|

|

市場調査レポート

商品コード

1637363

欧州のノンアルコール飲料市場:製品・投資・主要動向 - 分析・予測 (2024~2034年)Europe Non-Alcoholic Beverage Market: Focus on Products, Investments, Key Trends - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のノンアルコール飲料市場:製品・投資・主要動向 - 分析・予測 (2024~2034年) |

|

出版日: 2025年01月20日

発行: BIS Research

ページ情報: 英文 117 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のノンアルコール飲料の市場規模は、2024年の2,992億米ドルから、予測期間中は5.67%のCAGRで推移し、2034年には5,192億米ドルの規模に成長すると予測されています。

欧州のノンアルコール飲料市場は、ジュース、紅茶、コーヒー、ソフトドリンク、ボトル入り飲料水、機能性飲料など、多種多様な商品を提供しています。消費者の嗜好は、より健康的で多様な飲料を好むように変化しており、これがこの市場を牽引しています。植物由来の飲料水や機能性飲料など、製品開発におけるイノベーションによって、より健康効果の高い飲料に対する需要の高まりが満たされています。

The Coca-Cola Company、PepsiCo、Nestleなどの市場リーダーがこの分野を支配しているため、市場は非常に競争が激しいです。消費者の選択はウェルネスと持続可能性に影響されており、天然素材や環境に優しいパッケージへの投資を企業に促しています。従来の飲料に代わる、より健康的な新しい飲料を提供するこのダイナミックな市場は、顧客の嗜好やライフスタイルの変化に合わせて変化し続けています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2034年 |

| 2024年の評価額 | 2,992億米ドル |

| 2034年予測 | 5,192億米ドル |

| CAGR | 5.67% |

市場セグメンテーション

セグメンテーション1:カテゴリー別

- ウォーター

- ジュース

- ソフトドリンク

- 紅茶

- コーヒー

- 乳製品・植物性ミルク

- ノンアルコールビール・ワイン

- 機能性飲料

- スペシャルティ飲料

ウォーター:

- スティルウォーター

- スパークリングウォーター

- フレーバーウォーター

ジュース:

- フルーツジュース

- 野菜ジュース

- スムージー

ソフトドリンク:

- 炭酸飲料

- 炭酸飲料

ティー:

- 伝統茶

- ハーブティー

- アイスティー

コーヒー:

- コーヒー

- エスプレッソ

- コールドブリューコーヒー

- カフェインレスコーヒー

乳製品・植物性ミルク:

- 生乳

- 植物性ミルク

- ミルクベースシェイク・ドリンク

ノンアルコールビール・ワイン:

- ノンアルコールビール

- ノンアルコールワイン

機能性飲料:

- エナジードリンク

- スポーツドリンク

- プロバイオティクス飲料

- 強化ウォーター・ジュース

- その他

特殊飲料:

- モクテル

- ココナッツウォーター

- コンブチャ

- その他

セグメンテーション2:製法別

- 小売パッケージ

- RTD (Ready-to-Drink)

- プレミックス飲料

- シロップ・濃縮飲料

- ミキサー

- レストラン・フードチェーン

セグメンテーション3:国別

- ドイツ

- フランス

- 英国

- イタリア

- オランダ

- ノルウェー

- その他

当レポートでは、欧州の欧州のノンアルコール飲料の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術開発・特許の動向、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場

- 動向:現在および将来の影響評価

- 飲料動向

- 消費者の嗜好と習慣の変化

- 観察された動向

- サプライチェーンの概要

- バリューチェーン分析

- 価格予測

- 研究開発レビュー

- 特許出願動向(国別、企業別)

- 規制状況

- 市場力学の概要

- 市場促進要因

- 市場の課題

- 市場機会

- スタートアップ資金調達の概要

第2章 地域

- 地域別概要

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- 製品

- ドイツ

- フランス

- 英国

- イタリア

- オランダ

- ノルウェー

- その他

第3章 市場:競合ベンチマーキング・企業プロファイル

- 次なるフロンティア

- 地理的評価

- Nestle

- Danone S.A.

- Unilever

- Diageo

- Britvic plc

- AB InBev

第4章 調査手法

List of Figures

- Figure 1: Non-Alcoholic Beverage Market (by Region), $Billion, 2024, 2030, and 2034

- Figure 2: Pricing Analysis for Non-Alcoholic Beverage Market (by Global and Region), $/Liter, 2024, 2030, and 2034

- Figure 3: Europe Non-Alcoholic Beverage Market (by Preparation), $Billion, 2024, 2030, and 2034

- Figure 4: Europe Non-Alcoholic Beverage Market (by Category), $Billion, 2024, 2030, and 2034

- Figure 5: Key Events

- Figure 6: Supply Chain and Risks within the Supply Chain

- Figure 7: Non-Alcoholic Beverage Market (by Country), January 2019 to December 2023

- Figure 8: Non-Alcoholic Beverage Market (by Company), January 2019 to December 2023

- Figure 9: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 10: Germany Non-Alcoholic Beverage Market, $Billion, 2023-2034

- Figure 11: France Non-Alcoholic Beverage Market, $Billion, 2023-2034

- Figure 12: U.K. Non-Alcoholic Beverage Market, $Billion, 2023-2034

- Figure 13: Italy Non-Alcoholic Beverage Market, $Billion, 2023-2034

- Figure 14: Netherlands Non-Alcoholic Beverage Market, $Billion, 2023-2034

- Figure 15: Norway Non-Alcoholic Beverage Market, $Billion, 2023-2034

- Figure 16: Rest-of-Europe Non-Alcoholic Beverage Market, $Billion, 2023-2034

- Figure 17: Strategic Initiatives, January 2019- June 2024

- Figure 18: Share of Strategic Initiatives, 2019-2024

- Figure 19: Business and Corporate Strategy Outlook: Focusing Trends

- Figure 20: Data Triangulation

- Figure 21: Top-Down and Bottom-Up Approach

- Figure 22: Assumptions and Limitations

List of Tables

- Table 1: Opportunities across Regions

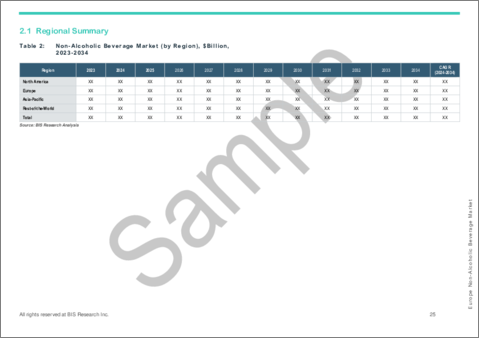

- Table 2: Non-Alcoholic Beverage Market (by Region), $Billion, 2023-2034

- Table 3: Europe Non-Alcoholic Beverage Market (by Category), $Billion, 2023-2034

- Table 4: Europe Non-Alcoholic Beverage Market (by Water), $Billion, 2023-2034

- Table 5: Europe Non-Alcoholic Beverage Market (by Juice), $Billion, 2023-2034

- Table 6: Europe Non-Alcoholic Beverage Market (by Soft Drinks), $Billion, 2023-2034

- Table 7: Europe Non-Alcoholic Beverage Market (by Tea), $Billion, 2023-2034

- Table 8: Europe Non-Alcoholic Beverage Market (by Coffee), $Billion, 2023-2034

- Table 9: Europe Non-Alcoholic Beverage Market (by Dairy and Plant-Based Milk), $Billion, 2023-2034

- Table 10: Europe Non-Alcoholic Beverage Market (by Non-Alcoholic Beer and Wine), $Billion, 2023-2034

- Table 11: Europe Non-Alcoholic Beverage Market (by Functional Beverages), $Billion, 2023-2034

- Table 12: Europe Non-Alcoholic Beverage Market (by Specialty Drinks), $Billion, 2023-2034

- Table 13: Europe Non-Alcoholic Beverage Market (by Preparation), $Billion, 2023-2034

- Table 14: Europe Non-Alcoholic Beverage Market (by Retail Packaged), $Billion, 2023-2034

- Table 15: Germany Non-Alcoholic Beverage Market (by Category), $Billion, 2023-2034

- Table 16: Germany Non-Alcoholic Beverage Market (by Water), $Billion, 2023-2034

- Table 17: Germany Non-Alcoholic Beverage Market (by Juice), $Billion, 2023-2034

- Table 18: Germany Non-Alcoholic Beverage Market (by Soft Drinks), $Billion, 2023-2034

- Table 19: Germany Non-Alcoholic Beverage Market (by Tea), $Billion, 2023-2034

- Table 20: Germany Non-Alcoholic Beverage Market (by Coffee), $Billion, 2023-2034

- Table 21: Germany Non-Alcoholic Beverage Market (by Dairy and Plant-Based Milk), $Billion, 2023-2034

- Table 22: Germany Non-Alcoholic Beverage Market (by Non-Alcoholic Beer and Wine), $Billion, 2023-2034

- Table 23: Germany Non-Alcoholic Beverage Market (by Functional Beverages), $Billion, 2023-2034

- Table 24: Germany Non-Alcoholic Beverage Market (by Specialty Drinks), $Billion, 2023-2034

- Table 25: Germany Non-Alcoholic Beverage Market (by Preparation), $Billion, 2023-2034

- Table 26: Germany Non-Alcoholic Beverage Market (by Retail Packaged), $Billion, 2023-2034

- Table 27: France Non-Alcoholic Beverage Market (by Category), $Billion, 2023-2034

- Table 28: France Non-Alcoholic Beverage Market (by Water), $Billion, 2023-2034

- Table 29: France Non-Alcoholic Beverage Market (by Juice), $Billion, 2023-2034

- Table 30: France Non-Alcoholic Beverage Market (by Soft Drinks), $Billion, 2023-2034

- Table 31: France Non-Alcoholic Beverage Market (by Tea), $Billion, 2023-2034

- Table 32: France Non-Alcoholic Beverage Market (by Coffee), $Billion, 2023-2034

- Table 33: France Non-Alcoholic Beverage Market (by Dairy and Plant-Based Milk), $Billion, 2023-2034

- Table 34: France Non-Alcoholic Beverage Market (by Non-Alcoholic Beer and Wine), $Billion, 2023-2034

- Table 35: France Non-Alcoholic Beverage Market (by Functional Beverages), $Billion, 2023-2034

- Table 36: France Non-Alcoholic Beverage Market (by Specialty Drinks), $Billion, 2023-2034

- Table 37: France Non-Alcoholic Beverage Market (by Preparation), $Billion, 2023-2034

- Table 38: France Non-Alcoholic Beverage Market (by Retail Packaged), $Billion, 2023-2034

- Table 39: U.K. Non-Alcoholic Beverage Market (by Category), $Billion, 2023-2034

- Table 40: U.K. Non-Alcoholic Beverage Market (by Water), $Billion, 2023-2034

- Table 41: U.K. Non-Alcoholic Beverage Market (by Juice), $Billion, 2023-2034

- Table 42: U.K. Non-Alcoholic Beverage Market (by Soft Drinks), $Billion, 2023-2034

- Table 43: U.K. Non-Alcoholic Beverage Market (by Tea), $Billion, 2023-2034

- Table 44: U.K. Non-Alcoholic Beverage Market (by Coffee), $Billion, 2023-2034

- Table 45: U.K. Non-Alcoholic Beverage Market (by Dairy and Plant-Based Milk), $Billion, 2023-2034

- Table 46: U.K. Non-Alcoholic Beverage Market (by Non-Alcoholic Beer and Wine), $Billion, 2023-2034

- Table 47: U.K. Non-Alcoholic Beverage Market (by Functional Beverages), $Billion, 2023-2034

- Table 48: U.K. Non-Alcoholic Beverage Market (by Specialty Drinks), $Billion, 2023-2034

- Table 49: U.K. Non-Alcoholic Beverage Market (by Preparation), $Billion, 2023-2034

- Table 50: U.K. Non-Alcoholic Beverage Market (by Retail Packaged), $Billion, 2023-2034

- Table 51: Italy Non-Alcoholic Beverage Market (by Category), $Billion, 2023-2034

- Table 52: Italy Non-Alcoholic Beverage Market (by Water), $Billion, 2023-2034

- Table 53: Italy Non-Alcoholic Beverage Market (by Juice), $Billion, 2023-2034

- Table 54: Italy Non-Alcoholic Beverage Market (by Soft Drinks), $Billion, 2023-2034

- Table 55: Italy Non-Alcoholic Beverage Market (by Tea), $Billion, 2023-2034

- Table 56: Italy Non-Alcoholic Beverage Market (by Coffee), $Billion, 2023-2034

- Table 57: Italy Non-Alcoholic Beverage Market (by Dairy and Plant-Based Milk), $Billion, 2023-2034

- Table 58: Italy Non-Alcoholic Beverage Market (by Non-Alcoholic Beer and Wine), $Billion, 2023-2034

- Table 59: Italy Non-Alcoholic Beverage Market (by Functional Beverages), $Billion, 2023-2034

- Table 60: Italy Non-Alcoholic Beverage Market (by Specialty Drinks), $Billion, 2023-2034

- Table 61: Italy Non-Alcoholic Beverage Market (by Preparation), $Billion, 2023-2034

- Table 62: Italy Non-Alcoholic Beverage Market (by Retail Packaged), $Billion, 2023-2034

- Table 63: Netherlands Non-Alcoholic Beverage Market (by Category), $Billion, 2023-2034

- Table 64: Netherlands Non-Alcoholic Beverage Market (by Water), $Billion, 2023-2034

- Table 65: Netherlands Non-Alcoholic Beverage Market (by Juice), $Billion, 2023-2034

- Table 66: Netherlands Non-Alcoholic Beverage Market (by Soft Drinks), $Billion, 2023-2034

- Table 67: Netherlands Non-Alcoholic Beverage Market (by Tea), $Billion, 2023-2034

- Table 68: Netherlands Non-Alcoholic Beverage Market (by Coffee), $Billion, 2023-2034

- Table 69: Netherlands Non-Alcoholic Beverage Market (by Dairy and Plant-Based Milk), $Billion, 2023-2034

- Table 70: Netherlands Non-Alcoholic Beverage Market (by Non-Alcoholic Beer and Wine), $Billion, 2023-2034

- Table 71: Netherlands Non-Alcoholic Beverage Market (by Functional Beverages), $Billion, 2023-2034

- Table 72: Netherlands Non-Alcoholic Beverage Market (by Specialty Drinks), $Billion, 2023-2034

- Table 73: Netherlands Non-Alcoholic Beverage Market (by Preparation), $Billion, 2023-2034

- Table 74: Netherlands Non-Alcoholic Beverage Market (by Retail Packaged), $Billion, 2023-2034

- Table 75: Norway Non-Alcoholic Beverage Market (by Category), $Billion, 2023-2034

- Table 76: Norway Non-Alcoholic Beverage Market (by Water), $Billion, 2023-2034

- Table 77: Norway Non-Alcoholic Beverage Market (by Juice), $Billion, 2023-2034

- Table 78: Norway Non-Alcoholic Beverage Market (by Soft Drinks), $Billion, 2023-2034

- Table 79: Norway Non-Alcoholic Beverage Market (by Tea), $Billion, 2023-2034

- Table 80: Norway Non-Alcoholic Beverage Market (by Coffee), $Billion, 2023-2034

- Table 81: Norway Non-Alcoholic Beverage Market (by Dairy and Plant-Based Milk), $Billion, 2023-2034

- Table 82: Norway Non-Alcoholic Beverage Market (by Non-Alcoholic Beer and Wine), $Billion, 2023-2034

- Table 83: Norway Non-Alcoholic Beverage Market (by Functional Beverages), $Billion, 2023-2034

- Table 84: Norway Non-Alcoholic Beverage Market (by Specialty Drinks), $Billion, 2023-2034

- Table 85: Norway Non-Alcoholic Beverage Market (by Preparation), $Billion, 2023-2034

- Table 86: Norway Non-Alcoholic Beverage Market (by Retail Packaged), $Billion, 2023-2034

- Table 87: Rest-of-Europe Non-Alcoholic Beverage Market (by Category), $Billion, 2023-2034

- Table 88: Rest-of-Europe Non-Alcoholic Beverage Market (by Water), $Billion, 2023-2034

- Table 89: Rest-of-Europe Non-Alcoholic Beverage Market (by Juice), $Billion, 2023-2034

- Table 90: Rest-of-Europe Non-Alcoholic Beverage Market (by Soft Drinks), $Billion, 2023-2034

- Table 91: Rest-of-Europe Non-Alcoholic Beverage Market (by Tea), $Billion, 2023-2034

- Table 92: Rest-of-Europe Non-Alcoholic Beverage Market (by Coffee), $Billion, 2023-2034

- Table 93: Rest-of-Europe Non-Alcoholic Beverage Market (by Dairy and Plant-Based Milk), $Billion, 2023-2034

- Table 94: Rest-of-Europe Non-Alcoholic Beverage Market (by Non-Alcoholic Beer and Wine), $Billion, 2023-2034

- Table 95: Rest-of-Europe Non-Alcoholic Beverage Market (by Functional Beverages), $Billion, 2023-2034

- Table 96: Rest-of-Europe Non-Alcoholic Beverage Market (by Specialty Drinks), $Billion, 2023-2034

- Table 97: Rest-of-Europe Non-Alcoholic Beverage Market (by Preparation), $Billion, 2023-2034

- Table 98: Rest-of-Europe Non-Alcoholic Beverage Market (by Retail Packaged), $Billion, 2023-2034

- Table 99: Market Share, 2023

Introduction to Europe Non-Alcoholic Beverage Market

The Europe non-alcoholic beverage market is projected to reach $519.2 billion by 2034 from $299.2 billion in 2024, growing at a CAGR of 5.67% during the forecast period 2024-2034. The European market for non-alcoholic beverages offers a wide variety of goods, including juices, teas, coffees, soft drinks, bottled water, and functional beverages. Consumer preferences are changing in favor of healthier and more diverse drink options, which is driving this market. The increasing demand for beverages with extra health benefits is being met by innovations in product development, such as plant-based waters and functional drinks.

With market leaders like The Coca-Cola Company, PepsiCo, and Nestle controlling the sector, the market is extremely competitive. Consumer choices are being influenced by growing wellness and sustainability awareness, which is pushing businesses to spend money on natural ingredients and eco-friendly packaging. Offering new, healthier substitutes for conventional beverages, this dynamic market keeps changing as it adjusts to the shifting tastes and lifestyles of its customers.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $299.2 Billion |

| 2034 Forecast | $519.2 Billion |

| CAGR | 5.67% |

Market Introduction

The market for non-alcoholic beverages in Europe is expanding quickly due to shifting consumer tastes for more varied and healthful beverage options. A wide variety of goods are sold in this market, such as fruit juices, teas, coffees, soft drinks, bottled water, and functional beverages. Demand for beverages with additional nutritional value and wellness benefits is rising as consumers become more health conscious. This increasing demand is being met by innovations in product development, such as the launch of sugar-free beverages, plant-based waters, and functional beverages with probiotics, vitamins, and minerals added.

Major international corporations like The Coca-Cola Company, PepsiCo, and Nestle dominate the competitive landscape and are constantly diversifying their product lines to satisfy changing consumer demands. Furthermore, sustainability is a major priority in the European market, with many companies investing in eco-friendly packaging, natural ingredients, and environmentally responsible production practices.

European consumers are placing a greater emphasis on wellness, and functional beverages provide advantages like increased energy, better hydration, and digestive health. The rising demand for plant-based and organic beverage options goes hand in hand with this trend. To stay competitive in the rapidly growing non-alcoholic beverage market, businesses must adjust to these shifting consumer preferences and make investments in creative solutions.

Market Segmentation

Segmentation 1: by Category

- Water

- Juices

- Soft Drinks

- Tea

- Coffee

- Dairy and Plant-Based Milk

- Non-Alcoholic Beer and Wine

- Functional Beverages

- Specialty Drinks

By Water

- Still Water

- Sparkling Water

- Flavored Water

By Juices

- Fruit Juices

- Vegetable Juices

- Smoothies

By Soft Drinks

- Sodas

- Non-Carbonated Soft Drinks

By Tea

- Traditional Tea

- Herbal Tea

- Iced Tea

By Coffee

- Brewed Coffee

- Espresso

- Cold Brew Coffee

- Decaffeinated Coffee

By Dairy and Plant-Based Milk

- Raw Milk

- Plant-Based Milk

- Milk-Based Shakes and Drinks

By Non-Alcoholic Beer and Wine

- Non-Alcoholic Beer

- Non-Alcoholic Wine

By Functional Beverages

- Energy Drinks

- Sports Drinks

- Probiotic Drinks

- Fortified Water and Juice

- Others

By Specialty Drinks

- Mocktails

- Coconut Water

- Kombucha

- Others

Segmentation 2: by Preparation

- Retail Packaged

- Ready-to-Drink

- Pre-Mix Beverages

- Syrups and Concentrates

- Mixers

- Restaurants and Food Chain

Segmentation 3: by Country

- Germany

- France

- U.K.

- Italy

- Netherlands

- Norway

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products available in Europe region. Moreover, the study provides the reader with a detailed understanding of the non-alcoholic beverage market by products based on category and preparation.

Growth/Marketing Strategy: The Europe non-alcoholic beverage market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been product launches and acquisitions to strengthen their position in the non-alcoholic beverage market.

Competitive Strategy: Key players in the Europe non-alcoholic beverage market have been analyzed and profiled in the study of non-alcoholic beverage products. Moreover, a detailed competitive benchmarking of the players operating in the non-alcoholic beverage market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- Nestle

- Unilever

- Diageo

- AB InBev

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Beverage Trends

- 1.1.1.1 Rise of Functional Beverages

- 1.1.1.1.1 Investments and Key Companies

- 1.1.1.2 Personalized Beverages

- 1.1.1.2.1 Investments and Key Companies

- 1.1.1.3 Plant-Based Waters

- 1.1.1.3.1 Investments and Key Companies

- 1.1.1.4 Non-Alcoholic Alternatives

- 1.1.1.4.1 Investments and Key Companies

- 1.1.1.1 Rise of Functional Beverages

- 1.1.2 Consumer Preferences and Change in Drinking Habits

- 1.1.3 Trends Observed

- 1.1.1 Beverage Trends

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country, Company)

- 1.4 Regulatory Landscape

- 1.5 Market Dynamics Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Growing Population and Urbanization

- 1.5.1.2 Growing Demand for Alcohol Alternatives

- 1.5.2 Market Challenges

- 1.5.2.1 Strict Government Regulations for the Food and Beverage Industry

- 1.5.2.2 Volatility in Ingredient Costs

- 1.5.3 Market Opportunities

- 1.5.3.1 Growth of E-Commerce for the Beverage Industry

- 1.5.1 Market Drivers

- 1.6 Startup Funding Summary

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.3.1 Trends Identified

- 2.2.4 Product

- 2.2.5 Germany

- 2.2.6 France

- 2.2.7 U.K.

- 2.2.8 Italy

- 2.2.9 Netherlands

- 2.2.10 Norway

- 2.2.11 Rest-of-Europe

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 Nestle

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Market Developments

- 3.2.1.6 Recent Investments

- 3.2.1.7 Mergers and Acquisitions

- 3.2.1.8 Key Focus Area

- 3.2.1.9 Analyst View

- 3.2.2 Danone S.A.

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Market Developments

- 3.2.2.6 Recent Investments

- 3.2.2.7 Mergers and Acquisitions

- 3.2.2.8 Key Focus Area

- 3.2.2.9 Analyst View

- 3.2.3 Unilever

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Focus Area

- 3.2.3.6 Analyst View

- 3.2.4 Diageo

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Market Developments

- 3.2.4.6 Recent Investments

- 3.2.4.7 Mergers and Acquisitions

- 3.2.4.8 Key Focus Area

- 3.2.4.9 Analyst View

- 3.2.5 Britvic plc

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers

- 3.2.5.5 Market Developments

- 3.2.5.6 Recent Investments

- 3.2.5.7 Mergers and Acquisitions

- 3.2.5.8 Key Focus Area

- 3.2.5.9 Analyst View

- 3.2.6 AB InBev

- 3.2.6.1 Overview

- 3.2.6.2 Top Products/Product Portfolio

- 3.2.6.3 Top Competitors

- 3.2.6.4 Target Customers

- 3.2.6.5 Market Developments

- 3.2.6.6 Recent Investments

- 3.2.6.7 Key Focus Area

- 3.2.6.8 Analyst View

- 3.2.1 Nestle

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast