|

|

市場調査レポート

商品コード

1578771

欧州のコンパニオン診断薬市場:用途別、エンドユーザー別、技術別、国別 - 分析と予測(2023年~2033年)Europe Companion Diagnostics Market: Focus on Application, End User, Technology, and Country - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のコンパニオン診断薬市場:用途別、エンドユーザー別、技術別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年10月29日

発行: BIS Research

ページ情報: 英文 73 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のコンパニオン診断薬の市場規模は、2023年に11億1,650万米ドルとなりました。

同市場は、2023年から2033年にかけて12.30%のCAGRで拡大し、2033年には35億6,210万米ドルに達すると予測されています。バイオメディカルイメージングの進歩、コンパニオン診断薬製品認可の増加、がん罹患率の上昇が、欧州におけるコンパニオン診断薬市場拡大の原動力となっています。これらの要素は、個別化されたがん治療におけるコンパニオン診断薬と精密医療の普及を支える大きな力となっています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 11億1,650万米ドル |

| 2033年の予測 | 35億6,210万米ドル |

| CAGR | 12.3% |

精密医療への要望の高まりとがん罹患率の上昇が、欧州におけるコンパニオン診断薬業界を牽引しています。特にがん領域では、コンパニオン診断薬は、特定の医薬品が最も有効である可能性の高い患者を特定することにより、治療レジメンを調整するために不可欠です。コンパニオン診断薬は、治療成績を向上させるために極めて重要なツールです。なぜなら、欧州全体におけるがん罹患率の増加により、そのような重点的な医薬品の必要性が高まっているからです。

新しいコンパニオン診断薬は、欧州の規制当局によって積極的に承認されつつあり、これが市場成長の原動力となっています。市場は、強化された生物医学的イメージング法や次世代シーケンシング(NGS)を含む分子診断の技術開拓により拡大しています。これらの開発により、バイオマーカーをより正確に特定することが可能になり、より精度の高いオーダーメイド治療が可能になります。

コンパニオン診断薬は、がん領域だけでなく、感染症や循環器疾患などの他の治療領域においても普及しつつあります。欧州におけるコンパニオン診断薬市場は、研究開発費の増加と良好な規制の枠組みにより徐々に拡大し、同大陸全体でオーダーメイド医療の利用を拡大し、患者の転帰を後押しすると予測されています。

当レポートでは、欧州のコンパニオン診断薬市場について調査し、市場の概要とともに、用途別、エンドユーザー別、技術別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- 歴史的観点から見たコンパニオン診断薬

- コンパニオン診断薬(CDx)開発の構成要素

- コンパニオン診断薬(CDx):将来の可能性

- 市場力学の概要

第2章 地域

- 地域別概要

- 促進要因と抑制要因

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- bioMerieux

- F. Hoffmann-La Roche Ltd

- ICON plc

- QIAGEN N.V.

第4章 調査手法

List of Figures

- Figure 1: Europe Companion Diagnostics Market, $Million, 2023, 2026, and 2033

- Figure 2: Europe Companion Diagnostics Market (by Application), $Million, 2022, 2026, and 2033

- Figure 3: Europe Companion Diagnostics Market (by Technology), $Million, 2022, 2026, and 2033

- Figure 4: Europe Companion Diagnostics Market (by End User), $Million, 2022, 2026, and 2033

- Figure 5: Key Industrial Developments in Companion Diagnostics Market, 2023

- Figure 6: Key Aspects Related to Liquid Biopsy-Based Companion Diagnostics

- Figure 7: Applications of Digital Diagnostics

- Figure 8: Supply Chain and Risks within the Supply Chain

- Figure 9: Europe Companion Diagnostics Market (by Country), January 2021-December 2023

- Figure 10: Europe Companion Diagnostics (by Year), January 2021-December 2023

- Figure 11: Evolution of Companion Diagnostics

- Figure 12: Components Required to Develop Companion Diagnostics

- Figure 13: Future Prospects of CDx

- Figure 14: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 15: Factors Impacting Reimbursement Scenario

- Figure 16: Advancements in Companion Diagnostics

- Figure 17: Future Outlook of Epigenomics

- Figure 18: Europe Companion Diagnostics Market, $Million, 2022-2033

- Figure 19: France Companion Diagnostics Market, $Million, 2022-2033

- Figure 20: Germany Companion Diagnostics Market, $Million, 2022-2033

- Figure 21: U.K. Companion Diagnostics Market, $Million, 2022-2033

- Figure 22: Spain Companion Diagnostics Market, $Million, 2022-2033

- Figure 23: Italy Companion Diagnostics Market, $Million, 2022-2033

- Figure 24: Rest-of-Europe Companion Diagnostics Market, $Million, 2022-2033

- Figure 25: Strategic Initiatives, 2021-2023

- Figure 26: Share of Strategic Initiatives, 2021-2023

- Figure 27: Data Triangulation

- Figure 28: Top-Down and Bottom-Up Approach

- Figure 29: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Companion Diagnostics Market, Opportunities

- Table 3: Some of FDA Approved Liquid Biopsy CDx Tests

- Table 4: Cancer Cases Expected between 2020 and 2040

- Table 5: Product Approvals in the Field of Companion Diagnostics

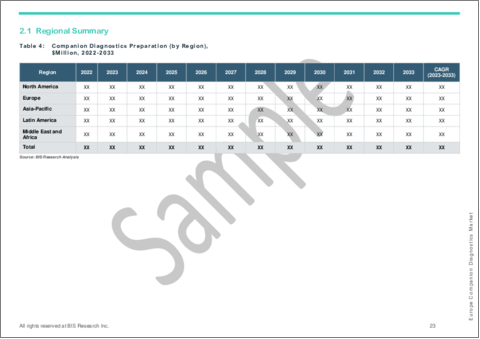

- Table 6: Companion Diagnostics Preparation (by Region), $Million, 2022-2033

- Table 7: Europe Companion Diagnostics Market (by Application), $Million, 2022-2033

- Table 8: Europe Companion Diagnostics Market (by End User), $Million, 2022-2033

- Table 9: Europe Companion Diagnostics Market (by Technology), $Million, 2022-2033

- Table 10: France Companion Diagnostics Market (by Application), $Million, 2022-2033

- Table 11: France Companion Diagnostics Market (by End User), $Million, 2022-2033

- Table 12: France Companion Diagnostics Market (by Technology), $Million, 2022-2033

- Table 13: Germany Companion Diagnostics Market (by Application), $Million, 2022-2033

- Table 14: Germany Companion Diagnostics Market (by End User), $Million, 2022-2033

- Table 15: Germany Companion Diagnostics Market (by Technology), $Million, 2022-2033

- Table 16: U.K. Companion Diagnostics Market (by Application), $Million, 2022-2033

- Table 17: U.K. Companion Diagnostics Market (by End User), $Million, 2022-2033

- Table 18: U.K. Companion Diagnostics Market (by Technology), $Million, 2022-2033

- Table 19: Spain Companion Diagnostics Market (by Application), $Million, 2022-2033

- Table 20: Spain Companion Diagnostics Market (by End User), $Million, 2022-2033

- Table 21: Spain Companion Diagnostics Market (by Technology), $Million, 2022-2033

- Table 22: Italy Companion Diagnostics Market (by Application), $Million, 2022-2033

- Table 23: Italy Companion Diagnostics Market (by End User), $Million, 2022-2033

- Table 24: Italy Companion Diagnostics Market (by Technology), $Million, 2022-2033

- Table 25: Rest-of-Europe Companion Diagnostics Market (by Application), $Million, 2022-2033

- Table 26: Rest-of-Europe Companion Diagnostics Market (by End User), $Million, 2022-2033

- Table 27: Rest-of-Europe Companion Diagnostics Market (by Technology), $Million, 2022-2033

Introduction to Europe Companion Diagnostics Market

The Europe companion diagnostics market was valued at $1,116.5 million in 2023 and is expected to reach $3,562.1 million by 2033, growing at a CAGR of 12.30% between 2023 and 2033. Advances in biomedical imaging, a rise in companion diagnostics product approvals, and the rising prevalence of cancer are driving the companion diagnostics market's expansion in Europe. These elements are major forces behind the region's growing use of companion diagnostics and precision medicine in individualized cancer care.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $1,116.5 Million |

| 2033 Forecast | $3,562.1 Million |

| CAGR | 12.3% |

The growing desire for precision medicine and the rising incidence of cancer are driving the companion diagnostics industry in Europe. Particularly in oncology, companion diagnostics are essential for tailoring treatment regimens by identifying patients who are most likely to benefit from particular medicines. Companion diagnostics is a crucial tool for improving treatment outcomes because the increase in cancer incidence throughout Europe has increased the need for such focused medicines.

New companion diagnostics devices are being actively approved by European regulatory bodies, which is driving the market's growth. The market is expanding due to technological developments in molecular diagnostics, including enhanced biomedical imaging methods and next-generation sequencing (NGS). These developments make it possible to identify biomarkers more precisely, which enables more precisely tailored treatments.

Companion diagnostics are becoming popular not only in oncology but also in other treatment domains as infectious and cardiovascular illnesses. The companion diagnostics market in Europe is anticipated to expand gradually due to rising R&D expenditures and a favorable regulatory framework, expanding the use of customized medicine and boosting patient outcomes throughout the continent.

Market Segmentation

Segmentation 1: by Technology

- Polymerase Chain Reaction (PCR)

- Immunohistochemistry (IHC)

- In-Situ Hybridization (ISH)

- Next-Generation Sequencing (NGS)

- Others

Segmentation 2: by Application

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Leukemia

- Stomach Cancer

- Melanoma

- Others

Segmentation 3: by End User

- Pharmaceutical and Biotechnology Companies

- Reference Laboratories and Hospitals

- Others

Segmentation 4: by Country

- Germany

- U.K.

- France

- Italy

- Spain

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The Europe companion diagnostics market has been segmented based on various categories, such as technology, application, end user, and country.

Competitive Strategy: The Europe companion diagnostics market is a highly fragmented market, with many smaller and private companies constantly entering the market. Key players in the Europe companion diagnostics market analyzed and profiled in the study involve established players that offer various kinds of products and services.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- bioMerieux

- F. Hoffmann-La Roche Ltd

- ICON Plc

- QIAGEN N.V.

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Companion Diagnostics Market Trend Analysis

- 1.1.2 Implementation of Liquid Biopsy-Based Companion Diagnostics

- 1.1.3 Combining Artificial Intelligence and Companion Diagnostics

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country, Year)

- 1.4 Regulatory Landscape

- 1.4.1 Legal Requirements and Framework by the FDA

- 1.4.2 Legal Requirements and Framework by the EMA

- 1.5 CDx from a Historical Perspective

- 1.6 Constituents for Companion Diagnostics (CDx) Development

- 1.7 Companion Diagnostics (CDx): Future Potential

- 1.8 Market Dynamics Overview

- 1.8.1 Market Drivers

- 1.8.1.1 Rising Prevalence of Cancer Cases

- 1.8.1.2 Increasing Product Approvals in the Field of Companion Diagnostics

- 1.8.1.3 Advancing Biomedical Imaging as the Driving Force for Precision Medicine's Companion Diagnostics

- 1.8.2 Market Restraints

- 1.8.2.1 Uncertain Reimbursement Scenario

- 1.8.2.2 Stringent Regulatory Approval Processes

- 1.8.3 Market Opportunities

- 1.8.3.1 Progress in Companion Diagnostics Driven by Continuous Development and Technological Advancements

- 1.8.3.2 Introduction of Epigenomics-Based Companion Diagnostics

- 1.8.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Drivers and Restraints

- 2.3 Europe

- 2.3.1 Regional Overview

- 2.3.2 Driving Factors for Market Growth

- 2.3.3 Factors Challenging the Market

- 2.3.4 Application

- 2.3.5 Product

- 2.3.6 France

- 2.3.7 Application

- 2.3.8 Product

- 2.3.9 Germany

- 2.3.10 Application

- 2.3.11 Product

- 2.3.12 U.K.

- 2.3.13 Application

- 2.3.14 Product

- 2.3.15 Spain

- 2.3.16 Application

- 2.3.17 Product

- 2.3.18 Italy

- 2.3.19 Application

- 2.3.20 Product

- 2.3.21 Rest-of-Europe

- 2.3.22 Application

- 2.3.23 Product

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers.....

- 3.2 Geographic Assessment

- 3.2.1 bioMerieux

- 3.2.1.1 Overview

- 3.2.1.2 Top Products

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.2 F. Hoffmann-La Roche Ltd

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.3 ICON plc

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.4 QIAGEN N.V.

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.1 Target Customers

- 3.2.4.2 Key Personnel

- 3.2.4.3 Analyst View

- 3.2.1 bioMerieux

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecasta