|

|

市場調査レポート

商品コード

1744397

軍用サーマルカメラ市場- 世界と地域別分析:製品タイプ別、プラットフォーム別、検出器タイプ別、赤外線波長別、用途別、国別 - 分析と予測(2025年~2034年)Military Thermal Camera Market - A Global and Regional Analysis: Focus on Product Type, Platform, Detector Type, Infrared Wavelength, Application, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 軍用サーマルカメラ市場- 世界と地域別分析:製品タイプ別、プラットフォーム別、検出器タイプ別、赤外線波長別、用途別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年06月10日

発行: BIS Research

ページ情報: 英文 150 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

軍用サーマルカメラ市場は、より広範な防衛・セキュリティ技術のエコシステムの中で重要なセグメントを占めています。

サーマルイメージング技術は、センサーの感度、画像処理アルゴリズム、コマンド&コントロールシステムとの統合の改善により、進歩を続けています。軍事用赤外線カメラは、低照度、霧、煙などの厳しい環境下での監視、偵察、目標捕捉、ナビゲーションなど、さまざまな用途に展開されています。最近の非冷却型マイクロボロメーターセンサーや冷却型光子検出器の開発により、システムの小型化と消費電力の削減を実現しながら性能が向上しています。さらに、脅威の自動検出と分類を可能にするため、サーマルカメラへの人工知能や機械学習機能の搭載が進んでいます。軍用サーマルカメラ市場は、ハンドヘルド機器、車両搭載型システム、空中プラットフォーム、艦艇など、さまざまな防衛プラットフォーム向けの運用能力の拡大と低価格化を目指した研究開発への多額の投資による恩恵を受けています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 89億5,000万米ドル |

| 2034年の予測 | 134億2,000万米ドル |

| CAGR | 4.6% |

現在、軍用サーマルカメラ市場は、防衛予算の拡大と高度な監視技術への需要の高まりに支えられ、力強い成長段階にあります。多くのサーマルカメラソリューションが高い技術成熟度(TRL 7~9)に達しており、世界中の軍事用途で広く採用されています。北米、欧州、アジア太平洋の各国政府は、次世代赤外線サーマルカメラシステムを統合することで軍備の近代化を進めており、市場の勢いに拍車をかけています。赤外線カメラメーカー、防衛関連企業、ソフトウェア開発者の協力体制は、統合された相互運用可能なシステムを提供する上で極めて重要です。輸出規制やサイバーセキュリティに重点を置いた規制の枠組みは市場力学に影響を与える一方、デジタル信号処理とセンサーの小型化の進歩は配備の障壁を減らし続けています。軍用サーマルカメラ市場は、進化する戦術的要件と新興市場での急速な技術導入により、今後10年間は安定した成長を維持すると予測されます。

軍用サーマルカメラ市場のセグメンテーション

セグメンテーション1:製品タイプ別

- ハンドヘルドサーマルカメラ

- 車両搭載型サーマルカメラ

- 装甲車

- 航空機

- その他軍用車両

- 固定型サーモグラフィ

セグメンテーション2:プラットフォーム別

- 陸上

- 航空

- 海上

セグメンテーション3:検出器タイプ別

- コーティング検出器

- 非冷却型検出器

セグメンテーション4:赤外線波長別

- 長波長赤外線(LWIR)

- 中波長赤外線(MWIR)

- 短波長赤外線(SWIR)

セグメンテーション5:用途別

- 監視

- ターゲット検出

- ナビゲーション

- その他(パトロール、捜索救助など)

セグメンテーション6:地域別

- 北米- 米国、カナダ、メキシコ

- 欧州- ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域- 中国、日本、韓国、インド、その他

- その他地域- 南米、中東・アフリカ

需要- 促進要因と限界

軍用サーマルカメラ市場の需要促進要因は以下の通りです:

- 世界の防衛費の増加と近代化への取り組み

- 全天候型および暗視機能に対する需要の高まり

- 目標検出と追跡のためのAIと高度な分析の統合

軍用サーマルカメラ市場は、以下の課題によっていくつかの制限にも直面すると予想される:

- 高い開発・統合コスト

- 複雑なシステム相互運用性要件

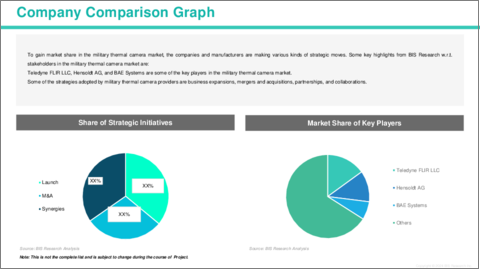

軍用サーマルカメラ市場の主要参入企業と競合情勢

軍用サーマルカメラ市場は、防衛技術のリーダー企業や革新的な画像ソリューションプロバイダーによって形成された競争の激しい市場です。Teledyne FLIR LLC、Leonardo DRS、Hensoldt AG、Thermoteknix Systems Ltd.、Ophir Optronics Solutions Ltd.などの著名な世界企業は、軍用グレードの赤外線サーマルカメラ技術の発展に重要な役割を果たしています。これらの主な企業は、検出能力を強化した高解像度の長距離赤外線カメラの開発、兵器システムとの統合、AIを活用したターゲット認識に力を入れています。こうした老舗企業のほかにも、新興企業やスタートアップ企業が、小型化、低消費電力化、マルチセンサーフュージョンに重点を置いた斬新な設計を提供し、現代の防衛上の課題に取り組んでいます。軍用サーマルカメラ市場の競合は、防衛関連企業との戦略的パートナーシップ、継続的な技術革新、地域の防衛近代化プログラムによって推進されています。軍用サーマルカメラ市場が成長するにつれ、各社は世界中の軍隊の進化する運用要件に対応するため、拡張性と適応性に優れたソリューションの提供に注力しています。

当レポートでは、世界の軍用サーマルカメラ市場について調査し、市場の概要とともに、製品タイプ別、プラットフォーム別、検出器タイプ別、赤外線波長別、用途別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 市場力学の概要

- 規制および政策影響分析

- 特許分析

- 技術情勢

- 従来の可視光カメラと比較したサーマルカメラの利点

- スタートアップの情勢

- 投資情勢と研究開発動向

- バリューチェーン分析

- 業界の魅力

第2章 世界の軍用サーマルカメラ市場(製品タイプ別)

- ハンドヘルドサーマルカメラ

- 車載型サーマルカメラ

- 装甲車両

- 航空機

- その他の軍用車両

- 固定式サーマルカメラ

第3章 世界の軍用サーマルカメラ市場(プラットフォーム別)

- 陸上

- 航空

- 海上

第4章 世界の軍用サーマルカメラ市場(検出器タイプ別)

- コーティング検出器

- 非冷却型検出器

第5章 世界の軍用サーマルカメラ市場(赤外線波長別)

- 長波赤外線(LWIR)

- 中波赤外線(MWIR)

- 短波赤外線(SWIR)

第6章 世界の軍用サーマルカメラ市場(用途別)

- 監視

- ターゲット検出

- ナビゲーション

- その他(パトロール、捜索救助など)

第7章 世界の軍用サーマルカメラ市場(地域別)

- 世界の軍用サーマルカメラ市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第8章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Larson Electronics, LLC

- MSA

- Teledyne FLIR LLC

- Leonardo DRS

- Collins Aerospace

- Hensoldt AG

- JAI

- Thermoteknix Systems Ltd.

- Ophir Optronics Solutions Ltd.

- Infiniti Electro-Optics

- Raytheon Technologies Corporation

- BAE Systems

- Rheinmetall AG

- DELOPT

- その他の主要企業

第9章 調査手法

List of Figures

- Figure 1: Military Thermal Camera Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Military Thermal Camera Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Military Thermal Camera Market (by Product Type), $Billion, 2024, 2027, and 2034

- Figure 4: Military Thermal Camera Market (by Platform), $Billion, 2024, 2027, and 2034

- Figure 5: Military Thermal Camera Market (by Detector Type), $Billion, 2024, 2027, and 2034

- Figure 6: Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024, 2027, and 2034

- Figure 7: Military Thermal Camera Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 8: Competitive Landscape Snapshot

- Figure 9: Supply Chain Analysis

- Figure 10: Value Chain Analysis

- Figure 11: Patent Analysis (by Country), January 2021-April 2025

- Figure 12: Patent Analysis (by Company), January 2021-April 2025

- Figure 13: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 14: U.S. Military Thermal Camera Market, $Billion, 2024-2034

- Figure 15: Canada Military Thermal Camera Market, $Billion, 2024-2034

- Figure 16: Mexico Military Thermal Camera Market, $Billion, 2024-2034

- Figure 17: Germany Military Thermal Camera Market, $Billion, 2024-2034

- Figure 18: France Military Thermal Camera Market, $Billion, 2024-2034

- Figure 19: Italy Military Thermal Camera Market, $Billion, 2024-2034

- Figure 20: Spain Military Thermal Camera Market, $Billion, 2024-2034

- Figure 21: U.K. Military Thermal Camera Market, $Billion, 2024-2034

- Figure 22: Rest-of-Europe Military Thermal Camera Market, $Billion, 2024-2034

- Figure 23: China Military Thermal Camera Market, $Billion, 2024-2034

- Figure 24: Japan Military Thermal Camera Market, $Billion, 2024-2034

- Figure 25: India Military Thermal Camera Market, $Billion, 2024-2034

- Figure 26: South Korea Military Thermal Camera Market, $Billion, 2024-2034

- Figure 27: Rest-of-Asia-Pacific Military Thermal Camera Market, $Billion, 2024-2034

- Figure 28: South America Military Thermal Camera Market, $Billion, 2024-2034

- Figure 29: Middle East and Africa Military Thermal Camera Market, $Billion, 2024-2034

- Figure 30: Strategic Initiatives (by Company), 2021-2025

- Figure 31: Share of Strategic Initiatives, 2021-2025

- Figure 32: Data Triangulation

- Figure 33: Top-Down and Bottom-Up Approach

- Figure 34: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Military Thermal Camera Market Pricing Forecast, 2024-2034

- Table 5: Military Thermal Camera Market (by Region), $Billion, 2024-2034

- Table 6: North America Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 7: North America Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 8: North America Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 9: North America Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 10: North America Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 12: U.S. Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 13: U.S. Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 14: U.S. Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 15: U.S. Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 16: Canada Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 17: Canada Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 18: Canada Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 19: Canada Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 20: Canada Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 21: Mexico Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 22: Mexico Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 23: Mexico Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 24: Mexico Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 25: Mexico Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 26: Europe Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 27: Europe Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 28: Europe Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 29: Europe Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 30: Europe Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 31: Germany Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 32: Germany Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 33: Germany Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 34: Germany Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 35: Germany Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 36: France Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 37: France Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 38: France Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 39: France Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 40: France Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 41: Italy Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 42: Italy Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 43: Italy Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 44: Italy Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 45: Italy Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 46: Spain Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 47: Spain Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 48: Spain Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 49: Spain Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 50: Spain Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 51: U.K. Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 52: U.K. Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 53: U.K. Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 54: U.K. Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 55: U.K. Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 56: Rest-of-Europe Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 57: Rest-of-Europe Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 58: Rest-of-Europe Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 59: Rest-of-Europe Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 60: Rest-of-Europe Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 61: China Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 62: China Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 63: China Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 64: China Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 65: China Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 66: Japan Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 67: Japan Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 68: Japan Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 69: Japan Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 70: Japan Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 71: India Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 72: India Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 73: India Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 74: India Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 75: India Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 76: South Korea Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 77: South Korea Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 78: South Korea Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 79: South Korea Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 80: South Korea Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 81: Rest-of-Asia-Pacific Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 82: Rest-of-Asia-Pacific Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 83: Rest-of-Asia-Pacific Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 84: Rest-of-Asia-Pacific Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 85: Rest-of-Asia-Pacific Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 86: Rest-of-the-World Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 87: Rest-of-the-World Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 88: Rest-of-the-World Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 89: Rest-of-the-World Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 90: Rest-of-the-World Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 91: South America Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 92: South America Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 93: South America Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 94: South America Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 95: South America Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 96: Middle East and Africa Military Thermal Camera Market (by Product Type), $Billion, 2024-2034

- Table 97: Middle East and Africa Military Thermal Camera Market (by Platform), $Billion, 2024-2034

- Table 98: Middle East and Africa Military Thermal Camera Market (by Detector Type), $Billion, 2024-2034

- Table 99: Middle East and Africa Military Thermal Camera Market (by Infrared Wavelength), $Billion, 2024-2034

- Table 100: Middle East and Africa Military Thermal Camera Market (by Application), $Billion, 2024-2034

- Table 101: Market Share

Military Thermal Camera Market Industry and Technology Overview

The military thermal camera market represents a vital segment within the broader defense and security technology ecosystem. Thermal imaging technology continues to advance with improvements in sensor sensitivity, image processing algorithms, and integration with command and control systems. Military thermal cameras are deployed across multiple applications including surveillance, reconnaissance, target acquisition, and navigation in challenging environments such as low-light, fog, or smoke. Recent developments in uncooled microbolometer sensors and cooled photon detectors have enhanced performance while reducing system size and power consumption. Furthermore, artificial intelligence and machine learning capabilities are increasingly embedded in thermal cameras to enable automated threat detection and classification. The military thermal camera market benefits from significant investments in R&D, aimed at expanding operational capabilities and improving affordability for various defense platforms, including handheld devices, vehicle-mounted systems, airborne platforms, and naval vessels.

Global Military Thermal Camera Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $8.95 Billion |

| 2034 Forecast | $13.42 Billion |

| CAGR | 4.6% |

Currently, the military thermal camera market is in a robust growth phase supported by expanding defense budgets and increasing demand for advanced surveillance technologies. Many thermal camera solutions have reached high Technology Readiness Levels (TRL 7-9), with widespread adoption in military applications worldwide. Governments in North America, Europe, and Asia-Pacific are modernizing their armed forces by integrating next-generation thermal imaging systems, fueling market momentum. Collaborative initiatives among thermal camera manufacturers, defense contractors, and software developers are pivotal for delivering integrated and interoperable systems. Regulatory frameworks focused on export controls and cybersecurity impact market dynamics, while advancements in digital signal processing and sensor miniaturization continue to reduce deployment barriers. The military thermal camera market is projected to maintain steady growth over the next decade, driven by evolving tactical requirements and rapid technology adoption in emerging markets.

Military Thermal Camera Market Segmentation:

Segmentation 1: by Product Type

- Handheld Thermal Cameras

- Vehicle-Mounted Thermal Cameras

- Armored Vehicles

- Aircraft

- Other Military Vehicles

- Fixed-Mounted Thermal Cameras

Segmentation 2: by Platform

- Ground

- Airborne

- Naval

Segmentation 3: by Detector Type

- Coated Detectors

- Uncooled Detectors

Segmentation 4: by Infrared Wavelength

- Long-Wave Infrared (LWIR)

- Medium-Wave Infrared (MWIR)

- Short-Wave Infrared (SWIR)

Segmentation 5: by Application

- Surveillance

- Target Detection

- Navigation

- Others (Patrols, Search and Rescue, etc.)

Segmentation 6: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

Demand - Drivers and Limitations

The following are the demand drivers for the military thermal camera market:

- Increasing defense expenditure and modernization efforts globally

- Enhanced demand for all-weather and night-vision capabilities

- Integration of AI and advanced analytics for target detection and tracking

The military thermal camera market is expected to face some limitations as well due to the following challenges:

- High development and integration costs

- Complex system interoperability requirements

Military Thermal Camera Market Key Players and Competition Synopsis

The military thermal camera market features a highly competitive landscape shaped by established defense technology leaders and innovative imaging solution providers. Prominent global companies such as Teledyne FLIR LLC, Leonardo DRS, Hensoldt AG, Thermoteknix Systems Ltd., and Ophir Optronics Solutions Ltd. play critical roles in advancing military-grade thermal imaging technologies. These key players emphasize the development of high-resolution, long-range thermal cameras with enhanced detection capabilities, integration with weapon systems, and AI-enabled target recognition. Alongside these established companies, emerging firms and startups are contributing novel designs focusing on miniaturization, lower power consumption, and multi-sensor fusion to address modern defense challenges. Competition in the military thermal camera market is driven by strategic partnerships with defense contractors, continuous technological innovation, and regional defense modernization programs. As the military thermal camera market grows, players are concentrating on delivering scalable and adaptable solutions to meet the evolving operational requirements of armed forces globally.

Some prominent names established in the military thermal camera market are:

- Larson Electronics, LLC

- MSA

- Teledyne FLIR LLC

- Leonardo DRS

- Collins Aerospace

- Hensoldt AG

- JAI

- Thermoteknix Systems Ltd.

- Ophir Optronics Solutions Ltd.

- Infiniti Electro-Optics

- Rheinmetall AG

- BAE Systems

- Raytheon Technologies Corporation

- DELOPT

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.2 Market Restraints

- 1.2.3 Market Opportunities

- 1.3 Regulatory & Policy Impact Analysis

- 1.3.1 By Region

- 1.4 Patent Analysis

- 1.4.1 By Year

- 1.4.2 By Region

- 1.5 Technology Landscape

- 1.6 Advantages of Thermal Cameras over Traditional Visible Light Cameras

- 1.7 Start-Up Landscape

- 1.8 Investment Landscape and R&D Trends

- 1.9 Value Chain Analysis

- 1.10 Industry Attractiveness

2. Global Military Thermal Camera Market (by Product Type)

- 2.1 Handheld Thermal Cameras

- 2.2 Vehicle-Mounted Thermal Cameras

- 2.2.1 Armored Vehicles

- 2.2.2 Aircraft

- 2.2.3 Other Military Vehicles

- 2.3 Fixed-Mounted Thermal Cameras

3. Global Military Thermal Camera Market (by Platform)

- 3.1 Ground

- 3.2 Airborne

- 3.3 Naval

4. Global Military Thermal Camera Market (by Detector Type)

- 4.1 Coated Detectors

- 4.2 Uncooled Detectors

5. Global Military Thermal Camera Market (by Infrared Wavelength)

- 5.1 Long-Wave Infrared (LWIR)

- 5.2 Medium-Wave Infrared (MWIR)

- 5.3 Short-Wave Infrared (SWIR)

6. Global Military Thermal Camera Market (by Application)

- 6.1 Surveillance

- 6.2 Target Detection

- 6.3 Navigation

- 6.4 Others (Patrols, Search and Rescue, etc.)

7. Global Military Thermal Camera Market (by Region)

- 7.1 Global Military Thermal Camera Market (by Region)

- 7.2 North America

- 7.2.1 Regional Overview

- 7.2.2 Driving Factors for Market Growth

- 7.2.3 Factors Challenging the Market

- 7.2.4 Key Companies

- 7.2.5 Product Type

- 7.2.6 Platform

- 7.2.7 Detector Type

- 7.2.8 Infrared Wavelength

- 7.2.9 Application

- 7.2.10 North America (by Country)

- 7.2.10.1 U.S.

- 7.2.10.1.1 Market by Product Type

- 7.2.10.1.2 Market by Platform

- 7.2.10.1.3 Market by Detector Type

- 7.2.10.1.4 Market by Infrared Wavelength

- 7.2.10.1.5 Market by Application

- 7.2.10.2 Canada

- 7.2.10.2.1 Market by Product Type

- 7.2.10.2.2 Market by Platform

- 7.2.10.2.3 Market by Detector Type

- 7.2.10.2.4 Market by Infrared Wavelength

- 7.2.10.2.5 Market by Application

- 7.2.10.3 Mexico

- 7.2.10.3.1 Market by Product Type

- 7.2.10.3.2 Market by Platform

- 7.2.10.3.3 Market by Detector Type

- 7.2.10.3.4 Market by Infrared Wavelength

- 7.2.10.3.5 Market by Application

- 7.2.10.1 U.S.

- 7.3 Europe

- 7.3.1 Regional Overview

- 7.3.2 Driving Factors for Market Growth

- 7.3.3 Factors Challenging the Market

- 7.3.4 Key Companies

- 7.3.5 Product Type

- 7.3.6 Platform

- 7.3.7 Detector Type

- 7.3.8 Infrared Wavelength

- 7.3.9 Application

- 7.3.10 Europe (by Country)

- 7.3.10.1 Germany

- 7.3.10.1.1 Market by Product Type

- 7.3.10.1.2 Market by Platform

- 7.3.10.1.3 Market by Detector Type

- 7.3.10.1.4 Market by Infrared Wavelength

- 7.3.10.1.5 Market by Application

- 7.3.10.2 France

- 7.3.10.2.1 Market by Product Type

- 7.3.10.2.2 Market by Platform

- 7.3.10.2.3 Market by Detector Type

- 7.3.10.2.4 Market by Infrared Wavelength

- 7.3.10.2.5 Market by Application

- 7.3.10.3 Italy

- 7.3.10.3.1 Market by Product Type

- 7.3.10.3.2 Market by Platform

- 7.3.10.3.3 Market by Detector Type

- 7.3.10.3.4 Market by Infrared Wavelength

- 7.3.10.3.5 Market by Application

- 7.3.10.4 Spain

- 7.3.10.4.1 Market by Product Type

- 7.3.10.4.2 Market by Platform

- 7.3.10.4.3 Market by Detector Type

- 7.3.10.4.4 Market by Infrared Wavelength

- 7.3.10.4.5 Market by Application

- 7.3.10.5 U.K.

- 7.3.10.5.1 Market by Product Type

- 7.3.10.5.2 Market by Platform

- 7.3.10.5.3 Market by Detector Type

- 7.3.10.5.4 Market by Infrared Wavelength

- 7.3.10.5.5 Market by Application

- 7.3.10.6 Rest-of-Europe

- 7.3.10.6.1 Market by Product Type

- 7.3.10.6.2 Market by Platform

- 7.3.10.6.3 Market by Detector Type

- 7.3.10.6.4 Market by Infrared Wavelength

- 7.3.10.6.5 Market by Application

- 7.3.10.1 Germany

- 7.4 Asia-Pacific

- 7.4.1 Regional Overview

- 7.4.2 Driving Factors for Market Growth

- 7.4.3 Factors Challenging the Market

- 7.4.4 Key Companies

- 7.4.5 Product Type

- 7.4.6 Platform

- 7.4.7 Detector Type

- 7.4.8 Infrared Wavelength

- 7.4.9 Application

- 7.4.10 Asia-Pacific (by Country)

- 7.4.10.1 China

- 7.4.10.1.1 Market by Product Type

- 7.4.10.1.2 Market by Platform

- 7.4.10.1.3 Market by Detector Type

- 7.4.10.1.4 Market by Infrared Wavelength

- 7.4.10.1.5 Market by Application

- 7.4.10.2 Japan

- 7.4.10.2.1 Market by Product Type

- 7.4.10.2.2 Market by Platform

- 7.4.10.2.3 Market by Detector Type

- 7.4.10.2.4 Market by Infrared Wavelength

- 7.4.10.2.5 Market by Application

- 7.4.10.3 India

- 7.4.10.3.1 Market by Product Type

- 7.4.10.3.2 Market by Platform

- 7.4.10.3.3 Market by Detector Type

- 7.4.10.3.4 Market by Infrared Wavelength

- 7.4.10.3.5 Market by Application

- 7.4.10.4 South Korea

- 7.4.10.4.1 Market by Product Type

- 7.4.10.4.2 Market by Platform

- 7.4.10.4.3 Market by Detector Type

- 7.4.10.4.4 Market by Infrared Wavelength

- 7.4.10.4.5 Market by Application

- 7.4.10.5 Rest-of-Asia-Pacific

- 7.4.10.5.1 Market by Product Type

- 7.4.10.5.2 Market by Platform

- 7.4.10.5.3 Market by Detector Type

- 7.4.10.5.4 Market by Infrared Wavelength

- 7.4.10.5.5 Market by Application

- 7.4.10.1 China

- 7.5 Rest-of-the-World

- 7.5.1 Regional Overview

- 7.5.2 Driving Factors for Market Growth

- 7.5.3 Factors Challenging the Market

- 7.5.4 Key Companies

- 7.5.5 Product Type

- 7.5.6 Platform

- 7.5.7 Detector Type

- 7.5.8 Infrared Wavelength

- 7.5.9 Application

- 7.5.10 Rest-of-the-World (by Region)

- 7.5.10.1 South America

- 7.5.10.1.1 Market by Product Type

- 7.5.10.1.2 Market by Platform

- 7.5.10.1.3 Market by Detector Type

- 7.5.10.1.4 Market by Infrared Wavelength

- 7.5.10.1.5 Market by Application

- 7.5.10.2 Middle East and Africa

- 7.5.10.2.1 Market by Product Type

- 7.5.10.2.2 Market by Platform

- 7.5.10.2.3 Market by Detector Type

- 7.5.10.2.4 Market by Infrared Wavelength

- 7.5.10.2.5 Market by Application

- 7.5.10.1 South America

8. Markets - Competitive Benchmarking & Company Profiles

- 8.1 Next Frontiers

- 8.2 Geographic Assessment

- 8.3 Company Profiles

- 8.3.1 Larson Electronics, LLC

- 8.3.1.1 Overview

- 8.3.1.2 Top Products/Product Portfolio

- 8.3.1.3 Top Competitors

- 8.3.1.4 Target Customers

- 8.3.1.5 Key Personnel

- 8.3.1.6 Analyst View

- 8.3.1.7 Market Share

- 8.3.2 MSA

- 8.3.2.1 Overview

- 8.3.2.2 Top Products/Product Portfolio

- 8.3.2.3 Top Competitors

- 8.3.2.4 Target Customers

- 8.3.2.5 Key Personnel

- 8.3.2.6 Analyst View

- 8.3.2.7 Market Share

- 8.3.3 Teledyne FLIR LLC

- 8.3.3.1 Overview

- 8.3.3.2 Top Products/Product Portfolio

- 8.3.3.3 Top Competitors

- 8.3.3.4 Target Customers

- 8.3.3.5 Key Personnel

- 8.3.3.6 Analyst View

- 8.3.3.7 Market Share

- 8.3.4 Leonardo DRS

- 8.3.4.1 Overview

- 8.3.4.2 Top Products/Product Portfolio

- 8.3.4.3 Top Competitors

- 8.3.4.4 Target Customers

- 8.3.4.5 Key Personnel

- 8.3.4.6 Analyst View

- 8.3.4.7 Market Share

- 8.3.5 Collins Aerospace

- 8.3.5.1 Overview

- 8.3.5.2 Top Products/Product Portfolio

- 8.3.5.3 Top Competitors

- 8.3.5.4 Target Customers

- 8.3.5.5 Key Personnel

- 8.3.5.6 Analyst View

- 8.3.5.7 Market Share

- 8.3.6 Hensoldt AG

- 8.3.6.1 Overview

- 8.3.6.2 Top Products/Product Portfolio

- 8.3.6.3 Top Competitors

- 8.3.6.4 Target Customers

- 8.3.6.5 Key Personnel

- 8.3.6.6 Analyst View

- 8.3.6.7 Market Share

- 8.3.7 JAI

- 8.3.7.1 Overview

- 8.3.7.2 Top Products/Product Portfolio

- 8.3.7.3 Top Competitors

- 8.3.7.4 Target Customers

- 8.3.7.5 Key Personnel

- 8.3.7.6 Analyst View

- 8.3.7.7 Market Share

- 8.3.8 Thermoteknix Systems Ltd.

- 8.3.8.1 Overview

- 8.3.8.2 Top Products/Product Portfolio

- 8.3.8.3 Top Competitors

- 8.3.8.4 Target Customers

- 8.3.8.5 Key Personnel

- 8.3.8.6 Analyst View

- 8.3.8.7 Market Share

- 8.3.9 Ophir Optronics Solutions Ltd.

- 8.3.9.1 Overview

- 8.3.9.2 Top Products/Product Portfolio

- 8.3.9.3 Top Competitors

- 8.3.9.4 Target Customers

- 8.3.9.5 Key Personnel

- 8.3.9.6 Analyst View

- 8.3.9.7 Market Share

- 8.3.10 Infiniti Electro-Optics

- 8.3.10.1 Overview

- 8.3.10.2 Top Products/Product Portfolio

- 8.3.10.3 Top Competitors

- 8.3.10.4 Target Customers

- 8.3.10.5 Key Personnel

- 8.3.10.6 Analyst View

- 8.3.10.7 Market Share

- 8.3.11 Raytheon Technologies Corporation

- 8.3.11.1 Overview

- 8.3.11.2 Top Products/Product Portfolio

- 8.3.11.3 Top Competitors

- 8.3.11.4 Target Customers

- 8.3.11.5 Key Personnel

- 8.3.11.6 Analyst View

- 8.3.11.7 Market Share

- 8.3.12 BAE Systems

- 8.3.12.1 Overview

- 8.3.12.2 Top Products/Product Portfolio

- 8.3.12.3 Top Competitors

- 8.3.12.4 Target Customers

- 8.3.12.5 Key Personnel

- 8.3.12.6 Analyst View

- 8.3.12.7 Market Share

- 8.3.13 Rheinmetall AG

- 8.3.13.1 Overview

- 8.3.13.2 Top Products/Product Portfolio

- 8.3.13.3 Top Competitors

- 8.3.13.4 Target Customers

- 8.3.13.5 Key Personnel

- 8.3.13.6 Analyst View

- 8.3.13.7 Market Share

- 8.3.14 DELOPT

- 8.3.14.1 Overview

- 8.3.14.2 Top Products/Product Portfolio

- 8.3.14.3 Top Competitors

- 8.3.14.4 Target Customers

- 8.3.14.5 Key Personnel

- 8.3.14.6 Analyst View

- 8.3.14.7 Market Share

- 8.3.1 Larson Electronics, LLC

- 8.4 Other Key Companies