|

|

市場調査レポート

商品コード

1619870

学生向け宿泊施設市場- 世界の産業規模、シェア、動向、機会、予測、宿泊タイプ別、教育レベル別、地域別、競合、2019年~2029年Student Accommodation Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Accommodation Type, By Education Grade, By Region & Competition, 2019-2029F |

||||||

カスタマイズ可能

|

|||||||

| 学生向け宿泊施設市場- 世界の産業規模、シェア、動向、機会、予測、宿泊タイプ別、教育レベル別、地域別、競合、2019年~2029年 |

|

出版日: 2024年12月20日

発行: TechSci Research

ページ情報: 英文 185 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

学生向け宿泊施設の世界市場規模は2023年に122億9,000万米ドルとなり、予測期間中のCAGRは4.8%で2029年には162億8,000万米ドルに達すると予測されています。

世界の学生人口の増加、特に留学生の増加が大きな成長の起爆剤となっています。海外教育を選択する学生の増加に伴い、質の高い、安全で便利な住宅への需要が急増しています。主に、米国、英国、オーストラリア、カナダといった国々が、こうした学生の主要な留学先であり続け、現在の宿泊施設のインフラを圧迫しています。大学は学生募集の幅を広げているが、急増する住宅需要を満たすには不十分な場合が多く、そのため、民間開発業者や投資家が学生専用宿泊施設(PBSA)を提供する道が開かれています。この動向は、発展途上国における中産階級の開花と、世界の教育価値の高まりに後押しされ、今後も続くと予測されます。学生数の継続的な増加は、世界市場の成長を著しく後押ししています。特に米国、英国、オーストラリア、カナダなど、海外へ進学する学生の数が増えるにつれて、適切な住宅に対するニーズは著しく高まっています。この人口層の拡大は、より多くの学生向け宿泊施設の需要に拍車をかけるだけでなく、彼らの嗜好を満たすように設計された、高品質でアメニティに富んだ物件の創造にも拍車をかけています。世界各地の教育機関が国際的な人材の獲得に努める中、学生寮市場はこうした需要の高まりに応えるべく、着実な成長を続けています。

| 市場概要 | |

|---|---|

| 予測期間 | 2025-2029 |

| 市場規模:2023年 | 122億9,000万米ドル |

| 市場規模:2029年 | 162億8,000万米ドル |

| CAGR:2024年~2029年 | 4.8% |

| 急成長セグメント | 大学院生 |

| 最大市場 | 北米 |

市場促進要因

留学生の急増

新興諸国における中間層の拡大

機関投資家や不動産開発業者からの投資

主な市場課題

需給の不均衡

高コストと値ごろ感の問題

主要市場動向

学生向け宿泊施設における技術統合

学生のライフスタイルの変化と嗜好

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の学生向け宿泊施設市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 宿泊タイプ別(専用施設(PBSA)、大学管理宿泊施設、民間賃貸宿泊施設、その他)

- 教育レベル別(学部生、大学院生、専門・継続教育学生)

- 地域別

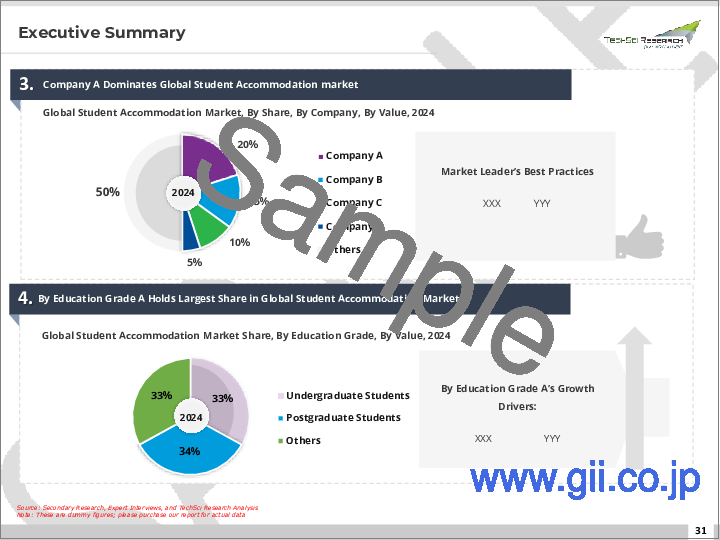

- 上位5社、その他(2023)

- 世界の学生向け宿泊施設市場マッピング&機会評価

- 宿泊タイプ別

- 教育レベル別

- 地域別

第6章 北米の学生向け宿泊施設市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 宿泊タイプ別

- 教育レベル別

- 国別

第7章 欧州の学生向け宿泊施設市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 宿泊タイプ別

- 教育レベル別

- 国別

第8章 アジア太平洋地域の学生向け宿泊施設市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 宿泊タイプ別

- 教育レベル別

- 国別

第9章 中東・アフリカの学生向け宿泊施設市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 宿泊タイプ別

- 教育レベル別

- 国別

第10章 南米の学生向け宿泊施設市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 宿泊タイプ別

- 教育レベル別

- 国別

第11章 市場力学

- 促進要因

- 課題

第12章 COVID-19が世界の学生向け宿泊施設市場に与える影響

- 影響評価モデル

- 影響を受ける主要セグメント

- 影響を受ける主要地域

- 影響を受ける主要国

第13章 市場動向と発展

第14章 競合情勢

- 企業プロファイル

- American Campus Communities LLC

- GSA International Limited

- Campus Living Villages Pty Ltd

- TSH Management B.V.

- UNITE Group Plc

- Harrison Street Real Estate Capital, LLC

- Greystar Worldwide, LLC

- Casita

- Kohlberg Kravis Roberts & Co. L.P.

- Mapletree Investments Pte Ltd

第15章 戦略的提言・アクションプラン

- 主要な重点分野

- 対象:宿泊タイプ

- 対象:教育レベル

第16章 調査会社について・免責事項

The global student accommodation market was valued at USD 12.29 Billion in 2023 and is expected to reach USD 16.28 Billion by 2029 with a CAGR of 4.8% during the forecast period. The rise in the global student population, particularly of international students, serves as a major growth catalyst. With a growing number of students opting for overseas education, there's a surge in the demand for quality, safe, and convenient housing. Predominantly, countries like the U.S., UK, Australia, and Canada remain prime destinations for these students, putting pressure on the current accommodation infrastructure. While universities are broadening their intake, they often fall short in meeting the escalating housing demands, thereby opening avenues for private developers and investors to offer purpose-built student accommodations (PBSA). This trend is projected to persist, driven by the blossoming middle class in developing nations and the mounting value of global education. The continual increase in student numbers is notably propelling the global market's growth. As larger cohorts of students head overseas for higher education, particularly to destinations like the U.S., UK, Australia, and Canada, the need for suitable housing rises significantly. This expanding demographic group not only spurs the demand for more student accommodations but also fuels the creation of high-quality, amenity-rich properties designed to meet their preferences. As educational institutions globally strive to draw international talent, the student housing market is on a steady growth path to cater to this increasing demand.

| Market Overview | |

|---|---|

| Forecast Period | 2025-2029 |

| Market Size 2023 | USD 12.29 Billion |

| Market Size 2029 | USD 16.28 Billion |

| CAGR 2024-2029 | 4.8% |

| Fastest Growing Segment | Postgraduate Students |

| Largest Market | North America |

Key Market Drivers

Surge in International Student Enrollment

A surge in international student enrollments has notably increased the demand for quality student housing. Popular study destinations such as the U.S., UK, Australia, and Canada are experiencing a rise in the necessity for adequate student lodgings. A 2023 report by the Institute of International Education and the U.S. Department of State's Bureau of Educational and Cultural Affairs highlighted a 14% rise in new international student enrollments during the 2022-2023 academic year, building upon an 80% increase the prior year. Universities are under mounting pressure to provide sufficient accommodation, leading to increased interest from private developers and investors aiming to offer purpose-built student accommodations (PBSA).

Expanding Middle-Class in Developing Countries

The expanding middle class in developing countries significantly contributes to the growing demand for student accommodations abroad. Fuelled by the increasing perception that international qualifications offer better career prospects, more students from middle-class backgrounds in nations like China and India are opting for overseas education. This rise in student numbers from developing countries puts additional strain on the student housing market in popular educational destinations. This demographic is inclined to invest in quality education and, consequently, high-standard housing, making them a vital market for PBSAs.

Investment from Institutional Investors and Real Estate Developers

There has been a noticeable uptick in PBSA investments from institutional investors and real estate developers. These investors are drawn to the student housing market due to its resilience and long-term potential. For instance, in August 2024, Far East Orchard Limited, a leading private property developer in Singapore, established its private fund, FE UK Student Accommodation Development Fund, closing an initial £70 million (USD 120 million) by August 22, aimed at PBSA developments in the UK. The sector's attractive yields and relatively low volatility compared to other real estate segments make it an appealing investment avenue.

Key Market Challenges

Supply-Demand Imbalance

A critical challenge in the student accommodation market is the imbalance between supply and demand. Although demand for student housing is rising, universities often lag in expanding their accommodation offerings at a matching rate. This disparity results in a scarcity of student housing, driving up rents and increasing competition for limited spaces. Furthermore, private developers and investors frequently encounter regulatory and zoning obstacles that delay new construction, exacerbating the supply-demand imbalance.

High Costs and Affordability Issues

Developing and maintaining top-notch student accommodations can be prohibitively expensive, especially in urban areas with high real estate prices. For students, the escalating costs of accommodation add significantly to the financial burden of studying abroad, making such opportunities less accessible to students from lower-income backgrounds. The ability of governments and educational institutions to subsidize housing costs is often limited, compelling many students to opt for more affordable, albeit lower-quality, housing options.

Key Market Trends

Technological Integration in Student Accommodation

The adoption of technology in student accommodation is emerging as a major growth driver, especially among the tech-savvy student demographic. Modern student housing is now expected to feature smart living amenities such as automated climate control, keyless entry, high-speed internet, and digital communication platforms. These advancements not only enhance the living experience but also address critical concerns related to safety, security, and convenience. Additionally, data analytics and property management software are being used to streamline operations and maintenance, making the sector more attractive to students and investors alike.

Lifestyle Changes and Preferences Among Students

Changes in students' lifestyles and preferences have a considerable impact on market growth. Today's students seek more than just a place to sleep-they desire environments conducive to academic, social, and personal development. This shift has spurred demand for housing that integrates private and communal spaces, supporting community building while offering personal privacy. Amenities like fitness centers, study lounges, social event spaces, and sustainable living features have become crucial factors influencing student housing choices.

Segmental Insights

Accommodation Type Insights

Purpose-built student accommodation (PBSA) represented a leading accommodation type in the market. The investment momentum in student housing saw a significant boost in the early 21st century, propelled by the increase in global student mobility. As international students sought high-quality education from prestigious institutions worldwide, the demand for reliable and high-standard housing grew. For example, students from countries like India or China pursuing higher education in the U.S. or UK often needed more familiarity with the local housing markets and lacked the support of local guardians, making them an ideal target market for PBSAs that provide secure and convenient living tailored to their needs. The private rental student accommodations market is anticipated to be emerging segment. The global demand for private rental student accommodations is robust, driven by several factors. The rising number of students pursuing higher education internationally, especially from emerging economies, has created a strong demand for quality housing that offers flexibility and independence. Unlike traditional university-managed accommodations, private rentals appeal to students seeking more personalized living experiences, complete with better amenities, privacy, and proximity to urban centers.

Regional Insights

North America's student accommodation market has emerged as a dominant force globally, particularly driven by the rapid expansion of educational programs and a substantial influx of international students. Canada, in particular, has become a focal point for this growth. The country's reputation as a welcoming destination for students worldwide, coupled with its robust educational offerings, has led to an unprecedented demand for student housing. One of the key factors driving this demand is the expansion of university and college programs across the region. As more students, both domestic and international, enroll in these institutions, the need for adequate housing has intensified. Many universities, however, face significant challenges in providing sufficient on-campus accommodation due to space and resource limitations. This shortfall has prompted educational institutions to seek partnerships with private developers to create off-campus housing solutions that cater to the growing student population.

These off-campus housing projects are increasingly characterized by modern amenities that appeal to the contemporary student lifestyle. Features such as high-speed internet, fitness centers, study lounges, and social spaces are now standard, with a focus on providing a seamless blend of academic and social environments. The proximity of these accommodations to academic facilities is also a crucial factor, as it ensures convenience and accessibility for students, further enhancing their overall experience. The region's commitment to attracting and retaining global talent is another significant driver of this market growth. Governments and educational institutions alike recognize the importance of offering high-quality living standards that meet international expectations. This commitment is reflected in the development of student housing that not only satisfies basic needs but also enhances the overall appeal of studying in North America. North America's student accommodation market is thriving, fueled by the expansion of educational programs, a surge in international students, and the region's dedication to providing top-tier housing solutions that meet global standards.

Key Market Players

- American Campus Communities LLC

- GSA International Limited

- Campus Living Villages Pty Ltd

- TSH Management B.V.

- UNITE Group Plc

- Harrison Street Real Estate Capital, LLC

- Greystar Worldwide, LLC

- Casita

- Kohlberg Kravis Roberts & Co. L.P.

- Mapletree Investments Pte Ltd

Report Scope:

In this report, the global student accommodation market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Student Accommodation Market, By Accommodation Type:

- Purpose-Built Student Accommodation (PBSA)

- University-Managed Accommodation

- Private Rental Accommodation

- Others

Student Accommodation Market, By Education Grade:

- Undergraduate Students

- Postgraduate Students

- Professional and Continuing Education Students

Student Accommodation Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Kuwait

- Egypt

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the global student accommodation market.

Available Customizations:

Global Student Accommodation market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Introduction

- 1.1. Product Overview

- 1.2. Key Highlights of the Report

- 1.3. Market Coverage

- 1.4. Market Segments Covered

- 1.5. Research Tenure Considered

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Key Industry Partners

- 2.4. Major Association and Secondary Sources

- 2.5. Forecasting Methodology

- 2.6. Data Triangulation & Validation

- 2.7. Assumptions and Limitations

3. Executive Summary

- 3.1. Market Overview

- 3.2. Market Forecast

- 3.3. Key Regions

- 3.4. Key Segments

4. Voice of Customer

- 4.1. Factors Influencing Purchase Decision

- 4.2. Sources of Information

5. Global Student Accommodation Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Accommodation Type Market Share Analysis (Purpose-Built Student Accommodation (PBSA), University-Managed Accommodation, Private Rental Accommodation, Others)

- 5.2.2. By Education Grade Market Share Analysis (Undergraduate Students, Postgraduate Students, Professional and Continuing Education Students)

- 5.2.3. By Regional Market Share Analysis

- 5.2.3.1. North America Market Share Analysis

- 5.2.3.2. Europe Market Share Analysis

- 5.2.3.3. Asia-Pacific Market Share Analysis

- 5.2.3.4. Middle East & Africa Market Share Analysis

- 5.2.3.5. South America Market Share Analysis

- 5.2.4. By Top 5 Companies Market Share Analysis, Others (2023)

- 5.3. Global Student Accommodation Market Mapping & Opportunity Assessment

- 5.3.1. By Accommodation Type Market Mapping & Opportunity Assessment

- 5.3.2. By Education Grade Market Mapping & Opportunity Assessment

- 5.3.3. By Regional Market Mapping & Opportunity Assessment

6. North America Student Accommodation Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Accommodation Type Market Share Analysis

- 6.2.2. By Education Grade Market Share Analysis

- 6.2.3. By Country Market Share Analysis

- 6.2.3.1. United States Student Accommodation Market Outlook

- 6.2.3.1.1. Market Size & Forecast

- 6.2.3.1.1.1. By Value

- 6.2.3.1.2. Market Share & Forecast

- 6.2.3.1.2.1. By Accommodation Type Market Share Analysis

- 6.2.3.1.2.2. By Education Grade Market Share Analysis

- 6.2.3.2. Canada Student Accommodation Market Outlook

- 6.2.3.2.1. Market Size & Forecast

- 6.2.3.2.1.1. By Value

- 6.2.3.2.2. Market Share & Forecast

- 6.2.3.2.2.1. By Accommodation Type Market Share Analysis

- 6.2.3.2.2.2. By Education Grade Market Share Analysis

- 6.2.3.3. Mexico Student Accommodation Market Outlook

- 6.2.3.3.1. Market Size & Forecast

- 6.2.3.3.1.1. By Value

- 6.2.3.3.2. Market Share & Forecast

- 6.2.3.3.2.1. By Accommodation Type Market Share Analysis

- 6.2.3.3.2.2. By Education Grade Market Share Analysis

- 6.2.3.1. United States Student Accommodation Market Outlook

7. Europe Student Accommodation Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Accommodation Type Market Share Analysis

- 7.2.2. By Education Grade Market Share Analysis

- 7.2.3. By Country Market Share Analysis

- 7.2.3.1. France Student Accommodation Market Outlook

- 7.2.3.1.1. Market Size & Forecast

- 7.2.3.1.1.1. By Value

- 7.2.3.1.2. Market Share & Forecast

- 7.2.3.1.2.1. By Accommodation Type Market Share Analysis

- 7.2.3.1.2.2. By Education Grade Market Share Analysis

- 7.2.3.2. Germany Student Accommodation Market Outlook

- 7.2.3.2.1. Market Size & Forecast

- 7.2.3.2.1.1. By Value

- 7.2.3.2.2. Market Share & Forecast

- 7.2.3.2.2.1. By Accommodation Type Market Share Analysis

- 7.2.3.2.2.2. By Education Grade Market Share Analysis

- 7.2.3.3. Spain Student Accommodation Market Outlook

- 7.2.3.3.1. Market Size & Forecast

- 7.2.3.3.1.1. By Value

- 7.2.3.3.2. Market Share & Forecast

- 7.2.3.3.2.1. By Accommodation Type Market Share Analysis

- 7.2.3.3.2.2. By Education Grade Market Share Analysis

- 7.2.3.4. Italy Student Accommodation Market Outlook

- 7.2.3.4.1. Market Size & Forecast

- 7.2.3.4.1.1. By Value

- 7.2.3.4.2. Market Share & Forecast

- 7.2.3.4.2.1. By Accommodation Type Market Share Analysis

- 7.2.3.4.2.2. By Education Grade Market Share Analysis

- 7.2.3.5. United Kingdom Student Accommodation Market Outlook

- 7.2.3.5.1. Market Size & Forecast

- 7.2.3.5.1.1. By Value

- 7.2.3.5.2. Market Share & Forecast

- 7.2.3.5.2.1. By Accommodation Type Market Share Analysis

- 7.2.3.5.2.2. By Education Grade Market Share Analysis

- 7.2.3.1. France Student Accommodation Market Outlook

8. Asia-Pacific Student Accommodation Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Accommodation Type Market Share Analysis

- 8.2.2. By Education Grade Market Share Analysis

- 8.2.3. By Country Market Share Analysis

- 8.2.3.1. China Student Accommodation Market Outlook

- 8.2.3.1.1. Market Size & Forecast

- 8.2.3.1.1.1. By Value

- 8.2.3.1.2. Market Share & Forecast

- 8.2.3.1.2.1. By Accommodation Type Market Share Analysis

- 8.2.3.1.2.2. By Education Grade Market Share Analysis

- 8.2.3.2. Japan Student Accommodation Market Outlook

- 8.2.3.2.1. Market Size & Forecast

- 8.2.3.2.1.1. By Value

- 8.2.3.2.2. Market Share & Forecast

- 8.2.3.2.2.1. By Accommodation Type Market Share Analysis

- 8.2.3.2.2.2. By Education Grade Market Share Analysis

- 8.2.3.3. India Student Accommodation Market Outlook

- 8.2.3.3.1. Market Size & Forecast

- 8.2.3.3.1.1. By Value

- 8.2.3.3.2. Market Share & Forecast

- 8.2.3.3.2.1. By Accommodation Type Market Share Analysis

- 8.2.3.3.2.2. By Education Grade Market Share Analysis

- 8.2.3.4. Vietnam Student Accommodation Market Outlook

- 8.2.3.4.1. Market Size & Forecast

- 8.2.3.4.1.1. By Value

- 8.2.3.4.2. Market Share & Forecast

- 8.2.3.4.2.1. By Accommodation Type Market Share Analysis

- 8.2.3.4.2.2. By Education Grade Market Share Analysis

- 8.2.3.5. South Korea Student Accommodation Market Outlook

- 8.2.3.5.1. Market Size & Forecast

- 8.2.3.5.1.1. By Value

- 8.2.3.5.2. Market Share & Forecast

- 8.2.3.5.2.1. By Accommodation Type Market Share Analysis

- 8.2.3.5.2.2. By Education Grade Market Share Analysis

- 8.2.3.1. China Student Accommodation Market Outlook

9. Middle East & Africa Student Accommodation Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Accommodation Type Market Share Analysis

- 9.2.2. By Education Grade Market Share Analysis

- 9.2.3. By Country Market Share Analysis

- 9.2.3.1. South Africa Student Accommodation Market Outlook

- 9.2.3.1.1. Market Size & Forecast

- 9.2.3.1.1.1. By Value

- 9.2.3.1.2. Market Share & Forecast

- 9.2.3.1.2.1. By Accommodation Type Market Share Analysis

- 9.2.3.1.2.2. By Education Grade Market Share Analysis

- 9.2.3.2. Saudi Arabia Student Accommodation Market Outlook

- 9.2.3.2.1. Market Size & Forecast

- 9.2.3.2.1.1. By Value

- 9.2.3.2.2. Market Share & Forecast

- 9.2.3.2.2.1. By Accommodation Type Market Share Analysis

- 9.2.3.2.2.2. By Education Grade Market Share Analysis

- 9.2.3.3. UAE Student Accommodation Market Outlook

- 9.2.3.3.1. Market Size & Forecast

- 9.2.3.3.1.1. By Value

- 9.2.3.3.2. Market Share & Forecast

- 9.2.3.3.2.1. By Accommodation Type Market Share Analysis

- 9.2.3.3.2.2. By Education Grade Market Share Analysis

- 9.2.3.4. Turkey Student Accommodation Market Outlook

- 9.2.3.4.1. Market Size & Forecast

- 9.2.3.4.1.1. By Value

- 9.2.3.4.2. Market Share & Forecast

- 9.2.3.4.2.1. By Accommodation Type Market Share Analysis

- 9.2.3.4.2.2. By Education Grade Market Share Analysis

- 9.2.3.5. Kuwait Student Accommodation Market Outlook

- 9.2.3.5.1. Market Size & Forecast

- 9.2.3.5.1.1. By Value

- 9.2.3.5.2. Market Share & Forecast

- 9.2.3.5.2.1. By Accommodation Type Market Share Analysis

- 9.2.3.5.2.2. By Education Grade Market Share Analysis

- 9.2.3.6. Egypt Student Accommodation Market Outlook

- 9.2.3.6.1. Market Size & Forecast

- 9.2.3.6.1.1. By Value

- 9.2.3.6.2. Market Share & Forecast

- 9.2.3.6.2.1. By Accommodation Type Market Share Analysis

- 9.2.3.6.2.2. By Education Grade Market Share Analysis

- 9.2.3.1. South Africa Student Accommodation Market Outlook

10. South America Student Accommodation Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Accommodation Type Market Share Analysis

- 10.2.2. By Education Grade Market Share Analysis

- 10.2.3. By Country Market Share Analysis

- 10.2.3.1. Brazil Student Accommodation Market Outlook

- 10.2.3.1.1. Market Size & Forecast

- 10.2.3.1.1.1. By Value

- 10.2.3.1.2. Market Share & Forecast

- 10.2.3.1.2.1. By Accommodation Type Market Share Analysis

- 10.2.3.1.2.2. By Education Grade Market Share Analysis

- 10.2.3.2. Argentina Student Accommodation Market Outlook

- 10.2.3.2.1. Market Size & Forecast

- 10.2.3.2.1.1. By Value

- 10.2.3.2.2. Market Share & Forecast

- 10.2.3.2.2.1. By Accommodation Type Market Share Analysis

- 10.2.3.2.2.2. By Education Grade Market Share Analysis

- 10.2.3.3. Colombia Student Accommodation Market Outlook

- 10.2.3.3.1. Market Size & Forecast

- 10.2.3.3.1.1. By Value

- 10.2.3.3.2. Market Share & Forecast

- 10.2.3.3.2.1. By Accommodation Type Market Share Analysis

- 10.2.3.3.2.2. By Education Grade Market Share Analysis

- 10.2.3.1. Brazil Student Accommodation Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. Impact of COVID-19 on Global Student Accommodation Market

- 12.1. Impact Assessment Model

- 12.1.1. Key Segments Impacted

- 12.1.2. Key Regions Impacted

- 12.1.3. Key Countries Impacted

13. Market Trends & Developments

14. Competitive Landscape

- 14.1. Company Profiles

- 14.1.1. American Campus Communities LLC

- 14.1.1.1. Company Details

- 14.1.1.2. Products

- 14.1.1.3. Financials (As Per Availability)

- 14.1.1.4. Key Market Focus & Geographical Presence

- 14.1.1.5. Recent Developments

- 14.1.1.6. Key Management Personnel

- 14.1.2. GSA International Limited

- 14.1.2.1. Company Details

- 14.1.2.2. Products

- 14.1.2.3. Financials (As Per Availability)

- 14.1.2.4. Key Market Focus & Geographical Presence

- 14.1.2.5. Recent Developments

- 14.1.2.6. Key Management Personnel

- 14.1.3. Campus Living Villages Pty Ltd

- 14.1.3.1. Company Details

- 14.1.3.2. Products

- 14.1.3.3. Financials (As Per Availability)

- 14.1.3.4. Key Market Focus & Geographical Presence

- 14.1.3.5. Recent Developments

- 14.1.3.6. Key Management Personnel

- 14.1.4. TSH Management B.V.

- 14.1.4.1. Company Details

- 14.1.4.2. Products

- 14.1.4.3. Financials (As Per Availability)

- 14.1.4.4. Key Market Focus & Geographical Presence

- 14.1.4.5. Recent Developments

- 14.1.4.6. Key Management Personnel

- 14.1.5. UNITE Group Plc

- 14.1.5.1. Company Details

- 14.1.5.2. Products

- 14.1.5.3. Financials (As Per Availability)

- 14.1.5.4. Key Market Focus & Geographical Presence

- 14.1.5.5. Recent Developments

- 14.1.5.6. Key Management Personnel

- 14.1.6. Harrison Street Real Estate Capital, LLC

- 14.1.6.1. Company Details

- 14.1.6.2. Products

- 14.1.6.3. Financials (As Per Availability)

- 14.1.6.4. Key Market Focus & Geographical Presence

- 14.1.6.5. Recent Developments

- 14.1.6.6. Key Management Personnel

- 14.1.7. Greystar Worldwide, LLC

- 14.1.7.1. Company Details

- 14.1.7.2. Products

- 14.1.7.3. Financials (As Per Availability)

- 14.1.7.4. Key Market Focus & Geographical Presence

- 14.1.7.5. Recent Developments

- 14.1.7.6. Key Management Personnel

- 14.1.8. Casita

- 14.1.8.1. Company Details

- 14.1.8.2. Products

- 14.1.8.3. Financials (As Per Availability)

- 14.1.8.4. Key Market Focus & Geographical Presence

- 14.1.8.5. Recent Developments

- 14.1.8.6. Key Management Personnel

- 14.1.9. Kohlberg Kravis Roberts & Co. L.P.

- 14.1.9.1. Company Details

- 14.1.9.2. Products

- 14.1.9.3. Financials (As Per Availability)

- 14.1.9.4. Key Market Focus & Geographical Presence

- 14.1.9.5. Recent Developments

- 14.1.9.6. Key Management Personnel

- 14.1.10. Mapletree Investments Pte Ltd

- 14.1.10.1. Company Details

- 14.1.10.2. Products

- 14.1.10.3. Financials (As Per Availability)

- 14.1.10.4. Key Market Focus & Geographical Presence

- 14.1.10.5. Recent Developments

- 14.1.10.6. Key Management Personnel

- 14.1.1. American Campus Communities LLC

15. Strategic Recommendations/Action Plan

- 15.1. Key Focus Areas

- 15.2. Target Accommodation Type

- 15.3. Target Education Grade