|

|

市場調査レポート

商品コード

1697459

分子腫瘍学診断市場- 世界および地域別分析:製品別、技術別、用途別、がんタイプ別、エンドユーザー別、国別 - 分析と予測(2024年~2033年)Molecular Oncology Diagnostics Market - A Global and Regional Analysis: Focus on Product, Technology, Application, Cancer Type, End User, and Country - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| 分子腫瘍学診断市場- 世界および地域別分析:製品別、技術別、用途別、がんタイプ別、エンドユーザー別、国別 - 分析と予測(2024年~2033年) |

|

出版日: 2025年04月08日

発行: BIS Research

ページ情報: 英文 171 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の分子腫瘍学診断の市場規模は2024年に24億1,090万米ドルとなりました。

同市場は、11.06%のCAGRで拡大し、2033年には61億9,510万米ドルに達すると予測されています。世界の分子腫瘍学診断市場の成長は、次世代シーケンシング、デジタルPCR、リキッドバイオプシーなどの分子診断における技術進歩の高まりと、世界のがんの有病率の上昇によって牽引されると予想されます。しかしながら、世界の分子腫瘍学診断市場の拡大はいくつかの課題によって阻害されています。特に、ヘルスケア資金が制限されがちな中低所得国では、分子診断検査の高額な費用が依然として大きな障壁となっています。さらに、これらの高度な診断ツールを効果的に使用するための訓練を受けた熟練した専門家の不足も顕著であり、これが成長をさらに抑制しています。

このような課題にもかかわらず、世界の分子腫瘍学診断市場は、絶え間ない技術進歩に牽引されて成長を続けています。バイオテクノロジー企業、製薬会社、学術機関の戦略的提携は不可欠であり、イノベーションを促進し、新しい診断技術の開発と採用を加速しています。世界のがん医療の改善において分子診断の可能性を最大限に引き出すには、コストと人材育成のハードルを克服することが重要です。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年の評価 | 24億1,000万米ドル |

| 2033年の予測 | 61億9,000万米ドル |

| CAGR | 11.06% |

世界の分子腫瘍学診断市場は進行段階にあります。分子腫瘍学診断のエコシステムは、革新的な製品の発売と規制当局の承認取得の急増を目の当たりにしており、がん治療の大幅な進歩を牽引しています。企業は、次世代シーケンシング(NGS)、リキッドバイオプシー、デジタルPCRなどの最先端技術を活用した新しい診断ツールを継続的に開発しており、がんの検出とモニタリングの精度と効率を高めています。これらの技術革新は、個別化された治療計画を提供し、患者の転帰を改善する上で極めて重要です。

今後数年間における世界の分子腫瘍学診断市場の拡大は、主にあらゆる種類のがんの有病率の上昇によってもたらされるとみられています。高齢化、座りがちなライフスタイル、遺伝性危険因子などの要因により、世界のがん罹患率は増加し続けています。2022年には、世界中で約2,000万人のがん患者が新たに発生し、970万人ががんに関連して死亡しました。肺がんが12.40%と最も多く、次いで乳がんが11.60%となっています。がん罹患数の増加と早期発見の重要性の高まりが、予測期間中の分子腫瘍学診断薬市場の成長を促進すると予想されます。

製品別では、キットおよびアッセイは定期的な需要があり、低コストであることから、世界の分子腫瘍学診断市場は製品セグメントによって支配されると予想されます。

技術別では、高感度、高精度、費用対効果の高さから、世界の分子腫瘍学診断市場はポリメラーゼ連鎖反応(PCR)分野が独占しています。

用途別では、世界の分子腫瘍学診断市場は臨床診断が支配的です。この優位性は、ヘルスケアにおける精密医療の採用が増加していることに起因しており、分子診断薬は、標的治療の決定を導くために特定のがん原性変異を同定するために不可欠です。

がんタイプ別にみると、世界の分子腫瘍学診断市場は固形がんが独占しています。この優位性は、血液悪性腫瘍と比較して、乳がん、肺がん、大腸がんなどの固形がんの有病率が高いことに起因しています。固形がんは最も一般的ながんの一つであり、効果的な治療計画を立てるためには広範な診断検査が必要であるため、この分野での分子診断薬に対する需要が高まっています。

エンドユーザー別では、世界の分子腫瘍学診断薬市場は病院セグメントが独占しています。これは主に、病院が患者を直接治療する場であり、迅速かつ正確な診断検査ががん治療におけるタイムリーな意思決定に不可欠であるためです。

北米は2023年に9億6,960万米ドルの売上高を計上しました。北米の分子腫瘍学診断市場は、いくつかの重要な要因によって大きく成長しようとしています。2050年までに固形がんと血液悪性腫瘍の両方が大幅に増加するという予測もあります。さらに、この地域は世界企業とローカル企業の両方が強い存在感を示しており、高度な診断技術へのアクセスが向上しています。

当レポートでは、世界の分子腫瘍学診断市場について調査し、市場の概要とともに、製品別、技術別、用途別、がんタイプ別、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 世界の分子腫瘍学診断市場:業界展望

- 世界のがんの発生率と有病率(がんタイプ別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

- 動向:現状と将来への影響評価

- 参入企業間のパートナーシップの強化

- 分子腫瘍学診断エコシステムにおける革新的な製品の発売と規制承認の増加

- 規制状況

- COVID-19による分子腫瘍学診断市場への影響

- 液体生検に基づくがん分子診断

- 臨床検査(LDT)と体外診断(IVD)

- 分子腫瘍学診断市場におけるコンパニオン診断の役割

- 市場力学

- 市場の促進要因

- 市場の課題

- 市場の機会

第2章 世界の分子腫瘍学診断市場(製品別)

- 製品のサマリー

- キットとアッセイ

- 機器

- ソフトウェア

第3章 世界の分子腫瘍学診断市場(技術別)

- 技術のサマリー

- ポリメラーゼ連鎖反応

- 次世代シーケンシング

- 免疫組織化学

- 蛍光in-situハイブリダイゼーション

- フローサイトメトリー

- その他

第4章 世界の分子腫瘍学診断市場(用途別)

- 用途のサマリー

- 臨床診断

- 調査利用

第5章 世界の分子腫瘍学診断市場(がんタイプ別)

- がんタイプのサマリー

- 固形腫瘍

- 乳がん

- 肺がん

- 大腸がん

- 前立腺がん

- 卵巣がん

- その他

- 造血悪性腫瘍

- リンパ腫

- 白血病

- 多発性骨髄腫

- その他

第6章 世界の分子腫瘍学診断市場(エンドユーザー別)

- エンドユーザーのサマリー

- 病院と診断センター

- 参照試験所

- 製薬会社・バイオテクノロジー企業

- 学術研究機関

第7章 世界の分子腫瘍学診断市場(地域別)

- 地域サマリー

- 促進要因と抑制要因

- 北米

- 欧州

- アジア太平洋

- その他の地域

第8章 世界の分子腫瘍学診断市場-競合ベンチマーキングと企業プロファイル

- 主要な戦略開発

- 企業シェア分析

- 企業プロファイル

- Abbott Laboratories

- Agilent Technologies, Inc.

- Biocartis Group NV

- bioMerieux

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd.

- Guardant Health, Inc.

- Hologic, Inc.

- Illumina, Inc.

- Invivoscribe, Inc.

- Myriad Genetics, Inc.

- QIAGEN N.V.

- Sysmex Corporation

- Thermo Fisher Scientific, Inc.

第9章 調査手法

List of Figures

- Figure 1 Global Molecular Oncology Diagnostics Market, $Million, 2024, 2028, and 2033

- Figure 2 Global Molecular Oncology Diagnostics Market (by Region), $Million, 2023, 2027, and 2033

- Figure 3 Global Molecular Oncology Diagnostics Market (by Product), $Million, 2023, 2027, and 2033

- Figure 4 Global Molecular Oncology Diagnostics Market (by Application), $Million, 2023, 2027, and 2033

- Figure 5 Global Molecular Oncology Diagnostics Market (by Technology), $Million, 2023, 2027, and 2033

- Figure 6 Global Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023, 2027, and 2033

- Figure 7 Global Molecular Oncology Diagnostics Market (by End User), $Million, 2023, 2027, and 2033

- Figure 8 Role of Diagnostics in Healthcare

- Figure 9 Cancer Prevalence and Incidence (by Cancer Type), in Million, North America, 2022

- Figure 10 Cancer Prevalence and Incidence (by Cancer Type), in Million, Europe, 2022

- Figure 11 Cancer Prevalence and Incidence (by Cancer Type), in Million, Asia-Pacific, 2022

- Figure 12 Cancer Prevalence and Incidence (by Cancer Type), in Million, Rest-of-the-World, 2022

- Figure 13 FDA Guidelines for CDx Approval

- Figure 14 Criteria for CMS Coverage/Reimbursement

- Figure 15 Europe In-Vitro Diagnostic Devices Regulation Regulatory Process

- Figure 16 Workflow for Medical Device Regulations

- Figure 17 Technological Advances in Liquid Biopsy Analysis

- Figure 18 List of Some Liquid Biopsy-Based Available Tests Approved by FDA/CE-IVD

- Figure 19 Prominent FDA-Approved Companion Diagnostics

- Figure 20 Impact Analysis of Market Navigating Factors, 2022-2033

- Figure 21 Global Distribution of Cases and Deaths (by Cancer Type), 2022

- Figure 22 Global Incidence for Cancer Types, 2018-2022

- Figure 23 U.S. Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 24 Canada Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 25 Germany Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 26 France Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 27 U.K. Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 28 Italy Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 29 Spain Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 30 Rest-of-Europe Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 31 China Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 32 India Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 33 Japan Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 34 South Korea Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 35 Australia Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 36 Rest-of-Asia-Pacific Molecular Oncology Diagnostics Market, $Million, 2023-2033

- Figure 37 Partnerships, Alliances, and Business Expansions, January 2021-July 2024

- Figure 38 New Offerings, January 2021-July 2024

- Figure 39 Mergers and Acquisitions, January 2021-July 2024

- Figure 40 Regulatory and Legal Activities, January 2021-July 2024

- Figure 41 Data Triangulation

- Figure 42 Top-Down and Bottom-Up Approach

- Figure 43 Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Key Trends, Impact Analysis

- Table 3: Global Molecular Oncology Diagnostics Market, Partnerships and Collaborations

- Table 4: Global Molecular Oncology Diagnostics Market, Product Launches and Regulatory Approvals

- Table 5: Global Molecular Oncology Diagnostics Market, New Offerings

- Table 6: Biomarkers for Different Cancer Types

- Table 7: Significance of Different Biomarkers in Clinical Outcomes of Various Cancer

- Table 8: Cost of Liquid Biopsy-Based NGS Kits

- Table 9: Global Molecular Oncology Diagnostics Market, Reimbursement and Medical Coverage

- Table 10: Global Molecular Oncology Diagnostics Market (by Product), $Million, 2023-2033

- Table 11: Global Molecular Oncology Diagnostics Market (by Technology), $Million, 2023-2033

- Table 12: Global Molecular Oncology Diagnostics Market (by Offering), $Million, 2023-2033

- Table 13: Global Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 14: Global Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 15: Global Molecular Oncology Diagnostics Market Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 16: Global Molecular Oncology Diagnostics Market (by End User, $Million, 2023-2033

- Table 17: Global Molecular Oncology Diagnostics Market (by Region), $Million, 2023-2033

- Table 18: North America Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 19: North America Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 20: North America Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 21: North America Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 22: U.S. Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 23: U.S. Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 24: U.S. Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 25: U.S. Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 26: Canada Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 27: Canada Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 28: Canada Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 29: Canada Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 30: Europe Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 31: Europe Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 32: Europe Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 33: Europe Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 34: Germany Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 35: Germany Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 36: Germany Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 37: Germany Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 38: France Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 39: France Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 40: France Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 41: France Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 42: U.K. Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 43: U.K. Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 44: U.K. Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 45: U.K. Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 46: Italy Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 47: Italy Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 48: Italy Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 49: Italy Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 50: Spain Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 51: Spain Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 52: Spain Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 53: Spain Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 54: Rest-of-Europe Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 55: Rest-of-Europe Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 56: Rest-of-Europe Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 57: Rest-of-Europe Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 58: Asia-Pacific Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 59: Asia-Pacific Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 60: Asia-Pacific Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 61: Asia-Pacific Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 62: China Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 63: China Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 64: China Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 65: China Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 66: India Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 67: India Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 68: India Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 69: India Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 70: Japan Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 71: Japan Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 72: Japan Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 73: Japan Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 74: South Korea Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 75: South Korea Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 76: South Korea Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 77: South Korea Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 78: Australia Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 79: Australia Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 80: Australia Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 81: Australia Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 82: Rest-of-Asia-Pacific Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 83: Rest-of-Asia-Pacific Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 84: Rest-of-Asia-Pacific Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 85: Rest-of-Asia-Pacific Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 86: Rest-of-the-World Molecular Oncology Diagnostics Market (by Cancer Type), $Million, 2023-2033

- Table 87: Rest-of-the-World Molecular Oncology Diagnostics Market, Cancer Type (by Solid Tumors), $Million, 2023-2033

- Table 88: Rest-of-the-World Molecular Oncology Diagnostics Market, Cancer Type (by Hematological Malignancies), $Million, 2023-2033

- Table 89: Rest-of-the-World Molecular Oncology Diagnostics Market (by End User), $Million, 2023-2033

- Table 90: Global Molecular Oncology Diagnostics Market, Company Share Analysis, 2023

Global Molecular Oncology Diagnostics Industry Overview:

The global molecular oncology diagnostics market was valued at $2,410.9 million in 2024, and the market is expected to grow with a CAGR of 11.06% and reach $6,195.1 million by 2033. The growth in the global molecular oncology diagnostics market is expected to be driven by rising technological advancements in molecular diagnostics such as next-generation sequencing, digital PCR, and liquid biopsy, among others and the rising prevalence of cancers globally. However, the expansion of the global molecular oncology diagnostics market has been hindered by several challenges. The high cost of molecular diagnostic tests remains a major barrier, particularly in low- and middle-income countries where healthcare funding is often limited. Additionally, there has been a noticeable gap in the availability of skilled professionals who are trained to use these advanced diagnostic tools effectively, further restraining the growth.

Despite these challenges, the global molecular oncology diagnostics market continues to grow, driven by continuous technological advancements. Strategic collaborations between biotechnology companies, pharmaceutical firms, and academic institutions are vital, fostering innovation and accelerating the development and adoption of new diagnostic technologies. Overcoming the hurdles of cost and workforce training will be crucial for maximizing the potential of molecular diagnostics in improving cancer care globally.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $2.41 Billion |

| 2033 Forecast | $6.19 Billion |

| CAGR | 11.06% |

Market Lifecycle Stage

The global molecular oncology diagnostics market is in progressive phase. The molecular oncology diagnostics ecosystem is witnessing a surge in the launch of innovative products and obtaining regulatory approvals, driving significant advancements in cancer care. Companies are continuously developing new diagnostic tools that leverage cutting-edge technologies such as next-generation sequencing (NGS), liquid biopsy, and digital PCR, which enhance the accuracy and efficiency of cancer detection and monitoring. These innovations are crucial in providing personalized treatment plans and improving patient outcomes.

Impact

The expansion of the global molecular oncology diagnostics market in the coming years will be primarily driven by the rising prevalence of cancer across all types. The global incidence of cancer continues to increase due to factors such as an aging population, sedentary lifestyles, and hereditary risk factors. In 2022, there were approximately 20 million new cancer cases and 9.7 million cancer-related deaths worldwide. Lung cancer accounted for the highest share of total cancer cases at 12.40%, followed by breast cancer at 11.60%. The growing burden of cancer and the increasing emphasis on early detection are expected to propel the growth of the molecular oncology diagnostics market over the forecast period.

Market Segmentation:

Segmentation 1: by Product

- Kits and Assays

- Instruments

- Software

Based on product, the kits and assays in the global molecular oncology diagnostics market is expected to dominate by product segment owing to their recurring demand and lower cost.

Segmentation 2: by Technology

- Polymerase Chain Reaction

- Next-Generation Sequencing

- Immunohistochemistry

- Fluorescence In-Situ Hybridization

- Flow Cytometry

- Other Technologies

On the basis of technology, the global molecular oncology diagnostics market is dominated by the polymerase chain reaction segment due to its high sensitivity, accuracy, and cost-effectiveness.

Segmentation 3: by Application

- Clinical Diagnostics

- Research Use

Based on application, the global molecular oncology diagnostics market is dominated by the clinical diagnostics. This predominance has been driven by the increasing adoption of precision medicine in healthcare, where molecular diagnostics are integral for identifying specific oncogenic mutations to guide targeted therapy decisions.

Segmentation 4: by Cancer Type

- Solid Tumors

- Hematologic Malignancies

Based on cancer type, the global molecular oncology diagnostics market is dominated by the solid tumors. This predominance can be attributed to the higher prevalence of solid tumors, such as breast, lung, and colorectal cancers, compared to hematological malignancies. Solid tumors represent a broad array of the most common cancers, which necessitates extensive diagnostic testing for effective treatment planning, thus driving higher demand for molecular diagnostics within this segment.

Segmentation 5: by End User

- Hospitals and Diagnostic Centers

- Reference Laboratories

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

Based on end user, the global molecular oncology diagnostics market is dominated by the hospitals segment. This is primarily due to hospitals' direct patient care setting, where rapid and accurate diagnostic testing is crucial for timely decision-making in cancer treatment.

Segmentation 6: by Region

- North America - U.S., and Canada

- Europe - U.K., Germany, France, Italy, Spain, and Rest-of-Europe

- Asia-Pacific - Japan, China, India, South Korea, Australia, and Rest-of-Asia-Pacific

- Rest-of-the-World

North America generated the highest revenue of $969.6 million in 2023. The molecular oncology diagnostics market in North America is poised for significant growth driven by several key factors. The increasing incidence of cancer across the region is a major driver, with projections indicating a substantial rise in both solid tumors and hematological malignancies by 2050. Moreover, the region benefits from the strong presence of both global and local players, enhancing accessibility to advanced diagnostic technologies.

Recent Developments in the Global Molecular Oncology Diagnostics Market

- In May 2024, Becton, Dickinson and Company announced that the U.S. Food and Drug Administration (FDA) has approved the use of self-collected vaginal specimens for human papillomavirus (HPV) testing, to be utilized when cervical specimens are not available.

- In February 2024, Myriad Genetics, Inc. announced a research collaboration with the National Cancer Center Hospital East (NCCHE) in Japan to investigate the prognostic and predictive value of molecular residual disease (MRD) testing. The SCRUM-MONSTAR-SCREEN-3 study will utilize Myriad's ultra-sensitive MRD test, Precise MRD, to monitor circulating tumor DNA (ctDNA) over time in patients with various solid tumors and hematological cancers.

- In January 2024, Guardant Health and Hikma have partnered to provide cancer screening and comprehensive genomic profiling tests in the Middle East and North Africa.

- In November 2023, Illumina launched an advanced liquid biopsy assay designed to enable comprehensive genomic profiling of solid tumors.

Demand - Drivers and Limitations

The following are the demand drivers for the global molecular oncology diagnostics market:

- Rising Incidence of Cancer Cases

- Rising Technological Advancements in Molecular Diagnostics

- Growth in Biomarker Identification and Transformation in Molecular Techniques

- Growing Demand for Personalized Medicine

The market is expected to face some limitations due to the following challenges:

- Lack of Qualified Professionals

- High Cost of Molecular Diagnostic Kits and Assays Hindering the Adoption Rate

Key Market Players and Competition Synopsis

The global molecular oncology diagnostics market is expected to witness significant growth, fueled by the increasing incidence of cancer worldwide and the rising demand for personalized medicine. This sector is revolutionizing cancer treatment by enabling precise tumor profiling through advanced technologies such as next-generation sequencing (NGS). These innovations allow for the early detection of cancers and the identification of specific genetic mutations, facilitating tailored therapeutic strategies that enhance treatment efficacy and patient outcomes.

Some of the prominent key players in this market are:

- Abbott Laboratories

- Agilent Technologies, Inc.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Biocartis Group NV

- bioMerieux

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd

- Guardant Health, Inc.

- Hologic, Inc.

- Illumina, Inc.

- Invivoscribe, Inc.

- Myriad Genetics, Inc.

- QIAGEN N.V.

- Sysmex Corporation

- Thermo Fisher Scientific, Inc.

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Global Molecular Oncology Diagnostics Market: Industry Outlook

- 1.1 Global Incidence and Prevalence of Cancer (by Cancer Type)

- 1.1.1 North America

- 1.1.2 Europe

- 1.1.3 Asia-Pacific

- 1.1.4 Rest-of-the-World

- 1.2 Trends: Current and Future Impact Assessment

- 1.2.1 Increasing Partnerships among Players

- 1.2.2 Increasing Launch of Innovative Products and Regulatory Approvals in Molecular Oncology Diagnostics Ecosystem

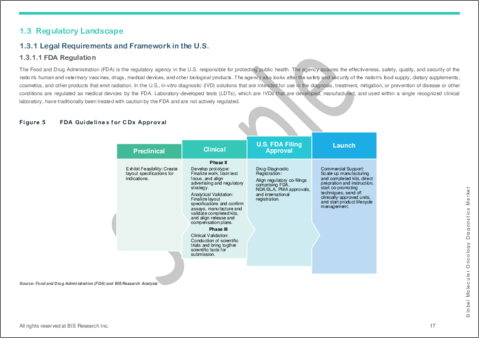

- 1.3 Regulatory Landscape

- 1.3.1 Legal Requirements and Framework in the U.S.

- 1.3.1.1 FDA Regulation

- 1.3.1.2 CMS Regulation (Reimbursement Scenario)

- 1.3.2 Legal Requirements and Framework in Europe

- 1.3.3 Legal Requirements and Framework in Asia-Pacific

- 1.3.3.1 China

- 1.3.3.2 Japan

- 1.3.1 Legal Requirements and Framework in the U.S.

- 1.4 Impact of COVID-19 on the Molecular Oncology Diagnostics Market

- 1.5 Liquid Biopsy-Based Cancer Molecular Diagnostics

- 1.6 Laboratory-Developed Test (LDT) vs. In-Vitro Diagnostics (IVD)

- 1.7 Role of Companion Diagnostics in the Molecular Oncology Diagnostics Market

- 1.8 Market Dynamics

- 1.8.1 Market Drivers

- 1.8.1.1 Rising Incidence of Cancer Cases

- 1.8.1.2 Rising Technological Advancements in Molecular Diagnostics

- 1.8.1.3 Growth in Biomarker Identification and Transformations in Molecular Techniques

- 1.8.1.4 Growing Demand for Personalized Medicine

- 1.8.2 Market Challenges

- 1.8.2.1 Lack of Qualified Professionals

- 1.8.2.2 High Cost of Molecular Diagnostic Kits and Assays Hindering the Adoption Rate

- 1.8.3 Market Opportunities

- 1.8.3.1 Focus on Reimbursement and Medical Coverage for Molecular Oncology Diagnostics

- 1.8.3.2 Focus on Next-Generation Ultrasensitive Molecular Diagnostics

- 1.8.3.3 Increasing Growth Opportunities for Molecular Diagnostics Companies in Emerging Economies

- 1.8.1 Market Drivers

2 Global Molecular Oncology Diagnostics Market (by Product)

- 2.1 Product Summary

- 2.2 Kits and Assays

- 2.3 Instruments

- 2.4 Software

3 Global Molecular Oncology Diagnostics Market (by Technology)

- 3.1 Technology Summary

- 3.2 Polymerase Chain Reaction

- 3.3 Next-Generation Sequencing

- 3.4 Immunohistochemistry

- 3.5 Fluorescence In-Situ Hybridization

- 3.6 Flow Cytometry

- 3.7 Other Technologies

4 Global Molecular Oncology Diagnostics Market (by Application)

- 4.1 Application Summary

- 4.2 Clinical Diagnostics

- 4.3 Research Use

5 Global Molecular Oncology Diagnostics Market (by Cancer Type)

- 5.1 Cancer Type Summary

- 5.2 Solid Tumors

- 5.2.1 Breast Cancer

- 5.2.2 Lung Cancer

- 5.2.3 Colorectal Cancer

- 5.2.4 Prostate Cancer

- 5.2.5 Ovarian Cancer

- 5.2.6 Other Solid Tumors

- 5.3 Hematological Malignancies

- 5.3.1 Lymphoma

- 5.3.2 Leukemia

- 5.3.3 Multiple Myeloma

- 5.3.4 Other Hematological Malignancies

6 Global Molecular Oncology Diagnostic Market (by End User)

- 6.1 End User Summary

- 6.2 Hospitals and Diagnostic Centers

- 6.3 Reference Laboratories

- 6.4 Pharmaceutical and Biotechnology Companies

- 6.5 Academic and Research Institutes

7 Global Molecular Oncology Diagnostics Market: by Region

- 7.1 Regional Summary

- 7.2 Drivers and Restraints

- 7.3 North America

- 7.3.1 Regional Overview

- 7.3.2 Driving Factors for Market Growth

- 7.3.3 Factors Challenging the Market

- 7.3.4 By Cancer Type

- 7.3.5 By End User

- 7.3.6 U.S.

- 7.3.6.1 By Cancer Type

- 7.3.6.2 By End User

- 7.3.7 Canada

- 7.3.7.1 By Cancer Type

- 7.3.7.2 By End User

- 7.4 Europe

- 7.4.1 Regional Overview

- 7.4.2 Driving Factors for Market Growth

- 7.4.3 Factors Challenging the Market

- 7.4.4 By Cancer Type

- 7.4.5 By End User

- 7.4.6 Germany

- 7.4.6.1 By Cancer Type

- 7.4.6.2 By End User

- 7.4.7 France

- 7.4.7.1 By Cancer Type

- 7.4.7.2 By End User

- 7.4.8 U.K.

- 7.4.8.1 By Cancer Type

- 7.4.8.2 By End User

- 7.4.9 Italy

- 7.4.9.1 By Cancer Type

- 7.4.9.2 By End User

- 7.4.10 Spain

- 7.4.10.1 By Cancer Type

- 7.4.10.2 By End User

- 7.4.11 Rest-of-Europe

- 7.4.11.1 By Cancer Type

- 7.4.11.2 By End User

- 7.5 Asia-Pacific

- 7.5.1 Regional Overview

- 7.5.2 Driving Factors for Market Growth

- 7.5.3 Factors Challenging the Market

- 7.5.4 By Cancer Type

- 7.5.5 By End User

- 7.5.6 China

- 7.5.6.1 By Cancer Type

- 7.5.6.2 By End User

- 7.5.7 India

- 7.5.7.1 By Cancer Type

- 7.5.7.2 By End User

- 7.5.8 Japan

- 7.5.8.1 By Cancer Type

- 7.5.8.2 By End User

- 7.5.9 South Korea

- 7.5.9.1 By Cancer Type

- 7.5.9.2 By End User

- 7.5.10 Australia

- 7.5.10.1 By Cancer Type

- 7.5.10.2 By End User

- 7.5.11 Rest-of-Asia-Pacific

- 7.5.11.1 By Cancer Type

- 7.5.11.2 By End User

- 7.6 Rest-of-the-World

- 7.6.1 Regional Overview

- 7.6.2 Driving Factors for Market Growth

- 7.6.3 Factors Challenging the Market

- 7.6.4 By Cancer Type

- 7.6.5 By End User

8 Global Molecular Oncology Diagnostics Market - Competitive Benchmarking & Company Profiles

- 8.1 Key Strategic Development

- 8.1.1 Partnerships, Alliances, and Business Expansions

- 8.1.2 New Offerings

- 8.1.3 Mergers and Acquisitions

- 8.1.4 Regulatory and Legal Activities

- 8.2 Company Share Analysis

- 8.3 Company Profiles

- 8.3.1 Abbott Laboratories

- 8.3.1.1 Overview

- 8.3.1.2 Top Products

- 8.3.1.3 Top Competitors

- 8.3.1.4 Target Customers/End User

- 8.3.1.5 Key Personnel

- 8.3.1.6 Corporate Strategies

- 8.3.1.7 Analyst View

- 8.3.2 Agilent Technologies, Inc.

- 8.3.2.1 Overview

- 8.3.2.2 Top Products/Product Portfolio

- 8.3.2.3 Top Competitors

- 8.3.2.4 Target Customers/End User

- 8.3.2.5 Key Personnel

- 8.3.2.6 Analyst View

- 8.3.3 Biocartis Group NV

- 8.3.3.1 Overview

- 8.3.3.2 Top Products

- 8.3.3.3 Top Competitors

- 8.3.3.4 Target Customers/End User

- 8.3.3.5 Key Personnel

- 8.3.3.6 Analyst View

- 8.3.4 bioMerieux

- 8.3.4.1 Overview

- 8.3.4.2 Top Products

- 8.3.4.3 Top Competitors

- 8.3.4.4 Target Customers/End User

- 8.3.4.5 Key Personnel

- 8.3.4.6 Analyst View

- 8.3.5 Bio-Rad Laboratories, Inc.

- 8.3.5.1 Overview

- 8.3.5.2 Top Products

- 8.3.5.3 Top Competitors

- 8.3.5.4 Target Customers/End User

- 8.3.5.5 Key Personnel

- 8.3.5.6 Analyst View

- 8.3.6 Danaher Corporation

- 8.3.6.1 Overview

- 8.3.6.2 Top Products/Product Portfolio

- 8.3.6.3 Top Competitors

- 8.3.6.4 Target Customers/End User

- 8.3.6.5 Key Personnel

- 8.3.6.6 Analyst View

- 8.3.7 Exact Sciences Corporation

- 8.3.7.1 Overview

- 8.3.7.2 Top Products/Product Portfolio

- 8.3.7.3 Top Competitors

- 8.3.7.4 Target Customers/End User

- 8.3.7.5 Key Personnel

- 8.3.7.6 Analyst View

- 8.3.8 F. Hoffmann-La Roche Ltd.

- 8.3.8.1 Overview

- 8.3.8.2 Top Products

- 8.3.8.3 Top Competitors

- 8.3.8.4 Target Customers/End User

- 8.3.8.5 Key Personnel

- 8.3.8.6 Analyst View

- 8.3.9 Guardant Health, Inc.

- 8.3.9.1 Overview

- 8.3.9.2 Top Products

- 8.3.9.3 Top Competitors

- 8.3.9.4 Target Customers/End User

- 8.3.9.5 Key Personnel

- 8.3.9.6 Analyst View

- 8.3.10 Hologic, Inc.

- 8.3.10.1 Overview

- 8.3.10.2 Top Products

- 8.3.10.3 Top Competitors

- 8.3.10.4 Target Customers/End User

- 8.3.10.5 Key Personnel

- 8.3.10.6 Analyst View

- 8.3.11 Illumina, Inc.

- 8.3.11.1 Overview

- 8.3.11.2 Top Products

- 8.3.11.3 Top Competitors

- 8.3.11.4 Target Customers/End User

- 8.3.11.5 Key Personnel

- 8.3.11.6 Analyst View

- 8.3.12 Invivoscribe, Inc.

- 8.3.12.1 Overview

- 8.3.12.2 Top Products

- 8.3.12.3 Target Competitors

- 8.3.12.4 Target Customers/End User

- 8.3.12.5 Key Personnel

- 8.3.12.6 Analyst View

- 8.3.13 Myriad Genetics, Inc.

- 8.3.13.1 Overview

- 8.3.13.2 Top Products

- 8.3.13.3 Top Competitors

- 8.3.13.4 Target Customers/End User

- 8.3.13.5 Key Personnel

- 8.3.13.6 Analyst View

- 8.3.14 QIAGEN N.V.

- 8.3.14.1 Overview

- 8.3.14.2 Top Products

- 8.3.14.3 Top Competitors

- 8.3.14.4 Target Customers/End User

- 8.3.14.5 Key Personnel

- 8.3.14.6 Analyst View

- 8.3.15 Sysmex Corporation

- 8.3.15.1 Overview

- 8.3.15.2 Top Products

- 8.3.15.3 Top Competitors

- 8.3.15.4 Target Customers/End User

- 8.3.15.5 Key Personnel

- 8.3.15.6 Analyst View

- 8.3.16 Thermo Fisher Scientific, Inc.

- 8.3.16.1 Overview

- 8.3.16.2 Top Products

- 8.3.16.3 Top Competitors

- 8.3.16.4 Target Customers/End User

- 8.3.16.5 Key Personnel

- 8.3.16.6 Analyst View

- 8.3.1 Abbott Laboratories

9 Research Methodology

- 9.1 Data Sources

- 9.1.1 Primary Data Sources

- 9.1.2 Secondary Data Sources

- 9.1.3 Data Triangulation

- 9.2 Market Estimation and Forecast