|

|

市場調査レポート

商品コード

1549502

流通ロジスティクス市場:成長、将来展望、競合分析、2024年~2032年Distribution Logistics Market - Growth, Future Prospects and Competitive Analysis, 2024 - 2032 |

||||||

|

|||||||

| 流通ロジスティクス市場:成長、将来展望、競合分析、2024年~2032年 |

|

出版日: 2024年08月21日

発行: Acute Market Reports

ページ情報: 英文 174 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

流通ロジスティクス市場は、2024年から2032年の予測期間中にCAGR 5.5%で成長すると予測され、メーカーから消費者への商品の効率的な移動と保管を保証します。この市場には、輸送、倉庫管理、在庫管理、注文処理など幅広い活動が含まれます。世界貿易の複雑化と、より迅速で信頼性の高い配送サービスに対する需要の高まりが、流通ロジスティクス分野の著しい成長を後押ししています。eコマースの台頭はこの成長をさらに加速させ、ロジスティクス・プロバイダーに新たな機会と課題を生み出しています。自動化、人工知能、モノのインターネット(IoT)などの技術の進歩が業界を変革し、より効率的なオペレーションと顧客サービスの向上を可能にしています。しかし、この市場は、運用コストの高騰、規制への対応、持続可能な慣行の必要性などの課題にも直面しています。このような課題にもかかわらず、流通ロジスティクス市場は、世界貿易の継続的な拡大と効率的なサプライチェーン管理の重視の高まりにより、力強い成長を続けると予想されます。eコマースの継続的な成長とデジタル・ロジスティクス・ソリューションの採用拡大が市場拡大の原動力となり、北米、欧州、アジア太平洋などの地域で大きな機会が見込まれます。流通ロジスティクス市場は、高い運用コストや規制遵守などの課題にもかかわらず、世界貿易の継続的な進化やサプライチェーンの効率化と持続可能性の重視の高まりに支えられ、堅調な成長を続けると予想されます。

主な市場促進要因

eコマースの拡大

eコマースの急成長は、流通ロジスティクス市場の最も重要な促進要因の一つです。世界のeコマース分野は、インターネット普及率の上昇、オンラインショッピングに対する消費者の嗜好の高まり、デジタル決済ソリューションの進歩などを背景に、過去10年間で飛躍的な成長を遂げてきました。2023年には、世界のeコマース売上高は5兆7,000億米ドルに達すると推定され、オンライン小売への依存度の高まりを反映しています。このようなオンライン・ショッピングの急増は、商品をタイムリーかつ正確に配送するための効率的な流通ロジスティクスに対する大きな需要を生み出しています。アマゾン、アリババ、ウォルマートなどのeコマース大手は、物流インフラに多額の投資を行い、配送スピードと信頼性の新たなベンチマークを設定しています。例えばアマゾンは、増大する需要に対応するため、フルフィルメント・センター、配送ステーション、ラストマイル・デリバリー・サービスの広範なネットワークを確立しました。同社のロジスティクス・ネットワークは、2023年には約25億個の荷物を扱い、eコマース・ビジネスを支えるために必要な事業規模を明らかにしています。さらに、小売企業がオンラインとオフラインのチャネルを統合するオムニチャネル小売の台頭により、流通ロジスティクスの複雑性が増しています。小売企業は現在、複数のチャネルにまたがる在庫を管理し、注文処理を最適化し、シームレスな顧客体験を提供しなければなりません。この複雑さが、リアルタイムの在庫追跡、自動倉庫管理、効率的なラスト・マイル・デリバリーなど、高度なロジスティクス・ソリューションの必要性を高めています。eコマース・ブームは今後も続くと予想され、世界のeコマース売上高は2024年から2032年にかけてCAGR 14.7%で成長すると予測され、流通ロジスティクスサービスに対する需要をさらに促進しています。

技術の進歩

技術の進歩は流通ロジスティクス市場を変革し、効率性、正確性、透明性を促進しています。自動化、人工知能(AI)、モノのインターネット(IoT)は、業界を再形成する主要技術のひとつです。倉庫や配送センターにおける自動化は、ロボットやコンベアシステムの利用を通じて、手作業を減らし、ミスを最小限に抑えることで業務効率を高める。例えば、DHLやフェデックスのような企業は、自動仕分けシステムやロボットピッキングソリューションを導入し、業務を合理化しています。これらのテクノロジーは、より迅速な注文処理と精度の向上を可能にし、eコマース顧客の高い期待に応えています。AIと機械学習アルゴリズムは、ルート計画、需要予測、在庫管理など、ロジスティクスの様々な側面を最適化するために活用されています。AIを活用した予測分析は、ロジスティクス・プロバイダーが需要変動を予測し、在庫レベルを最適化し、コストを削減するのに役立ちます。例えば、UPSはAIを利用して配送ルートを最適化し、燃料消費量の削減と配送時間の短縮を実現しています。IoTテクノロジーは、貨物のリアルタイムの追跡と監視を可能にし、サプライチェーン全体の可視性を提供します。トラックやコンテナに埋め込まれたスマートセンサーやGPSデバイスが、貨物の位置、温度、状態に関するデータを送信し、事前管理とタイムリーな介入を可能にします。マースクやCMA CGMなどの企業は、IoTを活用してコンテナ追跡機能を強化し、安全で効率的な貨物輸送を実現しています。ブロックチェーン技術の採用は、流通ロジスティクスでも人気を集めており、取引の記録や貨物の追跡に安全で透明性の高い方法を提供しています。ブロックチェーンは、エンド・ツー・エンドの可視性とトレーサビリティを可能にし、不正のリスクを低減し、サプライチェーンのセキュリティを向上させる。企業は業務効率を高め、顧客の進化する要求に応えようとしているため、これらの技術的進歩は流通ロジスティクス市場の成長を引き続き促進すると予想されます。

世界貿易の拡大

世界貿易の拡大も流通ロジスティクス市場の重要な促進要因です。経済の世界化の進展は、貿易自由化政策や輸送インフラの進歩と相まって、国境を越えた物品の移動を促進しています。2023年には、COVID-19パンデミックによる混乱からの回復を反映して、世界の貿易量は3.5%増加したと推定されます。世界貿易の成長は、国家間の物品の移動をサポートする効率的なロジスティクス・サービスに対する大きな需要を生み出しました。北米自由貿易協定(NAFTA)や欧州連合(EU)の単一市場といった主要な貿易協定は、国境を越えた貿易の拡大に貢献し、強固な流通ロジスティクスネットワークの必要性を促しています。アジアとアフリカを中心とする新興市場の台頭も、世界貿易の拡大に貢献しています。中国、インド、ベトナムのような国々は主要な製造拠点となり、世界市場に輸出するさまざまな商品を生産しています。このため、製造拠点から国際市場への商品の移動を促進する広範なロジスティクス・ネットワークが開発されました。DHLやDBシェンカーのような企業は、これらの地域でのプレゼンスを拡大し、増大する貿易量をサポートするためのロジスティクス・インフラとサービスに投資しています。さらに、複数のサプライヤーや生産拠点を抱える世界・サプライチェーンの複雑化により、物品の流れを管理する効率的なロジスティクス・ソリューションの必要性が高まっています。自動倉庫、リアルタイムの追跡、データ分析などの高度なロジスティクス技術の活用は、国境を越えた物品のスムーズで効率的な移動を確保するために不可欠です。世界貿易の拡大は、経済成長、貿易自由化、輸送インフラの進歩によって今後も続くと予想され、流通ロジスティクスサービスの需要をさらに押し上げます。

市場抑制要因

高い運用コスト

運用コストの高さが流通ロジスティクス市場の大きな抑制要因となっています。ロジスティクス業務には、輸送、倉庫保管、人件費、燃料費など、さまざまなコストがかかります。特に燃料費の高騰は、物流コストの大部分を占める輸送費に直接的な影響を与えます。例えば、2023年の世界平均原油価格は前年比で約20%上昇し、燃料価格の上昇につながった。このような燃料費の上昇は、輸送費が上昇するため、物流業者の収益性に直接影響します。さらに、物流業界は、特に熟練労働者の需要が高い地域において、労働力不足と人件費の上昇に直面しています。米国と欧州におけるトラック運転手の不足は根強い問題であり、賃金上昇と採用コスト増につながっています。米国トラック協会(ATA)によると、米国のトラック運送業界は2023年に約8万人の 促進要因不足に直面するといいます。この不足は人件費を押し上げ、物流業務の効率に影響を与えます。また、保管スペースの需要増と高度な倉庫ソリューションの必要性により、倉庫コストも上昇傾向にあります。eコマースの成長とオムニチャネル小売業へのシフトは、フルフィルメントセンターと配送ハブに対する需要の急増につながっています。このような倉庫スペースに対する需要の高まりは、賃貸料と運営コストを押し上げています。さらに、ロジスティクス業界は、業務効率を高め、顧客の期待に応えるために、先進的なテクノロジーやインフラに投資しなければならないです。こうした投資は長期的な成長に不可欠である一方、物流業者の全体的なコスト負担の一因にもなっています。企業は、競争力のある価格設定を維持し、収益性を確保しながら、こうしたコスト課題を乗り切らなければならないです。輸送ルートの最適化、燃料効率の改善、自動化の活用など、効果的なコスト管理戦略は、物流業者にとって、高い運営コストの影響を軽減するために極めて重要です。

流通チャネル別:市場セグメンテーション

流通ロジスティクス市場は、流通チャネル別に消費者直販、小売店、卸売業者、eコマースに区分されます。なかでもeコマースは、オンラインショッピングの急成長と効率的なラストワンマイルデリバリーサービスに対する需要の高まりにより、2023年に最も高い売上高を記録しました。アマゾン、アリババ、JD.comのようなeコマース大手の台頭は、配送スピードと信頼性の新たな基準を設定し、情勢に革命をもたらしました。2023年、世界のeコマース・ロジスティクス市場は約3,200億米ドルと評価されたが、これは急成長するeコマース部門をサポートするためのロジスティクス・インフラとサービスへの多額の投資を反映しています。eコマース分野は、オンライン小売の継続的な拡大とデジタル決済ソリューションの採用増加により、2024年から2032年の予測期間中に最も高いCAGRを記録すると予想されています。市場セグメンテーション(DTC)分野もまた、流通ロジスティクス市場に大きく貢献しています。メーカーやブランドは、顧客とのエンゲージメントを強化し、サプライチェーンを管理するために、DTCモデルを採用するようになっています。小売店は、eコマースの台頭という課題に直面しながらも、流通ロジスティクス市場において重要な役割を果たし続けています。メーカーと小売業者の仲介役である卸売業者は、大量流通と在庫管理サービスを提供する重要な流通チャネルであり続けています。eコマースの成長とオムニチャネル小売へのシフトは、複数のチャネルにまたがるシームレスで効率的な流通をサポートするため、ロジスティクス・インフラとテクノロジーへの大規模な投資を促進しています。

最終用途別:市場セグメンテーション

流通ロジスティクス市場は、最終用途別にヘルスケア、製造、航空宇宙、通信、政府・公共事業、銀行・金融サービス、小売、メディア・娯楽、貿易・運輸、その他に区分されます。2023年には、小売業のサプライチェーンをサポートする効率的なロジスティクスサービスに対する大きな需要に牽引され、小売業セグメントが最も高い収益シェアを占めました。eコマースとオムニチャネル小売の台頭により、複雑な物流要件が生まれ、商品のタイムリーで正確な配送を保証する高度な物流ソリューションが必要とされています。小売企業は、顧客の高い期待に応えるため、フルフィルメント・センター、配送ハブ、ラストマイル・デリバリー・サービスなどの物流インフラに多額の投資を行っています。小売分野は、eコマースの継続的な成長と効率的なサプライチェーン・マネジメントの重視の高まりにより、2024年から2032年にかけても優位を保つと予想されます。ヘルスケア分野も、医薬品、医療機器、ヘルスケア製品の輸送・保管に特化したロジスティクス・ソリューションの必要性によって、流通ロジスティクス市場に大きく貢献しています。COVID-19のパンデミックは、ワクチンや医療用品の世界の流通に堅牢なロジスティクス・インフラが必要とされ、効率的なヘルスケア・ロジスティクスの重要性を浮き彫りにしました。航空宇宙分野は、収益シェアこそ小さいもの、航空機部品・コンポーネントの需要増と航空宇宙サプライチェーンを支える効率的なロジスティクス・ソリューションの必要性により、大きな成長が見込まれています。通信分野も流通ロジスティクス市場に貢献しているが、これは通信インフラの展開と保守をサポートする効率的なロジスティクス・サービスのニーズによるものです。政府・公共事業セグメントは、規模こそ小さいもの、必要不可欠な商品や機器の輸送・保管のために専門的なロジスティクス・ソリューションを必要としています。銀行・金融サービス分野は、現金や貴重書類の安全な輸送のために効率的なロジスティクス・サービスに依存しています。メディア・エンターテインメント分野は、メディア・コンテンツや機器の流通によって牽引され、市場セグメンテーション市場にも貢献しています。貿易・輸送分野は、物品の移動に関わる様々な業界を包含しており、世界貿易をサポートする効率的なロジスティクス・ソリューションの必要性によって、市場に大きく貢献しています。

タイプ別:市場セグメンテーション

流通ロジスティクス市場は、タイプ別にソリューションとサービスに区分されます。2023年には、輸送、倉庫保管、注文処理などのロジスティクスサービスに対する大きな需要によって、サービス分野が最も高い収益シェアを占めました。DHL、FedEx、UPSなどのロジスティクス・サービス・プロバイダーは、物品の効率的な移動や保管をサポートする幅広いサービスを提供し、流通ロジスティクス市場で重要な役割を果たしています。これらの企業は、サービス能力を強化し、顧客の進化する要求に応えるため、ロジスティクス・インフラとテクノロジーに多額の投資を行ってきました。サービス・セグメントは、eコマースの継続的な成長と効率的なロジスティクス・サービスに対する需要の高まりに牽引され、2024年から2032年まで優位性を維持すると予想されます。ロジスティクス・ソフトウェアとテクノロジー・ソリューションを含むソリューション・セグメントも、業務効率の向上とサプライチェーンの可視性向上のための先進テクノロジーへのニーズによって、市場セグメンテーションに大きく寄与しています。輸送管理システム(TMS)、倉庫管理システム(WMS)、サプライチェーン管理(SCM)ソリューションなどの物流ソフトウェアの採用は、企業が物流業務の最適化を図り、競争力を高めようとする中で増加しています。2024年から2032年の予測期間中、デジタル技術の採用が増加し、統合されたロジスティクス・ソリューションへのニーズが高まっていることから、ソリューション分野は大きな成長が見込まれています。

輸送形態別:市場セグメンテーション

流通ロジスティクス市場は、輸送形態別に道路輸送、鉄道輸送、航空輸送、海上輸送に区分されます。2023年には、道路輸送が最も高い売上シェアを占めました。これは、短距離および中距離の貨物輸送にトラックが広く使用されていることが要因です。道路輸送は最も柔軟で広く利用されている輸送手段であり、ドア・ツー・ドアの配達を提供し、様々な種類の貨物を扱うことができます。eコマースの成長とラスト・マイル・デリバリー・サービスの需要の増加が、道路輸送の需要をさらに押し上げています。eコマースの継続的な成長と効率的なラストマイル配送ソリューションの必要性によって、2024年から2032年までのCAGRは9.5%と予測され、道路輸送セグメントは優位性を維持すると予想されます。航空貨物は収益シェアこそ小さいもの、高価値で時間的制約のある商品の迅速かつ信頼性の高い輸送に対する需要の高まりに牽引され、予測期間中に最も高いCAGRを記録すると予想されます。航空貨物分野は、迅速な配送サービスに対する需要の高まりと貿易の世界化の進展によって、2024年から2032年の予測期間中に成長すると予想されます。バルク貨物や長距離輸送において最もコスト効率の高い輸送手段である海上貨物も、流通ロジスティクス市場に大きく貢献しています。世界貿易の拡大とコンテナ輸送の需要増加が海上貨物サービスの需要を牽引しています。海上貨物分野は、世界貿易の継続的な拡大とバルク貨物の効率的輸送の必要性により、2024年から2032年にかけて着実な成長が見込まれます。鉄道輸送は、収益シェアこそ小さいもの、特に重量物やバルク貨物の長距離輸送に不可欠な輸送手段でもあります。鉄道輸送分野は、鉄道インフラへの投資の増加と持続可能な輸送ソリューションの必要性により、2024年から2032年にかけて緩やかな成長が見込まれます。

在庫管理別:市場セグメンテーション

流通ロジスティクス市場は、在庫管理別にジャストインタイム(JIT)在庫、倉庫管理、ドロップシッピング、ベンダー管理在庫(VMI)に区分されます。2023年には、保管スペースに対する大きな需要と効率的な在庫管理ソリューションの必要性から、倉庫管理が最も高い売上シェアを占めました。eコマースの成長とオムニチャネル小売へのシフトは、フルフィルメントセンターと配送ハブの需要を増加させ、高度な倉庫ソリューションの必要性を促進しています。アマゾン、ウォルマート、アリババのような企業は、eコマース事業をサポートするために倉庫インフラに多額の投資を行っています。倉庫管理分野は、eコマースの継続的な成長と効率的な在庫管理ソリューションへの需要の高まりにより、2024年から2032年の予測期間中も優位を保つと予想されます。在庫レベルを最小化し、保有コストを削減することを目的としたジャストインタイム(JIT)在庫管理も、流通ロジスティクス市場に大きく貢献しています。費用対効果が高く効率的な在庫ソリューションの必要性から、JIT在庫管理の採用が増加しています。JIT在庫管理分野は、リーン生産と効率的なサプライチェーン管理の重視が高まっていることから、2024年から2032年にかけて大きな成長が見込まれています。小売業者がサプライヤーから直接注文を受けるドロップシッピングも、流通ロジスティクス市場の牽引役となっています。ドロップシッピング分野は、eコマースの台頭と柔軟な在庫管理ソリューションへのニーズによって、2024年から2032年にかけてCAGR 11.8%で成長する見込みです。サプライヤーが小売業者に代わって在庫レベルを管理するベンダー管理在庫(VMI)も、効率的な補充を可能にし、在庫切れを減らす重要な在庫管理ソリューションです。VMI分野は、協調的なサプライチェーン慣行の採用の増加と効率的な在庫管理の必要性により、2024年から2032年までのCAGRが9.6%と予測され、着実な成長が見込まれています。

地理的動向

流通ロジスティクス市場は地理的な変動が大きく、地域によって成長と収益貢献のレベルが異なります。2023年には、アジア太平洋地域が最も高い収益シェアを占めました。これは、中国、インド、日本などの国々における大幅な経済成長と効率的なロジスティクスサービスに対する需要の高まりによるものです。これらの国々における急速な工業化、都市化、eコマースの台頭は、ロジスティクス・プロバイダーに大きなビジネスチャンスをもたらしています。特に中国は、世界貿易と製造業の主要拠点となり、堅牢な流通ロジスティクスネットワークへの需要を牽引しています。アジア太平洋地域は、継続的な経済成長と物流インフラへの投資の増加により、2024年から2032年の予測期間中も優位を保つと予想されます。北米は、収益シェアこそ小さいもの、高度なロジスティクス・ソリューションに対する需要の高まりとeコマースの成長により、予測期間中に最も高いCAGRを記録すると予想されます。北米の流通ロジスティクス市場は、テクノロジーとインフラへの多額の投資が特徴で、アマゾン、フェデックス、UPSなどの企業がロジスティクスのイノベーションを先導しています。物流インフラが確立している欧州も、流通ロジスティクス市場に大きく貢献しています。この地域は強力なロジスティクス・ネットワークと高度なロジスティクス技術を特徴としており、国境を越えた効率的な商品の移動を支えています。欧州の流通ロジスティクス市場は、持続可能性を重視する傾向が強まり、国境を越えた貿易をサポートする効率的なロジスティクス・ソリューションの必要性が高まっていることから、2024年から2032年の予測期間中にCAGRが予測され、着実な成長が見込まれています。中東・アフリカは、規模こそ小さいもの、物流インフラへの投資の増加と効率的なサプライチェーン・ソリューションへの需要の高まりにより、同市場に大きな成長機会をもたらしています。同地域は、継続的な経済発展とロジスティクス・イノベーションへの注目の高まりによって成長が見込まれています。

競合動向

流通ロジスティクス市場は競争が激しく、主要企業は競争力を獲得し、市場での地位を高めるためにさまざまな戦略を採用しています。2023年には、DHL、FedEx、UPS、DBシェンカー、C.H. Robinson、DSV Panalpina、Kuehne+Nagelなどの大手ロジスティクス・プロバイダーが、広範なロジスティクス・ネットワーク、先進技術、包括的なサービス提供を活用して、引き続き市場を独占しています。これらの企業は、フルフィルメントセンター、配送ハブ、輸送フリートなどのロジスティクス・インフラに多額の投資を行い、世界な事業をサポートしています。例えば、DHLは2023年、戦略的立地に新たなフルフィルメントセンターを開設してロジスティクスネットワークを拡大し、eコマースロジスティクスに対する需要の高まりに対応する能力を強化しました。同様に、フェデックスもロジスティクス・インフラへの投資を継続し、自動化とデジタル技術への大規模な投資により、業務効率の向上と顧客サービスの改善を図った。UPSは、配送ステーションの広範なネットワークと地元の宅配業者との提携を活用して、ラストマイル配送能力の拡大に注力しました。一方、DBシェンカーは、持続可能性とデジタルトランスフォーメーションを重視し、グリーン・ロジスティクス・ソリューションと革新的なテクノロジーを業務に統合することで、環境への影響を低減し、サービス品質を向上させました。XPO Logistics、Kuehne+Nagel、Ceva Logisticsなどその他の主要企業も、市場での存在感を強化するために戦略的イニシアチブを採用しました。例えばXPO Logisticsはコントラクト・ロジスティクスとeコマース・フルフィルメント・サービスの拡大に注力し、Kuehne+Nagelはサプライチェーンの可視性と効率性を高めるデジタル・ロジスティクス・ソリューションに投資しました。一方、セバ・ロジスティクスは、地理的拡大とサービスの多様化戦略を追求し、新たな市場に参入し、進化する顧客のニーズに応えるため、より広範なロジスティクス・ソリューションを提供しました。全体として、2023年の市場情勢の競合情勢は、各社が差別化を図り、成長市場でより大きなシェアを獲得しようとする中で、技術、インフラ、持続可能性への大規模な投資が特徴的でした。

本レポートでお答えする主な質問

流通ロジスティクス市場の成長に影響を与えている主要なミクロおよびマクロ環境要因は何か?

現在および予測期間中の製品セグメントと地域に関する主な投資ポケットは?

2032年までの推定推計・市場予測

予測期間中にCAGRが最も速いセグメントは?

市場シェアの大きいセグメントとその理由は?

中低所得国は流通ロジスティクス市場に投資しているか?

流通ロジスティクス市場で最大の地域市場はどこか?

アジア太平洋、ラテンアメリカ、中東・アフリカなどの新興市場における市場動向と力学は?

流通ロジスティクス市場の成長を促進する主要動向は?

世界の流通ロジスティクス市場で存在感を高めるための主要な競合企業とその主要戦略とは?

目次

第1章 序文

- レポート内容

- レポートの目的

- 対象者

- 主な提供

- 市場セグメンテーション

- 調査手法

- フェーズⅠ-二次調査

- フェーズⅡ-一次調査

- フェーズⅢ-有識者レビュー

- 前提条件

- 採用したアプローチ

第2章 エグゼクティブサマリー

第3章 流通ロジスティクス市場:競合分析

- 主要ベンダーの市場ポジショニング

- ベンダーが採用した戦略

- 主要な産業戦略

第4章 流通ロジスティクス市場:マクロ分析と市場力学

- イントロダクション

- 世界の流通ロジスティクス市場金額 2022-2032

- 市場力学

- 市場促進要因

- 市場抑制要因

- 主な課題

- 主な機会

- 促進要因と抑制要因の影響分析

- シーソー分析

- ポーターのファイブフォースモデル

- サプライヤーパワー

- バイヤーパワー

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- PESTEL分析

- 政治情勢

- 経済情勢

- テクノロジーの情勢

- 法的な情勢

- 社会情勢

第5章 流通ロジスティクス市場:タイプ別 2022-2032

- 市場概要

- 成長・収益分析:2023 vs 2032

- 市場セグメンテーション

- ソリューション

- サービス

第6章 流通ロジスティクス市場:輸送形態別 2022-2032

- 市場概要

- 成長・収益分析:2023 vs 2032

- 市場セグメンテーション

- 道路輸送

- 鉄道輸送

- 航空貨物

- 海上輸送

第7章 流通ロジスティクス市場:在庫管理別 2022-2032

- 市場概要

- 成長・収益分析:2023 vs 2032

- 市場セグメンテーション

- ジャストインタイム在庫

- 倉庫保管

- ドロップシッピング

- ベンダー管理在庫

第8章 流通ロジスティクス市場:流通チャネル別 2022-2032

- 市場概要

- 成長・収益分析:2023 vs 2032

- 市場セグメンテーション

- 消費者に直接販売

- 小売店

- 卸売業者

- eコマース

第9章 流通ロジスティクス市場:最終用途別 2022-2032

- 市場概要

- 成長・収益分析:2023 vs 2032

- 市場セグメンテーション

- ヘルスケア

- 製造業

- 航空宇宙

- 通信

- 政府・公共事業

- 銀行・金融サービス

- 小売り

- メディアとエンターテイメント

- 貿易と輸送

- その他

第10章 北米の流通ロジスティクス市場 2022-2032

- 市場概要

- 流通ロジスティクス市場:タイプ別 2022-2032

- 流通ロジスティクス市場:輸送形態別 2022-2032

- 流通ロジスティクス市場:在庫管理別 2022-2032

- 流通ロジスティクス市場:流通チャネル別 2022-2032

- 流通ロジスティクス市場:最終用途別 2022-2032

- 流通ロジスティクス市場:地域別 2022-2032

- 北米

- 米国

- カナダ

- その他北米地域

- 北米

第11章 英国と欧州連合の流通ロジスティクス市場 2022-2032

- 市場概要

- 流通ロジスティクス市場:タイプ別 2022-2032

- 流通ロジスティクス市場:輸送形態別 2022-2032

- 流通ロジスティクス市場:在庫管理別 2022-2032

- 流通ロジスティクス市場:流通チャネル別 2022-2032

- 流通ロジスティクス市場:最終用途別 2022-2032

- 流通ロジスティクス市場:地域別 2022-2032

- 英国と欧州連合

- 英国

- ドイツ

- スペイン

- イタリア

- フランス

- その他欧州地域

- 英国と欧州連合

第12章 アジア太平洋の流通ロジスティクス市場 2022-2032

- 市場概要

- 流通ロジスティクス市場:タイプ別 2022-2032

- 流通ロジスティクス市場:輸送形態別 2022-2032

- 流通ロジスティクス市場:在庫管理別 2022-2032

- 流通ロジスティクス市場:流通チャネル別 2022-2032

- 流通ロジスティクス市場:最終用途別 2022-2032

- 流通ロジスティクス市場:地域別 2022-2032

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- アジア太平洋地域

第13章 ラテンアメリカの流通ロジスティクス市場 2022-2032

- 市場概要

- 流通ロジスティクス市場:タイプ別 2022-2032

- 流通ロジスティクス市場:輸送形態別 2022-2032

- 流通ロジスティクス市場:在庫管理別 2022-2032

- 流通ロジスティクス市場:流通チャネル別 2022-2032

- 流通ロジスティクス市場:最終用途別 2022-2032

- 流通ロジスティクス市場:地域別 2022-2032

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ地域

- ラテンアメリカ

第14章 中東・アフリカの流通ロジスティクス市場 2022-2032

- 市場概要

- 流通ロジスティクス市場:タイプ別 2022-2032

- 流通ロジスティクス市場:輸送形態別 2022-2032

- 流通ロジスティクス市場:在庫管理別 2022-2032

- 流通ロジスティクス市場:流通チャネル別 2022-2032

- 流通ロジスティクス市場:最終用途別 2022-2032

- 流通ロジスティクス市場:地域別 2022-2032

- 中東・アフリカ

- GCC

- アフリカ

- その他中東・アフリカ地域

- 中東・アフリカ

第15章 企業プロファイル

- DHL

- FedEx

- UPS

- DB Schenker

- C.H. Robinson

- DSV Panalpina

- Kuehne+Nagel

- その他の主要企業

List of Tables

- TABLE 1 Global Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 2 Global Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 3 Global Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 4 Global Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 5 Global Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 6 North America Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 7 North America Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 8 North America Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 9 North America Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 10 North America Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 11 U.S. Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 12 U.S. Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 13 U.S. Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 14 U.S. Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 15 U.S. Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 16 Canada Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 17 Canada Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 18 Canada Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 19 Canada Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 20 Canada Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 21 Rest of North America Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 22 Rest of North America Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 23 Rest of North America Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 24 Rest of North America Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 25 Rest of North America Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 26 UK and European Union Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 27 UK and European Union Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 28 UK and European Union Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 29 UK and European Union Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 30 UK and European Union Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 31 UK Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 32 UK Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 33 UK Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 34 UK Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 35 UK Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 36 Germany Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 37 Germany Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 38 Germany Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 39 Germany Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 40 Germany Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 41 Spain Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 42 Spain Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 43 Spain Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 44 Spain Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 45 Spain Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 46 Italy Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 47 Italy Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 48 Italy Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 49 Italy Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 50 Italy Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 51 France Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 52 France Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 53 France Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 54 France Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 55 France Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 56 Rest of Europe Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 57 Rest of Europe Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 58 Rest of Europe Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 59 Rest of Europe Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 60 Rest of Europe Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 61 Asia Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 62 Asia Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 63 Asia Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 64 Asia Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 65 Asia Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 66 China Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 67 China Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 68 China Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 69 China Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 70 China Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 71 Japan Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 72 Japan Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 73 Japan Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 74 Japan Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 75 Japan Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 76 India Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 77 India Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 78 India Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 79 India Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 80 India Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 81 Australia Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 82 Australia Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 83 Australia Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 84 Australia Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 85 Australia Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 86 South Korea Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 87 South Korea Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 88 South Korea Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 89 South Korea Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 90 South Korea Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 91 Latin America Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 92 Latin America Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 93 Latin America Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 94 Latin America Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 95 Latin America Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 96 Brazil Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 97 Brazil Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 98 Brazil Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 99 Brazil Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 100 Brazil Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 101 Mexico Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 102 Mexico Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 103 Mexico Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 104 Mexico Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 105 Mexico Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 106 Rest of Latin America Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 107 Rest of Latin America Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 108 Rest of Latin America Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 109 Rest of Latin America Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 110 Rest of Latin America Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 111 Middle East and Africa Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 112 Middle East and Africa Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 113 Middle East and Africa Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 114 Middle East and Africa Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 115 Middle East and Africa Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 116 GCC Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 117 GCC Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 118 GCC Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 119 GCC Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 120 GCC Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 121 Africa Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 122 Africa Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 123 Africa Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 124 Africa Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 125 Africa Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

- TABLE 126 Rest of Middle East and Africa Distribution Logistics Market By Type, 2022-2032, USD (Million)

- TABLE 127 Rest of Middle East and Africa Distribution Logistics Market By Transportation, 2022-2032, USD (Million)

- TABLE 128 Rest of Middle East and Africa Distribution Logistics Market By Inventory Management, 2022-2032, USD (Million)

- TABLE 129 Rest of Middle East and Africa Distribution Logistics Market By Distribution Channel, 2022-2032, USD (Million)

- TABLE 130 Rest of Middle East and Africa Distribution Logistics Market By End-Use, 2022-2032, USD (Million)

List of Figures

- FIG. 1 Global Distribution Logistics Market: Market Coverage

- FIG. 2 Research Methodology and Data Sources

- FIG. 3 Market Size Estimation - Top Down & Bottom-Up Approach

- FIG. 4 Global Distribution Logistics Market: Quality Assurance

- FIG. 5 Global Distribution Logistics Market, By Type, 2023

- FIG. 6 Global Distribution Logistics Market, By Transportation, 2023

- FIG. 7 Global Distribution Logistics Market, By Inventory Management, 2023

- FIG. 8 Global Distribution Logistics Market, By Distribution Channel, 2023

- FIG. 9 Global Distribution Logistics Market, By End-Use, 2023

- FIG. 10 Global Distribution Logistics Market, By Geography, 2023

- FIG. 11 Market Geographical Opportunity Matrix - Global Distribution Logistics Market, 2023

FIG. 12Market Positioning of Key Distribution Logistics Market Players, 2023

FIG. 13Global Distribution Logistics Market - Tier Analysis - Percentage of Revenues by Tier Level, 2023 Versus 2032

- FIG. 14 Global Distribution Logistics Market, By Type, 2023 Vs 2032, %

- FIG. 15 Global Distribution Logistics Market, By Transportation, 2023 Vs 2032, %

- FIG. 16 Global Distribution Logistics Market, By Inventory Management, 2023 Vs 2032, %

- FIG. 17 Global Distribution Logistics Market, By Distribution Channel, 2023 Vs 2032, %

- FIG. 18 Global Distribution Logistics Market, By End-Use, 2023 Vs 2032, %

- FIG. 19 U.S. Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 20 Canada Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 21 Rest of North America Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 22 UK Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 23 Germany Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 24 Spain Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 25 Italy Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 26 France Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 27 Rest of Europe Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 28 China Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 29 Japan Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 30 India Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 31 Australia Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 32 South Korea Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 33 Rest of Asia Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 34 Brazil Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 35 Mexico Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 36 Rest of Latin America Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 37 GCC Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 38 Africa Distribution Logistics Market (US$ Million), 2022 - 2032

- FIG. 39 Rest of Middle East and Africa Distribution Logistics Market (US$ Million), 2022 - 2032

The distribution logistics market is expected to grow at a CAGR of 5.5% during the forecast period of 2024 to 2032, ensuring the efficient movement and storage of goods from manufacturers to consumers. This market encompasses a wide range of activities, including transportation, warehousing, inventory management, and order fulfillment. The growing complexity of global trade, coupled with the increasing demand for faster and more reliable delivery services, has driven significant growth in the distribution logistics sector. The rise of e-commerce has further accelerated this growth, creating new opportunities and challenges for logistics providers. Technological advancements, such as automation, artificial intelligence, and the Internet of Things (IoT), are transforming the industry, enabling more efficient operations and improved customer service. However, the market also faces challenges, including high operational costs, regulatory compliance, and the need for sustainable practices. Despite these challenges, the distribution logistics market is expected to continue its robust growth, driven by the ongoing expansion of global trade and the increasing emphasis on efficient supply chain management. The ongoing growth of e-commerce and the increasing adoption of digital logistics solutions are expected to drive the market's expansion, with significant opportunities in regions such as North America, Europe, and Asia Pacific. Despite challenges such as high operational costs and regulatory compliance, the distribution logistics market is expected to continue its robust growth, supported by the ongoing evolution of global trade and the increasing emphasis on supply chain efficiency and sustainability.

Key Market Drivers

E-commerce Expansion

The rapid growth of e-commerce has been one of the most significant drivers of the distribution logistics market. The global e-commerce sector has seen exponential growth over the past decade, driven by increasing internet penetration, rising consumer preference for online shopping, and advancements in digital payment solutions. In 2023, global e-commerce sales were estimated to have reached $5.7 trillion, reflecting the increasing reliance on online retail. This surge in online shopping has created a massive demand for efficient distribution logistics to ensure timely and accurate delivery of goods. E-commerce giants like Amazon, Alibaba, and Walmart have heavily invested in their logistics infrastructure, setting new benchmarks for delivery speed and reliability. Amazon, for instance, has established an extensive network of fulfilment centers, delivery stations, and last-mile delivery services to meet the growing demand. The company's logistics network handled approximately 2.5 billion packages in 2023, underscoring the scale of operations required to support its e-commerce business. Furthermore, the rise of omnichannel retailing, where retailers integrate their online and offline channels, has increased the complexity of distribution logistics. Retailers must now manage inventory across multiple channels, optimize order fulfilment, and provide seamless customer experiences. This complexity drives the need for advanced logistics solutions, including real-time inventory tracking, automated warehousing, and efficient last-mile delivery. The e-commerce boom is expected to continue, with global e-commerce sales projected to grow at a CAGR of 14.7% from 2024 to 2032, further fueling the demand for distribution logistics services.

Technological Advancements

Technological advancements are transforming the distribution logistics market, driving efficiency, accuracy, and transparency. Automation, artificial intelligence (AI), and the Internet of Things (IoT) are among the key technologies reshaping the industry. Automation in warehousing and distribution centers, through the use of robotics and conveyor systems, enhances operational efficiency by reducing manual labor and minimizing errors. For example, companies like DHL and FedEx have implemented automated sorting systems and robotic picking solutions to streamline their operations. These technologies enable faster order processing and improved accuracy, meeting the high expectations of e-commerce customers. AI and machine learning algorithms are being leveraged to optimize various aspects of logistics, including route planning, demand forecasting, and inventory management. AI-driven predictive analytics helps logistics providers anticipate demand fluctuations, optimize inventory levels, and reduce costs. For instance, UPS uses AI to optimize its delivery routes, reducing fuel consumption and improving delivery times. IoT technology enables real-time tracking and monitoring of shipments, providing visibility into the entire supply chain. Smart sensors and GPS devices embedded in trucks and containers transmit data on location, temperature, and condition of goods, allowing for proactive management and timely interventions. Companies like Maersk and CMA CGM are utilizing IoT to enhance their container tracking capabilities, ensuring the safe and efficient transport of goods. The adoption of blockchain technology is also gaining traction in distribution logistics, providing a secure and transparent way to record transactions and track shipments. Blockchain enables end-to-end visibility and traceability, reducing the risk of fraud and improving supply chain security. These technological advancements are expected to continue driving the growth of the distribution logistics market, as companies seek to enhance their operational efficiency and meet the evolving demands of customers.

Global Trade Expansion

The expansion of global trade is another key driver of the distribution logistics market. The increasing globalization of economies, coupled with trade liberalization policies and advancements in transportation infrastructure, has facilitated the movement of goods across borders. In 2023, global trade volumes were estimated to have grown by 3.5%, reflecting the recovery from the disruptions caused by the COVID-19 pandemic. The growth in global trade has created a significant demand for efficient logistics services to support the movement of goods between countries. Major trade agreements, such as the North American Free Trade Agreement (NAFTA) and the European Union's Single Market, have contributed to the growth of cross-border trade, driving the need for robust distribution logistics networks. The rise of emerging markets, particularly in Asia and Africa, has also contributed to the expansion of global trade. Countries like China, India, and Vietnam have become major manufacturing hubs, producing a wide range of goods for export to global markets. This has led to the development of extensive logistics networks to facilitate the movement of goods from manufacturing centers to international markets. Companies like DHL and DB Schenker have expanded their presence in these regions, investing in logistics infrastructure and services to support the growing trade volumes. Additionally, the increasing complexity of global supply chains, with multiple suppliers and production locations, has heightened the need for efficient logistics solutions to manage the flow of goods. The use of advanced logistics technologies, such as automated warehousing, real-time tracking, and data analytics, is essential to ensure the smooth and efficient movement of goods across borders. The expansion of global trade is expected to continue, driven by economic growth, trade liberalization, and advancements in transportation infrastructure, further boosting the demand for distribution logistics services.

Market Restraint

High Operational Costs

High operational costs pose a significant restraint to the distribution logistics market. Logistics operations involve various cost components, including transportation, warehousing, labor, and fuel. The rising cost of fuel, in particular, has a direct impact on transportation expenses, which constitute a significant portion of logistics costs. For instance, in 2023, the average global price of crude oil increased by approximately 20% compared to the previous year, leading to higher fuel prices. This increase in fuel costs directly affects the profitability of logistics providers, as transportation expenses rise. Additionally, the logistics industry faces labor shortages and increasing labor costs, particularly in regions with high demand for skilled workers. The shortage of truck drivers in the United States and Europe has been a persistent issue, leading to higher wages and increased recruitment costs. According to the American Trucking Association (ATA), the trucking industry in the U.S. faced a shortage of approximately 80,000 drivers in 2023. This shortage drives up labor costs and impacts the efficiency of logistics operations. Warehousing costs have also been on the rise, driven by the increasing demand for storage space and the need for advanced warehousing solutions. The growth of e-commerce and the shift towards omnichannel retailing have led to a surge in demand for fulfillment centers and distribution hubs. This increased demand for warehousing space has driven up rental rates and operational costs. Additionally, the logistics industry must invest in advanced technologies and infrastructure to enhance operational efficiency and meet customer expectations. While these investments are essential for long-term growth, they also contribute to the overall cost burden on logistics providers. Companies must navigate these cost challenges while maintaining competitive pricing and ensuring profitability. Effective cost management strategies, such as optimizing transportation routes, improving fuel efficiency, and leveraging automation, are crucial for logistics providers to mitigate the impact of high operational costs.

Market Segmentation by Distribution Channel

The distribution logistics market is segmented by distribution channel into direct-to-consumers, retail stores, wholesalers, and e-commerce. Among these, e-commerce held the highest revenue in 2023, driven by the rapid growth of online shopping and the increasing demand for efficient last-mile delivery services. The rise of e-commerce giants like Amazon, Alibaba, and JD.com has revolutionized the distribution logistics landscape, setting new standards for delivery speed and reliability. In 2023, the global e-commerce logistics market was valued at approximately $320 billion, reflecting the substantial investment in logistics infrastructure and services to support the booming e-commerce sector. The e-commerce segment is expected to witness the highest CAGR during the forecast period of 2024 to 2032, driven by the ongoing expansion of online retail and the increasing adoption of digital payment solutions. The direct-to-consumer (DTC) segment also contributes significantly to the distribution logistics market, as manufacturers and brands increasingly adopt DTC models to enhance customer engagement and control over their supply chains. Retail stores, while facing challenges from the rise of e-commerce, continue to play a vital role in the distribution logistics market, particularly in regions with strong brick-and-mortar retail presence. Wholesalers, which act as intermediaries between manufacturers and retailers, remain a critical distribution channel, providing bulk distribution and inventory management services. The growth of e-commerce and the shift towards omnichannel retailing are driving significant investments in logistics infrastructure and technologies to support seamless and efficient distribution across multiple channels.

Market Segmentation by End Use

The distribution logistics market is segmented by end-use into healthcare, manufacturing, aerospace, telecommunication, government and public utilities, banking and financial services, retail, media and entertainment, trade and transportation, and others. In 2023, the retail segment accounted for the highest revenue share, driven by the significant demand for efficient logistics services to support the retail supply chain. The rise of e-commerce and omnichannel retailing has created complex logistics requirements, necessitating advanced distribution solutions to ensure timely and accurate delivery of goods. Retailers are investing heavily in logistics infrastructure, including fulfillment centers, distribution hubs, and last-mile delivery services, to meet the high expectations of customers. The retail segment is expected to continue its dominance from 2024 to 2032, driven by the ongoing growth of e-commerce and the increasing emphasis on efficient supply chain management. The healthcare segment is also a significant contributor to the distribution logistics market, driven by the need for specialized logistics solutions for the transportation and storage of pharmaceuticals, medical devices, and healthcare products. The COVID-19 pandemic highlighted the critical importance of efficient healthcare logistics, with the global distribution of vaccines and medical supplies requiring robust logistics infrastructure. The aerospace segment, while smaller in revenue share, is expected to witness significant growth, driven by the increasing demand for aircraft parts and components, as well as the need for efficient logistics solutions to support the aerospace supply chain. The telecommunication segment also contributes to the distribution logistics market, driven by the need for efficient logistics services to support the deployment and maintenance of telecommunication infrastructure. The government and public utilities segment, while smaller in size, requires specialized logistics solutions for the transportation and storage of essential goods and equipment. The banking and financial services segment relies on efficient logistics services for the secure transportation of cash and valuable documents. The media and entertainment segment, driven by the distribution of media content and equipment, also contributes to the distribution logistics market. The trade and transportation segment, encompassing various industries involved in the movement of goods, is a significant contributor to the market, driven by the need for efficient logistics solutions to support global trade.

Market Segmentation by Type

The distribution logistics market is segmented by type into solutions and services. In 2023, the services segment accounted for the highest revenue share, driven by the significant demand for logistics services, including transportation, warehousing, and order fulfilment. Logistics service providers, such as DHL, FedEx, and UPS, play a critical role in the distribution logistics market, offering a wide range of services to support the efficient movement and storage of goods. These companies have invested heavily in logistics infrastructure and technologies to enhance their service capabilities and meet the evolving demands of customers. The services segment is expected to continue its dominance from 2024 to 2032, driven by the ongoing growth of e-commerce and the increasing demand for efficient logistics services. The solution segment, which includes logistics software and technology solutions, also contributes significantly to the distribution logistics market, driven by the need for advanced technologies to enhance operational efficiency and improve supply chain visibility. The adoption of logistics software, such as transportation management systems (TMS), warehouse management systems (WMS), and supply chain management (SCM) solutions, is increasing as companies seek to optimize their logistics operations and gain a competitive edge. The solution segment is expected to witness significant growth, during the forecast period of 2024 to 2032, driven by the increasing adoption of digital technologies and the need for integrated logistics solutions.

Market Segmentation by Transportation

The distribution logistics market is segmented by transportation mode into road transport, rail transport, air freight, and sea freight. In 2023, road transport accounted for the highest revenue share, driven by the extensive use of trucks for the transportation of goods over short and medium distances. Road transport is the most flexible and widely used mode of transportation, offering door-to-door delivery and the ability to handle various types of cargo. The growth of e-commerce and the increasing demand for last-mile delivery services have further boosted the demand for road transport. The road transport segment is expected to continue its dominance, with a projected CAGR of 9.5% from 2024 to 2032, driven by the ongoing growth of e-commerce and the need for efficient last-mile delivery solutions. Air freight, while smaller in revenue share, is expected to witness the highest CAGR during the forecast period, driven by the increasing demand for fast and reliable transportation of high-value and time-sensitive goods. The air freight segment is expected to grow during the forecast period of 2024 to 2032, driven by the rising demand for expedited delivery services and the increasing globalization of trade. Sea freight, which is the most cost-effective mode of transportation for bulk goods and long-distance shipments, also contributes significantly to the distribution logistics market. The growth of global trade and the increasing demand for containerized shipping are driving the demand for sea freight services. The sea freight segment is expected to witness steady growth from 2024 to 2032, driven by the ongoing expansion of global trade and the need for efficient transportation of bulk goods. Rail transport, while smaller in revenue share, is also a critical mode of transportation, particularly for the movement of heavy and bulk goods over long distances. The rail transport segment is expected to witness moderate growth from 2024 to 2032, driven by the increasing investment in rail infrastructure and the need for sustainable transportation solutions.

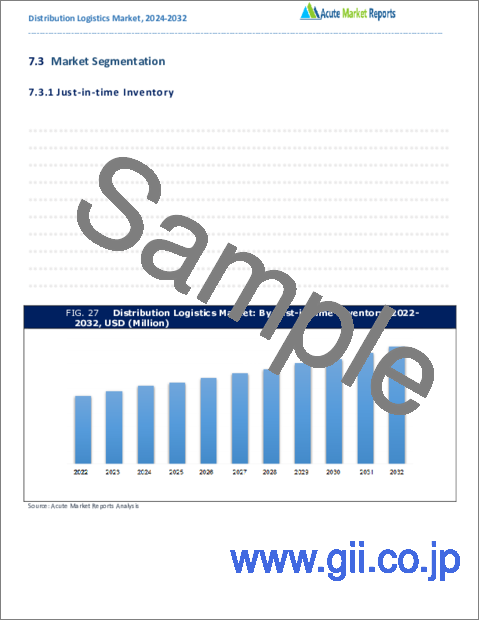

Market Segmentation by Inventory Management

The distribution logistics market is segmented by inventory management into just-in-time (JIT) inventory, warehousing, drop shipping, and vendor-managed inventory (VMI). In 2023, warehousing accounted for the highest revenue share, driven by the significant demand for storage space and the need for efficient inventory management solutions. The growth of e-commerce and the shift towards omnichannel retailing have increased the demand for fulfillment centers and distribution hubs, driving the need for advanced warehousing solutions. Companies like Amazon, Walmart, and Alibaba have invested heavily in their warehousing infrastructure to support their e-commerce operations. The warehousing segment is expected to continue its dominance, during the forecast period of 2024 to 2032, driven by the ongoing growth of e-commerce and the increasing demand for efficient inventory management solutions. Just-in-time (JIT) inventory management, which aims to minimize inventory levels and reduce holding costs, also contributes significantly to the distribution logistics market. The adoption of JIT inventory management is increasing, driven by the need for cost-effective and efficient inventory solutions. The JIT inventory management segment is expected to witness significant growth from 2024 to 2032, driven by the increasing emphasis on lean manufacturing and efficient supply chain management. Drop shipping, which allows retailers to fulfill orders directly from suppliers, is also gaining traction in the distribution logistics market. The drop shipping segment is expected to grow at a CAGR of 11.8% from 2024 to 2032, driven by the rise of e-commerce and the need for flexible inventory management solutions. Vendor-managed inventory (VMI), where suppliers manage inventory levels on behalf of retailers, is also a critical inventory management solution, enabling efficient replenishment and reducing stockouts. The VMI segment is expected to witness steady growth, with a projected CAGR of 9.6% from 2024 to 2032, driven by the increasing adoption of collaborative supply chain practices and the need for efficient inventory management.

Geographic Trends

The distribution logistics market exhibits significant geographic variations, with different regions showing varying levels of growth and revenue contribution. In 2023, the Asia-Pacific region accounted for the highest revenue share, driven by substantial economic growth and the increasing demand for efficient logistics services in countries like China, India, and Japan. The rapid industrialization, urbanization, and the rise of e-commerce in these countries have created significant opportunities for logistics providers. China, in particular, has become a major hub for global trade and manufacturing, driving the demand for robust distribution logistics networks. The Asia-Pacific region is expected to continue its dominance during the forecast period of 2024 to 2032, driven by the ongoing economic growth and the increasing investment in logistics infrastructure. North America, while smaller in revenue share, is expected to witness the highest CAGR during the forecast period, driven by the increasing demand for advanced logistics solutions and the growth of e-commerce. The North American distribution logistics market is characterized by significant investment in technology and infrastructure, with companies like Amazon, FedEx, and UPS leading the way in logistics innovation. Europe, which has a well-established logistics infrastructure, also contributes significantly to the distribution logistics market. The region is characterized by strong logistics networks and advanced logistics technologies, supporting the efficient movement of goods across borders. The European distribution logistics market is expected to witness steady growth, with a projected CAGR during the forecast period of 2024 to 2032, driven by the increasing emphasis on sustainability and the need for efficient logistics solutions to support cross-border trade. The Middle East and Africa, while smaller in size, also present significant growth opportunities for the distribution logistics market, driven by the increasing investment in logistics infrastructure and the growing demand for efficient supply chain solutions. The region is expected to grow driven by the ongoing economic development and the increasing focus on logistics innovation.

Competitive Trends

The distribution logistics market is highly competitive, with key players adopting various strategies to gain a competitive edge and enhance their market position. In 2023, leading logistics providers like DHL, FedEx, UPS, DB Schenker, C.H. Robinson, DSV Panalpina, and Kuehne + Nagel continued to dominate the market, leveraging their extensive logistics networks, advanced technologies, and comprehensive service offerings. These companies have invested heavily in logistics infrastructure, including fulfillmentcenters, distribution hubs, and transportation fleets, to support their global operations. For instance, in 2023, DHL expanded its logistics network by opening new fulfillment centers in strategic locations, enhancing its capability to meet the growing demand for e-commerce logistics. Similarly, FedEx continued to invest in its logistics infrastructure, with significant investments in automation and digital technologies to enhance operational efficiency and improve customer service. UPS focused on expanding its last-mile delivery capabilities, leveraging its extensive network of delivery stations and partnerships with local couriers. DB Schenker, on the other hand, emphasized sustainability and digital transformation, integrating green logistics solutions and innovative technologies into its operations to reduce environmental impact and improve service quality. Other notable players, such as XPO Logistics, Kuehne + Nagel, and Ceva Logistics, also adopted strategic initiatives to strengthen their market presence. XPO Logistics, for example, focused on expanding its contract logistics and e-commerce fulfillment services, while Kuehne + Nagel invested in digital logistics solutions to enhance supply chain visibility and efficiency. Ceva Logistics, meanwhile, pursued a strategy of geographic expansion and service diversification, entering new markets and offering a broader range of logistics solutions to meet the evolving needs of customers. Overall, the competitive landscape of the distribution logistics market in 2023 was characterized by significant investments in technology, infrastructure, and sustainability, as companies sought to differentiate themselves and capture a larger share of the growing market.

Historical & Forecast Period

This study report represents an analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends & technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. The key data points that enable the estimation of Distribution Logistics market are as follows:

Research and development budgets of manufacturers and government spending

Revenues of key companies in the market segment

Number of end users & consumption volume, price, and value.

Geographical revenues generated by countries considered in the report

Micro and macro environment factors that are currently influencing the Distribution Logistics market and their expected impact during the forecast period.

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top-down and bottom-up approach for validation of market estimation assures logical, methodical, and mathematical consistency of the quantitative data.

Market Segmentation

Type

- Solution

- Services

Transportation

- Road Transport

- Rail Transport

- Air Freight

- Sea Freight

Inventory Management

- Just-in-time Inventory

- Warehousing

- Drop Shipping

- Vendor Managed Inventory

Distribution Channel

- Direct to Consumers

- Retail Stores

- Wholesalers

- E-Commerce

End-Use

- Healthcare

- Manufacturing

- Aerospace

- Telecommunication

- Government and public utilities

- Banking and financial services

- Retail

- Media and entertainment

- Trade and Transportation

- Others

Region Segment (2022-2032; US$ Million)

North America

U.S.

Canada

Rest of North America

UK and European Union

UK

Germany

Spain

Italy

France

Rest of Europe

Asia Pacific

China

Japan

India

Australia

South Korea

Rest of Asia Pacific

Latin America

Brazil

Mexico

Rest of Latin America

Middle East and Africa

GCC

Africa

Rest of Middle East and Africa

Key questions answered in this report

What are the key micro and macro environmental factors that are impacting the growth of Distribution Logistics market?

What are the key investment pockets concerning product segments and geographies currently and during the forecast period?

Estimated forecast and market projections up to 2032.

Which segment accounts for the fastest CAGR during the forecast period?

Which market segment holds a larger market share and why?

Are low and middle-income economies investing in the Distribution Logistics market?

Which is the largest regional market for Distribution Logistics market?

What are the market trends and dynamics in emerging markets such as Asia Pacific, Latin America, and Middle East & Africa?

Which are the key trends driving Distribution Logistics market growth?

Who are the key competitors and what are their key strategies to enhance their market presence in the Distribution Logistics market worldwide?

Table of Contents

1. Preface

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. Target Audience

- 1.1.3. Key Offerings

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.3.1. Phase I - Secondary Research

- 1.3.2. Phase II - Primary Research

- 1.3.3. Phase III - Expert Panel Review

- 1.3.4. Assumptions

- 1.3.5. Approach Adopted

2. Executive Summary

- 2.1. Market Snapshot: Global Distribution Logistics Market

- 2.2. Global Distribution Logistics Market, By Type, 2023 (US$ Million)

- 2.3. Global Distribution Logistics Market, By Transportation, 2023 (US$ Million)

- 2.4. Global Distribution Logistics Market, By Inventory Management, 2023 (US$ Million)

- 2.5. Global Distribution Logistics Market, By Distribution Channel, 2023 (US$ Million)

- 2.6. Global Distribution Logistics Market, By End-Use, 2023 (US$ Million)

- 2.7. Global Distribution Logistics Market, By Geography, 2023 (US$ Million)

- 2.8. Attractive Investment Proposition by Geography, 2023

3. Distribution Logistics Market: Competitive Analysis

- 3.1. Market Positioning of Key Distribution Logistics Market Vendors

- 3.2. Strategies Adopted by Distribution Logistics Market Vendors

- 3.3. Key Industry Strategies

4. Distribution Logistics Market: Macro Analysis & Market Dynamics

- 4.1. Introduction

- 4.2. Global Distribution Logistics Market Value, 2022 - 2032, (US$ Million)

- 4.3. Market Dynamics

- 4.3.1. Market Drivers

- 4.3.2. Market Restraints

- 4.3.3. Key Challenges

- 4.3.4. Key Opportunities

- 4.4. Impact Analysis of Drivers and Restraints

- 4.5. See-Saw Analysis

- 4.6. Porter's Five Force Model

- 4.6.1. Supplier Power

- 4.6.2. Buyer Power

- 4.6.3. Threat Of Substitutes

- 4.6.4. Threat Of New Entrants

- 4.6.5. Competitive Rivalry

- 4.7. PESTEL Analysis

- 4.7.1. Political Landscape

- 4.7.2. Economic Landscape

- 4.7.3. Technology Landscape

- 4.7.4. Legal Landscape

- 4.7.5. Social Landscape

5. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 5.1. Market Overview

- 5.2. Growth & Revenue Analysis: 2023 Versus 2032

- 5.3. Market Segmentation

- 5.3.1. Solution

- 5.3.2. Services

6. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 6.1. Market Overview

- 6.2. Growth & Revenue Analysis: 2023 Versus 2032

- 6.3. Market Segmentation

- 6.3.1. Road Transport

- 6.3.2. Rail Transport

- 6.3.3. Air Freight

- 6.3.4. Sea Freight

7. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 7.1. Market Overview

- 7.2. Growth & Revenue Analysis: 2023 Versus 2032

- 7.3. Market Segmentation

- 7.3.1. Just-in-time Inventory

- 7.3.2. Warehousing

- 7.3.3. Drop Shipping

- 7.3.4. Vendor Managed Inventory

8. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 8.1. Market Overview

- 8.2. Growth & Revenue Analysis: 2023 Versus 2032

- 8.3. Market Segmentation

- 8.3.1. Direct to Consumers

- 8.3.2. Retail Stores

- 8.3.3. Wholesalers

- 8.3.4. E-Commerce

9. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 9.1. Market Overview

- 9.2. Growth & Revenue Analysis: 2023 Versus 2032

- 9.3. Market Segmentation

- 9.3.1. Healthcare

- 9.3.2. Manufacturing

- 9.3.3. Aerospace

- 9.3.4. Telecommunication

- 9.3.5. Government and public utilities

- 9.3.6. Banking and financial services

- 9.3.7. Retail

- 9.3.8. Media and entertainment

- 9.3.9. Trade and Transportation

- 9.3.10. Others

10. North America Distribution Logistics Market, 2022-2032, USD (Million)

- 10.1. Market Overview

- 10.2. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 10.3. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 10.4. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 10.5. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 10.6. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 10.7.Distribution Logistics Market: By Region, 2022-2032, USD (Million)

- 10.7.1.North America

- 10.7.1.1. U.S.

- 10.7.1.1.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 10.7.1.1.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 10.7.1.1.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 10.7.1.1.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 10.7.1.1.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 10.7.1.2. Canada

- 10.7.1.2.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 10.7.1.2.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 10.7.1.2.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 10.7.1.2.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 10.7.1.2.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 10.7.1.3. Rest of North America

- 10.7.1.3.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 10.7.1.3.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 10.7.1.3.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 10.7.1.3.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 10.7.1.3.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 10.7.1.1. U.S.

- 10.7.1.North America

11. UK and European Union Distribution Logistics Market, 2022-2032, USD (Million)

- 11.1. Market Overview

- 11.2. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 11.3. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 11.4. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 11.5. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 11.6. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 11.7.Distribution Logistics Market: By Region, 2022-2032, USD (Million)

- 11.7.1.UK and European Union

- 11.7.1.1. UK

- 11.7.1.1.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 11.7.1.1.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 11.7.1.1.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 11.7.1.1.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 11.7.1.1.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 11.7.1.2. Germany

- 11.7.1.2.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 11.7.1.2.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 11.7.1.2.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 11.7.1.2.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 11.7.1.2.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 11.7.1.3. Spain

- 11.7.1.3.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 11.7.1.3.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 11.7.1.3.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 11.7.1.3.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 11.7.1.3.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 11.7.1.4. Italy

- 11.7.1.4.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 11.7.1.4.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 11.7.1.4.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 11.7.1.4.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 11.7.1.4.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 11.7.1.5. France

- 11.7.1.5.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 11.7.1.5.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 11.7.1.5.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 11.7.1.5.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 11.7.1.5.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 11.7.1.6. Rest of Europe

- 11.7.1.6.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 11.7.1.6.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 11.7.1.6.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 11.7.1.6.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 11.7.1.6.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 11.7.1.1. UK

- 11.7.1.UK and European Union

12. Asia Pacific Distribution Logistics Market, 2022-2032, USD (Million)

- 12.1. Market Overview

- 12.2. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 12.3. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 12.4. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 12.5. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 12.6. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 12.7.Distribution Logistics Market: By Region, 2022-2032, USD (Million)

- 12.7.1.Asia Pacific

- 12.7.1.1. China

- 12.7.1.1.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 12.7.1.1.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 12.7.1.1.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 12.7.1.1.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 12.7.1.1.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 12.7.1.2. Japan

- 12.7.1.2.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 12.7.1.2.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 12.7.1.2.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 12.7.1.2.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 12.7.1.2.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 12.7.1.3. India

- 12.7.1.3.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 12.7.1.3.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 12.7.1.3.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 12.7.1.3.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 12.7.1.3.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 12.7.1.4. Australia

- 12.7.1.4.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 12.7.1.4.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 12.7.1.4.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 12.7.1.4.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 12.7.1.4.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 12.7.1.5. South Korea

- 12.7.1.5.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 12.7.1.5.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 12.7.1.5.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 12.7.1.5.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 12.7.1.5.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 12.7.1.6. Rest of Asia Pacific

- 12.7.1.6.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 12.7.1.6.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 12.7.1.6.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 12.7.1.6.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 12.7.1.6.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 12.7.1.1. China

- 12.7.1.Asia Pacific

13. Latin America Distribution Logistics Market, 2022-2032, USD (Million)

- 13.1. Market Overview

- 13.2. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 13.3. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 13.4. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 13.5. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 13.6. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 13.7.Distribution Logistics Market: By Region, 2022-2032, USD (Million)

- 13.7.1.Latin America

- 13.7.1.1. Brazil

- 13.7.1.1.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 13.7.1.1.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 13.7.1.1.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 13.7.1.1.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 13.7.1.1.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 13.7.1.2. Mexico

- 13.7.1.2.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 13.7.1.2.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 13.7.1.2.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 13.7.1.2.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 13.7.1.2.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 13.7.1.3. Rest of Latin America

- 13.7.1.3.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 13.7.1.3.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 13.7.1.3.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 13.7.1.3.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 13.7.1.3.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 13.7.1.1. Brazil

- 13.7.1.Latin America

14. Middle East and Africa Distribution Logistics Market, 2022-2032, USD (Million)

- 14.1. Market Overview

- 14.2. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 14.3. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 14.4. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 14.5. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 14.6. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 14.7.Distribution Logistics Market: By Region, 2022-2032, USD (Million)

- 14.7.1.Middle East and Africa

- 14.7.1.1. GCC

- 14.7.1.1.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 14.7.1.1.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 14.7.1.1.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 14.7.1.1.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 14.7.1.1.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 14.7.1.2. Africa

- 14.7.1.2.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 14.7.1.2.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 14.7.1.2.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 14.7.1.2.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 14.7.1.2.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 14.7.1.3. Rest of Middle East and Africa

- 14.7.1.3.1. Distribution Logistics Market: By Type, 2022-2032, USD (Million)

- 14.7.1.3.2. Distribution Logistics Market: By Transportation, 2022-2032, USD (Million)

- 14.7.1.3.3. Distribution Logistics Market: By Inventory Management, 2022-2032, USD (Million)

- 14.7.1.3.4. Distribution Logistics Market: By Distribution Channel, 2022-2032, USD (Million)

- 14.7.1.3.5. Distribution Logistics Market: By End-Use, 2022-2032, USD (Million)

- 14.7.1.1. GCC

- 14.7.1.Middle East and Africa

15. Company Profile

- 15.1. DHL

- 15.1.1. Company Overview

- 15.1.2. Financial Performance

- 15.1.3. Product Portfolio

- 15.1.4. Strategic Initiatives

- 15.2. FedEx

- 15.2.1. Company Overview

- 15.2.2. Financial Performance

- 15.2.3. Product Portfolio

- 15.2.4. Strategic Initiatives

- 15.3. UPS

- 15.3.1. Company Overview

- 15.3.2. Financial Performance

- 15.3.3. Product Portfolio

- 15.3.4. Strategic Initiatives

- 15.4. DB Schenker

- 15.4.1. Company Overview

- 15.4.2. Financial Performance

- 15.4.3. Product Portfolio

- 15.4.4. Strategic Initiatives

- 15.5. C.H. Robinson

- 15.5.1. Company Overview

- 15.5.2. Financial Performance

- 15.5.3. Product Portfolio

- 15.5.4. Strategic Initiatives

- 15.6. DSV Panalpina

- 15.6.1. Company Overview

- 15.6.2. Financial Performance

- 15.6.3. Product Portfolio

- 15.6.4. Strategic Initiatives

- 15.7. Kuehne + Nagel

- 15.7.1. Company Overview

- 15.7.2. Financial Performance

- 15.7.3. Product Portfolio

- 15.7.4. Strategic Initiatives

- 15.8. Other Notable Players

- 15.8.1. Company Overview

- 15.8.2. Financial Performance

- 15.8.3. Product Portfolio

- 15.8.4. Strategic Initiatives