|

|

市場調査レポート

商品コード

1715196

北米の非接触決済市場:2031年までの予測 - 地域別分析 - 決済モード別、コンポーネント別、業界別North America Contactless Payments Market Forecast to 2031 - Regional Analysis - by Payment Mode, Components, and Industry Verticals |

||||||

|

|||||||

| 北米の非接触決済市場:2031年までの予測 - 地域別分析 - 決済モード別、コンポーネント別、業界別 |

|

出版日: 2025年02月11日

発行: The Insight Partners

ページ情報: 英文 93 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

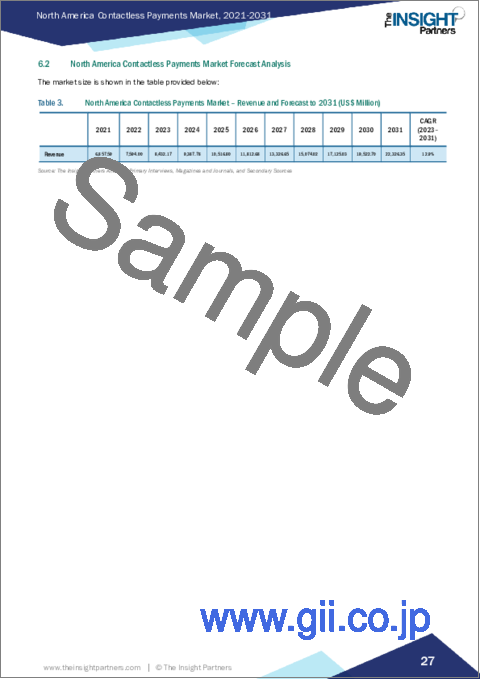

北米の非接触決済市場は、2023年に84億3,217万米ドルと評価され、2031年までには223億2,635万米ドルに達すると予測され、2023年から2031年までのCAGRは12.9%と推定されます。

デジタル決済を推進する政府の取り組みが北米の非接触決済市場を後押し

世界中のさまざまな政府がデジタル決済の利用を促進しています。米国連邦政府は、デジタルウォレットやモバイル決済など、デジタル決済を推進するためのイニシアチブをいくつかとっています。インターネット小売業者から銀行口座やクレジットカードの詳細を非公開にしたい顧客は、デジタルウォレットを利用することができます。さらに、一部の政府機関では、Apple Pay、Android Pay、Samsung Payなど、一般的になりつつある非接触決済に対応しています。これらのサービスはNFCを利用しています。このワイヤレス規格により、利用者はカード取得サービスを通じて端末にモバイル機器を近づけることで支払いができます。国防コミッサリーや国立公園サービスなどの参加施設の消費者は、これらの支払方法を使用して「チェックアウト」することができます。財務省はまた、連邦政府機関向けのiOSおよびAndroidモバイルソフトウェアであるFedRevCollectを通じてNFC機能を提供しています。民間企業でも利用できるようになった新しい最先端の支払い方法を提供することで、モバイルアプリは電子決済の数を増やすという財政サービスのeコマースミッションの重要な要素となっています。デジタル決済を推進するこうした政府の取り組みが、非接触決済市場を牽引しています。

北米の非接触決済市場概要

北米の非接触決済市場は、この技術が提供するスピード、利便性、セキュリティによって力強い成長を遂げました。同市場は、政府・金融機関からの支援や消費者の認知度向上により、今後も拡大が見込まれます。さらに、北米ではさまざまな企業が非接触決済を提供するために提携しています。例えば、2022年10月、Visa Inc.はPayPal Holdings Inc.と提携し、米国内の800万以上の小売店舗で非接触決済を可能にしました。この提携により、PayPalとVenmoのユーザーは、Visaの非接触決済に対応している加盟店でQRコードによる支払いが可能になります。また、この提携により、利用者が銀行口座に即座に送金できるリアルタイムのプッシュペイメントソリューション、Visa Directも可能になります。

北米の非接触決済市場の収益と2031年までの予測(金額)

北米の非接触決済市場のセグメンテーション

北米の非接触決済市場は、決済モード、コンポーネント、業界別、国別に分類されます。

決済モードに基づき、北米の非接触決済市場はスマートフォン、スマートカード、pos端末、その他に分けられます。2023年の北米の非接触決済市場シェアは、スマートフォン分野が最大です。

コンポーネント別では、北米の非接触決済市場はハードウェア、ソリューション、サービスに区分されます。2023年の北米の非接触決済市場シェアはハードウェア部門が最大でした。

業界別では、北米の非接触決済市場は小売、ホスピタリティ、ヘルスケア、交通・物流、メディア・エンターテイメント、その他に分けられます。2023年の北米の非接触決済市場シェアは小売セグメントが最大でした。

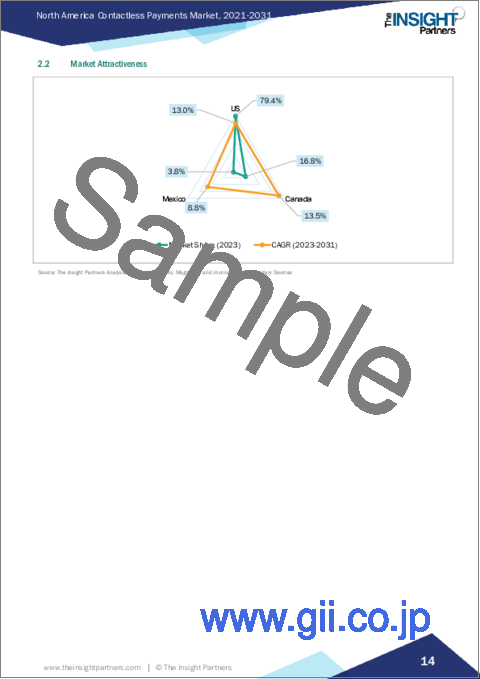

国別では、北米の非接触決済市場は米国、カナダ、メキシコに分類されます。2023年の北米の非接触決済市場シェアは米国が独占しました。

Thales SA、Infineon Technologies AG、Ingenico Group SA、IDEMIA France SAS、PAX Technology、SumUp Inc、Visa Inc、Mastercard Inc、CPI Card Group Incは、北米の非接触決済市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の非接触決済市場情勢

- PEST分析

- エコシステム分析

- ハードウェア・プロバイダー

- ソリューション・サービス・プロバイダー

- 物流・サプライチェーン管理プロバイダー

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 北米の非接触決済市場:主要市場力学

- 市場促進要因

- デジタル決済を推進する政府のイニシアチブの増加

- 非接触決済の効率性と費用対効果

- 市場抑制要因

- 潜在的なセキュリティ上の懸念と限界

- 市場機会

- 非接触決済の技術的進歩

- IoTを組み込んだ非接触決済

- 今後の動向

- 音声照合確認による音声ベース決済

- 促進要因と抑制要因の影響

第6章 非接触決済市場:北米市場分析

- 北米の非接触決済市場の収益、2021年~2031年

- 北米の非接触決済市場の予測分析

第7章 北米の非接触決済市場の分析:決済モード別

- スマートフォン

- スマートカード

- PoS端末

- その他

第8章 北米の非接触決済市場の分析:コンポーネント別

- ハードウェア

- ソリューション

- サービス

第9章 北米の非接触決済市場の分析:業界別

- 小売

- ホスピタリティ

- ヘルスケア

- 運輸・物流

- メディア・エンターテイメント

- その他

第10章 北米の非接触決済市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- 各社のポジショニングと集中度

- ヒートマップ分析:主要企業別

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

第13章 企業プロファイル

- Thales SA

- Infineon Technologies AG

- Ingenico Group SA

- IDEMIA France SAS

- PAX Technology

- SumUp Inc.

- Visa Inc

- Mastercard Inc

- CPI Card Group Inc

第14章 付録

List Of Tables

- Table 1. North America Contactless Payments Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. North America Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Payment Mode

- Table 5. North America Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Components

- Table 6. North America Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Industry Verticals

- Table 7. North America: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 8. United States: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Payment Mode

- Table 9. United States: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Components

- Table 10. United States: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Industry Verticals

- Table 11. Canada: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Payment Mode

- Table 12. Canada: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Components

- Table 13. Canada: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Industry Verticals

- Table 14. Mexico: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Payment Mode

- Table 15. Mexico: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Components

- Table 16. Mexico: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million) - by Industry Verticals

- Table 17. Heat Map Analysis by Key Players

- Table 18. List of Abbreviation

List Of Figures

- Figure 1. North America Contactless Payments Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. North America Contactless Payments Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. North America Contactless Payments Market Revenue (US$ Million), 2021-2031

- Figure 6. North America Contactless Payments Market Share (%) - by Payment Mode (2023 and 2031)

- Figure 7. Smartphones: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Smart Cards: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. PoS Terminals: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Others: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. North America Contactless Payments Market Share (%) - by Components (2023 and 2031)

- Figure 12. Hardware: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Solutions: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Services: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. North America Contactless Payments Market Share (%) - by Industry Verticals (2023 and 2031)

- Figure 16. Retail: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Hospitality: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Healthcare: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Transportation and Logistics: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Media and Entertainment: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Others: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. North America: Contactless Payments Market Revenue, by Key Countries, (2023) (US$ Mn)

- Figure 23. North America: Contactless Payments Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 24. United States: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million)

- Figure 25. Canada: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million)

- Figure 26. Mexico: Contactless Payments Market - Revenue and Forecast to 2031(US$ Million)

- Figure 27. Company Positioning & Concentration

The North America contactless payments market was valued at US$ 8,432.17 million in 2023 and is expected to reach US$ 22,326.35 million by 2031; it is estimated to register a CAGR of 12.9% from 2023 to 2031.

Increase in Government Initiatives to Promote Digital Payments Fuel North America Contactless Payments Market

Various governments across the globe are promoting the use of digital payments. The US Federal Government has taken several initiatives to promote digital payments, such as digital wallets and mobile payments. Customers who prefer to keep their bank account or credit card details private from internet retailers can use digital wallets. Moreover, at certain government locations, the Fiscal Service accepts the increasingly common contactless payment methods, including Apple Pay, Android Pay, and Samsung Pay. These services make use of NFC. This wireless standard enables users to pay with their mobile devices by hovering them close to a terminal through the Card Acquiring Service. Consumers at participating locations, such as Defense Commissaries and National Park Service sites, can "check out" using these payment methods. Treasury also provides NFC functionality through FedRevCollect, the iOS and Android mobile software for federal agencies. By providing new and cutting-edge payment methods that are now accessible in the private sector, the mobile app is a crucial component of the Fiscal Service's eCommerce mission to raise the number of electronic collections. Such government initiatives to promote digital payments drive the contactless payment market.

North America Contactless Payments Market Overview

The contactless payments market in North America witnessed strong growth, driven by the speed, convenience, and security offered by this technology. This market is expected to continue to expand in the coming years, owing to support from governments and financial institutions and increased consumer awareness. Moreover, various players across North America are partnering to provide contactless payment. For example, in October 2022, Visa Inc. partnered with PayPal Holdings Inc. to enable contactless payments at more than 8 million retail locations in the US. The partnership allows PayPal and Venmo users to pay with QR codes at any merchant accepting Visa contactless payments. The partnership also enables Visa Direct, a real-time push payment solution that allows users to transfer money to their bank accounts instantly.

North America Contactless Payments Market Revenue and Forecast to 2031 (US$ Million)

North America Contactless Payments Market Segmentation

The North America contactless payments market is categorized into payment mode, components, industry verticals, and country.

Based on payment mode, the North America contactless payments market is divided into smartphones, smart cards, pos terminals, and others. The smartphones segment held the largest North America contactless payments market share in 2023.

In terms of components, the North America contactless payments market is segmented into hardware, solutions, and services. The hardware segment held the largest North America contactless payments market share in 2023.

By industry verticals, the North America contactless payments market is divided into retail, hospitality, healthcare, transportation and logistics, media and entertainment, and others. The retail segment held the largest North America contactless payments market share in 2023.

Based on country, the North America contactless payments market is categorized into the US, Canada, and Mexico. The US dominated the North America contactless payments market share in 2023.

Thales SA, Infineon Technologies AG, Ingenico Group SA, IDEMIA France SAS, PAX Technology, SumUp Inc, Visa Inc, Mastercard Inc, and CPI Card Group Inc are some of the leading companies operating in the North America contactless payments market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.1 Country level data:

4. North America Contactless Payments Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Hardware Providers

- 4.3.2 Solution and Service Providers

- 4.3.3 Logistics and Supply Chain Management Providers

- 4.3.4 End Users

- 4.3.5 List of Vendors in the Value Chain

5. North America Contactless Payments Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increase in Government Initiatives to Promote Digital Payments

- 5.1.2 Efficiency and Cost-Effectiveness of Contactless Payments

- 5.2 Market Restraints

- 5.2.1 Potential Security Concerns and Limitations

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements in Contactless Payments

- 5.3.2 IoT-Embedded Contactless Payment

- 5.4 Future Trends

- 5.4.1 Voice-Based Payments with Voice Match Confirmation

- 5.5 Impact of Drivers and Restraints:

6. Contactless Payments Market - North America Market Analysis

- 6.1 North America Contactless Payments Market Revenue (US$ Million), 2021-2031

- 6.2 North America Contactless Payments Market Forecast Analysis

7. North America Contactless Payments Market Analysis - by Payment Mode

- 7.1 Smartphones

- 7.1.1 Overview

- 7.1.2 Smartphones: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Smart Cards

- 7.2.1 Overview

- 7.2.2 Smart Cards: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 PoS Terminals

- 7.3.1 Overview

- 7.3.2 PoS Terminals: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Contactless Payments Market Analysis - by Components

- 8.1 Hardware

- 8.1.1 Overview

- 8.1.2 Hardware: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Solutions

- 8.2.1 Overview

- 8.2.2 Solutions: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Services

- 8.3.1 Overview

- 8.3.2 Services: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Contactless Payments Market Analysis - by Industry Verticals

- 9.1 Retail

- 9.1.1 Overview

- 9.1.2 Retail: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Hospitality

- 9.2.1 Overview

- 9.2.2 Hospitality: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Healthcare

- 9.3.1 Overview

- 9.3.2 Healthcare: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Transportation and Logistics

- 9.4.1 Overview

- 9.4.2 Transportation and Logistics: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Media and Entertainment

- 9.5.1 Overview

- 9.5.2 Media and Entertainment: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Contactless Payments Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Contactless Payments Market Overview

- 10.1.2 North America: Contactless Payments Market Breakdown, by Key Countries, 2023 and 2031 (%)

- 10.1.2.1 North America: Contactless Payments Market - Revenue and Forecast Analysis - by Country

- 10.1.2.2 United States: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.2.1 United States: Contactless Payments Market Breakdown, by Payment Mode

- 10.1.2.2.2 United States: Contactless Payments Market Breakdown, by Components

- 10.1.2.2.3 United States: Contactless Payments Market Breakdown, by Industry Verticals

- 10.1.2.3 Canada: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.3.1 Canada: Contactless Payments Market Breakdown, by Payment Mode

- 10.1.2.3.2 Canada: Contactless Payments Market Breakdown, by Components

- 10.1.2.3.3 Canada: Contactless Payments Market Breakdown, by Industry Verticals

- 10.1.2.4 Mexico: Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.4.1 Mexico: Contactless Payments Market Breakdown, by Payment Mode

- 10.1.2.4.2 Mexico: Contactless Payments Market Breakdown, by Components

- 10.1.2.4.3 Mexico: Contactless Payments Market Breakdown, by Industry Verticals

11. Competitive Landscape

- 11.1 Company Positioning & Concentration

- 11.2 Heat Map Analysis by Key Players

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

13. Company Profiles

- 13.1 Thales SA

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Infineon Technologies AG

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Ingenico Group SA

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 IDEMIA France SAS

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 PAX Technology

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 SumUp Inc.

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Visa Inc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Mastercard Inc

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 CPI Card Group Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

14. Appendix

- 14.1 Word Index

- 14.2 About The Insight Partners