|

|

市場調査レポート

商品コード

1782075

自動車用BMS (バッテリー管理システム) の世界市場Automotive Battery Management System: Global Markets |

||||||

|

|||||||

| 自動車用BMS (バッテリー管理システム) の世界市場 |

|

出版日: 2025年07月25日

発行: BCC Research

ページ情報: 英文 147 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動車用BMS (バッテリー管理システム) の市場規模は、2025年の64億米ドルから、2025年から2030年までは16.8%のCAGRで推移し、2030年末には139億米ドルに達すると予測されています。

アジア太平洋地域市場は、2025年の39億米ドルから、予測期間中はCAGR 15.9%で推移し、2030年末には81億米ドルに達すると予測されています。欧州市場は、2025年の13億米ドルから、予測期間中はCAGR 19.7%で推移し、2030年末には33億米ドルに達すると予測されています。

当レポートでは、世界の自動車用BMS (バッテリー管理システム) の市場を調査し、市場概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析などをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

- 市場力学と成長要因

- 将来の動向と発展

- セグメント分析

- 地域分析と新興市場

- 結論

第2章 市場概要

- 現在の市場概要と将来のシナリオ

- マクロ経済要因の分析

- 自動車部品

- EV販売の概要

- 都市化とインフラ開発

- 米国関税が世界の自動車用BMS市場に与える影響

- 中国の反応

- カナダの対応

- 英国の対応

- 影響分析

- バリューチェーン分析

- ポーターのファイブフォース分析

- 規制・基準

- ケーススタディ

第3章 市場力学

- 概要

- 市場促進要因

- EV販売の増加

- バッテリーの性能と安全性への注目

- 新しい規制と政策の導入

- 抑制要因/課題

- 高い導入コスト

- 統合と構成の複雑さ

- 機会

- バッテリーの高度な診断と予測メンテナンス

- V2G技術

- 現在の市場動向

- バッテリーの安全性のための熱管理の必要性

- バッテリーのリサイクルと持続可能性への注力

第4章 新興技術と開発

- 概要

- 自動車用BMS市場における新興技術

- AI

- ワイヤレスBMS

- マルチモデル共同推定

- クラウドベースのBMS

- 新興の自動車用BMS用途

- 高度なバッテリー監視

- インテリジェントバッテリー保護

- バッテリーの最適化

- 特許分析

- 概要

- 自動車用BMS市場における主要特許一覧

- 主な所見

第5章 市場セグメント分析

- セグメンテーションの内訳

- 世界の自動車用BMS市場:提供区分別

- サマリー

- ハードウェア

- ソフトウェア

- サービス

- 世界の自動車用BMS市場:アーキテクチャ別

- サマリー

- 有線

- 無線

- 世界の自動車用BMS市場:トポロジー別

- サマリー

- 集中型

- モジュール型

- 分散型

- 世界の自動車用BMS市場:推進タイプ別

- サマリー

- バッテリーEV

- プラグインハイブリッドEV

- 燃料電池電気自動車

- 世界の自動車用BMS市場:バッテリータイプ別

- サマリー

- リチウムイオン電池

- ニッケル水素電池

- 鉛蓄電池

- 世界の自動車用BMS市場:車両タイプ別

- サマリー

- 電気自動車

- 電気バン

- 電気トラック

- 電気バス

- 地理的内訳

- 世界の自動車用BMS市場:地域別

- サマリー

- 北米

- 欧州

- アジア太平洋

- その他の地域

第6章 競合情勢

- 概要

- 主要企業の市場ランキング

- NXP Semiconductors

- Infineon Technologies AG

- Analog Devices Inc.

- STMicroelectronics

- Renesas Electronics Corp.

- 製品マッピング分析

第7章 世界の自動車用BMS市場における持続可能性:ESGの観点

- ESG:イントロダクション

- 環境への影響

- 社会的影響

- ガバナンスの影響

- 自動車用BMS業界におけるESGの現状

- ESGに対する消費者の態度

- ESGの成功事例

- Infineon Technologies AG

- STMicroelectronics

- BCCからの結論

第8章 付録

- 調査手法

- 参考文献

- 略語

- 企業プロファイル

- ANALOG DEVICES INC.

- AVL

- CONTINENTAL AG

- EATRON TECHNOLOGIES

- ELITHION INC.

- HELLA GMBH & CO. KGAA

- FICOSA INTERNATIONAL SA

- INFINEON TECHNOLOGIES AG

- LG ENERGY SOLUTION

- NXP SEMICONDUCTORS

- REC

- RENESAS ELECTRONICS CORP.

- ROBERT BOSCH GMBH

- SENSATA TECHNOLOGIES INC.

- STMICROELECTRONICS

- その他 (新興企業・スタートアップ)

List of Tables

- Summary Table : Global Market for Automotive Battery Management System, by Region, Through 2030

- Table 1 : Published Patents for Automotive BMS, 2022-2025

- Table 2 : Key Patents for Automotive BMS, 2022-2025

- Table 3 : Global Market for Automotive BMS, by Offering, Through 2030

- Table 4 : Global Market for Automotive BMS Hardware, by Region, Through 2030

- Table 5 : Global Market for Automotive BMS Software, by Region, Through 2030

- Table 6 : Global Market for Automotive BMS Services, by Region, Through 2030

- Table 7 : Global Market for Automotive BMS, by Architecture, Through 2030

- Table 8 : Global Market for Automotive Wired BMS, by Region, Through 2030

- Table 9 : Global Market for Automotive Wireless BMS, by Region, Through 2030

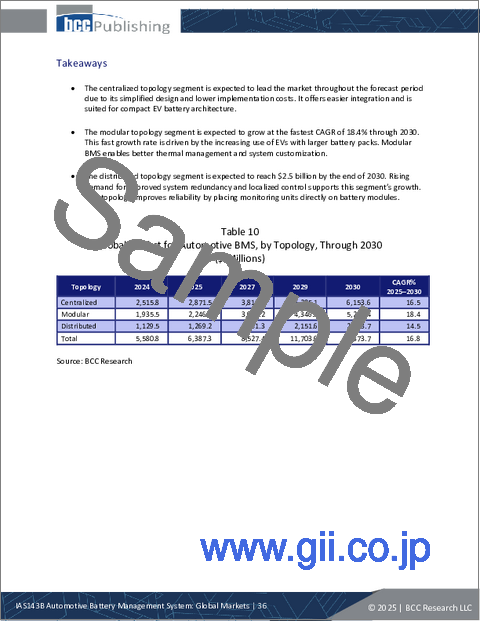

- Table 10 : Global Market for Automotive BMS, by Topology, Through 2030

- Table 11 : Global Market for Automotive BMS for Centralized Topology, by Region, Through 2030

- Table 12 : Global Market for Automotive BMS for Modular Topology, by Region, Through 2030

- Table 13 : Global Market for Automotive BMS for Distributed Topology, by Region, Through 2030

- Table 14 : Global Market for Automotive BMS, by Propulsion Type, Through 2030

- Table 15 : Global Market for Automotive BMS for BEVs, by Region, Through 2030

- Table 16 : Global Market for Automotive BMS for PHEVs, by Region, Through 2030

- Table 17 : Global Market for Automotive BMS for FCEVs, by Region, Through 2030

- Table 18 : Global Market for Automotive BMS, by Battery Type, Through 2030

- Table 19 : Global Market for Automotive BMS for Lithium-ion Batteries, by Region, Through 2030

- Table 20 : Global Market for Automotive BMS for NiMH Batteries, by Region, Through 2030

- Table 21 : Global Market for Automotive BMS for Lead-acid Batteries, by Region, Through 2030

- Table 22 : Global Market for Automotive BMS, by Vehicle Type, Through 2030

- Table 23 : Global Market for Automotive BMS for Electric Cars, by Region, Through 2030

- Table 24 : Global Market for Automotive BMS for Electric Vans, by Region, Through 2030

- Table 25 : Global Market for Automotive BMS for Electric Trucks, by Region, Through 2030

- Table 26 : Global Market for Automotive BMS for Electric Buses, by Region, Through 2030

- Table 27 : Global Market for Automotive BMS, by Region, Through 2030

- Table 28 : North American Market for Automotive BMS, by Country, Through 2030

- Table 29 : North American Market for Automotive BMS, by Offering, Through 2030

- Table 30 : North American Market for Automotive BMS, by Architecture, Through 2030

- Table 31 : North American Market for Automotive BMS, by Topology, Through 2030

- Table 32 : North American Market for Automotive BMS, by Propulsion Type, Through 2030

- Table 33 : North American Market for Automotive BMS, by Battery Type, Through 2030

- Table 34 : North American Market for Automotive BMS, by Vehicle Type, Through 2030

- Table 35 : European Market for Automotive BMS, by Country, Through 2030

- Table 36 : European Market for Automotive BMS, by Offering, Through 2030

- Table 37 : European Market for Automotive BMS, by Architecture, Through 2030

- Table 38 : European Market for Automotive BMS, by Topology, Through 2030

- Table 39 : European Market for Automotive BMS, by Propulsion Type, Through 2030

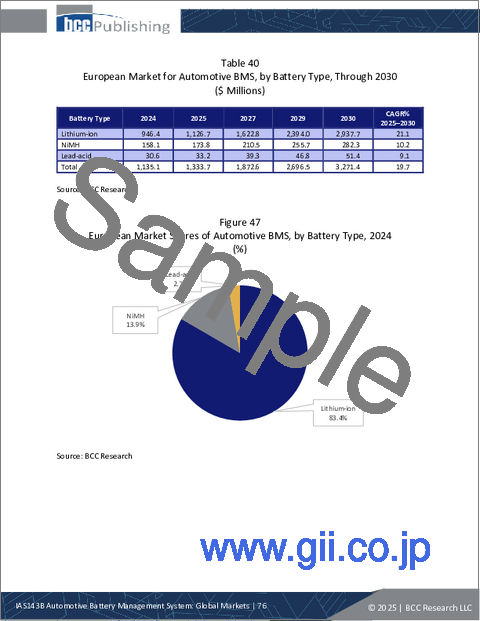

- Table 40 : European Market for Automotive BMS, by Battery Type, Through 2030

- Table 41 : European Market for Automotive BMS, by Vehicle Type, Through 2030

- Table 42 : Asia-Pacific Market for Automotive BMS, by Country, Through 2030

- Table 43 : Asia-Pacific Market for Automotive BMS, by Offering, Through 2030

- Table 44 : Asia-Pacific Market for Automotive BMS, by Architecture, Through 2030

- Table 45 : Asia-Pacific Market for Automotive BMS, by Topology, Through 2030

- Table 46 : Asia-Pacific Market for Automotive BMS, by Propulsion Type, Through 2030

- Table 47 : Asia-Pacific Market for Automotive BMS, by Battery Type, Through 2030

- Table 48 : Asia-Pacific Market for Automotive BMS, by Vehicle Type, Through 2030

- Table 49 : RoW Market for Automotive BMS, by Sub-region, Through 2030

- Table 50 : RoW Market for Automotive BMS, by Offering, Through 2030

- Table 51 : RoW Market for Automotive BMS, by Architecture, Through 2030

- Table 52 : RoW Market for Automotive BMS, by Topology, Through 2030

- Table 53 : RoW Market for Automotive BMS, by Propulsion Type, Through 2030

- Table 54 : RoW Market for Automotive BMS, by Battery Type, Through 2030

- Table 55 : RoW Market for Automotive BMS, by Vehicle Type, Through 2030

- Table 56 : Market Ranking of Companies in the Global Automotive BMS Market, 2024

- Table 57 : Product Mapping Analysis for Automotive BMS Companies

- Table 58 : Recent Developments in the Global Automotive BMS Industry, 2023-2025

- Table 59 : ESG Risk Rating Metrics, by Company, 2025*

- Table 60 : Infineon Technologies AG: Achievements in ESG

- Table 61 : STMicroelectronics: Achievements and Plans in ESG

- Table 62 : Abbreviations Used in the Report

- Table 63 : Analog Devices Inc.: Company Snapshot

- Table 64 : Analog Devices Inc.: Financial Performance, FY 2023 and 2024

- Table 65 : Analog Devices Inc.: Product Portfolio

- Table 66 : Analog Devices Inc.: News/Key Developments, 2023

- Table 67 : AVL: Company Snapshot

- Table 68 : AVL: Product Portfolio

- Table 69 : AVL: News/Key Developments, 2022

- Table 70 : Continental AG: Company Snapshot

- Table 71 : Continental AG: Financial Performance, FY 2023 and 2024

- Table 72 : Continental AG: Product Portfolio

- Table 73 : Continental AG: News/Key Developments, 2022

- Table 74 : Eatron Technologies: Company Snapshot

- Table 75 : Eatron Technologies: Product Portfolio

- Table 76 : Eatron Technologies: News/Key Developments, 2024 and 2025

- Table 77 : Elithion Inc.: Company Snapshot

- Table 78 : Elithion Inc.: Product Portfolio

- Table 79 : Elithion Inc.: News/Key Developments, 2024

- Table 80 : HELLA GmbH & Co. KGaA: Company Snapshot

- Table 81 : HELLA GmbH & Co. KGaA: Financial Performance, FY 2023 and 2024

- Table 82 : HELLA GmbH & Co. KGaA: Product Portfolio

- Table 83 : HELLA GmbH & Co. KGaA: News/Key Developments, 2024

- Table 84 : Ficosa International SA: Company Snapshot

- Table 85 : Ficosa International SA: Product Portfolio

- Table 86 : Ficosa International SA: News/Key Developments, 2023

- Table 87 : Infineon Technologies AG: Company Snapshot

- Table 88 : Infineon Technologies AG: Financial Performance, FY 2023 and 2024

- Table 89 : Infineon Technologies AG: Product Portfolio

- Table 90 : Infineon Technologies AG: News/Key Developments, 2024

- Table 91 : LG Energy Solution: Company Snapshot

- Table 92 : LG Energy Solution: Financial Performance, FY 2023 and 2024

- Table 93 : LG Energy Solution: Product Portfolio

- Table 94 : LG Energy Solution: News/Key Developments, 2024

- Table 95 : NXP Semiconductors: Company Snapshot

- Table 96 : NXP Semiconductors: Financial Performance, FY 2023 and 2024

- Table 97 : NXP Semiconductors: Product Portfolio

- Table 98 : NXP Semiconductors: News/Key Developments, 2023 and 2024

- Table 99 : REC: Company Snapshot

- Table 100 : REC: Product Portfolio

- Table 101 : REC: News/Key Developments, 2024

- Table 102 : Renesas Electronics Corp.: Company Snapshot

- Table 103 : Renesas Electronics Corp.: Financial Performance, FY 2023 and 2024

- Table 104 : Renesas Electronics Corp.: Product Portfolio

- Table 105 : Renesas Electronics Corp.: News/Key Developments, 2025

- Table 106 : Robert Bosch GmbH: Company Snapshot

- Table 107 : Robert Bosch GmbH: Financial Performance, FY 2023 and 2024

- Table 108 : Robert Bosch GmbH: Product Portfolio

- Table 109 : Sensata Technologies Inc.: Company Snapshot

- Table 110 : Sensata Technologies Inc.: Financial Performance, FY 2023 and 2024

- Table 111 : Sensata Technologies Inc.: Product Portfolio

- Table 112 : Sensata Technologies Inc.: News/Key Developments, 2022-2024

- Table 113 : STMicroelectronics: Company Snapshot

- Table 114 : STMicroelectronics: Financial Performance, FY 2023 and 2024

- Table 115 : STMicroelectronics: Product Portfolio

- Table 116 : STMicroelectronics: News/Key Developments, 2024

- Table 117 : Emerging Companies and Startups in the Automotive BMS Market

List of Figures

- Summary Figure : Global Market Shares of Automotive BMS, by Region, 2024

- Figure 1 : Global EV Sales, by Powertrain Type, 2023 and 2024

- Figure 2 : Global Investment in Road Transport Infrastructure, 2020-2040

- Figure 3 : Value Chain for the Global Automotive BMS Market

- Figure 4 : Market Dynamics Snapshot of Automotive BMS

- Figure 5 : Global Electric Cars Sales, by Powertrain Type, 2023 and 2024

- Figure 6 : Global EV Battery Recycling Capacity, 2023 and 2030

- Figure 7 : Emerging Automotive BMS Applications

- Figure 8 : Patent Shares on Automotive BMS Technology, by Applicant, 2024

- Figure 9 : Global Market Shares of Automotive BMS, by Offering, 2024

- Figure 10 : Global Market Shares of Automotive BMS Hardware, by Region, 2024

- Figure 11 : Global Market Shares of Automotive BMS Software, by Region, 2024

- Figure 12 : Global Market Shares of Automotive BMS Services, by Region, 2024

- Figure 13 : Global Market Shares of Automotive BMS, by Architecture, 2024

- Figure 14 : Global Market Shares of Automotive Wired BMS, by Region, 2024

- Figure 15 : Global Market Shares of Automotive Wireless BMS, by Region, 2024

- Figure 16 : Global Market Shares of Automotive BMS, by Topology, 2024

- Figure 17 : Global Market Shares of Automotive BMS for Centralized Topology, by Region, 2024

- Figure 18 : Global Market Shares of Automotive BMS for Modular Topology, by Region, 2024

- Figure 19 : Global Market Shares of Automotive BMS for Distributed Topology, by Region, 2024

- Figure 20 : Global Market Shares of Automotive BMS, by Propulsion Type, 2024

- Figure 21 : Global Market Shares of Automotive BMS for BEVs, by Region, 2024

- Figure 22 : Global Market Shares of Automotive BMS for PHEVs, by Region, 2024

- Figure 23 : Global Market Shares of Automotive BMS for FCEVs, by Region, 2024

- Figure 24 : Global Market Shares of Automotive BMS, by Battery Type, 2024

- Figure 25 : Global Manufacturing Capacity for Lithium-ion Batteries, 2022-2030

- Figure 26 : Global Market Shares of Automotive BMS for Lithium-ion Batteries, by Region, 2024

- Figure 27 : Global Market Shares of Automotive BMS for NiMH Batteries, by Region, 2024

- Figure 28 : Global Market Shares of Automotive BMS for Lead-acid Batteries, by Region, 2024

- Figure 29 : Global Market Shares of Automotive BMS, by Vehicle Type, 2024

- Figure 30 : Global Market Shares of Automotive BMS for Electric Cars, by Region, 2024

- Figure 31 : Global Market Shares of Automotive BMS for Electric Vans, by Region, 2024

- Figure 32 : Global Market Shares of Automotive BMS for Electric Trucks, by Region, 2024

- Figure 33 : Global Market Shares of Automotive BMS for Electric Buses, by Region, 2024

- Figure 34 : Global Market Shares of Automotive BMS, by Region, 2024

- Figure 35 : North American Market Shares of Automotive BMS, by Country, 2024

- Figure 36 : North American Market Shares of Automotive BMS, by Offering, 2024

- Figure 37 : North American Market Shares of Automotive BMS, by Architecture, 2024

- Figure 38 : North American Market Shares of Automotive BMS, by Topology, 2024

- Figure 39 : North American Market Shares of Automotive BMS, by Propulsion Type, 2024

- Figure 40 : North American Market Shares of Automotive BMS, by Battery Type, 2024

- Figure 41 : North American Market Shares of Automotive BMS, by Vehicle Type, 2024

- Figure 42 : European Market Shares of Automotive BMS, by Country, 2024

- Figure 43 : European Market Shares of Automotive BMS, by Offering, 2024

- Figure 44 : European Market Shares of Automotive BMS, by Architecture, 2024

- Figure 45 : European Market Shares of Automotive BMS, by Topology, 2024

- Figure 46 : European Market Shares of Automotive BMS, by Propulsion Type, 2024

- Figure 47 : European Market Shares of Automotive BMS, by Battery Type, 2024

- Figure 48 : European Market Shares of Automotive BMS, by Vehicle Type, 2024

- Figure 49 : Asia-Pacific Market Shares of Automotive BMS, by Country, 2024

- Figure 50 : Asia-Pacific Market Shares of Automotive BMS, by Offering, 2024

- Figure 51 : Asia-Pacific Market Shares of Automotive BMS, by Architecture, 2024

- Figure 52 : Asia-Pacific Market Shares of Automotive BMS, by Topology, 2024

- Figure 53 : Asia-Pacific Market Shares of Automotive BMS, by Propulsion Type, 2024

- Figure 54 : Asia-Pacific Market Shares of Automotive BMS, by Battery Type, 2024

- Figure 55 : Asia-Pacific Market Shares of Automotive BMS, by Vehicle Type, 2024

- Figure 56 : RoW Market Shares of Automotive BMS, by Sub-region, 2024

- Figure 57 : RoW Market Shares of Automotive BMS, by Offering, 2024

- Figure 58 : RoW Market Shares of Automotive BMS, by Architecture, 2024

- Figure 59 : RoW Market Shares of Automotive BMS, by Topology, 2024

- Figure 60 : RoW Market Shares of Automotive BMS, by Propulsion Type, 2024

- Figure 61 : RoW Market Shares of Automotive BMS, by Battery Type, 2024

- Figure 62 : RoW Market Shares of Automotive BMS, by Vehicle Type, 2024

- Figure 63 : Analog Devices Inc.: Revenue Share, by Business Unit, FY 2024

- Figure 64 : Analog Devices Inc.: Revenue Share, by Country/Region, FY 2024

- Figure 65 : Continental AG: Revenue Share, by Business Unit, FY 2024

- Figure 66 : Continental AG: Revenue Share, by Country/Region, FY 2024

- Figure 67 : HELLA GmbH & Co. KGaA: Revenue Share, by Business Unit, FY 2024

- Figure 68 : HELLA GmbH & Co. KGaA: Revenue Share, by Country/Region, FY 2024

- Figure 69 : Infineon Technologies AG: Revenue Share, by Business Unit, FY 2024

- Figure 70 : Infineon Technologies AG: Revenue Share, by Country/Region, FY 2024

- Figure 71 : LG Energy Solution: Revenue Share, by Country/Region, FY 2024

- Figure 72 : NXP Semiconductors: Revenue Share, by Business Unit, FY 2024

- Figure 73 : NXP Semiconductors: Revenue Share, by Country/Region, FY 2024

- Figure 74 : Renesas Electronics Corp.: Revenue Share, by Business Unit, FY 2024

- Figure 75 : Renesas Electronics Corp.: Revenue Share, by Country/Region, FY 2024

- Figure 76 : Robert Bosch GmbH: Revenue Share, by Business Unit, FY 2024

- Figure 77 : Robert Bosch GmbH: Revenue Share, by Country/Region, FY 2024

- Figure 78 : Sensata Technologies Inc.: Revenue Share, by Business Unit, FY 2024

- Figure 79 : Sensata Technologies Inc.: Revenue Share, by Country/Region, FY 2024

- Figure 80 : STMicroelectronics: Revenue Share, by Business Unit, FY 2024

- Figure 81 : STMicroelectronics: Revenue Share, by Country/Region, FY 2024

The global market for automotive battery management system (BMS) is projected to grow from $6.4 billion in 2025 to reach $13.9 billion by the end of 2030, at a compound annual growth rate (CAGR) of 16.8% from 2025 to 2030.

The Asia-Pacific market for automotive BMS is projected to grow from $3.9 billion in 2025 to reach $8.1 by the end of 2030, at a CAGR of 15.9% from 2025 to 2030.

The European market for automotive BMS is projected to grow from $1.3 billion in 2025 to reach $3.3 by the end of 2030, at a CAGR of 19.7% from 2025 to 2030.

Report Scope

In this report, the market for automotive battery management systems (BMS) is segmented by offering, architecture, topology, propulsion, battery type and vehicle type. The study focuses on battery electric vehicles (BEVs), plug-in hybrid EVs (PHEVs), and fuel cell EVs (FCEVs). Internal combustion engine (ICE) vehicles are outside the scope of the report. The regional analysis of the automotive BMS market covers North America, Europe, Asia-Pacific, and the Rest of the World (including South America, the Middle East, and Africa). The report also includes analysis of the countries where the opportunity for automotive BMS is gaining momentum.

The study also covers the competitive landscape, focusing on leading companies and their financials, product portfolios and recent developments. The report also discusses emerging technologies, patents, macroeconomic factors, and the impact of tariffs, including the tariffs imposed by the U.S. as well as retaliatory tariffs.

The report's tables and figures illustrate historical, current, and future market scenarios, with 2024 considered as the base year. Estimates are made for 2025 and market values are forecast through 2030. All market values are nominal and in $ millions.

Report Includes

- 65 data tables and 53 additional tables

- In-depth analysis of global market for automotive battery management systems (BMS) technology

- Analyses of global market trends, with revenue data for 2024, estimates for 2025, forecasts for 2027 and 2029, and projected CAGRs through 2030

- Estimates of the market's size and revenue prospects, along with a market share analysis by component (offerings), architecture type, topology, propulsion technology, battery type, vehicle type and region

- Facts and figures pertaining to market dynamics, technological advancements, regulations and the impact of macroeconomic factors

- Insights derived from Porter's Five Forces model, global value chain analysis and case studies

- Patent review, upcoming technologies and new developments in advanced BMS market

- Overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, and the ESG scores and practices of leading companies

- Analysis of the industry structure, including companies' market shares and rankings, strategic alliances, M&A activity and a venture funding outlook

- Profiles of the leading companies, including NXP Semiconductors, Infineon Technologies AG, Analog Devices Inc., STMicroelectronics and Renesas Electronics Corp.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

- Market Dynamics and Growth Factors

- Future Trends and Developments

- Segmental Analysis

- Regional Insights and Emerging Markets

- Conclusion

Chapter 2 Market Overview

- Current Market Overview and Future Scenario

- Analysis of Macroeconomic Factors

- Automotive Components

- EV Sales Overview

- Urbanization and Infrastructure Development

- Impact of U.S. Tariffs on the Global Automotive BMS Market

- China's Response

- Canada's Response

- U.K.'s Response

- Impact Analysis

- Value Chain Analysis

- Raw Material Providers

- Automotive BMS Hardware Manufacturers and Software and Service Providers

- Automotive OEMs

- End Users

- Porter's Five Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Potential for New Entrants to the Market

- Competition in the Industry

- Threat of Substitutes

- Regulations and Standards

- IEC 61508

- IEC 60068-2

- CENELEC CLC/TC 21X

- EN 62485

- UL 1974

- Case Studies

- Tata Elxsi

- Zenkins Technologies Pvt. Ltd.

Chapter 3 Market Dynamics

- Overview

- Market Drivers

- Increasing Sales of EVs

- Growing Focus on Battery Performance and Safety

- Introduction of New Regulations and Policies

- Restraints/Challenges

- High Implementation Cost

- Complexity in Integration and Configuration

- Opportunities

- Advanced Diagnostic and Predictive Maintenance of Batteries

- Vehicle-to-Grid (V2G) Technology

- Current Market Trends

- Need for Thermal Management for Battery Safety

- Focus on Battery Recycling and Sustainability

Chapter 4 Emerging Technologies and Developments

- Overview

- Emerging Technologies in the Automotive BMS Market

- Artificial Intelligence

- Wireless BMS

- Multi-model Co-estimation

- Cloud-based BMS

- Emerging Automotive BMS Applications

- Advanced Battery Monitoring

- Intelligent Battery Protection

- Battery Optimization

- Patent Analysis

- Overview

- List of Key Patents in the Automotive BMS Market

- Findings

Chapter 5 Market Segment Analysis

- Segmentation Breakdown

- Global Automotive BMS Market, by Offering

- Takeaways

- Hardware

- Software

- Services

- Global Automotive BMS Market, by Architecture

- Takeaways

- Wired

- Wireless

- Global Automotive BMS Market, by Topology

- Takeaways

- Centralized

- Modular

- Distributed

- Global Automotive BMS Market, by Propulsion Type

- Takeaways

- Battery EVs

- Plug-in Hybrid EVs

- Fuel Cell EVs

- Global Automotive BMS Market, by Battery Type

- Takeaways

- Lithium-ion Batteries

- NiMH Batteries

- Lead-acid Batteries

- Global Automotive BMS Market, by Vehicle Type

- Takeaways

- Electric Cars

- Electric Vans

- Electric Trucks

- Electric Buses

- Geographic Breakdown

- Global Automotive BMS Market, by Region

- Takeaways

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 6 Competitive Landscape

- Overview

- Market Rankings for Leading Companies

- NXP Semiconductors

- Infineon Technologies AG

- Analog Devices Inc.

- STMicroelectronics

- Renesas Electronics Corp.

- Product Mapping Analysis

- Recent Developments

Chapter 7 Sustainability in the Global Automotive BMS Market: ESG Perspective

- Introduction to ESG

- Environmental Impact

- Social Impact

- Governance Impact

- Status of ESG in the Automotive BMS Industry

- Consumer Attitudes Towards ESG

- Successful Implementations of ESG

- Infineon Technologies AG

- STMicroelectronics

- Concluding Remarks from BCC Research

Chapter 8 Appendix

- Methodology

- References

- Abbreviations

- Company Profiles

- ANALOG DEVICES INC.

- AVL

- CONTINENTAL AG

- EATRON TECHNOLOGIES

- ELITHION INC.

- HELLA GMBH & CO. KGAA

- FICOSA INTERNATIONAL SA

- INFINEON TECHNOLOGIES AG

- LG ENERGY SOLUTION

- NXP SEMICONDUCTORS

- REC

- RENESAS ELECTRONICS CORP.

- ROBERT BOSCH GMBH

- SENSATA TECHNOLOGIES INC.

- STMICROELECTRONICS

- Others (Emerging Companies and Startups)