|

|

市場調査レポート

商品コード

1784656

サハラ以南アフリカの水産飼料市場の分析(2021~2031年):市場範囲・区分・動向・競合分析Sub-Saharan Africa Aquafeed Market Report 2021-2031 by Scope, Segmentation, Dynamics, and Competitive Analysis |

||||||

|

|||||||

| サハラ以南アフリカの水産飼料市場の分析(2021~2031年):市場範囲・区分・動向・競合分析 |

|

出版日: 2025年07月10日

発行: The Insight Partners

ページ情報: 英文 202 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

サハラ以南アフリカの水産飼料の市場規模は、2024年の11億1,520万米ドルから2031年には16億8,131万米ドルに達すると予測されています。2024~2031年までのCAGRは6.0%を記録すると推定されます。

エグゼクティブサマリー - サハラ以南アフリカの水産飼料市場の分析

サハラ以南アフリカの水産飼料市場は、地域全体の水産養殖産業の拡大に支えられ、着実な成長を遂げています。伝統的な漁業が乱獲や環境課題のために魚の需要増を満たすのに苦戦する中、養殖は食糧安全保障を確保し、何百万もの人々に生計手段を提供するための実行可能な解決策として浮上しています。ナイジェリア、ケニア、ウガンダ、ザンビアといった国々が水産養殖生産をリードしており、ティラピア、ナマズ、コイといった養殖魚種の持続可能な成長を支える高品質の水産飼料への需要が高まっています。FAOによれば、新技術の導入がこのセクターに変化をもたらしています。サハラ以南アフリカでは、養殖生産は、主に池やラグーンでの最小限の管理による大規模・半集約的システムから、より集約的なシステム、再循環システム付きケージ、アクアポニックシステムの活用へと発展しています。ガーナ、ナイジェリア、南アフリカでは、ティラピア、ナマズ、マス、海産ヒレ科魚類が広く養殖されています。この地域の水産飼料メーカーは、大豆粕、キャッサバ、水産加工製品別など地元産の原料を使用するなど、費用対効果が高く栄養バランスの取れた配合飼料を提供することに注力しており、高価な輸入原料への依存度を下げる一助となっています。さらに、飼料効率とそれが魚の健康、成長率、水質に与える影響に対する意識の高まりが、商業養殖事業における特殊飼料製品の採用を促進しています。

サハラ以南アフリカの水産飼料市場 - セグメント別分析:

水産飼料市場の分析に寄与した主なセグメントは、成分タイプ、魚種、ライフサイクルです。

成分タイプ別では、大豆、トウモロコシ、魚粉・魚油、その他に区分されます。2024年にはその他が最大のシェアを占めています。

魚種別では、魚類、甲殻類、軟体動物、その他に区分されます。2024年には魚類が最大のシェアを占めています。

ライフサイクル別では、スターター飼料、グロワー飼料、フィニッシャー飼料、ブリーダー飼料に区分されます。2024年にはスターター飼料が最大シェアを占めました。

サハラ以南アフリカの水産飼料市場 - 展望

世界の魚消費量は、人口増加と、より健康的でタンパク質が豊富な食事へのシフトにより着実に増加しています。その結果、養殖がこの需要を満たす主要手段となっています。乱獲や環境上の制約といった課題に直面する従来の漁業とは異なり、養殖は持続可能でスケーラブルな解決策を提供し、今日世界中で消費される魚介類の半分以上を生産しています。水産養殖が拡大するにつれ、効率的で栄養バランスの取れた飼料の必要性は、養殖水産種の健康、成長、生産性を維持するために不可欠となっています。FAOによると、2022年の世界の漁業・養殖業生産量は2億2,320万トンに達し、2020年から4%増加しました。この生産量の内訳は、水産動物が1億8,540万トン、藻類が3,780万トンです。世界の養殖生産量は1億3,090万トンに達しました。タンパク質、脂肪、ビタミン、ミネラルなどの必須栄養素を配合した水産飼料は、最適な成長率、免疫力の向上、より高い収穫品質を保証することによって、現代の水産養殖において極めて重要な役割を果たしています。プロバイオティクス、酵素、代替タンパク質源の使用を含む飼料技術の進歩は、飼料効率をさらに高め、水産飼料を集約的養殖システムに不可欠なものにしています。さらに、エビやティラピアからサケやコイまで、水産養殖の種が多様化したことで、その種特有の栄養ニーズに合わせた種専用飼料の需要に拍車がかかっています。世界の水産養殖は、水産物消費の増加と持続可能な食料生産の推進によって、引き続き規模を拡大しています。

サハラ以南アフリカの水産飼料市場 - 国別考察

国別に見ると、サハラ以南アフリカの水産飼料市場はナイジェリア、南アフリカ、ケニア、サハラ以南アフリカのその他で構成されます。サハラ以南アフリカの残りの地域が2024年に最大のシェアを占めました。

ガーナ、ザンビア、ジンバブエ、ウガンダ、セネガル、モーリシャス、エチオピア、カメルーンなどがサハラ以南アフリカの残りの地域の水産飼料市場の主要国です。政府や民間利害関係者が魚の需要増に対応するため養殖拡大に投資しているため、高品質で費用対効果の高い水産飼料へのニーズが高まっています。サハラ以南アフリカでは、人口の急増と食生活の嗜好の変化により水産物の需要が高まっており、魚は手頃な価格で栄養価の高い蛋白源と考えられています。しかし、天然魚資源の減少により水産養殖の重要性が浮き彫りになり、養殖魚の生産性と健康を最適化する水産飼料の需要が高まっています。栄養バランスのとれた飼料の使用は魚の成長率を高め、生存率を向上させ、養殖業者の収益性を確保するため、養殖バリューチェーンの重要な要素となっています。2024年10月、農業のスペシャリストであるAgDevCoは、近代的な加工施設とその他の生産設備の建設資金として1,000万米ドルを投資すると発表しました。これにより、同社の生産能力は5年以内に3万トンに増加し、ガーナの栄養改善と食糧安全保障に貢献することになります。このように水産養殖への投資への注目が高まっていることが、この地域の水産飼料市場をさらに牽引しています。

サハラ以南アフリカの水産飼料市場 - 企業プロファイル

市場に参入している主な企業には、Cargill, Incorporated、World Feeds Limited、Kemin Industries Inc、Archer-Daniels-Midland Co、Alltech Inc、BioMar Group AS、Purina Animal Nutrition LLC、Godrej Agrovet Ltd、Aller Aqua AS、Raanan Fish Feed West Africa Limited、Godrej Agrovet Ltd、Aller Aqua AS、Arabian Agricultural Services Company、Bern Aqua NV、Avanti Feeds Limited、Skretting、Ridley Corporation Limited、Growel Feeds Pvt Ltd、Quality Feeds Limited、Grand Fish Feed、Dibaq Diproteg SA、Marubeni Nisshin Feed Co Ltdなどがあります。これらの企業は、消費者に革新的な製品を提供し、市場シェアを拡大するために、事業拡大、製品革新、M&Aなど様々な戦略を採用しています。

サハラ以南アフリカの水産飼料市場 - 調査手法:

本レポートで紹介するデータの収集と分析には、以下の調査手法を採用しています:

二次調査の調査プロセスは、各市場の質的・量的データを収集するために、社内外の情報源を活用した包括的な二次調査から始まります。一般的に参照される二次調査情報源は以下の通りですが、これらに限定されるものではありません:

企業のウェブサイト、年次報告書、財務諸表、ブローカーの分析、投資家のプレゼンテーション、業界専門誌、その他関連出版物政府文書、統計データベース、市場レポートニュース記事、プレスリリース、ウェブキャスト。(企業プロファイルに含まれる財務データはすべて米ドルで統一されています。他通貨で報告されている企業については、該当年度の関連為替レートを使用して数値を米ドルに換算しています。)

一次調査:インサイト・パートナーズでは、データ分析を検証し、貴重な知見を得るために、毎年、業界利害関係者や専門家と相当数の1次インタビューを実施しています。これらの調査は、以下を目的としています:

二次調査の結果を検証し、改良します。分析チームの専門知識と市場理解を深めます。市場規模、動向、成長パターン、競合力学、将来の見通しに関する考察を得るます。一次調査は、様々な市場、カテゴリー、セグメント、サブセグメントを対象とし、Eメールでのやり取りや電話インタビューで実施します。参加者は通常以下の通りです:

業界の利害関係者(副社長、事業開発マネージャー、マーケット・インテリジェンス・マネージャー、国内営業マネージャー)、業界固有の専門知識を持つ外部専門家(評価専門家、リサーチアナリスト、国内営業マネージャー、主要オピニオンリーダー)

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の動向

- データの三角測量

- 国レベルのデータ

第4章 サハラ以南アフリカの水産飼料市場情勢

- ポーターのファイブフォース分析

- エコシステム分析

- 原材料サプライヤー

- メーカー

- ディストリビューター/サプライヤー

- エンドユーザー

- 原材料供給業者リスト(GCCおよびイラク)

- 潜在顧客リスト(GCCおよびイラク)

- メーカー別生産能力、2023年(キロトン)

第5章 サハラ以南アフリカの水産飼料市場:主要市場力学

- 市場促進要因

- 水産養殖産業の成長

- 高品質飼料へのシフトの高まり

- 市場抑制要因

- 原材料の高コスト

- 市場機会

- 機能性・薬用飼料への需要の高まり

- 今後の動向

- 飼料生産における技術の進歩

- 促進要因と抑制要因の影響

第6章 サハラ以南アフリカの水産飼料市場の分析

- サハラ以南アフリカの水産飼料市場の規模(2021~2031年)

- サハラ以南アフリカの水産飼料市場の予測・分析(キロトン)

- サハラ以南アフリカの水産飼料市場の収益(2024~2031年)

- サハラ以南アフリカの水産飼料市場の予測・分析

第7章 サハラ以南アフリカの水産飼料の市場規模・収益分析:成分タイプ別

- 大豆

- トウモロコシ

- 魚粉・魚油

- その他

第8章 サハラ以南アフリカの水産飼料の市場規模・収益分析:魚種別

- 魚類

- 甲殻類

- 軟体動物

- その他

第9章 サハラ以南アフリカの水産飼料の市場規模・収益分析:ライフサイクル別

- スターター飼料

- グロワー飼料

- フィニッシャー飼料

- ブリーダー飼料

第10章 サハラ以南アフリカの水産飼料市場:国別分析

- サハラ以南アフリカ

- ナイジェリア

- 南アフリカ

- ケニア

- その他サハラ以南アフリカ

第11章 競合情勢

- 競合ベンチマーキング

- 競合ベンチマーキング-サハラ以南アフリカ

- 市場集中度

第12章 業界情勢

- 製品発表

- 企業ニュース

- 事業拡大

- 合弁事業

第13章 企業プロファイル

- Cargill, Incorporated

- World Feeds Limited

- Kemin Industries Inc

- Archer-Daniels-Midland Co

- Alltech Inc

- BioMar Group AS

- Purina Animal Nutrition LLC

- Godrej Agrovet Ltd

- Aller Aqua AS

- Raanan Fish Feed West Africa Limited

- Arabian Agricultural Services Company

- Bern Aqua NV

- Avanti Feeds Limited

- Skretting

- Ridley Corporation Limited

- Growel Feeds Pvt Ltd

- Quality Feeds Limited

- Grand Fish Feed

- Dibaq Diproteg SA

- Marubeni Nisshin Feed Co Ltd

第14章 付録

List Of Tables

- Table 1. Sub-Saharan Africa Aquafeed Market Segmentation

- Table 2. List of Raw Material Suppliers, GCC and Iraq

- Table 3. List of Potential Customers, GCC and Iraq

- Table 4. Production Capacity by Manufacturers, 2023 (Kilo Tons)

- Table 5. Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Table 6. Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Table 7. Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Ingredient Type

- Table 8. Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Ingredient Type

- Table 9. Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Species

- Table 10. Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Species

- Table 11. Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Lifecycle

- Table 12. Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Lifecycle

- Table 13. Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Country

- Table 14. Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Country

- Table 15. Nigeria: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Ingredient Type

- Table 16. Nigeria: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Ingredient Type

- Table 17. Nigeria: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Species

- Table 18. Nigeria: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Species

- Table 19. Nigeria: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Lifecycle

- Table 20. Nigeria: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Lifecycle

- Table 21. South Africa: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Ingredient Type

- Table 22. South Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Ingredient Type

- Table 23. South Africa: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Species

- Table 24. South Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Species

- Table 25. South Africa: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Lifecycle

- Table 26. South Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Lifecycle

- Table 27. Kenya: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Ingredient Type

- Table 28. Kenya: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Ingredient Type

- Table 29. Kenya: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Species

- Table 30. Kenya: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Species

- Table 31. Kenya: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Lifecycle

- Table 32. Kenya: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Lifecycle

- Table 33. Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Ingredient Type

- Table 34. Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Ingredient Type

- Table 35. Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Species

- Table 36. Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Species

- Table 37. Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons) - by Lifecycle

- Table 38. Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Lifecycle

List Of Figures

- Figure 1. Sub-Saharan Africa Aquafeed Market Segmentation - Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Aquafeed Market

- Figure 4. Sub-Saharan Africa Aquafeed Market - Key Market Dynamics

- Figure 5. World Aquaculture Production, 1990-2022

- Figure 6. Future Price Development of Fish Oil (A) and Fishmeal (B) in USD/ton Under the Four Climate Change and European Aquatic Resources (CERES) Scenarios

- Figure 7. Impact Analysis of Drivers and Restraints

- Figure 8. Sub-Saharan Africa Aquafeed Market Volume (Kilo Tons), 2021-2031

- Figure 9. Sub-Saharan Africa Aquafeed Market Revenue (US$ Million), 2024-2031

- Figure 10. Sub-Saharan Africa Aquafeed Market Share (%) - Ingredient Type, 2024 and 2031

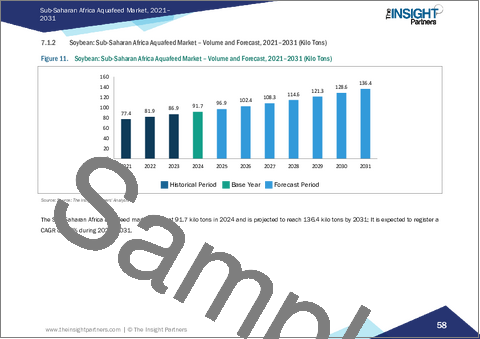

- Figure 11. Soybean: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 12. Soybean: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 13. Corn: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 14. Corn: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 15. Fishmeal and Fish Oil: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 16. Fishmeal and Fish Oil: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 17. Others: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 18. Others: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 19. Sub-Saharan Africa Aquafeed Market Share (%) - Species, 2024 and 2031

- Figure 20. Fish: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 21. Fish: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 22. Crustaceans: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 23. Crustaceans: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 24. Mollusks: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 25. Mollusks: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 26. Others: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 27. Others: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 28. Sub-Saharan Africa Aquafeed Market Share (%) - Lifecycle, 2024 and 2031

- Figure 29. Starter Feed: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 30. Starter Feed: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 31. Grower Feed: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 32. Grower Feed: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 33. Finisher Feed: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 34. Finisher Feed: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 35. Brooder Feed: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 36. Brooder Feed: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 37. Sub-Saharan Africa Aquafeed Market Breakdown by Key Countries, 2024 and 2031 (%)

- Figure 38. Nigeria: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 39. South Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 40. Kenya: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 41. Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 42. Market Concentration

The Sub-Saharan Africa aquafeed market size is expected to reach US$ 1,681.31 million by 2031 from US$ 1,115.20 million in 2024. The market is estimated to record a CAGR of 6.0% from 2024 to 2031.

Executive Summary and Sub-Saharan Africa Aquafeed Market Analysis:

The aquafeed market in Sub-Saharan Africa is experiencing steady growth, underpinned by the expanding aquaculture industry across the region. As traditional fishing struggles to meet the rising demand for fish due to overfishing and environmental challenges, aquaculture has emerged as a viable solution to ensure food security and provide a source of livelihood for millions. Countries such as Nigeria, Kenya, Uganda, and Zambia are leading the way in aquaculture production, creating a growing demand for high-quality aquafeed to support the sustainable growth of farmed fish species such as tilapia, catfish, and carp. According to the FAO, the adoption of new technologies is bringing changes to the sector. In sub-Saharan Africa, aquaculture production has evolved from extensive and semi-intensive systems, primarily in ponds and lagoons with minimal management, to the utilization of more intensive systems, cages with recirculating systems, and aquaponic systems. Tilapia, catfish, trout, and marine finfish are widely cultured in Ghana, Nigeria, and South Africa. Aquafeed manufacturers in the region are focusing on delivering cost-effective, nutritionally balanced feed formulations, including the use of locally sourced ingredients such as soybean meal, cassava, and fish processing by-products, which are helping reduce reliance on expensive imported raw materials. Furthermore, the increasing awareness of feed efficiency and its impact on fish health, growth rates, and water quality is driving the adoption of specialized feed products in commercial aquaculture operations.

Sub-Saharan Africa Aquafeed Market Segmentation Analysis:

Key segments that contributed to the derivation of the aquafeed market analysis are ingredient type, species, and lifecycle.

By ingredient type, the aquafeed market is segmented into soybean, corn, fishmeal, fish oil, and others. The others held the largest share of the market in 2024.

By species, the aquafeed market is segmented into fish, crustaceans, mollusks, and others. The fish held the largest share of the market in 2024.

By lifecycle, the aquafeed market is segmented into starter feed, grower feed, finisher feed, and brooder feed. The starter feed held the largest share of the market in 2024.

Sub-Saharan Africa Aquafeed Market Outlook

Global fish consumption is steadily rising due to population growth and a shift toward healthier, protein-rich diets. As a result, aquaculture has become the primary means of meeting this demand. Unlike traditional fisheries, which face challenges such as overfishing and environmental constraints, aquaculture offers a sustainable and scalable solution, producing over half of the seafood consumed worldwide today. As aquaculture expands, the need for efficient, nutritionally balanced feed has become critical to maintaining the health, growth, and productivity of farmed aquatic species. According to FAO, in 2022, the global fisheries and aquaculture production reached 223.2 million tons, representing ~4% increase from 2020. This production consisted of 185.4 million tons of aquatic animals and 37.8 million tons of algae. The global aquaculture production reached an unmatched 130.9 million tons. Aquafeed, formulated with essential nutrients such as proteins, fats, vitamins, and minerals, plays a pivotal role in modern aquaculture by ensuring optimal growth rates, improved immunity, and higher yield quality. Advancements in feed technology, including the use of probiotics, enzymes, and alternative protein sources, have further enhanced feed efficiency, making aquafeed indispensable for intensive farming systems. Additionally, the diversification of aquaculture species, from shrimp and tilapia to salmon and carp, has spurred the demand for species-specific feeds tailored to their unique nutritional needs. Global aquaculture continues to scale up, driven by increasing seafood consumption and the push for sustainable food production.

Sub-Saharan Africa Aquafeed Market Country Insights

Based on country, the Sub-Saharan Africa aquafeed market comprises Nigeria, South Africa, Kenya, and the Rest of Sub-Saharan Africa. The Rest of Sub-Saharan Africa held the largest share in 2024.

Ghana, Zambia, Zimbabwe, Uganda, Senegal, Mauritius, Ethiopia, and Cameroon are among the key countries in the Rest of Sub-Saharan Africa aquafeed market. The need for high-quality, cost-effective aquafeed is increasing as governments and private stakeholders invest in expanding aquaculture to meet the growing demand for fish. Sub-Saharan Africa faces a rising demand for seafood due to its rapidly growing population and changing dietary preferences, with fish considered an affordable and nutritious protein source. However, declining wild fish stocks have highlighted the importance of aquaculture, which is driving the demand for aquafeed to optimize the productivity and health of farmed fish. The use of nutritionally balanced feed enhances fish growth rates, improves survival, and ensures profitability for farmers, making it a vital component of the aquaculture value chain. In October 2024, Specialist agriculture investor AgDevCo announced the investment of US$ 10 million to finance the construction of a modern processing facility and other production equipment. This will increase the company's capacity to 30,000 tonnes within five years, contributing to improved nutrition and food security in Ghana. This increasing focus on investment in aquaculture is further driving the aquafeed market in the region.

Sub-Saharan Africa Aquafeed Market Company Profiles

Some of the key players operating in the market include Cargill, Incorporated; World Feeds Limited; Kemin Industries Inc; Archer-Daniels-Midland Co; Alltech Inc; BioMar Group AS; Purina Animal Nutrition LLC; Godrej Agrovet Ltd; Aller Aqua AS; Raanan Fish Feed West Africa Limited; Arabian Agricultural Services Company; Bern Aqua NV; Avanti Feeds Limited; Skretting; Ridley Corporation Limited; Growel Feeds Pvt Ltd; Quality Feeds Limited; Grand Fish Feed; Dibaq Diproteg SA; and Marubeni Nisshin Feed Co Ltd among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Sub-Saharan Africa Aquafeed Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Company websites , annual reports, financial statements, broker analyses, and investor presentations. Industry trade journals and other relevant publications. Government documents , statistical databases, and market reports. News articles , press releases, and webcasts specific to companies operating in the market. Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research The Insight Partners' conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Validate and refine findings from secondary research. Enhance the expertise and market understanding of the analysis team. Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects. Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

Industry stakeholders : Vice Presidents, business development managers, market intelligence managers, and national sales managers External experts : Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Table Of Contents

1. Introduction

- 1.1 Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macroeconomic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country-level data:

4. Sub-Saharan Africa Aquafeed Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers:

- 4.3.2 Manufacturers:

- 4.3.3 Distributors/Suppliers:

- 4.3.4 End Users:

- 4.4 List of Raw Material Suppliers, GCC and Iraq

- 4.5 List of Potential Customers, GCC and Iraq

- 4.6 Production Capacity by Manufacturers, 2023 (Kilo Tons)

5. Sub-Saharan Africa Aquafeed Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Aquaculture Industry

- 5.1.2 Increasing Shift Toward High-Quality Feed

- 5.2 Market Restraints

- 5.2.1 High Cost of Raw Materials

- 5.3 Market Opportunities

- 5.3.1 Rising Demand for Functional and Medicated Feed

- 5.4 Future Trends

- 5.4.1 Technological Advancements in Feed Production

- 5.5 Impact of Drivers and Restraints:

6. Sub-Saharan Africa Aquafeed Market Analysis

- 6.1 Sub-Saharan Africa Aquafeed Market Volume (Kilo Tons), 2021-2031

- 6.2 Sub-Saharan Africa Aquafeed Market Volume Forecast and Analysis (Kilo Tons)

- 6.3 Sub-Saharan Africa Aquafeed Market Revenue (US$ Million), 2024-2031

- 6.4 Sub-Saharan Africa Aquafeed Market Forecast and Analysis

7. Sub-Saharan Africa Aquafeed Market Volume and Revenue Analysis - by Ingredient Type

- 7.1 Soybean

- 7.1.1 Overview

- 7.1.2 Soybean: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.1.3 Soybean: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.2 Corn

- 7.2.1 Overview

- 7.2.2 Corn: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.2.3 Corn: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.3 Fishmeal and Fish Oil

- 7.3.1 Overview

- 7.3.2 Fishmeal and Fish Oil: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.3.3 Fishmeal and Fish Oil: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.4.3 Others: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

8. Sub-Saharan Africa Aquafeed Market Volume and Revenue Analysis - by Species

- 8.1 Fish

- 8.1.1 Overview

- 8.1.2 Fish: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 8.1.3 Fish: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2 Crustaceans

- 8.2.1 Overview

- 8.2.2 Crustaceans: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 8.2.3 Crustaceans: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3 Mollusks

- 8.3.1 Overview

- 8.3.2 Mollusks: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 8.3.3 Mollusks: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.4 Others

- 8.4.1 Overview

- 8.4.2 Others: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 8.4.3 Others: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

9. Sub-Saharan Africa Aquafeed Market Volume and Revenue Analysis - by Lifecycle

- 9.1 Starter Feed

- 9.1.1 Overview

- 9.1.2 Starter Feed: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 9.1.3 Starter Feed: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.2 Grower Feed

- 9.2.1 Overview

- 9.2.2 Grower Feed: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 9.2.3 Grower Feed: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.3 Finisher Feed

- 9.3.1 Overview

- 9.3.2 Finisher Feed: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 9.3.3 Finisher Feed: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.4 Brooder Feed

- 9.4.1 Overview

- 9.4.2 Brooder Feed: Sub-Saharan Africa Aquafeed Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 9.4.3 Brooder Feed: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

10. Sub-Saharan Africa Aquafeed Market - Country Analysis

- 10.1 Sub-Saharan Africa

- 10.1.1 Sub-Saharan Africa Aquafeed Market Revenue and Forecast and Analysis - by Country

- 10.1.1.1 Sub-Saharan Africa Aquafeed Market Volume and Forecast and Analysis - by Country

- 10.1.1.2 Sub-Saharan Africa Aquafeed Market Revenue and Forecast and Analysis - by Country

- 10.1.1.3 Nigeria: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.3.1 Nigeria: Sub-Saharan Africa Aquafeed Market Share - by Ingredient Type

- 10.1.1.3.2 Nigeria: Sub-Saharan Africa Aquafeed Market Share - by Species

- 10.1.1.3.3 Nigeria: Sub-Saharan Africa Aquafeed Market Share - by Lifecycle

- 10.1.1.4 South Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.4.1 South Africa: Sub-Saharan Africa Aquafeed Market Share - by Ingredient Type

- 10.1.1.4.2 South Africa: Sub-Saharan Africa Aquafeed Market Share - by Species

- 10.1.1.4.3 South Africa: Sub-Saharan Africa Aquafeed Market Share - by Lifecycle

- 10.1.1.5 Kenya: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.5.1 Kenya: Sub-Saharan Africa Aquafeed Market Share - by Ingredient Type

- 10.1.1.5.2 Kenya: Sub-Saharan Africa Aquafeed Market Share - by Species

- 10.1.1.5.3 Kenya: Sub-Saharan Africa Aquafeed Market Share - by Lifecycle

- 10.1.1.6 Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.6.1 Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market Share - by Ingredient Type

- 10.1.1.6.2 Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market Share - by Species

- 10.1.1.6.3 Rest of Sub-Saharan Africa: Sub-Saharan Africa Aquafeed Market Share - by Lifecycle

- 10.1.1 Sub-Saharan Africa Aquafeed Market Revenue and Forecast and Analysis - by Country

11. Competitive Landscape

- 11.1 Competitive Benchmarking

- 11.1.1 Competitive Benchmarking - Sub Saharan Africa

- 11.2 Market Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Product Launch

- 12.3 Company News

- 12.4 Expansion

- 12.5 Joint Venture

13. Company Profiles

- 13.1 Cargill, Incorporated

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 World Feeds Limited

- 13.2.1 Key Facts

- 13.2.2 Business Descriptions

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Kemin Industries Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Archer-Daniels-Midland Co

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Alltech Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 BioMar Group AS

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Purina Animal Nutrition LLC

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Godrej Agrovet Ltd

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Aller Aqua AS

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Raanan Fish Feed West Africa Limited

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Arabian Agricultural Services Company

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 Bern Aqua NV

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Avanti Feeds Limited

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 Skretting

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 Ridley Corporation Limited

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

- 13.16 Growel Feeds Pvt Ltd

- 13.16.1 Key Facts

- 13.16.2 Business Description

- 13.16.3 Products and Services

- 13.16.4 Financial Overview

- 13.16.5 SWOT Analysis

- 13.16.6 Key Developments

- 13.17 Quality Feeds Limited

- 13.17.1 Key Facts

- 13.17.2 Business Description

- 13.17.3 Products and Services

- 13.17.4 Financial Overview

- 13.17.5 SWOT Analysis

- 13.17.6 Key Developments

- 13.18 Grand Fish Feed

- 13.18.1 Key Facts

- 13.18.2 Business Description

- 13.18.3 Products and Services

- 13.18.4 Financial Overview

- 13.18.5 SWOT Analysis

- 13.18.6 Key Developments

- 13.19 Dibaq Diproteg SA

- 13.19.1 Key Facts

- 13.19.2 Business Description

- 13.19.3 Products and Services

- 13.19.4 Financial Overview

- 13.19.5 SWOT Analysis

- 13.19.6 Key Developments

- 13.20 Marubeni Nisshin Feed Co Ltd

- 13.20.1 Key Facts

- 13.20.2 Business Description

- 13.20.3 Products and Services

- 13.20.4 Financial Overview

- 13.20.5 SWOT Analysis

- 13.20.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners