|

|

市場調査レポート

商品コード

1741576

自動車用バッテリー管理システム(BMS)の世界市場:バッテリータイプ別、トポロジー別、用途別、地域別 - 2030年までの予測Automotive Battery Management System (BMS) Market by Battery Type (Lithium-ion, Lead-acid, Nickel-based, Solid-state Battery), Topology (Modular, Centralized, Distributed), Application (Passenger Vehicles, Commercial Vehicles) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用バッテリー管理システム(BMS)の世界市場:バッテリータイプ別、トポロジー別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月26日

発行: MarketsandMarkets

ページ情報: 英文 217 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動車用バッテリー管理システムの市場規模は、2025年に65億3,000万米ドル、2030年には156億5,000万米ドルに達すると予測され、予測期間中のCAGRは19.1%と見込まれています。

電動モビリティにおける安全性、効率性、エネルギー最適化の重要性を考慮すると、自動車業界ではスマートで信頼性の高いバッテリー管理システム(BMS)ソリューションに対するニーズが高まっています。自動車メーカーやEVメーカーは、リアルタイムのモニタリングを可能にし、過充電を回避し、バッテリー効率を向上させるために、洗練されたBMS技術の採用を進めています。これらのシステムは、故障の検出、バッテリー寿命の延長、厳しさを増す自動車安全基準の遵守において重要な役割を果たしています。市場の成長は、EVの生産台数の増加、環境に優しい自動車に対する政府の優遇措置、バッテリー技術における継続的な技術革新によっても支えられています。これらの要因が総合的に、自動車用バッテリー管理市場の安定した成長を後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | バッテリータイプ別、トポロジー別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

乗用車セグメントは2024年に最大シェアを占めると予測されています。この優位性の主な要因は、電気自動車(EV)の普及拡大、環境意識の高まり、世界の厳しい排ガス規制の施行です。持続可能な輸送に対する政府の優遇措置や規制支援は、自動車メーカーに乗用車の電動化を加速させるよう促しており、これが先進バッテリー管理システム(BMS)の需要を押し上げています。さらに、乗用車のコネクテッド機能やインテリジェント機能に対する需要の高まりが、このセグメントの存在感を高めています。自動車メーカーが遠隔監視、予知保全、無線アップデートなどの技術を採用するにつれ、スマートで適応性の高いバッテリー管理システム(BMS)の必要性が高まっています。これらのシステムは、バッテリー効率を最適化するだけでなく、車両テレマティクスやクラウドサービスとの円滑な統合を促進します。リチウムイオン電池技術の継続的な改善と電気自動車インフラへの投資の増加により、乗用車セグメントは自動車用バッテリー管理市場の主要な貢献者であり続けると思われます。

予測期間中、車載用バッテリー管理システム市場は、中電力用途における費用対効果の高いソリューションの必要性や、商用車に採用されるよりシンプルなバッテリーシステムにより、高いCAGRを記録すると予測されます。集中制御ユニットは、セルの保護とバランシングを担当すると同時に、さまざまな機能を実行します。さらに、バッテリーパック内のセルを監督し、調整します。通常、バッテリー内のセルの電圧レベルをルーティングするために、かなりの数のワイヤーハーネスが必要であり、バッテリー全体に温度センサーが配置されています。それにもかかわらず、これらのシステムは拡張性に欠けています。一般に、集中型バッテリー管理システムは手頃な価格だが、拡張性に欠けています。そのため、セルをコントローラーボードに接続するための接続が必要になる場合があり、セル数が限られたバッテリーパックに適しています。集中型バッテリー管理システムは、主にe-bikeや二輪車のような中出力用途や、商用車のよりシンプルなバッテリーシステムで利用されています。集中型トポロジーは、他の構成に比べて優れた計算能力を提供します。

欧州における電気自動車市場の確立は、同地域におけるリチウムイオン電池セル/パックの製造にプラスの影響を与えています。電気自動車の人気が高まっているため、この地域では電気自動車用バッテリーの需要が大幅に増加しています。これらの要因が、この地域における車載用バッテリー管理市場の成長を促進しています。さらに、この地域における車載用BMSの需要は、BMW Group(ドイツ)、Mercedes-Benz Group AG(ドイツ)、Volkswagen AG(ドイツ)などの大手自動車メーカーの製造施設が存在することに起因しています。欧州では、欧州自動車産業電池工業会やPRBAといった活発な団体が、同地域での電気自動車の使用を支援しています。欧州の自動車用バッテリー管理市場の主要企業には、Eberspacher(ドイツ)、Leclanche SA(スイス)、AVL(オーストリア)、BMS PowerSafe(フランス)などがあります。これらの企業は、エンドユーザーのニーズに応えるため、技術的に先進的な車載バッテリー管理ソリューションを市場に投入する取り組みを行っています。欧州では電気自動車の導入動向が高まっており、これらの自動車のバッテリーを効果的に管理するために車載用BMSへの要求も高まっています。

当レポートでは、世界の自動車用バッテリー管理システム(BMS)市場について調査し、バッテリータイプ別、トポロジー別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- BMSの主な機能

- エコシステム/市場マップ

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 基準と規制状況

- 2025年の米国関税の影響- 自動車用BMS市場

第6章 主要な自動車用BMS製品

- イントロダクション

- ハードウェア

- バッテリー制御ユニット

- 電源管理コンポーネント

- 通信コンポーネント

- ソフトウェア

第7章 自動車用BMSのタイプ

- イントロダクション

- スタンドアロンBMS

- 統合BMS

第8章 自動車用BMS市場(バッテリータイプ別)

- イントロダクション

- リチウムイオン

- 鉛蓄電池

- その他

第9章 自動車用BMS市場(トポロジー別)

- イントロダクション

- モジュール型

- 集中型

- 分散型

第10章 自動車用BMS市場(用途別)

- イントロダクション

- 乗用車

- 商用車

- その他

第11章 自動車用BMS市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- その他の地域

- 中東

- 南米

- アフリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- EBERSPACHER

- SENSATA TECHNOLOGIES, INC.

- AVL

- LG ENERGY SOLUTION

- FICOSA INTERNACIONAL SA

- EWERT ENERGY SYSTEMS, INC.

- FUTAVIS GMBH

- LECLANCHE SA

- NUVATION ENERGY

- その他の重要企業

- ANALOG DEVICES, INC.

- INFINEON TECHNOLOGIES AG

- NXP SEMICONDUCTORS

- PANASONIC HOLDINGS CORPORATION

- RENESAS ELECTRONICS CORPORATION

- STMICROELECTRONICS

- TEXAS INSTRUMENTS INCORPORATED

- その他の企業

- BMS POWERSAFE

- DUKOSI LIMITED

- POWERTECH SYSTEMS

- XING MOBILITY

- EATRON TECHNOLOGIES

- MOKOENERGY

- MUNICH ELECTRIFICATION GMBH

- BATKON BATTERY CONTROL TECHNOLOGIES INC.

- STAFL SYSTEMS, LLC.

第14章 付録

List of Tables

- TABLE 1 MAPPING OF KEY BMS SEMICONDUCTOR PROVIDERS, BY KEY FUNCTION

- TABLE 2 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE OF AUTOMOTIVE BATTERY MANAGEMENT SYSTEMS, BY KEY PLAYER, 2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE OF AUTOMOTIVE BATTERY MANAGEMENT SYSTEMS, BY REGION, 2024 (USD)

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ON AUTOMOTIVE BMS MARKET

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 7 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 8 US: TOP 20 PATENT OWNERS DURING 2014-2024

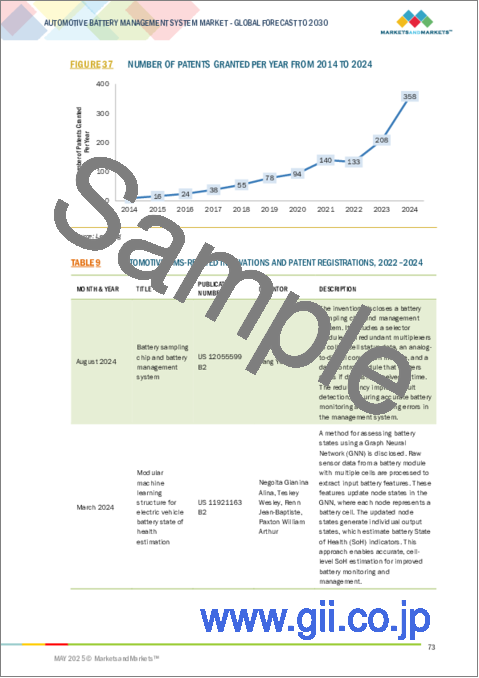

- TABLE 9 AUTOMOTIVE BMS-RELATED INNOVATIONS AND PATENT REGISTRATIONS, 2022-2024

- TABLE 10 AUTOMOTIVE BMS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 STANDARDS RELATED TO BATTERY MANAGEMENT SYSTEMS

- TABLE 16 US: ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR AUTOMOTIVE BMS

- TABLE 18 TABLE 3: EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 19 AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 20 AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 21 LITHIUM-ION: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 22 LITHIUM-ION: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 23 LITHIUM-ION: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 24 LITHIUM-ION: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 LEAD-ACID: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 26 LEAD-ACID: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27 LEAD-ACID: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 LEAD-ACID: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 OTHER BATTERIES: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 30 OTHER BATTERIES: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 31 OTHER BATTERIES: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 OTHER BATTERIES: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2021-2024 (USD MILLION)

- TABLE 34 AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2025-2030 (USD MILLION)

- TABLE 35 MODULAR TOPOLOGY: ADVANTAGES AND DISADVANTAGES

- TABLE 36 MODULAR: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 37 MODULAR: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 38 MODULAR: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 MODULAR: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 CENTRALIZED TOPOLOGY: ADVANTAGES AND DISADVANTAGES

- TABLE 41 CENTRALIZED: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 42 CENTRALIZED: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 CENTRALIZED: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 CENTRALIZED: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 DISTRIBUTED TOPOLOGY: ADVANTAGES AND DISADVANTAGES

- TABLE 46 DISTRIBUTED: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 47 DISTRIBUTED: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 48 DISTRIBUTED: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 DISTRIBUTED: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 51 AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 52 PASSENGER VEHICLES: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 PASSENGER VEHICLES: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 PASSENGER VEHICLES: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2021-2024 (USD MILLION)

- TABLE 55 PASSENGER VEHICLES: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2025-2030 (USD MILLION)

- TABLE 56 PASSENGER VEHICLES: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 PASSENGER VEHICLES: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 COMMERCIAL VEHICLES: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 COMMERCIAL VEHICLES: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 60 COMMERCIAL VEHICLES: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2021-2024 (USD MILLION)

- TABLE 61 COMMERCIAL VEHICLES: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2025-2030 (USD MILLION)

- TABLE 62 COMMERCIAL VEHICLES: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 COMMERCIAL VEHICLES: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 OTHER VEHICLES: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 OTHER VEHICLES: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 66 OTHER VEHICLES: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2021-2024 (USD MILLION)

- TABLE 67 OTHER VEHICLES: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2025-2030 (USD MILLION)

- TABLE 68 OTHER VEHICLES: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 OTHER VEHICLES: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: AUTOMOTIVE BMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: AUTOMOTIVE BMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2021-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 80 EUROPE: AUTOMOTIVE BMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 EUROPE: AUTOMOTIVE BMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 EUROPE: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 83 EUROPE: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2021-2024 (USD MILLION)

- TABLE 85 EUROPE: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2025-2030 (USD MILLION)

- TABLE 86 EUROPE: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 EUROPE: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: AUTOMOTIVE BMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 ASIA PACIFIC: AUTOMOTIVE BMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 91 ASIA PACIFIC: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2021-2024 (USD MILLION)

- TABLE 93 ASIA PACIFIC: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2025-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 95 ASIA PACIFIC: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 REST OF THE WORLD: AUTOMOTIVE BMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 REST OF THE WORLD: AUTOMOTIVE BMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 REST OF THE WORLD: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 99 REST OF THE WORLD: AUTOMOTIVE BMS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 100 REST OF THE WORLD: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2021-2024 (USD MILLION)

- TABLE 101 REST OF THE WORLD: AUTOMOTIVE BMS MARKET, BY TOPOLOGY, 2025-2030 (USD MILLION)

- TABLE 102 REST OF THE WORLD: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 103 REST OF THE WORLD: AUTOMOTIVE BMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 104 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 105 AUTOMOTIVE BMS MARKET: DEGREE OF COMPETITION

- TABLE 106 BATTERY MANAGEMENT IC PROVIDERS: DEGREE OF COMPETITION

- TABLE 107 AUTOMOTIVE BMS MARKET: COMPANY FOOTPRINT, 2024

- TABLE 108 AUTOMOTIVE BMS MARKET: APPLICATION FOOTPRINT

- TABLE 109 AUTOMOTIVE BMS MARKET: REGIONFOOTPRINT

- TABLE 110 AUTOMOTIVE BMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 111 AUTOMOTIVE BMS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 112 AUTOMOTIVE BMS MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 113 AUTOMOTIVE BMS MARKET: DEALS, JANUARY 2021-MARCH 2025

- TABLE 114 EBERSPACHER: COMPANY OVERVIEW

- TABLE 115 EBERSPACHER: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 116 EBERSPACHER: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 117 EBERSPACHER: DEALS, JANUARY 2021-MARCH 2025

- TABLE 118 SENSATA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 119 SENSATA TECHNOLOGIES, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 120 SENSATA TECHNOLOGIES, INC.: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 121 SENSATA TECHNOLOGIES, INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 122 AVL: COMPANY OVERVIEW

- TABLE 123 AVL: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 124 AVL: DEALS, JANUARY 2021-MARCH 2025

- TABLE 125 AVL: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 126 LG ENERGY SOLUTION: COMPANY OVERVIEW

- TABLE 127 LG ENERGY SOLUTION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 128 LG ENERGY SOLUTION: DEALS, JANUARY 2021-MARCH 2025

- TABLE 129 LG ENERGY SOLUTION: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 130 FICOSA INTERNACIONAL SA: COMPANY OVERVIEW

- TABLE 131 FICOSA INTERNACIONAL SA: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 132 EWERT ENERGY SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 133 EWERT ENERGY SYSTEMS, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 134 FUTAVIS GMBH: COMPANY OVERVIEW

- TABLE 135 FUTAVIS GMBH: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 136 LECLANCHE SA: COMPANY OVERVIEW

- TABLE 137 LECLANCHE SA: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 138 LECLANCHE SA: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 139 NUVATION ENERGY: COMPANY OVERVIEW

- TABLE 140 NUVATION ENERGY: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 141 NUVATION ENERGY: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 142 NUVATION ENERGY: DEALS, JANUARY 2021-MARCH 2025

- TABLE 143 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 144 ANALOG DEVICES, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 145 ANALOG DEVICES, INC.: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 146 ANALOG DEVICES, INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 147 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 148 INFINEON TECHNOLOGIES AG: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 149 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 150 INFINEON TECHNOLOGIES AG: DEALS, JANUARY 2021-MARCH 2025

- TABLE 151 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 152 NXP SEMICONDUCTORS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 153 NXP SEMICONDUCTORS: DEALS, JANUARY 2021-MARCH 2025

- TABLE 154 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 155 PANASONIC HOLDINGS CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 156 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 157 RENESAS ELECTRONICS CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 158 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 159 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 160 STMICROELECTRONICS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 161 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 162 TEXAS INSTRUMENTS INCORPORATED: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 163 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

List of Figures

- FIGURE 1 AUTOMOTIVE BMS MARKET SEGMENTATION

- FIGURE 2 AUTOMOTIVE BMS MARKET: RESEARCH DESIGN

- FIGURE 3 AUTOMOTIVE BMS MARKET: RESEARCH APPROACH

- FIGURE 4 AUTOMOTIVE BMS MARKET: TOP-DOWN APPROACH

- FIGURE 5 AUTOMOTIVE BMS MARKET: BOTTOM-UP APPROACH

- FIGURE 6 AUTOMOTIVE BMS MARKET: MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 9 AUTOMOTIVE BMS MARKET, 2021-2030 (USD MILLION)

- FIGURE 10 LITHIUM-ION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 MODULAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 PASSENGER VEHICLES SEGMENT TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTOMOTIVE BMS MARKET DURING FORECAST PERIOD

- FIGURE 14 RISING DEMAND FOR ELECTRIC VEHICLES TO FUEL MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 15 LITHIUM-ION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 MODULAR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 PASSENGER VEHICLES SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 PASSENGER VEHICLES AND US TO BE LARGEST SHAREHOLDERS OF NORTH AMERICAN AUTOMOTIVE BMS MARKET IN 2030

- FIGURE 19 CHINA TO EXHIBIT HIGHEST CAGR IN AUTOMOTIVE BMS MARKET FROM 2025 TO 2030

- FIGURE 20 AUTOMOTIVE BMS MARKET DYNAMICS

- FIGURE 21 GLOBAL EV CAR STOCK, 2020-2023 (MILLION UNITS)

- FIGURE 22 IMPACT ANALYSIS OF DRIVERS ON AUTOMOTIVE BMS MARKET

- FIGURE 23 IMPACT ANALYSIS OF RESTRAINTS ON AUTOMOTIVE BMS MARKET

- FIGURE 24 IMPACT ANALYSIS OF OPPORTUNITIES ON AUTOMOTIVE BMS MARKET

- FIGURE 25 IMPACT ANALYSIS OF CHALLENGES ON AUTOMOTIVE BMS MARKET

- FIGURE 26 AUTOMOTIVE BMS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 ECOSYSTEM ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE OF AUTOMOTIVE BATTERY MANAGEMENT SYSTEMS, BY KEY PLAYER, 2024 (USD)

- FIGURE 29 AVERAGE SELLING PRICE TREND FOR AUTOMOTIVE BMS, 2021-2024 (USD)

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 AUTOMOTIVE BMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 33 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 34 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 850650, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 35 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 850650, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 36 TOP 10 PATENT APPLICANTS IN LAST 10 YEARS

- FIGURE 37 NUMBER OF PATENTS GRANTED PER YEAR FROM 2014 TO 2024

- FIGURE 38 KEY AUTOMOTIVE BMS OFFERINGS

- FIGURE 39 TYPES OF AUTOMOTIVE BMS

- FIGURE 40 AUTOMOTIVE BMS MARKET, BY BATTERY TYPE

- FIGURE 41 LITHIUM-ION SEGMENT TO DOMINATE AUTOMOTIVE BMS MARKET DURING FORECAST PERIOD

- FIGURE 42 AUTOMOTIVE BMS MARKET, BY TOPOLOGY

- FIGURE 43 MODULAR SEGMENT TO LEAD AUTOMOTIVE BMS MARKET FROM 2025 TO 2030

- FIGURE 44 TYPICAL STRUCTURE OF MODULAR BATTERY MANAGEMENT SYSTEM

- FIGURE 45 TYPICAL STRUCTURE OF CENTRALIZED BATTERY MANAGEMENT SYSTEM

- FIGURE 46 TYPICAL STRUCTURE OF DISTRIBUTED BATTERY MANAGEMENT SYSTEM

- FIGURE 47 AUTOMOTIVE BMS MARKET, BY APPLICATION

- FIGURE 48 PASSENGER VEHICLES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 49 AUTOMOTIVE BMS MARKET, BY REGION

- FIGURE 50 CHINA TO BE FASTEST-GROWING COUNTRY-LEVEL AUTOMOTIVE BMS MARKET DURING FORECAST PERIOD

- FIGURE 51 NORTH AMERICA: AUTOMOTIVE BMS MARKET SNAPSHOT

- FIGURE 52 US TO CAPTURE LARGEST SHARE OF NORTH AMERICAN AUTOMOTIVE BMS MARKET IN 2030

- FIGURE 53 EUROPE: AUTOMOTIVE BMS MARKET SNAPSHOT

- FIGURE 54 GERMANY TO DOMINATE AUTOMOTIVE BMS MARKET IN EUROPE DURING 2025-2030

- FIGURE 55 ASIA PACIFIC: AUTOMOTIVE BMS MARKET SNAPSHOT

- FIGURE 56 CHINA TO LEAD AUTOMOTIVE BMS MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 57 SOUTH AMERICA TO COMMAND MAXIMUM SHARE OF AUTOMOTIVE BMS MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 58 AUTOMOTIVE BMS MARKET: FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS (2020-2024)

- FIGURE 59 AUTOMOTIVE BMS MARKET SHARE ANALYSIS

- FIGURE 60 AUTOMOTIVE BMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 61 AUTOMOTIVE BMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 62 EBERSPACHER: COMPANY SNAPSHOT

- FIGURE 63 SENSATA TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 64 LG ENERGY SOLUTION: COMPANY SNAPSHOT

- FIGURE 65 LECLANCHE SA: COMPANY SNAPSHOT

- FIGURE 66 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 67 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 68 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 69 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 72 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

The global automotive battery management market was valued at USD 6.53 billion in 2025 and is estimated to reach USD 15.65 billion by 2030, registering a CAGR of 19.1% during the forecast period. Given the importance of safety, efficiency, and energy optimization in electric mobility, there is an increasing need for smart and dependable battery management system (BMS) solutions in the automotive industry. Automakers and EV manufacturers are progressively adopting sophisticated BMS technologies to enable real-time monitoring, avoid overcharging, and improve battery efficiency. These systems play a crucial role in detecting faults, prolonging battery life, and adhering to the increasingly stringent automotive safety standards. The market growth is also supported by the rise in EV production, government incentives for eco-friendly vehicles, and ongoing innovations in battery technologies. Collectively, these factors are driving consistent growth of the automotive battery management market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Battery Type, Topology, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Passenger vehicle segment estimated to hold largest share of automotive battery management market in 2024."

The passenger vehicle segment is expected to hold the maximum share in 2024. This dominance is primarily driven by the increasing adoption of electric vehicles (EVs), rising environmental consciousness, and the enforcement of stringent global emission regulations. Government incentives and regulatory support for sustainable transportation are encouraging automakers to accelerate the electrification of their passenger vehicle fleets, which, in turn, is boosting the demand for advanced battery management systems (BMS). Additionally, the rising demand for connected and intelligent features in passenger vehicles is enhancing the segment's prominence. As car manufacturers adopt technologies like remote monitoring, predictive maintenance, and over-the-air updates, the need for smart and adaptable battery management systems (BMS) is becoming more important. These systems not only optimize battery efficiency but also facilitate smooth integration with vehicle telematics and cloud services. With ongoing improvements in lithium-ion battery technology and growing investments in electric vehicle infrastructure, the passenger vehicle segment is poised to remain a major contributor to the automotive battery management market.

"Centralized topology segment to record significant CAGR during the forecast period."

During the forecast period, the market for automotive battery management systems is expected to experience a high CAGR due to the necessity for cost-effective solutions in medium-power applications and simpler battery systems employed in commercial vehicles. The centralized control unit is responsible for cell protection and balancing while also executing various functions. Additionally, it oversees and regulates the cells within the battery pack. Typically, a considerable number of wiring harnesses are needed to route voltage levels for the cells in the battery, along with temperature sensors placed throughout the battery. Nevertheless, these systems lack expandability. Generally, a centralized battery management system is affordable but does not offer scalability. Therefore, connections may be needed to link the cells to the controller board, making it more suitable for battery packs with a limited number of cells. A centralized battery management system is mainly utilized in medium-power applications like e-bikes and two-wheelers, as well as simpler battery systems in commercial vehicles. The centralized topology provides superior computational power compared to other configurations.

"Europe to account for 2nd largest share of automotive battery management system market in 2030 "

The established electric vehicle market in Europe is positively impacting the manufacturing of lithium-ion battery cells/packs in the region. Due to the increasing popularity of electric vehicles, the demand for electric vehicle batteries has significantly risen in the region. These factors are driving the growth of the automotive battery management market in this region. Furthermore, the demand for automotive BMS in this region can be attributed to the presence of manufacturing facilities of major automotive manufacturers, such as BMW Group (Germany), Mercedes-Benz Group AG (Germany), and Volkswagen AG (Germany). Active associations in Europe, such as the Association of European Automotive Industrial Battery Manufacturers and PRBA, support the use of electric vehicles in the region. Key companies in the European automotive battery management market include Eberspacher (Germany), Leclanche SA (Switzerland), AVL (Austria), and BMS PowerSafe (France). These players are taking initiatives to launch technologically advanced automotive battery management solutions in the market to cater to the needs of end users. As there is a growing trend of adoption of electric vehicles in Europe, the requirement for automotive BMS has also increased to effectively manage batteries in these vehicles.

Extensive primary interviews were conducted with key industry experts in the automotive battery management market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors - 45%, Managers - 35%, and Others - 20%

- By Region: Asia Pacific - 28%, Europe - 35%, North America - 30%, and RoW - 7%

The automotive battery management market is dominated by a few globally established players, such as Eberspacher (Germany), Sensata Technologies, Inc. (US), LG Energy Solution (South Korea), AVL (Austria), Ficosa Internacional SA (Spain), Leclanche SA (Switzerland), and BMS PowerSafe (France).

The study includes an in-depth competitive analysis of these key players in the automotive battery management market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the automotive battery management market and forecasts its size by battery type (Lithium-ion, Lead-acid, Other Batteries), Application (Passenger Vehicles, Commercial Vehicles, Other Vehicles), and Topology (Modular, Centralized, Distributed). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a supply chain analysis of the key players and their competitive analysis in the automotive battery management ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Remarkable growth of electric vehicles industry, Strong focus on electrification of public transportation, Government-led initiatives to boost adoption of EVs), restraint (Developing universal battery management system standards for various applications), opportunities (Emergence of novel battery technologies, Advantages of wireless battery management systems over traditional systems, Development of cell management system (CMS) technology), challenges (Impact of external factors on performance of battery management systems, Complexity of modern battery technologies impeding development of reliable battery management systems)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the automotive battery management market

- Market Development: Comprehensive information about lucrative markets - analysis of the automotive battery management market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the automotive battery management market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Eberspacher (Germany), Sensata Technologies, Inc. (US), LG Energy Solution (South Korea), Ficosa Internacional SA (Spain), and AVL (Austria).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Estimation of market size using top-down approach

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Estimation of market size using bottom-up approach

- 2.2.1 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE BMS MARKET

- 4.2 AUTOMOTIVE BMS MARKET, BY BATTERY TYPE

- 4.3 AUTOMOTIVE BMS MARKET, BY TOPOLOGY

- 4.4 AUTOMOTIVE BMS MARKET, BY APPLICATION

- 4.5 NORTH AMERICA: AUTOMOTIVE BMS MARKET, BY COUNTRY AND APPLICATION

- 4.6 AUTOMOTIVE BMS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Strong growth of EV industry

- 5.2.1.2 Strong focus on electrification of public transportation

- 5.2.1.3 Government-led initiatives to boost adoption of EVs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Developing universal battery management system standards for various applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of novel battery technologies

- 5.2.3.2 Advantages of wireless battery management systems over traditional systems

- 5.2.3.3 Development of cell management system (CMS) technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Impact of external factors on performance of battery management systems

- 5.2.4.2 Complexities of modern battery technologies impeding development of reliable BMS

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 BATTERY PASSPORT AND ITS IMPACT ON BATTERY VALUE CHAIN

- 5.4 KEY FUNCTIONS OF BMS

- 5.4.1 BATTERY MANAGEMENT

- 5.4.2 CELL BALANCING

- 5.4.3 THERMAL MANAGEMENT

- 5.4.4 STATE OF CHARGE

- 5.4.5 STATE OF HEALTH

- 5.5 ECOSYSTEM/MARKET MAP

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.6.2 AVERAGE SELLING PRICE TREND FOR AUTOMOTIVE BMS

- 5.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 AB BATTERY SYSTEM

- 5.8.2 SODIUM-ION BATTERY

- 5.8.3 SOLID-STATE BATTERY

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 BARGAINING POWER OF SUPPLIERS

- 5.9.2 BARGAINING POWER OF BUYERS

- 5.9.3 THREAT OF NEW ENTRANTS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 CASE STUDY 1: ABU DHABI'S MASDAR CITY TO INTRODUCE AUTONOMOUS PRT SYSTEM WITH LITHIUM-ION BATTERIES

- 5.11.2 CASE STUDY 2: SENSATA TECHNOLOGIES COLLABORATES WITH CHINESE OEM TO ENHANCE S-BMS FOR FAST-CHARGING EV BUSES

- 5.11.3 CASE STUDY 3: SENSATA'S S-BMS INTEGRATION WITH QEV ARCFOX GT ENSURES UNMATCHED SAFETY STANDARDS AND PERFORMANCE

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO FOR HS CODE 850650

- 5.12.2 EXPORT SCENARIO FOR HS CODE 850650

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 STANDARDS AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS AND REGULATIONS

- 5.16 IMPACT OF 2025 US TARIFF-AUTOMOTIVE BMS MARKET

- 5.16.1 KEY TARIFF RATES

- 5.16.2 PRICE IMPACT ANALYSIS

- 5.16.3 IMPACT ON COUNTRY/REGION

- 5.16.3.1 US

- 5.16.3.2 Europe

- 5.16.3.3 APAC

- 5.16.4 IMPACT ON END-USE INDUSTRIES

6 KEY AUTOMOTIVE BMS OFFERINGS

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 BATTERY CONTROL UNITS

- 6.2.2 POWER MANAGEMENT COMPONENTS

- 6.2.3 COMMUNICATION COMPONENTS

- 6.3 SOFTWARE

7 TYPES OF AUTOMOTIVE BMS

- 7.1 INTRODUCTION

- 7.2 STANDALONE BMS

- 7.3 INTEGRATED BMS

8 AUTOMOTIVE BMS MARKET, BY BATTERY TYPE

- 8.1 INTRODUCTION

- 8.2 LITHIUM-ION

- 8.2.1 GROWING ELECTRIC VEHICLES MARKET TO INDUCE DEMAND FOR BATTERY MANAGEMENT SYSTEMS

- 8.3 LEAD-ACID

- 8.3.1 INCREASING DEMAND FOR ADVANCED LEAD-ACID BATTERIES IN COMMERCIAL VEHICLE APPLICATIONS TO DRIVE MARKET

- 8.4 OTHER BATTERIES

9 AUTOMOTIVE BMS MARKET, BY TOPOLOGY

- 9.1 INTRODUCTION

- 9.2 MODULAR

- 9.2.1 ADVANTAGES OF HIGH FLEXIBILITY AND SUPERIOR PERFORMANCE TO BOOST ADOPTION OF MODULAR TOPOLOGY

- 9.3 CENTRALIZED

- 9.3.1 ADOPTION OF CENTRALIZED BATTERY MANAGEMENT SYSTEMS IN LESS SOPHISTICATED BATTERY SYSTEMS TO DRIVE MARKET

- 9.4 DISTRIBUTED

- 9.4.1 SUITABILITY FOR HIGH-POWER APPLICATIONS TO FUEL DEMAND FOR DISTRIBUTED BATTERY MANAGEMENT SYSTEMS

10 AUTOMOTIVE BMS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 PASSENGER VEHICLES

- 10.2.1 RISING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

- 10.2.1.1 Battery electric vehicles

- 10.2.1.2 Hybrid electric vehicles and plug-in hybrid electric vehicles

- 10.2.1 RISING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

- 10.3 COMMERCIAL VEHICLES

- 10.3.1 GROWING EFFORTS TO ELECTRIFY PUBLIC TRANSPORTATION GLOBALLY TO DRIVE MARKET

- 10.4 OTHER VEHICLES

11 AUTOMOTIVE BMS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Government initiatives to boost adoption of EVs to support market growth

- 11.2.2 CANADA

- 11.2.2.1 Focus on strengthening local electric vehicle and battery industry to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Growing EV manufacturing activities to boost demand for automotive battery management systems

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Strong presence of prominent automakers to create opportunities for BMS manufacturers

- 11.3.2 UK

- 11.3.2.1 Electrification of public transportation to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Strong focus on developing innovative battery management systems to contribute to market growth

- 11.3.4 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Rising focus on increasing battery manufacturing capacity to boost market growth

- 11.4.2 JAPAN

- 11.4.2.1 Presence of battery manufacturing companies to favor market growth

- 11.4.3 INDIA

- 11.4.3.1 Expanding EV market to create opportunities for BMS manufacturers

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Flourishing EVs industry to induce demand for battery management systems

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 REST OF THE WORLD

- 11.5.1 MIDDLE EAST

- 11.5.1.1 Increased funding for EV production to drive the market

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Huge presence of lithium reserves to support market growth

- 11.5.3 AFRICA

- 11.5.3.1 Rising awareness and government support to favor market growth

- 11.5.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMOTIVE BMS MARKET

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Application footprint

- 12.5.5.3 Region footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- 12.7.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 EBERSPACHER

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SENSATA TECHNOLOGIES, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 AVL

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 LG ENERGY SOLUTION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 FICOSA INTERNACIONAL SA

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 EWERT ENERGY SYSTEMS, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.7 FUTAVIS GMBH

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 LECLANCHE SA

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.9 NUVATION ENERGY

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches & enhancements

- 13.1.9.3.2 Deals

- 13.1.1 EBERSPACHER

- 13.2 OTHER IMPORTANT PLAYERS

- 13.2.1 ANALOG DEVICES, INC.

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches

- 13.2.1.3.2 Deals

- 13.2.2 INFINEON TECHNOLOGIES AG

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches

- 13.2.2.3.2 Deals

- 13.2.3 NXP SEMICONDUCTORS

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.4 PANASONIC HOLDINGS CORPORATION

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.5 RENESAS ELECTRONICS CORPORATION

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches

- 13.2.6 STMICROELECTRONICS

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.7 TEXAS INSTRUMENTS INCORPORATED

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.1 ANALOG DEVICES, INC.

- 13.3 OTHER PLAYERS

- 13.3.1 BMS POWERSAFE

- 13.3.2 DUKOSI LIMITED

- 13.3.3 POWERTECH SYSTEMS

- 13.3.4 XING MOBILITY

- 13.3.5 EATRON TECHNOLOGIES

- 13.3.6 MOKOENERGY

- 13.3.7 MUNICH ELECTRIFICATION GMBH

- 13.3.8 BATKON BATTERY CONTROL TECHNOLOGIES INC.

- 13.3.9 STAFL SYSTEMS, LLC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS