|

|

市場調査レポート

商品コード

1319173

植物性アイスクリームの世界市場-2023年~2030年Global Plant-Based Ice Cream Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 植物性アイスクリームの世界市場-2023年~2030年 |

|

出版日: 2023年07月31日

発行: DataM Intelligence

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

世界の植物性アイスクリーム市場は、2022年に28億米ドルに達し、2030年には53億米ドルに達し、予測期間2023-2030年のCAGRは8.4%で成長すると予測されます。予測期間中、世界の植物性アイスクリーム市場の需要は、健康的な摂取に対する消費者の意識の高まりにより増加すると予測されます。

植物性アイスクリーム市場は、乳糖不耐症者の増加と菜食主義者の増加により、今後数年間で有利な成長見通しと機会を示すと予測されます。これら2つの主要な側面は、特に新興国において、植物性アイスクリーム市場の世界のダイナミックな開拓につながる可能性が高いです。また、世界の植物性アイスクリーム市場を基盤とする企業へのベンチャー投資も増加しています。

さらに、植物・タンパク質代替メーカーや新興経済諸国による研究開発や新製品発売の増加が、有利な植物性アイスクリーム市場の機会を生み出すと予想されます。2022年、アイスクリーム、フローズンヨーグルト、シャーベットを製造する米国企業Ben &Jerry'sは、2種類の植物性アイスクリームフレーバー"チョコレートミルク&クッキー"と"ダートケーキ"を発売しました。

市場力学

ビーガン人口の増加がベーカリー製品市場の成長を牽引すると推定されます

消費者はますますビーガンライフスタイルを受け入れ、乳製品や他の従来のタンパク質源の健康的な代替品を選ぶようになっており、最終的に業界における植物性食品の需要を増加させています。例えば、Veganzによると、2020年には、ドイツでは人口の3.6%が菜食主義者となります。植物性アイスクリームに含まれるさまざまな天然素材と、健康上の利点に関する意識の高まりが、予測期間中の植物性アイスクリーム市場の成長に大きく貢献しました。

ミレニアル世代は、この世界の動物性食品離れの中心的推進者であり、植物性食を正常化し、消費者の需要をリードしています。有名人からアスリート、グーグルなどの企業全体、そして国々に至るまで、誰もが植物性食品をより多く食べることを推進しています。これらの食品は、その健康と環境への利点により、世界中で絶大な支持を得ています。

植物ベースの製品に関連する健康上の利点が市場成長を牽引しています

顧客は、全体的な健康状態の改善、体重管理、より持続可能な食生活への欲求など、さまざまな理由から植物ベースの食事をより多く食べるようになったと主張しています。インターネットやソーシャルメディアの普及が進んでいることは、植物性製品を摂取することの様々な利点について人々を教育する上で非常に重要です。大手企業はこれらのプラットフォームを利用して、最大限の聴衆にリーチし、植物性食品市場の売上を伸ばしています。

大手企業は、革新的な製品を発売して顧客を惹きつけ、市場の成長機会を拡大しています。新たなフレーバーや製品は顧客を惹きつけています。例えば、2022年には乳製品不使用アイスクリームのチョコレートチップクッキードーフレーバーがLittle Red Rooster Ice Cream CompanyのブランドNadaMooから発売されました。

植物性アイスクリームの高コストが市場成長を抑制

植物性アイスクリームは従来のものと比べて配合が複雑なため、加工コストが高くなり、市場成長の妨げとなっています。アイスクリームから乳製品を取り除くと、同様の味と食感を出すために代替原料が必要になるため、食品表示が複雑になります。これは植物性アイスクリームの売上にとって潜在的な脅威となることが予想されます。

豆乳、アーモンドミルク、カシューミルク、ココナッツミルクなどの植物性ミルクは、乳製品ミルクに比べてコストが高いです。さらに、このミルクの抽出コストは動物性ミルクよりも高いです。このミルクは、主にフィットネス志向の消費者やビーガンの消費者に消費されています。したがって、植物性ミルクの高価格がヴィーガン・アイスクリームのコストを引き上げており、そのため中産階級の消費者は植物性アイスクリームにお金をかけられない可能性があり、これが世界市場の成長を抑制しています。

COVID-19影響分析

COVID-19分析には、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格力学(COVID前シナリオと比較したパンデミック中およびパンデミック後の価格変動を含む)、需給スペクトラム(取引制限、封鎖、およびその後の問題による需給の変化)、政府の取り組み(政府機関による市場、セクター、産業を活性化させる取り組み)、メーカーの戦略的取り組み(COVID問題を緩和するためにメーカーが行ったことをここで取り上げる)が含まれます。

目次

第1章 調査手法と調査範囲

第2章 市場の定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場への影響要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 形態別

- シングル

- ブレンド

第8章 供給源別

- 豆乳

- アーモンドミルク

- ココナッツミルク

- カシューミルク

- オーツ麦ミルク

- ライスミルク

第9章 フレーバー別

- チョコレート

- バニラ

- ストロベリー

- マンゴー

- その他

第10章 製品タイプ別

- カップ

- スティック

- コーン

- バー

- その他

第11章 流通チャネル別

- スーパーマーケットおよびハイパーマーケット

- コンビニエンスストア

- 専門店

- オンラインストア

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- The Hain Celestial Group

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Creamy Coconuts LLC

- Bliss Unlimited

- Ben and Jerry's

- White Wave Foods Company

- Kleins Ice Cream

- Wink Frozen Desserts

- Booja-Booja

- Unilever

- Cado

第15章 付録

Market Overview

Global Plant-Based Ice Cream Market reached US$ 2.8 billion in 2022 and is expected to reach US$ 5.3 billion by 2030 and grow with a CAGR of 8.4% during the forecast period 2023-2030. Over the projection period, global plant-based ice cream market demand is anticipated to increase due to rising consumer awareness of healthy intakes.

The plant-based ice cream market is anticipated to witness lucrative growth prospects and opportunities in the upcoming years, due to the growing number of lactose-intolerant individuals and increasing rates of veganism. These two major aspects will likely lead to the dynamic development of the plant-based ice cream market globally, particularly in developed nations. There are also rising venture investments in global plant-based ice cream market-based companies.

In addition, the increasing number of research and development and new product launches by plant and protein alternative manufacturers and emerging economies are expected to create lucrative plant-based ice cream market opportunities. In 2022, Ben & Jerry's, an American company that manufactures ice cream, frozen yogurt, and sorbet, launched two plant-based ice cream flavors: "Chocolate Milk and Cookies" and "Dirt Cake."

Market Dynamics

The Growing Vegan Population is Estimated to Drive the Bakery Products Market Growth.

Consumers are increasingly embracing the vegan lifestyle and opting for healthy substitutes for dairy, and other conventional protein sources, which ultimately increases the demand for plant-based food in the industry. For instance, in 2020, according to Veganz, 3.6% of the population is vegan in Germany. Various natural ingredients in plant-based ice cream with growing awareness regarding health benefits contributed significantly to plant-based ice cream market growth over the forecast period.

Millennials are central drivers of this worldwide shift away from consuming animal products - normalising plant-based eating and leading consumer demand. Everyone from celebrities to athletes to entire companies, including Google, and countries are promoting eating more plant-based foods. These food products are gaining immense traction worldwide due to their health and environmental benefits.

Health Advantages Associated with Plant-Based Products are Driving the Market Growth.

Customers claim to eat more plant-based meals for various reasons, including improved overall health, weight management, and a desire to eat more sustainably. The rising internet and social media penetration are critical in educating people about the various benefits of consuming plant-based products. Leading players use these platforms to reach maximum audiences and increase plant-based food market sales.

Major players are launching innovative products to attract customers and increase their market growth opportunities. The emerging new flavors and products are attracting customers. For instance, in 2022, the dairy-free ice cream chocolate chip cookie dough flavor was introduced by Little Red Rooster Ice Cream Company's brand NadaMoo.

High Cost of Plant-Based Ice Cream Restrains the Market Growth.

Complicated formulation of plant-based ice creams compared to conventional counterparts results in high processing charges, hindering the market growth. Removing dairy from ice creams complicates its food label as more, substitute ingredients are required to produce similar taste and texture. This is expected to represent a potential threat to sales of plant-based ice creams.

Plant-based milk such as soy, almond, cashew, and coconut milk is costly compared to dairy milk. Moreover, the extraction cost of this milk is higher than animal milk. The milk is consumed mainly by fitness-conscious and vegan consumers. Thus, the high price of plant-based milk is raising the cost of vegan ice cream, due to which middle-class consumers may not be able to spend n plant-based ice creams, which restrains the growth of the global market.

COVID-19 Impact Analysis

The COVID-19 Analysis includes Pre-COVID Scenario, COVID Scenario and Post-COVID Scenario along with Pricing Dynamics (Including pricing change during and post-pandemic comparing it with pre-COVID scenarios), Demand-Supply Spectrum (Shift in demand and supply owing to trading restrictions, lockdown, and subsequent issues), Government Initiatives (Initiatives to revive market, sector or Industry by Government Bodies) and Manufacturers Strategic Initiatives (What manufacturers did to mitigate the COVID issues will be covered here).

Segment Analysis

The global plant-based ice creams market is segmented based on form, source, flavor, product type, distribution channel, and region.

In the Global Plant-Based Ice Cream Market, the Coconut Milk Segment Holds the Largest Market Share.

The global plant-based ice cream market has been segmented by source into soy, almond, coconut, cashew, oats, and rice milk. In the plant-based ice cream market analysis report, the coconut milk segment held the largest plant-based ice cream market share of 38.8% in 2022. The growth of the target segment is attributed to the increasing demand for healthy plant-based ice creams.

Coconut milk contains low fat. a neutral base taste that can impart the flavour of ice cream. It provides several health benefits such as helping with weight loss, preventing cardiac diseases and strengthening the immune system. Thus fitness-conscious consumers prefer coconut milk ice cream, which significantly contributes to the growth of the plant-based ice cream market.

Geographical Analysis

The Asia-Pacific Region Held the Largest Share of the Plant-Based Ice Cream Market.

The global plant-based ice cream market is segmented into five parts based on geography: North America, South America, Europe, Asia-Pacific, the Middle East, and Africa. The Asia-Pacific plant-based ice cream market held the largest market share of 38.6% in 2022 in the plant-based ice cream market analysis. The increase in health awareness among most people is attributed to the plant-based ice cream market growth in this region.

Consumer preferences shifting from dairy-based plant-based ice cream to non-dairy-based plant-based ice cream products in this region are driving the market. Furthermore, product development, a high level of disposable income, and the presence of various plant-based ice cream flavors will accelerate the market's growth rate in this region. In 2021, Oatly, a Swedish food company announced introducing a vegan ice cream bar line in different flavors.

Competitive Landscape

The major global players in the market include: The Hain Celestial Group, Creamy Coconuts LLC, Bliss Unlimited, Ben and Jerry's, White Wave Foods Company, Kleins Ice Cream, Wink Frozen Desserts, Booja-Booja, Unilever, and Coda.

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

COVID-19 Impact:

The unprecedented COVID-19 pandemic in 2020 profoundly affected the frozen dessert industry. COVID-19 has considerably impacted the global frozen dessert supply chain phases involving plant-based ice cream production, processing, distribution, and consumption due to lockdowns and restrictions imposed by various governments.

Everything has changed due to the COVID-19 epidemic. It has influenced practically every industry, whether positively or negatively. The COVID-19 pandemic's effects on world economic conditions have had an influence. They could impact interest rates, foreign exchange rates, commodities and energy prices, and the efficient operation of financial and capital markets.

The COVID-19 pandemic issue has had an impact on the food industries as well. The COVID-19 pandemic is upending life, and the food sector is seeing an increase in trends like plant-based ice creams. The food businesses are launching innovative programs, including plant-based ice creams, which are readily available and straightforward to consume.

Why Purchase the Report?

- To visualize the global plant-based ice cream market segmentation based on form, source, flavor, product type, distribution channel, and region and understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of plant-based ice cream market-level with all segments.

- The PDF report includes a comprehensive market analysis after exhaustive qualitative interviews and an in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

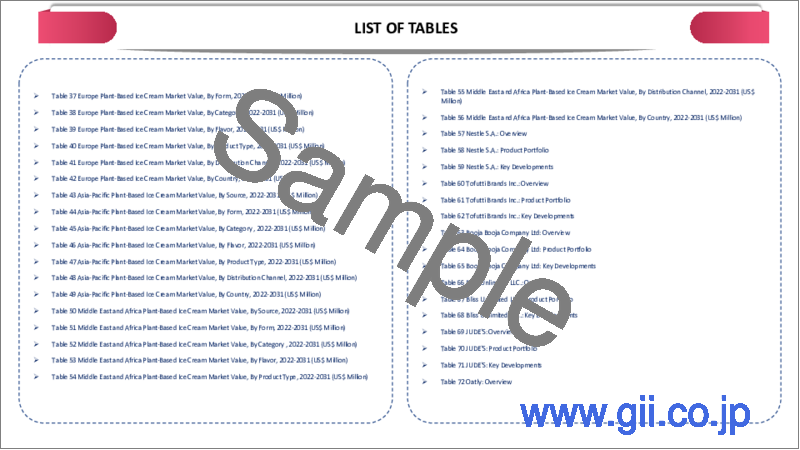

The Global Plant-Based Ice Cream Market report would provide approximately 70 tables, 77 figures and 195 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Market Definition and Overview

3. Executive Summary

- 3.1. Market Snippet, by Form

- 3.2. Market Snippet, by Source

- 3.3. Market Snippet, by Flavor

- 3.4. Market Snippet, by Product Type

- 3.5. Market Snippet, by Distribution Channel

- 3.6. Market Snippet, by Region

4. Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.2. Restraints

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19 on the Market

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Form

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 7.1.2. Market Attractiveness Index, By Form

- 7.2. Singles

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Blends

8. By Source

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 8.1.2. Market Attractiveness Index, By Source

- 8.2. Soy Milk

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Almond Milk

- 8.4. Coconut Milk

- 8.5. Cashew Milk

- 8.6. Oats Milk

- 8.7. Rice Milk

9. By Flavor

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavor

- 9.1.2. Market Attractiveness Index, By Flavor

- 9.2. Chocolate

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Vanilla

- 9.4. Strawberry

- 9.5. Mango

- 9.6. Others

10. By Product Type

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.1.2. Market Attractiveness Index, By Product Type

- 10.2. Cups

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Sticks

- 10.4. Cones

- 10.5. Bars

- 10.6. Others

11. By Distribution Channel

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.1.2. Market Attractiveness Index, By Distribution Channel

- 11.2. Supermarkets and Hypermarkets

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Convenience Stores

- 11.4. Specialty Stores

- 11.5. Online Stores

- 11.6. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavor

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. The U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavor

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. The U.K.

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Spain

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavor

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavor

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavor

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. The Hain Celestial Group

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Creamy Coconuts LLC

- 14.3. Bliss Unlimited

- 14.4. Ben and Jerry's

- 14.5. White Wave Foods Company

- 14.6. Kleins Ice Cream

- 14.7. Wink Frozen Desserts

- 14.8. Booja-Booja

- 14.9. Unilever

- 14.10. Cado

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us