|

|

市場調査レポート

商品コード

1764931

アジア太平洋のラップフィルム市場の予測 (2031年まで) - 地域別分析 (材料の種類別、形状別、最終用途別)Asia Pacific Cling Films Market Forecast to 2031 - Regional Analysis - by Material Type, Form, and End Use |

||||||

|

|||||||

| アジア太平洋のラップフィルム市場の予測 (2031年まで) - 地域別分析 (材料の種類別、形状別、最終用途別) |

|

出版日: 2025年04月17日

発行: The Insight Partners

ページ情報: 英文 118 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋のラップフィルム(クリングフィルム)市場は、2023年に23億2,538万米ドルと評価され、2031年には36億6,063万米ドルに達すると予測され、2023年から2031年までのCAGRは5.8%と推定されます。

機能性ラップフィルムへの需要の高まりがアジア太平洋のラップフィルム市場を後押し

消費者は、優れた密封性、鮮度保持、耐久性の向上など、機能性を強化した製品を求めるようになっています。そのため、メーカー各社は先進的なラップフィルム・ソリューションの革新と開発に力を注いでいます。2023年12月、Berry Globalは生鮮食品用ポリエチレンラップフィルムOmni Xtraの新バージョンを発売しました。このフィルムは、従来のポリ塩化ビニル(PVC)製ラップフィルムに代わる高性能の代替品を提供します。さらに、食品包装における利便性と汎用性への傾斜の高まりが、機能性ラップフィルムの需要に寄与しています。忙しいライフスタイルや食事の下ごしらえの増加により、消費者は冷蔵、冷凍、電子レンジ加熱など様々な条件に耐えられる包装を求めています。このような要求を満たす機能性ラップフィルムは、ユーザーエクスペリエンスを向上させ、用途の幅を広げます。こうした消費者ニーズの進化に対応することで、機能性ラップフィルムはより幅広い顧客層を獲得することが期待されます。したがって、機能性ラップフィルムに対する需要の高まりは、予測期間中、ラップフィルム市場に有利な機会を提供すると思われます。

アジア太平洋のラップフィルム市場の概要

アジア太平洋の飲食品市場は、様々な革新的な種類の加工食品やパッケージ食品が入手可能になり、ミレニアル世代からの需要が高まっているため、成長を目の当たりにしています。アジア太平洋の外食産業は、急速な経済成長、消費者のライフスタイルの向上、観光産業の成長、可処分所得水準の上昇により急速に拡大しています。シンガポールのような国々は物流のハブとして機能し、この地域の食品の主要バイヤー数社の本社を受け入れています。その結果、食品の生産量が増加し、食品業界の包装材料としてのラップフィルムの需要を後押ししています。

食品と食料品のオンライン小売セクターの成長は、ラップフィルムの需要にプラスの影響を与えます。国際貿易局によると、アジアの消費者の57%は買い物のニーズにオンライン小売を主に利用しています。これには、包装用ラップフィルムを必要とする食料品や食品のオンラインショッピングも含まれます。このように、アジア太平洋における食品産業の成長は、同地域全体のラップフィルムの需要を押し上げています。

アジア太平洋のラップフィルム市場の収益と2031年までの予測(金額)

アジア太平洋のラップフィルム市場セグメンテーション

アジア太平洋のラップフィルム市場は、材料の種類、形状、最終用途、国別に分類されます。

材料の種類別に見ると、アジア太平洋のラップフィルム市場は、低密度ポリエチレン、二軸延伸ポリプロピレン、ポリ塩化ビニル、ポリ塩化ビニリデン、その他に区分されます。2023年には、低密度ポリエチレンセグメントがアジア太平洋のラップフィルム市場で最大のシェアを占めています。

形状別では、アジア太平洋のラップフィルム市場はキャストラップフィルムとブローラップフィルムに二分されます。2023年には、キャストラップフィルム部門がアジア太平洋のラップフィルム市場でより大きなシェアを占めています。

最終用途別では、アジア太平洋のラップフィルム市場は食品、医療・医薬品、消費財、工業、その他に分けられます。2023年にアジア太平洋のラップフィルム市場で最大のシェアを占めたのは工業分野でした。

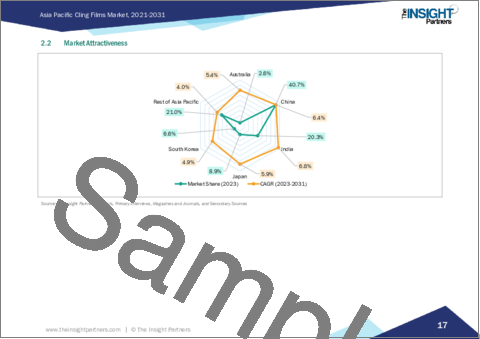

国別では、アジア太平洋のラップフィルム市場はオーストラリア、インド、中国、日本、韓国、その他アジア太平洋に区分されます。2023年のアジア太平洋のラップフィルム市場シェアは中国が独占しました。

Berry Global Group Inc、Cedo Ltd、Dow Inc、POLIFILM、Mitsubishi Chemical Group Corp.は、アジア太平洋のラップフィルム市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 分析手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

- 限界と前提

第4章 アジア太平洋のラップフィルム市場情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 代替品の脅威

- 買い手の交渉力:新規参入企業の脅威

- 供給企業の交渉力

- 競争企業間の敵対関係

- エコシステム分析

- 原材料サプライヤー

- 製造業者

- 流通業者または供給業者

- 最終用途産業

- バリューチェーンのベンダー一覧

第5章 アジア太平洋のラップフィルム市場:主な市場力学

- 市場促進要因

- 食品産業の急成長

- 医療・製薬業界からの需要急増

- 市場抑制要因

- 代替品の入手可能性

- 市場機会

- 機能性ラップフィルムの需要増大

- 今後の動向

- 環境に優しいラップフィルムへの注目の高まり

- 促進要因と抑制要因の影響

第6章 ラップフィルム市場:アジア太平洋市場の分析

- アジア太平洋のラップフィルム市場の収益 (2021~2031年)

- アジア太平洋のラップフィルム市場の予測・分析

第7章 アジア太平洋ラップフィルム市場の分析:材料の種類別

- 低密度ポリエチレン

- 二軸延伸ポリプロピレン

- ポリ塩化ビニル

- ポリ塩化ビニリデン

- その他

第8章 アジア太平洋のラップフィルム市場の分析:形状別

- キャストラップフィルム

- ブローラップフィルム

第9章 アジア太平洋のラップフィルム市場の分析:最終用途別

- 食品

- 医療・医薬品

- 消費財

- 工業

- その他

第10章 アジア太平洋のラップフィルム市場:国別分析

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

第11章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第12章 業界情勢

- 新製品の上市

- コラボレーション

- 企業合併・買収 (M&A)

第13章 企業プロファイル

- Berry Global Group Inc

- Cedo Ltd

- Dow Inc

- POLIFILM

- Mitsubishi Chemical Group Corp

第14章 付録

List Of Tables

- Table 1. Asia Pacific Cling Films Market Segmentation

- Table 2. List of Vendors

- Table 3. Asia Pacific Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Asia Pacific Cling Films Market - Revenue and Forecast to 2031 (US$ Million) - by Material Type

- Table 5. Asia Pacific Cling Films Market - Revenue and Forecast to 2031 (US$ Million) - by Form

- Table 6. Asia Pacific Cling Films Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 7. Asia Pacific: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 8. Australia: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Material Type

- Table 9. Australia: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Form

- Table 10. Australia: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by End Use

- Table 11. China: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Material Type

- Table 12. China: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Form

- Table 13. China: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by End Use

- Table 14. India: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Material Type

- Table 15. India: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Form

- Table 16. India: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by End Use

- Table 17. Japan: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Material Type

- Table 18. Japan: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Form

- Table 19. Japan: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by End Use

- Table 20. South Korea: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Material Type

- Table 21. South Korea: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Form

- Table 22. South Korea: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by End Use

- Table 23. Rest of Asia Pacific: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Material Type

- Table 24. Rest of Asia Pacific: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by Form

- Table 25. Rest of Asia Pacific: Cling Films Market - Revenue and Forecast to 2031(US$ Million) - by End Use

List Of Figures

- Figure 1. Asia Pacific Cling Films Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Asia Pacific Cling Films Market

- Figure 4. Asia Pacific Cling Films Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Asia Pacific Cling Films Market Revenue (US$ Million), 2021-2031

- Figure 7. Asia Pacific Cling Films Market Share (%) - by Material Type (2023 and 2031)

- Figure 8. Low Density Polyethylene: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Biaxially Oriented Polypropylene: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Polyvinyl Chloride: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Polyvinylidene Chloride: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Others: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Asia Pacific Cling Films Market Share (%) - by Form (2023 and 2031)

- Figure 14. Cast Cling Film: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Blow Cling Film: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Asia Pacific Cling Films Market Share (%) - by End Use (2023 and 2031)

- Figure 17. Food: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Healthcare and Pharmaceuticals: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Consumer Goods: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Industrial: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Others: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Asia Pacific: Cling Films Market Revenue, by Key Countries, (2023) (US$ Mn)

- Figure 23. Asia Pacific: Cling Films Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 24. Australia: Cling Films Market - Revenue and Forecast to 2031(US$ Million)

- Figure 25. China: Cling Films Market - Revenue and Forecast to 2031(US$ Million)

- Figure 26. India: Cling Films Market - Revenue and Forecast to 2031(US$ Million)

- Figure 27. Japan: Cling Films Market - Revenue and Forecast to 2031(US$ Million)

- Figure 28. South Korea: Cling Films Market - Revenue and Forecast to 2031(US$ Million)

- Figure 29. Rest of Asia Pacific: Cling Films Market - Revenue and Forecast to 2031(US$ Million)

- Figure 30. Heat Map Analysis by Key Players

- Figure 31. Company Positioning & Concentration

The Asia Pacific cling films market was valued at US$ 2,325.38 million in 2023 and is expected to reach US$ 3,660.63 million by 2031; it is estimated to register a CAGR of 5.8% from 2023 to 2031.

Rising Demand for Functional Cling Films Boosts Asia Pacific Cling Films Market

Consumers increasingly seek products that offer enhanced performance features such as superior sealing capabilities, extended freshness, and increased durability. Thus, manufacturers are driven to innovate and develop advanced cling film solutions. In December 2023, Berry Global launched a new version of Omni Xtra polyethylene cling film for fresh food applications. The film provides a high-performance alternative to traditional polyvinyl chloride (PVC) cling films. Moreover, the increasing inclination toward convenience and versatility in food packaging contributes to the demand for functional cling films. With busy lifestyles and the rise of meal prepping, consumers are looking for packaging that can withstand various conditions such as refrigeration, freezing, and microwave heating. Functional cling films that meet these demands enhance user experience and expand the scope of their applications. By addressing these evolving consumer needs, functional cling films are expected to gain a broader customer base. Therefore, the rising demand for functional cling films would offer lucrative opportunities for the cling films market during the forecast period.

Asia Pacific Cling Films Market Overview

The food & beverage market in Asia Pacific is witnessing growth due to the availability of various innovative varieties of processed and packaged food products and growing demand from the millennial population. The foodservice sector in Asia Pacific is rapidly expanding owing to rapid economic growth, improving lifestyles of consumers, growth of the tourism sector, and rising disposable income levels. Countries such as Singapore serve as a logistic hub and host the headquarters for several key buyers of food products in the region. This results in an increased production of food products, which propels the demand for cling films as a packaging material in the food industry.

The growing online retail sector for food and groceries positively impacts the demand for cling films. According to the International Trade Administration, 57% of Asian consumers predominantly use online retail for their shopping needs. This includes online shopping for grocery and food products that require cling films for packaging. Thus, the growing food industry in Asia Pacific boosts the demand for cling films across the region.

Asia Pacific Cling Films Market Revenue and Forecast to 2031 (US$ Million)

Asia Pacific Cling Films Market Segmentation

The Asia Pacific cling films market is categorized into material type, form, end use, and country.

Based on material type, the Asia Pacific cling films market is segmented into low density polyethylene, biaxially oriented polypropylene, polyvinyl chloride, polyvinylidene chloride, and others. The low density polyethylene segment held the largest Asia Pacific cling films market share in 2023.

In terms of form, the Asia Pacific cling films market is bifurcated into cast cling film and blow cling film. The cast cling film segment held a larger Asia Pacific cling films market share in 2023.

By end use, the Asia Pacific cling films market is divided into food, healthcare and pharmaceuticals, consumer goods, industrial, and others. The industrial segment held the largest Asia Pacific cling films market share in 2023.

By country, the Asia Pacific cling films market is segmented into Australia, India, China, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific cling films market share in 2023.

Berry Global Group Inc, Cedo Ltd, Dow Inc, POLIFILM, and Mitsubishi Chemical Group Corp. are some of the leading companies operating in the Asia Pacific cling films market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

- 3.2.1 Limitations and Assumptions:

4. Asia Pacific Cling Films Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants:

- 4.2.2 Threat of Substitutes:

- 4.2.3 Bargaining Power of Buyers:

- 4.2.4 Bargaining Power of Suppliers:

- 4.2.5 Competitive Rivalry:

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors or Suppliers

- 4.3.4 End-Use Industry

- 4.3.5 List of Vendors in the Value Chain

5. Asia Pacific Cling Films Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rapid Growth in Food Industry

- 5.1.2 Soaring Demand from Healthcare and Pharmaceutical Industries

- 5.2 Market Restraints

- 5.2.1 Availability of Substitutes

- 5.3 Market Opportunities

- 5.3.1 Rising Demand for Functional Cling Films

- 5.4 Future Trends

- 5.4.1 Growing Focus on Eco-Friendly Cling Films

- 5.5 Impact of Drivers and Restraints:

6. Cling Films Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Cling Films Market Revenue (US$ Million), 2021-2031

- 6.2 Asia Pacific Cling Films Market Forecast Analysis

7. Asia Pacific Cling Films Market Analysis - by Material Type

- 7.1 Low Density Polyethylene

- 7.1.1 Overview

- 7.1.2 Low Density Polyethylene: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Biaxially Oriented Polypropylene

- 7.2.1 Overview

- 7.2.2 Biaxially Oriented Polypropylene: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Polyvinyl Chloride

- 7.3.1 Overview

- 7.3.2 Polyvinyl Chloride: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Polyvinylidene Chloride

- 7.4.1 Overview

- 7.4.2 Polyvinylidene Chloride: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

8. Asia Pacific Cling Films Market Analysis - by Form

- 8.1 Cast Cling Film

- 8.1.1 Overview

- 8.1.2 Cast Cling Film: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Blow Cling Film

- 8.2.1 Overview

- 8.2.2 Blow Cling Film: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

9. Asia Pacific Cling Films Market Analysis - by End Use

- 9.1 Food

- 9.1.1 Overview

- 9.1.2 Food: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Healthcare and Pharmaceuticals

- 9.2.1 Overview

- 9.2.2 Healthcare and Pharmaceuticals: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Consumer Goods

- 9.3.1 Overview

- 9.3.2 Consumer Goods: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Industrial

- 9.4.1 Overview

- 9.4.2 Industrial: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

10. Asia Pacific Cling Films Market - Country Analysis

- 10.1 Asia Pacific

- 10.1.1 Asia Pacific: Cling Films Market Breakdown, by Key Countries, 2023 and 2031 (%)

- 10.1.1.1 Asia Pacific: Cling Films Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 Australia: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.2.1 Australia: Cling Films Market Breakdown, by Material Type

- 10.1.1.2.2 Australia: Cling Films Market Breakdown, by Form

- 10.1.1.2.3 Australia: Cling Films Market Breakdown, by End Use

- 10.1.1.3 China: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.3.1 China: Cling Films Market Breakdown, by Material Type

- 10.1.1.3.2 China: Cling Films Market Breakdown, by Form

- 10.1.1.3.3 China: Cling Films Market Breakdown, by End Use

- 10.1.1.4 India: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.4.1 India: Cling Films Market Breakdown, by Material Type

- 10.1.1.4.2 India: Cling Films Market Breakdown, by Form

- 10.1.1.4.3 India: Cling Films Market Breakdown, by End Use

- 10.1.1.5 Japan: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.5.1 Japan: Cling Films Market Breakdown, by Material Type

- 10.1.1.5.2 Japan: Cling Films Market Breakdown, by Form

- 10.1.1.5.3 Japan: Cling Films Market Breakdown, by End Use

- 10.1.1.6 South Korea: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.6.1 South Korea: Cling Films Market Breakdown, by Material Type

- 10.1.1.6.2 South Korea: Cling Films Market Breakdown, by Form

- 10.1.1.6.3 South Korea: Cling Films Market Breakdown, by End Use

- 10.1.1.7 Rest of Asia Pacific: Cling Films Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.7.1 Rest of Asia Pacific: Cling Films Market Breakdown, by Material Type

- 10.1.1.7.2 Rest of Asia Pacific: Cling Films Market Breakdown, by Form

- 10.1.1.7.3 Rest of Asia Pacific: Cling Films Market Breakdown, by End Use

- 10.1.1 Asia Pacific: Cling Films Market Breakdown, by Key Countries, 2023 and 2031 (%)

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 New Product Launch

- 12.3 Collaboration

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Berry Global Group Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Cedo Ltd

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Dow Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 POLIFILM

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Mitsubishi Chemical Group Corp

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners