|

|

市場調査レポート

商品コード

1580137

デジタルPCR市場 - 世界および地域の分析:タイプ・用途・エンドユーザー・国別の分析・予測 (2024~2034年)Digital PCR Market - A Global and Regional Analysis: Focus on Type, Application, End User, and Country Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| デジタルPCR市場 - 世界および地域の分析:タイプ・用途・エンドユーザー・国別の分析・予測 (2024~2034年) |

|

出版日: 2024年10月31日

発行: BIS Research

ページ情報: 英文 135 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のデジタルPCRの市場規模は、2023年の6億7,810万米ドルから、予測期間中は15.75%のCAGRで推移し、2034年には33億5,100万米ドルの規模に成長すると予測されています。

同市場は2桁の大幅な成長を遂げていますが、その主な要因は、遺伝性疾患のスクリーニングと診断を目的とした個別化医療の採用の増加にあります。このアプローチは、各患者の特性に合わせた治療を行うもので、デジタルPCR (dPCR) は、さまざまながんに関連する希少な遺伝子変異の検出と定量化を可能にすることで重要な役割を果たしています。さらに、感染症の流行が拡大していることも、医療提供者が迅速で正確な診断ソリューションを求める中で、dPCRの需要を押し上げています。技術の進歩も市場拡大に寄与しており、液滴デジタルPCR、ナノプレート技術、マイクロ流体プラットフォームなどの技術革新がデジタルPCRの能力を高めています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2034年 |

| 2024年評価 | 7億7,620万米ドル |

| 2034年予測 | 33億5,100万米ドル |

| CAGR | 15.75% |

デジタルPCR (dPCR) 市場は、診断能力を向上させる最先端技術と戦略的提携に後押しされ、現在大きな成長を遂げています。例えば、Bio-Rad LaboratoriesとOncocyte Corporationの提携は、移植モニタリング用ソリューションの開発に不可欠であり、個別化医療におけるdPCRの重要性を示しています。さらに、Thermo Fisher Scientificなどの大手企業は、腫瘍学や感染症診断におけるdPCRの利用を加速させています。同社は最近、ラボの効率を高めるように設計されたAutoRun dPCR Suiteを発表しました。低存在変異を検出するdPCRの能力が認められつつあり、オーダーメイド治療アプローチにおけるdPCRの重要性がさらに高まっています。継続的な技術革新と支持的な規制により、dPCR市場は大幅に拡大する態勢にあり、高度な分子診断を通じて、患者の転帰改善につなげています。

製品別では、消耗品の部門がリードし、2023年には60.30%のシェアを示しました。この大きな市場シェアは、キット、アッセイ、試薬を含むデジタルPCR消耗品への高い需要を示しています。消耗品部門の優位性は、信頼性の高い結果を促進し、遺伝子検査の全体的な有効性を高める上でのデジタルPCRプロセスにおける高品質の試薬とキットの重要性を表しています。

用途別では、臨床・研究用途の部門がリードし、2023年には86.48%のシェアを示しました。同部門のリードは、診断精度の向上と科学研究の進展におけるデジタルPCR (dPCR) の重要な役割を示しています。高い精度と感度を持つdPCRは、腫瘍学、感染症、希少疾患、生殖遺伝学、移植診断を含むさまざまな分野で不可欠です。この技術は核酸の効果的な定量を容易にし、がんの早期発見や個別化治療戦略を可能にします。さらに、dPCRは感染症の正確な病原体検出や希少疾患に関連する遺伝子変異の同定を可能にします。dPCRは、出生前・出生後のスクリーニングや移植モニタリングを改善することで、効果的で個別化されたヘルスケアソリューションを提供するためにますます不可欠になっています。

当レポートでは、世界のデジタルPCRの市場を調査し、業界の動向、技術・特許の動向、法規制環境、市場成長促進要因・抑制要因、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場

- 市場概要

- デジタルPCRのワークフロー

- qPCRとdPCRの比較

- 動向:現在および将来の影響評価

- 次世代シーケンシング (NGS) との統合

- デジタルPCRのリアルタイムモニタリングとポイントオブケアアプリケーションの増加

- d-PCRエコシステムにおける製品発売の増加

- サプライチェーンの概要

- 研究開発レビュー

- 特許出願動向 (地域別)

- 特許出願動向 (国別)

- 特許出願動向 (年別)

- 進行中のデジタルPCR臨床試験

- 規制状況

- 米国

- EU

- アジア太平洋

- 市場力学:概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 世界のデジタルPCR市場:製品別

- 概要

- システム

- ドロップレットデジタルPCRシステム

- チップベースデジタルPCRシステム

- 消耗品 (キット・アッセイ・試薬)

- ソフトウェア・サービス

第3章 世界のデジタルPCR市場:用途別

- 概要

- 臨床・研究用

- 腫瘍学

- 感染症

- 希少疾患

- 生殖遺伝学

- 移植診断

- その他

- 環境

- その他

第4章 世界のデジタルPCR市場:エンドユーザー別

- 概要

- 学術研究機関

- 病院・診療所

- 診断センター

- 製薬・バイオ医薬品企業

- その他

第5章 地域

- 地域別概要

- 促進要因・抑制要因

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第6章 市場:競合ベンチマーキング・企業プロファイル

- 競合情勢

- 市場シェア分析

- 企業プロファイル

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- HoffmannF. -La Roche Ltd

- Standard BioTools Inc.

- Merck KGaA

- Stilla Technologies Inc.

- SAGA Diagnostics AB

- Naveris, Inc.

- Genetron Holdings Limited

- RevoSketch Inc.

- JN Medsys

- JETA Molecular BV.

- Sysmex Corporation

第7章 調査手法

List of Figures

- Figure 1: Global Digital PCR Market, by Region, $Million, 2023, 2029, and 2034

- Figure 2: Global Digital PCR Market (by Product), $Million, 2023, 2029 and 2034

- Figure 3: Global Digital PCR Market (by Application), $Million 202, 2029 and 2034

- Figure 4: Global Digital PCR Market (by End User), $Million, 2023, 2029, and 2034

- Figure 5: Key Events to Keep Track of in the Digital PCR Market

- Figure 6: Supply Chain and Risks within the Supply Chain

- Figure 7: Global Digital PCR Market (by Region), January 2020-September 2024

- Figure 8: Global Digital PCR Market (by Country), January 2020-September 2024

- Figure 9: Global Digital PCR Market (by Year), January 2020-September 2024

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Digital PCR Market, $Million, 2023-2034

- Figure 12: Canada Digital PCR Market, $Million, 2023-2034

- Figure 13: France Digital PCR Market, $Million, 2023-2034

- Figure 14: Germany Digital PCR Market, $Million, 2023-2034

- Figure 15: U.K. Digital PCR Market, $Million, 2023-2034

- Figure 16: Spain Digital PCR Market, $Million, 2023-2034

- Figure 17: Italy Digital PCR Market, $Million, 2023-2034

- Figure 18: Rest-of-Europe Digital PCR Market, $Million, 2023-2034

- Figure 19: China Digital PCR Market, $Million, 2023-2034

- Figure 20: Australia Digital PCR Market, $Million, 2023-2034

- Figure 21: South Korea Digital PCR Market, $Million, 2023-2034

- Figure 22: Japan Digital PCR Market, $Million, 2023-2034

- Figure 23: Rest-of-Asia-Pacific Digital PCR Market, $Million, 2023-2034

- Figure 24: Brazil Digital PCR Market, $Million, 2023-2034

- Figure 25: Mexico Digital PCR Market, $Million, 2023-2034

- Figure 26: Rest-of-Latin America Digital PCR Market, $Million, 2023-2034

- Figure 27: K.S.A Digital PCR Market, $Million, 2023-2034

- Figure 28: Egypt Digital PCR Market, $Million, 2023-2034

- Figure 29: Rest-of-Middle East and Africa Digital PCR Market, $Million, 2023-2034

- Figure 30: Strategic Initiatives, January 2019-September 2024

- Figure 31: Share of Strategic Initiatives, January 2019-September 2024

- Figure 32: Global Digital PCR Market, Mergers and Acquisitions, January 2019-September 2024

- Figure 33: Global Digital PCR Market, Synergistic Activities, January 2019-September 2024

- Figure 34: Global Digital PCR Market, Product Launch and Approval Activities, January 2019-September 2024

- Figure 35: Global Digital PCR Market, Expansion, Funding, and Other Activities January 2019-September 2024

- Figure 36: Data Triangulation

- Figure 37: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 38: Top-Down Approach (Segment-Wise Analysis)

- Figure 39: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Global Digital PCR Market, Share Analysis, 2023

- Table 4: Comparison of qPCR and dPCR

- Table 5: Global Digital PCR Market, Trend Analysis

- Table 6: Global Digital PCR Market, Recent Product Launches

- Table 7: Some of the Ongoing Digital PCR (d-PCR) Clinical Trials

- Table 8: Regulatory Framework

- Table 9: Funding Allocated for Precision Medicine to Different Agencies Globally

- Table 10: Cost for Different Commercialized Digital PCR (d-PCR) Platforms

- Table 11: Global Digital PCR Market (by Product), $Million, 2023-2034

- Table 12: Global Digital PCR System Market, (by Type), $Million, 2023-2034

- Table 13: Global Digital PCR Market (by Application), $Million, 2023-2034

- Table 14: Global Digital PCR Market, Clinical and Research, (by Clinical and Research Applications), $Million, 2023-2034

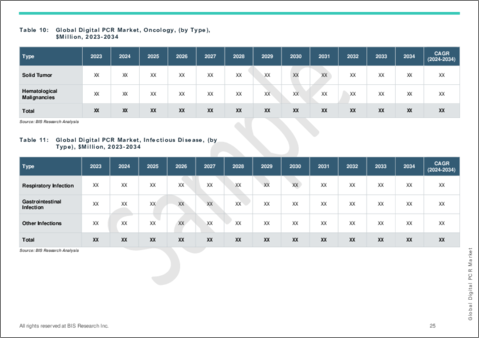

- Table 15: Global Digital PCR Market, Oncology, (by Type), $Million, 2023-2034

- Table 16: Global Digital PCR Market, Infectious Disease, (by Type), $Million, 2023-2034

- Table 17: Global Digital PCR Market, Rare Disease, (by Type), $Million, 2023-2034

- Table 18: Global Digital PCR Market, Reproductive Genetics, (by Type), $Million, 2023-2034

- Table 19: Global Digital PCR Market (by End User), $Million, 2023-2034

- Table 20: Global Digital PCR Market (by Region), $Million, 2023-2034

- Table 21: North America Digital PCR Market (by Application), $Million, 2023-2034

- Table 22: North America Digital PCR Market (by End User), $Million, 2023-2034

- Table 23: U.S. Digital PCR Market (by Application), $Million, 2023-2034

- Table 24: U.S. Digital PCR Market (by End User), $Million, 2023-2034

- Table 25: Canada Digital PCR Market (by Application), $Million, 2023-2034

- Table 26: Canada Digital PCR Market (by End User), $Million, 2023-2034

- Table 27: Europe Digital PCR Market (by Application), $Million, 2023-2034

- Table 28: Europe Digital PCR Market (by End User), $Million, 2023-2034

- Table 29: France Digital PCR Market (by Application), $Million, 2023-2034

- Table 30: France Digital PCR Market (by End User), $Million, 2023-2034

- Table 31: Germany Digital PCR Market (by Application), $Million, 2023-2034

- Table 32: Germany Digital PCR Market (by End User), $Million, 2023-2034

- Table 33: U.K. Digital PCR Market (by Application), $Million, 2023-2034

- Table 34: U.K. Digital PCR Market (by End User), $Million, 2023-2034

- Table 35: Spain Digital PCR Market (by Application), $Million, 2023-2034

- Table 36: Spain Digital PCR Market (by End User), $Million, 2023-2034

- Table 37: Italy Digital PCR Market (by Application), $Million, 2023-2034

- Table 38: Italy Digital PCR Market (by End User), $Million, 2023-2034

- Table 39: Rest-of-Europe Digital PCR Market (by Application), $Million, 2023-2034

- Table 40: Rest-of-Europe Digital PCR Market (by End User), $Million, 2023-2034

- Table 41: Asia-Pacific Digital PCR Market (by Application), $Million, 2023-2034

- Table 42: Asia-Pacific Digital PCR Market (by End User), $Million, 2023-2034

- Table 43: China Digital PCR Market (by Application), $Million, 2023-2034

- Table 44: China Digital PCR Market (by End User), $Million, 2023-2034

- Table 45: Australia Digital PCR Market (by Application), $Million, 2023-2034

- Table 46: Australia Digital PCR Market (by End User), $Million, 2023-2034

- Table 47: South Korea Digital PCR Market (by Application), $Million, 2023-2034

- Table 48: South Korea Digital PCR Market (by End User), $Million, 2023-2034

- Table 49: Japan Digital PCR Market (by Application), $Million, 2023-2034

- Table 50: Japan Digital PCR Market (by End User), $Million, 2023-2034

- Table 51: Rest-of-Asia-Pacific Digital PCR Market (by Application), $Million, 2023-2034

- Table 52: Rest-of-Asia-Pacific Digital PCR Market (by End User), $Million, 2023-2034

- Table 53: Latin America Digital PCR Market (by Application), $Million, 2023-2034

- Table 54: Latin America Digital PCR Market (by End User), $Million, 2023-2034

- Table 55: Brazil Digital PCR Market (by Application), $Million, 2023-2034

- Table 56: Brazil Digital PCR Market (by End User), $Million, 2023-2034

- Table 57: Mexico Digital PCR Market (by Application), $Million, 2023-2034

- Table 58: Mexico Digital PCR Market (by End User), $Million, 2023-2034

- Table 59: Rest-of-Latin America Digital PCR Market (by Application), $Million, 2023-2034

- Table 60: Rest-of-Latin America Digital PCR Market (by End User), $Million, 2023-2034

- Table 61: Middle East and Africa Digital PCR Market (by Application), $Million, 2023-2034

- Table 62: Middle East and Africa Digital PCR Market (by End User), $Million, 2023-2034

- Table 63: K.S.A. Digital PCR Market (by Application), $Million, 2023-2034

- Table 64: K.S.A. Digital PCR Market (by End User), $Million, 2023-2034

- Table 65: Egypt Digital PCR Market (by Application), $Million, 2023-2034

- Table 66: Egypt Digital PCR Market (by End User), $Million, 2023-2034

- Table 67: Rest-of-Middle East and Africa Digital PCR Market (by Application), $Million, 2023-2034

- Table 68: Rest-of-Middle East and Africa Digital PCR Market (by End User), $Million, 2023-2034

- Table 69: Global Digital PCR Market. Market Share Analysis, 2023

Introduction of Digital PCR

The global digital PCR market, initially valued at $678.1 million in 2023, is poised for substantial growth, projected to surge to $3,351.0 million by 2034, marking a remarkable compound annual growth rate (CAGR) of 15.75% over the period from 2024 to 2034. The market has been experiencing significant double-digit growth, primarily fueled by the rising adoption of personalized medicine to screen and diagnose genetic disorders. This approach tailors medical treatment to the unique characteristics of each patient, with digital PCR (dPCR) playing a crucial role by enabling the detection and quantification of rare genetic mutations linked to various cancers. Additionally, the growing prevalence of infectious diseases is driving the demand for dPCR as healthcare providers seek rapid and accurate diagnostic solutions. Technological advancements have also contributed to market expansion, with innovations such as droplet digital PCR, nanoplate technology, and microfluidic platforms enhancing the capabilities of digital PCR.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $776.2 Million |

| 2034 Forecast | $3,351.0 Million |

| CAGR | 15.75% |

The digital PCR (dPCR) market is currently experiencing significant growth, fueled by cutting-edge technology and strategic collaborations that improve diagnostic capabilities. For instance, the partnership between Bio-Rad Laboratories and Oncocyte Corporation is crucial for developing solutions for transplant monitoring, highlighting dPCR's role in personalized medicine. Additionally, major companies such as Thermo Fisher Scientific have been accelerating the use of dPCR in oncology and infectious disease diagnostics, i.e., their recent launch of the AutoRun dPCR Suite, which is designed to enhance laboratory efficiency. The increasing acknowledgment of dPCR's ability to detect low-abundance mutations is further driving its importance for tailored treatment approaches. With ongoing innovations and supportive regulations, the dPCR market is poised for substantial expansion, ultimately leading to better patient outcomes through advanced molecular diagnostics.

Industrial Impact

The digital PCR (dPCR) market has significantly shaped the landscape of molecular diagnostics, driven by key players such as Bio-Rad Laboratories, Thermo Fisher Scientific, and QIAGEN. These companies leverage innovative technologies to provide highly sensitive and precise solutions for applications in oncology, infectious diseases, and genetic testing. dPCR systems, known for their exceptional accuracy in quantifying nucleic acids, facilitate the detection of low-abundance mutations, which is crucial for personalized treatment strategies.

The industrial impact of dPCR extends beyond diagnostics, i.e., it plays a vital role in drug development and clinical trials by providing reliable data on patient responses and treatment efficacy. This is particularly evident in oncology, where dPCR helps identify specific biomarkers that guide targeted therapies. Additionally, the integration of dPCR into public health initiatives enhances disease monitoring and outbreak response capabilities.

As dPCR technologies continue to evolve and regulatory support increases, the market's influence on research and clinical practices is profound. By driving advancements in precision medicine and enabling deeper insights into genetic conditions, the dPCR market is at the forefront of transforming healthcare and improving patient outcomes worldwide.

Market Segmentation:

Segmentation 1: by Product

- Systems

- Consumables (Kits, Assay, and Reagents)

- Software and Services

Consumable Segment to Dominate the Digital PCR Market (by Product)

Based on product, the global digital PCR market was led by the consumables segment, which held a 60.30% share in 2023. This substantial market share indicates the high demand for digital PCR consumables, including kits, assays, and reagents. The dominance of the consumable segment underscores the critical role of high-quality reagents and kits in digital PCR processes, facilitating reliable results and enhancing the overall effectiveness of genetic testing. This emphasis on consumables is essential for achieving accurate diagnoses and advancing personalized healthcare solutions, as they provide the necessary tools for precisely detecting and quantifying genetic variations.

Segmentation 2: by Application

- Clinical and Research Application

- Environmental Application

- Other Application

Clinical and Research Application Segment to Dominate the Digital PCR Market (by Application)

Based on application, the global digital PCR testing market was led by the clinical and research application segment, which held an 86.48% share in 2023. The prominence of clinical and research applications underscores the critical role of digital PCR (dPCR) in enhancing diagnostic accuracy and advancing scientific inquiry. With its high precision and sensitivity, dPCR is essential across various fields, including oncology, infectious diseases, rare diseases, reproductive genetics, and transplant diagnostics. This technology facilitates the effective quantification of nucleic acids, enabling early cancer detection and personalized treatment strategies. Additionally, dPCR provides accurate pathogen detection for infectious diseases and identifies genetic mutations associated with rare conditions. dPCR has become increasingly vital for delivering effective, personalized healthcare solutions by improving prenatal and postnatal screening and transplant monitoring.

Segmentation 3: by End User

- Academic and Research Institutes

- Hospitals and Clinics

- Diagnostic Centers

- Pharmaceutical and Biopharmaceutical Companies

- Other End User

Academic and Research Institute Segment to Dominate the Digital PCR Market (by End User)

Based on end user, the global digital PCR market was led by the academic and research institute segment, which held a 33.77% share in 2023. The dominance of academic and research institutes in the digital PCR (dPCR) market is underscored by their engagement in advanced research applications that require the high sensitivity and precision dPCR offers. These institutions leverage this technology for various studies, including genetic research, cancer investigations, and pathogen detection, driving significant advancements in genomics and molecular biology. By utilizing dPCR to explore new genetic variants and understand complex biological processes, academic settings remain at the forefront of scientific innovation. Additionally, partnerships with leading companies provide access to specialized dPCR systems and assays tailored to their research needs, enhancing the quality of studies and experiments. Moreover, with an increasing emphasis on personalized medicine and public health, these institutes contribute significantly to developing and validating innovative diagnostic tools, solidifying their dominance in the market.

Segmentation 4: by Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest-of-Europe

- Asia-Pacific

- China

- Japan

- South Korea

- Australia

- Rest-of-Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest-of-Latin America

- Middle East and Africa

- K.S.A.

- Egypt

- Rest-of-Middle East and Africa

The digital PCR market in the North America region is expected to witness a significant growth rate of 16.04% during the forecast period. This notable growth can be attributed to several key factors. The increasing emphasis on personalized medicine has been driving demand for precise and sensitive diagnostic tools. Additionally, substantial investments in research and development from the public and private sectors have fostered innovation in dPCR technologies. Furthermore, government initiatives focused on enhancing healthcare infrastructure and supporting research have significantly fueled the expansion of the dPCR market. However, the Asia-Pacific region is expected to reach $695.5 million in 2034 from $124.8 million in 2023, at a CAGR of 17.02% during the forecast period 2024-2034.

Recent Developments in the Digital PCR Market

- In September 2024, QIAGEN N.V. launched 100 new assays for its digital PCR (dPCR) platform, QIAcuity. These assays are intended for research in cancer, inherited genetic disorders, infectious disease monitoring, and food and environmental assessments.

- In June 2024, QIAGEN N.V. launched its new Custom Assay Design Tool for digital PCR (dPCR), specifically designed for copy number variation (CNV) analysis on the QIAcuity platform.

- In June 2024, Stilla Technologies launched two new digital PCR system configurations that have been added to the Nio product line, launched in November 2023 with the introduction of the flagship Nio+ instrument. The two new configurations are designed to deliver digital PCR solutions with a throughput that is fully tailored to the user's requirements.

- In April 2024, Bio-Rad Laboratories, Inc. collaborated with Oncocyte Corporation to develop and commercialize transplant monitoring products utilizing Bio-Rad's Droplet Digital PCR (ddPCR) instruments and reagents. As part of the agreement, Bio-Rad will participate in a private placement of Oncocyte's equity and has obtained exclusive commercial rights in specific markets to market Oncocyte's assay for transplant monitoring research with Bio-Rad's QX600 ddPCR System.

- In March 2023, Thermo Fisher Scientific launched its latest digital PCR research solution: the Applied Biosystems QuantStudio Absolute Q AutoRun dPCR Suite. This is the only digital PCR system on the market that facilitates lab automation while minimizing overhead costs, all without compromising consistency, flexibility, and user-friendliness.

Demand - Drivers, Challenges, and Opportunities

Market Drivers:

Growing Demand for Precision Medicine: The growing demand for precision medicine has been significantly driving the adoption of digital PCR (dPCR) due to its capacity for accurate genetic profiling. As healthcare increasingly focuses on tailored treatments, dPCR's high sensitivity allows for the precise quantification of low-abundance mutations, which is essential for identifying specific patient needs. This technology supports targeted therapies by providing reliable diagnostics to monitor treatment efficacy and detect resistance mutations. Furthermore, dPCR facilitates the early detection of genetic disorders and cancers, enabling timely interventions that are vital for personalized care. The emphasis on individualized treatment also spurs innovation in dPCR technologies, expanding their applications in clinical and research settings and enhancing their overall relevance in modern healthcare.

Market Challenges:

High Cost of Platforms Associated with Digital PCR: The high costs associated with digital PCR (dPCR) platforms significantly hinder market growth in several ways. The substantial initial investment required for dPCR systems can deter smaller laboratories and healthcare facilities, especially in developing regions with tight budgets, slowing adoption rates. Additionally, healthcare systems often prioritize essential services and established technologies over newer, more expensive dPCR options, leading providers to rely on traditional PCR methods. This financial barrier also affects research institutions, where funding agencies may be reluctant to support projects involving costly technologies, limiting innovation. Overall, these high costs restrict broader adoption and hinder the expansion of the dPCR market.

Market Opportunities:

Growing Adoption of Digital PCR Solutions for Therapeutic Drug Development and Comprehensive Treatment Strategies: The growing adoption of digital PCR (dPCR)-based solutions for developing therapeutic drugs and comprehensive treatment plans offers significant growth opportunities in the dPCR market. As pharmaceutical and biotechnology industries shift toward personalized medicine, dPCR's exceptional sensitivity and precision enable the identification of biomarkers critical for therapeutic development. This technology enhances the monitoring of disease progression and treatment responses, facilitating tailored therapeutic strategies. Moreover, regulatory agencies increasingly value robust molecular diagnostics in clinical trials, further driving demand for dPCR solutions. With rising chronic diseases and ongoing advancements in dPCR methodologies, the market is set for substantial expansion, fueled by data-driven approaches in drug development and personalized healthcare.

How can this report add value to an organization?

Product/Innovation Strategy: The global digital PCR market has been extensively segmented based on various categories, such as product, application, end user, and region. This can help readers understand which segments account for the largest share and which are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Mergers, acquisitions, and product launches accounted for the maximum number of key developments, i.e., nearly 50.61% of the total developments in the global digital PCR market were between January 2019 and September 2024.

Competitive Strategy: The global digital PCR market has numerous established players with product portfolios. Key players in the global digital PCR market analyzed and profiled in the study involve established players offering products for digital PCR.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2023. A historical year analysis has been done for the period FY2019-FY2022. The market size has been estimated for FY2023 and projected for the period FY2024-FY2034.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report provides a market study of upstream and downstream products of the digital PCR market.

- The market contribution of digital PCR is anticipated to be launched in the future and has been calculated based on the historical analysis of the solutions.

- The company's revenue has been referenced from their annual reports for FY2022 and FY2023. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The market has been mapped based on the available digital PCR solutions. All the key companies with significant offerings in this field have been considered and profiled in this report.

Primary Research:

The primary sources involve industry experts in digital PCR, including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from the secondary sources include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players of the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts, who have analyzed company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- F. Hoffmann-La Roche Ltd

- Standard BioTools Inc.

- Merck KGaA

- Stilla Technologies Inc.

- SAGA Diagnostics AB

- RevoSketch Inc.

- JN Medsys

- JETA Molecular BV.

- Sysmex Corporation

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Market Overview

- 1.1.1 Workflow of Digital PCR

- 1.1.2 Comparison of qPCR and dPCR

- 1.2 Trends: Current and Future Impact Assessment

- 1.2.1 Integration with Next-Generation Sequencing (NGS)

- 1.2.2 Increased Real-time Monitoring and Point-of-care Applications of Digital PCR

- 1.2.3 Increasing Product Launches in d-PCR Ecosystem

- 1.3 Supply Chain Overview

- 1.4 Research and Development Review

- 1.4.1 Patent Filing Trend (by Region)

- 1.4.2 Patent Filing Trend (by Country)

- 1.4.3 Patent Filing Trend (by Year)

- 1.5 Ongoing Digital PCR Clinical Trials

- 1.6 Regulatory Landscape

- 1.6.1 U.S.

- 1.6.2 European Union

- 1.6.3 Asia Pacific

- 1.6.3.1 Japan

- 1.6.3.2 China

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Increasing Adoption of Personalized Medicine for Screening and Diagnostics of Genetic Disorders such as Rare Diseases and Cancer

- 1.7.1.2 Increasing Incidence of Infectious Diseases

- 1.7.1.3 Technological Advancement in dPCR to Enhance Market Growth

- 1.7.2 Market Restraints

- 1.7.2.1 High Cost of Platforms Associated with Digital-PCR

- 1.7.2.2 Shortage of Skilled Professionals and Trained Laboratory Technicians

- 1.7.3 Market Opportunities

- 1.7.3.1 Increased Use of Digital-PCR-Based Solutions for the Development of Therapeutics Drugs and Comprehensive Treatment Plan

- 1.7.3.2 Growing Adoption of dPCR in Emerging Markets

- 1.7.1 Market Drivers

2 Global Digital PCR Market, by Product, $Million, 2023-2034

- 2.1 Overview

- 2.2 Systems

- 2.2.1 Droplet Digital PCR Systems

- 2.2.2 Chip-Based Digital PCR Systems

- 2.3 Consumables (Kits, Assays, and Reagents)

- 2.4 Software and Services

3 Global Digital PCR Maret, by Application, $Million, 2023-2034

- 3.1 Overview

- 3.2 Clinical and Research Application

- 3.2.1 Oncology

- 3.2.1.1 Solid Tumor

- 3.2.1.2 Hematological Malignancies

- 3.2.2 Infectious Diseases

- 3.2.2.1 Respiratory Infections

- 3.2.2.2 Gastrointestinal Infections

- 3.2.2.3 Other Infections

- 3.2.3 Rare Diseases

- 3.2.3.1 Inherited Trait Type

- 3.2.3.2 Acquired Trait Type

- 3.2.4 Reproductive Genetics

- 3.2.4.1 Prenatal Diseases

- 3.2.4.2 Postnatal Diseases

- 3.2.5 Transplant Diagnostics

- 3.2.6 Other Clinical and Research Applications

- 3.2.1 Oncology

- 3.3 Environmental Applications

- 3.4 Other Applications

4 Global Digital PCR Market, by End User, $Million, 2023-2034

- 4.1 Overview

- 4.2 Academic and Research Institutes

- 4.3 Hospitals and Clinics

- 4.4 Diagnostic Centers

- 4.5 Pharmaceutical and Biopharmaceutical Companies

- 4.6 Other End Users

5 Regions

- 5.1 Regional Summary

- 5.2 Drivers and Restraints

- 5.3 North America

- 5.3.1 Regional Overview

- 5.3.2 Driving Factors for Market Growth

- 5.3.3 Factors Challenging the Market

- 5.3.4 By Application

- 5.3.5 By End User

- 5.3.6 U.S.

- 5.3.7 Canada

- 5.4 Europe

- 5.4.1 Regional Overview

- 5.4.2 Driving Factors for Market Growth

- 5.4.3 Factors Challenging the Market

- 5.4.4 By Application

- 5.4.5 By End User

- 5.4.6 France

- 5.4.7 Germany

- 5.4.8 U.K.

- 5.4.9 Spain

- 5.4.10 Italy

- 5.4.11 Rest-of-Europe

- 5.5 Asia-Pacific

- 5.5.1 Regional Overview

- 5.5.2 Driving Factors for Market Growth

- 5.5.3 Factors Challenging the Market

- 5.5.4 Application

- 5.5.5 By End User

- 5.5.6 China

- 5.5.7 Australia

- 5.5.8 South Korea

- 5.5.9 Japan

- 5.5.10 Rest-of-Asia-Pacific

- 5.6 Latin America

- 5.6.1 Regional Overview

- 5.6.2 Driving Factors for Market Growth

- 5.6.3 Factors Challenging the Market

- 5.6.4 By Application

- 5.6.5 By End User

- 5.6.6 Brazil

- 5.6.7 Mexico

- 5.6.8 Rest-of-Latin America

- 5.7 Middle East and Africa

- 5.7.1 Regional Overview

- 5.7.2 Driving Factors for Market Growth

- 5.7.3 Factors Challenging the Market

- 5.7.4 By Application

- 5.7.5 By End User

- 5.7.6 K.S.A.

- 5.7.7 Egypt

- 5.7.8 Rest-of-Middle East and Africa

6 Markets - Competitive Benchmarking & Company Profiles

- 6.1 Competitive Landscape

- 6.1.1 Mergers and Acquisitions

- 6.1.2 Synergistic Activities

- 6.1.3 Product Launch and Approval Activities

- 6.1.4 Expansion, Funding, and Other Activities

- 6.2 Market Share Analysis

- 6.3 Company Profile

- 6.3.1 Bio-Rad Laboratories, Inc.

- 6.3.1.1 Overview

- 6.3.1.2 Top Products/Product Portfolio

- 6.3.1.3 Top Competitors

- 6.3.1.4 Target Customers

- 6.3.1.5 Key Personnel

- 6.3.1.6 Analyst View

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.2.1 Overview

- 6.3.2.2 Top Products/Product Portfolio

- 6.3.2.3 Top Competitors

- 6.3.2.4 Target Customers

- 6.3.2.5 Key Personnel

- 6.3.2.6 Analyst View

- 6.3.3 QIAGEN N.V.

- 6.3.3.1 Overview

- 6.3.3.2 Top Products/Product Portfolio

- 6.3.3.3 Top Competitors

- 6.3.3.4 Target Customers

- 6.3.3.5 Key Personnel

- 6.3.3.6 Analyst View

- 6.3.4 F. Hoffmann-La Roche Ltd

- 6.3.4.1 Overview

- 6.3.4.2 Top Products/Product Portfolio

- 6.3.4.3 Top Competitors

- 6.3.4.4 Target Customers

- 6.3.4.5 Key Personnel

- 6.3.4.6 Analyst View

- 6.3.5 Standard BioTools Inc.

- 6.3.5.1 Overview

- 6.3.5.2 Top Products/Product Portfolio

- 6.3.5.3 Top Competitors

- 6.3.5.4 Target Customers

- 6.3.5.5 Key Personnel

- 6.3.5.6 Analyst View

- 6.3.6 Merck KGaA

- 6.3.6.1 Overview

- 6.3.6.2 Top Products/Product Portfolio

- 6.3.6.3 Top Competitors

- 6.3.6.4 Target Customers

- 6.3.6.5 Key Personnel

- 6.3.6.6 Analyst View

- 6.3.7 Stilla Technologies Inc.

- 6.3.7.1 Overview

- 6.3.7.2 Top Products/Product Portfolio

- 6.3.7.3 Top Competitors

- 6.3.7.4 Target Customers

- 6.3.7.5 Key Personnel

- 6.3.7.6 Analyst View

- 6.3.8 SAGA Diagnostics AB

- 6.3.8.1 Overview

- 6.3.8.2 Top Products/Product Portfolio

- 6.3.8.3 Top Competitors

- 6.3.8.4 Target Customers

- 6.3.8.5 Key Personnel

- 6.3.8.6 Analyst View

- 6.3.9 Naveris, Inc.

- 6.3.9.1 Overview

- 6.3.9.2 Top Products/Product Portfolio

- 6.3.9.3 Top Competitors

- 6.3.9.4 Target Customers

- 6.3.9.5 Key Personnel

- 6.3.9.6 Analyst View

- 6.3.10 Genetron Holdings Limited

- 6.3.10.1 Overview

- 6.3.10.2 Top Products/Product Portfolio

- 6.3.10.3 Top Competitors

- 6.3.10.4 Target Customers

- 6.3.10.5 Key Personnel

- 6.3.10.6 Analyst View

- 6.3.11 RevoSketch Inc.

- 6.3.11.1 Overview

- 6.3.11.2 Top Products/Product Portfolio

- 6.3.11.3 Top Competitors

- 6.3.11.4 Target Customers

- 6.3.11.5 Key Personnel

- 6.3.11.6 Analyst View

- 6.3.12 JN Medsys

- 6.3.12.1 Overview

- 6.3.12.2 Top Products/Product Portfolio

- 6.3.12.3 Top Competitors

- 6.3.12.4 Target Customers

- 6.3.12.5 Key Personnel

- 6.3.12.6 Analyst View

- 6.3.13 JETA Molecular BV.

- 6.3.13.1 Overview

- 6.3.13.2 Top Products/Product Portfolio

- 6.3.13.3 Top Competitors

- 6.3.13.4 Target Customers

- 6.3.13.5 Key Personnel

- 6.3.13.6 Analyst View

- 6.3.14 Sysmex Corporation.

- 6.3.14.1 Overview

- 6.3.14.2 Top Products/Product Portfolio

- 6.3.14.3 Top Competitors

- 6.3.14.4 Target Customers

- 6.3.14.5 Key Personnel

- 6.3.14.6 Analyst View

- 6.3.1 Bio-Rad Laboratories, Inc.

7 Research Methodology

- 7.1 Data Sources

- 7.1.1 Primary Data Sources

- 7.1.2 Secondary Data Sources

- 7.1.3 Data Triangulation

- 7.2 Market Estimation and Forecast