|

|

市場調査レポート

商品コード

1402518

防水混和剤市場:世界および地域別分析(2023年~2033年)Waterproofing Admixtures Market: A Global and Regional Analysis, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 防水混和剤市場:世界および地域別分析(2023年~2033年) |

|

出版日: 2024年01月09日

発行: BIS Research

ページ情報: 英文 158 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 目次

世界の防水混和剤の市場規模は近年、様々な重要な促進要因によって大きな成長を遂げています。

この成長の主な要因の1つは、建築・インフラ部門における耐久性と防水性に優れた建設資材に対する意識の高まりと重視です。防水混和剤は、混合の過程でコンクリートやモルタルに添加される化学化合物で、材料の耐水性を高めます。建設業界が構造物の長寿命化と持続可能性の向上を目指す中、特に降雨量が多い地域や湿度が高い地域では、防水混和剤の需要が急増しています。これらの混和剤は、水の浸入を防ぎ、構造物の損傷リスクを低減し、建物やインフラの全体的な耐久性を向上させる効果的なソリューションを提供します。

さらに、特に新興経済諸国における都市化とインフラ整備の成長は、防水混和剤の需要を促進する上で重要な役割を果たしています。集合住宅、商業ビル、交通インフラなどの大規模建設プロジェクトに投資する国が増えるにつれ、信頼性の高い防水ソリューションの必要性が極めて重要になっています。防水混和剤は、従来の外部防水工法よりも優れており、建設段階においてよりシームレスで費用対効果の高いソリューションを提供します。さらに、環境問題への関心が環境に優しい防水混和剤の開発に拍車をかけ、持続可能で環境に優しい建設慣行を目指す世界の動向に合致しています。建設業界が弾力性があり環境に配慮した建材を優先し続ける中、世界の防水混和剤市場は今後数年間で持続的な成長を遂げるとみられています。

当レポートでは、世界の防水混和剤市場について調査し、市場の概要とともに、用途別、タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- ステークホルダーの分析

- 主要な世界的出来事- COVID-19、ロシア/ウクライナ、中東危機の影響分析

- 防水混和剤市場の主要企業による最近の動向

- 市場力学の概要

第2章 用途

- 用途のセグメンテーション

- 用途の概要

- 世界の防水混和剤市場- 用途別

第3章 製品

- 製品のセグメンテーション

- 製品概要

- 世界の防水混和剤市場- タイプ別

第4章 地域

- 地域別の概要

- 促進要因と抑制要因

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合情勢と企業プロファイル

- 競合情勢

- 企業プロファイル

- Sika AG

- Basf SE

- GCP Applied Technologies

- Mapei Corporation

- Rhein Chemotechnik GmbH

- Wacker Chemie AG

- Master Builders Solutions Ltd.

- Oscrete Concrete Solutions

- Fosroc International

- ECMAS Group

- W.R. Grace And Co

- DOW Corning Corporation

- RPM International Inc

- Pidilite Industries

- Evonik Industries

- その他の主要な市場参入企業

第6章 成長の機会と提言

第7章 調査手法

“Waterproofing Admixtures Market Makes Waves as Infrastructure Boom Drives Demand.”

The global market for waterproofing admixtures has experienced substantial growth in recent years, driven by various key factors and driving forces. One primary contributor to this growth is the increasing awareness and emphasis on durable and waterproof construction materials within the building and infrastructure sector. Waterproofing admixtures are chemical compounds added to concrete or mortar during the mixing process to enhance the material's resistance to water penetration. With the construction industry aiming to enhance the longevity and sustainability of structures, the demand for waterproofing admixtures has surged, particularly in regions prone to heavy rainfall or high humidity. These admixtures provide an effective solution for preventing water ingress, reducing the risk of structural damage, and improving the overall durability of buildings and infrastructure.

Furthermore, the growth of urbanization and infrastructure development, particularly in emerging economies, has played a significant role in driving the demand for waterproofing admixtures. As more countries invest in large-scale construction projects such as residential complexes, commercial buildings, and transportation infrastructure, the need for reliable waterproofing solutions becomes crucial. Waterproofing admixtures offer advantages over traditional external waterproofing methods, providing a more seamless and cost-effective solution during the construction phase. Additionally, environmental concerns have spurred the development of eco-friendly waterproofing admixtures, aligning with the global trend toward sustainable and green construction practices. As the construction industry continues to prioritize resilient and environmentally conscious building materials, the global waterproofing admixtures market is poised for sustained growth in the coming years.

Market Segmentation:

Segmentation 1: by Application

- Commercial

- Residential

- Infrastructure

- Others

Segmentation 2: by Type

- Pore blocking

- Crystalline

- Densifier

- Others

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing company coverage, product portfolio, and market penetration.

Some of the prominent names established in this market are:

|

|

Key Questions Answered in this Report:

- What are the main factors driving the demand for global waterproofing admixtures market?

- What are the major patents filed by the companies active in the global waterproofing admixtures market?

- What are the strategies adopted by the key companies to gain a competitive edge in waterproofing admixtures industry?

- What is the futuristic outlook for the waterproofing admixtures industry in terms of growth potential?

- Which application, and product type is expected to lead the market over the forecast period (2023-2033)?

Table of Contents

1. Markets: Industry Outlook

- 1.1. Trends: Current and Future Impact Assessment

- 1.1.1. Growing Construction Industry

- 1.1.2. Rising Demand for Effective Waterproofing Solutions

- 1.2. Supply Chain Overview

- 1.2.1. Value chain Analysis

- 1.2.2. Market Map

- 1.2.3. Pricing Forecast

- 1.3. R&D Review

- 1.3.1. Patent Filing Trend by Country, by Company

- 1.4. Regulatory Landscape

- 1.5. Stakeholder Analysis

- 1.5.1. Use case

- 1.5.2. End User and buying criteria

- 1.6. Impact analysis for Key Global Events-covid19, Russia/Ukraine or Middle East crisis

- 1.7. Recent Developments by Key Players in Waterproofing Admixtures Market

- 1.8. Market Dynamics Overview

- 1.8.1. Market Drivers

- 1.8.2. Market Restraints

- 1.8.3. Market Opportunities

2. Application

- 2.1. Application Segmentation

- 2.2. Application Summary

- 2.3. Global Waterproofing Admixtures Market - by Application

- 2.3.1. Commercial

- 2.3.2. Residential

- 2.3.3. Infrastructure

- 2.3.4. Others

3. Product

- 3.1. Product Segmentation

- 3.2. Product Summary

- 3.3. Global Waterproofing Admixtures Market - by Type

- 3.3.1. Pore blocking

- 3.3.2. Crystalline

- 3.3.3. Densifier

- 3.3.4. Others

4. Regions

- 4.1. Regional Summary

- Table: Global Waterproofing Admixtures Market, By Region, (Kilo Tons), 2022-2033

- Table: Global Waterproofing Admixtures Market, By Region, ($ Million), 2022-2033

- 4.2. Drivers and Restraints

- 4.3. North America

- 4.3.1. Key Market Participants in North America

- 4.3.2. Business Drivers

- 4.3.3. Business Challenges

- 4.3.4. Application

- Table: North America Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: North America Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- 4.3.5. Product

- Table: North America Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: North America Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.3.6. North America Waterproofing Admixtures Market (by Country)

- 4.3.6.1. U.S.

- Table: U.S. Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: U.S. Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: U.S. Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: U.S. Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.3.6.2. Canada

- Table: Canada Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Canada Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: Canada Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Canada Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.3.6.3. Mexico

- Table: Mexico Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Mexico Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: Mexico Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Mexico Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.3.6.1. U.S.

- 4.4. Europe

- 4.4.1. Key Market Participants in Europe

- 4.4.2. Business Drivers

- 4.4.3. Business Challenges

- 4.4.4. Application

- Table: Europe Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Europe Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- 4.4.5. Product

- Table: Europe Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Europe Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.4.6. Europe Waterproofing Admixtures Market (by Country)

- 4.4.6.1. Germany

- Table: Germany Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Germany Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: Germany Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Germany Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.4.6.2. France

- Table: France Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: France Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: France Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: France Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.4.6.3. Italy

- Table: Italy Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Italy Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: Italy Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Italy Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

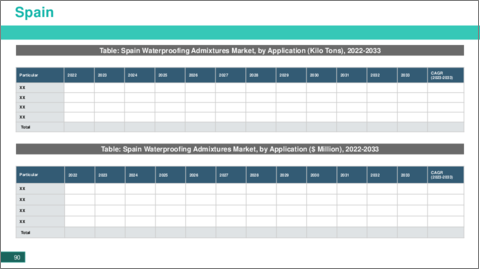

- 4.4.6.4. Spain

- Table: Spain Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Spain Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: Spain Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Spain Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.4.6.5. U.K.

- Table: U.K. Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: U.K. Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: U.K. Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: U.K. Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.4.6.6. Rest-of-Europe

- Table: Rest-of-Europe Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Rest-of-Europe Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: Rest-of-Europe Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Rest-of-Europe Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.4.6.1. Germany

- 4.5. Asia-Pacific

- 4.5.1. Key Market Participants in Asia-Pacific

- 4.5.2. Business Drivers

- 4.5.3. Business Challenges

- 4.5.4. Application

- Table: Asia-Pacific Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Asia-Pacific Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- 4.5.5. Product

- Table: Asia-Pacific Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Asia-Pacific Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.5.6. Asia-Pacific Waterproofing Admixtures Market (by Country)

- 4.5.6.1. China

- Table: China Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: China Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: China Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: China Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.5.6.2. Japan

- Table: Japan Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Japan Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: Japan Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Japan Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.5.6.3. India

- Table: India Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: India Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: India Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: India Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.5.6.4. South Korea

- Table: South Korea Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: South Korea Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: South Korea Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: South Korea Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.5.6.5. Rest-of-Asia-Pacific

- Table: Rest-of-Asia-Pacific Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Rest-of-Asia-Pacific Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: Rest-of-Asia-Pacific Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Rest-of-Asia-Pacific Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.5.6.1. China

- 4.6. Rest-of-the-World

- 4.6.1. Key Market Participants in Rest-of-the-World

- 4.6.2. Business Drivers

- 4.6.3. Business Challenges

- 4.6.4. Application

- Table: Rest-of-the-World Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: Rest-of-the-World Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- 4.6.5. Product

- Table: Rest-of-the-World Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: Rest-of-the-World Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.6.6. Rest of the World Waterproofing Admixtures Market (By Region)

- 4.6.6.1. The Middle East and Africa

- Table: The Middle East and Africa Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: The Middle East and Africa Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: The Middle East and Africa Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: The Middle East and Africa Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.6.6.2. South America

- Table: South America Waterproofing Admixtures Market, by Application (Kilo Tons), 2022-2033

- Table: South America Waterproofing Admixtures Market, by Application ($ Million), 2022-2033

- Table: South America Waterproofing Admixtures Market, by Type (Kilo Tons), 2022-2033

- Table: South America Waterproofing Admixtures Market, by Type ($ Million), 2022-2033

- 4.6.6.1. The Middle East and Africa

5. Markets - Competitive Landscape & Company Profiles

- 5.1. Competitive Landscape

- 5.2. Company Profiles

- 5.2.1. Sika AG

- 5.2.1.1. Overview

- 5.2.1.2. Top Products / Product Portfolio

- 5.2.1.3. Top Competitors

- 5.2.1.4. Target Customers/End-Users

- 5.2.1.5. Key Personnel

- 5.2.1.6. Analyst View

- 5.2.1.7. Market Share

- 5.2.2. Basf SE

- 5.2.2.1. Overview

- 5.2.2.2. Top Products / Product Portfolio

- 5.2.2.3. Top Competitors

- 5.2.2.4. Target Customers/End-Users

- 5.2.2.5. Key Personnel

- 5.2.2.6. Analyst View

- 5.2.2.7. Market Share

- 5.2.3. GCP Applied Technologies

- 5.2.3.1. Overview

- 5.2.3.2. Top Products / Product Portfolio

- 5.2.3.3. Top Competitors

- 5.2.3.4. Target Customers/End-Users

- 5.2.3.5. Key Personnel

- 5.2.3.6. Analyst View

- 5.2.3.7. Market Share

- 5.2.4. Mapei Corporation

- 5.2.4.1. Overview

- 5.2.4.2. Top Products / Product Portfolio

- 5.2.4.3. Top Competitors

- 5.2.4.4. Target Customers/End-Users

- 5.2.4.5. Key Personnel

- 5.2.4.6. Analyst View

- 5.2.4.7. Market Share

- 5.2.5. Rhein Chemotechnik GmbH

- 5.2.5.1. Overview

- 5.2.5.2. Top Products / Product Portfolio

- 5.2.5.3. Top Competitors

- 5.2.5.4. Target Customers/End-Users

- 5.2.5.5. Key Personnel

- 5.2.5.6. Analyst View

- 5.2.5.7. Market Share

- 5.2.6. Wacker Chemie AG

- 5.2.6.1. Overview

- 5.2.6.2. Top Products / Product Portfolio

- 5.2.6.3. Top Competitors

- 5.2.6.4. Target Customers/End-Users

- 5.2.6.5. Key Personnel

- 5.2.6.6. Analyst View

- 5.2.6.7. Market Share

- 5.2.7. Master Builders Solutions Ltd.

- 5.2.7.1. Overview

- 5.2.7.2. Top Products / Product Portfolio

- 5.2.7.3. Top Competitors

- 5.2.7.4. Target Customers/End-Users

- 5.2.7.5. Key Personnel

- 5.2.7.6. Analyst View

- 5.2.7.7. Market Share

- 5.2.8. Oscrete Concrete Solutions

- 5.2.8.1. Overview

- 5.2.8.2. Top Products / Product Portfolio

- 5.2.8.3. Top Competitors

- 5.2.8.4. Target Customers/End-Users

- 5.2.8.5. Key Personnel

- 5.2.8.6. Analyst View

- 5.2.8.7. Market Share

- 5.2.9. Fosroc International

- 5.2.9.1. Overview

- 5.2.9.2. Top Products / Product Portfolio

- 5.2.9.3. Top Competitors

- 5.2.9.4. Target Customers/End-Users

- 5.2.9.5. Key Personnel

- 5.2.9.6. Analyst View

- 5.2.9.7. Market Share

- 5.2.10. ECMAS Group

- 5.2.10.1. Overview

- 5.2.10.2. Top Products / Product Portfolio

- 5.2.10.3. Top Competitors

- 5.2.10.4. Target Customers/End-Users

- 5.2.10.5. Key Personnel

- 5.2.10.6. Analyst View

- 5.2.10.7. Market Share

- 5.2.11. W.R. Grace And Co

- 5.2.11.1. Overview

- 5.2.11.2. Top Products / Product Portfolio

- 5.2.11.3. Top Competitors

- 5.2.11.4. Target Customers/End-Users

- 5.2.11.5. Key Personnel

- 5.2.11.6. Analyst View

- 5.2.11.7. Market Share

- 5.2.12. DOW Corning Corporation

- 5.2.12.1. Overview

- 5.2.12.2. Top Products / Product Portfolio

- 5.2.12.3. Top Competitors

- 5.2.12.4. Target Customers/End-Users

- 5.2.12.5. Key Personnel

- 5.2.12.6. Analyst View

- 5.2.12.7. Market Share

- 5.2.13. RPM International Inc

- 5.2.13.1. Overview

- 5.2.13.2. Top Products / Product Portfolio

- 5.2.13.3. Top Competitors

- 5.2.13.4. Target Customers/End-Users

- 5.2.13.5. Key Personnel

- 5.2.13.6. Analyst View

- 5.2.13.7. Market Share

- 5.2.14. Pidilite Industries

- 5.2.14.1. Overview

- 5.2.14.2. Top Products / Product Portfolio

- 5.2.14.3. Top Competitors

- 5.2.14.4. Target Customers/End-Users

- 5.2.14.5. Key Personnel

- 5.2.14.6. Analyst View

- 5.2.14.7. Market Share

- 5.2.15. Evonik Industries

- 5.2.15.1. Overview

- 5.2.15.2. Top Products / Product Portfolio

- 5.2.15.3. Top Competitors

- 5.2.15.4. Target Customers/End-Users

- 5.2.15.5. Key Personnel

- 5.2.15.6. Analyst View

- 5.2.15.7. Market Share

- 5.2.1. Sika AG

- 5.3. Other Key Market Participants