|

|

市場調査レポート

商品コード

1927583

血液悪性腫瘍検査市場- 世界および地域別分析:製品別、プラットフォーム別、疾患別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年)Hematologic Malignancies Testing Market - A Global and Regional Analysis: Focus on Product, Platform, Disease, End User, and Region - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 血液悪性腫瘍検査市場- 世界および地域別分析:製品別、プラットフォーム別、疾患別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2026年02月03日

発行: BIS Research

ページ情報: 英文 301 Pages

納期: 1~5営業日

|

概要

世界の血液悪性腫瘍検査の市場規模は、2024年に43億4,100万米ドルと評価され、2035年までに184億450万米ドルへと大幅に成長し、2025年から2035年までの期間において14.00%という顕著なCAGRを記録すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年時点の評価額 | 49億6,520万米ドル |

| 2035年予測 | 184億450万米ドル |

| CAGR | 14% |

世界の血液悪性腫瘍検査市場は、白血病、リンパ腫、骨髄腫などの血液がんの増加に伴い、著しい成長を遂げています。医療提供者がより的を絞った効果的な治療を提供しようとする中、正確かつ早期の診断検査への需要が高まっています。血液細胞の制御不能な増殖を特徴とする悪性血液腫瘍は、診断、分類、治療経過のモニタリングに専門的な検査を必要とします。これらのがんは治療において個別化アプローチが求められることが多く、個々の症例に関する特定の分子・遺伝学的知見を提供できる高度な検査手法への需要が高まっています。次世代シーケンシングや液体生検を含む分子診断分野の主な発展は、血液がん向けのより精密な検査ソリューションの開発を加速させています。

技術的進歩は血液悪性腫瘍検査の状況を再構築しており、AI駆動のデータ分析やハイスループットスクリーニングといった革新技術が、診断手順の精度と効率向上に重要な役割を果たしています。市場の成長見通しがある一方で、高度な検査技術の高コスト、規制上の障壁、専門的知見の必要性といった課題は依然として重大です。しかしながら、研究開発への継続的な投資と、医療提供者、学術機関、非公開会社間の連携強化が、市場のさらなる進展を促進すると期待されています。

市場概要

次世代診断技術の採用と戦略的提携により、世界の血液悪性腫瘍検査市場は変革を遂げています。企業は、血液がん診断の速度・精度・正確性を向上させるため、次世代シーケンシング(NGS)、液体生検、多重PCRなどの先進技術を積極的に導入しています。マルチプレックスバイオマーカーパネルの開発や予測分析のためのAI統合といった注目すべき進歩は、診断能力の向上に業界が注力していることを強調しています。血液悪性腫瘍の有病率が高まる中、診断検査の革新が市場の方向性を形作り、これらの技術を血液がんの治療と管理の中心に位置づけることが期待されています。

産業への影響

精密で標的を絞った診断ソリューションへの需要増加と、個別化治療戦略への重視の高まりを背景に、世界の血液悪性腫瘍検査市場は著しい成長を遂げています。Adaptive Biotechnologies、Bio-Rad Laboratories, Inc.、ICON plc、Illumina, Inc.、Laboratory Corporation of America Holdings、Thermo Fisher Scientific, Inc.などの主要企業は、診断技術の進歩において中心的な役割を果たし、血液がんの検出とモニタリングのためのより効果的かつ効率的なツールの開発を促進しています。これらの革新は、白血病、リンパ腫、骨髄腫などの領域において極めて重要であり、より正確かつ迅速な診断を可能にし、治療決定に情報を提供することで治療成果の向上に寄与しています。バイオマーカーの特定速度と精度を向上させ、検査コストを削減し、最先端の診断技術へのアクセスを拡大することで、血液悪性腫瘍検査は、がん治療におけるより効率的で包括的なアプローチに貢献しています。この市場の影響力は、個別化医療に対する世界の需要の高まりと相まってさらに増幅され、先進的な診断ツールを次世代がん治療の基盤として位置づけています。

市場セグメンテーション:

セグメンテーション1:製品・サービス別

- キット

- サービス

サービス分野が血液悪性腫瘍検査市場を牽引(製品・サービス別)

製品およびサービス別では、サービスセグメントが市場をリードする見込みであり、複雑な診断手順において専門的な検査サービスプロバイダーへの依存度が高まっていることから、大きなシェアを占めるでしょう。白血病やリンパ腫などの血液悪性腫瘍は、フローサイトメトリー、分子診断、次世代シーケンシングといった高度な検査手法を必要とする場合が多く、高度な専門知識と洗練された検査室インフラが求められます。これらのサービスは、疾患の予後、治療効果、微小残存病変の検出に関する重要な知見を提供するため、臨床現場においてますます不可欠なものとなっています。サービスプロバイダーは、正確かつタイムリーな診断に対する需要の高まりに対応するため、戦略的提携、技術アップグレード、プロセス改善を通じて提供内容を強化しています。

セグメンテーション2:プラットフォーム別

- ポリメラーゼ連鎖反応(PCR)

- 次世代シーケンシング

- 蛍光in situハイブリダイゼーション

- 免疫組織化学

- フローサイトメトリー

- その他のプラットフォーム

ポリメラーゼ連鎖反応(PCR)が血液悪性腫瘍検査市場を主導(プラットフォーム別)

検査プラットフォームに関して、ポリメラーゼ連鎖反応(PCR)は、血液がんに関連する遺伝子変異や異常の検出において確立された役割を担っていることから、血液悪性腫瘍診断において最も広く使用されるプラットフォームであり続けると予想されます。PCRは迅速かつ信頼性の高い結果を提供するため、日常的な診断検査の基盤となっています。しかし、次世代シーケンシング(NGS)は予測期間中に15.86%のCAGRで拡大し、最も急速な成長が見込まれています。NGSは遺伝子変異をはるかに高い解像度で分析できる能力により、血液悪性腫瘍検査を変革し、より精密な診断、リスク層別化、個別化治療オプションを可能にしています。ゲノムプロファイリングが血液がん管理の不可欠な要素となる中、NGSはますます重要な役割を担い、この分野における著しい進歩を牽引する態勢が整っています。

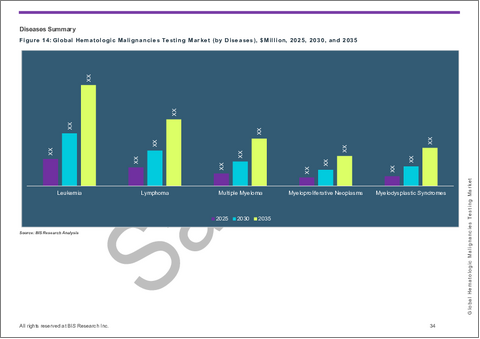

セグメンテーション3:疾患別

- 白血病

- リンパ腫

- 多発性骨髄腫

- 骨髄増殖性腫瘍

- 骨髄異形成症候群

白血病が血液悪性腫瘍検査市場を牽引(疾患別)

疾患分野においては、白血病が市場をリードすると見込まれています。これは主に、その診断の複雑さと、分子検査、細胞遺伝学的検査、フローベース検査の反復的な広範な使用によるものです。白血病の多様な遺伝的サブタイプは、初期診断から治療後の経過観察に至るまで、患者の経過を通じて頻繁な検査を必要とし、その管理には精密医療に基づくアプローチが求められます。そのため、白血病に関連する特定の変異や染色体異常を迅速かつ正確に特定できる診断ツールの需要が高まっています。包括的なプロファイリングのための次世代シーケンシング(NGS)やPCRなどの先進技術の活用拡大、および世界の白血病発生率の上昇が、このセグメントの堅調な市場成長を牽引すると予想されます。

セグメンテーション4:エンドユーザー別

- 専門クリニックおよび病院

- 診断検査室

- 参考検査機関

- 研究機関

診断検査室が血液悪性腫瘍検査市場を牽引(エンドユーザー別)

エンドユーザー別では、診断検査室が最も高い成長率を示すと予測されます。これは、血液悪性腫瘍に対する検査室ベースの検査件数が増加していることに起因します。血液がんがより一般的になるにつれ、診断検査室は専門的な検査に対する需要の高まりに対応するため、その能力を拡大しています。この成長は、アジア太平洋地域の一部など、医療インフラが急速に発展している地域で特に顕著です。診断検査室では、より詳細かつ正確な情報を提供し、治療方針の決定を支援し、患者の転帰を改善するため、次世代シーケンシング(NGS)や分子診断などの先端技術を積極的に導入しています。このような高度な検査室検査への移行により、診断検査室は血液悪性腫瘍検査市場の拡大における主要な貢献者として位置づけられています。

セグメンテーション5:地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- デンマーク

- その他

- アジア太平洋

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- シンガポール

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

北米が血液悪性腫瘍検査市場を地域別で主導

世界の血液悪性腫瘍検査市場は急速な成長を遂げており、いくつかの主要セグメントがその拡大を牽引しています。北米は、先進的な医療インフラ、分子・ゲノム診断技術の早期導入、そして堅牢な償還制度の恩恵を受け、引き続き主要地域としての地位を維持すると予想されます。同地域の市場規模は、革新的な診断手法への継続的な需要に支えられ、2035年までに92億5,960万米ドルに達すると予測されています。北米の市場における主導的地位は、確立された医学研究機関と臨床現場における精密医療の広範な統合によっても支えられています。さらに、血液がんの有病率の上昇と個別化治療への注目の高まりが、先進的診断ツールへの持続的な需要に寄与し、北米の市場優位性を強化しています。

血液悪性腫瘍検査市場の最近の動向

- 2025年11月、Pairidexは、融合遺伝子別血液悪性腫瘍の測定可能な残存病変(MRD)をモニタリングするための、個別化されたRNAベースのデジタルPCRアッセイ「FusionMRD」を発売しました。このアッセイは、白血病患者に対して末梢血から0.001%の感度を提供します。

- 2025年10月、Integrated DNA Technologies, Inc.とHamiltonは、Hamiltonの液体処理プラットフォーム上で、包括的なゲノムプロファイリングのためのカスタマイズ可能なNGSワークフローを自動化する戦略的パートナーシップを発表し、固形腫瘍と血液がんの調査ニーズの両方に特化した、プラットフォームに依存しないソリューションを提供しています。

- 2025年5月、Laboratory Corporation of America Holdingsは、精密腫瘍学のポートフォリオを拡大し、血液悪性腫瘍用の新しいNGSパネル、Rapid AMLパネル、OmniSeq INSIGHTでのHRD検査、および固形腫瘍用のFDA承認のコンパニオン診断薬の強化版を発表しました。

需要- 促進要因、課題、および機会

市場促進要因

血液悪性腫瘍の発生率の増加が診断ソリューションの需要を牽引 - ホジキンリンパ腫、非ホジキンリンパ腫、多発性骨髄腫、白血病などの血液悪性腫瘍の有病率の増加は、特殊な検査キットやサービスの需要を牽引する重要な要因であり続けています。特に高齢層におけるこれらのがんの発生率の増加は、早期かつ正確な診断方法の必要性を強調しています。世界的に血液悪性腫瘍の有病率が上昇し続ける中、血液悪性腫瘍検査キットを含む効果的な診断ツールへの需要はより緊急性を帯びています。これらのツールは、タイムリーな検出を可能にし、標的治療介入を支援するために不可欠です。精密診断、早期発見、個別化治療計画に焦点を当てた、より統合的な血液悪性腫瘍管理アプローチを促進する上で、高度で包括的な診断ソリューションへの移行が貢献しています。これらの疾患の増加する負担は、より正確かつ迅速な検査ソリューションへの需要に応えようとする診断企業や医療提供者にとって、大きな市場機会をもたらしています。

市場の課題

次世代シーケンシング(NGS)の臨床実践への統合における課題 - 次世代シーケンシング(NGS)は血液悪性腫瘍の診断と管理において大きな可能性を秘めていますが、臨床実践への統合にはいくつかの課題が存在します。特に血液がんにおいて、NGS由来の分子データを解釈する複雑さは、その普及における大きな障壁となっています。急性・慢性骨髄性悪性腫瘍などの疾患における遺伝的・表現型の多様性は、臨床的に重要な変異を正確に特定するために高度な専門知識と先進的なバイオインフォマティクスツールを必要とします。多くの臨床検査室や医療提供者は、体細胞変異と生殖細胞変異の区別や、微小残存病変(MRD)検出のための十分な感度達成など、技術的な課題に直面し続けています。さらに、NGS技術の導入には、特に小規模または資源制約のある医療環境において、財政的・運営上の負担が非常に大きいです。分子マーカーの急速な進化はNGSの統合をさらに複雑化し、検査パネルや解釈アルゴリズムの継続的な更新を必要とするため、複雑さとコストが増大します。これらの課題により、日常的な臨床現場でのNGS導入は遅れており、患者の治療成果を大幅に改善する可能性を制限し、市場全体の成長を阻んでいます。

市場機会

人工知能(AI)を活用した診断能力の向上 - 血液悪性腫瘍の診断プロセスへの人工知能(AI)の組み込みは、世界の検査市場における重要な成長機会を表しています。AI技術は、特に従来の方法では限界がある複雑な症例において、診断の精度と速度を向上させる能力を示しています。例えば、AI搭載アルゴリズムは原発性骨髄線維症や本態性血小板血症といった希少血液がんの鑑別において卓越した性能を示し、臨床医や病理医にとって重要な支援を提供しています。診断ワークフローへのAI統合は、診断の精度向上、臨床判断の改善、患者管理の効率化を可能とします。さらに、AIが大量の複雑な医療データを高速で分析する能力により、より迅速かつ信頼性の高い診断が可能となり、臨床試験への患者登録の迅速化や新治療法の開発促進につながります。医療システムが進化を続け、増大する医療データの複雑性を管理するためにAI技術に依存するにつれ、AI駆動型診断ソリューションへの需要は拡大すると予想されます。AI技術への投資や戦略的提携を通じてこれらの能力を強化する診断企業は、急速に発展する血液悪性腫瘍検査市場において主導的な立場を確立し、この分野の革新と成長を牽引するでしょう。

世界の血液悪性腫瘍検査市場は、製品タイプ、検査プラットフォーム、疾患カテゴリー、エンドユーザー、地域市場など、いくつかの主要セグメントに分類されています。どのセグメントが最大のシェアを占め、どのセグメントに成長の可能性があるかを理解することで、当レポートは製品の革新と拡充を目指す組織にとって貴重な知見を提供します。

成長・マーケティング戦略:戦略的提携、共同研究、事業拡大は、血液悪性腫瘍検査市場の成長において中核的な役割を果たすと予想されます。診断企業、医療提供者、研究機関間の主な発展や提携は、すでに市場力学の重要な部分を形成し始めています。

血液悪性腫瘍検査市場は競争が激しく、数多くの確立された企業が様々な診断製品・サービスを提供しています。主要市場参入企業は、ゲノムプロファイリングや精密診断を含む革新的な技術を積極的に開発・採用し、市場での差別化を図っています。

調査手法

市場設計および検証における主な考慮事項と前提条件

- 世界市場規模の推定には2024年から2035年までの期間を考慮し、2024年を基準年、2025年から2035年を予測期間と定めました。

- 当レポートの調査範囲は、専門クリニックや病院、診断検査室、基準検査室、研究所など、様々な分野の業界専門家からの包括的な情報を基にしています。

- 血液悪性腫瘍検査の市場貢献度は、将来的に大幅に成長すると予測されており、その予測は利用可能なソリューションの過去分析に基づいています。

- 企業の収益データは、2024年度の年次報告書より収集しています。非公開会社については、1次調査データ、資金調達履歴、市場連携状況、および事業実績に基づき収益を推定しています。

- 本市場は、既存の血液悪性腫瘍検査製品およびサービスに基づいてマッピングされています。本分野で重要な製品・サービスを提供する主要企業を特定し、本報告書内でプロファイリングしています。

主要市場参入企業と競合要約

プロファイル対象企業は、企業カバレッジ、製品ポートフォリオ、市場浸透度の分析から得られた情報を基に選定されています。

この市場で確立されている著名な企業は以下の通りです。

- Abbott Laboratories

- Adaptive Biotechnologies

- ARUP Laboratories

- Bio-Rad Laboratories, Inc.

- ICON plc

- Illumina, Inc.

- Invivoscribe Inc.

- Laboratory Corporation of America Holdings

- NeoGenomics Laboratories

- OHSU's Knight Diagnostic Laboratories

- QIAGEN N.V.

- Quest Diagnostics

- Sysmex Corporation

- Tempus Labs, Inc.

- Bio-Techne

- DiaSorin S.p.A

- Thermo Fisher Scientific, Inc.

- Bruker Corporation

- Vela Diagnostics

- Amoy Diagnostics Co., Ltd.

- Integrated DNA Technologies, Inc. (Danaher Corporation)

目次

エグゼクティブサマリー

第1章 世界の血液悪性腫瘍検査市場:市場概要

- イントロダクション

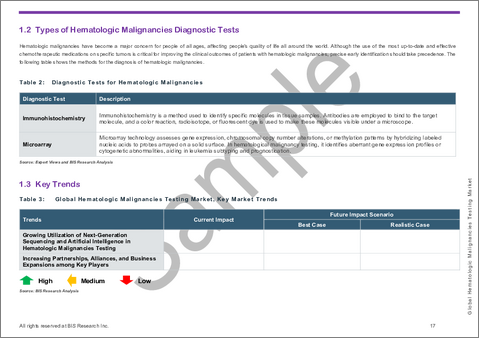

- 造血悪性腫瘍の種類と診断検査

- 主な動向

- 血液悪性腫瘍検査における次世代シーケンシングと人工知能の利用拡大

- 主要参入企業間のパートナーシップ、アライアンス、事業拡大の増加

- 規制状況/コンプライアンス

- 米国の規制枠組み

- 欧州の規制枠組み

- アジア太平洋の規制枠組み

- ラテンアメリカにおける規制枠組み

- サプライチェーン分析

- サプライチェーンの主要企業

- 価格分析

- 造血悪性腫瘍の疫学的分析

- 造血悪性腫瘍における将来の検査パラダイム

- 異なるパラメータ別造血悪性腫瘍検査の比較分析

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 世界の血液悪性腫瘍検査市場(製品・サービス別)、100万米ドル、2024年~2035年

- キット

- サービス

第3章 世界の血液悪性腫瘍検査市場(プラットフォーム別)、100万米ドル、2024年~2035年

- ポリメラーゼ連鎖反応

- 次世代シーケンシング

- 蛍光in-situハイブリダイゼーション

- 免疫組織化学

- フローサイトメトリー

- その他

第4章 世界の血液悪性腫瘍検査市場(疾患別)、100万米ドル、2024年~2035年

- 白血病

- リンパ腫

- 多発性骨髄腫

- 骨髄増殖性腫瘍

- 骨髄異形成症候群

第5章 世界の血液悪性腫瘍検査市場(エンドユーザー別)、100万米ドル、2024年~2035年

- 専門クリニックと病院

- 診断検査室

- 参照検査室

- 研究機関

第6章 世界の血液悪性腫瘍検査市場(地域別)、100万米ドル、2024年~2035年

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢と企業プロファイル

- 主な発展と戦略

- 合併と買収

- 規制当局の承認と製品の発売

- パートナーシップ、コラボレーション、そして事業拡大

- 企業プロファイル

- Abbott Laboratories

- Adaptive Biotechnologies

- ARUP Laboratories

- Bio-Rad Laboratories, Inc.

- ICON plc

- Illumina, Inc.

- Invivoscribe Inc.

- Laboratory Corporation of America Holdings

- NeoGenomics Laboratories

- OHSU's Knight Diagnostic Laboratories

- QIAGEN N.V.

- Quest Diagnostics

- Sysmex Corporation

- Tempus Labs, Inc

- Bio-Techne

- DiaSorin S.p.A

- Thermo Fisher Scientific, Inc.

- Bruker Corporation

- Vela Diagnostics

- Amoy Diagnostics Co., Ltd.

- Integrated DNA Technologies, Inc. (Danaher Corporation)

- その他