|

|

市場調査レポート

商品コード

1735430

OTC薬・ビタミン類および栄養補助食品の世界市場Over-the-Counter (OTC) Drugs, and Vitamins & Dietary Supplements: Global Markets |

||||||

|

|||||||

| OTC薬・ビタミン類および栄養補助食品の世界市場 |

|

出版日: 2025年05月13日

発行: BCC Research

ページ情報: 英文 155 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のOTC薬・ビタミン類および栄養補助食品の市場規模は、2025年の2,769億ドルから2030年末には3,717億ドルに拡大すると見込まれており、2025年から2030年にかけてのCAGRは6.1%と予測されています。

アジア太平洋地域の市場規模は、2025年の1,202億ドルから2030年末には1,723億ドルに拡大すると見込まれており、同期間のCAGRは7.5%とされています。

北米の市場規模は、2025年の753億ドルから2030年末には937億ドルに拡大すると見込まれており、同期間のCAGRは4.5%と予測されています。

当レポートでは、世界のOTC薬・ビタミン類および栄養補助食品の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 調査範囲

- 市場サマリー

第2章 市場概要

- 市場の定義

- OTC薬

- ビタミン類および栄養補助食品

- 業界概要

- マクロ経済分析

- ポーターのファイブフォース分析

第3章 市場力学

- 市場促進要因

- セルフケアと予防ケアへの傾向の高まり

- 人口動態の変化による高齢化

- 公衆衛生システムへの圧力の高まり

- プレミアム化とイノベーションが価格設定を推進

- オンライン販売チャネルの増加と遠隔医療プラットフォームの成長

- 市場抑制要因

- プライベートブランドの入手可能性と受容性の向上

- 代替品の脅威

- 代替手段の存在

- 季節性の影響

- 市場機会

- 新興国における中流階級の拡大

- 女性の健康と認知機能サポート製品の需要の増加

- ハーブやオーガニック製品への移行

- eコマースと消費者直販

- 重要ポイント

第4章 規制状況

- 米国

- OTC薬

- ビタミン類および栄養補助食品

- 欧州

- OTC薬

- ビタミン類および栄養補助食品

- アジア太平洋

- OTC薬

- ビタミン類および栄養補助食品

第5章 新興技術と開発

- 成分表示への意識向上

- イノベーションによるブランド拡張

- 処方薬からOTC薬への切り替え

第6章 市場セグメンテーション分析

- セグメンテーションの内訳

- OTC薬・ビタミン類および栄養補助食品市場:製品タイプ別

- ビタミン類および栄養補助食品

- 市場概要

- 重要ポイント

- 市場収益・予測

- ビタミン類および栄養補助食品市場:販売場所別

- 小売薬局・店舗

- eコマース

- その他

- OTC薬

- 市場概要

- 重要ポイント

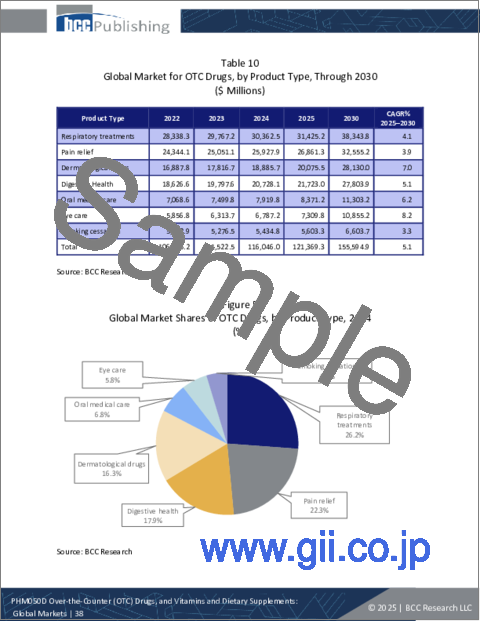

- 市場収益・予測:製品タイプ別

- 呼吸器治療

- 疼痛緩和

- 消化器系の健康

- 皮膚科薬

- 口腔医療

- アイケア

- 禁煙

- OTC薬市場:販売場所別

- 小売薬局・店舗

- オンライン薬局

- 地理的内訳

- OTC薬・ビタミン類および栄養補助食品市場:地域別

- 重要ポイント

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第7章 競合情報

- 重要ポイント

- OTC薬

- ビタミン類および栄養補助食品

- 主な展開・戦略

第8章 OTC薬・ビタミン類および栄養補助食品市場における持続可能性:ESGの観点

- ESG:イントロダクション

- 環境

- 社会

- ガバナンス

- ESGリスク評価

- 総論

第9章 付録

- 調査手法

- 出典

- 略語

- 企業プロファイル

- ABBOTT

- AMWAY CORP.

- BAYER AG

- DSM- FIRMENICH

- HALEON GROUP OF CO.

- HERBALIFE LTD.

- KENVUE

- NESTLE HEALTH SCIENCE

- OPELLA HEALTHCARE GROUP SAS

- PHARMAVITE

- PROCTER & GAMBLE

- RECKITT

- STADA ARZNEIMITTEL AG

- TAISHO PHARMACEUTICAL HOLDINGS CO. LTD.

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- 新興スタートアップ企業/市場ディスラプター

List of Tables

- Summary Table : Global Market for OTC Drugs, Vitamins and Dietary Supplements, by Region, Through 2030

- Table 1 : Benefits of Over-the-Counter (OTC) Drugs

- Table 2 : Porter's Five Forces: Rating Scale

- Table 3 : Number and Proportion of Persons Aged 65 Years and Over, by Development Group, 2023 and 2050

- Table 4 : Asia-Pacific: Regulatory Landscape

- Table 5 : Rx-to-OTC Switch Drugs, 2020-2024*

- Table 6 : Global Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 7 : Common Dietary Supplements

- Table 8 : Specialty Dietary Supplements

- Table 9 : Global Market for Vitamins and Dietary Supplements, by Point of Sale, Through 2030

- Table 10 : Global Market for OTC Drugs, by Product Type, Through 2030

- Table 11 : Common OTC Respiratory Drugs

- Table 12 : Most Common OTC Pain Relievers

- Table 13 : Digestive Health OTC Drugs

- Table 14 : Most Common OTC Dermatological Drugs

- Table 15 : OTC Eye Care Drugs

- Table 16 : OTC Smoking Cessation Products

- Table 17 : Global Market for OTC Drugs, by Point of Sale, Through 2030

- Table 18 : Global Market for OTC Drugs, Vitamins and Dietary Supplements, by Region, Through 2030

- Table 19 : North American Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 20 : North American Market for Vitamins and Dietary Supplements, by Point of Sale, Through 2030

- Table 21 : North American Market for OTC Drugs, by Point of Sale, Through 2030

- Table 22 : North American Population and GDP Data, by Country, 2023

- Table 23 : U.S. Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 24 : Canadian Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 25 : Mexican Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 26 : European Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 27 : European Market for Vitamins and Dietary Supplements, by Point of Sale, Through 2030

- Table 28 : European Market for OTC Drugs, by Point of Sale, Through 2030

- Table 29 : German Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 30 : U.K. Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 31 : French Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 32 : Italian Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 33 : Rest of European Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 34 : Asia-Pacific Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 35 : Asia-Pacific Market for Vitamins and Dietary Supplements, by Point of Sale, Through 2030

- Table 36 : Asia-Pacific Market for OTC Drugs, by Point of Sale, Through 2030

- Table 37 : Chinese Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 38 : Japanese Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 39 : Indian Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 40 : Rest of APAC Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 41 : Middle Eastern and African Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 42 : Middle Eastern and African Market for Vitamins and Dietary Supplements, by Point of Sale, Through 2030

- Table 43 : Middle Eastern and African Market for OTC Drugs, by Point of Sale, Through 2030

- Table 44 : South American Market for OTC Drugs, Vitamins and Dietary Supplements, by Product Type, Through 2030

- Table 45 : South American Market for Vitamins and Dietary Supplements, by Point of Sale, Through 2030

- Table 46 : South American Market for OTC Drugs, by Point of Sale, Through 2030

- Table 47 : OTC Drugs: Market Player Share Analysis, 2024

- Table 48 : Leading Vitamin and Dietary Supplement Companies and Their Key Brands, 2024

- Table 49 : Key Developments and Strategies, 2023-2025

- Table 50 : ESG Pillars for OTC Drugs, Vitamins and Dietary Supplements Market

- Table 51 : ESG Risk Rankings for OTC Drugs, Vitamins and Dietary Supplements Companies, 2025*

- Table 52 : Report Sources

- Table 53 : Abbreviations Used in This Report

- Table 54 : Abbott: Company Snapshot

- Table 55 : Abbott: Financial Performance, FY 2023 and 2024

- Table 56 : Abbott: Product Portfolio

- Table 57 : Amway Corp.: Company Snapshot

- Table 58 : Amway Corp.: Product Portfolio

- Table 59 : Bayer AG: Company Snapshot

- Table 60 : Bayer AG: Financial Performance, FY 2023 and 2024

- Table 61 : Bayer AG: Product Portfolio

- Table 62 : Bayer AG: News/Key Developments, 2024 and 2025

- Table 63 : DSM-Firmenich: Company Snapshot

- Table 64 : DSM-Firmenich: Financial Performance, FY 2023 and 2024

- Table 65 : DSM-Firmenich: Product Portfolio

- Table 66 : DSM-Firmenich: News/Key Developments, 2023 and 2024

- Table 67 : Haleon Group of Co.: Company Snapshot

- Table 68 : Haleon Group of Co.: Financial Performance, FY 2023 and 2024

- Table 69 : Haleon Group of Co.: Product Portfolio

- Table 70 : Haleon Group of Co.: News/Key Developments, 2023

- Table 71 : Herbalife Ltd.: Company Snapshot

- Table 72 : Herbalife Ltd.: Financial Performance, FY 2023 and 2024

- Table 73 : Herbalife Ltd.: Product Portfolio

- Table 74 : Herbalife Ltd.: News/Key Developments, 2023

- Table 75 : Kenvue: Company Snapshot

- Table 76 : Kenvue: Financial Performance, FY 2023 and 2024

- Table 77 : Kenvue: Product Portfolio

- Table 78 : Kenvue: News/Key Developments, 2023

- Table 79 : Nestle Health Science: Company Snapshot

- Table 80 : Nestle Health Science: Financial Performance, FY 2023 and 2024

- Table 81 : Nestle Health Science: Product Portfolio

- Table 82 : Opella Healthcare Group SAS: Company Snapshot

- Table 83 : Opella Healthcare Group SAS: Product Portfolio

- Table 84 : Opella Healthcare Group SAS: News/Key Developments, 2023-2025

- Table 85 : Pharmavite: Company Snapshot

- Table 86 : Pharmavite: Product Portfolio

- Table 87 : Pharmavite: News/Key Developments, 2023 and 2024

- Table 88 : Procter & Gamble: Company Snapshot

- Table 89 : Procter & Gamble: Financial Performance, FY 2022 and 2023

- Table 90 : Procter & Gamble: Product Portfolio

- Table 91 : Reckitt: Company Snapshot

- Table 92 : Reckitt: Financial Performance, FY 2023 and 2024

- Table 93 : Reckitt: Product Portfolio

- Table 94 : Reckitt: News/Key Developments, 2024

- Table 95 : Stada Arzneimittel AG: Company Snapshot

- Table 96 : Stada Arzneimittel AG: Financial Performance, FY 2022 and 2023

- Table 97 : Stada Arzneimittel AG: Product Portfolio

- Table 98 : Stada Arzneimittel AG: News/Key Developments, 2023 and 2024

- Table 99 : Taisho Pharmaceutical Holdings Co. Ltd.: Company Snapshot

- Table 100 : Taisho Pharmaceutical Holdings Co. Ltd.: Product Portfolio

- Table 101 : Teva Pharmaceutical Industries Ltd.: Company Snapshot

- Table 102 : Teva Pharmaceutical Industries Ltd.: Financial Performance, FY 2023 and 2024

- Table 103 : Teva Pharmaceutical Industries Ltd.: Product Portfolio

- Table 104 : List of Few Emerging Startups/ Market Disruptors

List of Figures

- Summary Figure : Global Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Region, 2024

- Figure 1 : Porter's Five Forces Analysis

- Figure 2 : Market Dynamics Snapshot

- Figure 3 : Global Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 4 : Global Market Shares of Vitamins and Dietary Supplements, by Point of Sale, 2024

- Figure 5 : Global Market Shares of OTC Drugs, by Product Type, 2024

- Figure 6 : Global Market Shares of OTC Drugs, by Point of Sale, 2024

- Figure 7 : Global Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Region, 2024

- Figure 8 : North American Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 9 : North American Market Shares of Vitamins and Dietary Supplements, by Point of Sale, 2024

- Figure 10 : North American Market Shares of OTC Drugs, by Point of Sale, 2024

- Figure 11 : U.S. Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 12 : Canadian Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 13 : Mexican Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 14 : European Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 15 : European Market Shares of Vitamins and Dietary Supplements, by Point of Sale, 2024

- Figure 16 : European Market Shares of OTC Drugs, by Point of Sale, 2024

- Figure 17 : German Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 18 : U.K. Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 19 : French Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 20 : Italian Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 21 : Rest of European Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 22 : Asia-Pacific Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 23 : Asia-Pacific Market Shares of Vitamins and Dietary Supplements, by Point of Sale, 2024

- Figure 24 : Asia-Pacific Market Shares of OTC Drugs, by Point of Sale, 2024

- Figure 25 : Chinese Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 26 : Japanese Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 27 : Indian Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 28 : Rest of APAC Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 29 : Middle Eastern and African Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 30 : Middle Eastern and African Market Shares of Vitamins and Dietary Supplements, by Point of Sale, 2024

- Figure 31 : Middle Eastern and African Market Shares of OTC Drugs, by Point of Sale, 2024

- Figure 32 : South American Market Shares of OTC Drugs, Vitamins and Dietary Supplements, by Product Type, 2024

- Figure 33 : South American Market Shares of Vitamins and Dietary Supplements, by Point of Sale, 2024

- Figure 34 : South American Market Shares of OTC Drugs, by Point of Sale, 2024

- Figure 35 : Abbott: Revenue Shares, by Business Unit, FY 2024

- Figure 36 : Abbott: Revenue Shares, by Country/Region, FY 2024

- Figure 37 : Bayer AG: Revenue Shares, by Business Unit, FY 2024

- Figure 38 : Bayer AG: Revenue Shares, by Country/Region, FY 2024

- Figure 39 : DSM-Firmenich: Revenue Shares, by Business Unit, FY 2024

- Figure 40 : DSM-Firmenich: Revenue Shares, by Country/Region, FY 2024

- Figure 41 : Haleon Group of Co.: Revenue Shares, by Business Unit, FY 2024

- Figure 42 : Haleon Group of Co.: Revenue Shares, by Country/Region, FY 2024

- Figure 43 : Herbalife Ltd.: Revenue Shares, by Business Unit, FY 2024

- Figure 44 : Herbalife Ltd.: Revenue Shares, by Country/Region, FY 2024

- Figure 45 : Kenvue: Revenue Shares, by Business Unit, FY 2024

- Figure 46 : Kenvue: Revenue Shares, by Country/Region, FY 2024

- Figure 47 : Procter & Gamble: Revenue Shares, by Business Unit, FY 2023

- Figure 48 : Procter & Gamble: Revenue Shares, by Country/Region, FY 2023

- Figure 49 : Reckitt: Revenue Shares, by Business Unit, FY 2024

- Figure 50 : Reckitt: Revenue Shares, by Country/ Region, FY 2024

- Figure 51 : Stada Arzneimittel AG: Revenue Shares, by Business Unit, FY 2023

- Figure 52 : Stada Arzneimittel AG: Revenue Shares, by Country/ Region, FY 2023

- Figure 53 : Teva Pharmaceutical Industries Ltd.: Market Shares, by Business Unit, 2024

The global market for over-the- counter (OTC) drugs, vitamins and dietary supplements is expected to grow from $276.9 billion in 2025 and is projected to reach $371.7 billion by the end of 2030, at a compound annual growth rate (CAGR) of 6.1% during the forecast period of 2025 to 2030.

The Asia-Pacific market for OTC drugs, vitamins and dietary supplements is expected to grow from $120.2 billion in 2025 and is projected to reach $172.3 billion by the end of 2030, at a CAGR of 7.5% during the forecast period of 2025 to 2030.

The North American market for OTC drugs, vitamins and dietary supplements is expected to grow from $75.3 billion in 2025 and is projected to reach $93.7 billion by the end of 2030, at a CAGR of 4.5% during the forecast period of 2025 to 2030.

Report Scope

This report provides an overview of the global over-the-counter (OTC) drugs, vitamins and dietary supplements market and analyzes trends in this market. It includes global revenue ($ million) for the base year of 2024, estimated market values for 2025, and market values for the forecast period 2025 through 2030. In this report, market revenue refers to ex-factory or ex-manufacturer sales, representing the value of goods as they leave the manufacturer and before any markups by wholesalers or retailers.

The report focuses on the major driving trends and challenges that affect the OTC drugs, vitamins and dietary supplements market and its vendor landscape. It covers the latest new products, acquisitions and collaborations taking place in this market. It also analyzes environmental, social, and corporate governance (ESG) developments and discusses emerging opportunities and challenges related to the market.

The report concludes with an analysis of the competitive landscape of this market, providing the ranking and share of key players. It also has a company profiles section that is dedicated to providing details about leading market players.

It is important to note that this report's scope covers only pharmacological OTC drugs and excludes any other types of drugs, such as alternative therapies. Also, dietary supplements for weight management, meal replacements, medical nutrition, sports nutrition, and skin care are not included in this report.

Report Includes

- 46 data tables and 59 additional tables

- An overview of the global market for over-the-counter drugs, vitamins and dietary supplements

- An analysis of the global market trends with market revenue data from 2022 to 2024, estimates for 2025, and projected CAGRs through 2030

- Highlights of the current and future market potential and quantification of the market by product type, point of sales, and geographic region

- Discussion on market opportunities for over-the-counter drugs, vitamins and dietary supplement applications, industry structure, and regulatory scenarios

- Information on the latest developments in healthcare interoperability solutions and new industry research, upcoming technologies, and economic trends

- Identification of challenges and discussion on how to overcome those to reach its commercialization potential, and ESG trends of the market

- Market share analysis of the key companies of the industry and coverage of their proprietary technologies, strategic alliances, and other key market strategies and a relevant patent analysis

- Comprehensive company profiles of the leading players of the industry, including Haleon Group of Companies, Kenvue, Opella Healthcare Group SAS, Bayer AG, and Procter & Gamble

Table of Contents

Chapter 1 Executive Summary

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Market Definitions

- Over-the-counter (OTC) Drugs

- Vitamins and Dietary Supplements

- Industry Overview

- Macroeconomic Analysis

- Porter's Five Forces Analysis

- Bargaining Power of Buyers (High)

- Bargaining Power of Suppliers (Moderate to Low)

- Threat of New Entrants (Moderate)

- Threat of Substitutes (Low)

- Industry Competition (High)

Chapter 3 Market Dynamics

- Market Drivers

- Increasing Trend Toward Self-Care and Preventive Care

- Changing Demographics Resulting in Aging Population

- Increasing Pressure on Public Health Systems

- Premiumization and Innovation Driving Pricing

- Rising Online Sales Channels and Growth of Telehealth Platforms

- Market Restraints

- Increases in the Availability and Acceptance of Private-Label Brands

- Threat from Counterfeit Products

- Presence of Alternative Methods

- Impact of Seasonality

- Market Opportunities

- Growing Middle Class in Emerging Economies

- Growing Demand for Women's Health and Cognitive Health Support Products

- Shift Toward Herbal and Organic Products

- E-Commerce and Direct-to-Consumer Sales

- Key Takeaways

Chapter 4 Regulatory Landscape

- U.S.

- OTC Drugs

- Vitamins and Dietary Supplements

- Europe

- OTC Drugs

- Vitamins and Dietary Supplements

- Asia-Pacific

- OTC Drugs

- Vitamins and Dietary Supplements

Chapter 5 Emerging Technologies and Developments

- Increased Awareness of Ingredient Labeling

- Brand Extension Fueled by Innovation

- Rx-to-OTC Switch

Chapter 6 Market Segmentation Analysis

- Segmentation Breakdown

- OTC Drugs, Vitamins and Dietary Supplements Market, by Product Type

- Vitamins and Dietary Supplements

- Market Overview

- Key Takeaways

- Market Revenue and Forecast

- Vitamins and Dietary Supplements Market, by Point of Sale

- Retail Pharmacies and Stores

- E-Commerce

- Other Points of Sales

- OTC Drugs

- Market Overview

- Key Takeaways

- Market Revenue and Forecast, by Product Type

- Respiratory Treatments

- Pain Relief

- Digestive Health

- Dermatological Drugs

- Oral Medical Care

- Eye Care

- Smoking Cessation

- OTC Drugs Market, by Point of Sale

- Retail Pharmacies and Stores

- E-Pharmacies

- Geographic Breakdown

- OTC Drugs, Vitamins and Dietary Supplements Market, by Region

- Key Takeaways

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- South America

Chapter 7 Competitive Intelligence

- Key Takeaways

- OTC Drugs

- Vitamins and Dietary Supplements

- Key Developments and Strategies

Chapter 8 Sustainability in OTC Drugs, Vitamins and Dietary Supplements Market: ESG Perspective

- Introduction to ESG

- Environment

- Social

- Governance

- ESG Risk Ratings

- Conclusion

Chapter 9 Appendix

- Methodology

- Sources

- Abbreviations

- Company Profiles

- ABBOTT

- AMWAY CORP.

- BAYER AG

- DSM- FIRMENICH

- HALEON GROUP OF CO.

- HERBALIFE LTD.

- KENVUE

- NESTLE HEALTH SCIENCE

- OPELLA HEALTHCARE GROUP SAS

- PHARMAVITE

- PROCTER & GAMBLE

- RECKITT

- STADA ARZNEIMITTEL AG

- TAISHO PHARMACEUTICAL HOLDINGS CO. LTD.

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- Emerging Start-ups/ Market Disruptors