|

|

市場調査レポート

商品コード

1765015

北米の保険第三者機関市場の2031年までの予測-地域別分析-保険タイプ別、エンドユーザー別North America Insurance Third-Party Administrator Market Forecast to 2031 - Regional Analysis - by Insurance Type (Healthcare, Retirement Plans, Commercial General Liability Insurers, and Other Insurance Types) and End User (Large Enterprises and SMEs) |

||||||

|

|||||||

| 北米の保険第三者機関市場の2031年までの予測-地域別分析-保険タイプ別、エンドユーザー別 |

|

出版日: 2025年04月14日

発行: The Insight Partners

ページ情報: 英文 107 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

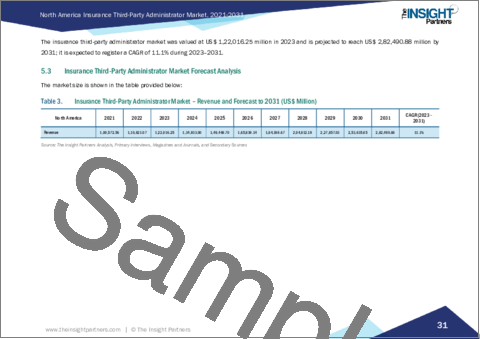

北米の保険第三者機関市場は、2023年に1,220億1,625万米ドルと評価され、2031年には2,824億9,088万米ドルに達すると予測され、2023~2031年のCAGRは11.1%を記録すると予測されます。

健康保険における機関選好の高まりが北米の保険第三者機関市場を後押し

第三者保険機関は、保険会社と保険契約者の間を取り持つ役割を果たします。医療保険会社に代わって、保険金請求の処理、カスタマーサポートの提供、決済取引の管理など、特定のサービスを監督します。これらのサービスプロバイダは、医療保険のさまざまな側面を処理する上で極めて重要な役割を果たしています。保険契約者の重要な記録を専用のデータベースで管理し、スムーズな後方支援を記載しています。第三者機関はまた、保険契約者の請求が正しく処理されることを保証します。彼らは、管理する病院がネットワーク加盟の基準を満たしていることを保証し、手間のかからない請求決済を可能にします。第三者保険会社が提供する付加価値サービスには、専門的な相談、救急車サービス、医療用品、ウェルネスプログラム、ライフスタイル管理、24時間フリーダイヤルのヘルプライン、健康施設などがあります。こうした利点から、様々な有名保険会社が第三者機関を選んでいます。このように、ヘルスケア保険における第三者保険会社の幅広い用途が市場の成長を後押ししています。

北米の保険第三者機関市場概要

米国、カナダ、メキシコは北米の主要経済国のひとつです。この地域は世界の保険第三者機関市場で大きなシェアを占めています。これらの保険会社は保険金請求業務やその他様々なサービスを保険会社に提供しています。北米は高度に先進的な地域です。この地域の企業は、ビジネスワークフローと業務を簡素化するために先進的なソリューションを広く採用しています。保険産業における継続的なデジタル化は、北米のにおける保険第三者機関市場の成長を促進する要因のひとつです。例えば、LIDPは2023年10月、革新的で包括的なソリューションを導入するため、デジタルファーストのビジネスプロセスアズ・アサービス(BPaaS)を提供する世界企業、サザーランドと提携しました。デジタルツールとAIは、ミドルオフィスとバックオフィスのデジタル化とカスタマーエクスペリエンス(CX)を推進するとともに、保険会社のビジネスと成長に関するより正確な洞察を記載しています。

北米の保険第三者機関市場の収益と2031年までの予測(金額)

北米の保険第三者機関市場のセグメンテーション

北米の保険第三者機関市場は、保険タイプ、エンドユーザー、国によって区分されます。保険タイプ別に見ると、北米の保険サードパーティ機関市場は、ヘルスケア、退職年金、商業賠償責任保険会社、その他の保険タイプに区分されます。2023年にはヘルスケアセグメントが最大の市場シェアを占めています。

エンドユーザー別では、北米の保険第三者機関市場は大企業と中小企業に二分されます。2023年には大企業セグメントがより大きな市場シェアを占めています。

国別に見ると、北米の保険第三者機関市場は米国、カナダ、メキシコに区分されます。2023年の北米の保険第三者機関市場シェアは米国が圧倒的でした。

Sedgwick、Crawford and Company、CorVel Corp、UnitedHealth Group Inc、Liberty Mutual Insurance Company、Charles Taylor Limited、ExlService Holdings, Inc、Arthur J Gallagher & Co、Meritain Health、and Chubb Ltdは、北米の保険第三者機関市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

- 市場の魅力

第3章 調査手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の保険第三者機関市場情勢

- イントロダクション

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の保険第三者機関市場:主要市場力学

- 保険第三者機関市場-主要市場力学

- 市場促進要因

- 健康保険における機関選好の高まり

- 保険金請求の複雑化

- 市場抑制要因

- データプライバシーとセキュリティへの懸念

- 市場機会

- 保険産業の普及

- 市場動向

- デジタル第三者機関

- 促進要因と抑制要因の影響

第6章 保険第三者機関市場:北米市場分析

- イントロダクション

- 保険第三者機関市場の収益(2021~2031年)

- 保険第三者機関の市場予測分析

第7章 北米の保険第三者機関市場分析-保険タイプ別

- ヘルスケア

- 退職プラン

- 商業賠償責任保険会社

- その他の保険タイプ

第8章 北米の保険第三者機関市場分析-エンドユーザー別

- 大企業

- 中小企業

第9章 北米の保険第三者機関市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- 企業のポジショニングと集中度

- 主要参入企業によるヒートマップ分析

第11章 産業情勢

- イントロダクション

- 市場イニシアティブ

- 合併と買収

- 製品開発

第12章 企業企業プロファイル

- Sedgwick

- Crawford and Company

- CorVel Corp

- UnitedHealth Group Inc

- Liberty Mutual Insurance Company

- Charles Taylor Limited

- ExlService Holdings, Inc.

- Arthur J Gallagher & Co

- Meritain Health

- Chubb Ltd

第13章 付録

List Of Tables

- Table 1. Insurance Third-Party Administrator Market Segmentation

- Table 2. List of Vendors

- Table 3. Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million) - by Insurance Type

- Table 5. Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million) - by End Users

- Table 6. North America: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 7. United States: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million) - by Insurance Type

- Table 8. United States: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million) - by End Users

- Table 9. Canada: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million) - by Insurance Type

- Table 10. Canada: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million) - by End Users

- Table 11. Mexico: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million) - by Insurance Type

- Table 12. Mexico: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million) - by End Users

- Table 13. Heat Map Analysis by Key Players

- Table 14. List of Abbreviation

List Of Figures

- Figure 1. Insurance Third-Party Administrator Market Segmentation, by Country

- Figure 2. Impact Analysis of Drivers and Restraints

- Figure 3. Insurance Third-Party Administrator Market Revenue (US$ Million), 2021-2031

- Figure 4. Insurance Third-Party Administrator Market Share (%) - by Insurance Type (2023 and 2031)

- Figure 5. Healthcare: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 6. Retirement Plans: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Commercial General Liability Insurers: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Other Insurance Types: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Insurance Third-Party Administrator Market Share (%) - by End Users (2023 and 2031)

- Figure 10. Large Enterprises: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. SMEs: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. North America: Insurance Third-Party Administrator Market, by Key Countries - Revenue (2023) (US$ Million)

- Figure 13. North America: Insurance Third-Party Administrator Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 14. United States: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million)

- Figure 15. Canada: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million)

- Figure 16. Mexico: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031(US$ Million)

- Figure 17. Company Positioning & Concentration

The North America insurance third-party administrator market was valued at US$ 1,22,016.25 million in 2023 and is expected to reach US$ 2,82,490.88 million by 2031; it is estimated to record a CAGR of 11.1% from 2023 to 2031.

Increase in Preference for Administrators in Health Insurance Fuels North America Insurance Third-Party Administrator Market

Third-party administrators serve as mediators between insurance companies and policyholders. They oversee specific services, such as processing claims, providing customer support, and managing payment transactions on behalf of health insurance companies. These service providers play a pivotal role in handling different facets of health insurance. They maintain policyholders' important records in a dedicated database and provide smooth back-end assistance. Third-party administrators also ensure the correct processing of policyholders' claims. They guarantee that the hospitals they manage meet the standards of network membership, allowing for hassle-free claim settlement. Various value-added services provided by several third-party administrators include specialized consultations, ambulance services, medical supplies, wellness programs, lifestyle management, 24-hour toll-free helplines, and health facilities. Due to these benefits, various renowned insurers opt for third-party administrators. Thus, a broad application of third-party administrators in healthcare insurance drives the growth of the market.

North America Insurance Third-Party Administrator Market Overview

The US, Canada, and Mexico are among the major economies in North America. This region accounts for a significant share of the global insurance third-party administrator market. These administrators handle claims operations and various other services for the insurance companies. North America is a highly advanced region. Businesses in this region widely adopt advanced solutions to simplify their business workflow and operations. Continuous digitalization in the insurance industry is one of the factors fueling the insurance third-party administrator market growth in North America. For example, in October 2023, LIDP partnered with Sutherland, a global digital-first business-process-as-a-service (BPaaS) provider, to introduce innovative, comprehensive solutions. Digital tools and AI drive middle-office and back-office digitization and customer experience (CX), along with providing more precise insights into the insurance carrier business and growth.

North America Insurance Third-Party Administrator Market Revenue and Forecast to 2031 (US$ Million)

North America Insurance Third-Party Administrator Market Segmentation

The North America insurance third-party administrator market is segmented based on insurance type, end users, and country. Based on insurance type, the North America insurance third-party administrator market is segmented into healthcare, retirement plans, commercial general liability insurers, and other insurance types. The healthcare segment held the largest market share in 2023.

In terms of end users, the North America insurance third-party administrator market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

Based on country, the North America insurance third-party administrator market is segmented into the US, Canada, and Mexico. The US dominated the North America insurance third-party administrator market share in 2023.

Sedgwick; Crawford and Company; CorVel Corp; UnitedHealth Group Inc; Liberty Mutual Insurance Company; Charles Taylor Limited; ExlService Holdings, Inc; Arthur J Gallagher & Co; Meritain Health; and Chubb Ltd are some of the leading players operating in the North America insurance third-party administrator market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Insurance Third-Party Administrator Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in the Value Chain

5. North America Insurance Third-Party Administrator Market - Key Market Dynamics

- 5.1 Insurance Third-Party Administrator Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increase in Preference for Administrators in Health Insurance

- 5.2.2 Growing Complexity of Insurance Claims

- 5.3 Market Restraints

- 5.3.1 Data Privacy and Security Concerns

- 5.4 Market Opportunities

- 5.4.1 Proliferation of Insurance Industry

- 5.5 Market Trends

- 5.5.1 Digital Third-Party Administrators

- 5.6 Impact of Drivers and Restraints:

6. Insurance Third-Party Administrator Market - North America Market Analysis

- 6.1 Overview

- 6.2 Insurance Third-Party Administrator Market Revenue (US$ Million), 2021-2031

- 6.3 Insurance Third-Party Administrator Market Forecast Analysis

7. North America Insurance Third-Party Administrator Market Analysis - by Insurance Type

- 7.1 Healthcare

- 7.1.1 Overview

- 7.1.2 Healthcare: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Retirement Plans

- 7.2.1 Overview

- 7.2.2 Retirement Plans: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Commercial General Liability Insurers

- 7.3.1 Overview

- 7.3.2 Commercial General Liability Insurers: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Other Insurance Types

- 7.4.1 Overview

- 7.4.2 Other Insurance Types: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Insurance Third-Party Administrator Market Analysis - by End Users

- 8.1 Large Enterprises

- 8.1.1 Overview

- 8.1.2 Large Enterprises: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 SMEs

- 8.2.1 Overview

- 8.2.2 SMEs: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Insurance Third-Party Administrator Market - Country Analysis

- 9.1 North America

- 9.1.1 North America Insurance Third-Party Administrator Market Overview

- 9.1.2 North America: Insurance Third-Party Administrator Market - Revenue and Forecast Analysis - by Country

- 9.1.2.1 North America: Insurance Third-Party Administrator Market - Revenue and Forecast Analysis - by Country

- 9.1.2.2 United States: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.2.2.1 United States: Insurance Third-Party Administrator Market Breakdown, by Insurance Type

- 9.1.2.2.2 United States: Insurance Third-Party Administrator Market Breakdown, by End Users

- 9.1.2.3 Canada: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.2.3.1 Canada: Insurance Third-Party Administrator Market Breakdown, by Insurance Type

- 9.1.2.3.2 Canada: Insurance Third-Party Administrator Market Breakdown, by End Users

- 9.1.2.4 Mexico: Insurance Third-Party Administrator Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.2.4.1 Mexico: Insurance Third-Party Administrator Market Breakdown, by Insurance Type

- 9.1.2.4.2 Mexico: Insurance Third-Party Administrator Market Breakdown, by End Users

10. Competitive Landscape

- 10.1 Company Positioning & Concentration

- 10.2 Heat Map Analysis by Key Players

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Merger and Acquisition

- 11.4 Product Development

12. Company Profiles

- 12.1 Sedgwick

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Crawford and Company

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 CorVel Corp

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 UnitedHealth Group Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Liberty Mutual Insurance Company

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Charles Taylor Limited

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 ExlService Holdings, Inc.

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Arthur J Gallagher & Co

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Meritain Health

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Chubb Ltd

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 Word Index

- 13.2 About The Insight Partners