|

|

市場調査レポート

商品コード

1784583

EOTクレーンの中南米市場、2021年~2031年:タイプ別、ブリッジクレーン別、アプリケーション別South and Central America Electric Overhead Training (EOT) Cranes Market Report 2021-2031 by Scope, Segmentation, Dynamics, and Competitive Analysis |

||||||

|

|||||||

| EOTクレーンの中南米市場、2021年~2031年:タイプ別、ブリッジクレーン別、アプリケーション別 |

|

出版日: 2025年07月10日

発行: The Insight Partners

ページ情報: 英文 164 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

中南米のEOTクレーン市場規模は、2023年の2億180万米ドルから2031年には3億3,413万米ドルに達すると予測されます。2023年から2031年までのCAGRは6.5%を記録すると推定されます。

エグゼクティブサマリーと中南米のEOTクレーン市場分析:

建設セクターの成長とインフラ整備のための政府イニシアチブの増加は、ブラジル、アルゼンチン、その他の南米諸国全体でEOTクレーンの需要を促進すると予測されます。空港、橋、地下鉄駅の建設が増加していることも、この地域のEOTクレーン市場に好影響を与えています。都市化と人口増加に伴う住宅や商業ビルの需要の急増は、南米のEOTクレーン市場にさらに利益をもたらしています。

2023年7月、アルゼンチン政府は、ブエノスアイレスの廃水処理プラントの開発と拡張に1億1,500万米ドルを拠出すると発表しました。2021年2月、世界銀行理事会は、アルゼンチンのブエノスアイレス大都市圏における水と衛生サービスの開発と更なる拡大のために3億米ドルの融資を承認しました。さらに、ブエノスアイレス州の1万人以上の住民が恩恵を受けると予想される社会住宅開発のために、1億2,000万米ドルの追加融資が承認されました。都市部と農村部の人口増加の要件を満たすためのスマート施設開発への注目の高まりは、ブラジルの建設セクターの成長を後押しし、南米におけるEOTクレーン市場の進展を後押ししています。

南米における天然ガス消費量は、今後数年間は年平均0.6%のペースで拡大し、2025年までに年間5bcm増加すると予想されています。エネルギー部門は、電力需要の高まりと燃料転換の必要性によって天然ガス消費に大きく貢献しています。南米におけるエネルギー需要の増加は、人口増加と工業化の進展に起因しており、その結果、ガス生産の必要性が高まっています。そのため、南米の石油・ガス産業は、国内外の企業から多額の投資を集めています。南米では、クリーンなエネルギー源へのエネルギー転換への注目が高まっているため、天然ガス・原油インフラへの投資が増加しています。このため、アルゼンチン、ブラジル、ボリビア、チリ、コロンビア、ペルー、ベネズエラ、ウルグアイでは、石油・ガス部門がこれらのクレーンの主要な用途分野の1つであることから、いくつかの大規模な石油・ガスプロジェクトがEOTクレーン市場にプラスの影響を与えています。

中南米のEOTクレーン市場のセグメンテーション分析:

EOTクレーン市場の分析に貢献した主なセグメントは、タイプ、ブリッジクレーン、アプリケーションです。

タイプ別では、EOTクレーン市場はブリッジクレーン、ガントリークレーン、ジブクレーン、その他に区分されます。2023年には、ブリッジクレーンが最大のシェアを占めています。

ブリッジクレーンの観点から、EOTクレーン市場はシングルガーダークレーンとダブルガーダークレーンに二分されます。シングルガーダークレーンセグメントが2023年の市場で大きなシェアを占めています。

アプリケーション別では、EOTクレーン市場は、建設、鉱業・金属、化学、海運、自動車・輸送、石油・ガス、一般製造、その他に分類されます。2023年には自動車・輸送部門が最大シェアを占めています。

中南米のEOTクレーン市場の展望

建設産業は、低・中価格帯住宅プロジェクト、商業インフラ、道路・橋梁・高速道路などの政府支援インフラ構想の増加に伴い、世界的に拡大しています。建設活動の増加は主に、都市化の進展、人口の増加、経済の成長によってもたらされています。ワード銀行が2023年に発表したデータによると、2010年には35億人だった総人口の56%(44億人)が、2022年には都市部に住むようになります。

住宅や商業施設に対する需要の高まり、政府のイニシアチブの高まり、高層ビル建設の急増は、インフラ開発に政府が力を入れるようになったことが原因です。例えば、ブラジルは今後5年間で、空港容量の拡張とアップグレードを計画しています。この開発には全国130の空港が参加する予定で、ブラジル史上最大の空港投資となります。2024年12月、ブラジルの港湾・空港大臣は、航空輸送の普遍化計画の第一段階を発表しました。このプログラムは、2024年までにブラジルの航空運賃を引き下げ、運航コストを削減することを目的としています。さらに2024年7月、近代化・拡張プロジェクトの一環として、ヴィンチ・エアポーツは、ドミニカ共和国の首都サント・ドミンゴに就航するラス・アメリカス国際空港の改善を発表しました。3,000万米ドル以上を投資するこのプロジェクトには、空港到着エリアの改修、ファサード、屋根、情報システム、照明、空調の改修、車両駐車場の開発と改修が含まれます。2024年9月、サント・ドミンゴ水道事業体(CAASD)は、ドミニカ共和国の首都における水不足と下水道の不足がもたらす課題に対処するためのプロジェクト群を発表し、同国における建設・インフラ開発活動の数を促進しました。

ブラジルは、上下水道インフラを改善するため、2024年に1,000億米ドルの投資を誘致しようとしています。このイニシアチブは、所得水準に関係なく、すべての国民が質の高い衛生サービスを利用できるようにすることを目的としています。

このように、政府の戦略的イニシアティブ、急速な工業化、インフラ開発がEOTクレーン市場を牽引しています。

中南米のEOTクレーン市場の国別インサイト

国別に見ると、中南米のEOTクレーン市場は、ブラジル、アルゼンチン、その他中南米で構成されます。2023年にはブラジルが最大のシェアを占めています。

中南米のEOTクレーン市場の企業プロファイル

同市場で事業を展開する主要企業は、Dafang Heavy Machine Co., Ltd.、住友商事、Spanco, Inc.、ABUS Kransysteme GmbH、Columbus McKinnon Corporation、Konecranes Plc、WHCRANE、VERLINDE SA、Gorbel Inc.、American Equipment、Safex Industries Limited、Uesco Cranes、Harrington Hoists, Inc.、K2 Cranes &Components Pvt.、TAWI ABなどです。これらの企業は、消費者に革新的な製品を提供し、市場シェアを拡大するために、事業拡大、製品革新、M&Aなど様々な戦略を採用しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

第4章 中南米のEOTクレーン市場情勢

- PEST分析

- エコシステム分析

- 原材料サプライヤー

- クレーンメーカー

- エンドユーザー

第5章 中南米のEOTクレーン市場:主要市場力学

- 市場促進要因

- 工業化とインフラ開発の動向の高まり

- 石油・ガス産業の開発の高まり

- 市場抑制要因

- 高い初期投資要件

- 市場機会

- 産業オペレーションの効率化、自動化、安全性確保に向けた応用範囲のシフト

- 今後の動向

- EOTクレーンにおけるIoTの統合

- 促進要因と抑制要因の影響

第6章 EOTクレーン市場:中南米分析

- 中南米のEOTクレーン市場収益、2021年~2031年

- 中南米のEOTクレーン市場予測分析

第7章 中南米のEOTクレーン市場分析:タイプ別

- ブリッジクレーン

- ガントリークレーン

- ジブクレーン

- その他

第8章 中南米のEOTクレーン市場分析:ブリッジクレーン別

- シングルガーダークレーン

- ダブルガーダークレーン

第9章 中南米のEOTクレーン市場分析:アプリケーション別

- 建設

- 鉱業・金属

- 化学

- 海運

- 自動車・輸送

- 石油・ガス

- 一般製造

- その他

第10章 中南米のEOTクレーン市場:国別分析

- 中南米

- ブラジル

- アルゼンチン

- その他中南米

第11章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Dafang Heavy Machine Co.,Ltd.

- Sumitomo Corp

- Spanco, Inc.

- ABUS Kransysteme GmbH

- Columbus McKinnon Corporation

- Konecranes Plc

- WHCRANE

- VERLINDE SA

- Gorbel Inc

- American Equipment

- Safex Industries Limited

- Uesco Cranes

- Harrington Hoists, Inc.

- K2 Cranes & Components Pvt. Ltd.

- TAWI AB

第14章 付録

List Of Tables

- Table 1. South and Central America Electric Overhead Traveling (EOT) Cranes Market Segmentation

- Table 2. South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Table 3. South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Type

- Table 4. South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Bridge Crane

- Table 5. South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Application

- Table 6. South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Country

- Table 7. Brazil: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Type

- Table 8. Brazil: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Bridge Crane

- Table 9. Brazil: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 10. Argentina: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Type

- Table 11. Argentina: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Bridge Crane

- Table 12. Argentina: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 13. Rest of South and Central America: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Type

- Table 14. Rest of South and Central America: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Bridge Crane

- Table 15. Rest of South and Central America: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 16. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. South and Central America Electric Overhead Traveling (EOT) Cranes Market Segmentation - Country

- Figure 2. PEST Analysis

- Figure 3. South and Central America Electric Overhead Traveling (EOT) Cranes Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. South and Central America Electric Overhead Traveling (EOT) Cranes Market Revenue (US$ Million), 2021-2031

- Figure 6. South and Central America Electric Overhead Traveling (EOT) Cranes Market Share (%) - by Type (2023 and 2031)

- Figure 7. Bridge Cranes: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 8. Gantry Crane: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

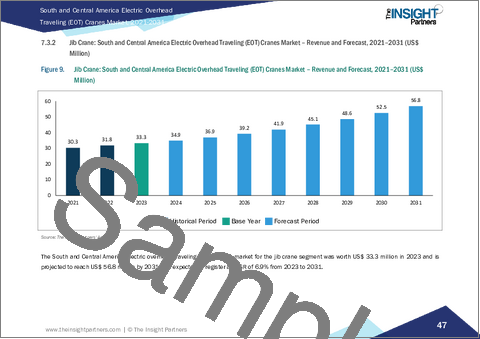

- Figure 9. Jib Crane: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 10. Others: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 11. South and Central America Electric Overhead Traveling (EOT) Cranes Market Share (%) - by Bridge Crane (2023 and 2031)

- Figure 12. Single Girder Crane: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 13. Double Girder Crane: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 14. South and Central America Electric Overhead Traveling (EOT) Cranes Market Share (%) - by Application (2023 and 2031)

- Figure 15. Construction: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 16. Mining and Metals: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 17. Chemical: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 18. Shipping Industry: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 19. Automotive and Transportation: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 20. Oil and Gas: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 21. General Manufacturing: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 22. Others: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 23. South and Central America Electric Overhead Traveling (EOT) Cranes Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 24. Brazil: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 25. Argentina: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 26. Rest of South and Central America: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 27. Company Positioning and Concentration

The South and Central America Electric Overhead Training (EOT) Cranes Market size is expected to reach US$ 334.13 million by 2031 from US$ 201.80 million in 2023. The market is estimated to record a CAGR of 6.5% from 2023 to 2031.

Executive Summary and South and Central America Electric Overhead Training (EOT) Cranes Market Analysis:

The growing construction sector and increasing government initiatives for upgrading infrastructure development are anticipated to drive the demand for electric overhead traveling cranes across Brazil, Argentina, and other South American countries. The increasing construction of airports, bridges, and metro stations also has a positive impact on the electric overhead traveling cranes market in the region. The burgeoning demand for residential and commercial buildings with urbanization and rising population further benefits the electric overhead traveling cranes market in South America.

In July 2023, Argentina's Government announced and sanctioned US$ 115 million for the development and extension of a wastewater treatment plant in Buenos Aires. In February 2021, The World Bank Board of Directors sanctioned a US$ 300 million loan to develop and further expand water and sanitation services in Metropolitan Buenos Aires, Argentina. Moreover, an additional US$ 120 million was approved for the development of social housing, which is anticipated to benefit ~10,000 residents of Buenos Aires Province. The rising focus on developing smart facilities to meet the growing requirements of urban and rural populations boosts the growth of the construction sector in Brazil, which favors the electric overhead traveling cranes market progress in South America.

Natural gas consumption in South America is anticipated to expand at an average annual rate of 0.6% in the coming years, adding ~5 bcm/year by 2025. The energy sector is a prominent contributor to natural gas consumption, driven by a mounting electricity demand and a need for fuel switching. The rising energy demand in South America is attributed to population growth and the evolution of industrialization, which results in an increased need for gas production. Thus, the oil and gas industry in South America attracts significant investments from domestic and foreign companies. Investments in natural gas and crude oil infrastructure are on the rise in South America due to the surging focus on energy transition toward clean sources. Thus, several major oil and gas projects in Argentina, Brazil, Bolivia, Chile, Colombia, Peru, Venezuela, and Uruguay have a positive impact on the electric overhead traveling cranes market, as the oil and gas sector is one of the major application areas for these cranes.

South and Central America Electric Overhead Training (EOT) Cranes Market Segmentation Analysis:

Key segments that contributed to the derivation of the electric overhead training (EOT) cranes market analysis are type, bridge crane, and application.

By type, the electric overhead training (EOT) cranes market is segmented into bridge cranes, gantry crane, jib crane, and others. The bridge cranes held the largest share of the market in 2023.

In terms of bridge crane, the electric overhead training (EOT) cranes market is bifurcated into single girder crane and double girder crane. The single girder crane segment held a larger share of the market in 2023.

Based on application, the electric overhead training (EOT) cranes market is categorized into construction, mining and metals, chemical, shipping industry, automotive and transportation, oil and gas, general manufacturing, and others. The automotive and transportation segment held the largest share of the market in 2023.

South and Central America Electric Overhead Training (EOT) Cranes Market Outlook

Construction industries are expanding globally with the rising number of low-to-medium-priced residential housing projects, commercial infrastructures; and government-backed infrastructure initiatives, including roads, bridges, and highways. The rise in construction activities is mainly driven by rising urbanization, increasing population, and a growing economy. According to the data published by the Word Bank in 2023, ~56% of the total population (or 4.4 billion people) were living in urban areas in 2022, which was 3.5 billion in 2010.

Growing demand for residential and commercial complexes, rising government initiatives, and surging high-rise constructions are attributed to the increasing government focus on infrastructure development. For instance, Brazil plans to expand and upgrade its airport capacity over the next five years. This development will involve 130 airports across the country and will be the largest airport investment in Brazil's history. In December 2024, Brazil's Minister of Ports and Airports announced the first phase of the Universalization of Air Transport Programme. This program aims to lower airfares and reduce operating costs in Brazil by 2024. Moreover, in July 2024, as a part of a modernization and expansion project, Vinci Airports announced improvements to Las Americas International Airport, which caters to the Dominican Republic's capital city, Santo Domingo. With an investment of more than US$ 30 million, the project incorporates the upgrades and renovation of the airport's arrivals area; renovation of the facades, roofs, information systems, lighting, and air conditioning; and the development and renovation of the vehicle parking lot. In September 2024, Santo Domingo Water Utility (CAASD) announced a bunch of projects to address challenges posed by water shortages and lack of sewers in the capital city of the Dominican Republic, promoting the number of construction and infrastructure development activities in the country.

Brazil seeks to attract US$ 100 billion in investments in 2024 to improve its water and sewage infrastructure. This initiative aims to provide all citizens with access to quality sanitation services, regardless of their income levels.

Thus, strategic government initiatives, rapid industrialization, and infrastructure development are driving the electric overhead traveling cranes market.

South and Central America Electric Overhead Training (EOT) Cranes Market Country Insights

Based on country, the South and Central America electric overhead training (EOT) cranes market comprises Brazil, Argentina, and the Rest of South and Central America. Brazil held the largest share in 2023.

The construction and infrastructure sector in Brazil is experiencing significant growth, driven by its economic development and a growing population. Advancements in airport, railway, and commercial infrastructures propel the demand for electric overhead traveling cranes in Brazil. Several expansion and modernization projects are in progress at Sao Paulo and Rio de Janeiro airports to accommodate the rising number of passengers. Campinas Viracopos International Airport Modernization, Lucas do Rio Verde-Vilhena Railway Link, Feijao Hybrid Wind and Solar Power Plant, and Pedra de Ferro Iron Ore Processing Plant are among the major construction projects in Brazil. The Government's commitment to privatization is attracting investments from both domestic and international players to facilitate infrastructural development in the country, which benefits the electric overhead traveling cranes market.

The Brazilian Government has been encouraging vehicle manufacturers to initiate new investments for modernizing their manufacturing facilities to move toward the production of hybrid and electric vehicles to meet its long-term sustainability goals. As per the Brazilian Association of Vehicle Manufacturers, ~US$ 22 billion has been announced in investments in 2024, which would be executed in stages until 2032. The flourishing automotive sector provides a boost to the electric overhead traveling cranes market in the country.

Brazil is one of the top exporters of gas across the world. Several Brazilian companies are planning to establish new onshore rigs in the future. In September 2023, Petrobras, a Brazilian oil and gas company, announced its plans to install 11 new drilling platforms across Brazil. Thus, a rise in oil and gas exploration activities bolsters the development of gas exploration infrastructure, propelling the application of electric overhead traveling cranes in Brazil. In 2022, the New Development Bank sanctioned US$ 300 million for the development of 727,000 smart water supply systems in the state of Sao Paulo. It also encourages environmental protection by extending wastewater treatment capacity, among other development outputs. The rising focus on developing smart facilities to meet the developing needs of urban and rural populations propels the number of construction activities in Brazil, in turn driving the electric overhead traveling cranes market in the country.

South and Central America Electric Overhead Training (EOT) Cranes Market Company Profiles

Some of the key players operating in the market include Dafang Heavy Machine Co., Ltd.; Sumitomo Corp; Spanco, Inc.; ABUS Kransysteme GmbH; Columbus McKinnon Corporation; Konecranes Plc; WHCRANE; VERLINDE SA; Gorbel Inc; American Equipment; Safex Industries Limited; Uesco Cranes; Harrington Hoists, Inc.; K2 Cranes & Components Pvt. Ltd.; and TAWI AB., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

South and Central America Electric Overhead Training (EOT) Cranes Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Company websites , annual reports, financial statements, broker analyses, and investor presentations. Industry trade journals and other relevant publications. Government documents , statistical databases, and market reports. News articles , press releases, and webcasts specific to companies operating in the market. Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research The Insight Partners' conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Validate and refine findings from secondary research. Enhance the expertise and market understanding of the analysis team. Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects. Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

Industry stakeholders : Vice Presidents, business development managers, market intelligence managers, and national sales managers External experts : Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Table Of Contents

1. Introduction

- 1.1 Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. South and Central America Electric Overhead Traveling (EOT) Cranes Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Crane Manufacturers

- 4.3.3 End Users

5. South and Central America Electric Overhead Traveling (EOT) Cranes Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Trend of Industrialization and Infrastructure Development

- 5.1.2 Rising Development of Oil & Gas Industry

- 5.2 Market Restraints

- 5.2.1 High Initial Investment Requirements

- 5.3 Market Opportunities

- 5.3.1 Shift in Application Scope to Ensure Efficiency, Automation, and Safety in Industrial Operations

- 5.4 Future Trends

- 5.4.1 Integration of IoT in Electric Overhead Traveling Cranes

- 5.5 Impact of Drivers and Restraints:

6. Electric Overhead Traveling (EOT) Cranes Market - South and Central America Analysis

- 6.1 South and Central America Electric Overhead Traveling (EOT) Cranes Market Revenue (US$ Million), 2021-2031

- 6.2 South and Central America Electric Overhead Traveling (EOT) Cranes Market Forecast Analysis

7. South and Central America Electric Overhead Traveling (EOT) Cranes Market Analysis - by Type

- 7.1 Bridge Cranes

- 7.1.1 Overview

- 7.1.2 Bridge Cranes: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.2 Gantry Crane

- 7.2.1 Overview

- 7.2.2 Gantry Crane: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.3 Jib Crane

- 7.3.1 Overview

- 7.3.2 Jib Crane: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

8. South and Central America Electric Overhead Traveling (EOT) Cranes Market Analysis - by Bridge Crane

- 8.1 Single Girder Crane

- 8.1.1 Overview

- 8.1.2 Single Girder Crane: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2 Double Girder Crane

- 8.2.1 Overview

- 8.2.2 Double Girder Crane: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

9. South and Central America Electric Overhead Traveling (EOT) Cranes Market Analysis - by Application

- 9.1 Construction

- 9.1.1 Overview

- 9.1.2 Construction: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.2 Mining and Metals

- 9.2.1 Overview

- 9.2.2 Mining and Metals: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.3 Chemical

- 9.3.1 Overview

- 9.3.2 Chemical: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.4 Shipping Industry

- 9.4.1 Overview

- 9.4.2 Shipping Industry: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.5 Automotive and Transportation

- 9.5.1 Overview

- 9.5.2 Automotive and Transportation: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.6 Oil and Gas

- 9.6.1 Overview

- 9.6.2 Oil and Gas: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.7 General Manufacturing

- 9.7.1 Overview

- 9.7.2 General Manufacturing: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.8 Others

- 9.8.1 Overview

- 9.8.2 Others: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

10. South and Central America Electric Overhead Traveling (EOT) Cranes Market - Country Analysis

- 10.1 South and Central America

- 10.1.1 South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 Brazil: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.2.1 Brazil: South and Central America Electric Overhead Traveling (EOT) Cranes Market Share - by Type

- 10.1.1.2.2 Brazil: South and Central America Electric Overhead Traveling (EOT) Cranes Market Share - by Bridge Crane

- 10.1.1.2.3 Brazil: South and Central America Electric Overhead Traveling (EOT) Cranes Market Share - by Application

- 10.1.1.3 Argentina: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.3.1 Argentina: South and Central America Electric Overhead Traveling (EOT) Cranes Market Share - by Type

- 10.1.1.3.2 Argentina: South and Central America Electric Overhead Traveling (EOT) Cranes Market Share - by Bridge Crane

- 10.1.1.3.3 Argentina: South and Central America Electric Overhead Traveling (EOT) Cranes Market Share - by Application

- 10.1.1.4 Rest of South and Central America: South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.4.1 Rest of South and Central America: South and Central America Electric Overhead Traveling (EOT) Cranes Market Share - by Type

- 10.1.1.4.2 Rest of South and Central America: South and Central America Electric Overhead Traveling (EOT) Cranes Market Share - by Bridge Crane

- 10.1.1.4.3 Rest of South and Central America: South and Central America Electric Overhead Traveling (EOT) Cranes Market Share - by Application

- 10.1.1 South and Central America Electric Overhead Traveling (EOT) Cranes Market - Revenue and Forecast Analysis - by Country

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning and Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Product Development

- 12.3 Mergers & Acquisitions

13. Company Profiles

- 13.1 Dafang Heavy Machine Co.,Ltd.

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Sumitomo Corp

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Spanco, Inc.

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 ABUS Kransysteme GmbH

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Columbus McKinnon Corporation

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Konecranes Plc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 WHCRANE

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 VERLINDE SA

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Gorbel Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 American Equipment

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Safex Industries Limited

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 Uesco Cranes

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Harrington Hoists, Inc.

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 K2 Cranes & Components Pvt. Ltd.

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 TAWI AB

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners