|

|

市場調査レポート

商品コード

1744400

小売業の調達・購買市場- 世界および地域別分析:用途別、展開別、国別 - 分析と予測(2025年~2034年)Retail Sourcing and Procurement Market - A Global and Regional Analysis: Focus on Application, Product, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 小売業の調達・購買市場- 世界および地域別分析:用途別、展開別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年06月10日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の小売業の調達・購買市場は、複雑化するオムニチャネル小売オペレーションの中で、コストを最適化し、サプライチェーンの回復力を確保し、俊敏性を高めることが求められています。

小売企業は、戦略的ソーシング、契約ライフサイクル管理、支出分析、サプライヤー・リスク・モニタリングを統合デジタル・バックボーンに統合するモジュール式の調達・支払スイートやサプライヤー管理プラットフォームを導入しています。コアとなる実現技術には、迅速な展開と継続的なアップグレードをサポートするクラウドネイティブアーキテクチャ、需要予測、処方的ソーシング、異常検知のための人工知能と機械学習、サプライヤーとの取引記録を不変化するブロックチェーン、調達ワークフローをマーチャンダイジング、在庫、物流システムと接続するローコード/ノーコード統合フレームワークなどがあります。これらのイノベーションの総体として、消極的な取引中心の調達から、積極的で洞察に基づくサプライヤーのコラボレーションと価値の共創へのシフトが推進されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 62億2,000万米ドル |

| 2034年の予測 | 116億6,000万米ドル |

| CAGR | 7.23% |

現在、小売業の調達・購買市場は、急速なテクノロジー導入と活発な新規参入を特徴とする高成長段階にあります。大手小売企業も中堅チェーンも、長年にわたるデジタルトランスフォーメーションの試験運用を経て、クラウドベースのas-a-service調達の展開を拡大しており、一方で、ベスト・オブ・ブリードのベンダーやコンサルティング会社は、AIを活用したアシスタントボット、サステナビリティ連携モジュール、コミュニティ・インテリジェンス・マーケットプレースの導入を競っています。ティアワン・スイート・プロバイダーや専門企業の戦略的買収によって市場の統合が進んでいますが、断片化は依然として顕著で、革新的な新興企業がニッチなユースケース(ESGデータの統合、ブロックチェーンのトレーサビリティなど)を獲得する余地は十分に残されています。この成長ステージは2020年代後半まで続くと予想され、ジェネレーティブAIと組み込み型アナリティクスの継続的な進歩が、新たな調達中心のビジネスモデルとパフォーマンス向上を解き放ち続けるからです。

小売業の調達・購買・購買市場のセグメンテーション:

セグメンテーション1:用途別

- ソリューション

- 戦略的ソーシング

- サプライヤー管理

- 契約管理

- P2P

- 支出分析

- サービス

- インプリメンテーション

- コンサルティング

- トレーニングとサポート

ソリューションは、世界の小売業の調達・購買・購買市場において顕著な応用セグメントの一つです。

セグメンテーション2:展開別

- オンプレミス

- クラウドベース

世界の小売業の調達・購買市場は、クラウドベースのセグメントが展開の面でリードしていると推定されます。

セグメンテーション3:地域別

- 北米- 米国、カナダ、メキシコ

- 欧州- ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域- 中国、日本、韓国、インド、その他

- その他地域- 南米、中東アフリカ

小売業の調達・購買市場では、絶えず変化する小売シーン、サプライチェーンの複雑さ、技術的改善、顧客行動の変化を考慮すると、北米が生産面で牽引力を増すと予想されます。

需要- 促進要因と抑制要因

以下は、世界の小売業の調達・購買・購買市場の需要促進要因です:

- 急速なデジタル化とクラウドベースの調達プラットフォームの採用

世界の小売業の調達・購買市場は、以下の課題により、いくつかの制限にも直面すると予想されます:

- 最新の調達ソリューションと従来のERPシステムとの統合における高額な先行投資と複雑さ

小売業の調達・購買・購買市場の主要参入企業と競合の概要

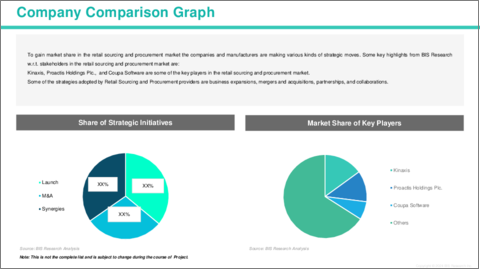

小売業の調達・購買における競合は、広範な機能的深さと専門領域における迅速なイノベーションのトレードオフが中心となっています。ティアワン・インクラスの既存ベンダー(SAP、Oracle、IBM)は、世界な導入実績と、マーチャンダイジング、在庫管理、ERPシステムとの深い連携を活かし、複雑なサプライチェーンを持つ大規模小売企業にサービスを提供しています。対照的に、アジャイルベンダー(Coupa、Ivalua、Epicor、GEP)は、クラウドネイティブアーキテクチャ、AIを活用した意思決定サポート、モジュール型デプロイメントモデルを重視し、価値実現までの時間短縮と継続的な機能提供を推進しています。キナクシス(Kinaxis)やバスウェア(Basware)のようなニッチ企業は、リアルタイムの需要検知、サプライヤーネットワークのオーケストレーション、持続可能性に関連したソーシングに注力することで、競争圧力をさらに強めています。このダイナミックな動きは、戦略的パートナーシップや買収を通じた継続的な統合を促進し、すべてのベンダーに、オムニチャネルのサプライヤーポータル、組み込み型ESG指標、予測補充アルゴリズムなど、小売業に特化したイノベーションへの多額の投資を促しています。小売業の調達・購買市場は、包括的なスイート・ベンダーと専門的なソリューション・プロバイダーが混在しています。代表的なエンタープライズ・プラットフォームには、SAP SE、Oracle Corporation、Coupa Software Inc.、IBM Corporation、Infor Inc.などがあり、小売のワークフローに合わせたエンド・ツー・エンドのソース・ツー・ペイ機能を提供しています。Epicor Software Corporation、Ivalua Inc.、GEP Worldwide、Jaggaer Inc.などのベスト・オブ・ブリードの専門企業は、高度な支出分析、サプライヤー・リスク管理、AI主導のソーシング・モジュールによって差別化を図っています。さらに、キナクシス(Kinaxis)、プロアクティスホールディングス(Proactis Holdings Plc)、バスウェア(Basware Corporation)、ハイジャンプ・ソフトウェア(HighJump Software)、ブルー・ヨンダー・グループ(Blue Yonder Group)は、需要主導型補充、カテゴリー管理、オムニチャネル・サプライヤー・コラボレーションなど、小売業特有の課題に取り組んでいます。

当レポートでは、世界の小売業の調達・購買市場について調査し、市場の概要とともに、用途別、展開別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- ステークホルダー分析

- 市場力学の概要

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

第2章 小売業の調達・購買市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- 小売業の調達・購買市場(コンポーネント別)

- ソリューション

- サービス

第3章 小売業の調達・購買市場(製品別)

- 製品のセグメンテーション

- 製品のサマリー

- 小売業の調達・購買市場(展開別)

- クラウドベース

- オンプレミス

- 小売業の調達・購買市場(企業タイプ別)

- 中小企業

- 大企業

第4章 小売業の調達・購買市場(地域別)

- 小売業の調達・購買市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Kinaxis

- Proactis Holdings Plc.

- Coupa Software

- HighJump Software

- Basware Corporation

- SAP SE

- Oracle Corporation

- IBM Corporation

- Epicor Software Corporation

- JDA Software Group, Inc.

- JAGGER, Inc.

- Infor Nexus

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Retail Sourcing and Procurement Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Retail Sourcing and Procurement Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Retail Sourcing and Procurement Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: Retail Sourcing and Procurement Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 12: Canada Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 13: Mexico Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 14: Germany Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 15: France Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 16: Italy Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 17: Spain Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 18: U.K. Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 19: Rest-of-Europe Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 20: China Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 21: Japan Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 22: India Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 23: South Korea Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 24: Rest-of-Asia-Pacific Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 25: South America Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 26: Middle East and Africa Retail Sourcing and Procurement Market, $Billion, 2024-2034

- Figure 27: Strategic Initiatives (by Company), 2021-2025

- Figure 28: Share of Strategic Initiatives, 2021-2025

- Figure 29: Data Triangulation

- Figure 30: Top-Down and Bottom-Up Approach

- Figure 31: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Retail Sourcing and Procurement Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Retail Sourcing and Procurement Market (by Region), $Billion, 2024-2034

- Table 8: North America Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 9: North America Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 10: U.S. Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 12: Canada Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 13: Canada Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 14: Mexico Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 15: Mexico Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 16: Europe Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 17: Europe Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 18: Germany Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 19: Germany Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 20: France Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 21: France Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 22: Italy Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 23: Italy Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 24: Spain Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 25: Spain Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 26: U.K. Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 27: U.K. Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 28: Rest-of-Europe Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 29: Rest-of-Europe Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 30: Asia-Pacific Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 31: Asia-Pacific Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 32: China Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 33: China Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 34: Japan Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 35: Japan Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 36: India Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 37: India Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 38: South Korea Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 39: South Korea Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 40: Rest-of-Asia-Pacific Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-Asia-Pacific Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 42: Rest-of-the-World Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 43: Rest-of-the-World Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 44: South America Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 45: South America Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 46: Middle East and Africa Retail Sourcing and Procurement Market (by Application), $Billion, 2024-2034

- Table 47: Middle East and Africa Retail Sourcing and Procurement Market (by Product), $Billion, 2024-2034

- Table 48: Market Share

Global Retail Sourcing and Procurement Market: Industry Overview

The global retail sourcing and procurement market is anchored by the imperative to optimize cost, ensure supply-chain resilience and enhance agility amid increasingly complex omnichannel retail operations. Retailers are deploying modular procure-to-pay suites and supplier-management platforms that integrate strategic sourcing, contract-lifecycle management, spend analytics and supplier-risk monitoring into a unified digital backbone. Core enabling technologies include cloud-native architectures that support rapid deployment and continuous upgrades; artificial intelligence and machine learning for demand forecasting, prescriptive sourcing and anomaly detection; blockchain for immutable supplier-transaction records; and low-code/no-code integration frameworks that connect procurement workflows with merchandising, inventory and logistics systems. Collectively, these innovations are driving a shift from reactive, transactional procurement to proactive, insight-driven supplier collaboration and value co-creation.

Retail Sourcing and Procurement Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $6.22 Billion |

| 2034 Forecast | $11.66 Billion |

| CAGR | 7.23% |

Currently, the retail sourcing and procurement market is in a high-growth phase characterized by rapid technology adoption and vigorous new-entrant activity. Following years of digital-transformation pilots, major retailers and mid-market chains alike are scaling cloud-based procurement-as-a-service deployments, while best-of-breed vendors and consultancies race to introduce AI-powered assistant bots, sustainability-linkage modules and community-intelligence marketplaces. Although market consolidation is underway-driven by strategic acquisitions among tier-one suite providers and specialist entrants-fragmentation remains pronounced, leaving ample space for innovative startups to capture niche use cases (e.g., ESG data integration, blockchain traceability). This growth stage is expected to extend through the late 2020s, as ongoing advances in generative AI and embedded analytics continue to unlock new procurement-centric business models and performance-enhancing applications.

Retail Sourcing and Procurement Market Segmentation:

Segmentation 1: by Application

- Solution

- Strategic Sourcing

- Supplier Management

- Contract Management

- Procure-to-pay

- Spend Analysis

- Service

- Implementation

- Consulting

- Training & Support

Solution is one of the prominent application segments in the global retail sourcing and procurement market.

Segmentation 2: by Deployment

- On-Premise

- Cloud-Based

The global retail sourcing and procurement market is estimated to be led by the cloud-based segment in terms of deployment.

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the retail sourcing and procurement market, North America is anticipated to gain traction in terms of production, given the continuously changing retail scene, supply chain complexities, technological improvements, and shifting customer behaviors.

Demand - Drivers and Limitations

The following are the demand drivers for the global retail sourcing and procurement market:

- Rapid Digitalization and Adoption of Cloud-based Procurement Platforms

The global retail sourcing and procurement market is expected to face some limitations as well due to the following challenges:

- High Upfront Investment and Complexity in Integrating Modern Sourcing Solutions with Legacy ERP Systems

Retail Sourcing and Procurement Market Key Players and Competition Synopsis

Competition in retail sourcing and procurement centers on the trade-off between broad functional depth and rapid innovation in specialized domains. Tier-one incumbents (SAP, Oracle, IBM) leverage their global implementation footprints and deep integrations with merchandising, inventory and ERP systems to serve large retailers with complex supply chains. In contrast, agile vendors (Coupa, Ivalua, Epicor, GEP) emphasize cloud-native architectures, AI-powered decision-support and modular deployment models that drive faster time-to-value and continuous feature delivery. Niche players like Kinaxis and Basware further intensify competitive pressure by focusing on real-time demand sensing, supplier network orchestration and sustainability-linked sourcing. This dynamic fosters ongoing consolidation-through strategic partnerships and acquisitions-and compels all vendors to invest heavily in retail-specific innovations such as omnichannel supplier portals, embedded ESG metrics and predictive replenishment algorithms. The retail sourcing and procurement market is dominated by a blend of comprehensive suite vendors and specialized solution providers. Leading enterprise platforms include SAP SE, Oracle Corporation, Coupa Software Inc., IBM Corporation and Infor Inc., which offer end-to-end source-to-pay capabilities tailored for retail workflows. Best-of-breed specialists such as Epicor Software Corporation, Ivalua Inc., GEP Worldwide and Jaggaer Inc. differentiate through advanced spend analytics, supplier-risk management and AI-driven sourcing modules. Additionally, regional and niche players-Kinaxis, Proactis Holdings Plc., Basware Corporation, HighJump Software and Blue Yonder Group-address specific retail challenges like demand-driven replenishment, category management and omnichannel supplier collaboration

Some prominent names established in the retail sourcing and procurement market are:

- Kinaxis

- Proactis Holdings Plc.

- Coupa Software

- HighJump Software

- Basware Corporation

- SAP SE

- Oracle Corporation

- IBM Corporation

- Epicor Software Corporation

- JDA Software Group, Inc.

- JAGGER, Inc.

- Infor Nexus

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Investment Landscape and R&D Trends

- 1.5 Future Outlook and Market Roadmap

2. Retail Sourcing and Procurement Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Retail Sourcing and Procurement Market (by Component)

- 2.3.1 Solution

- 2.3.1.1 Strategic Sourcing

- 2.3.1.2 Supplier Management

- 2.3.1.3 Contract Management

- 2.3.1.4 Procure-to-pay

- 2.3.1.5 Spend Analysis

- 2.3.2 Service

- 2.3.2.1 Implementation

- 2.3.2.2 Consulting

- 2.3.2.3 Training & Support

- 2.3.1 Solution

3. Retail Sourcing and Procurement Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Retail Sourcing and Procurement Market (by Deployment)

- 3.3.1 Cloud-Based

- 3.3.2 On-Premise

- 3.4 Retail Sourcing and Procurement Market (by Enterprise Type)

- 3.4.1 Small and Medium Enterprises

- 3.4.2 Large Enterprises

4. Retail Sourcing and Procurement Market (by Region)

- 4.1 Retail Sourcing and Procurement Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Market by Application

- 4.2.6.1.2 Market by Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Market by Application

- 4.2.6.2.2 Market by Product

- 4.2.6.3 Mexico

- 4.2.6.3.1 Market by Application

- 4.2.6.3.2 Market by Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Market by Application

- 4.3.6.1.2 Market by Product

- 4.3.6.2 France

- 4.3.6.2.1 Market by Application

- 4.3.6.2.2 Market by Product

- 4.3.6.3 Italy

- 4.3.6.3.1 Market by Application

- 4.3.6.3.2 Market by Product

- 4.3.6.4 Spain

- 4.3.6.4.1 Market by Application

- 4.3.6.4.2 Market by Product

- 4.3.6.5 U.K.

- 4.3.6.5.1 Market by Application

- 4.3.6.5.2 Market by Product

- 4.3.6.6 Rest-of-Europe

- 4.3.6.6.1 Market by Application

- 4.3.6.6.2 Market by Product

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Market by Application

- 4.4.6.1.2 Market by Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Market by Application

- 4.4.6.2.2 Market by Product

- 4.4.6.3 India

- 4.4.6.3.1 Market by Application

- 4.4.6.3.2 Market by Product

- 4.4.6.4 South Korea

- 4.4.6.4.1 Market by Application

- 4.4.6.4.2 Market by Product

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.4.6.5.1 Market by Application

- 4.4.6.5.2 Market by Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Market by Application

- 4.5.6.1.2 Market by Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Market by Application

- 4.5.6.2.2 Market by Product

- 4.5.6.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Kinaxis

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Proactis Holdings Plc.

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Coupa Software

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 HighJump Software

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Basware Corporation

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 SAP SE

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Oracle Corporation

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 IBM Corporation

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Epicor Software Corporation

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 JDA Software Group, Inc.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 JAGGER, Inc.

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 Infor Nexus

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.1 Kinaxis

- 5.4 Other Key Companies