|

市場調査レポート

商品コード

1641737

建設用潤滑剤の世界市場:ベースオイル別、タイプ別、用途別 - 機会分析と産業予測(2024年~2033年)Construction Lubricants Market By Base Oil , By Type By Application : Global Opportunity Analysis and Industry Forecast, 2024-2033 |

||||||

|

|||||||

| 建設用潤滑剤の世界市場:ベースオイル別、タイプ別、用途別 - 機会分析と産業予測(2024年~2033年) |

|

出版日: 2024年11月01日

発行: Allied Market Research

ページ情報: 英文 480 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

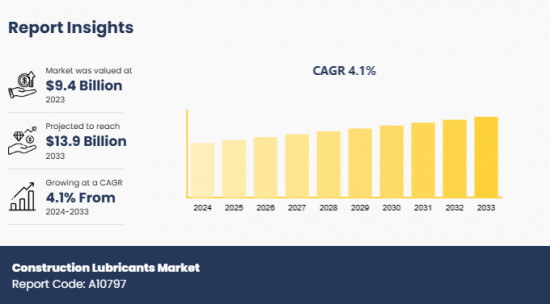

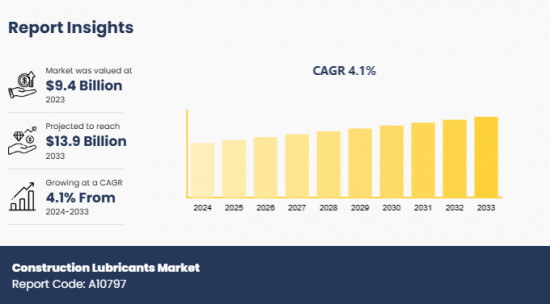

世界の建設用潤滑剤の市場規模は、2023年に94億米ドルと評価され、2024年~2033年にCAGR4.1%で成長し、2033年には139億米ドルに達すると予測されています。

建設用潤滑剤は、建設工程で使用される機械や設備の摩擦、摩耗、発熱を低減するために設計された特殊な物質です。これらの潤滑剤は、ベアリング、ギア、油圧システム、その他の機械部品を含む様々な部品の円滑な動作を保証し、それによって建設機械の効率と寿命を向上させます。潤滑剤には、オイル、グリース、特殊製品などさまざまな形態があり、それぞれが建設業界で一般的に遭遇する特定の操作上の要求や環境条件を満たすように調合されています。

世界の建設用潤滑剤市場の成長は、特に新興経済圏における建設産業の拡大と、円滑な操業を確保するための建設機械・設備に対する需要の急増が主な要因となっています。最近の調査によると、総工事費の30%は人件費に起因しており、そのため建設会社は設備のアップグレードが必要となっています。このことが、特殊潤滑剤の需要を大幅に押し上げています。建設機械の複雑化と大型化は、高圧、高温、高荷重といった過酷な条件下でも作動する潤滑剤の需要を煽り、市場の需要をさらに押し上げています。さらに、先進地域と発展途上地域の両方で急速な都市化とインフラ整備が進み、建設活動の必要性が高まっているため、建設分野における潤滑剤の需要が高まっています。さらに、AIや機械学習技術の統合を含む建設機械の自動化動向の高まりは、スマート機械において最適な機器機能を維持できる特殊潤滑剤への依存度を高め、それによって市場の成長を増強しています。しかし、高性能潤滑剤、特に特定の建設機械や環境に優しい製品向けに設計された潤滑剤に関連する高コストは、市場の成長を著しく妨げています。さらに、合成油や油圧作動油などの代替製品が入手可能であることも、世界市場の主要な抑制要因となっています。逆に、建設機械がより高度化・複雑化するにつれて、電気機械や自律型機械などの新技術の性能要求を満たすことができる特殊潤滑剤のニーズは高まり続けており、予測期間中に世界市場の拡大に有益な機会を提供すると期待されています。

世界の建設用潤滑剤市場は、ベースオイル、タイプ、用途、地域によって区分されます。ベースオイル別では、市場は鉱物油、合成油、バイオベースオイルに分類されます。タイプ別では、油圧作動油、エンジンオイル、ギアオイル、トランスミッション液、グリース、その他に分類されます。用途別では、重機・土木機械、クレーン、道路建設機械、コンクリート・セメント機械、掘削機械、その他に分類されます。地域別では、北米、欧州、アジア太平洋、ラテンアメリカ・中東・アフリカなどの地域で調査されています。

主な調査結果

ベースオイル別では、2024年~2033年に合成油セグメントが市場を独占すると予測されます。

タイプ別では、油圧作動油セグメントが予測期間中トップの座を維持すると予測されます。

用途別では、重機・土木機械セグメントが予測期間中に最も高い成長を示すと予測されます。

地域別では、アジア太平洋が予測期間を通じて建設用潤滑剤の最も有利な市場として浮上する可能性が高いです。

本レポートで可能なレポートカスタマイズ(追加費用とタイムラインに関しましては販売担当へご連絡ください)

- 製造能力

- 設備投資の内訳

- エンドユーザーの嗜好とペインポイント

- 産業ライフサイクル評価:地域別

- インストールベース分析

- 投資機会

- 製品ベンチマーク/製品仕様と用途

- 製品ライフサイクル

- シナリオ分析と成長動向比較

- サプライチェーン分析とベンダーのマージン

- 地域別の新規参入企業

- ディストリビューターのマージン分析

- 市場参入戦略

- 製品/セグメント別の市場セグメンテーション

- 主な企業の新製品開発/製品マトリックス

- ペインポイント分析

- 規制ガイドライン

- 戦略的提言

- 顧客の関心に特化した追加企業プロファイル

- 国別または地域別の追加分析:市場規模と予測

- 平均販売価格分析/価格帯分析

- ブランドシェア分析

- クリスクロスセグメント分析:市場規模と予測

- 企業プロファイルの拡張リスト

- 過去の市場データ

- 輸出入分析/データ

- 主要企業の詳細(所在地、連絡先詳細、サプライヤー/ベンダーネットワークなどを含む、エクセル形式)

- 顧客/消費者/原料サプライヤーのリスト:バリューチェーン分析

- 世界/地域/国別レベルでの企業の市場シェア分析

- 製品消費分析

- 償還シナリオ

- SWOT分析

- 数量市場規模と予測

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 市場情勢

- 市場の定義と範囲

- 主な調査結果

- 主な投資機会

- 主要成功戦略

- ポーターのファイブフォース分析

- 市場力学

- 促進要因

- 抑制要因

- 機会

第4章 建設用潤滑剤市場:ベースオイル別

- 市場概要

- 鉱物油

- 合成油

- バイオベース油

第5章 建設用潤滑剤市場:タイプ別

- 市場概要

- 油圧作動油

- エンジンオイル

- ギアオイル

- トランスミッション液

- グリース

- その他

第6章 建設用潤滑剤市場:用途別

- 市場概要

- 重機・土木機械

- クレーン

- 道路建設機械

- コンクリート・セメント機械

- 掘削機械

- その他

第7章 建設用潤滑剤市場:地域別

- 市場概要

- 北米

- 主な市場動向と機会

- 米国の建設用潤滑剤市場

- カナダの建設用潤滑剤市場

- メキシコの建設用潤滑剤市場

- 欧州

- 主な市場動向と機会

- フランスの建設用潤滑剤市場

- ドイツの建設用潤滑剤市場

- イタリアの建設用潤滑剤市場

- スペインの建設用潤滑剤市場

- 英国の建設用潤滑剤市場

- その他欧州の建設用潤滑剤市場

- アジア太平洋

- 主な市場動向と機会

- 中国の建設用潤滑剤市場

- 日本の建設用潤滑剤市場

- インドの建設用潤滑剤市場

- 韓国の建設用潤滑剤市場

- オーストラリアの建設用潤滑剤市場

- その他アジア太平洋の建設用潤滑剤市場

- ラテンアメリカ・中東・アフリカ

- 主要市場動向と機会

- ブラジルの建設用潤滑剤市場

- 南アフリカの建設用潤滑剤市場

- サウジアラビアの建設用潤滑剤市場

- その他ラテンアメリカ・中東・アフリカの建設用潤滑剤市場

第8章 競合情勢

- イントロダクション

- 主要成功戦略

- 主要10企業の製品マッピング

- 競合ダッシュボード

- 競合ヒートマップ

- 主要企業のポジショニング:2023年

第9章 企業プロファイル

- Saudi Aramco

- Shell PLC

- S-Oil Corporation

- Phillips 66 Company

- Chevron Corporation

- British Petroleum

- Exxon Mobil Corporation

- Neste OYJ

- PT. Pertamina

- Marathon Petroleum Corporation

The construction lubricants market was valued at $9.4 billion in 2023, and is projected to reach $13.9 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033.

Construction lubricants are specialized substances designed to reduce friction, wear, and heat generation in machinery and equipment used in construction processes. These lubricants ensure the smooth operation of various components, including bearings, gears, hydraulic systems, and other mechanical parts, thereby enhancing the efficiency and longevity of construction machinery. They come in various forms, including oils, greases, and specialty products, each formulated to meet specific operational demands and environmental conditions commonly encountered in the construction industry.

The growth of the global construction lubricants market is majorly driven by the expansion of the construction industry, particularly in emerging economies, and surge in demand for construction machinery and equipment to ensure smooth operations. As per a recent study revealed that 30% of the total cost of the work is due to the cost of manpower, which makes it necessary for the construction companies to upgrade their equipment. This, in turn, significantly boosts the demand for specialized lubricants. Growing complexity and size of construction equipment fuel the demand lubricants that can operate under extreme conditions, such as high pressures, temperatures, and loads, further fueling market demand. In addition, rapid urbanization and infrastructure development in both developed and developing regions are increasing the need for construction activities, thereby driving the demand for lubricants in the construction sector. Furthermore, growing trend toward automation in construction equipment, including the integration of AI and machine learning technologies, increases the reliance on specialized lubricants that can maintain optimal equipment function in smart machinery, thereby augmenting the market growth. However, high cost associated with high-performance lubricants, especially those designed for specific construction machinery and environmentally friendly products, significantly hampers the market growth. In addition, availability of alternative products, such as synthetic oils and hydraulic fluids, acts as a key deterrent factor of the global market. On the contrary, as construction equipment becomes more advanced and complex, the need for specialized lubricants that can meet the performance demands of new technologies, such as electric and autonomous machinery, continues to grow, which is expected to offer remunerative opportunities for the expansion of the global market during the forecast period.

The global construction lubricants market is segmented on the basis of base oil, type, application, and region. By base oil, the market is classified into mineral oil, synthetic oil, and bio-based oil. On the basis of type, it is classified into hydraulic fluids, engine oil, gear oil, transmission fluids, greases, and others. Depending on application, it is categorized into heavy machinery & earthmoving equipment, cranes, road construction equipment, concrete & cement equipment, drilling equipment, and others. Region wise, the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Key Findings

By base oil, the synthetic oil segment is expected to dominate the market from 2024 to 2033.

On the basis of type, the hydraulic fluid segment is anticipated to maintain its lead position during the forecast period.

Depending on application, the heavy machinery & earthmoving equipment segment is projected to exhibit the highest growth during the forecast period.

Region wise, Asia-Pacific is likely to emerge as the most lucrative market for construction lubricants throughout the forecast period.

Competition Analysis

The major players operating in the global construction lubricants market include Saudi Aramco, Shell PLC, S-Oil Corporation, Phillips 66 Company, Chevron Corporation, British Petroleum, Exxon Mobil Corporation, Neste OYJ, PT. Pertamina, and Marathon Petroleum Corporation. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships to sustain the intense competition and gain a strong foothold in the global market.

Additional benefits you will get with this purchase are:

- Quarterly Update and* (only available with a corporate license, on listed price)

- 5 additional Company Profile of client Choice pre- or Post-purchase, as a free update.

- Free Upcoming Version on the Purchase of Five and Enterprise User License.

- 16 analyst hours of support* (post-purchase, if you find additional data requirements upon review of the report, you may receive support amounting to 16 analyst hours to solve questions, and post-sale queries)

- 15% Free Customization* (in case the scope or segment of the report does not match your requirements, 15% is equivalent to 3 working days of free work, applicable once)

- Free data Pack on the Five and Enterprise User License. (Excel version of the report)

- Free Updated report if the report is 6-12 months old or older.

- 24-hour priority response*

- Free Industry updates and white papers.

Possible Customization with this report (with additional cost and timeline, please talk to the sales executive to know more)

- Manufacturing Capacity

- Capital Investment breakdown

- End user preferences and pain points

- Industry life cycle assessment, by region

- Installed Base analysis

- Investment Opportunities

- Product Benchmarking / Product specification and applications

- Product Life Cycles

- Scenario Analysis & Growth Trend Comparison

- Supply Chain Analysis & Vendor Margins

- Upcoming/New Entrant by Regions

- Distributor margin Analysis

- Go To Market Strategy

- Market share analysis of players by products/segments

- New Product Development/ Product Matrix of Key Players

- Pain Point Analysis

- Patient/epidemiology data at country, region, global level

- Regulatory Guidelines

- Strategic Recommendations

- Surgical procedures data- specific or multiple surgery types

- Additional company profiles with specific to client's interest

- Additional country or region analysis- market size and forecast

- Average Selling Price Analysis / Price Point Analysis

- Brands Share Analysis

- Criss-cross segment analysis- market size and forecast

- Expanded list for Company Profiles

- Historic market data

- Import Export Analysis/Data

- Key player details (including location, contact details, supplier/vendor network etc. in excel format)

- List of customers/consumers/raw material suppliers- value chain analysis

- Market share analysis of players at global/region/country level

- Product Consumption Analysis

- Reimbursement Scenario

- SWOT Analysis

- Volume Market Size and Forecast

Key Market Segments

By Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

By Type

- Hydraulic Fluids

- Engine Oil

- Gear Oil

- Transmission Fluids

- Greases

- Others

By Application

- Heavy Machinery and Earthmoving Equipment

- Cranes

- Road Construction Equipment

- Concrete and Cement Equipment

- Drilling Equipment

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Key Market Players:

- Saudi Aramco

- Shell PLC

- S-Oil Corporation

- Phillips 66 Company

- Chevron Corporation

- British Petroleum

- Exxon Mobil Corporation

- Neste OYJ

- PT. Pertamina

- Marathon Petroleum Corporation

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report Description

- 1.2. Key Market Segments

- 1.3. Key Benefits

- 1.4. Research Methodology

- 1.4.1. Primary Research

- 1.4.2. Secondary Research

- 1.4.3. Analyst Tools and Models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO Perspective

CHAPTER 3: MARKET LANDSCAPE

- 3.1. Market Definition and Scope

- 3.2. Key Findings

- 3.2.1. Top Investment Pockets

- 3.2.2. Top Winning Strategies

- 3.3. Porter's Five Forces Analysis

- 3.3.1. Bargaining Power of Suppliers

- 3.3.2. Threat of New Entrants

- 3.3.3. Threat of Substitutes

- 3.3.4. Competitive Rivalry

- 3.3.5. Bargaining Power among Buyers

- 3.4. Market Dynamics

- 3.4.1. Drivers

- 3.4.2. Restraints

- 3.4.3. Opportunities

CHAPTER 4: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL

- 4.1. Market Overview

- 4.1.1 Market Size and Forecast, By Base Oil

- 4.2. Mineral Oil

- 4.2.1. Key Market Trends, Growth Factors and Opportunities

- 4.2.2. Market Size and Forecast, By Region

- 4.2.3. Market Share Analysis, By Country

- 4.3. Synthetic Oil

- 4.3.1. Key Market Trends, Growth Factors and Opportunities

- 4.3.2. Market Size and Forecast, By Region

- 4.3.3. Market Share Analysis, By Country

- 4.4. Bio-based Oil

- 4.4.1. Key Market Trends, Growth Factors and Opportunities

- 4.4.2. Market Size and Forecast, By Region

- 4.4.3. Market Share Analysis, By Country

CHAPTER 5: CONSTRUCTION LUBRICANTS MARKET, BY TYPE

- 5.1. Market Overview

- 5.1.1 Market Size and Forecast, By Type

- 5.2. Hydraulic Fluids

- 5.2.1. Key Market Trends, Growth Factors and Opportunities

- 5.2.2. Market Size and Forecast, By Region

- 5.2.3. Market Share Analysis, By Country

- 5.3. Engine Oil

- 5.3.1. Key Market Trends, Growth Factors and Opportunities

- 5.3.2. Market Size and Forecast, By Region

- 5.3.3. Market Share Analysis, By Country

- 5.4. Gear Oil

- 5.4.1. Key Market Trends, Growth Factors and Opportunities

- 5.4.2. Market Size and Forecast, By Region

- 5.4.3. Market Share Analysis, By Country

- 5.5. Transmission Fluids

- 5.5.1. Key Market Trends, Growth Factors and Opportunities

- 5.5.2. Market Size and Forecast, By Region

- 5.5.3. Market Share Analysis, By Country

- 5.6. Greases

- 5.6.1. Key Market Trends, Growth Factors and Opportunities

- 5.6.2. Market Size and Forecast, By Region

- 5.6.3. Market Share Analysis, By Country

- 5.7. Others

- 5.7.1. Key Market Trends, Growth Factors and Opportunities

- 5.7.2. Market Size and Forecast, By Region

- 5.7.3. Market Share Analysis, By Country

CHAPTER 6: CONSTRUCTION LUBRICANTS MARKET, BY APPLICATION

- 6.1. Market Overview

- 6.1.1 Market Size and Forecast, By Application

- 6.2. Heavy Machinery And Earthmoving Equipment

- 6.2.1. Key Market Trends, Growth Factors and Opportunities

- 6.2.2. Market Size and Forecast, By Region

- 6.2.3. Market Share Analysis, By Country

- 6.3. Cranes

- 6.3.1. Key Market Trends, Growth Factors and Opportunities

- 6.3.2. Market Size and Forecast, By Region

- 6.3.3. Market Share Analysis, By Country

- 6.4. Road Construction Equipment

- 6.4.1. Key Market Trends, Growth Factors and Opportunities

- 6.4.2. Market Size and Forecast, By Region

- 6.4.3. Market Share Analysis, By Country

- 6.5. Concrete And Cement Equipment

- 6.5.1. Key Market Trends, Growth Factors and Opportunities

- 6.5.2. Market Size and Forecast, By Region

- 6.5.3. Market Share Analysis, By Country

- 6.6. Drilling Equipment

- 6.6.1. Key Market Trends, Growth Factors and Opportunities

- 6.6.2. Market Size and Forecast, By Region

- 6.6.3. Market Share Analysis, By Country

- 6.7. Others

- 6.7.1. Key Market Trends, Growth Factors and Opportunities

- 6.7.2. Market Size and Forecast, By Region

- 6.7.3. Market Share Analysis, By Country

CHAPTER 7: CONSTRUCTION LUBRICANTS MARKET, BY REGION

- 7.1. Market Overview

- 7.1.1 Market Size and Forecast, By Region

- 7.2. North America

- 7.2.1. Key Market Trends and Opportunities

- 7.2.2. Market Size and Forecast, By Base Oil

- 7.2.3. Market Size and Forecast, By Type

- 7.2.4. Market Size and Forecast, By Application

- 7.2.5. Market Size and Forecast, By Country

- 7.2.6. U.S. Construction Lubricants Market

- 7.2.6.1. Market Size and Forecast, By Base Oil

- 7.2.6.2. Market Size and Forecast, By Type

- 7.2.6.3. Market Size and Forecast, By Application

- 7.2.7. Canada Construction Lubricants Market

- 7.2.7.1. Market Size and Forecast, By Base Oil

- 7.2.7.2. Market Size and Forecast, By Type

- 7.2.7.3. Market Size and Forecast, By Application

- 7.2.8. Mexico Construction Lubricants Market

- 7.2.8.1. Market Size and Forecast, By Base Oil

- 7.2.8.2. Market Size and Forecast, By Type

- 7.2.8.3. Market Size and Forecast, By Application

- 7.3. Europe

- 7.3.1. Key Market Trends and Opportunities

- 7.3.2. Market Size and Forecast, By Base Oil

- 7.3.3. Market Size and Forecast, By Type

- 7.3.4. Market Size and Forecast, By Application

- 7.3.5. Market Size and Forecast, By Country

- 7.3.6. France Construction Lubricants Market

- 7.3.6.1. Market Size and Forecast, By Base Oil

- 7.3.6.2. Market Size and Forecast, By Type

- 7.3.6.3. Market Size and Forecast, By Application

- 7.3.7. Germany Construction Lubricants Market

- 7.3.7.1. Market Size and Forecast, By Base Oil

- 7.3.7.2. Market Size and Forecast, By Type

- 7.3.7.3. Market Size and Forecast, By Application

- 7.3.8. Italy Construction Lubricants Market

- 7.3.8.1. Market Size and Forecast, By Base Oil

- 7.3.8.2. Market Size and Forecast, By Type

- 7.3.8.3. Market Size and Forecast, By Application

- 7.3.9. Spain Construction Lubricants Market

- 7.3.9.1. Market Size and Forecast, By Base Oil

- 7.3.9.2. Market Size and Forecast, By Type

- 7.3.9.3. Market Size and Forecast, By Application

- 7.3.10. UK Construction Lubricants Market

- 7.3.10.1. Market Size and Forecast, By Base Oil

- 7.3.10.2. Market Size and Forecast, By Type

- 7.3.10.3. Market Size and Forecast, By Application

- 7.3.11. Rest Of Europe Construction Lubricants Market

- 7.3.11.1. Market Size and Forecast, By Base Oil

- 7.3.11.2. Market Size and Forecast, By Type

- 7.3.11.3. Market Size and Forecast, By Application

- 7.4. Asia-Pacific

- 7.4.1. Key Market Trends and Opportunities

- 7.4.2. Market Size and Forecast, By Base Oil

- 7.4.3. Market Size and Forecast, By Type

- 7.4.4. Market Size and Forecast, By Application

- 7.4.5. Market Size and Forecast, By Country

- 7.4.6. China Construction Lubricants Market

- 7.4.6.1. Market Size and Forecast, By Base Oil

- 7.4.6.2. Market Size and Forecast, By Type

- 7.4.6.3. Market Size and Forecast, By Application

- 7.4.7. Japan Construction Lubricants Market

- 7.4.7.1. Market Size and Forecast, By Base Oil

- 7.4.7.2. Market Size and Forecast, By Type

- 7.4.7.3. Market Size and Forecast, By Application

- 7.4.8. India Construction Lubricants Market

- 7.4.8.1. Market Size and Forecast, By Base Oil

- 7.4.8.2. Market Size and Forecast, By Type

- 7.4.8.3. Market Size and Forecast, By Application

- 7.4.9. South Korea Construction Lubricants Market

- 7.4.9.1. Market Size and Forecast, By Base Oil

- 7.4.9.2. Market Size and Forecast, By Type

- 7.4.9.3. Market Size and Forecast, By Application

- 7.4.10. Australia Construction Lubricants Market

- 7.4.10.1. Market Size and Forecast, By Base Oil

- 7.4.10.2. Market Size and Forecast, By Type

- 7.4.10.3. Market Size and Forecast, By Application

- 7.4.11. Rest of Asia-Pacific Construction Lubricants Market

- 7.4.11.1. Market Size and Forecast, By Base Oil

- 7.4.11.2. Market Size and Forecast, By Type

- 7.4.11.3. Market Size and Forecast, By Application

- 7.5. LAMEA

- 7.5.1. Key Market Trends and Opportunities

- 7.5.2. Market Size and Forecast, By Base Oil

- 7.5.3. Market Size and Forecast, By Type

- 7.5.4. Market Size and Forecast, By Application

- 7.5.5. Market Size and Forecast, By Country

- 7.5.6. Brazil Construction Lubricants Market

- 7.5.6.1. Market Size and Forecast, By Base Oil

- 7.5.6.2. Market Size and Forecast, By Type

- 7.5.6.3. Market Size and Forecast, By Application

- 7.5.7. South Africa Construction Lubricants Market

- 7.5.7.1. Market Size and Forecast, By Base Oil

- 7.5.7.2. Market Size and Forecast, By Type

- 7.5.7.3. Market Size and Forecast, By Application

- 7.5.8. Saudi Arabia Construction Lubricants Market

- 7.5.8.1. Market Size and Forecast, By Base Oil

- 7.5.8.2. Market Size and Forecast, By Type

- 7.5.8.3. Market Size and Forecast, By Application

- 7.5.9. Rest of LAMEA Construction Lubricants Market

- 7.5.9.1. Market Size and Forecast, By Base Oil

- 7.5.9.2. Market Size and Forecast, By Type

- 7.5.9.3. Market Size and Forecast, By Application

CHAPTER 8: COMPETITIVE LANDSCAPE

- 8.1. Introduction

- 8.2. Top Winning Strategies

- 8.3. Product Mapping Of Top 10 Player

- 8.4. Competitive Dashboard

- 8.5. Competitive Heatmap

- 8.6. Top Player Positioning, 2023

CHAPTER 9: COMPANY PROFILES

- 9.1. Saudi Aramco

- 9.1.1. Company Overview

- 9.1.2. Key Executives

- 9.1.3. Company Snapshot

- 9.1.4. Operating Business Segments

- 9.1.5. Product Portfolio

- 9.1.6. Business Performance

- 9.1.7. Key Strategic Moves and Developments

- 9.2. Shell PLC

- 9.2.1. Company Overview

- 9.2.2. Key Executives

- 9.2.3. Company Snapshot

- 9.2.4. Operating Business Segments

- 9.2.5. Product Portfolio

- 9.2.6. Business Performance

- 9.2.7. Key Strategic Moves and Developments

- 9.3. S-Oil Corporation

- 9.3.1. Company Overview

- 9.3.2. Key Executives

- 9.3.3. Company Snapshot

- 9.3.4. Operating Business Segments

- 9.3.5. Product Portfolio

- 9.3.6. Business Performance

- 9.3.7. Key Strategic Moves and Developments

- 9.4. Phillips 66 Company

- 9.4.1. Company Overview

- 9.4.2. Key Executives

- 9.4.3. Company Snapshot

- 9.4.4. Operating Business Segments

- 9.4.5. Product Portfolio

- 9.4.6. Business Performance

- 9.4.7. Key Strategic Moves and Developments

- 9.5. Chevron Corporation

- 9.5.1. Company Overview

- 9.5.2. Key Executives

- 9.5.3. Company Snapshot

- 9.5.4. Operating Business Segments

- 9.5.5. Product Portfolio

- 9.5.6. Business Performance

- 9.5.7. Key Strategic Moves and Developments

- 9.6. British Petroleum

- 9.6.1. Company Overview

- 9.6.2. Key Executives

- 9.6.3. Company Snapshot

- 9.6.4. Operating Business Segments

- 9.6.5. Product Portfolio

- 9.6.6. Business Performance

- 9.6.7. Key Strategic Moves and Developments

- 9.7. Exxon Mobil Corporation

- 9.7.1. Company Overview

- 9.7.2. Key Executives

- 9.7.3. Company Snapshot

- 9.7.4. Operating Business Segments

- 9.7.5. Product Portfolio

- 9.7.6. Business Performance

- 9.7.7. Key Strategic Moves and Developments

- 9.8. Neste OYJ

- 9.8.1. Company Overview

- 9.8.2. Key Executives

- 9.8.3. Company Snapshot

- 9.8.4. Operating Business Segments

- 9.8.5. Product Portfolio

- 9.8.6. Business Performance

- 9.8.7. Key Strategic Moves and Developments

- 9.9. PT. Pertamina

- 9.9.1. Company Overview

- 9.9.2. Key Executives

- 9.9.3. Company Snapshot

- 9.9.4. Operating Business Segments

- 9.9.5. Product Portfolio

- 9.9.6. Business Performance

- 9.9.7. Key Strategic Moves and Developments

- 9.10. Marathon Petroleum Corporation

- 9.10.1. Company Overview

- 9.10.2. Key Executives

- 9.10.3. Company Snapshot

- 9.10.4. Operating Business Segments

- 9.10.5. Product Portfolio

- 9.10.6. Business Performance

- 9.10.7. Key Strategic Moves and Developments