|

|

市場調査レポート

商品コード

1706271

核融合発電およびその他のプラズマ工学の材料およびハードウェアの機会:2025-2045年の市場Nuclear Fusion Power and Other Plasma Engineering Materials and Hardware Opportunities: Markets 2025-2045 |

||||||

|

|||||||

| 核融合発電およびその他のプラズマ工学の材料およびハードウェアの機会:2025-2045年の市場 |

|

出版日: 2025年04月16日

発行: Zhar Research

ページ情報: 英文 218 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

「核融合の体操選手」としてのホウ素:

ホウ素は、医療から航空宇宙まで、核融合以外にも幅広く応用されており、開発コストのリスクは軽減されるでしょう。例えば、高温超電導体、高出力レーザー、タングステン、銅、ケイ素 (シリコン)、リチウム、鉄、炭素同位体などが挙げられ、これらは合金、化合物、ナノテクノロジーを用いた形態など、多様な形で使われています。なぜホウ素ベースの材料は「核融合の体操選手」と呼ばれるのでしょうか?それは、核融合装置において非常に多くの重要な用途の基盤となっているからです。また、レアアース (希土類元素) や有機ポリマー、その他多くの材料も同様に注目されています。

投資の洪水、未来を見据えて:

現在、核融合開発企業は、急速に増加する巨額の資金を高付加価値の材料や構造物に投じようとしています。核融合発電や関連する新興用途の成功がさらに進めば、プラズマ技術、レーザー、極低温 (クライオジェニック) などの技術が巨大なハードウェア市場を切り開くことになります。本レポートでは、有望な応用分野、潜在的なパートナー、競合企業が明らかにされており、2025年から2045年にかけてのロードマップと市場予測も含まれています。

目次

第1章 エグゼクティブサマリー・総論

- 本レポートの目的

- 分析手法

- 一般的な結論 (7項目)

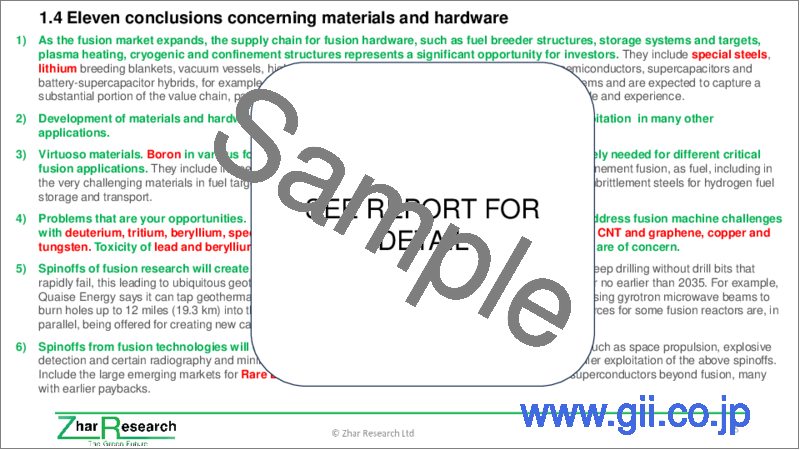

- 材料およびハードウェアに関する結論 (11項目)

- 2025年の研究・開発者の優先事項に基づく、主要23種の材料およびハードウェアの機会

- プラズマ関連材料およびハードウェアの機会

- 核融合バリューチェーンにおける膜材料と関連機器の高度化レベル別の整理

- 民間の核融合企業への投資動向に関する3つの結論

- グリッド電力としての核融合の可能性に対するSWOT分析

- 磁場閉じ込め核融合をグリッド電源として見た場合のSWOT分析

- 慣性閉じ込め核融合をグリッド電源として見た場合のSWOT分析

- 核融合および関連システムにおける材料・ハードウェアの技術と市場のロードマップ

- 22項目にわたる市場予測とグラフ (2025~2045年)

第2章 再生可能エネルギー、再構築された水素経済、他産業における核融合発電とその他のプラズマ工学

- 概要

- 水素経済:誤ったスタート、再構築、水素融合への期待

- 民間の核融合企業と政府:水素融合発電へ競って参入

- 核融合発電への大規模な政府投資

- 水素同位体の主な用途

- 通常の水素 (プロチウム) と他の燃料、重水素・三重水素との性質比較

- 水素:電化のパートナーであり、代替手段でもある

- 実際の核分裂発電システムと、計画中の核融合発電システムの比較

- 核融合によるグリッド電力供給の最速実現予測時期

- 重水素を用いたその他の融合およびプラズマ工学の用途

第3章 核融合の基礎と高付加価値材料の機会の具体例

- 概要

- 候補となる燃料、反応方式、炉の運転原理と設計

- 核融合発電における主要なマイルストーン、装置の小型化が進む理由、代表的な企業例

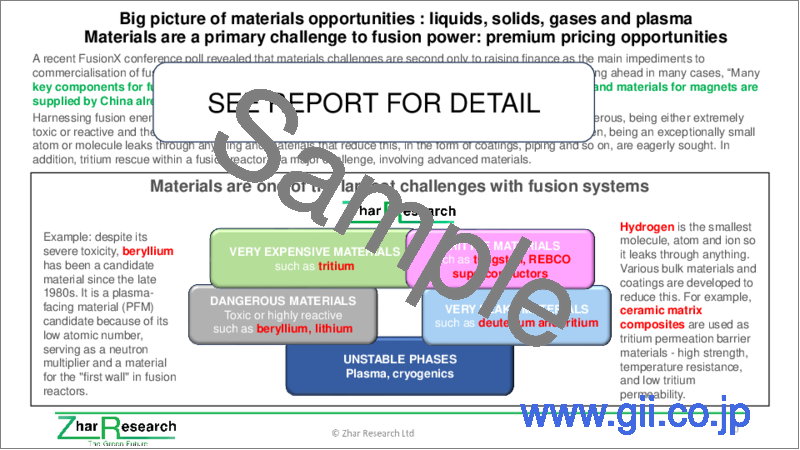

- 材料の機会の全体像:液体・固体・気体・プラズマ

- 核融合炉施設向けの鋼鉄およびその他の鉄系合金の配合と構造設計

- 水素タンク用の材料および化学的水素貯蔵材料

- 核融合バリューチェーンにおける膜材料と、関連機器の高度化レベル別の整理

第4章 磁場閉じ込め核融合発電:材料とハードウェアの機会

- 概要

- グリッド電源としての磁場閉じ込め核融合:SWOT分析

- 核融合発電のための磁場閉じ込め方式の形状設計

- プラズマ隣接する材料の機会

- 磁石技術の進展

- ヒートシンク/熱伝達・冷却材の技術革新

- 2025年時点のダイバータ材料研究と新しいITER設置機器

- プラズマ加熱システムおよびロボティクスの進展

- 核融合用電源システムと発電システム

- tokamakやZ-Pinchハードウェアの機会の例:JET、ITERなど

- 2025年のトロイダル型および関連する核融合発電ハードウェアの研究

- インサイドアウト型磁場閉じ込め

第5章 慣性閉じ込めと磁気慣性核融合発電:材料とハードウェアの可能性

- 概要

- グリッド電源としての慣性閉じ込め核融合:SWOT分析

- レーザー型慣性閉じ込め核融合のレーザー設計

- 融合ターゲットの機会 (燃料ペレットなど)

- Lawrence Livermore National Laboratories (LLNL) のNational Ignition Facility (NIF)

- 中国が先行している? (国際的な競争の状況)

- その他の慣性閉じ込め核融合 (ICF) および 磁気慣性閉じ込め核融合 (MIF) の開発者たち

第6章 変化する投資の焦点、注目すべき企業・ハードウェア・材料

- 関心と投資の急増:どの技術がなぜ?

- 民間企業へへの投資

- 投資家の意向と取引:技術別

- 世界の取り組み

- 水素核融合発電装置の製造を競う民間核融合企業の分析

- 国別の有力核融合企業:各種のパフォーマンス基準と資金調達状況による評価

- 政府投資と民間投資における核融合発電の立地と技術の優位性

- 投資を誘致する重要な鍵となる材料とハードウェア

- 高付加価値材料が頻繁に言及されている例:人気と核融合での具体的な用途の紹介

第7章 核融合発電を超えた核融合技術における材料の可能性

- 概要

- 融合推進宇宙船のために提案された基本原理

- 静電慣性閉じ込め核融合の進展と2025年のターゲット用途

- 核融合およびその先を見据えた中性子源の研究

- ジャイロトロン技術のスピンオフ応用 (核融合以外の活用) :地熱掘削など

- 高温超伝導体 (HTS) の核融合以外での利用可能性

Summary

Good news. The quest for fusion power is opening up many opportunities for your high added value materials and hardware. Thoroughly analysing your opportunities is the new commercially-oriented 218-page Zhar Research report, "Nuclear Fusion and Other Plasma Engineering Materials and Hardware Opportunities: Markets 2025-2045". Whether your skills lie in metallurgy, composites or chemistry based on the many elements it examines, this report details your road ahead.

Boron the gymnast

Learn how your development costs are derisked by these materials having many other applications beyond fusion power from medical to aerospace. Examples include high temperature superconductors, high power lasers, tungsten, copper, silicon, lithium, iron, carbon isotopes, many in forms varying from alloys to compounds and nano technology. Why is boron-based material the gymnast of fusion, being the basis of so many vital uses in fusion machines? See how rare earths, organic polymers and many other materials are also in the frame.

Flood of investment, see the future

Fusion developers now have massive, rapidly-rising funding to spend on your essential added value materials and structures. Further success in fusion power or allied emerging applications means that these plasma, laser, cryogenic and other technologies will open up huge hardware markets. Winning applications, potential partners and competitors are identified with 2025-2045 roadmaps and forecasts.

Comprehensive report

The 35 page "Executive summary and conclusions" is sufficient in itself with 21 key conclusions, 3 SWOT appraisals, 2025-2045 roadmaps both for technology and for markets and 22 forecast lines as graphs and tables. New infograms make it all easy to absorb in a short time. 23 key materials and hardware opportunities from 2025 research and company initiatives are prioritised.

Pivoting to a hydrogen economy reinvented

Then comes context and options in Chapter 2. "Fusion power and other plasma engineering in the context of renewable energy, the hydrogen economy reinvented and other industry" (30 pages). Learn the significance of the hydrogen isotopes. Understand why the original idea of a hydrogen economy based on fuel for your car and house is doomed. We are pivoting to a reinvented hydrogen economy mostly based on fusion grid power, making basic chemicals and aerospace and ship propulsion because they have far greater chance of success, though nothing is guaranteed.

Derisk your investment

Then come four chapters detailing your opportunities in fusion and allied plasma engineering, with particular emphasis on 2025 research and breakthroughs. The report ends with a chapter on the other emerging markets needing the same or similar materials, often well before any possible success with fusion for electricity generation. This derisks your investment.

Size reduction and other priorities

Chapter 3. "Basics of fusion and examples of its high-value materials opportunities" (39 pages) presents the detail including candidate fuels, reactions, reactor operating principles and designs, with much 2025 research, most notably deuterium, tritium, alpha particle and neutron-related. See candidate operating principles and designs of fusion power reactors and understand the changing views on winning technologies and changing relative achievements, plans and the most important milestones ahead. Why is size reduction now a strong focus even if the materials achieving this are expensive? Here is the big picture of materials opportunities, encompassing liquids, solids, gases and plasma.

Materials surviving a perfect storm

See how fusion subsystems present many added burdens for materials, withstanding chemical, heat, radiation, hydrogen embrittlement and plasma damage. Here is appraisal of the research in 2025 that leads you to candidate materials solving identified future needs. Examples explained include many different steels and membranes, mostly using advanced polymers.

Better materials urgently needed

Chapter 4. "Magnetic confinement fusion power: materials and hardware opportunities" (50 pages) concerns the fusion power option receiving the most public and private investment. Materials focus here particularly includes complex multi-wall structures for tokamaks and stellarators and identified derivatives. These formulations variously withstand or magnetically contain plasma, breed fuel, multiply neutrons, remove heat, block radiation. Can you rescue this industry from its lethally toxic and dangerously chemically-reactive materials? Metals, alloys, composites, compounds or what? High added value also comes from wall-conditioning, multipurpose blanket materials. Massive power supplies, "divertors" and other giant subsystems are needed. Why are- stellarators - gaining more attention and what are their materials? Inside-out magnetic confinement, levitated dipole, reverse triangulation and other approaches and needs? It is all here.

The 25 close-packed pages of Chapter 5. "Inertial confinement and magneto-inertial fusion power: materials and hardware opportunities" concerns the second most important fusion power option in investment and number of participants. It is the only one that has demonstrated "ignition" so far. See why it is now getting more attention as smaller, higher-power lasers, analysed here, arrive and China builds a massive facility 50% bigger than the American one. On the other hand, hybrid magneto-inertial options promise direct production of electricity but it is wrong to think of this as no-neutrons/ no-radioactivity. Which problems are your materials opportunities in magnetic confinement fusion? Colliding plasmas or projectiles instead of lasers?

Changing investment focus

Chapter 6. "Changing Investment focus, companies, hardware and materials to watch" (10 pages) explains the sudden surge in interest and investment: which technology and why. Detail is presented on investment in private companies, investor intentions and deals by technology. See how this is now a global effort. Here is analysis of private fusion companies racing to make hydrogen fusion electricity generators, winning fusion power companies by country, various performance criteria and funding. What are the winning fusion power locations and technologies for government vs private investments? What are significant key enabling materials and hardware attracting investment from analysis of 214 recent advances?

Profusion of opportunities

Those seeking investment may whisper it quietly but there is a possibility of fusion power not being commercialised in the 2025-2045 timeframe. Contrast allied technologies such as high temperature superconductors in medical scanners that are already commercialised with many more applications soon. The report therefore closes with Chapter 7. "Materials opportunities in fusion technologies beyond fusion power generation" (14 pages). Learn how spacecraft will not just drift after lift-off but use fusion power continuously and which options are emerging for this. Electrostatic inertial confinement fusion is not promising for generating electricity but see other advances and targetted uses for it from 2025. See plasma neutron sources for beyond fusion, with 2025 research. Gyrotron technology, not mainstream for power, can spin off beyond fusion for geothermal drilling and other uses. See detail on this high-profile new development and also the remarkable scope for high temperature superconductors beyond fusion.

Latest information and views

Fusion is now a fast-moving subject, so old information is useless. Most of the report, "Nuclear Fusion Power and Other Plasma Engineering Materials and Hardware Opportunities: Markets 2025-2045" interprets advances in 2025 and it is constantly updated so you only get the latest. It is your essential reading for your materials and hardware opportunities with realistic appraisal of timescales.

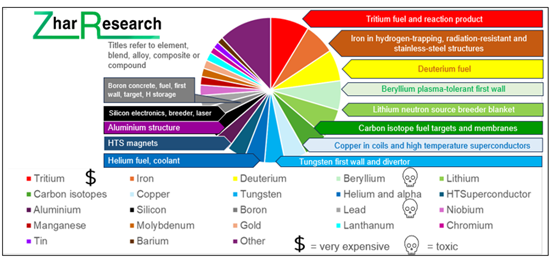

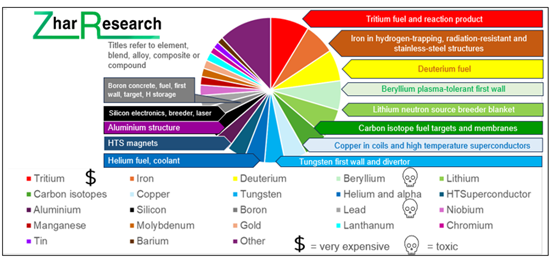

CAPTION: Simplified version of image in the report, "Nuclear Fusion Power and Other Plasma Engineering Materials and Hardware Opportunities: Markets 2025-2045", giving priority by number of primary mentions of high added-value materials and uses in the large amount of research and other activity analysed, with examples of applications.

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Seven general conclusions

- 1.4. Eleven conclusions concerning materials and hardware

- 1.5. 23 key materials and hardware opportunities from 2025 research and developers prioritised

- 1.6. Materials and hardware opportunities adjacent to the plasma

- 1.7. Membrane materials in the fusion value chain and related devices by level of sophistication

- 1.8. Three conclusions: Investment trends in private fusion companies

- 1.9. SWOT appraisal of the potential of fusion grid power

- 1.10. SWOT appraisal of magnetic confinement fusion as a potential source grid electricity

- 1.11. SWOT appraisal of inertial confinement fusion as a potential source grid electricity

- 1.12. Fusion and allied systems, materials and hardware roadmap for technology vs market 2025-2045

- 1.13. Market forecasts in 22 lines, graphs 2025-2045

- 1.13.1. Specialist materials and assemblies for fusion power including experiments: market inorganic vs organic $ billion 2025-2045

- 1.13.2. Hydrogen hardware market: fusion reactors + 7 lines $ billion 2025-2045, table, graphs

- 1.13.3. Number of companies seeking to make fusion reactors 2025-2045

- 1.13.4. Fusion machine energy output trend with and without ignition

- 1.13.5. Hydrogen market million tonnes 2025-2045 in seven lines, table, graphs

2. Fusion power and other plasma engineering in the context of renewable energy, the hydrogen economy reinvented and other industry

- 2.1. Overview

- 2.2. Hydrogen economy: a false start, reinvention and the promise of hydrogen fusion

- 2.2.1. The big picture

- 2.2.2. Lessons of history and new objectives for 2025-2045

- 2.2.3. Materials for the hydrogen economy reinvented

- 2.2.4. Supporting information

- 2.3. Private fusion companies and governments race into hydrogen fusion power

- 2.4. Major government investment in fusion power

- 2.5. Hydrogen isotopes and their primary uses actual and targetted

- 2.6. Comparison of properties of regular hydrogen (protium) with other fuels and with the deuterium and tritium forms of hydrogen

- 2.7. Hydrogen is both partner and alternative to electrification

- 2.8. Comparison of actual fission and planned fusion power systems

- 2.9. Earliest dates for fusion grid electricity being delivered

- 2.10. Other fusion and plasma engineering and other uses for deuterium

3. Basics of fusion and examples of its high-value materials opportunities

- 3.1. Overview

- 3.2. Candidate fuels, reactions, reactor operating principles and designs

- 3.2.1. Candidate fusion fuels and reactions with 2025 research

- 3.2.2. Deuterium-related fusion research advances in 2025

- 3.2.3. Tritium-related fusion research advances in 2025

- 3.2.4. Alpha particle-related fusion research advances in 2025

- 3.2.5. Neutron-related fusion research advances in 2025

- 3.2.6. Candidate operating principles and designs of fusion power reactors

- 3.2.7. Changing views on winning technologies and changing relative achievements and plans

- 3.3. Milestones, reasons for size reduction and examples of companies for fusion power

- 3.4. Big picture of materials opportunities : liquids, solids, gases and plasma

- 3.4.1. Materials are a primary challenge to fusion power: premium pricing opportunities

- 3.4.2. Fusion subsystems present many added burdens for materials

- 3.4.3. Radiation and plasma damage of the materials: research in 2025 and future needs

- 3.4.4. Some candidate materials reflecting various of these needs

- 3.5. Steel and other iron-based alloy formulations and structures for fusion reactor facilities

- 3.5.1. Steels for general fusion facility structures, radiative environments with 2025 research

- 3.5.2. Resisting hydrogen embrittlement

- 3.5.3. Welding and other structural optimisation with 2025 research

- 3.6. Hydrogen tank materials and chemical hydrogen storage materials

- 3.6.1. Hydrogen tank materials

- 3.6.2. Hydrogen leakage causing global warming: research in 2025

- 3.7. Membrane materials in the fusion value chain and related devices by level of sophistication

4. Magnetic confinement fusion power: materials and hardware opportunities

- 4.1. Overview

- 4.2. SWOT appraisal of magnetic confinement fusion as a potential source grid electricity

- 4.3. Magnetic confinement geometries for fusion power

- 4.4. Materials opportunities adjacent to the plasma

- 4.4.1. Multilayer wall and proximate structures

- 4.4.2. Wall conditioning materials advances through 2025

- 4.4.3. Multifunctional blanket materials research in 2025

- 4.5. Magnet advances

- 4.6. Heat sink/ heat transfer, coolant materials advances

- 4.7. Divertor materials research in 2025 and the new ITER installation

- 4.8. Plasma heating systems and robotics

- 4.9. Fusion power supplies and electricity generation systems

- 4.9.1. Power generation from fusion reactors

- 4.9.2. Power supply to fusion reactors

- 4.10. Examples of tokamak and Z-Pinch hardware opportunities: JET, ITER and others

- 4.11. Research in 2025 on toroidal and allied fusion power hardware

- 4.11.1. General

- 4.11.2. Stellarators and their materials research in 2025

- 4.12. Inside-out magnetic confinement:

- 4.12.1. OpenStar levitated dipole fusion reactor

- 4.12.2. Reverse triangulation

5. Inertial confinement and magneto-inertial fusion power: materials and hardware opportunities

- 5.1. Overview

- 5.2. SWOT appraisal of inertial confinement fusion as a potential source grid electricity

- 5.3. Laser-based inertial confinement fusion (LICF) laser designs

- 5.3.1. Neodymium glass lasers

- 5.3.2. Ultraviolet lasers

- 5.3.3. Quantum cascade lasers

- 5.4. Fusion target opportunities

- 5.4.1. HUB project targets

- 5.4.2. NIF project targets

- 5.4.3. Fundamentals of target operation

- 5.5. Lawrence Livermore National Laboratories LLNL National Ignition Facility NIF

- 5.6. China pulling ahead?

- 5.7. Other inertial and magneto-inertial confinement developers

- 5.7.1. General picture

- 5.7.2. Helion and its key materials and devices

- 5.7.3. Electrostatic inertial confinement fusion advances in 2025

6. Changing Investment focus, companies, hardware and materials to watch

- 6.1. Sudden surge in interest and investment: which technology and why

- 6.2. Investment in private companies

- 6.3. Investor intentions and deals by technology

- 6.4. Global effort

- 6.5. Analysis of private fusion companies racing to make hydrogen fusion electricity generators

- 6.6. Winning fusion power companies by country, various performance criteria, funding

- 6.6. Winning fusion power locations and technologies for government vs private investments

- 6.7. Significant key enabling materials and hardware attracting investment

- 6.8. Primary mentions of high added-value materials indicating popularity with examples of fusion uses

7. Materials opportunities in fusion technologies beyond fusion power generation

- 7.1. Overview

- 7.2. Principles proposed for fusion-propelled spacecraft

- 7.3. Electrostatic inertial confinement fusion advances, targeted uses in 2025

- 7.4. Neutron sources for fusion and beyond: 2025 research

- 7.5. Gyrotron technology spinoff beyond fusion: geothermal drilling, other

- 7.5.1. Principle of operation

- 7.5.2. Geothermal drilling, material processing, other

- 7.5.3. Recent research

- 7.5.4. Gyrotron materials and designs

- 7.6. High temperature superconductors beyond fusion