|

|

市場調査レポート

商品コード

1071523

防錆塗料の世界市場Anticorrosion Coatings: Global Markets |

||||||

| 防錆塗料の世界市場 |

|

出版日: 2022年04月20日

発行: BCC Research

ページ情報: 英文 140 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の防錆塗料の市場規模は、2022年に284億米ドルになるとみられています。

同市場は、2022年~2027年にかけ3.7%のCAGRで拡大し、2027年には340億米ドルに達すると予測されています。

当レポートでは、世界の防錆塗料市場について調査し、市場の概要とともに、製品タイプ別、技術別、業界エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。目次

第1章 イントロダクション

第2章 まとめとハイライト

第3章 市場概要

- 市場の可能性

- 市場シェア

- バリューチェーン分析

- 規制の枠組み

- ポーターのファイブフォース分析

- 業界の成長要因

- 市場の抑制要因の分析

第4章市場内訳、製品タイプ別

- エポキシ防錆塗料

- ポリウレタン防錆塗料

- アクリル防錆塗料

- アルキド防錆塗料

- 亜鉛防錆塗料

- 塩素化ゴムおよびその他の防錆塗料

第5章 市場内訳、技術別

- 溶剤型防錆塗料

- 水性防錆塗料

- 粉体塗装およびその他

第6章 市場の内訳、業界エンドユーザー別

- 船舶

- 石油・ガス

- 工業製造

- 建設

- エネルギー

- 自動車

- その他

第7章 市場内訳、地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第8章 市場内訳、国別

- 米国

- 英国

- ドイツ

- インド

- 中国

- ブラジル

第9章 業界構造

第10章 企業プロファイル

- 3M

- AKZONOBEL N.V.

- BASF SE

- THE DOW CHEMICAL COMPANY

- DUPONT DE NEMOURS INC.

- HEMPEL A/S

- JOTUN

- RPM INTERNATIONAL INC.

- THE SHERWIN-WILLIAMS COMPANY

- WACKER CHEMIE AG

第11章 付録:頭字語

List of Tables

- Summary Table : Global Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 1 : Drivers of the Market for Anticorrosion Coatings

- Table 2 : Market Restraints for Anticorrosion Coatings

- Table 3 : Global Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 4 : Global Market for Epoxy Anticorrosion Coatings, by Region, Through 2027

- Table 5 : Global Market for Polyurethane Anticorrosion Coatings, by Region, Through 2027

- Table 6 : Global Market for Acrylic Anticorrosion Coatings, by Region, Through 2027

- Table 7 : Global Market for Alkyd Anticorrosion Coatings, by Region, Through 2027

- Table 8 : Global Market for Zinc Anticorrosion Coatings, by Region, Through 2027

- Table 9 : Global Market for Chlorinated Rubber and Other Types of Anticorrosion Coatings, by Region, Through 2027

- Table 10 : Global Market for Anticorrosion Coatings, by Technology, Through 2027

- Table 11 : Global Market for Solvent-borne Anticorrosion Coatings, by Region, Through 2027

- Table 12 : Global Market for Water-borne Anticorrosion Coatings, by Region, Through 2027

- Table 13 : Global Market for Powder Coatings and Other Technology Types, by Region, Through 2027

- Table 14 : Global Market for Anticorrosion Coatings, by End User, Through 2027

- Table 15 : Global Market for Anticorrosion Coatings in the Marine Industry, by Region, Through 2027

- Table 16 : Global Market for Anticorrosion Coatings in the Oil and Gas Industry, by Region, Through 2027

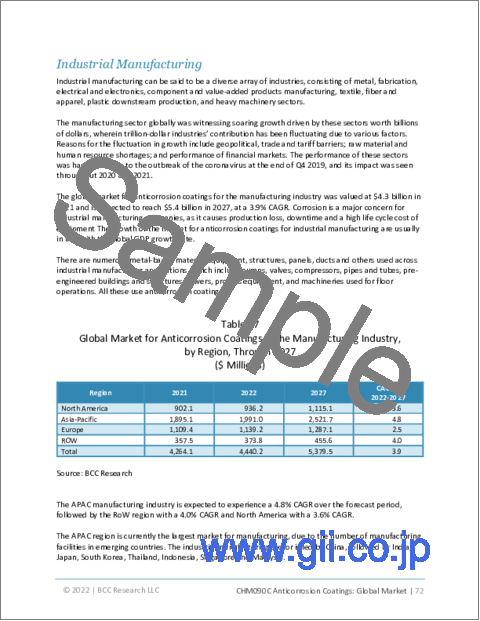

- Table 17 : Global Market for Anticorrosion Coatings in the Manufacturing Industry, by Region, Through 2027

- Table 18 : Global Market for Anticorrosion Coatings in the Construction Industry, by Region, Through 2027

- Table 19 : Global Market for Anticorrosion Coatings in the Energy Industry, by Region, Through 2027

- Table 20 : Global Market for Anticorrosion Coatings in the Automotive Industry, by Region, Through 2027

- Table 21 : Global Market for Anticorrosion Coatings in Other Industries, by Region, Through 2027

- Table 22 : Global Market for Anticorrosion Coatings, by Region, Through 2027

- Table 23 : North American Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 24 : North American Market for Anticorrosion Coatings, by Technology, Through 2027

- Table 25 : North American Market for Anticorrosion Coatings, by End User, Through 2027

- Table 26 : European Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 27 : European Market for Anticorrosion Coatings, by Technology, Through 2024

- Table 28 : European Market for Anticorrosion Coatings, by End User, Through 2027

- Table 29 : APAC Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 30 : APAC Market for Anticorrosion Coatings, by Technology, Through 2027

- Table 31 : APAC Market for Anticorrosion Coatings, by End User, Through 2027

- Table 32 : RoW Market for Anticorrosion Coatings, by Product Type, Through 2024

- Table 33 : RoW Market for Anticorrosion Coatings, by Technology, Through 2027

- Table 34 : RoW Market for Anticorrosion Coatings, by End User, Through 2024

- Table 35 : Global Market for Anticorrosion Coatings, by Key Countries, Through 2027

- Table 36 : U.S. Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 37 : U.S. Market for Anticorrosion Coatings, by Technology, Through 2027

- Table 38 : U.S. Market for Anticorrosion Coatings, by End User, Through 2027

- Table 39 : U.K. Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 40 : U.K. Market for Anticorrosion Coatings, by Technology, Through 2027

- Table 41 : U.K. Market for Anticorrosion Coatings, by End User, Through 2027

- Table 42 : German Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 43 : German Market for Anticorrosion Coatings, by Technology, Through 2024

- Table 44 : German Market for Anticorrosion Coatings, by End User, Through 2027

- Table 45 : Indian Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 46 : Indian Market for Anticorrosion Coatings, by Technology, Through 2027

- Table 47 : Indian Market for Anticorrosion Coatings, by End User, Through 2027

- Table 48 : Chinese Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 49 : Chinese Market for Anticorrosion Coatings, by Technology, Through 2027

- Table 50 : Chinese Market for Anticorrosion Coatings, by End User, Through 2027

- Table 51 : Brazilian Market for Anticorrosion Coatings, by Product Type, Through 2027

- Table 52 : Brazilian Market for Anticorrosion Coatings, by Technology, Through 2027

- Table 53 : Brazilian Market for Anticorrosion Coatings, by End User, Through 2027

- Table 54 : 3M: Company Overview

- Table 55 : 3M: Product Portfolio

- Table 56 : 3M: Recent Developments, 2021

- Table 57 : AkzoNobel N.V.: Company Overview, 2021

- Table 58 : AkzoNobel N.V.: Product Portfolio

- Table 59 : AkzoNobel N.V.: Recent Developments, 2021

- Table 60 : BASF SE: Company Overview, 2021

- Table 61 : BASF SE: Product Portfolio

- Table 62 : BASF SE: Recent Developments, 2021

- Table 63 : The Dow Chemical Company: Company Overview, 2021

- Table 64 : The Dow Chemical Company: Product Portfolio

- Table 65 : The Dow Chemical Company: Recent Developments, 2021

- Table 66 : DuPont de Nemours Inc.: Company Overview, 2021

- Table 67 : DuPont: Product Portfolio

- Table 68 : Hempel A/S: Company Overview, 2021

- Table 69 : Hempel A/S: Product Portfolio

- Table 70 : Hempel A/S: Recent Developments, 2021

- Table 71 : Jotun: Company Overview, 2021

- Table 72 : Jotun: Product Portfolio

- Table 73 : RPM International: Company Overview, 2020

- Table 74 : RPM International: Product Portfolio

- Table 75 : RPM International: Recent Developments, 2021

- Table 76 : The Sherwin-Williams Company: Company Overview, 2021

- Table 77 : The Sherwin-Williams Company: Product Portfolio

- Table 78 : The Sherwin-Williams Company: Recent Developments, 2021

- Table 79 : Wacker Chemie AG: Company Overview, 2021

- Table 80 : Wacker Chemie AG: Product Portfolio

- Table 81 : Wacker Chemie AG: Recent Developments, 2021

- Table 82 : Acronyms Used in This Report

List of Figures

- Summary Figure : Global Market for Anticorrosion Coatings, by Product Type, 2021-2027

- Figure 1 : Global Market Shares of Coatings, by Revenue Segment, 2021

- Figure 2 : Value Chain Analysis of the Market for Anticorrosion Coatings

- Figure 3 : Global Water Consumption Projection and Trends, 2020-2040

- Figure 4 : Global Annualized Water Demand, by Applications, 2005-2030

- Figure 5 : Average R&D Spending of Chemical Companies, by Category, 2019

- Figure 6 : Global Market for Functional Foods, 2019-2024

- Figure 7 : Global Production of Lightweight Vehicles, 2019-2024

- Figure 8 : Global Market Shares of Anticorrosion Coatings, by Product Type, 2021

- Figure 9 : Global Market Shares of Anticorrosion Coatings, by Technology, 2021

- Figure 10 : Global Market Shares of Anticorrosion Coatings, by Industry End User, 2021

- Figure 11 : Global EV Sales, 2020-2030

- Figure 12 : Global Market Shares of Anticorrosion Coatings, by Region, 2021

- Figure 13 : North American Market Shares of Anticorrosion Coatings, by Country, 2021

- Figure 14 : European Market Shares of Anticorrosion Coatings, by Country, 2021

- Figure 15 : APAC Market Shares of Anticorrosion Coatings, by Country, 2021

- Figure 16 : 3M: Company Revenue, 2020 and 2021

- Figure 17 : 3M: R&D Expenditures, 2020 and 2021

- Figure 18 : 3M: Revenue Share, by Segment, 2021

- Figure 19 : 3M: Revenue Share, by Region, 2021

- Figure 20 : AkzoNobel N.V.: Company Revenue, 2020 and 2021

- Figure 21 : AkzoNobel N.V.: Revenue Share, by Segment, 2021

- Figure 22 : AkzoNobel N.V.: Revenue Share, by Region, 2021

- Figure 23 : BASF SE: Company Revenue, 2020 and 2021

- Figure 24 : BASF SE: R&D Expenditure, 2020 and 2021

- Figure 25 : BASF SE: Revenue Share, by Segment, 2021

- Figure 26 : BASF SE: Revenue Share, by Region, 2021

- Figure 27 : The Dow Chemical Company: Company Revenue, 2020 and 2021

- Figure 28 : The Dow Chemical Company: R&D Expenditures, 2020 and 2021

- Figure 29 : The Dow Chemical Company: Revenue Share, by Segment, 2021

- Figure 30 : The Dow Chemical Company: Revenue Share, by Region, 2021

- Figure 31 : DuPont de Nemours Inc.: Company Revenue, 2020 and 2021

- Figure 32 : DuPont de Nemours Inc.: R&D Expenditures, 2020 and 2021

- Figure 33 : DuPont de Nemours Inc.: Revenue Share, by Segment, 2021

- Figure 34 : DuPont de Nemours Inc.: Revenue Share, by Region, 2021

- Figure 35 : Hempel A/S: Company Revenue, 2020 and 2021

- Figure 36 : Hempel A/S: R&D Expenditures, 2020 and 2021

- Figure 37 : Hempel A/S: Revenue Share, by Segment, 2021

- Figure 38 : Hempel A/S: Revenue Share, by Region, 2021

- Figure 39 : Jotun: Company Revenue, 2020 and 2021

- Figure 40 : Jotun: R&D Expenditures, 2020 and 2021

- Figure 41 : Jotun: Revenue Share, by Segment, 2021

- Figure 42 : Jotun: Revenue Share, by Region, 2021

- Figure 43 : RPM International: Company Revenue, 2019 and 2020

- Figure 44 : RPM International: R&D Expenditures, 2019 and 2020

- Figure 45 : RPM International: Revenue Share, by Segment, 2020

- Figure 46 : RPM International: Revenue Share, by Region, 2020

- Figure 47 : The Sherwin-Williams Company: Company Revenue, 2020 and 2021

- Figure 48 : The Sherwin-Williams Company: Revenue Share, by Segment, 2021

- Figure 49 : Wacker Chemie AG: Company Revenue, 2020 and 2021

- Figure 50 : Wacker Chemie AG: R&D Expenditures, 2020 and 2021

- Figure 51 : Wacker Chemie AG: Revenue Share, by Segment, 2021

- Figure 52 : Wacker Chemie AG: Revenue Share, by Region, 2021

Highlights:

The global market for anticorrosion coatings should grow from $28.4 billion in 2022 to $34.0 billion by 2027 with compound annual growth rate (CAGR) of 3.7% for the period of 2022-2027.

The global market for epoxy anticorrosion coatings should grow from $12.9 billion in 2022 to $15.6 billion by 2027 with compound annual growth rate (CAGR) of 3.9% for the period of 2022-2027.

The global market for acrylic anticorrosion coatings should grow from $5.7 billion in 2022 to $7.1 billion by 2027 with compound annual growth rate (CAGR) of 4.4% for the period of 2022-2027.

Report Scope:

The scope of this report is broad and covers various product types used across anticorrosion coating applications and end-user segments. This report classifies the product types as epoxy, polyurethane, acrylic, alkyd, zinc, chlorinated rubber, and others, in an effort to help companies and investors prioritize product opportunities and strategic movements.

End-user industries covered include marine, oil and gas, industrial manufacturing, construction, energy, automotive and others. These sectors consume anticorrosion coatings for applications such as heat exchangers, cooling towers, boilers, effluent water treatment plants, pipelines, drill equipment and rails that require specialized coating technologies to deal with corrosion resistance boosting for operational performance to be delivered by each of these major assets. Every component of an asset has a lifetime cost attached to it, and the life cycle purely depends on the regular maintenance work performed on the asset.

The market segmentation is further classified into technology-based waterborne, solvent-borne,

powder coating and others. Solvent-based anticorrosion coatings contain a high amount of VOCs that are hazardous to human health and the environment. Water-borne coatings are gaining in popularity due to their properties, such as low VOC content in comparison with solvent-borne coatings. Powder coatings are used for metal protective coating applications as they deliver superior results, and in terms of color they stay bright and fresh for a long period.

Revenues are reported and estimated from 2021 to 2027 and given for each product type and end-user with estimated values derived from the companies' total revenues.

The report also includes a discussion of the leaders in each regional market. Further, it explains the major drivers and regional dynamics of the global market for anticorrosion coatings and current industry trends.

The report offers a focus on the vendor landscape and concludes with profiles of the major vendors in the global market.

Report Includes:

- 52 data tables and 31 additional tables

- An updated overview of the global market for anticorrosion coatings

- Estimation of the market size and analyses of global market trends, with data from 2021, estimates for 2022, with projections of compound annual growth rates (CAGRs) through 2027

- Detailed insights into factors driving and restraining the growth of the global anticorrosion coatings market and a country-level market value analysis for each segment

- Highlights of the market potential of anticorrosion coatings, along with global market share analysis on the basis of product type, technology, end-user with major regions and countries involved

- Information on market opportunities, prospects and threats, new and upcoming technologies, regulatory developments, and demographic shifts that are affecting the market

- Industry value chain analysis of global anticorrosion coatings market providing a systematic study of the key intermediaries involved, which could further assist stakeholders in formulating appropriate strategies

- Market share analysis of the key companies of the industry and coverage of their proprietary technologies, strategic alliances, and other key market strategies

- Comprehensive company profiles of the leading players of the industry, including The Dow Chemical Company, The Sherwin-Williams Company, Wacker Chemie AG, Hempel A/S, AkzoNobel N.V. and 3M

Table of Contents

Chapter 1 Introduction

- Market Definition

- Study Goals and Objectives

- Reasons for Doing this Study

- Scope of Report

- Intended Audience

- Methodology

- What's New in This Report?

- Geographic Breakdown

- Analyst's Credentials

- BCC Custom Research

- Related BCC Research Reports

Chapter 2 Summary and Highlights

Chapter 3 Market Overview

- Market Potential

- Market Share

- Value Chain Analysis

- Regulatory Framework

- ACQPA, France

- Occupational Safety and Health Administration (OSHA)

- American Chemistry Council (ACC)

- The Canadian Environmental Protection Act, 1999 (CEPA)

- Society of Chemical Manufacturers and Affiliates (SOCMA)

- Toxic Substance Control Act (TSCA)

- European Chemicals Agency (ECHA)

- REACH Regulation (EC) No 1272/2008

- Specific Regulatory Efforts Concerned with Coatings

- Porter's Five Forces Analysis

- Bargaining Power of Buyers: High

- Bargaining Power of Suppliers: High

- Threat of Substitutes: Moderate

- Threat of New Entrants: Low

- Competitive Rivalry: High

- Industry Growth Drivers

- Growing Need for Water as a Strategic Resource for Industrial Applications

- Increasing Adoption of Advanced Technologies Driving Manufacturing

- Growing Need for Drinking Water and Municipal Wastewater Treatment

- Annual Maintenance Contracts and OEM Product Retrofit Opportunities

- Increased R&D by Coating Companies

- Growth of Food and Beverage Industry

- Analysis of Market Restraints

- Increasing Operational Expenditure (OPEX) Concerns

- Increasing Environmental Concerns

- Increased Demand for Lightweight Vehicles to Reduce the Consumption of Anticorrosion Coatings

Chapter 4 Market Breakdown by Type of Product

- Epoxy Anticorrosion Coatings

- Polyurethane Anticorrosion Coatings

- Acrylic Anticorrosion Coatings

- Alkyd Anticorrosion Coatings

- Zinc Anticorrosion Coatings

- Chlorinated Rubber and Other Anticorrosion Coatings

Chapter 5 Market Breakdown by Technology

- Solvent-borne Anticorrosion Coatings

- Water-borne Anticorrosion Coatings

- Powder Coatings and Others

Chapter 6 Market Breakdown by Industry End User

- Marine

- Oil and Gas

- Industrial Manufacturing

- Construction

- Energy

- Automotive

- Other Industries

Chapter 7 Market Breakdown by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 8 Market Breakdown by Country

- United States

- United Kingdom

- Germany

- India

- China

- Brazil

Chapter 9 Industry Structure

Chapter 10 Company Profiles

- 3M

- AKZONOBEL N.V.

- BASF SE

- THE DOW CHEMICAL COMPANY

- DUPONT DE NEMOURS INC.

- HEMPEL A/S

- JOTUN

- RPM INTERNATIONAL INC.

- THE SHERWIN-WILLIAMS COMPANY

- WACKER CHEMIE AG