|

|

市場調査レポート

商品コード

1383743

バリアフィルムフレキシブルエレクトロニクス市場-世界の産業規模、シェア、動向、機会、予測、製品タイプ別、用途別、エンドユーザー産業別、地域別、競合別、2018~2028年Barrier Films Flexible Electronics Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented by Product Type, By Application By End-User Industry, By Region, By Competition, 2018-2028 |

||||||

カスタマイズ可能

|

|||||||

| バリアフィルムフレキシブルエレクトロニクス市場-世界の産業規模、シェア、動向、機会、予測、製品タイプ別、用途別、エンドユーザー産業別、地域別、競合別、2018~2028年 |

|

出版日: 2023年10月03日

発行: TechSci Research

ページ情報: 英文 175 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界のバリアフィルムフレキシブルエレクトロニクス市場は、近年著しい成長を遂げており、2028年まで力強い勢いを維持する展望です。

2022年の市場規模は356億5,000万米ドルで、予測期間中の複合年間成長率は18.62%を記録すると予測されています。

世界のバリアフィルムフレキシブルエレクトロニクス市場は、世界中の産業界を席巻しているデジタル変革イニシアチブの波によって、かつてない急成長を遂げています。コンシューマー・エレクトロニクス、緊急サービス、小売などの主要セクターは、日々の業務を支える堅牢でミッションクリティカルな通信機能を自由に使えるようにすることの戦略的必要性をますます認識するようになっています。

この目覚しい成長の軌道は、業界ベンダーによる技術革新への多大な投資によって推進されてきました。こうした投資は、強化された機能だけでなく、接続オプションも大幅に強化されたバリアフィルムフレキシブルエレクトロニクス・プラットフォームという形で実を結んでいます。特に、緊急対応などの分野では、セキュアなLTE(Long-Term Evolution)ネットワークを介してデータと音声の両方をリアルタイムでシームレスに伝送する能力が、有利なものからビジネスクリティカルなものへと進化しています。さらに、統合型産業用PCソリューションの登場により、複雑なネットワークを一元管理し、さまざまな管轄区域にまたがるコマンドを調整する手段が提供されました。この機能は、緊急事態における省庁間のシームレスな連携を可能にする上で、非常に貴重であることが証明されています。ベンダーはまた、過酷で厳しい作業環境の厳しさに耐えるよう調整された、堅牢なデバイスの開発にも力を注いでいます。

| 市場概要 | |

|---|---|

| 予測期間 | 2024~2028年 |

| 市場規模 | 356億5,000万米ドル |

| 2028年の市場規模 | 1,042億8,000万米ドル |

| CAGR 2023~2028年 | 18.62% |

| 急成長セグメント | フレキシブルプリンテッドエレクトロニクス |

| 最大市場 | アジア太平洋 |

産業用ネットワークがモノのインターネット(IoT)、クラウドコンピューティング、アナリティクスなどの先進技術を取り入れ続けるにつれ、意思決定者に実用的な洞察を提供する能力が高まっています。この強化された機能により、あらゆる分野の組織が、より多くの情報に基づいたデータ駆動型の運用とロジスティクスの意思決定を行うことができるようになり、最終的には成果の改善につながります。ネットワークスライシングのような新たな5G機能は、さらに低遅延でデータ集約的なアプリケーションを強力にサポートする見込みで、新たな可能性をもたらしています。

目次

第1章 サービス概要

- 市場の定義

- 市場の範囲

- 対象市場

- 調査対象年

- 主要市場セグメンテーション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 バリアフィルムフレキシブルエレクトロニクスの世界市場概要

第6章 バリアフィルムフレキシブルエレクトロニクスの世界市場展望

- 市場規模と予測

- 金額別

- 市場シェアと予測

- 製品タイプ別(有機バリアフィルム、無機バリアフィルム)

- 用途別(フレキシブルディスプレイ、フレキシブルプリンテッドエレクトロニクス、フレキシブル太陽光発電(太陽電池)、フレキシブルバッテリー、その他、SCADA(監視制御およびデータ収集))

- エンドユーザー産業別(コンシューマーエレクトロニクス、自動車、輸送・物流、医療、航空宇宙・防衛)

- 地域別

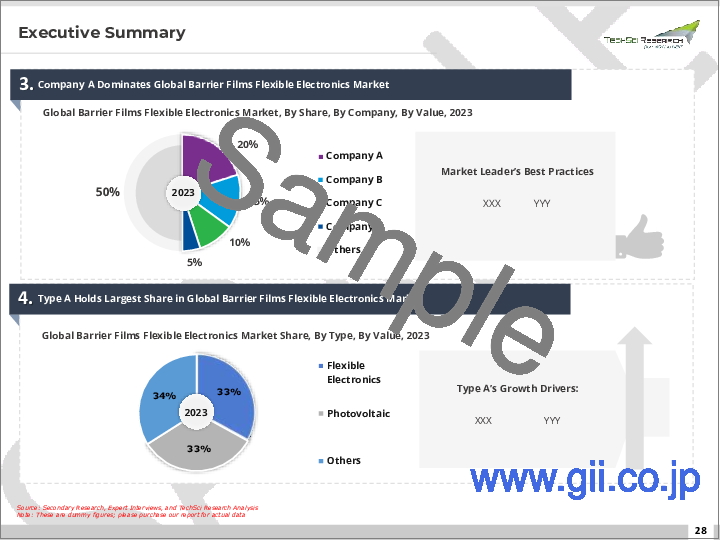

- 企業別(2022年)

- 市場マップ

第7章 北米のバリアフィルムフレキシブルエレクトロニクス市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 製品タイプ別

- 用途別

- エンドユーザー産業別

- 国別

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第8章 欧州のバリアフィルムフレキシブルエレクトロニクス市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 製品タイプ別

- 用途別

- エンドユーザー産業別

- 国別

- 欧州:国別分析

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

第9章 アジア太平洋のバリアフィルムフレキシブルエレクトロニクス市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 製品タイプ別

- 用途別

- エンドユーザー産業別

- 国別

- アジア太平洋:国別分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

第10章 南米のバリアフィルムフレキシブルエレクトロニクス市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 製品タイプ別

- 用途別

- エンドユーザー産業別

- 国別

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第11章 中東・アフリカのバリアフィルムフレキシブルエレクトロニクス市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 製品タイプ別

- 用途別

- エンドユーザー産業別

- 国別

- 中東・アフリカ:国別分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

- トルコ

- エジプト

第12章 市場力学

- 促進要因

- 課題

第13章 市場動向と発展

第14章 企業プロファイル

- 3M Company

- Honeywell International Inc

- Eastman Chemical Company

- Alcan Packaging

- Fraunhofer POLO

- Sigma Technologies Int'l, LLC

- Centre for Process Innovation

- Beneq

- Toppan Printing Co. Ltd.

- General Electric

第15章 戦略的提言

第16章 調査会社について・免責事項

Global Barrier Films Flexible Electronics market has experienced tremendous growth in recent years and is poised to maintain strong momentum through 2028. The market was valued at USD 35.65 billion in 2022 and is projected to register a compound annual growth rate of 18.62% during the forecast period.

Global Barrier Films Flexible Electronics market has experienced an unprecedented surge in growth, driven by the sweeping wave of digital transformation initiatives that have swept across industries worldwide. Key sectors such as Consumer Electronics, emergency services, and retail have increasingly come to realize the strategic imperative of having robust, mission-critical communication capabilities at their disposal to underpin their day-to-day operations.

This remarkable growth trajectory has been propelled by substantial investments in innovation made by industry vendors. These investments have borne fruit in the form of Barrier Films Flexible Electronics platforms that offer not only enhanced features but also significantly bolstered connectivity options. Notably, in sectors like emergency response, the ability to seamlessly transmit both data and voice in real-time via secure Long-Term Evolution (LTE) networks has evolved from being advantageous to business-critical. Moreover, the advent of integrated Industrial PC solutions has provided a centralized means of managing complex networks and coordinating commands across various jurisdictions. This capability has proven invaluable in enabling seamless inter-agency collaboration during emergency situations. Vendors have also focused their efforts on developing ruggedized devices tailored to endure the rigors of harsh and demanding work environments.

| Market Overview | |

|---|---|

| Forecast Period | 2024-2028 |

| Market Size 2022 | USD 35.65 Billion |

| Market Size 2028 | USD 104.28 Billion |

| CAGR 2023-2028 | 18.62% |

| Fastest Growing Segment | Flexible Printed Electronics |

| Largest Market | Asia-Pacific |

As industrial networks continue to incorporate advanced technologies like the Internet of Things (IoT), cloud computing, and analytics, they are increasingly capable of delivering actionable insights to decision-makers. This enhanced capability empowers organizations across sectors to make more informed and data-driven operational and logistical decisions, ultimately leading to improved outcomes. The promise of emerging 5G capabilities, such as network slicing, adds another layer of potential, with the prospect of even lower latency and robust support for data-intensive applications.

In a global landscape where organizations place a premium on the modernization of their mission-critical communications infrastructure, industry analysts maintain a bullish outlook regarding the long-term market potential for Barrier Films Flexible Electronics. As network capabilities continue to evolve to support new and emerging applications, Industrial PCs are poised to remain central to connecting frontline workers and providing essential support for the seamless functioning of business operations across diverse industries. This undeniable symbiosis between advancing technology and the ever-expanding needs of contemporary industries underscores the continued growth and innovation within the Barrier Films Flexible Electronics market.

Key Market Drivers

Increasing Demand for Flexible Display Technologies

The global demand for flexible display technologies, driven by the consumer electronics industry, has emerged as a prominent driver for the Barrier Films Flexible Electronics market. The proliferation of smartphones, wearable devices, and foldable gadgets has fueled the need for flexible electronic components, including OLED and LCD displays. These devices require advanced barrier films to protect against environmental factors like moisture and oxygen while maintaining flexibility. As consumer preferences gravitate toward sleeker, more portable, and innovative devices, manufacturers are investing heavily in research and development to produce thinner, lighter, and more durable barrier films that can meet these demands. This surge in demand for flexible displays is expected to continue propelling the growth of the Barrier Films Flexible Electronics market.

Advancements in IoT and Wearable Technologies

The rapid expansion of the Internet of Things (IoT) and wearable technologies across industries such as healthcare, fitness, and logistics has become a major driver for the Barrier Films Flexible Electronics market. IoT sensors and wearable devices often require flexible electronic components like sensors, batteries, and printed circuits to function optimally. These components must be protected from environmental factors and wear and tear. Barrier films, with their ability to offer high levels of protection without compromising flexibility, have become essential in ensuring the durability and reliability of these devices. As IoT and wearable technologies continue to evolve, the demand for advanced barrier films that can provide exceptional protection while allowing for flexibility is poised to grow substantially.

Increasing Focus on Sustainable Packaging

Sustainability has become a driving force in the Barrier Films Flexible Electronics market, particularly in the context of flexible packaging. With the rising awareness of environmental concerns, there is a growing emphasis on sustainable packaging materials and practices. Barrier films are crucial in extending the shelf life of food products, pharmaceuticals, and other perishable goods while reducing food waste. As regulatory bodies and consumers alike demand eco-friendly packaging solutions, manufacturers are developing barrier films that are not only effective in preserving the contents but are also recyclable and environmentally friendly. This shift towards sustainable packaging is leading to increased adoption of advanced barrier films, creating opportunities for growth in the market as companies seek to align with global sustainability goals and consumer preferences.

Key Market Challenges

Cost and Complexity of Barrier Film Manufacturing

One of the primary challenges facing the Global Barrier Films Flexible Electronics market is the cost and complexity associated with the manufacturing of advanced barrier films. As the demand for flexible electronic devices, such as foldable smartphones and wearable technology, continues to grow, manufacturers are under pressure to produce barrier films that offer exceptional protection against environmental factors like moisture and oxygen. Achieving the necessary barrier properties while maintaining flexibility requires specialized materials and manufacturing processes, often involving the deposition of thin layers of materials like metal oxides or polymers onto flexible substrates.

These manufacturing techniques can be capital-intensive, involving the use of specialized equipment and cleanroom facilities. Moreover, the quality control and precision required in barrier film production contribute to increased production costs. Balancing the need for cost-effective manufacturing with the demand for high-performance barrier films is a significant challenge for industry players. Cost-efficient scaling of production and optimizing manufacturing processes are essential to address this challenge and make barrier films more accessible to a broader range of applications and industries.

Rapid Technological Advancements and Obsolescence

The Global Barrier Films Flexible Electronics market faces the challenge of rapid technological advancements and the subsequent risk of product obsolescence. The flexible electronics industry is characterized by continuous innovation, with new materials and technologies constantly emerging. As a result, barrier film solutions that were considered cutting-edge a few years ago may become outdated in a relatively short time frame.

This dynamic environment poses several challenges for market participants. First, companies must invest in ongoing research and development efforts to stay competitive and ensure their barrier films keep pace with industry advancements. Second, the risk of investing in a technology that may soon become obsolete can deter potential buyers and investors. Lastly, managing existing inventory and ensuring a smooth transition to newer technologies without significant financial losses can be a complex task.

To address this challenge, companies in the Barrier Films Flexible Electronics market must maintain a strong focus on innovation, regularly updating their product portfolios to meet the evolving needs of industries like consumer electronics and healthcare. Additionally, effective communication with customers about the benefits of adopting the latest barrier film technologies and strategies for managing product obsolescence is crucial for long-term success in this dynamic market.

Key Market Trends

Sustainable Barrier Films Gain Prominence in Flexible Electronics

One notable trend shaping the Global Barrier Films Flexible Electronics market is the increasing focus on sustainability. As environmental consciousness grows across industries and among consumers, there is a rising demand for eco-friendly materials and practices in the production of flexible electronics and their associated barrier films. Manufacturers are now exploring and adopting sustainable alternatives to traditional barrier film materials, such as recyclable polymers and bio-based coatings.

These sustainable barrier films not only offer the required protection against moisture and oxygen but also align with corporate sustainability goals and regulatory requirements. This trend reflects a broader shift towards responsible and eco-conscious manufacturing practices, as companies seek to reduce their carbon footprint and meet the expectations of environmentally aware consumers. As sustainability continues to be a driving force in business decisions, the market for sustainable barrier films in flexible electronics is expected to see steady growth.

Enhanced Barrier Performance for Advanced Flexible Displays

The evolution of flexible display technologies is driving a trend towards the development of barrier films with enhanced performance characteristics. As consumer electronics manufacturers strive to create more innovative and durable products, there is a growing need for barrier films that can offer superior protection while allowing for the extreme flexibility demanded by foldable and rollable displays.

To meet these demands, barrier film manufacturers are investing in research and development to engineer films with exceptionally high barrier properties, capable of shielding displays from moisture, oxygen, and external contaminants. These advanced films enable the production of cutting-edge devices like foldable smartphones, wearable tech, and rollable OLED screens. This trend highlights the critical role of barrier films in enabling the next generation of flexible electronic displays and the competitive advantage they offer to manufacturers who can deliver superior performance.

Integration of Smart Barrier Films with IoT Devices

A significant trend in the Global Barrier Films Flexible Electronics market is the integration of smart features into barrier films to enhance functionality in IoT (Internet of Things) devices. IoT sensors and devices are increasingly reliant on flexible electronics to gather and transmit data. Barrier films are vital in protecting these sensitive components from environmental factors.

However, the trend goes beyond basic protection. Smart barrier films now incorporate sensors, coatings, or responsive materials that can actively monitor environmental conditions, such as humidity or gas concentrations. When combined with IoT devices, these smart films enable real-time data collection and analysis, providing valuable insights for various applications, including healthcare, agriculture, and industrial monitoring. This convergence of flexible electronics and IoT technology is driving innovation in barrier films, making them not only protective but also an integral part of the intelligent, connected systems that define the IoT landscape. As IoT adoption continues to grow across sectors, the demand for smart barrier films is poised for significant expansion.

Segmental Insights

Product Type Insights

Organic barrier films dominated the global barrier films flexible electronics market in 2022 and are expected to maintain its dominance during the forecast period. Organic barrier films accounted for the largest share of more than 60% of the global barrier films flexible electronics market in 2022. Organic barrier films offer excellent barrier properties against moisture, oxygen, and other gases at a lower cost as compared to inorganic barrier films. They provide high barrier against moisture and gases while maintaining flexibility, which is a key requirement in flexible electronics applications. Organic barrier films such as PEN, PET, and others are widely used in manufacturing flexible OLED displays, printed sensors, flexible solar cells, and other flexible electronics products. Their excellent barrier properties coupled with flexibility and lower cost make organic barrier films the material of choice for a majority of flexible electronics applications. Hence, organic barrier films are expected to continue dominating the global barrier films flexible electronics market during the forecast period from 2023 to 2028.

Application Insights

Flexible displays dominated the global barrier films flexible electronics market in 2022 and are expected to maintain its dominance during the forecast period. Flexible displays accounted for over 35% of the global barrier films flexible electronics market in 2022. Barrier films play a crucial role in manufacturing flexible displays as they help prevent diffusion of moisture, oxygen, and other gases into flexible OLED and LCD displays. The increasing demand for flexible displays from various end-use industries such as consumer electronics, automotive, healthcare, and others is driving the growth of the segment. Factors such as the rising popularity of wearable devices, foldable smartphones and tablets, and increasing applications of flexible displays in automotive interiors are fueling the demand for barrier films in flexible displays. Additionally, continuous technological advancements and mass production of flexible displays are further supporting the growth of the segment. Moreover, flexible displays offer advantages such as flexibility, lightweight, shatter resistance, and portability which is increasing their adoption across various applications. Owing to the rising demand for flexible displays and the crucial role played by barrier films in their manufacturing, the flexible displays segment is expected to continue dominating the global barrier films flexible electronics market during the forecast period from 2023 to 2028...

Regional Insights

The Asia Pacific region dominated the global barrier films flexible electronics market in 2022 and is expected to maintain its dominance during the forecast period until 2028. The Asia Pacific region accounted for over 40% share of the global barrier films flexible electronics market in 2022. This large share of the region is attributed to the presence of key barrier films manufacturers as well as flexible electronics companies in countries such as China, Japan, South Korea, and Taiwan. These countries are leading producers of barrier films as well as end-use industries such as consumer electronics, automotive, healthcare, and others.

The growth of the Asia Pacific region is driven by strong demand from the consumer electronics industry, especially from China, Japan, and South Korea. The rising demand for smartphones, wearables, tablets, and other consumer electronic devices is fueling the need for barrier films in the region. Additionally, the presence of a robust manufacturing base for flexible displays, printed electronics, and other flexible electronic components in Asia Pacific is propelling the demand for barrier films in the region. Countries like China and South Korea are also emerging as major hubs for the production of flexible OLED displays and other flexible electronics, thereby boosting barrier films consumption. Furthermore, supportive government policies and initiatives to promote domestic manufacturing of flexible electronics are expected to continue aiding the growth of the barrier films market in Asia Pacific. With dominant manufacturing and consumption, Asia Pacific is anticipated to retain its leading position in the global barrier films flexible electronics market during the forecast period.

Key Market Players

3M Company

Honeywell International Inc

Eastman Chemical Company

Alcan Packaging

Fraunhofer POLO

Centre for Process Innovation

Beneq

Toppan Printing Co. Ltd

Sigma Technologies Int'l, LLC

General Electric

Report Scope:

In this report, the Global Barrier Films Flexible Electronics Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Barrier Films Flexible Electronics Market, By Product Type:

- Organic Barrier Films

- Inorganic Barrier Films

Barrier Films Flexible Electronics Market, By Application:

- Flexible Displays

- Flexible Printed Electronics

- Flexible Photovoltaics (Solar Cells)

- Flexible Batteries

- Others

Barrier Films Flexible Electronics Market, By End-User Industry:

- Consumer Electronics

- Automotive

- Transportation and Logistics

- Healthcare

- Aerospace and Defense

Barrier Films Flexible Electronics Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

- Company Profiles: Detailed analysis of the major companies present in the Global Barrier Films Flexible Electronics Market.

Available Customizations:

- Global Barrier Films Flexible Electronics Market report with the given market data, Tech Sci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Service Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.2.3. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Formulation of the Scope

- 2.4. Assumptions and Limitations

- 2.5. Sources of Research

- 2.5.1. Secondary Research

- 2.5.2. Primary Research

- 2.6. Approach for the Market Study

- 2.6.1. The Bottom-Up Approach

- 2.6.2. The Top-Down Approach

- 2.7. Methodology Followed for Calculation of Market Size & Market Shares

- 2.8. Forecasting Methodology

- 2.8.1. Data Triangulation & Validation

3. Executive Summary

4. Voice of Customer

5. Global Barrier Films Flexible Electronics Market Overview

6. Global Barrier Films Flexible Electronics Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Product Type (Organic Barrier Films, Inorganic Barrier Films)

- 6.2.2. By Application (Flexible Displays, Flexible Printed Electronics, Flexible Photovoltaics (Solar Cells), Flexible Batteries, Others, SCADA (Supervisory Control and Data Acquisition))

- 6.2.3. By End-User Industry (Consumer Electronics, Automotive, Transportation and Logistics, Healthcare, Aerospace and Defense)

- 6.2.4. By Region

- 6.3. By Company (2022)

- 6.4. Market Map

7. North America Barrier Films Flexible Electronics Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Product Type

- 7.2.2. By Application

- 7.2.3. By End-User Industry

- 7.2.4. By Country

- 7.3. North America: Country Analysis

- 7.3.1. United States Barrier Films Flexible Electronics Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Product Type

- 7.3.1.2.2. By Application

- 7.3.1.2.3. By End-User Industry

- 7.3.1.1. Market Size & Forecast

- 7.3.2. Canada Barrier Films Flexible Electronics Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Product Type

- 7.3.2.2.2. By Application

- 7.3.2.2.3. By End-User Industry

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Mexico Barrier Films Flexible Electronics Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Product Type

- 7.3.3.2.2. By Application

- 7.3.3.2.3. By End-User Industry

- 7.3.3.1. Market Size & Forecast

- 7.3.1. United States Barrier Films Flexible Electronics Market Outlook

8. Europe Barrier Films Flexible Electronics Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Product Type

- 8.2.2. By Application

- 8.2.3. By End-User Industry

- 8.2.4. By Country

- 8.3. Europe: Country Analysis

- 8.3.1. Germany Barrier Films Flexible Electronics Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Product Type

- 8.3.1.2.2. By Application

- 8.3.1.2.3. By End-User Industry

- 8.3.1.1. Market Size & Forecast

- 8.3.2. United Kingdom Barrier Films Flexible Electronics Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Product Type

- 8.3.2.2.2. By Application

- 8.3.2.2.3. By End-User Industry

- 8.3.2.1. Market Size & Forecast

- 8.3.3. Italy Barrier Films Flexible Electronics Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecasty

- 8.3.3.2.1. By Product Type

- 8.3.3.2.2. By Application

- 8.3.3.2.3. By End-User Industry

- 8.3.3.1. Market Size & Forecast

- 8.3.4. France Barrier Films Flexible Electronics Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Product Type

- 8.3.4.2.2. By Application

- 8.3.4.2.3. By End-User Industry

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Spain Barrier Films Flexible Electronics Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Product Type

- 8.3.5.2.2. By Application

- 8.3.5.2.3. By End-User Industry

- 8.3.5.1. Market Size & Forecast

- 8.3.1. Germany Barrier Films Flexible Electronics Market Outlook

9. Asia-Pacific Barrier Films Flexible Electronics Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Product Type

- 9.2.2. By Application

- 9.2.3. By End-User Industry

- 9.2.4. By Country

- 9.3. Asia-Pacific: Country Analysis

- 9.3.1. China Barrier Films Flexible Electronics Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Product Type

- 9.3.1.2.2. By Application

- 9.3.1.2.3. By End-User Industry

- 9.3.1.1. Market Size & Forecast

- 9.3.2. India Barrier Films Flexible Electronics Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Product Type

- 9.3.2.2.2. By Application

- 9.3.2.2.3. By End-User Industry

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Japan Barrier Films Flexible Electronics Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Product Type

- 9.3.3.2.2. By Application

- 9.3.3.2.3. By End-User Industry

- 9.3.3.1. Market Size & Forecast

- 9.3.4. South Korea Barrier Films Flexible Electronics Market Outlook

- 9.3.4.1. Market Size & Forecast

- 9.3.4.1.1. By Value

- 9.3.4.2. Market Share & Forecast

- 9.3.4.2.1. By Product Type

- 9.3.4.2.2. By Application

- 9.3.4.2.3. By End-User Industry

- 9.3.4.1. Market Size & Forecast

- 9.3.5. Australia Barrier Films Flexible Electronics Market Outlook

- 9.3.5.1. Market Size & Forecast

- 9.3.5.1.1. By Value

- 9.3.5.2. Market Share & Forecast

- 9.3.5.2.1. By Product Type

- 9.3.5.2.2. By Application

- 9.3.5.2.3. By End-User Industry

- 9.3.5.1. Market Size & Forecast

- 9.3.1. China Barrier Films Flexible Electronics Market Outlook

10. South America Barrier Films Flexible Electronics Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Product Type

- 10.2.2. By Application

- 10.2.3. By End-User Industry

- 10.2.4. By Country

- 10.3. South America: Country Analysis

- 10.3.1. Brazil Barrier Films Flexible Electronics Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Product Type

- 10.3.1.2.2. By Application

- 10.3.1.2.3. By End-User Industry

- 10.3.1.1. Market Size & Forecast

- 10.3.2. Argentina Barrier Films Flexible Electronics Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Product Type

- 10.3.2.2.2. By Application

- 10.3.2.2.3. By End-User Industry

- 10.3.2.1. Market Size & Forecast

- 10.3.3. Colombia Barrier Films Flexible Electronics Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Product Type

- 10.3.3.2.2. By Application

- 10.3.3.2.3. By End-User Industry

- 10.3.3.1. Market Size & Forecast

- 10.3.1. Brazil Barrier Films Flexible Electronics Market Outlook

11. Middle East and Africa Barrier Films Flexible Electronics Market Outlook

- 11.1. Market Size & Forecast

- 11.1.1. By Value

- 11.2. Market Share & Forecast

- 11.2.1. By Product Type

- 11.2.2. By Application

- 11.2.3. By End-User Industry

- 11.2.4. By Country

- 11.3. MEA: Country Analysis

- 11.3.1. South Africa Barrier Films Flexible Electronics Market Outlook

- 11.3.1.1. Market Size & Forecast

- 11.3.1.1.1. By Value

- 11.3.1.2. Market Share & Forecast

- 11.3.1.2.1. By Product Type

- 11.3.1.2.2. By Application

- 11.3.1.2.3. By End-User Industry

- 11.3.1.1. Market Size & Forecast

- 11.3.2. Saudi Arabia Barrier Films Flexible Electronics Market Outlook

- 11.3.2.1. Market Size & Forecast

- 11.3.2.1.1. By Value

- 11.3.2.2. Market Share & Forecast

- 11.3.2.2.1. By Product Type

- 11.3.2.2.2. By Application

- 11.3.2.2.3. By End-User Industry

- 11.3.2.1. Market Size & Forecast

- 11.3.3. UAE Barrier Films Flexible Electronics Market Outlook

- 11.3.3.1. Market Size & Forecast

- 11.3.3.1.1. By Value

- 11.3.3.2. Market Share & Forecast

- 11.3.3.2.1. By Product Type

- 11.3.3.2.2. By Application

- 11.3.3.2.3. By End-User Industry

- 11.3.3.1. Market Size & Forecast

- 11.3.4. Kuwait Barrier Films Flexible Electronics Market Outlook

- 11.3.4.1. Market Size & Forecast

- 11.3.4.1.1. By Value

- 11.3.4.2. Market Share & Forecast

- 11.3.4.2.1. By Product Type

- 11.3.4.2.2. By Application

- 11.3.4.2.3. By End-User Industry

- 11.3.4.1. Market Size & Forecast

- 11.3.5. Turkey Barrier Films Flexible Electronics Market Outlook

- 11.3.5.1. Market Size & Forecast

- 11.3.5.1.1. By Value

- 11.3.5.2. Market Share & Forecast

- 11.3.5.2.1. By Product Type

- 11.3.5.2.2. By Application

- 11.3.5.2.3. By End-User Industry

- 11.3.5.1. Market Size & Forecast

- 11.3.6. Egypt Barrier Films Flexible Electronics Market Outlook

- 11.3.6.1. Market Size & Forecast

- 11.3.6.1.1. By Value

- 11.3.6.2. Market Share & Forecast

- 11.3.6.2.1. By Product Type

- 11.3.6.2.2. By Application

- 11.3.6.2.3. By End-User Industry

- 11.3.6.1. Market Size & Forecast

- 11.3.1. South Africa Barrier Films Flexible Electronics Market Outlook

12. Market Dynamics

- 12.1. Drivers

- 12.2. Challenges

13. Market Trends & Developments

14. Company Profiles

- 14.1. 3M Company

- 14.1.1. Business Overview

- 14.1.2. Key Revenue and Financials

- 14.1.3. Recent Developments

- 14.1.4. Key Personnel/Key Contact Person

- 14.1.5. Key Product/Services Offered

- 14.2. Honeywell International Inc

- 14.2.1. Business Overview

- 14.2.2. Key Revenue and Financials

- 14.2.3. Recent Developments

- 14.2.4. Key Personnel/Key Contact Person

- 14.2.5. Key Product/Services Offered

- 14.3. Eastman Chemical Company

- 14.3.1. Business Overview

- 14.3.2. Key Revenue and Financials

- 14.3.3. Recent Developments

- 14.3.4. Key Personnel/Key Contact Person

- 14.3.5. Key Product/Services Offered

- 14.4. Alcan Packaging

- 14.4.1. Business Overview

- 14.4.2. Key Revenue and Financials

- 14.4.3. Recent Developments

- 14.4.4. Key Personnel/Key Contact Person

- 14.4.5. Key Product/Services Offered

- 14.5. Fraunhofer POLO

- 14.5.1. Business Overview

- 14.5.2. Key Revenue and Financials

- 14.5.3. Recent Developments

- 14.5.4. Key Personnel/Key Contact Person

- 14.5.5. Key Product/Services Offered

- 14.6. Sigma Technologies Int'l, LLC

- 14.6.1. Business Overview

- 14.6.2. Key Revenue and Financials

- 14.6.3. Recent Developments

- 14.6.4. Key Personnel/Key Contact Person

- 14.6.5. Key Product/Services Offered

- 14.7. Centre for Process Innovation

- 14.7.1. Business Overview

- 14.7.2. Key Revenue and Financials

- 14.7.3. Recent Developments

- 14.7.4. Key Personnel/Key Contact Person

- 14.7.5. Key Product/Services Offered

- 14.8. Beneq

- 14.8.1. Business Overview

- 14.8.2. Key Revenue and Financials

- 14.8.3. Recent Developments

- 14.8.4. Key Personnel/Key Contact Person

- 14.8.5. Key Product/Services Offered

- 14.9. Toppan Printing Co. Ltd.

- 14.9.1. Business Overview

- 14.9.2. Key Revenue and Financials

- 14.9.3. Recent Developments

- 14.9.4. Key Personnel/Key Contact Person

- 14.9.5. Key Product/Services Offered

- 14.10. General Electric

- 14.10.1. Business Overview

- 14.10.2. Key Revenue and Financials

- 14.10.3. Recent Developments

- 14.10.4. Key Personnel/Key Contact Person

- 14.10.5. Key Product/Services Offered