|

|

市場調査レポート

商品コード

1439696

医療美容機器 - 世界市場の考察、競合情勢、市場予測(2030年)Medical Aesthetic Devices - Market Insights, Competitive Landscape, and Market Forecast - 2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 医療美容機器 - 世界市場の考察、競合情勢、市場予測(2030年) |

|

出版日: 2024年02月01日

発行: DelveInsight

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

世界の医療美容機器の市場規模は、2023年に135億3,326万米ドル、2030年までに258億843万米ドルに達し、2024年~2030年の予測期間にCAGRで11.46%の成長が見込まれます。市場の拡大は主に、老年人口の急激な増加とさまざまな美容手技の採用の増加によるものです。加えて、美しい外見に対する意識の高まりや、世界中で行われているさまざまな美容手技が市場を押し上げる可能性が高いです。また、あまり複雑でない低侵襲または非侵襲性の美容手技への選好の変化や、人々の肥満の増加、製品分野における技術の進歩などが、予測期間(2024年~2030年)にこれらの機器の市場を押し上げると見込まれる主な要因です。

医療美容機器の市場力学

医療美容機器市場は、世界の老年人口の増加により、かなりの成長が見込まれます。これは、特に目の周り、頬、顎などの顔の皮膚の緩み、荒れた皮膚や乾燥した皮膚などが、通常、人が年を取ると現れる一般的な現象であるためです。また、多くの調査で、美容整形が50歳以上の人々に受け入れられつつあることがわかっています。例えば、International Society of Aesthetic Plastic Surgeryが発表した2019年の統計によると、51歳~64歳の高齢者にボツリヌストキシンによる美容整形手術が行われた割合は全世界で約25.2%、65歳以上の高齢者に行われた割合は全世界で約6%でした。このように、老年人口の増加は、今後数年間における世界の医療美容機器の潜在的な促進要因となります。例えば、世界保健機関(WHO)が発表した2022年のデータによると、2019年に世界中で約10億人が60歳以上の高齢者でした。また、2030年までに14億人、2050年までに21億人に増加すると予測されています。

さらに、ターゲット人口に対応するためにさまざまな美容機器を積極的に製造している、新しく革新的な製品を開発し発売する主要企業による活動の高まりは、今後数年間の医療美容機器市場の成長につながる可能性が高いです。例えば、2022年7月20日、エネルギーベースの医療美容ソリューションのグローバルリーダーであるSisram Medical CompanyのAlmaは、Alma Hybrid(TM)のFDA認可を取得しました。Alma Hybrid(TM)は、皮膚リサーフェシング用のアブレーション10,600nm(CO2)レーザーと非アブレーション1,570nmレーザーを含む初のレーザープラットフォームです。この新しいプラットフォームは、それぞれのクラス最高のレーザーを単独で利用し、両方の波長を組み合わせて治療パターンをカスタマイズする包括的なソリューションを医師に提供します。

このように、前述の要因はすべて、調査期間の医療美容機器市場の成長に総体的に寄与しました。

しかし、これらの機器に加えて手技にもかかる高いコストや、医療美容手技に関連する臨床リスクと合併症、さまざまな国における償還政策の欠如は、世界の医療美容機器市場の抑制要因です。

さらに、COVID-19パンデミックは、感染の伝播を抑制するために世界中で選択手術がキャンセルされたり拒否されたりしたことにより、医療美容機器市場を低迷させています。例えば、2023年に発表された世界保健機関(WHO)の「パルス調査」によると、3分の2の国が選択的手術の中断を報告しており、パンデミックが長期化するにつれてその影響は累積しています。また、American Society of Plastic Surgeonsが2023年に発表したデータによると、2020年に、鼻の整形、豊胸などの美容整形手術の総数が15%減少しています。しかし、世界中で多くのCOVID-19ワクチンが承認され投与されているため、パンデミック後の市場は平常を取り戻すと予測されています。

当レポートでは、世界の医療美容機器市場について調査分析し、市場規模と予測、促進要因と課題、企業と製品のプロファイルなどを提供しています。

目次

第1章 医療美容機器市場レポートのイントロダクション

第2章 医療美容機器市場のエグゼクティブサマリー

- 調査範囲

- 市場の概要

- 競合の評価

第3章 規制分析

- 米国

- 欧州

- 日本

- 中国

第4章 医療美容機器市場の主な要因の分析

- 医療美容機器市場の促進要因

- 老年人口の増加

- 世界中での美容整形手術の件数の増加

- 非侵襲性および低侵襲性の美容整形手術に対する選好の高まり

- 製品セグメントにおける技術の進歩

- 医療美容機器市場の抑制要因と課題

- これらの機器に加え手技にもかかる高いコスト、臨床上のリスクと合併症

- 適切な償還の欠如

- 医療美容機器市場の機会

- 在宅医療の動向を活用し在宅機器を市場に投入

- 低中所得国におけるメディカルツーリズムの増加が医療美容機器市場に機会をもたらす可能性がある

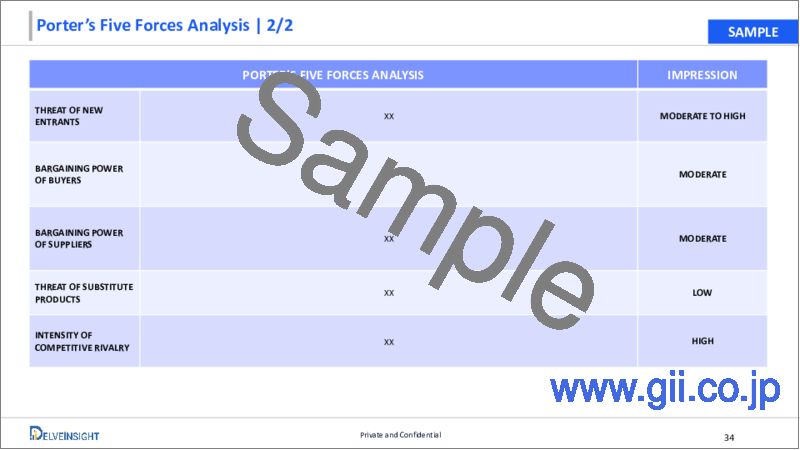

第5章 医療美容機器のポーターのファイブフォース分析

第6章 医療美容機器市場に対するCOVID-19の影響分析

第7章 医療美容機器市場のレイアウト

- 製品タイプ別

- エネルギーベース美容機器

- 非エネルギーベース美容機器

- 用途別

- スキンリサーフェシング、タイトニング

- ボディコントゥアリング、セルライト除去

- 脱毛

- フェイシャルエステ手技

- 豊胸

- その他

- エンドユーザー別

- 病院

- 皮膚科クリニック

- 地域別

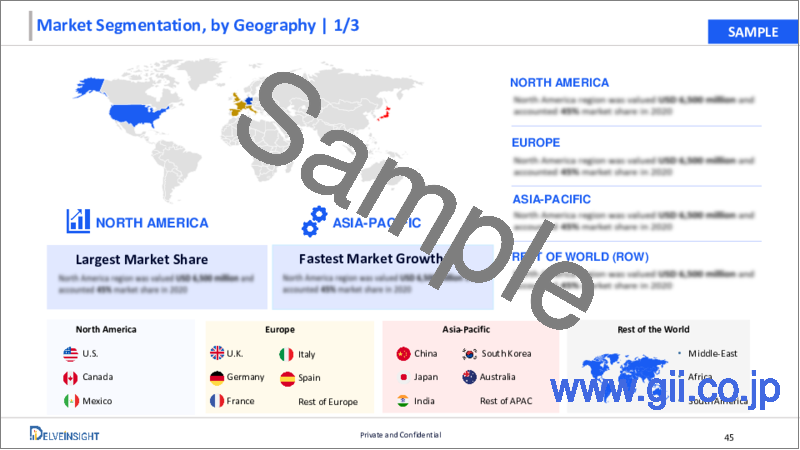

- 北米

- 欧州

- アジア太平洋

- その他の地域

第8章 医療美容機器:世界の企業シェア分析 - 主要3~5社

第9章 医療美容機器の企業と製品のプロファイル

- Johnson & Johnson

- HansBioMed.

- AbbVie Inc.

- Sebbin

- Sientra, Inc.

- POLYTECH Health & Aesthetics GmbH

- Suneva Medical

- Hanson Medical Inc.

- SurgiSil

- Surgiform Technologies LLC

- Alma Lasers

- Candela Medical.

- Lumenis.

- Cutera.

- Sciton Inc

- Merz Pharma GmbH & Co.KGaA

- Bausch Health Companies Inc.

- Venus Concept.

- Cynosure Inc.

- TRIA BEAUTY

- GALDERMA

第10章 KOLの見解

第11章 プロジェクトのアプローチ

第12章 DelveInsightについて

第13章 免責事項とお問い合わせ

List of Tables

- Table 1: Competitive Analysis

- Table 2: COVID-19 Impact Analysis on Medical Aesthetic Devices Market

- Table 3: Medical Aesthetic Devices Market Analysis in Global (2021-2030)

- Table 4: Medical Aesthetic Devices Market Analysis in Global by Product Type (2021-2030)

- Table 5: Medical Aesthetic Devices Market Analysis in Global by Application (2021-2030)

- Table 6: Medical Aesthetic Devices Market Analysis in Global by End User (2021-2030)

- Table 7: Medical Aesthetic Devices Market Analysis in Global by Geography (2021-2030)

- Table 8: Medical Aesthetic Devices Market Analysis in North America (2021-2030)

- Table 9: Medical Aesthetic Devices Market Analysis in North America by Country (2021-2030)

- Table 10: Medical Aesthetic Devices Market Analysis in the US (2021-2030)

- Table 11: Medical Aesthetic Devices Market Analysis in Canada (2021-2030)

- Table 12: Medical Aesthetic Devices Market Analysis in Mexico (2021-2030)

- Table 13: Medical Aesthetic Devices Market Analysis in Europe (2021-2030)

- Table 14: Medical Aesthetic Devices Market Analysis in Europe by Country (2021-2030)

- Table 15: Medical Aesthetic Devices Market Analysis in France (2021-2030)

- Table 16: Medical Aesthetic Devices Market Analysis in Germany (2021-2030)

- Table 17: Medical Aesthetic Devices Market Analysis in the UK (2021-2030)

- Table 18: Medical Aesthetic Devices Market Analysis in Italy (2021-2030)

- Table 19: Medical Aesthetic Devices Market Analysis in Spain (2021-2030)

- Table 20: Medical Aesthetic Devices Market Analysis in Russia (2021-2030)

- Table 21: Medical Aesthetic Devices Market Analysis in Rest of Europe (2021-2030)

- Table 22: Medical Aesthetic Devices Market Analysis in Asia-Pacific (2021-2030)

- Table 23: Medical Aesthetic Devices Market Analysis in Asia-Pacific by Country (2021-2030)

- Table 24: Medical Aesthetic Devices Market Analysis in China (2021-2030)

- Table 25: Medical Aesthetic Devices Market Analysis in Japan (2021-2030)

- Table 26: Medical Aesthetic Devices Market Analysis in India (2021-2030)

- Table 27: Medical Aesthetic Devices Market Analysis in Australia (2021-2030)

- Table 28: Medical Aesthetic Devices Market Analysis in South Korea (2021-2030)

- Table 29: Medical Aesthetic Devices Market Analysis in Rest of Asia-Pacific (2021-2030)

- Table 30: Medical Aesthetic Devices Market Analysis in Rest of World (2021-2030)

- Table 31: Medical Aesthetic Devices Market Analysis in Rest of World by Region (2021-2030)

- Table 32: Medical Aesthetic Devices Market Analysis in the Middle East (2021-2030)

- Table 33: Medical Aesthetic Devices Market Analysis in Africa (2021-2030)

- Table 34: Medical Aesthetic Devices Market Analysis in South America (2021-2030)

List of Figures

- Figure 1: Competitive Analysis

- Figure 2: COVID-19 Impact Analysis on Medical Aesthetic Devices Market

- Figure 3: Medical Aesthetic Devices Market Analysis in Global (2021-2030)

- Figure 4: Medical Aesthetic Devices Market Analysis in Global by Product Type (2021-2030)

- Figure 5: Medical Aesthetic Devices Market Analysis in Global by Application (2021-2030)

- Figure 6: Medical Aesthetic Devices Market Analysis in Global by End User (2021-2030)

- Figure 7: Medical Aesthetic Devices Market Analysis in Global by Geography (2021-2030)

- Figure 8: Medical Aesthetic Devices Market Analysis in North America (2021-2030)

- Figure 9: Medical Aesthetic Devices Market Analysis in North America by Country (2021-2030)

- Figure 10: Medical Aesthetic Devices Market Analysis in the US (2021-2030)

- Figure 11: Medical Aesthetic Devices Market Analysis in Canada (2021-2030)

- Figure 12: Medical Aesthetic Devices Market Analysis in Mexico (2021-2030)

- Figure 13: Medical Aesthetic Devices Market Analysis in Europe (2021-2030)

- Figure 14: Medical Aesthetic Devices Market Analysis in Europe by Country (2021-2030)

- Figure 15: Medical Aesthetic Devices Market Analysis in France (2021-2030)

- Figure 16: Medical Aesthetic Devices Market Analysis in Germany (2021-2030)

- Figure 17: Medical Aesthetic Devices Market Analysis in the UK (2021-2030)

- Figure 18: Medical Aesthetic Devices Market Analysis in Italy (2021-2030)

- Figure 19: Medical Aesthetic Devices Market Analysis in Spain (2021-2030)

- Figure 20: Medical Aesthetic Devices Market Analysis in Russia (2021-2030)

- Figure 21: Medical Aesthetic Devices Market Analysis in Rest of Europe (2021-2030)

- Figure 22: Medical Aesthetic Devices Market Analysis in Asia-Pacific (2021-2030)

- Figure 23: Medical Aesthetic Devices Market Analysis in Asia-Pacific by Country (2021-2030)

- Figure 24: Medical Aesthetic Devices Market Analysis in China (2021-2030)

- Figure 25: Medical Aesthetic Devices Market Analysis in Japan (2021-2030)

- Figure 26: Medical Aesthetic Devices Market Analysis in India (2021-2030)

- Figure 27: Medical Aesthetic Devices Market Analysis in Australia (2021-2030)

- Figure 28: Medical Aesthetic Devices Market Analysis in South Korea (2021-2030)

- Figure 29: Medical Aesthetic Devices Market Analysis in Rest of Asia-Pacific (2021-2030)

- Figure 30: Medical Aesthetic Devices Market Analysis in Rest of World (2021-2030)

- Figure 31: Medical Aesthetic Devices Market Analysis in Rest of World by Region (2021-2030)

- Figure 32: Medical Aesthetic Devices Market Analysis in the Middle East (2021-2030)

- Figure 33: Medical Aesthetic Devices Market Analysis in Africa (2021-2030)

- Figure 34: Medical Aesthetic Devices Market Analysis in South America (2021-2030)

- Figure 35: Market Drivers

- Figure 36: Market Barriers

- Figure 37: Market Opportunities

- Figure 38: PORTER's Five Force Analysis

Medical Aesthetic Devices Market By Product Type (Energy-Based Aesthetic Devices [ Laser-Based Aesthetic Devices, Radiofrequency (RF)-Based Aesthetic Devices, Light-Based Aesthetic Devices, Others], Non-Energy Based Aesthetic Devices [Botulinum Toxin, Dermal Fillers, Dermabrasion & Microdermabrasion, Implants, Others]), By Application (Skin Resurfacing And Tightening, Body Contouring And Cellulite Reduction, Hair Removal, Facial Aesthetic Procedures, Breast Augmentation, Others), By End-User (Hospitals, Dermatology Clinics, Others), by geography, is anticipated to grow at a significant CAGR till 2030 owing to the increase in the number of aesthetically conscious population across the globe and growing preference for minimally invasive and non-invasive aesthetic procedures

The global medical aesthetic devices market was valued at USD 13,533.26 million in 2023, growing at a CAGR of 11.46% during the forecast period from 2024 to 2030, in order to reach USD 25,808.43 million by 2030. The increase in the market for medical aesthetic devices is predominantly owing to an exponential rise in the aging population and an increase in the adoption of various aesthetic procedures. Additionally, the growing awareness among the population to look aesthetically presentable and also regarding the various cosmetic procedures performed across the globe is likely to boost the market. Also, shifting preferences towards less complex minimally invasive or non-invasive aesthetic procedures, a rise in obesity among the population, and growing technological advancement in the product arena, among others are some of the key factors expected to raise the market for these devices during the forecast period (2024-2030).

Medical Aesthetic Devices Market Dynamics:

The market for medical aesthetic devices is anticipated to witness considerable growth due to the increase in the geriatric population across the globe. This is because loose facial skin, especially around the eyes, cheeks, and jowls, and roughened or dry skin, among others are some of the common phenomena that usually appear when a person ages. Many surveys have also found that cosmetic surgery is becoming more accepted among those over the age of 50 years. For instance, according to the 2019 statistics published by the International Society of Aesthetic Plastic Surgery, approximately 25.2% of botulinum toxin cosmetic procedures were performed among the population aging between 51 and 64 years, globally and around 6% of the same procedure were performed among the people 65 years or older, worldwide in the same year. Thus, the rising old age population becomes a potential driving factor for the global medical aesthetic devices in the forthcoming years. For instance, according to the 2022 data released by the World Health Organization (WHO), in the year 2019, approximately 1 billion people were aged 60 years and older across the globe. The source also projected the number to increase to 1.4 billion by 2030 and 2.1 billion by 2050.

Moreover, the rising efforts by the key players to develop and launch new and innovative products, who are actively manufacturing various aesthetic devices to cater to the target population is likely to the growth of the market for medical aesthetic devices in the upcoming years. For instance, on July 20, 2022, Alma, a Sisram Medical Company and a global leader in the energy-based medical and aesthetic solutions received FDA clearance for its Alma Hybrid(TM), the first laser platform to include an ablative 10,600 nm (CO2) laser and a non-ablative 1570 nm laser for skin resurfacing. This new platform provides physicians a comprehensive solution to utilize each best-in-class laser independently and to customize the treatment pattern by combining both wavelengths.

Thus, all the aforementioned factors collectively contributed to the growth of the medical aesthetic devices market during the study period.

However, the high cost associated with these devices as well as procedures coupled with clinical risks and complications associated with medical aesthetic procedures, and the lack of reimbursement policies in various countries are some of the restraining factors for the global medical aesthetic devices market.

Additionally, the COVID-19 pandemic has slumped the market for medical aesthetic devices due to the canceled or denied elective surgeries across the globe to curb the transmission of the infection. For instance, as per the World Health Organization "pulse survey" published in the year 2023, two-thirds of countries reported disruptions in elective surgeries, with accumulating consequences as the pandemic is prolonged. Also, as per the data provided by the American Society of Plastic Surgeons in the year 2023, there was an overall 15% reduction in the total number of cosmetic surgeries which included, nose reshaping, breast augmentation, and others in the year 2020. However, owing to the approval and administration of numerous COVID-19 vaccines across the globe, the market is projected to regain normalcy during the post-pandemic.

Medical Aesthetic Devices Market Segment Analysis:

Medical Aesthetic Devices Market By Product Type (Energy-Based Aesthetic Devices [ Laser-Based Aesthetic Devices, Radiofrequency (RF)-Based Aesthetic Devices, Light-Based Aesthetic Devices, Others], Non-Energy Based Aesthetic Devices [Botulinum Toxin, Dermal Fillers, Dermabrasion & Microdermabrasion, Implants, Others]), By Application (Skin Resurfacing And Tightening, Body Contouring and Cellulite Reduction, Hair Removal, Facial Aesthetic Procedures, Breast Augmentation, Others), By End-User (Hospitals, Dermatology Clinics, Others), and By Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the application segment of the medical aesthetic devices market, the body contouring and cellulite reduction subsegment is expected to hold a significant market share in the year 2023. The rising prevalence of obesity worldwide is one of the key factors responsible for an increased demand for body contouring and cellulite reduction procedures across the globe will increase the demand for the related devices. For instance, as per the 2019 data released by the World Obesity Federation, an estimated 2.7 billion adults will be overweight, over 1 billion affected by obesity, and 177 million adults severely affected by obesity by 2025.

Furthermore, a rise in the adoption of various aesthetic and cosmetic procedures by the obese population as they are more tend towards reducing weight and look beautiful is likely to raise the demand for the aesthetic devices.

For instance, according to the International Society of Aesthetic Plastic Surgery 2020 data, globally, about 1,525,197 and 560,464 procedures of liposuction and nonsurgical fat reduction, respectively were performed in the same year.

Additionally, giant manufacturers indulging in various business expansion activities in the body contouring and cellulite reduction field are further expected to bolster the segment growth in the forthcoming years. For instance, recently on May 10, 2022, Allergan Aesthetics, an AbbVie company, and Soliton entered into a definitive agreement under which Allergan Aesthetics will acquire Soliton and RESONICTM, its Rapid Acoustic Pulse device, non-invasive treatment for the short-term improvement in the appearance of cellulite. The acquisition of Soliton expands and complements Allergan Aesthetics' Body Contouring treatment portfolio which includes CoolSculpting® Elite.

Hence, the interplay of all the above-mentioned factors is projected to boost the medical aesthetic devices market in the upcoming years.

North America is expected to dominate the overall Medical Aesthetic Devices Market:

Among all the regions, North America is expected to hold a major share in the overall medical aesthetic devices market in the year 2023 and will retain its market position during the forecast period. This is owing to an increase in the number of various cosmetic surgeries. Moreover, the rising burden of breast cancer, trauma injuries, and an increasing prevalence of obesity, among others, along with the presence of key manufacturers, and the presence of well-developed and advanced healthcare systems in the region are some of the other factors contributing to the regional market growth of medical aesthetic devices market.

For instance, as per the data provided by the American Society of Plastic Surgeons in the year 2020, a total of 15.6 million cosmetic procedures were performed in the same year out of which 2.3 million were cosmetic surgical procedures and 13.2 million were cosmetic minimally-invasive procedures.

Also, the International Society of Aesthetic Plastic Surgery 2020 report stated that approximately 404,229 non-surgical cosmetic surgeries were performed in Mexico in the same year with botulinum toxin being the most common procedure comprising 48.0% of the total non-invasive cosmetic procedures.

Furthermore, the rising incidence of breast cancer in the region would also contribute to the growth of the regional breast implant market. For instance, according to the GLOBOCAN observatory data, published in the year 2020, there were an estimated 253, 465 breast cancer cases in the US in the year 2020 which accounted for about 11.1% of the total new cancer cases.

Also, according to various studies, more than 100,000 women in the US undergo mastectomies which could increase the demand for breast implants thereby augmenting the medical aesthetic devices market.

Furthermore, the launch of various medical aesthetic devices in the countries present in the region such as the United States is also anticipated to bolster the market for these devices during the forecast period. For instance, in June 2020, Cynosure launched the Elite iQ(TM) aesthetic workstation for laser hair removal and skin revitalization in the US along with other countries across the globe.

Hence, all the above-stated factors are projected to propel the regional market growth of medical aesthetic devices during the forecast period.

Medical Aesthetic Devices Market Key Players:

Some of the key market players operating in the Medical Aesthetic Devices market include Johnson & Johnson, HansBioMed., AbbVie Inc., Sebbin, Sientra, Inc., POLYTECH Health & Aesthetics GmbH, Suneva Medical, Hanson Medical Inc., SurgiSil, Surgiform Technologies LLC, Alma Lasers, Candela Medical., Lumenis., Cutera., Sciton Inc, Merz Pharma GmbH & Co.KGaA, Bausch Health Companies Inc., Venus Concept., TRIA BEAUTY, Cynosure Inc., GALDERMA, and others.

Recent Developmental Activities in the Medical Aesthetic Devices Market:

In May 2022, GC Aesthetics, Inc., a privately-held medical technology company providing aesthetic solutions launched its next generation of breast implants, PERLE(TM).

In February 2022, Galderma received the US Food and Drug Administration (FDA) approval for Restylane® Defyne for the augmentation and correction of mild to moderate chin retrusion for adults over the age of 21.

In November 2020, Lutronic Introduced Intelligent Care in Muscle Stimulation with IntelliSTIM(TM) - a third-generation body sculpting device.

Key Takeaways from the Medical Aesthetic Devices Market Report Study

- Market size analysis for current market size (2023), and market forecast for 5 years (2024-2030)

- The effect of the COVID-19 pandemic on this market is significant. To capture and analyze suitable indicators, our experts are closely watching the Medical Aesthetic Devices market.

- Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened in the last 3 years

- Key companies dominating the Global Medical Aesthetic Devices Market.

- Various opportunities available for the other competitor in the Medical Aesthetic Devices Market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030.

- Which are the top-performing regions and countries in the current market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for Medical Aesthetic Devices market growth in the coming future?

Target Audience who can be benefited from the Medical Aesthetic Devices Market Report Study

- Medical Aesthetic Devices providers

- Research organizations and consulting companies

- Medical Aesthetic Devices-related organization, association, forum, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders in Medical Aesthetic Devices

- Various End-users want to know more about the Medical Aesthetic Devices Market and the latest technological developments in the Medical Aesthetic Devices market.

Frequently Asked Questions for the Medical Aesthetic Devices Market:

1. What are Medical Aesthetic Devices?

Medical aesthetic devices are used to treat various impairments associated with an individual's aesthetic appearance such as wrinkles, scar management, skin discoloration, and excessive fat, among others. The aesthetic devices available in the market are used to perform various minimally invasive and non-invasive cosmetic procedures. Some of the non-invasive devices make use of lasers, ultrasonic sound waves, and others.

2. What is the market for Global Medical Aesthetic Devices?

The global medical aesthetic devices market was valued at USD 13,533.26 million in 2023, growing at a CAGR of 11.46% during the forecast period from 2024 to 2030, in order to reach USD 25,808.43 million by 2030.

3. What are the drivers for Global Medical Aesthetic Devices?

The major factors driving the demand for Medical Aesthetic Devices are an exponential rise in the aging population and an increase in the adoption of various aesthetic procedures. Additionally, growing awareness among the worldwide population regarding various cosmetic procedures and to look aesthetically presentable, shifting preferences towards less complex, minimally invasive, or non-invasive aesthetic procedures, rise in obesity among the population, and growing technological advancement in the product arena, among others are some of the factors expected to raise the market for these devices during the forecast period (2024-2030).

4. Who are the key players operating in Global Medical Aesthetic Devices?

Some of the key market players operating in the Medical Aesthetic Devices market include Johnson & Johnson, HansBioMed., AbbVie Inc., Sebbin, Sientra, Inc., POLYTECH Health & Aesthetics GmbH, Suneva Medical, Hanson Medical Inc., SurgiSil, Surgiform Technologies LLC, Alma Lasers, Candela Medical., Lumenis., Cutera., Sciton Inc, Merz Pharma GmbH & Co.KGaA, Bausch Health Companies Inc., Venus Concept., TRIA BEAUTY, Cynosure Inc., GALDERMA, and others.

5. Which region has the highest share in the Medical Aesthetic Devices market?

Among all the regions, North America is expected to hold a major share in the overall medical aesthetic devices market in the year 2023 and will retain its market position during the forecast period. This is owing to an increase in the number of various cosmetic surgeries. Moreover, the rising burden of breast cancer, trauma injuries, and an increasing prevalence of obesity, among others, the presence of key manufacturers, and the presence of well-developed and advanced healthcare systems in the region along with an increase in healthcare expenditure are some of the other factors contributing to the regional market growth of medical aesthetic devices market.

Table of Contents

1.Medical Aesthetic Devices Market Report Introduction

2.Medical Aesthetic Devices Market Executive summary

- 2.1. Scope of the Study

- 2.2. Market at Glance

- 2.3. Competitive Assessment

3. Regulatory Analysis

- 3.1. The United States

- 3.2. Europe

- 3.3. Japan

- 3.4. China

4. Medical Aesthetic Devices Market Key factors analysis

- 4.1. Medical Aesthetic Devices Market Drivers

- 4.1.1. The rise in the geriatric population

- 4.1.2. Increase in the number of cosmetic surgeries across the globe

- 4.1.3. Rising preference for non-invasive and minimally invasive cosmetic surgeries

- 4.1.4. Technological advancements in the product arena

- 4.2. Medical Aesthetic Devices Market Restraints and Challenges

- 4.2.1. High costs associated with these devices as well as procedures coupled with clinical risks and complications

- 4.2.2. Lack of proper reimbursement

- 4.3. Medical Aesthetic Devices Market Opportunities

- 4.3.1. Leveraging the home healthcare trend to market at-home devices

- 4.3.2. An increase in medical tourism in low and middle-income nations can provide opportunities for the aesthetic medical devices market

5. Medical Aesthetic Devices Porter's Five Forces Analysis

- 5.1. Bargaining Power of Suppliers

- 5.2. Bargaining Power of Consumers

- 5.3. Threat of New Entrants

- 5.4. Threat of Substitutes

- 5.5. Competitive Rivalry

6. COVID-19 Impact Analysis on Medical Aesthetic Devices Market

7. Medical Aesthetic Devices Market layout

- 7.1. By Product Type

- 7.1.1. Energy-Based Aesthetic Devices

- 7.1.1.1. Laser-based Aesthetic Device

- 7.1.1.2. Radiofrequency (RF)-based Aesthetic Device

- 7.1.1.3. Light-based Aesthetic Device

- 7.1.1.4. Others

- 7.1.2. Non-Energy Based Aesthetic Devices

- 7.1.2.1. Botulinum Toxin

- 7.1.2.2. Dermal Fillers

- 7.1.2.3. Dermabrasion & Microdermabrasion

- 7.1.2.4. Implants

- 7.1.2.5. Others

- 7.1.1. Energy-Based Aesthetic Devices

- 7.2. By Application

- 7.2.1. Skin Resurfacing and Tightening

- 7.2.2. Body Contouring and Cellulite Reduction

- 7.2.3. Hair Removal

- 7.2.4. Facial Aesthetic Procedures

- 7.2.5. Breast Augmentation

- 7.2.6. Others

- 7.3. By End-user

- 7.3.1. Hospitals

- 7.3.2. Dermatology Clinics

- 7.3.3. Others

- 7.4. By Geography

- 7.4.1. North America

- 7.4.1.1. United States

- 7.4.1.2. Canada

- 7.4.1.3. Mexico

- 7.4.2. Europe

- 7.4.2.1. France

- 7.4.2.2. Germany

- 7.4.2.3. United Kingdom

- 7.4.2.4. Italy

- 7.4.2.5. Spain

- 7.4.2.6. Russia

- 7.4.2.7. Rest of Europe

- 7.4.3. Asia-Pacific

- 7.4.3.1. China

- 7.4.3.2. Japan

- 7.4.3.3. India

- 7.4.3.4. Australia

- 7.4.3.5. South Korea

- 7.4.3.6. Rest of Asia Pacific

- 7.4.4. Rest of the World (RoW)

- 7.4.4.1. Middle East

- 7.4.4.2. Africa

- 7.4.4.3. South America

- 7.4.1. North America

8. Medical Aesthetic Devices Global Company Share Analysis - Key 3-5 Companies

9. Medical Aesthetic Devices Company and Product Profiles

- 9.1. Johnson & Johnson

- 9.1.1. Company Overview

- 9.1.2. Company Snapshot

- 9.1.3. Financial Overview

- 9.1.4. Product Listing

- 9.1.5. Entropy

- 9.2. HansBioMed.

- 9.2.1. Company Overview

- 9.2.2. Company Snapshot

- 9.2.3. Financial Overview

- 9.2.4. Product Listing

- 9.2.5. Entropy

- 9.3. AbbVie Inc.

- 9.3.1. Company Overview

- 9.3.2. Company Snapshot

- 9.3.3. Financial Overview

- 9.3.4. Product Listing

- 9.3.5. Entropy

- 9.4. Sebbin

- 9.4.1. Company Overview

- 9.4.2. Company Snapshot

- 9.4.3. Financial Overview

- 9.4.4. Product Listing

- 9.4.5. Entropy

- 9.5. Sientra, Inc.

- 9.5.1. Company Overview

- 9.5.2. Company Snapshot

- 9.5.3. Financial Overview

- 9.5.4. Product Listing

- 9.5.5. Entropy

- 9.6. POLYTECH Health & Aesthetics GmbH

- 9.6.1. Company Overview

- 9.6.2. Company Snapshot

- 9.6.3. Financial Overview

- 9.6.4. Product Listing

- 9.6.5. Entropy

- 9.7. Suneva Medical

- 9.7.1. Company Overview

- 9.7.2. Company Snapshot

- 9.7.3. Financial Overview

- 9.7.4. Product Listing

- 9.7.5. Entropy

- 9.8. Hanson Medical Inc.

- 9.8.1. Company Overview

- 9.8.2. Company Snapshot

- 9.8.3. Financial Overview

- 9.8.4. Product Listing

- 9.8.5. Entropy

- 9.9. SurgiSil

- 9.9.1. Company Overview

- 9.9.2. Company Snapshot

- 9.9.3. Financial Overview

- 9.9.4. Product Listing

- 9.9.5. Entropy

- 9.10. Surgiform Technologies LLC,

- 9.10.1. Company Overview

- 9.10.2. Company Snapshot

- 9.10.3. Financial Overview

- 9.10.4. Product Listing

- 9.10.5. Entropy

- 9.11. Alma Lasers

- 9.11.1. Company Overview

- 9.11.2. Company Snapshot

- 9.11.3. Financial Overview

- 9.11.4. Product Listing

- 9.11.5. Entropy

- 9.12. Candela Medical.

- 9.12.1. Company Overview

- 9.12.2. Company Snapshot

- 9.12.3. Financial Overview

- 9.12.4. Product Listing

- 9.12.5. Entropy

- 9.13. Lumenis.

- 9.13.1. Company Overview

- 9.13.2. Company Snapshot

- 9.13.3. Financial Overview

- 9.13.4. Product Listing

- 9.13.5. Entropy

- 9.14. Cutera.

- 9.14.1. Company Overview

- 9.14.2. Company Snapshot

- 9.14.3. Financial Overview

- 9.14.4. Product Listing

- 9.14.5. Entropy

- 9.15. Sciton Inc

- 9.15.1. Company Overview

- 9.15.2. Company Snapshot

- 9.15.3. Financial Overview

- 9.15.4. Product Listing

- 9.15.5. Entropy

- 9.16. Merz Pharma GmbH & Co.KGaA

- 9.16.1. Company Overview

- 9.16.2. Company Snapshot

- 9.16.3. Financial Overview

- 9.16.4. Product Listing

- 9.16.5. Entropy

- 9.17. Bausch Health Companies Inc.

- 9.17.1. Company Overview

- 9.17.2. Company Snapshot

- 9.17.3. Financial Overview

- 9.17.4. Product Listing

- 9.17.5. Entropy

- 9.18. Venus Concept.

- 9.18.1. Company Overview

- 9.18.2. Company Snapshot

- 9.18.3. Financial Overview

- 9.18.4. Product Listing

- 9.18.5. Entropy

- 9.19. Cynosure Inc.

- 9.19.1. Company Overview

- 9.19.2. Company Snapshot

- 9.19.3. Financial Overview

- 9.19.4. Product Listing

- 9.19.5. Entropy

- 9.20. TRIA BEAUTY

- 9.20.1. Company Overview

- 9.20.2. Company Snapshot

- 9.20.3. Financial Overview

- 9.20.4. Product Listing

- 9.20.5. Entropy

- 9.21. GALDERMA

- 9.21.1. Company Overview

- 9.21.2. Company Snapshot

- 9.21.3. Financial Overview

- 9.21.4. Product Listing

- 9.21.5. Entropy