|

|

市場調査レポート

商品コード

1784597

EOTクレーンのアジア太平洋地域市場、2021年~2031年:タイプ別、ブリッジクレーン別、アプリケーション別Asia Pacific Electric Overhead Training (EOT) Cranes Market Report 2021-2031 by Scope, Segmentation, Dynamics, and Competitive Analysis |

||||||

|

|||||||

| EOTクレーンのアジア太平洋地域市場、2021年~2031年:タイプ別、ブリッジクレーン別、アプリケーション別 |

|

出版日: 2025年07月10日

発行: The Insight Partners

ページ情報: 英文 177 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋地域のEOTクレーン市場規模は、2023年の7億9,787万米ドルから2031年には13億9,907万米ドルに達し、2023年から2031年までのCAGRで7.3%の成長が予測されています。

エグゼクティブサマリーとアジア太平洋地域のEOTクレーン市場分析

アジア太平洋地域の建設・インフラセクターは、経済成長と人口増加に後押しされ、力強い拡大・開発イニシアチブが進行中です。主なインフラ開発には、鉄道駅、商業スペース、ビル、住宅、空港、水処理施設などの増加が含まれます。

ニュージーランド政府は、上下水道、道路・鉄道網、送電、通信インフラなどのインフラ整備に力を入れています。人口の増加と都市化の進展が、国内の重要なインフラ施設の拡張とアップグレードの必要性を高めています。政府は今後5年間で、インフラ開発に470億米ドルを拠出する計画です。インフラ開発への注目が高まることで、今後数年間、同国全体の建設活動とEOTクレーンの用途の成長が促進されると予想されます。

シンガポールのチャンギ国際空港、北京首都国際空港、仁川国際空港などの空港施設近代化プロジェクトの増加は、建設・インフラ部門全体にプラスの影響を与えています。インドネシアやタイなどの国々も、接続性を向上させるため、地方空港に重点を置いた国内インフラ開発に投資しています。現在、全世界の空港・空港インフラ開発プロジェクト425件のうち、アジア太平洋では155件が開発中で、投資額は2,090億米ドルです。アジア太平洋地域で最大の空港開発プロジェクトのひとつは、ベトナムのロンタイン国際空港で、投資額は145億米ドルにのぼり、2025年までに完成する予定です。また、シンガポールのチャンギ空港のターミナル5の拡張は100億米ドルのプロジェクトで、2030年までに完成する予定です。

中国、インド、日本などの国々における自動車セクターの開発拡大は、アジア太平洋地域におけるEOTクレーンのアプリケーションに拍車をかけています。

2022年7月、フィリピンは、30年の歴史を持つカドラオ油田を再開発し、今後数年間で同国の石油生産を増強する計画を発表しました。同様に2022年5月には、2つの異なる企業から成るホアンロン共同事業会社が、ベトナムのクーロン盆地で計画中の石油・ガス開発井の掘削リグを確保しました。このような開発は、アジア太平洋地域におけるEOTの需要を生み出しています。

アジア太平洋地域のEOTクレーン市場のセグメンテーション分析:

EOTクレーン市場の分析に貢献した主なセグメントは、タイプ、ブリッジクレーン、アプリケーションです。

タイプ別では、EOTクレーン市場はブリッジクレーン、ガントリークレーン、ジブクレーン、その他に区分されます。2023年には、ブリッジクレーンが最大のシェアを占めています。

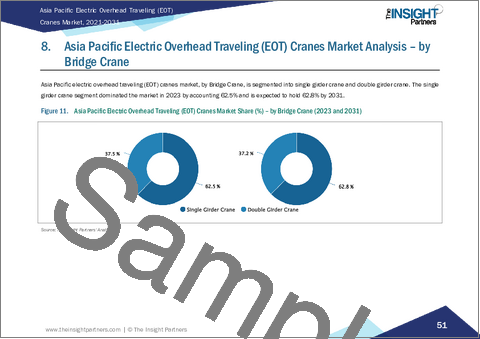

ブリッジクレーンの観点から、EOTクレーン市場はシングルガーダークレーンとダブルガーダークレーンに二分されます。シングルガーダークレーンセグメントが2023年の市場で大きなシェアを占めています。

アプリケーション別では、EOTクレーン市場は、建設、鉱業・金属、化学、海運、自動車・輸送、石油・ガス、一般製造、その他に分類されます。2023年には一般製造セグメントが最大シェアを占めています。

アジア太平洋地域のEOTクレーン市場の展望

陸上および海上での鉱物探査作業には、高レベルの掘削活動が伴うため、EOTの用途が拡大しています。各国政府は、経済開発の主要な一環として鉱物探査プロジェクトに取り組んでいます。また、既存の採掘場のアップグレードやメンテナンスとともに、新しい採掘場の発見にも力を入れています。鉱物探査活動の高まりは、EOTクレーン市場の成長を促進します。

アジア太平洋地域のEOTクレーン市場の国別インサイト

国別に見ると、アジア太平洋地域のEOTクレーン市場は、オーストラリア、中国、インド、日本、韓国、その他のアジア太平洋地域で構成されます。2023年には中国が最大のシェアを占めています。

アジア太平洋地域のEOTクレーン市場の企業プロファイル

同市場で事業を展開する主要企業は、Dafang Heavy Machine Co., Ltd.、Sumitomo Corp、Spanco, Inc.、ABUS Kransysteme GmbH、Columbus McKinnon Corporation、Konecranes Plc、WHCRANE、VERLINDE SA、Gorbel Inc.、American Equipment、Safex Industries Limited、Uesco Cranes、Harrington Hoists, Inc.、K2 Cranes & Components Pvt.、TAWI ABなどです。これらの企業は、消費者に革新的な製品を提供し、市場シェアを拡大するために、事業拡大、製品革新、M&Aなど様々な戦略を採用しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

第4章 アジア太平洋地域のEOTクレーン市場情勢

- PEST分析

- エコシステム分析

- 原材料サプライヤー

- クレーンメーカー

- エンドユーザー

- サプライヤー一覧

第5章 アジア太平洋地域のEOTクレーン市場:主な市場力学

- 市場促進要因

- 工業化とインフラ開発の動向の高まり

- 石油・ガス産業の開発の高まり

- 市場抑制要因

- 高い初期投資要件

- 市場機会

- 産業オペレーションの効率化、自動化、安全性確保への応用範囲のシフト

- 鉱業における重要性の高まり

- 今後の動向

- EOTクレーンにおけるIoTの統合

- 促進要因と抑制要因の影響

第6章 EOTクレーン市場:アジア太平洋地域の分析

- アジア太平洋地域のEOTクレーン市場収益、2021年~2031年

- アジア太平洋地域のEOTクレーン市場予測分析

第7章 アジア太平洋地域のEOTクレーン市場分析:タイプ別

- ブリッジクレーン

- ガントリークレーン

- ジブクレーン

- その他

第8章 アジア太平洋地域のEOTクレーン市場分析:ブリッジクレーン別

- シングルガーダークレーン

- ダブルガーダークレーン

第9章 アジア太平洋地域のEOTクレーン市場分析:アプリケーション別

- 建設

- 鉱業・金属

- 化学

- 海運

- 自動車・輸送

- 石油・ガス

- 一般製造

- その他

第10章 アジア太平洋地域のEOTクレーン市場:国別分析

- アジア太平洋地域

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋地域

第11章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Dafang Heavy Machine Co.,Ltd.

- Sumitomo Corp

- Spanco, Inc.

- ABUS Kransysteme GmbH

- Columbus McKinnon Corporation

- Konecranes Plc

- WHCRANE

- VERLINDE SA

- Gorbel Inc

- American Equipment

- Safex Industries Limited

- Uesco Cranes

- Harrington Hoists, Inc

- K2 Cranes & Components Pvt. Ltd.

- TAWI AB

第14章 付録

List Of Tables

- Table 1. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Segmentation

- Table 2. List of Suppliers

- Table 3. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Table 4. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Type

- Table 5. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Bridge Crane

- Table 6. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Application

- Table 7. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Country

- Table 8. Australia: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Type

- Table 9. Australia: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Bridge Crane

- Table 10. Australia: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 11. China: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Type

- Table 12. China: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Bridge Crane

- Table 13. China: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 14. India: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Type

- Table 15. India: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Bridge Crane

- Table 16. India: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 17. Japan: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Type

- Table 18. Japan: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Bridge Crane

- Table 19. Japan: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 20. South Korea: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Type

- Table 21. South Korea: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Bridge Crane

- Table 22. South Korea: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 23. Rest of APAC: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Type

- Table 24. Rest of APAC: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Bridge Crane

- Table 25. Rest of APAC: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 26. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Segmentation - Country

- Figure 2. PEST Analysis

- Figure 3. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Revenue (US$ Million), 2021-2031

- Figure 6. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share (%) - by Type (2023 and 2031)

- Figure 7. Bridge Cranes: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 8. Gantry Crane: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 9. Jib Crane: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 10. Others: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 11. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share (%) - by Bridge Crane (2023 and 2031)

- Figure 12. Single Girder Crane: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 13. Double Girder Crane: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 14. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share (%) - by Application (2023 and 2031)

- Figure 15. Construction: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 16. Mining and Metals: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 17. Chemical: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 18. Shipping Industry: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 19. Automotive and Transportation: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 20. Oil and Gas: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 21. General Manufacturing: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 22. Others: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 23. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 24. Australia: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 25. China: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 26. India: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 27. Japan: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 28. South Korea: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 29. Rest of APAC: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 30. Company Positioning and Concentration

The Asia Pacific Electric Overhead Training (EOT) Cranes Market size is expected to reach US$ 1,399.07 million by 2031 from US$ 797.87 million in 2023. The market is estimated to record a CAGR of 7.3 % from 2023 to 2031.

Executive Summary and Asia Pacific Electric Overhead Training (EOT) Cranes Market Analysis:

Asia Pacific's construction and infrastructure sector is undergoing strong expansion and development initiatives, propelled by the region's surging economic growth and increasing population. Key infrastructure developments include a growing number of railway stations, commercial spaces, buildings, residential housing, airports, and water treatment facilities.

The Government of New Zealand is emphasizing on infrastructure development, such as water and wastewater systems, road and rail networks, electricity transmission, and telecommunication infrastructure. Growing population and increasing urbanization are boosting the need to expand and upgrade important infrastructure facilities in the country. The government plans to offer ~US$ 47 billion for infrastructure development over the coming five years. The growing focus on infrastructure development is anticipated to propel the growth of construction activities and the application of electric overhead traveling cranes across the country in the coming years.

The increasing airport facility modernization projects, including Singapore Changi, Beijing Capital International, and Incheon International, are positively impacting the overall construction and infrastructure sector. Countries such as Indonesia and Thailand are also investing in domestic infrastructural development with more focus on regional airports to improve connectivity. Currently, out of 425 airport and airport infrastructure development projects across the globe, 155 projects are under development in Asia Pacific with an investment of US$ 209 billion. One of the largest airport development projects in Asia Pacific is Long Thanh International Airport in Vietnam, which has an investment of US$ 14.5 billion and is expected to be completed by 2025. In addition, the expansion of Terminal 5 at Changi Airport, Singapore, is a US$ 10 billion project and is expected to be completed by 2030.

The growing development of the automotive sector in countries such as China, India, and Japan is fueling the application of electric overhead traveling cranes in Asia Pacific.

In July 2022, the Philippines announced plans to redevelop its 30-year-old Cadlao Oil Field to boost the country's oil production in the coming years. Similarly, in May 2022, The Hoang Long joint operating company, consisting of two different companies, secured a drilling rig for its planned oil and gas development wells in the Cuu Long basin in Vietnam. Such developments are creating the demand for electric overhead traveling cranes in Asia Pacific.

Asia Pacific Electric Overhead Training (EOT) Cranes Market Segmentation Analysis:

Key segments that contributed to the derivation of the electric overhead training (EOT) cranes market analysis are type, bridge crane, and application.

By type, the electric overhead training (EOT) cranes market is segmented into bridge cranes, gantry crane, jib crane, and others. The bridge cranes held the largest share of the market in 2023.

In terms of bridge crane, the electric overhead training (EOT) cranes market is bifurcated into single girder crane and double girder crane. The single girder crane segment held a larger share of the market in 2023.

Based on application, the electric overhead training (EOT) cranes market is categorized into construction, mining and metals, chemical, shipping industry, automotive and transportation, oil and gas, general manufacturing, and others. The general manufacturing segment held the largest share of the market in 2023.

Asia Pacific Electric Overhead Training (EOT) Cranes Market Outlook

Onshore and offshore mineral exploration operations involve a high level of drilling activities, which boosts the application of electric overhead traveling cranes. Governments are working on mineral exploration projects as one of the major parts of their economic development. Also, they are focused on the discovery of new mining locations, along with the upgrading and maintenance of pre-existing mining sites. For instance, in 2023, Irving Resources Inc. started diamond drilling at its East Yamagano high-grade epithermal gold-silver vein project in Kyushu, Japan. In the same year, Metal Tiger plc announced the initiation of drilling at the Deokon Au-Ag project in South Korea for Southern Gold Limited. Southern Gold is anticipated to commence drilling the first of the two diamond drill holes for 500 meters at the untested extensions of the Deokon Main Mine at the Deokon Project. Thus, rising mineral exploration activities fuels the electric overhead traveling cranes market growth.

Asia Pacific Electric Overhead Training (EOT) Cranes Market Country Insights

Based on country, the Asia Pacific electric overhead training (EOT) cranes market comprises Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China held the largest share in 2023.

China's construction and infrastructure industry has witnessed transformative developments driven by rapid economic growth and the nation's ascent as a global economic powerhouse. China is one of the largest construction markets worldwide. The government included an expenditure of US$ 4 trillion (CNY 28.6 trillion) in 2024, an increase of ~3.8% compared with the 2023 Budget.

In March 2024, the government of China announced its target to fund US$ 173 billion (CNY 1.2 trillion) in transport infrastructure projects by the end of 2024. In March 2024, the Yangtze River Delta region government announced an investment of US$ 19.6 billion (CNY 140 billion) to build 32 railway infrastructure projects in the region in 2024. In February 2024, the Shanghai government announced its target to initiate work on 24 projects with a combined investment of US$ 5.8 billion (CNY 42.1 billion) in 2024.

Major airports, including Beijing Capital International Airport and Shanghai Pudong International Airport, have undergone extensive modernization projects to meet the surging demand for air travel. The government's commitment to establishing key airports as international hubs has resulted in massive investments, encompassing new runways, cutting-edge terminals, and advanced technologies.

According to the government's transportation network planning outline, the country aimed to add 400 airports by 2035, an increase from ~240 airports in 2022. According to the Civil Aviation Administration of China (CAAC), China's 32 large and busy airports are suffering from capacity overload, and 40 of China's 50 largest airports need renovation or expansion. China's 14th Five-Year Plan covers 140 airport projects, including greenfield construction, relocation, renovation, and expansion by 2025. With such sustained investments and a focus on innovation toward infrastructure, China continues to shape its construction sector to accommodate escalating development and assert its positive influence in the electric overhead traveling cranes market.

China is one of the largest vehicle manufacturers in terms of manufacturing output and annual sales, with domestic production estimated to account for more than 35 million vehicles by 2025. As per the data from the Ministry of Industry and Information Technology, more than 26 million vehicles were sold in 2021, which included 21.48 million passenger vehicles, which was an increase of ~7.1% from 2020. The growing development in the automotive sector is acting as a major driver for the electric overhead traveling cranes market in the country.

China, Mongolia, and Russia are working on the expansion of the Power of Siberia 2 pipeline. The pipeline is anticipated to supply Europe-bound gas from western Siberian fields to China, and it is projected to be operational by 2030. Thus, the development of oil and gas projects contributes to the demand for electric overhead traveling cranes across China.

Asia Pacific Electric Overhead Training (EOT) Cranes Market Company Profiles

Some of the key players operating in the market include Dafang Heavy Machine Co., Ltd.; Sumitomo Corp; Spanco, Inc.; ABUS Kransysteme GmbH; Columbus McKinnon Corporation; Konecranes Plc; WHCRANE; VERLINDE SA; Gorbel Inc; American Equipment; Safex Industries Limited; Uesco Cranes; Harrington Hoists, Inc.; K2 Cranes & Components Pvt. Ltd.; and TAWI AB., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Asia Pacific Electric Overhead Training (EOT) Cranes Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Company websites , annual reports, financial statements, broker analyses, and investor presentations. Industry trade journals and other relevant publications. Government documents , statistical databases, and market reports. News articles , press releases, and webcasts specific to companies operating in the market. Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research The Insight Partners' conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Validate and refine findings from secondary research. Enhance the expertise and market understanding of the analysis team. Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects. Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

Industry stakeholders : Vice Presidents, business development managers, market intelligence managers, and national sales managers External experts : Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Table Of Contents

1. Introduction

- 1.1 Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Crane Manufacturers

- 4.3.3 End Users

- 4.3.4 List of Suppliers

5. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Trend of Industrialization and Infrastructure Development

- 5.1.2 Rising Development of Oil & Gas Industry

- 5.2 Market Restraints

- 5.2.1 High Initial Investment Requirements

- 5.3 Market Opportunities

- 5.3.1 Shift in Application Scope to Ensure Efficiency, Automation, and Safety in Industrial Operations

- 5.3.2 Growing Importance in Mining Industry

- 5.4 Future Trends

- 5.4.1 Integration of IoT in Electric Overhead Traveling Cranes

- 5.5 Impact of Drivers and Restraints:

6. Electric Overhead Traveling (EOT) Cranes Market - Asia Pacific Analysis

- 6.1 Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Revenue (US$ Million), 2021-2031

- 6.2 Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Forecast Analysis

7. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Analysis - by Type

- 7.1 Bridge Cranes

- 7.1.1 Overview

- 7.1.2 Bridge Cranes: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.2 Gantry Crane

- 7.2.1 Overview

- 7.2.2 Gantry Crane: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.3 Jib Crane

- 7.3.1 Overview

- 7.3.2 Jib Crane: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

8. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Analysis - by Bridge Crane

- 8.1 Single Girder Crane

- 8.1.1 Overview

- 8.1.2 Single Girder Crane: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2 Double Girder Crane

- 8.2.1 Overview

- 8.2.2 Double Girder Crane: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

9. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Analysis - by Application

- 9.1 Construction

- 9.1.1 Overview

- 9.1.2 Construction: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.2 Mining and Metals

- 9.2.1 Overview

- 9.2.2 Mining and Metals: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.3 Chemical

- 9.3.1 Overview

- 9.3.2 Chemical: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.4 Shipping Industry

- 9.4.1 Overview

- 9.4.2 Shipping Industry: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.5 Automotive and Transportation

- 9.5.1 Overview

- 9.5.2 Automotive and Transportation: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.6 Oil and Gas

- 9.6.1 Overview

- 9.6.2 Oil and Gas: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.7 General Manufacturing

- 9.7.1 Overview

- 9.7.2 General Manufacturing: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.8 Others

- 9.8.1 Overview

- 9.8.2 Others: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

10. Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Country Analysis

- 10.1 Asia Pacific

- 10.1.1 Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 Australia: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.2.1 Australia: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Type

- 10.1.1.2.2 Australia: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Bridge Crane

- 10.1.1.2.3 Australia: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Application

- 10.1.1.3 China: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.3.1 China: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Type

- 10.1.1.3.2 China: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Bridge Crane

- 10.1.1.3.3 China: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Application

- 10.1.1.4 India: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.4.1 India: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Type

- 10.1.1.4.2 India: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Bridge Crane

- 10.1.1.4.3 India: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Application

- 10.1.1.5 Japan: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.5.1 Japan: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Type

- 10.1.1.5.2 Japan: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Bridge Crane

- 10.1.1.5.3 Japan: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Application0

- 10.1.1.6 South Korea: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)0

- 10.1.1.6.1 South Korea: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Type3

- 10.1.1.6.2 South Korea: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Bridge Crane4

- 10.1.1.6.3 South Korea: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Application5

- 10.1.1.7 Rest of APAC: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)5

- 10.1.1.7.1 Rest of APAC: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Type8

- 10.1.1.7.2 Rest of APAC: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Bridge Crane9

- 10.1.1.7.3 Rest of APAC: Asia Pacific Electric Overhead Traveling (EOT) Cranes Market Share - by Application0

- 10.1.1 Asia Pacific Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast Analysis - by Country

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning and Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Product Development

- 12.3 Mergers & Acquisitions

13. Company Profiles

- 13.1 Dafang Heavy Machine Co.,Ltd.

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Sumitomo Corp

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Spanco, Inc.

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 ABUS Kransysteme GmbH

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Columbus McKinnon Corporation

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Konecranes Plc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 WHCRANE

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 VERLINDE SA

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Gorbel Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 American Equipment

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Safex Industries Limited

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 Uesco Cranes

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Harrington Hoists, Inc

- 13.13.1 Key Facts8

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 K2 Cranes & Components Pvt. Ltd.

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 TAWI AB

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners