|

|

市場調査レポート

商品コード

1514756

アジア太平洋の培養肉市場:流通チャネル別、製品タイプ別、国別 - 分析と予測(2024年~2033年)Asia-Pacific Cultured Meat Market: Focus on Distribution Channel, Product Type, and Country - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の培養肉市場:流通チャネル別、製品タイプ別、国別 - 分析と予測(2024年~2033年) |

|

出版日: 2024年07月18日

発行: BIS Research

ページ情報: 英文 60 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の培養肉の市場規模は、2024年に1億7,900万米ドルになるとみられており、今後大幅な拡大が見込まれ、2033年には5億1,070万米ドルに達すると予測されています。

培養肉は、その合理化された生産工程のおかげで、従来の畜産よりも多くの利点を提供する態勢を整えています。初期のライフサイクル評価では、養殖肉は消費する資源が少なく、農業に関連する汚染や富栄養化を緩和する可能性があることが示されています。調査によれば、再生可能エネルギーを使用して生産された養殖肉は、従来の牛肉生産と比較して、温室効果ガス排出量を最大92%削減し、土地利用を最大90%削減できる可能性があります。さらに、養殖肉の商業生産は抗生物質を使用しないため、腸内病原体への暴露を最小限に抑え、食中毒を減らす可能性があると期待されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年の評価 | 1億7,900万米ドル |

| 2033年の予測 | 5億1,070万米ドル |

| CAGR | 12.35% |

アジア太平洋の培養肉市場は、同地域の食品事業における有望なセグメントとして台頭しつつあります。細胞農業によって生産される培養肉は、従来の畜産に代わる持続可能な代替手段を提供すると同時に、環境への影響を大幅に低減し、食糧安全保障の懸念に対処します。バイオテクノロジーの進歩と持続可能性に対する消費者の意識の高まりにより、アジア太平洋諸国は培養肉生産の将来性に注目しています。このブレークスルーは、タンパク質が豊富な食事に対する需要の高まりに対応するだけでなく、倫理的な動物扱いを奨励し、従来の食肉生産に関連する温室効果ガスの排出を最小限に抑えることも意図しています。アジア太平洋諸国が食糧安全保障と持続可能性の目標を達成しようとする中、培養肉技術への投資と法的支援が拡大し、競争市場環境が促進され、同地域内の細胞農業の技術進歩が促進されると予測されます。

当レポートでは、アジア太平洋の培養肉市場について調査し、市場の概要とともに、流通チャネル別、製品タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 培養肉の登場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- 市場力学の概要

第2章 地域

- 地域別概要

- 促進要因と抑制要因

- アジア太平洋

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Vow Group Pty Ltd

- Shiok Meats Pte Ltd

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Cultured Meat Market (by Scenario), $Million, 2024, 2026, and 2033

- Figure 2: Asia-Pacific Cultured Meat Market (by Distribution Channel), $Million, 2024, 2026, 2033

- Figure 3: Asia-Pacific Cultured Meat Market (by Product Type), $Million, 2024, 2026, 2033

- Figure 4: Key Events

- Figure 5: Production Timeline

- Figure 6: Greenhouse Gas Emissions per Kilogram of Meat Products

- Figure 7: Supply Chain and Risks within the Supply Chain

- Figure 8: Patent Analysis (by Company), January 2021-December 2023

- Figure 9: Patent Analysis (by Country), January 2021-December 2023

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2033

- Figure 11: Number of Animals Getting Slaughtered for Meat Everyday

- Figure 12: China Cultured Meat Market, $Million, 2024-2033

- Figure 13: Singapore Cultured Meat Market, $Million, 2024-2033

- Figure 14: South Korea Cultured Meat Market, $Million, 2024-2033

- Figure 15: Australia Cultured Meat Market, $Million, 2024-2033

- Figure 16: Rest-of-Asia-Pacific Cultured Meat Market, $Million, 2024-2033

- Figure 17: Strategic Initiatives, 2020-2023

- Figure 18: Share of Strategic Initiatives

- Figure 19: Data Triangulation

- Figure 20: Top-Down and Bottom-Up Approach

- Figure 21: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities

- Table 3: Share of Vegans in 2022

- Table 4: Regulatory Landscape

- Table 5: Meat Consumption by Country (Kilogram), 2020

- Table 6: Cultured Meat Market (by Region), $Million, 2024-2033

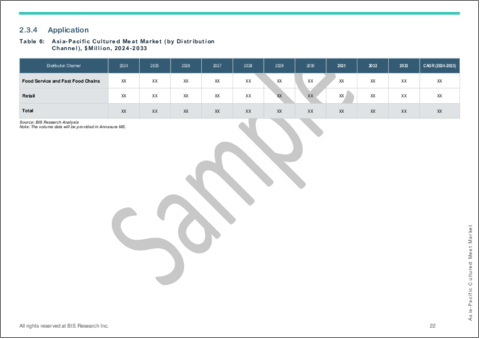

- Table 7: Asia-Pacific Cultured Meat Market (by Distribution Channel), $Million, 2024-2033

- Table 8: Asia-Pacific Cultured Meat Market (by Product Type), $Million, 2024-2033

- Table 9: China Cultured Meat Market (by Distribution Channel), $Million, 2024-2033

- Table 10: China Cultured Meat Market (by Product Type), $Million, 2024-2033

- Table 11: Singapore Cultured Meat Market (by Distribution Channel), $Million, 2024-2033

- Table 12: Singapore Cultured Meat Market (by Product Type), $Million, 2024-2033

- Table 13: South Korea Cultured Meat Market (by Distribution Channel), $Million, 2024-2033

- Table 14: South Korea Cultured Meat Market (by Product Type), $Million, 2024-2033

- Table 15: Australia Cultured Meat Market (by Distribution Channel), $Million, 2024-2033

- Table 16: Australia Cultured Meat Market (by Product Type), $Million, 2024-2033

- Table 17: Rest-of-Asia-Pacific Cultured Meat Market (by Distribution Channel), $Million, 2024-2033

- Table 18: Rest-of-Asia-Pacific Cultured Meat Market (by Product Type), $Million, 2024-2033

- Table 19: Market Share

Introduction to Asia Pacific (APAC) Cultured Meat Market

The Asia Pacific cultured meat market, which is expected to be valued at $179.0 million in 2024, is anticipated to undergo substantial expansion, reaching an estimated $510.7 million by 2033. Cultivated meat is poised to provide numerous benefits over traditional animal agriculture, thanks to its streamlined production process. Initial life cycle assessments indicate that cultivated meat consumes fewer resources and has the potential to mitigate pollution and eutrophication linked with agriculture. Research indicates that cultivated meat produced using renewable energy could reduce greenhouse gas emissions by up to 92% and lower land use by up to 90% compared to conventional beef production. Furthermore, commercial production of cultivated meat is expected to be antibiotic-free, potentially reducing foodborne illnesses by minimizing exposure to enteric pathogens.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $179.0 Million |

| 2033 Forecast | $510.7 Million |

| CAGR | 12.35% |

Market Introduction

The Asia Pacific cultured meat market is emerging as a promising segment of the region's food business. Cultured meat, produced by cellular agriculture, provides a sustainable alternative to traditional livestock farming while drastically decreasing environmental impact and addressing food security concerns. With advances in biotechnology and rising consumer awareness of sustainability, Asia-Pacific (APAC) countries are looking into prospects in cultured meat production. This breakthrough intends not just to address the growing demand for protein-rich diets, but also to encourage ethical animal treatment and minimize greenhouse gas emissions linked with traditional meat production. As APAC countries try to achieve food security and sustainability goals, investments and legislative support for cultured meat technologies are projected to expand, promoting a competitive market landscape and driving technological advancements in cellular agriculture within the region.

Market Segmentation

Segmentation 1: by Distribution Channel

- Food Service and Fast Food Chains

- Retail

Segmentation 2: by Product Type

- Poultry

- Beef

- Seafood

- Pork

- Others

Segmentation 3: by Country

- China

- Singapore

- South Korea

- Australia

- Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of the cultured meat products available based on distribution channel (food service and fast food chains and retail), product type (poultry, beef, seafood, pork, and others), ingredient type (plant-derived ingredient and animal-derived ingredient). The market is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of cultivated meat as an alternative protein. Therefore, the cultured meat business is a high-investment and high-revenue generating model.

Growth/Marketing Strategy: The Asia Pacific cultured meat market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships and collaborations.

Competitive Strategy: The key players in the Asia Pacific cultured meat market analyzed and profiled in the study include cultured meat manufacturers that produce cultured meat. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing company coverage, product portfolio, and market penetration.

Some of the prominent companies in this market are:

- Vow Group Pty Ltd

- Shiok Meats Pte Ltd

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Emergence of Cultured Meat

- 1.2 Trends: Current and Future Impact Assessment

- 1.2.1 Trends: Overview

- 1.2.2 Rise in Adoption of Vegan Lifestyle

- 1.2.3 Emphasis on Environmental Sustainability

- 1.3 Supply Chain Overview

- 1.3.1 Value Chain Analysis

- 1.3.2 Market Map

- 1.4 Research and Development Review

- 1.4.1 Patent Filing Trend (by Company, Country)

- 1.5 Regulatory Landscape

- 1.6 Market Dynamics Overview

- 1.6.1 Market Drivers

- 1.6.1.1 Increase in Demand for Alternative Protein

- 1.6.1.2 Increase in Awareness Related to Animal Cruelty in Meat and Dairy Industry

- 1.6.1.3 Increase in Investment and Funding of Lab-Grown Meat

- 1.6.2 Market Challenges

- 1.6.2.1 High Production Cost

- 1.6.2.2 Skepticism among Consumers

- 1.6.3 Market Opportunities

- 1.6.3.1 High Per Capita Meat Consumption and Imports in Countries

- 1.6.3.2 Growth in Approval Rates for Commercial Sales and Increase in New Product Launch

- 1.6.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Drivers and Restraints

- 2.3 Asia-Pacific

- 2.3.1 Regional Overview

- 2.3.2 Driving Factors for Market Growth

- 2.3.3 Factors Challenging the Market

- 2.3.4 Application

- 2.3.5 Product

- 2.3.6 China

- 2.3.7 Singapore

- 2.3.8 South Korea

- 2.3.9 Australia

- 2.3.10 Rest-of-Asia-Pacific

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 Vow Group Pty Ltd

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share

- 3.2.2 Shiok Meats Pte Ltd

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share

- 3.2.1 Vow Group Pty Ltd

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast