demand for aromatherapy and wellness products, flavoring agents in the food and beverage industry, and the significance of aroma ingredients in perfumery.

One key driver of the aroma ingredients market is the rising consumer demand for natural and sustainable fragrance options. For instance, many consumers are actively seeking out products that use plant-based aroma ingredients derived from renewable sources. Companies like The Body Shop have capitalized on this trend by offering fragrance products that are cruelty-free, vegan, and formulated with sustainably sourced natural ingredients.

Market Dynamics

Aromatherapy and Natural Odorants Drive Growth in the Aroma Ingredients Market

The aroma ingredients market share is experiencing significant growth due to the increasing popularity of aromatherapy and the use of natural odorants. Aromatherapy has gained immense traction as a holistic practice that utilizes essential oils and other natural fragrance compounds to promote relaxation, alleviate stress, and improve overall well-being.

Consumers are seeking out aroma ingredients, such as lavender, eucalyptus, and citrus oils, to create a calming and rejuvenating atmosphere in their personal spaces. This growing interest in aromatherapy has created a robust demand for odorants, contributing to the expansion of the aroma ingredients market.

Perfumery and Synthetic Fragrances Fuel the Growth of the Aroma Ingredients Market

The aroma ingredients market trend is also being propelled by the demand for fragrance compounds in perfumery, particularly in the realm of synthetic fragrances. Perfumers rely on a diverse range of aroma ingredients, both natural and synthetic, to create captivating and long-lasting scents for perfumes, colognes, and other personal care products.

Synthetic fragrances offer advantages such as cost-effectiveness, consistency, and a broad range of fragrance options, making them highly sought-after by manufacturers. The continuous innovation and development of new synthetic fragrance compounds have spurred the growth of the aroma ingredients market, as they cater to the evolving preferences of consumers for unique and enticing scents.

Stringent Regulations and Limited Availability of Natural Ingredients Impact Aroma Ingredients Market Size

The aroma ingredients market faces several restraints, including challenges specific to aromatic chemicals, which impact its overall growth and size. One significant restraint is the stringent regulations imposed on aromatic chemicals due to concerns related to consumer safety and environmental impact. Compliance with these regulations requires extensive testing and documentation, leading to increased costs for manufacturers and potentially limiting product innovation.

Additionally, the limited availability and reliability of natural aromatic ingredients can affect the variety and diversity of aroma ingredients in the market. This constraint, along with the volatility of raw material prices, can further impact the aroma ingredients market share. Moreover, the aroma ingredients market size is influenced by the sensitivity to consumer preferences and trends, intense competition among manufacturers, and economic instability, which may reduce consumer spending on non-essential items such as fragrance products.

COVID-19 Impact Analysis

The COVID-19 Analysis includes Pre-COVID Scenario, COVID Scenario, and Post-COVID Scenario along with Pricing Dynamics (Including pricing change during and post-pandemic comparing it to pre-COVID scenarios), Demand-Supply Spectrum (Shift in demand and supply owing to trading restrictions, lockdown, and subsequent issues), Government Initiatives (Initiatives to revive market, sector or Industry by Government Bodies) and Manufacturers Strategic Initiatives (What manufacturers did to mitigate the COVID issues will be covered here).

Segment Analysis

The global aroma ingredients market has been segmented by application, type, and region.

Growing Consumer Preference Drives Natural Ingredients Segment to Prominent Position in Aroma Ingredients Market

The natural ingredients segment within the aroma ingredients market holds a significant position, driven by the growing consumer preference for natural and sustainable products. The demand for natural extracts aroma ingredients has witnessed a steady rise, with an approximate market share of around 45-50%. This segment comprises ingredients derived from botanical sources, including plants, flowers, fruits, and herbs.

The increasing awareness regarding the potential health benefits and environmentally friendly nature of natural ingredients has propelled their popularity among consumers. Additionally, the natural ingredients segment has experienced growth due to the expansion of the wellness industry and the incorporation of natural fragrances in various products such as personal care items, home fragrances, and spa treatments.

Geographical Analysis

Growing Demand for Natural Extracts Drives the Aroma Ingredients Market in the Asia Pacific Region

By region, the global aroma ingredients market is segmented into North America, South America, Europe, Asia-Pacific, Middle-east, and Africa.

The Asia-Pacific region is witnessing significant growth in the aroma ingredients market, fuelled by the rising demand for natural extracts. With an approximate market share of 40-45%, natural extracts play a crucial role in the region's fragrance industry. Consumers in countries like India, China, and Japan have a strong preference for natural and organic products, leading to a surge in the demand for aroma ingredients derived from botanical sources.

The market growth is driven by the increasing awareness about the benefits of natural extracts, such as their perceived health benefits, eco-friendliness, and unique aromatic profiles. Additionally, the expansion of the personal care and cosmetics industry in the region further contributes to the demand for natural aroma ingredients. These ingredients find application in a wide range of products, including perfumes, skincare, haircare, and home fragrances.

Furthermore, the Asia-Pacific region is witnessing a trend towards sustainable and clean-label products, leading to higher adoption of natural aroma ingredients. Consumers are increasingly seeking transparency in fragrance labeling and are drawn toward products that align with their values of environmental consciousness and ethical sourcing.

Competitive Landscape

The major global players in the market include: BASF SE, International Flavors & Fragrances Inc., Robertet SA, Takasago International Corporation, Yingyang Aroma Chemical Group, Firmenich SA, Symrise, Bel Flavors & Fragrances, Kao Corporation, and Givaudan.

Why Purchase the Report?

- To visualize the global aroma ingredients market segmentation based on application, type, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of aroma ingredients market-level with all segments.

- The PDF report consists of a cogently put-together market analysis after exhaustive qualitative interviews and an in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global aroma ingredients market report would provide approximately 53 tables, 47 figures, and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Market Definition and Overview

3. Executive Summary

- 3.1. Market Snippet, by Application

- 3.2. Market Snippet, by Type

- 3.3. Market Snippet, by Region

4. Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.2. Restraints

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19 on the Market

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturer's Strategic Initiatives

- 6.6. Conclusion

7. By Application

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 7.1.2. Market Attractiveness Index, By Application

- 7.2. Cosmetics*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Fine Fragrances

- 7.4. Home Care Products

- 7.5. Food Industry

8. By Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 8.1.2. Market Attractiveness Index, By Type

- 8.2. Natural Ingredients *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Synthetic Ingredients

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America*

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. The U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. The U.K.

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Spain

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. BASF SE*

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Key Developments

- 11.2. International Flavors & Fragrances Inc.

- 11.3. Robertet SA

- 11.4. Takasago International Corporation

- 11.5. Yingyang Aroma Chemical Group

- 11.6. Firmenich SA

- 11.7. Symrise

- 11.8. Bel Flavors & Fragrances

- 11.9. Kao Corporation

- 11.10. Givaudan

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us