|

|

市場調査レポート

商品コード

1728059

計測機器の市場規模、シェア、動向分析レポート:タイプ別、最終用途別、地域別、セグメント予測、2025年~2030年Metrology Equipment Market Size, Share & Trends Analysis Report By Type (Coordinate Measuring Machine, Optical Digitizer & Scanner) By End-use (Automotive, Electronics), By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 計測機器の市場規模、シェア、動向分析レポート:タイプ別、最終用途別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2025年04月09日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

計測機器の市場規模と動向:

計測機器の世界市場規模は2024年に105億8,000万米ドルとなり、2025年から2030年にかけてCAGR 6.2%で成長すると予測されています。

世界市場の成長は、いくつかの重要な要因によって牽引されています。産業界が製品の高い品質と精度を確保しようとしているため、産業オートメーションの増加と製造プロセスにおける精度の必要性が大きな要因となっています。加えて、航空宇宙分野と自動車分野の拡大が需要の原動力となっており、厳しい基準を満たし性能を向上させるために精密な測定と品質管理が必要とされています。さらに、計測機器にIoTやスマートセンサーを統合するなどの技術の進歩が、測定能力とデータ分析を強化し、市場拡大に拍車をかけています。

さまざまな産業で規制順守と品質保証が重視されるようになっていることが重要な役割を果たしており、企業は厳しい基準を満たし、コストのかかるエラーを回避するために高度な計測ソリューションを採用しています。さらに、研究開発活動の増加や最新製品の複雑化により、正確な測定と品質管理のための高度な計測機器が必要とされています。

制約事項には、高い初期費用とメンテナンス費用があり、中小企業にとっては法外な負担となり、高度計測システムの普及を制限します。さらに、新しい計測機器を既存のシステムに統合することの複雑さが課題となることもあり、効果的な導入とトレーニングには多大な時間と資源が必要となります。技術の進歩は装置の急速な陳腐化にもつながり、頻繁なアップグレードとそれに伴うコストにつながります。

一方、市場成長の機会も大きいです。航空宇宙、自動車、エレクトロニクスなど、さまざまな分野の製造における精度と品質への要求の高まりが、高度な計測ソリューションの必要性を高めています。IoT、AI、スマートセンサの統合などの技術革新は、測定能力の強化と新機能を提供し、成長の見通しを示しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 計測機器市場の変数、動向、範囲

- 市場系統の見通し

- 親市場の見通し

- 関連市場見通し

- 業界バリューチェーン分析

- 規制の枠組み

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 業界の課題

- 業界の機会

- 業界分析ツール

- ポーターのファイブフォース分析

- マクロ環境分析

第4章 計測機器市場:タイプの推定・動向分析

- セグメントダッシュボード

- 計測機器市場:タイプ変動分析と市場シェア、2024年と2030年

- 座標測定機(CMM)

- 光学デジタイザーおよびスキャナー(ODS)

- X線およびコンピュータ断層撮影(CT)システム

- 計測機器

- 形状測定装置

- その他

第5章 計測機器市場:最終用途の推定・動向分析

- セグメントダッシュボード

- 計測機器市場:最終用途変動分析と市場シェア、2024年と2030年

- 製造業

- 自動車

- 航空宇宙

- エレクトロニクス

- 医療

- その他

第6章 計測機器市場:地域推定・動向分析

- 地域変動分析と市場シェア、2024年と2030年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- ラテンアメリカ

- ブラジル

- アルゼンチン

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第7章 計測機器市場-競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 企業ヒートマップ/ポジション分析、2024年

- 戦略マッピング

- 拡大

- 合併と買収

- パートナーシップとコラボレーション

- 新しいタイプの発売

- 研究開発

- 企業プロファイル

- Hexagon AB

- Nikon Metrology NV(Nikon Corporation)

- ZEISS

- KEYENCE CORPORATION

- KLA Corporation.

- Mitutoyo America Corporation

- Jenoptik

- Renishaw plc.

- CREAFORM.

- Metro

- AMETEK.Inc.

- InspecVision Ltd.

List of Tables

- Table 1 List of Abbreviation

- Table 2 Metrology Equipment Market 2018 - 2030 (USD Million)

- Table 3 Global Market Estimates and Forecasts by Type, 2018 - 2030 (USD Million)

- Table 4 Global Market Estimates and Forecasts by End Use, 2018 - 2030 (USD Million)

- Table 5 Global Market Estimates and Forecasts by Region, 2018 - 2030 (USD Million)

- Table 6 North America Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 7 North America Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 8 U.S. Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 9 U.S. Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 10 Canada Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 11 Canada Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 12 Mexico Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 13 Mexico Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 14 Europe Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 15 Europe Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 16 Germany Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 17 Germany Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 18 UK Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 19 UK Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 20 France Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 21 France Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 22 Italy Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 23 Italy Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 24 Spain Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 25 Spain Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 26 Asia Pacific Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 27 Asia Pacific Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 28 China Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 29 China Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 30 India Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 31 India Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 32 Japan Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 33 Japan Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 34 South Korea Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 35 South Korea Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 36 Latin America Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 37 Latin America Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 38 Brazil Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 39 Brazil Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 40 Argentina Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 41 Argentina Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 42 Middle East & Africa Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 43 Middle East & Africa Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 44 Saudi Arabia Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 45 Saudi Arabia Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 46 UAE Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 47 UAE Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

- Table 48 South Africa Metrology Equipment Market by Type, 2018 - 2030 (USD Million)

- Table 49 South Africa Metrology Equipment Market by End Use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Market Research Process

- Fig. 2 Data Triangulation Techniques

- Fig. 3 Primary Research Pattern

- Fig. 4 Market Research Approaches

- Fig. 5 QFD Modeling for Market Share Assessment

- Fig. 6 Information Procurement

- Fig. 7 Market Formulation and Validation

- Fig. 8 Data Validating & Publishing

- Fig. 9 Market Segmentation & Scope

- Fig. 10 Metrology Equipment Market Snapshot

- Fig. 11 Segment Snapshot (1/2)

- Fig. 12 Segment Snapshot (1/2)

- Fig. 13 Competitive Landscape Snapshot

- Fig. 14 Parent Market Outlook

- Fig. 15 Metrology Equipment Market Value, 2024 (USD Million)

- Fig. 16 Metrology Equipment Market - Value Chain Analysis

- Fig. 17 Metrology Equipment Market - Market Dynamics

- Fig. 18 Metrology Equipment Market - Porter's Analysis

- Fig. 19 Metrology Equipment Market - PESTEL Analysis

- Fig. 20 Metrology Equipment Market Estimates & Forecasts, By Type: Key Takeaways

- Fig. 21 Metrology Equipment Market Share, By Type, 2024 & 2030

- Fig. 22 Coordinate Measuring Machine (CMM) Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Optical Digitizer and Scanner (ODS) Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 24 X-ray and Computed Tomography (CT) Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 25 Measuring Instruments Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 26 Form Measurement Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 27 Others Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 28 Metrology Equipment Market Estimates & Forecasts, By End Use: Key Takeaways

- Fig. 29 Metrology Equipment Market Share, By End Use, 2024 & 2030

- Fig. 30 Metrology Equipment Market Estimates & Forecasts, In Manufacturing, 2018 - 2030 (USD Million)

- Fig. 31 Metrology Equipment Market Estimates & Forecasts, In Automotive, 2018 - 2030 (USD Million)

- Fig. 32 Metrology Equipment Market Estimates & Forecasts, In Aerospace, 2018 - 2030 (USD Million)

- Fig. 33 Metrology Equipment Market Estimates & Forecasts, In Electronics, 2018 - 2030 (USD Million)

- Fig. 34 Metrology Equipment Market Estimates & Forecasts, In Medical, 2018 - 2030 (USD Million)

- Fig. 35 Metrology Equipment Market Estimates & Forecasts, In Others, 2018 - 2030 (USD Million)

- Fig. 36 Metrology Equipment Market Revenue, By Region, 2024 & 2030 (USD Million)

- Fig. 37 North America Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 38 U.S. Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 39 Canada Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 40 Mexico Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 41 Europe Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 42 Germany Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 43 UK Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 44 France Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 45 Spain Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 46 Italy Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 47 Asia Pacific Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 48 China Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 49 India Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 50 Japan Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 51 South Korea Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 52 Australia Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 53 Latin America Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 54 Brazil Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 55 Argentina Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 56 Middle East & Africa Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 57 Saudi Arabia Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 58 UAE Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 59 South Africa Metrology Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 60 Key Company Categorization

- Fig. 61 Company Market Positioning

- Fig. 62 Strategy Mapping

Metrology Equipment Market Size & Trends:

The global metrology equipment market size was valued at USD 10.58 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030. The growth of the global market is driven by several key factors. Increasing industrial automation and the need for precision in manufacturing processes are major contributors, as industries seek to ensure high quality and accuracy in their products. In addition, the expanding aerospace and automotive sectors drive demand, requiring precise measurements and quality control to meet stringent standards and improve performance. Furthermore, advancements in technology, such as the integration of IoT and smart sensors in metrology equipment, enhance measurement capabilities and data analysis, fueling market expansion.

The growing emphasis on regulatory compliance and quality assurance across various industries plays a significant role, as companies adopt advanced metrology solutions to meet stringent standards and avoid costly errors. Additionally, the rise in research and development activities and the increasing complexity of modern products necessitate advanced metrology equipment for precise measurements and quality control.Top of FormBottom of Form

Restraints include high initial costs and maintenance expenses, which can be prohibitive for smaller companies and limit the widespread adoption of advanced metrology systems. Moreover, the complexity of integrating new metrology equipment with existing systems can pose challenges, requiring significant time and resources for effective implementation and training. Technological advancements also contribute to rapid obsolescence of equipment, leading to frequent upgrades and associated costs.

On the other hand, opportunities for market growth are substantial. The increasing demand for precision and quality in manufacturing across various sectors, such as aerospace, automotive, and electronics, drives the need for advanced metrology solutions. Innovations in technology, such as the integration of IoT, AI, and smart sensors, offer enhanced measurement capabilities and new functionalities, presenting growth prospects.

Global Metrology Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global metrology equipment market report based on, type, end use, and region.

- Type Outlook (Revenue, USD Million, 2018 - 2030)

- Coordinate Measuring Machine (CMM)

- Optical Digitizer and Scanner (ODS)

- X-ray and Computed Tomography (CT) Systems

- Measuring Instruments

- Form Measurement Equipment

- Others

- End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Manufacturing

- Automotive

- Aerospace

- Electronics

- Medical

- Others

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

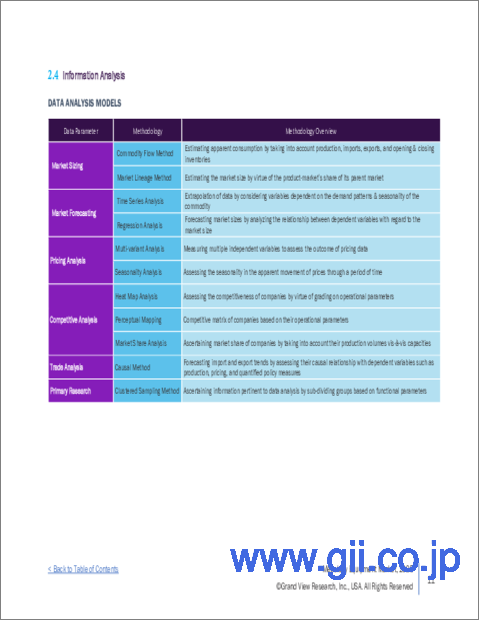

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Metrology Equipment Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent Market Outlook

- 3.1.2. Related Market Outlook

- 3.2. Industry Value Chain Analysis

- 3.3. Regulatory Framework

- 3.4. Market Dynamics

- 3.4.1. Market Driver Analysis

- 3.4.2. Market Restraint Analysis

- 3.4.3. Industry Challenges

- 3.4.4. Industry Opportunities

- 3.5. Industry Analysis Tools

- 3.5.1. Porter's Five Forces Analysis

- 3.5.2. Macro-environmental Analysis

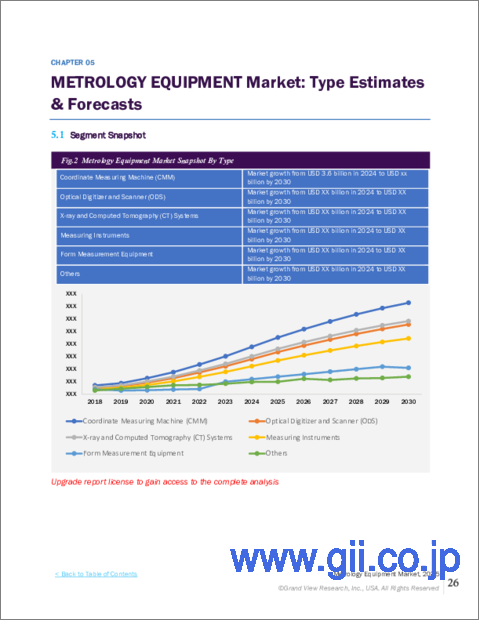

Chapter 4. Metrology Equipment Market: Type Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Metrology Equipment Market: Type Movement Analysis & Market Share, 2024 & 2030

- 4.3. Coordinate Measuring Machine (CMM)

- 4.3.1. Coordinate Measuring Machine (CMM) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Optical Digitizer and Scanner (ODS)

- 4.4.1. Optical Digitizer and Scanner (ODS) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.5. X-ray and Computed Tomography (CT) Systems

- 4.5.1. X-ray and Computed Tomography (CT) Systems Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.6. Measuring Instruments

- 4.6.1. Measuring Instruments Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.7. Form Measurement Equipment

- 4.7.1. Form Measurement Equipment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.8. Others

- 4.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Metrology Equipment Market: End Use Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Metrology Equipment Market: End Use Movement Analysis & Market Share, 2024 & 2030

- 5.3. Manufacturing

- 5.3.1. Manufacturing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4. Automotive

- 5.4.1. Automotive Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.5. Aerospace

- 5.5.1. Aerospace Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.6. Electronics

- 5.6.1. Electronics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.7. Medical

- 5.7.1. Medical Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.8. Others

- 5.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Metrology Equipment Market: Regional Estimates & Trend Analysis

- 6.1. Regional Movement Analysis & Market Share, 2024 & 2030

- 6.2. North America

- 6.2.1. North America Chemical Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.2.2. U.S.

- 6.2.2.1. Key Country Dynamics

- 6.2.2.2. U.S. Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.2.3. Canada

- 6.2.3.1. Key Country Dynamics

- 6.2.3.2. Canada Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.2.4. Mexico

- 6.2.4.1. Key Country Dynamics

- 6.2.4.2. Mexico Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.3. Europe

- 6.3.1. Europe Chemical Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.3.2. Germany

- 6.3.2.1. Key Country Dynamics

- 6.3.2.2. Germany Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.3.3. UK

- 6.3.3.1. Key Country Dynamics

- 6.3.3.2. UK Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.3.4. France

- 6.3.4.1. Key Country Dynamics

- 6.3.4.2. France Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.3.5. Italy

- 6.3.5.1. Key Country Dynamics

- 6.3.5.2. Italy Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.3.6. Spain

- 6.3.6.1. Key Country Dynamics

- 6.3.6.2. Spain Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.4. Asia Pacific

- 6.4.1. Asia Pacific Chemical Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.4.2. China

- 6.4.2.1. Key Country Dynamics

- 6.4.2.2. China Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.4.3. Japan

- 6.4.3.1. Key Country Dynamics

- 6.4.3.2. Japan Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.4.4. India

- 6.4.4.1. Key Country Dynamics

- 6.4.4.2. India Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.4.5. South Korea

- 6.4.5.1. Key Country Dynamics

- 6.4.5.2. South Korea Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.5. Latin America

- 6.5.1. Latin America Chemical Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.5.2. Brazil

- 6.5.2.1. Key Country Dynamics

- 6.5.2.2. Brazil Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.5.3. Argentina

- 6.5.3.1. Key Country Dynamics

- 6.5.3.2. Argentina Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.6. Middle East & Africa

- 6.6.1. Middles East & Africa Chemical Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.6.2. Saudi Arabia

- 6.6.2.1. Key Country Dynamics

- 6.6.2.2. Saudi Arabia Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.6.3. UAE

- 6.6.3.1. Key Country Dynamics

- 6.6.3.2. UAE Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.6.4. South Africa

- 6.6.4.1. Key Country Dynamics

- 6.6.4.2. South Africa Metrology Equipment Market Estimates & Forecast, 2018 - 2030 (USD Million)

Chapter 7. Metrology Equipment Market - Competitive Landscape

- 7.1. Recent Developments & Impact Analysis, By Key Market Participants

- 7.2. Company Categorization

- 7.3. Company Heat Map/ Position Analysis, 2024

- 7.4. Strategy Mapping

- 7.4.1. Expansion

- 7.4.2. Mergers & Acquisition

- 7.4.3. Partnerships & Collaborations

- 7.4.4. New Type Launches

- 7.4.5. Research and Development

- 7.5. Company Profiles

- 7.5.1. Hexagon AB

- 7.5.1.1. Participant's Overview

- 7.5.1.2. Financial Performance

- 7.5.1.3. Product Benchmarking

- 7.5.1.4. Recent Developments

- 7.5.2. Nikon Metrology NV (Nikon Corporation)

- 7.5.2.1. Participant's Overview

- 7.5.2.2. Financial Performance

- 7.5.2.3. Product Benchmarking

- 7.5.2.4. Recent Developments

- 7.5.3. ZEISS

- 7.5.3.1. Participant's Overview

- 7.5.3.2. Financial Performance

- 7.5.3.3. Product Benchmarking

- 7.5.3.4. Recent Developments

- 7.5.4. KEYENCE CORPORATION

- 7.5.4.1. Participant's Overview

- 7.5.4.2. Financial Performance

- 7.5.4.3. Product Benchmarking

- 7.5.4.4. Recent Developments

- 7.5.5. KLA Corporation.

- 7.5.5.1. Participant's Overview

- 7.5.5.2. Financial Performance

- 7.5.5.3. Product Benchmarking

- 7.5.5.4. Recent Developments

- 7.5.6. Mitutoyo America Corporation

- 7.5.6.1. Participant's Overview

- 7.5.6.2. Financial Performance

- 7.5.6.3. Product Benchmarking

- 7.5.6.4. Recent Developments

- 7.5.7. Jenoptik

- 7.5.7.1. Participant's Overview

- 7.5.7.2. Financial Performance

- 7.5.7.3. Product Benchmarking

- 7.5.7.4. Recent Developments

- 7.5.8. Renishaw plc.

- 7.5.8.1. Participant's Overview

- 7.5.8.2. Financial Performance

- 7.5.8.3. Product Benchmarking

- 7.5.8.4. Recent Developments

- 7.5.9. CREAFORM.

- 7.5.9.1. Participant's Overview

- 7.5.9.2. Financial Performance

- 7.5.9.3. Product Benchmarking

- 7.5.9.4. Recent Developments

- 7.5.10. Metro

- 7.5.10.1. Participant's Overview

- 7.5.10.2. Financial Performance

- 7.5.10.3. Product Benchmarking

- 7.5.10.4. Recent Developments

- 7.5.11. AMETEK.Inc.

- 7.5.11.1. Participant's Overview

- 7.5.11.2. Financial Performance

- 7.5.11.3. Product Benchmarking

- 7.5.11.4. Recent Developments

- 7.5.12. InspecVision Ltd.

- 7.5.12.1. Participant's Overview

- 7.5.12.2. Financial Performance

- 7.5.12.3. Product Benchmarking

- 7.5.12.4. Recent Developments

- 7.5.1. Hexagon AB