|

市場調査レポート

商品コード

1700502

産業機械ヘルスモニタリング:2029年までの機会と予測Industrial Machine Health Monitoring: Opportunities & Forecasts Through 2029 |

||||||

|

|||||||

| 産業機械ヘルスモニタリング:2029年までの機会と予測 |

|

出版日: 2025年04月10日

発行: VDC Research Group, Inc.

ページ情報: 英文 31 Pages/10 Exhibits; plus 19 Exhibits/Excel

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

IIoTによって可能となったデータ駆動型戦略の導入が進む中、多くの産業事業者は、稼動機器の健全性を監視するソリューションへの投資を優先しています。コンプレッサー、ギアボックス、モーター、ポンプ、その他の産業機械の状態と性能を継続的に監視することで、製造業者やその他の産業事業者は、稼働時間と生産高を最大化するのに役立つメンテナンス戦略を策定し、管理することができます。そのため、センシングハードウェア、リアルタイムモニタリング機能、高度な分析 (予測モデリングなど) を完全なエンドツーエンドソリューションに統合した産業機械ヘルスモニタリングソリューションは、運用効率や最適化を追求する企業にとって極めて重要なツールとして登場しています。

本レポートでは、世界の産業機械ヘルスモニタリングソリューションの市場を調査し、地域、販売チャネル、産業別の分析および予測を取り上げています。

どのような質問に対応するか?

- 産業機械のヘルスモニタリングソリューションの市場規模は?

- 今後5年間の成長を牽引する地域と産業はどこか?

- OT、IT、IoTの融合はこの市場をどのように形成しているか?

- マシンヘルスイニシアチブのサポートにもっとも積極的な産業オートメーションサプライヤーは?

- サイバーセキュリティの懸念は、これらのソリューションの採用と実装にどのような影響を与えているか?

本レポートに掲載されているベンダー

|

|

|

センシング技術の継続的な成熟は、本市場の初期段階における基盤的な成長要因となってきました。今後は、産業用AIの出現と成熟が、市場におけるもっとも重要な技術的成長要因の一つになると考えられています。

当市場には、機械の健全性に特化したスタートアップ企業、既存の産業用技術ベンダー、産業用部品サプライヤー、世界的な産業オートメーションの大手企業など、多様な事業者が参入しています。初期段階においては、Augury、i-care、KCF Technologiesといった機械の健全性に特化したプロバイダーが、特に大きな需要を生み出すことに成功しています。ソリューションの観点から見ると、この市場の競合企業は、センサーを販売する企業、センサーを販売し、サービス契約を通じて手動で診断や推奨を提供する企業、センサーを販売し、AIを活用して自動で診断・推奨を行う企業といったカテゴリーに分類されます。主要ベンダーに加えて、この市場の競争環境には、特定の地域、産業、または機械のヘルスモニタリングに特化した多様なニッチ競合企業も数多く存在しています。

2024年においては、食品・飲料業界が市場でもっとも大きな収益源となりました。これは主に、この業界の施設内に多数の機械が存在することが大きな要因です。食品・飲料業界の稼働環境は、比較的モニタリングが容易で複雑さが少ないため、システムの導入がスムーズであり、コスト削減効果も分かりやすく示しやすいという特徴があります。一方で、エネルギー・発電分野は、2029年までにもっとも急成長する産業部門となる見通しです。これは、企業の環境・社会・ガバナンス (ESG) 目標により、二酸化炭素排出やエネルギー管理に関する要件への対応が求められているためです。さらに、自動車メーカーおよび部品サプライヤーも、予測期間中の市場の成長を大きく後押しすることが見込まれています。

目次

どのような質問が取り上げられますか?

このレポートを読むべき人は誰ですか?

このレポートに掲載されているベンダー

エグゼクティブサマリー

- 主な調査結果

世界市場概要

- 市場サマリー

- 市場促進要因と戦略

- デジタルトランスフォーメーションを促す労働課題

- センサーの成熟度と相互運用性の要件が市場を形成

競合情勢

- 概要

- 課題

- 買収による市場シェアの獲得

- 最前線で働く従業員のバイインの強化

- 展開の拡張と進化する顧客要求への適応

- 機会

- AIパズルを解く

- OTスタック全体での統合の実現

- 新たな市場への参入に向けた提携の追求

世界市場:区分別

- 地域別市場・予測

- 概要

- 工業化が市場機会を創出

- 産業別市場・予測

- 概要

- 業界のサイロ化が市場の成長を抑制

- 監視技術別市場・予測

- 概要

- 機械知識の限界によって妨げられる代替技術

- チャネル別市場・予測

- 概要

- エンドユーザーはOEMソリューションに警戒感を抱く

ベンダーハイライト

- Advanced Technology Services (ATS)

- AssetWatch

- Augury

- I-care

- KCF Technologies

- その他

- Bently Nevada

- Emerson

- MaintainX

- TRACTIAN

- Waites

著者について

Inside this Report

As industrial organizations increasingly embrace the data-driven strategies enabled by the Industrial Internet of Things (IIoT), many have prioritized investments in solutions that monitor the health of their operational equipment. By continuously monitoring the status and performance of compressors, gear boxes, motors, pumps, and other industrial machinery, manufacturers and other industrial operators can develop and manage maintenance strategies that help maximize production uptime and output. As such, industrial machine health monitoring solutions - which combine sensing hardware, real-time monitoring capabilities, and advanced analytics (e.g., predictive modeling) within a complete, end-to-end solution - have emerged as critical tools in these organizations' pursuit of operational efficiency and optimization. This report covers the global market for industrial machine health monitoring solutions, including segmentations and forecasts by geographic region, channel, and industry.

What Questions are Addressed?

- How large is the market for industrial machine health solutions?

- Which regions and industries will drive growth over the next five years?

- How is the convergence of OT, IT, and IoT shaping this market?

- Which industrial automation suppliers have been most aggressive in supporting machine health initiatives?

- How have cybersecurity concerns affected the adoption and implementation of these solutions?

Who Should Read this Report?

This report is intended for those making critical decisions regarding product development, partnerships, go-to- market planning, and competitive strategy and tactics. It is written for executives, senior managers, and other decision-makers involved in the development, deployment, marketing, management, or sales of industrial machine health solutions, including those in the following roles:

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Vendors Listed in this Report:

|

|

|

Executive Summary

The continued maturation of sensing technologies has been a foundational growth driver throughout the early stages of this market. Moving forward, the emergence and maturation of industrial artificial intelligence will be among the most critical technological drivers for this market.

This market is populated by a diverse mix of machine health startups, established industrial technology vendors, industrial component suppliers, and global industrial automation giants. Through the early stages of this market, dedicated machine health providers such as Augury, I-care, and KCF Technologies have been the most successful in generating demand due to their laser focus on this sector. From a solution perspective, competitors in this market generally fit into one of several categories: companies that sell sensors, companies that sell sensors and provide manual diagnostics and recommendations via service engagements, and companies that sell sensors and provide automated diagnostics and recommendations leveraging AI. Beyond the leading vendors, the competitive landscape is further populated by variety of niche competitors that serve select geographies, industries, or machine health monitoring applications.

The food and beverage industry was the leading sources of industrial machine health monitoring revenue in 2024 due, in large part, to the high volume of machinery present in facilities within this space. Operating environments within the food and beverage industry are generally less complex to monitor, allowing for straightforward deployments and easily demonstrable cost savings. The energy and power generation sector will be the fastest- growing industry segment through 2029 as corporate environmental, societal, and governance (ESG) goals drive operators to address mounting requirements such as those around carbon emissions or energy management. Automotive manufacturers and component suppliers will also drive significant growth through the end of the forecast period.

Key Findings:

- The maturation of industrial artificial intelligence will be a critical growth driver for this market.

- Requirements around openness and interoperability have intensified as industrial organizations continue gaining access to new operational data sources.

- Competitors whose deployments rely on professional services will find it increasingly difficult to scale their services capacity as their install base grows.

- The Asia-Pacific region will attain the highest growth rate through the end of the forecast period.

- Vendors overwhelmingly rely on direct sales to engage with customers.

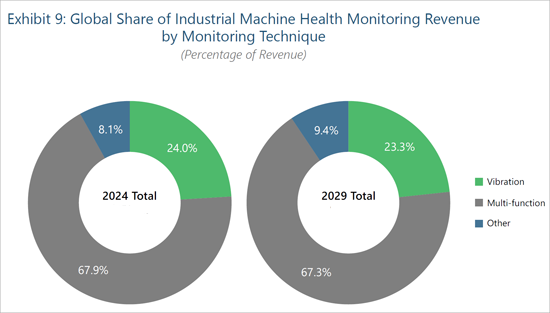

Monitoring Technique Segmentation and Forecast

Overview

Vibration monitoring - either via dedicated vibration sensors or multi-function sensors also including temperature and other measurements - generated the overwhelming majority of industrial machine health monitoring revenue in 2024. Due to its ability to identify abnormal behavior in common industrial equipment such as compressors, generators, fans, motors, pumps, and turbines, vibration monitoring is the de facto starting point for any industrial organization looking to prevent failures before they occur. The addition of temperature measurement allows multi-function sensors to provide a more comprehensive understanding of machine performance. Multi-function sensors from Augury, I-care, and other market leaders commonly include additional measurement parameters, such as impact and magnetic flux. The expanded coverage afforded by these additional measurement parameters will allow the growth rate of this segment to outpace that of the single- parameter vibration segment. Moving forward, vibration and multi-function sensors will continue to comprise the vast majority of this market through the end of the forecast period, however, alternative techniques such as corrosion monitoring, electrical monitoring, and oil analysis will grow at the greatest rate (nearly 16% per year through the end of the forecast period) as organizations begin to target non-rotating equipment such as drums, pipes, and tanks. Sensors measuring magnetic flux will become particularly attractive due to their ability to measure energy consumption and help organizations meet their ESG objectives.

Alternative Techniques Hindered by Limited Machine Knowledge

Even before the emergence of this IIoT-enabled market segment, vibration monitoring has long been at the forefront of industrial organizations' condition monitoring efforts. As such, solution providers have access to tremendous volumes of reference data detailing common failure points and fault conditions for most types of rotating industrial equipment. Used in conjunction with vendors' machine learning algorithms and AI capabilities, this reference data is a foundational element of the machine health market. Unfortunately, reference data for non- rotating, discrete machinery such as cranes and robots is comparatively scarce. Without a sufficient body of knowledge as to how these machines break and how they are fixed, vendors in this space have been hesitant to offer coverage in this area. To effectively cover assets with critical, non-rotating components, solution providers must amass not only sufficient reference data around each new class of machinery, but also sufficient in-house expertise to deliver value-adding advice to customers.

Table of Contents

What Questions are Addressed?

Who Should Read this Report?

Vendors Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

- Market Summary

- Market Drivers and Strategies

- Labor Challenges Prompting Digital Transformation

- Sensor Maturity, Interoperability Requirements Shaping Market

Competitive Landscape

- Overview

- Challenges

- Seizing Market Share via Acquisition

- Fostering Buy-In from Frontline Workers

- Scaling Deployments and Adapting to Evolving Customer Requests

- Opportunities

- Solving the AI Puzzle

- Enabling Integrations Throughout the OT Stack

- Pursuing Partnerships to Reach New Markets

Global Market Segmentations

- Regional Segmentation and Forecast

- Overview

- Industrialization Creates Market Opportunities

- Industry Segmentation and Forecast

- Overview

- Industry Silos Limit Market Growth

- Monitoring Technique Segmentation and Forecast

- Overview

- Alternative Techniques Hindered by Limited Machine Knowledge

- Channel Segmentation and Forecast

- Overview

- End Users Wary of OEM Solutions

Vendor Highlights

- Advanced Technology Services (ATS)

- AssetWatch

- Augury

- I-care

- KCF Technologies

- Others

- Bently Nevada

- Emerson

- MaintainX

- TRACTIAN

- Waites

About the Authors

List of Exhibits

- Exhibit 1: Global Revenue for Industrial Machine Health Monitoring

- Exhibit 2: Global Revenue for Industrial Machine Health Monitoring by Leading Vendors (2024)

- Exhibit 3: Global Revenue for Industrial Machine Health Monitoring by Region

- Exhibit 4: Global Share of Industrial Machine Health Monitoring Revenue by Region

- Exhibit 5: Global Revenue for Industrial Machine Health Monitoring by Industry

- Exhibit 6: Global Share of Industrial Machine Health Monitoring Revenue by Industry

- Exhibit 7: Global Revenue for Industrial Machine Health Monitoring by Monitoring Technique

- Exhibit 8: Global Share of Industrial Machine Health Monitoring Revenue by Monitoring Technique

- Exhibit 9: Global Revenue for Industrial Machine Health Monitoring by Channel

- Exhibit 10: Global Share of Industrial Machine Health Monitoring Revenue by Channel