|

市場調査レポート

商品コード

1156137

家具業界向けeコマースE-Commerce for the Furniture Industry |

||||||

| 家具業界向けeコマース |

|

出版日: 2022年11月17日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 118 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

2019年~2022年の期間において年率18%の成長を遂げるeコマース家具市場は、近年急速に進化しており、家具市場全体を上回る勢いで成長しています。世界のeコマースマーケットプレースでは、米国が最も普及率が高く、次いで中国となっています。

世界のシナリオが急速に変化していることが、eコマースチャネルの進化に強く影響しています。パンデミック時の好況を受け、市場はウクライナ戦争、エネルギー・食糧不足、強いインフレ圧力の影響を受けています。また、eコマースの競合分野にも乱れが生じています。家具のオンライン販売は減少しており、市場の低迷に強いオムニチャネル小売業者(実店舗)が優位に立つようになっています。

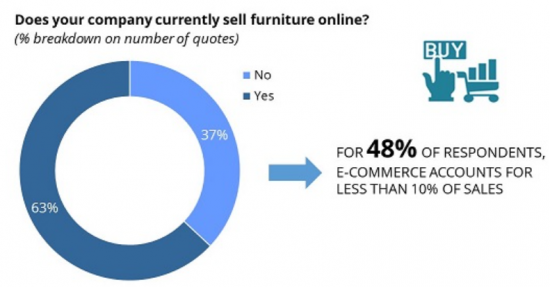

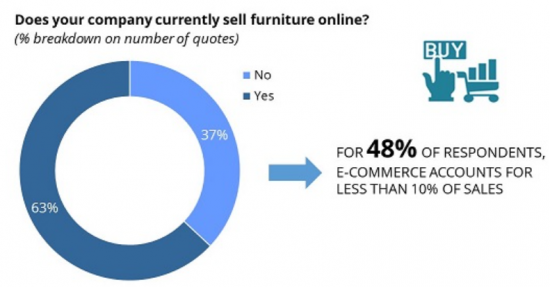

家具販売全体に占めるeコマースの活用と発生率(2022年)

CSIL調査回答者総サンプル数に対する割合のシェア

当レポートでは、世界の家具業界向けeコマースについて調査し、世界の家具産業の概要と、大規模市場における現在の家具消費、家具業界のeコマースにおける主要地域・国の主要企業の実績分析、収益や動向などの情報を提供しています。

当レポート掲載の主な企業

Amazon, Ambientedirect, Anthropologie, Bygghemma Group, C Discount, Coupang, Crate and Barrel, Dunhelm, Hayneedle, Harvey Norman, Home Depot, Home 24, Ikea, Jingdong, John Lewis, Lowe's, Otto, Overstock, Pepperfry, Restoration Hardware, Suning, Tmall, Wal-Mart, Wayfair, Westwing, Williams-Sonoma.com、など

目次

イントロダクション:調査ツール、企業のサンプル、用語と方法論に関する注意事項

エグゼクティブサマリー:家具部門のeコマースの概要

第1章 家具業界のeコマース

- 家具市場の概要:消費と輸入

- eコマース業界向けEC:基本データ

- 家具の総消費量に対するeコマースの割合

- 地理的地域別の家具の消費とeコマース販売

- 製品セグメント別の家具の消費とeコマース販売(布張り家具、アウトドア家具、キッチン家具、オフィス家具、その他の家具)

- チャネル別のeコマース家具の販売(eテーラー、家具専門家、非専門家/ライフスタイル/DIYおよびウェブストアを通じた家具メーカー)

- サンプル企業のeコマース販売実績

- eコマースビジネスのモデル:家具メーカー、卸売業者およびB2Bビジネス、eテーラー、実店舗企業、家具以外の専門チェーン、オープンプラットフォーム

第2章 活動の動向

- 家具販売とeコマース家具販売の成長

- 地域別のeコマース家具の売上高と上位10か国のeコマース家具の消費量

- 製品セグメント別eコマース家具売上高

- カテゴリ別のオンライン家具販売業者:規模、市場シェア、平均成長率

- ビジネスの進化と組織:オムニチャネルアプローチ、ダイナミックショッピング、持続可能性

地域別分析:欧州、北米、アジア太平洋

第3章 欧州における家具のeコマース

- 欧州における小売およびeコマースの販売:概要と需要の促進要因

- 欧州の家具市場:セクター概要

- 欧州のエンドユーザー価格での家具の消費と、国別のeコマース家具の販売(オーストリア、ベルギー、デンマーク、フィンランド、フランス、ドイツ、イタリア、オランダ、ノルウェー、スペイン、スウェーデン、スイス、英国)

- 欧州で家具を販売する主要なeコマースWebサイト:推定eコマース家具販売と総eコマース収益

第4章 北米における家具のeコマース

- 北米の小売およびeコマースの販売:概要と需要の促進要因

- 北米の家具市場:セクター概要

- 北米のエンドユーザー価格での家具の消費と、国別のeコマース家具の販売(米国、カナダ、メキシコ)

- オンラインで販売する家具メーカー

- 北米で家具を販売する主要なeコマースWebサイト:eコマースの推定販売と総eコマース収益

第5章 アジア太平洋地域における家具のeコマース

- アジア太平洋地域の小売およびeコマースの販売:概要と需要の促進要因

- アジア太平洋地域の家具市場:セクター概要

- アジア太平洋地域のエンドユーザー価格での家具の消費と、国別のeコマース家具の販売(オーストラリア、中国、インド、日本、韓国)

- アジア太平洋地域で家具を販売する主要なeコマースWebサイト:eコマースの総収益

第6章 家具業界のeコマース:調査結果

- 企業のサンプル

- 収益実績

- eコマースの利用

- eコマースチャネル

- 製品とプロモーションツール

This report analyses e-commerce for the furniture industry on a global level and it is mainly divided into two parts:

PART I. E-COMMERCE FOR THE FURNITURE INDUSTRY deals with the features and the incidence of the online channel in the furniture market with a focus on key geographical areas (Europe, North America, Asia Pacific) and key countries, and analyses the different e-commerce business models and the performance of the leading players.

An overview of the world furniture industry, with current furniture consumption in large markets, introduces this part.

Trends in furniture e-commerce sales, 2022 (preliminary estimates) compared to 2019, are provided by segment (upholstered furniture, outdoor furniture, office furniture, kitchen furniture, other furniture), by geographical area and by kind of distributor (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers selling online)

The different E-commerce business models (Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms) and their evolution and organization (the omnichannel approach, the 'dynamic shopping' through a mixture of live-streaming and online shopping, and strategies and investments toward sustainable and responsible growth) are discussed in light of companies' experience.

ANALYSIS BY GEOGRAPHICAL AREAS: The furniture e-commerce business in Europe, North America, and Asia Pacific: for each considered region, the report analyses demand drivers, the online furniture market performance and sales of the leading furniture e-commerce players. E-commerce furniture sales are also provided for the most relevant markets (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom - the United States, Canada, Mexico - Australia, China, India, Japan, South Korea).

Online sales are presented for around 190 leading players based in North America, Europe, and Asia Pacific, with profiles highlighting their e-commerce policies. Profiles of the major companies are also provided. E-commerce furniture sales are provided both for European and North American companies.

PART II. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS provides results of a CSIL survey conducted in the period October-November 2022 to a sample of around 150 furniture manufacturers from all over the world, aiming at understanding their approach to the web channel, their strategies, their future expectations, and the most-demanded products in the web channel.

This survey mainly focus on:

- Companies revenues and performance

- The use of e-commerce/ Intentions to invest in e-commerce

- Features of the companies' e-commerce channels

- Products sold online, strategies and promotion tools

Highlights:

The use of e-commerce and incidence of total furniture sales, 2022.

Percentage shares on the total sample of respondents to the CSIL survey

With a +18% yearly growth in the period 2019-2022, the e-commerce furniture market has evolved rapidly in recent years, growing faster than the whole furniture market. The United States is the largest world e-commerce marketplace, with the highest penetration rate, followed by China.

The swiftly changing worldwide scenario strongly influences the e-commerce channel evolution. Following the booming performance during the pandemic, the market has been impacted by the consequences of the war in Ukraine, energy and food shortages, and strong inflationary pressures.

Also, the e-commerce competitive arena is showing some turbulence. Online sales of furniture are downgrading giving an advantage to the omnichannel retailers (brick&click) which are showing resilience to the weak market conditions, maximising physical stores' potential in combination with the virtual experience.

Selected companies mentioned:

Amazon, Ambientedirect, Anthropologie, Bygghemma Group, C Discount, Coupang, Crate and Barrel, Dunhelm, Hayneedle, Harvey Norman, Home Depot, Home 24, Ikea, Jingdong, John Lewis, Lowe's, Otto, Overstock, Pepperfry, Restoration Hardware,Suning, Tmall, Wal-Mart, Wayfair, Westwing, Williams-Sonoma.

TABLE OF CONTENTS

INTRODUCTION: Research Tools, Sample of companies, Terminology and methodological notes

EXECUTIVE SUMMARY: E-commerce for the furniture sector at a glance

1. E-COMMERCE FOR THE FURNITURE INDUSTRY

- 1.1. An overview of the furniture market: Consumption and Imports

- 1.2. E-commerce for the furniture industry: basic data

- incidence of e-commerce on total furniture consumption

- furniture consumption and e-commerce sales by geographical region

- furniture consumption and e-commerce sales by product segment (Upholstered furniture, Outdoor furniture, Kitchen furniture, Office furniture, Other furniture)

- e-commerce furniture sales by channel (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers through webstores)

- 1.3. E-commerce sales performance in a sample of companies

- 1.4. Models of e-commerce business: Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms

2. ACTIVITY TRENDS

- 2.1. Furniture sales and e-commerce furniture sales growth

- E-commerce furniture sales by geographical region and E-commerce furniture consumption in the top 10 countries

- E-commerce furniture sales by product segment

- Online furniture distributors by category: dimension, market share and average growth

- 2.2. The business evolution and organisation: the Omnichannel approach, Dynamic shopping and Sustainability

ANALYSIS BY GEOGRAPHICAL AREA: Europe, North America, Asia Pacific

3. FURNITURE E-COMMERCE IN EUROPE

- 3.1. Retail and e-commerce sales in Europe: overview and demand drivers

- 3.2. The furniture market in Europe: Sector overview

- Furniture consumption at end-user prices in Europe and e-commerce furniture sales by country (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom)

- 3.3. The leading e-commerce websites selling furniture in Europe: Estimated e-commerce furniture sales and Total e-commerce revenues

4. FURNITURE E-COMMERCE IN NORTH AMERICA

- 4.1. Retail and e-commerce sales in North America: overview and demand drivers

- 4.2. The furniture market in North America: Sector overview

- Furniture consumption at end-user prices in North America and e-commerce furniture sales by country (United States, Canada and Mexico)

- 4.3. Furniture manufacturers selling on-line

- 4.4. The leading e-commerce websites selling furniture in North America: Estimated e-commerce furniture sales and Total e-commerce revenues

5. FURNITURE E-COMMERCE IN ASIA PACIFIC

- 5.1. Retail and e-commerce sales in Asia Pacific: overview and demand drivers

- 5.2. The furniture market in Asia Pacific: Sector overview

- Furniture consumption at end-user prices in Asia Pacific and e-commerce furniture sales by country (Australia, China, India, Japan, South Korea)

- 5.3. The leading e-commerce websites selling furniture in Asia Pacific: Total e-commerce revenues

6. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS

- 6.1. The sample of companies

- 6.2. Revenue performance

- 6.3. The use of e-commerce

- 6.4. E-commerce channels

- 6.5. Products and promotion tools