|

|

市場調査レポート

商品コード

1367762

核融合と先端材料:新たな機会Nuclear Fusion and Advanced Materials: Emerging Opportunities |

||||||

|

|||||||

| 核融合と先端材料:新たな機会 |

|

出版日: 2023年10月17日

発行: BCC Research

ページ情報: 英文 144 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の核融合技術の市場規模は、2035年の17億米ドルから、予測期間中は31.6%のCAGRで推移し、2040年末には68億米ドルの規模に成長すると予測されています。

地域別で見ると、北米市場は、2035年の12億米ドルから、同期間中29.4%のCAGRで推移し、2040年末には44億米ドルの規模に成長すると予測されています。また、アジア太平洋市場は、2035年の1億8,230万米ドルから、41.4%のCAGRで推移し、2040年末には10億米ドルの規模に成長すると予測されています。

当レポートでは、世界の核融合と先端材料の市場を調査し、市場および技術の概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、特許動向、法規制環境、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

第3章 市場および技術の概要

- 核融合の歴史

- 各国の核融合規制

- バリューチェーン分析

- 潜在的用途

- 特許分析

第4章 市場力学

- 市場促進要因

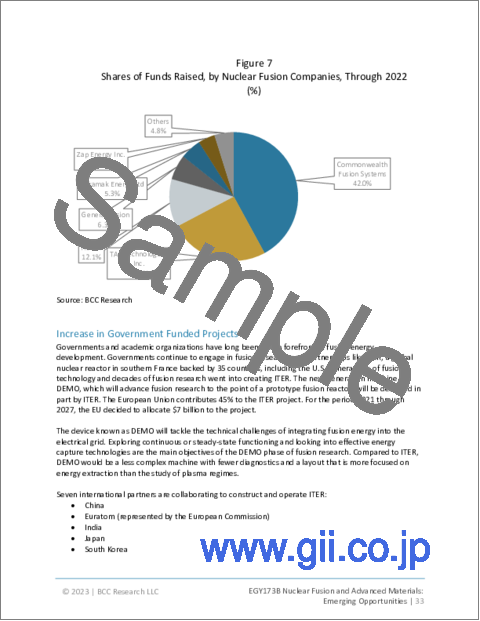

- 主要なベンチャーキャピタリストやその他の個人投資家からの資金調達の増加

- 政府資金によるプロジェクトの増加

- 核融合関連スタートアップの増加

- さらなるエネルギー量とゼロカーボンエネルギーへのニーズの高まり

- 市場機会

- 石油・ガス業界における代替エネルギー投資の機会

- 宇宙産業の成長の可能性

- 核融合のためのAIと機械学習 (ML) 技術の統合

- 市場の課題

- 核融合施設の建設と試運転にかかる高額な資本コスト

- プラズマの加熱、閉じ込め、安定性が直面する問題

- トリチウムのアベイラビリティ

- 商用核融合エネルギー施設の規制とライセンシング

第5章 市場内訳:技術別

- 概要

- 磁気閉じ込め核融合

- 慣性閉じ込め核融合

- 磁気慣性核融合

第6章 市場内訳:用途別

- 概要

- 発電

- 宇宙推進

- その他 (船舶推進、医療、オフグリッドエネルギー、水素/クリーン燃料、工業用暖房)

第7章 市場内訳:地域別

- 概要

- 北米

- 米国

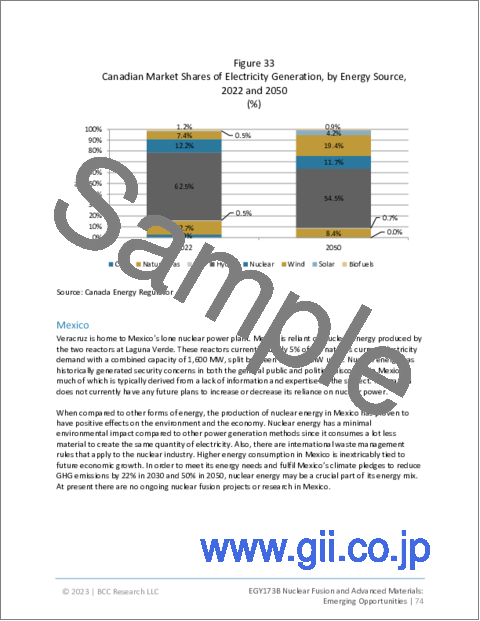

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- タイ

- アジア太平洋のその他の諸国

- その他の地域

第8章 競合情勢

- 戦略的分析

- 近年の主な展開

- 競合分析

- 代替発電技術の分析

- エネルギー技術の概念実証から早期実用化までの時間

- 小型モジュール炉 (SMR) は核融合にとって脅威となるか

第9章 企業プロファイル

- AVALANCHE ENERGY DESIGNS LLC

- COMMONWEALTH FUSION SYSTEMS (CFS)

- CTFUSION

- EX-FUSION INC.

- FOCUSED ENERGY

- FIRST LIGHT FUSION LTD

- GENERAL FUSION INC.

- HB11 ENERGY HOLDINGS PTY LTD

- HELION ENERGYINC.

- MARVEL FUSION GMBH

- MAGNETO-INERTIAL FUSION TECHNOLOGIES INC. (MIFTI)

- PRINCETON FUSION SYSTEMS INC.

- TAE TECHNOLOGIES INC.

- TOKAMAK ENERGY LTD.

- ZAP ENERGY INC.

第10章 付録:頭字語

List of Tables

- Summary Table : Global Market for Nuclear Fusion Technologies, by Region, Through 2040

- Table 1 : Notable Developments in the Timeline of Nuclear Fusion, 1950-2022

- Table 2 : Principal Regulations Currently Applicable to Fusion R&D in the U.K.

- Table 3 : Principal Regulations Currently Applicable to Fusion R&D in France

- Table 4 : Principal Regulations Currently Applicable to Fusion in China

- Table 5 : List of Component Manufacturer and Headquarters

- Table 6 : Global Market for Nuclear Fusion Technologies, by Type, Through 2040

- Table 7 : Three Key Technologies of Fusion and Their Challenges

- Table 8 : Global Market for Nuclear Fusion Technologies, by Application, Through 2040

- Table 9 : Global Projections of Electricity Consumption, by Energy Source, 2025-2050

- Table 10 : Global Market for Electricity Generation by Nuclear Fusion, by Region, Through 2040

- Table 11 : Global Market for Nuclear Fusion Space Propulsion Systems, by Region, Through 2040

- Table 12 : Global Market for Other Applications of Nuclear Fusion Technologies, by Region, Through 2040

- Table 13 : Global Nuclear Fusion Expected Commercialisation and Capacity, by Country

- Table 14 : Global Market for Nuclear Fusion Technologies, by Region, Through 2040

- Table 15 : U.S. Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 16 : Canadian Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 17 : Summary of Personnel and Institutions in Canada for Nuclear Research

- Table 18 : North American Market for Nuclear Fusion Technologies, by Application, Through 2040

- Table 19 : North American Market for Nuclear Fusion Technologies, by Country, Through 2040

- Table 20 : German Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 21 : U.K. Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 22 : French Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 23 : Italian Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 24 : Spanish Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 25 : Rest of European Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 26 : European Market for Nuclear Fusion Technologies, by Application, Through 2040

- Table 27 : European Market for Nuclear Fusion Technologies, by Country, Through 2040

- Table 28 : Chinese Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 29 : Japanese Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 30 : Indian Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 31 : Thai Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 32 : Rest of APAC Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 33 : APAC Market for Nuclear Fusion Technologies, by Application, Through 2040

- Table 34 : APAC Market for Nuclear Fusion Technologies, by Country, Through 2040

- Table 35 : South American Nuclear Fusion Device Status and Design Stage, by Device and Organization

- Table 36 : RoW Market for Nuclear Fusion Technologies, by Application, Through 2040

- Table 37 : Recent Key Developments, 2022 and 2023*

- Table 38 : Nuclear Fusion Companies Expected Capacity Generation

- Table 39 : Avalanche Energy Designs LLC: Company Snapshot

- Table 40 : Commonwealth Fusion Systems: Company Snapshot

- Table 41 : Commonwealth Fusion Systems: Recent Developments

- Table 42 : CTFusion: Company Snapshot

- Table 43 : EX-Fusion Inc.: Company Snapshot

- Table 44 : EX-Fusion Inc.: Recent Developments

- Table 45 : Focused Energy: Company Snapshot

- Table 46 : Focused Energy: Recent Developments

- Table 47 : First Light Fusion Ltd: Company Snapshot

- Table 48 : First Light Fusion Ltd: Recent Developments

- Table 49 : General Fusion Inc.: Company Snapshot

- Table 50 : General Fusion Inc.: Recent Developments

- Table 51 : HB11 Energy Holdings Pty Ltd: Company Snapshot

- Table 52 : HB11 Energy Holdings Pty Ltd: Recent Developments

- Table 53 : Helion Energy Inc.: Company Snapshot

- Table 54 : Helion Energy Inc.: Recent Developments

- Table 55 : Marvel Fusion GmbH: Company Snapshot

- Table 56 : Marvel Fusion GmbH: Recent Developments

- Table 57 : MIFTI: Company Snapshot

- Table 58 : Princeton Fusion Systems Inc.: Company Snapshot

- Table 59 : Princeton Fusion Systems Inc.: Recent Developments

- Table 60 : TAE Technologies Inc.: Company Snapshot

- Table 61 : TAE Technologies Inc.: Recent Developments

- Table 62 : Tokamak Energy Ltd: Company Snapshot

- Table 63 : Tokamak Energy Ltd: Recent Developments

- Table 64 : Zap Energy Inc.: Company Snapshot

- Table 65 : Zap Energy Inc.: Recent Developments

- Table 66 : Acronyms Used in This Report

List of Figures

- Summary Figure : Global Market Shares of Nuclear Fusion Technologies, by Region, 2035

- Figure 1 : Comparison between Prescriptive and Goal-Setting Approaches

- Figure 2 : Nuclear Fusion Industry Market Value Chain

- Figure 3 : Global Patent Applications on Nuclear Fusion Technologies, 2016-2022

- Figure 4 : Global Shares of Patent Applications on Nuclear Fusion Technologies, by Region, 2021

- Figure 5 : Key Drivers Fueling the Growth of the Market for Nuclear Fusion Technologies

- Figure 6 : Funds Raised, by Nuclear Fusion Companies, Till 2022

- Figure 7 : Shares of Funds Raised, by Nuclear Fusion Companies, Through 2022

- Figure 8 : Roadmap and Expected Timeline for ITER Project

- Figure 9 : Number of New Nuclear Fusion Start-ups, 2017-2022

- Figure 10 : Global Total Primary Energy Consumption Projections, 2020-2050

- Figure 11 : Global Projections of Shares of Primary Energy Consumption, by Energy Source, 2050

- Figure 12 : Oil Supply in the Net Zero Pathway, 2020 & 2050

- Figure 13 : Key Opportunities the Market for Nuclear Fusion Technologies

- Figure 14 : Oil & Gas Company Investments in Nuclear Fusion Power

- Figure 15 : Major Challenges Faced by Nuclear Fusion Power Plant Facilities

- Figure 16 : Shares of the Cost for Magnetic Confinement Fusion Reactors

- Figure 17 : Regulatory Hazards of Particular Concern for Commercial Fusion Facilities

- Figure 18 : Global Market Shares of Nuclear Fusion Technologies, by Type, 2035

- Figure 19 : Global Market Shares of Nuclear Fusion Technologies, by Type, 2040

- Figure 20 : Global Market Shares of Nuclear Fusion Technologies, by Application, 2035

- Figure 21 : Global Market Shares of Nuclear Fusion Technologies, by Application, 2040

- Figure 22 : Global Projections of Electricity Consumption, by Energy Source, 2025-2050

- Figure 23 : Global Market Shares of Electricity Generation by Nuclear Fusion, by Region, 2035

- Figure 24 : Global Market Shares of Electricity Generation by Nuclear Fusion, by Region, 2040

- Figure 25 : Global Market Shares of Nuclear Fusion Space Propulsion Systems, by Region, 2035

- Figure 26 : Global Market Shares of Nuclear Fusion Space Propulsion Systems, by Region, 2040

- Figure 27 : Global Market Shares of Other Applications of Nuclear Fusion Technologies, by Region, 2035

- Figure 28 : Global Market Shares of Other Applications of Nuclear Fusion Technologies, by Region, 2040

- Figure 29 : Global Market Shares of Nuclear Fusion Companies, by Region, 2022

- Figure 30 : Global Market Shares of Nuclear Fusion Technologies, by Region, 2035

- Figure 31 : Global Market Shares of Nuclear Fusion Technologies, by Region, 2040

- Figure 32 : U.S. Market Shares of Electricity Generation, by Energy Source, 2022 and 2050

- Figure 33 : Canadian Market Shares of Electricity Generation, by Energy Source, 2022 and 2050

- Figure 34 : Mexican Market Shares of Electricy Generation, by Energy Source, 2021

- Figure 35 : North American Market Shares of Nuclear Fusion Technologies, by Application, 2035

- Figure 36 : North American Market Shares of Nuclear Fusion Technologies, by Application, 2040

- Figure 37 : North American Market Shares of Nuclear Fusion Technologies, by Country, 2035

- Figure 38 : North American Market Shares of Nuclear Fusion Technologies, by Country, 2040

- Figure 39 : European Market Shares of Nuclear Fusion Projects by Public (Government and Institutions) and Private Organizations, 2022

- Figure 40 : German Market Shares of Electricy Generation, by Energy Source, 2021

- Figure 41 : U.K. Market Shares of Electricy Generation, by Energy Source, 2021

- Figure 42 : French Market Shares of Electricy Generation, by Energy Source, 2021

- Figure 43 : Italian Market Shares of Electricy Generation, by Energy Source, 2021

- Figure 44 : Spanish Market Shares of Electricy Generation, by Energy Source, 2021

- Figure 45 : European Market Shares of Nuclear Fusion Technologies, by Application, 2035

- Figure 46 : European Market Shares of Nuclear Fusion Technologies, by Application, 2040

- Figure 47 : European Market Shares of Nuclear Fusion Technologies, by Country, 2035

- Figure 48 : European Market Shares of Nuclear Fusion Technologies, by Country, 2040

- Figure 49 : APAC Market Shares of Nuclear Fusion Projects, by Public (Government and Institutions) and Private Organizations, 2022

- Figure 50 : Chinese Market Shares of Electricy Generation, by Energy Source, 2022 and 2050

- Figure 51 : Japanese Market Shares of Electricy Generation, by Energy Source, 2022 and 2050

- Figure 52 : Indian Market Shares of Electricy Generation, by Energy Source, 2022 and 2050

- Figure 53 : Thai Market Shares of Electricy Generation, by Energy Source, 2022 and 2050

- Figure 54 : APAC Market Shares of Nuclear Fusion Technologies, by Application, 2035

- Figure 55 : APAC Market Shares of Nuclear Fusion Technologies, by Application, 2040

- Figure 56 : APAC Market Shares of Nuclear Fusion Technologies, by Country, 2035

- Figure 57 : APAC Market Shares of Nuclear Fusion Technologies, by Country, 2040

- Figure 58 : RoW Market Shares of Nuclear Fusion Projects, by Public (Government and Institutions) and Private Organizations, 2022

- Figure 59 : RoW Market Shares of Nuclear Fusion Technologies, by Application, 2035

- Figure 60 : RoW Market Shares of Nuclear Fusion Technologies, by Application, 2040

- Figure 61 : Shares of Strategic Approaches Adopted, by Nuclear Fusion Companies, 2021-2023*

- Figure 62 : Shares of Nuclear Fusion Companies, by Technology, 2022

- Figure 63 : Shares of Nuclear Fusion Companies, by Fuel Type, 2022

- Figure 64 : Nuclear Fusion Companies Funding Range, 2021 and 2022

- Figure 65 : Shares of Capacity Factor for U.S., by Energy Source, 2021

- Figure 66 : Average External Costs of Selected Energy Sources

- Figure 67 : Average Capital Investment Required, by Energy Sources

- Figure 68 : Average LCOE, by Energy Sources

- Figure 69 : Time by Proof-of-Concept to Early Commercialization for Energy Technologies

Highlights:

The global market for nuclear fusion technologies is expected to increase from $1.7 billion in 2035 to $6.8 billion by the end of 2040, with a compound annual growth rate (CAGR) of 31.6% during the forecast period of 2035-2040.

The North American market for nuclear fusion technologies is expected to increase from $1.2 billion in 2035 to $4.4 billion by the end of 2040, with a CAGR of 29.4% during the forecast period of 2035-2040.

The Asia-Pacific market for nuclear fusion technologies is projected to increase from $182.3 million in 2035 to $1.0 billion by the end of 2040, with a CAGR of 41.4% during the forecast period of 2035-2040.

Report Scope:

The report provides an overview of the nuclear fusion market and analyzes market trends. The nuclear fusion market is through in the stages of R&D, and from the fusion company's information it is expected to be commercialized between 2032 to 2038. Hence, 2035 is considered as the base year, and the report provides market data for the forecast period 2036 through 2040 by estimating values derived from manufacturers. Revenue forecasts for this period are segmented based on technology, application, and geography.

The report also includes a section on the major players in the market. Further, it explains the major drivers, competitive landscape, and current trends of the nuclear fusion market. The report concludes with a focus on the nuclear fusion vendor landscape and includes profiles of the major players operating in the global market.

Report Includes:

- 14 data tables and 53 additional tables

- An overview of global market outlook for nuclear fusion and advanced materials

- Analyses of global market trends, with data from 2035-2040, and projections of compound annual growth rates (CAGRs) through 2040

- An identification of market trends, issues and forecasts impacting the global market and a breakdown of the market based on type, technology, and region

- An outline of the recent technological advances in certain advanced materials and their use in the commercialization of nuclear fusion power over the next few decades

- Coverage of nuclear fusion regulations across several countries, government funded projects, start-ups in nuclear fusion, and alternative energy investments opportunities in the oil & gas industry

- A discussion of the key advanced materials, the technologies related to fusion power, and their current and future potential

- Company profiles of major players within the industry, including Commonwealth Fusion Systems, First Light Fusion Ltd, General Fusion Inc., HB11 Energy Holdings Pty Ltd, and Marvel Fusion GmbH

Table of Contents

Chapter 1 Introduction

- Overview

- Study Goals and Objectives

- Reasons for Doing This Study

- Scope of Report

- What's New in this Update?

- Methodology

- Information Sources

- Geographic Breakdown

Chapter 2 Summary and Highlights

- Market Outlook

Chapter 3 Market and Technology Overview

- Nuclear Fusion History

- Nuclear Fusion Regulations by Country

- U.S.

- U.K.

- France

- Germany

- Russia

- China

- South Korea

- Analysis of the Abovementioned Regulations

- Value Chain Analysis of the Nuclear Fusion Industry

- Research & Development

- Component and Fuel Suppliers

- System Integrators/Nuclear Fusion Companies

- Potential Industry Applications

- Patent Analysis

Chapter 4 Market Dynamics

- Market Drivers

- Increased Funding by Top Venture Capitalist and Other Private Investors

- Increase in Government Funded Projects

- Growing Number of Start-ups in Nuclear Fusion

- Growing Need for Additional Amount of Energy and Zero Carbon Energy

- Market Opportunities

- Alternative Energy Investments Opportunities in the Oil & Gas Industry

- Growth Potential for Space Industry

- Integration of Artificial intelligence (AI) and Machine Learning (ML) Technologies for Nuclear Fusion

- Market Challenges

- High Capital Costs for Constructing and Commissioning of Nuclear Fusion Facilities

- Issues Faced by Plasma Heating, Confinement, and Stability

- Low Availability of Tritium

- Regulation and Licensing of Commercial Fusion Energy Facilities

Chapter 5 Market Breakdown by Technology

- Overview

- Magnetic Confinement Fusion

- Inertial Confinement Fusion

- Magneto Inertial Fusion

Chapter 6 Market Breakdown by Application

- Overview

- Electricity Generation

- Space Propulsion

- Others (Marine Propulsion, Medical, Off-Grid Energy, Hydrogen and/or Clean Fuels, Industrial Heating)

Chapter 7 Market Breakdown by Region

- Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- APAC

- China

- Japan

- India

- Thailand

- Rest of APAC

- Rest of the World

Chapter 8 Competitive Landscape

- Strategic Analysis

- Recent Key Developments

- Competitive Analysis

- Analysis on Alternative Power Generation Technologies

- Time by Proof-of-Concept to Early Commercialization for Energy Technologies

- Is Small Modular Reactor (SMR) a Threat for Nuclear Fusion?

Chapter 9 Company Profiles

- AVALANCHE ENERGY DESIGNS LLC

- COMMONWEALTH FUSION SYSTEMS (CFS)

- CTFUSION

- EX-FUSION INC.

- FOCUSED ENERGY

- FIRST LIGHT FUSION LTD

- GENERAL FUSION INC.

- HB11 ENERGY HOLDINGS PTY LTD

- HELION ENERGYINC.

- MARVEL FUSION GMBH

- MAGNETO-INERTIAL FUSION TECHNOLOGIES INC. (MIFTI)

- PRINCETON FUSION SYSTEMS INC.

- TAE TECHNOLOGIES INC.

- TOKAMAK ENERGY LTD.

- ZAP ENERGY INC.