|

|

市場調査レポート

商品コード

1681515

欧州のデジタルPCR市場:用途別、エンドユーザー別、国別 - 分析と予測(2024年~2034年)Europe Digital PCR Market: Focus on Application, End User, and Country Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のデジタルPCR市場:用途別、エンドユーザー別、国別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年03月19日

発行: BIS Research

ページ情報: 英文 72 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のデジタルPCR(d-PCR)の市場規模は、2024年の1億8,390万米ドルから2034年には7億6,270万米ドルに達し、予測期間の2024年~2034年のCAGRは15.29%になると予測されています。

欧州のデジタルPCR市場は、遺伝子疾患のスクリーニングと診断のための個別化医療の利用の増加により、2桁成長を遂げています。この患者個別化戦略は、デジタルPCR(dPCR)に大きく依存しており、様々ながんに関連する珍しい遺伝子変異を正確に同定・測定します。さらに、迅速かつ正確な診断ソリューションへのニーズは、欧州全域で感染症の発生率が高まっていることによっても高まっています。欧州における市場の成長は、dPCRの能力を向上させている液滴デジタルPCR、ナノプレート技術、マイクロ流体プラットフォームなどの技術進歩によって大きく助けられています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 1億8,390万米ドル |

| 2034年の予測 | 7億6,270万米ドル |

| CAGR | 15.29% |

欧州では個別化医療の普及と極めて正確な診断の必要性から、デジタルPCR市場が急成長しています。卓越した感度と特異性を持つデジタルPCR(dPCR)は、低存在量の遺伝子変異の同定や、早期診断や治療モニタリングに不可欠なバイオマーカーの測定に特に有用です。感染症、遺伝性疾患、がんの増加により、最先端の分子診断技術への投資が促されています。

液滴デジタルPCR、ナノプレート技術、マイクロ流体プラットフォームなどの技術進歩により、アッセイの精度、スループット、臨床ワークフローへの組み込みやすさが大幅に向上しています。さらに、市場導入は、政府のイニシアチブ、有利な規制の枠組み、ヘルスケアインフラのための資金増加により、大陸全体で加速しています。欧州のデジタルPCR市場は、トップレベルの研究機関とビジネスリーダーが協力して信頼性の高い患者特異的な診断ソリューションを生み出し続けているため、着実に成長すると予想されます。分子診断学の展望を変えるだけでなく、このダイナミックな市場は、患者の転帰を改善する個別化治療計画への扉を開いています。

全体として、技術革新、規制当局のサポート、進化する臨床的要求の融合が、欧州におけるデジタルPCR市場の堅調な拡大を牽引しています。さらに、成長する研究協力と投資は、欧州におけるデジタルPCRの統合をさらに進めるとみられています。

当レポートでは、欧州のデジタルPCR市場について調査し、市場の概要とともに、用途別、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 市場概要

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 進行中のデジタルPCR臨床試験

- 規制状況

- 市場力学の概要

第2章 地域

- 地域のサマリー

- 促進要因と抑制要因

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合情勢

- 市場シェア分析

- 企業プロファイル

- QIAGEN N.V.

- F. Hoffmann-La Roche Ltd

- Merck KGaA

- Stilla Technologies Inc.

- SAGA Diagnostics AB

- JETA Molecular BV.

第4章 調査手法

List of Figures

- Figure 1: Digital PCR Market, by Region, $Million, 2023, 2029, and 2034

- Figure 2: Europe Digital PCR Market (by Application), $Million 202, 2029 and 2034

- Figure 3: Europe Digital PCR Market (by End User), $Million, 2023, 2029, and 2034

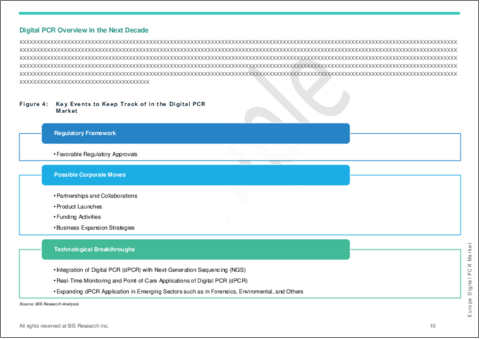

- Figure 4: Key Events to Keep Track of in the Digital PCR Market

- Figure 5: Supply Chain and Risks within the Supply Chain

- Figure 6: Digital PCR Market (by Region), January 2020-September 2024

- Figure 7: Digital PCR Market (by Country), January 2020-September 2024

- Figure 8: Digital PCR Market (by Year), January 2020-September 2024

- Figure 9: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 10: France Digital PCR Market, $Million, 2023-2034

- Figure 11: Germany Digital PCR Market, $Million, 2023-2034

- Figure 12: U.K. Digital PCR Market, $Million, 2023-2034

- Figure 13: Spain Digital PCR Market, $Million, 2023-2034

- Figure 14: Italy Digital PCR Market, $Million, 2023-2034

- Figure 15: Rest-of-Europe Digital PCR Market, $Million, 2023-2034

- Figure 16: Strategic Initiatives, January 2019-September 2024

- Figure 17: Share of Strategic Initiatives, January 2019-September 2024

- Figure 18: Digital PCR Market, Mergers and Acquisitions, January 2019-September 2024

- Figure 19: Digital PCR Market, Synergistic Activities, January 2019-September 2024

- Figure 20: Digital PCR Market, Product Launch and Approval Activities, January 2019-September 2024

- Figure 21: Digital PCR Market, Expansion, Funding, and Other Activities January 2019-September 2024

- Figure 22: Data Triangulation

- Figure 23: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 24: Top-Down Approach (Segment-Wise Analysis)

- Figure 25: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Digital PCR Market, Share Analysis, 2023

- Table 4: Comparison of qPCR and dPCR

- Table 5: Digital PCR Market, Trend Analysis

- Table 6: Digital PCR Market, Recent Product Launches

- Table 7: Some of the Ongoing Digital PCR (d-PCR) Clinical Trials

- Table 8: Funding Allocated for Precision Medicine to Different Agencies Globally

- Table 9: Cost for Different Commercialized Digital PCR (d-PCR) Platforms

- Table 10: Digital PCR Market (by Region), $Million, 2023-2034

- Table 11: Europe Digital PCR Market (by Application), $Million, 2023-2034

- Table 12: Europe Digital PCR Market (by End User), $Million, 2023-2034

- Table 13: France Digital PCR Market (by Application), $Million, 2023-2034

- Table 14: France Digital PCR Market (by End User), $Million, 2023-2034

- Table 15: Germany Digital PCR Market (by Application), $Million, 2023-2034

- Table 16: Germany Digital PCR Market (by End User), $Million, 2023-2034

- Table 17: U.K. Digital PCR Market (by Application), $Million, 2023-2034

- Table 18: U.K. Digital PCR Market (by End User), $Million, 2023-2034

- Table 19: Spain Digital PCR Market (by Application), $Million, 2023-2034

- Table 20: Spain Digital PCR Market (by End User), $Million, 2023-2034

- Table 21: Italy Digital PCR Market (by Application), $Million, 2023-2034

- Table 22: Italy Digital PCR Market (by End User), $Million, 2023-2034

- Table 23: Rest-of-Europe Digital PCR Market (by Application), $Million, 2023-2034

- Table 24: Rest-of-Europe Digital PCR Market (by End User), $Million, 2023-2034

- Table 25: Digital PCR Market. Market Share Analysis, 2023

Introduction to Europe Digital PCR Market

The Europe digital PCR (d-PCR) market is projected to reach $762.7 million by 2034 from $183.9 million in 2024, growing at a CAGR of 15.29% during the forecast period 2024-2034. The market for digital PCRs in Europe has grown by double digits due to the increasing use of personalised medicine for genetic disorder screening and diagnosis. This patient-specific strategy relies heavily on digital PCR (dPCR), which accurately identifies and measures uncommon genetic mutations connected to a range of cancers. Furthermore, the need for quick and precise diagnostic solutions is being fuelled by the growing incidence of infectious diseases throughout Europe. The market's growth in Europe is being greatly aided by technological advancements like droplet digital PCR, nanoplate technology, and microfluidic platforms, which are improving dPCR capabilities.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $183.9 Million |

| 2034 Forecast | $762.7 Million |

| CAGR | 15.29% |

The market for digital PCR is growing quickly in Europe due to the growing use of personalised medicine and the need for extremely accurate diagnostics. With its remarkable sensitivity and specificity, digital PCR (dPCR) is especially useful for identifying low-abundance genetic mutations and measuring biomarkers that are essential for early diagnosis and treatment monitoring. Increasing rates of infectious diseases, genetic disorders, and cancers have prompted investments in cutting-edge molecular diagnostic technologies.

The accuracy, throughput, and ease of integration of assays into clinical workflows have been greatly enhanced by technological advancements like droplet digital PCR, nanoplate technology, and microfluidic platforms. Furthermore, market adoption has accelerated throughout the continent due to government initiatives, favourable regulatory frameworks, and increased funding for healthcare infrastructure. The European digital PCR market is expected to grow steadily as top research institutes and business leaders keep working together to create reliable, patient-specific diagnostic solutions. In addition to changing the molecular diagnostics landscape, this dynamic market is opening the door for individualised treatment plans that improve patient outcomes.

Overall, the convergence of technological innovation, regulatory support, and evolving clinical demands is driving the digital PCR market's robust expansion in Europe. Additionally, growing research collaborations and investments will further integrate digital PCR in Europe.

Market Segmentation:

Segmentation 1: by Application

- Clinical and Research Application

- Environmental Application

- Other Application

Segmentation 2: by End User

- Academic and Research Institutes

- Hospitals and Clinics

- Diagnostic Centers

- Pharmaceutical and Biopharmaceutical Companies

- Other End User

Segmentation 3: by Region

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The Europe digital PCR market has been extensively segmented based on various categories, such as application, end user, and country. This can help readers understand which segments account for the largest share and which are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Mergers, acquisitions, and product launches accounted for the maximum number of key developments.

Competitive Strategy: The Europe digital PCR market has numerous established players with product portfolios. Key players in the Europe digital PCR market analyzed and profiled in the study involve established players offering products for digital PCR.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts, who have analyzed company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- QIAGEN N.V.

- F. Hoffmann-La Roche Ltd

- Merck KGaA

- Stilla Technologies Inc.

- SAGA Diagnostics AB

- JETA Molecular BV.

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Market Overview

- 1.1.1 Workflow of Digital PCR

- 1.1.2 Comparison of qPCR and dPCR

- 1.2 Trends: Current and Future Impact Assessment

- 1.2.1 Integration with Next-Generation Sequencing (NGS)

- 1.2.2 Increased Real-time Monitoring and Point-of-care Applications of Digital PCR

- 1.2.3 Increasing Product Launches in d-PCR Ecosystem

- 1.3 Supply Chain Overview

- 1.4 Research and Development Review

- 1.4.1 Patent Filing Trend (by Region)

- 1.4.2 Patent Filing Trend (by Country)

- 1.4.3 Patent Filing Trend (by Year)

- 1.5 Ongoing Digital PCR Clinical Trials

- 1.6 Regulatory Landscape

- 1.6.1 European Union

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Increasing Adoption of Personalized Medicine for Screening and Diagnostics of Genetic Disorders such as Rare Diseases and Cancer

- 1.7.1.2 Increasing Incidence of Infectious Diseases

- 1.7.1.3 Technological Advancement in dPCR to Enhance Market Growth

- 1.7.2 Market Restraints

- 1.7.2.1 High Cost of Platforms Associated with Digital-PCR

- 1.7.2.2 Shortage of Skilled Professionals and Trained Laboratory Technicians

- 1.7.3 Market Opportunities

- 1.7.3.1 Increased Use of Digital-PCR-Based Solutions for the Development of Therapeutics Drugs and Comprehensive Treatment Plan

- 1.7.3.2 Growing Adoption of dPCR in Emerging Markets

- 1.7.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Drivers and Restraints

- 2.3 Europe

- 2.3.1 Regional Overview

- 2.3.2 Driving Factors for Market Growth

- 2.3.3 Factors Challenging the Market

- 2.3.4 By Application

- 2.3.5 By End User

- 2.3.6 France

- 2.3.7 Germany

- 2.3.8 U.K.

- 2.3.9 Spain

- 2.3.10 Italy

- 2.3.11 Rest-of-Europe

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Landscape

- 3.1.1 Mergers and Acquisitions

- 3.1.2 Synergistic Activities

- 3.1.3 Product Launch and Approval Activities

- 3.1.4 Expansion, Funding, and Other Activities

- 3.2 Market Share Analysis

- 3.3 Company Profile

- 3.3.1 QIAGEN N.V.

- 3.3.1.1 Overview

- 3.3.1.2 Top Products/Product Portfolio

- 3.3.1.3 Top Competitors

- 3.3.1.4 Target Customers

- 3.3.1.5 Key Personnel

- 3.3.1.6 Analyst View

- 3.3.2 F. Hoffmann-La Roche Ltd

- 3.3.2.1 Overview

- 3.3.2.2 Top Products/Product Portfolio

- 3.3.2.3 Top Competitors

- 3.3.2.4 Target Customers

- 3.3.2.5 Key Personnel

- 3.3.2.6 Analyst View

- 3.3.3 Merck KGaA

- 3.3.3.1 Overview

- 3.3.3.2 Top Products/Product Portfolio

- 3.3.3.3 Top Competitors

- 3.3.3.4 Target Customers

- 3.3.3.5 Key Personnel

- 3.3.3.6 Analyst View

- 3.3.4 Stilla Technologies Inc.

- 3.3.4.1 Overview

- 3.3.4.2 Top Products/Product Portfolio

- 3.3.4.3 Top Competitors

- 3.3.4.4 Target Customers

- 3.3.4.5 Key Personnel

- 3.3.4.6 Analyst View

- 3.3.5 SAGA Diagnostics AB

- 3.3.5.1 Overview

- 3.3.5.2 Top Products/Product Portfolio

- 3.3.5.3 Top Competitors

- 3.3.5.4 Target Customers

- 3.3.5.5 Key Personnel

- 3.3.5.6 Analyst View

- 3.3.6 JETA Molecular BV.

- 3.3.6.1 Overview

- 3.3.6.2 Top Products/Product Portfolio

- 3.3.6.3 Top Competitors

- 3.3.6.4 Target Customers

- 3.3.6.5 Key Personnel

- 3.3.6.6 Analyst View

- 3.3.1 QIAGEN N.V.

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast