|

|

市場調査レポート

商品コード

1666288

北米の無停電電源装置市場:2031年までの予測 - 地域別分析 - タイプ別、定格別、エンドユーザー別North America Uninterrupted Power Supply Market Forecast to 2031 - Regional Analysis - by Type, Rating, and End User |

||||||

|

|||||||

| 北米の無停電電源装置市場:2031年までの予測 - 地域別分析 - タイプ別、定格別、エンドユーザー別 |

|

出版日: 2025年01月13日

発行: The Insight Partners

ページ情報: 英文 101 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の無停電電源装置市場は、2023年に31億9,211万米ドルとなり、2031年までには55億998万米ドルに達すると予測され、2023年から2031年までのCAGRは7.1%と推定されます。

スマートビルにおけるUPS要件の増加が北米の無停電電源装置市場を促進

スマートビルディングは、ビル資源の効率的な利用を保証するために、技術的に高度な製品を備えています。これは、居住者にとって安全で快適な環境を作り出すことを目的としています。モノのインターネット(IoT)センサー、ビル管理、人工知能(AI)システム、ロボットなどは、スマートビルで使用される技術のひとつで、これらはすべて統合され、省電力ソリューションによって強化されています。例えば、モノのインターネットに接続されたリアルタイムのモーションセンサーから送信されるデータとビル管理システムなど、多くのアクティビティが高度に関連しているため、スマートビルでは自動化が重要です。この自動化は、HVAC、照明、セキュリティシステムなどにも及んでいます。スマートビルを構成するすべての機器とシステムには、信頼性が高く、安定した高品質の電力供給が必要です。無停電電源装置(UPS)システムは、商業、ビジネス、教育、住宅を問わず、あらゆる建物のハードウェアとソフトウェアのインフラを保護することができます。電力供給が遮断された場合、UPSは必要な電力を供給し続けるため、建物に設置されたコンピュータ機器は電源を切って適切に再起動し、データを保存してバックアップコピーを作成するのに十分な時間を持つことができます。UPSシステムは、重大なデータ損失やハードウェアの損傷を引き起こす可能性のある電力変動から接続されたデバイスを保護します。UPSは無停電電源を提供し、停電時に接続機器の電源を切るのに十分な時間を与えます。従って、スマートビルにおけるUPSの台数の増加が市場の成長を促進しています。

北米の無停電電源装置市場概要

北米の無停電電源装置市場は、米国、カナダ、メキシコに区分されます。北米は工業的にも経済的にも先進地域です。同地域では、相当数のデータセンターが設立されており、今後数年の成長が見込まれています。例えば、Microsoftは2023年、ケベック州でのハイパースケール・クラウド・コンピューティングとAIインフラの開発に5億米ドルを投資する計画を発表しました。この投資は、地域のイノベーション経済を強化し、価値の高い雇用を創出し、将来のAI経済に備えるという目標を達成するために行われました。2024年、Amazonの子会社であるAWSは、クラウド・コンピューティング・サービスの需要拡大に対応するため、50億米ドルを投資してメキシコに複数のデータセンターを設立する計画を発表しました。Reutersによると、AWS Mexicoのルーベン・ムガルテギ最高経営責任者(CEO)は、新しいデータセンターはメキシコのケレタロ州に設立されると述べました。また、ムガルテギCEOは、同社はこのプロジェクトに5年以上取り組んでおり、投資額は15年間で分割するつもりだと述べました。また、この地域におけるスマートグリッドへの投資の増加は、無停電電力供給に対する需要の増加に寄与しています。2023年、米国エネルギー省は、風力発電と太陽光発電の容量を増やし、異常気象から送電線を強化し、バッテリーと電気自動車を統合し、停電時に照明を稼働させるマイクログリッドを開発するために、35億米ドルの補助金を出すと発表しました。同報告書では、米国の44州における58のプロジェクトが連邦政府の融資の対象として取り上げられています。州政府、地方自治体、電力会社、業界パートナーからの資金提供により、投資額は80億米ドル以上に達すると思われます。この政府の取り組みは、この地域の市場成長を促進すると思われます。

北米の無停電電源装置市場の収益と2031年までの予測(金額)

北米の無停電電源装置市場セグメンテーション

北米の無停電電源装置市場は、タイプ、定格、エンドユーザー、国に分類されます。

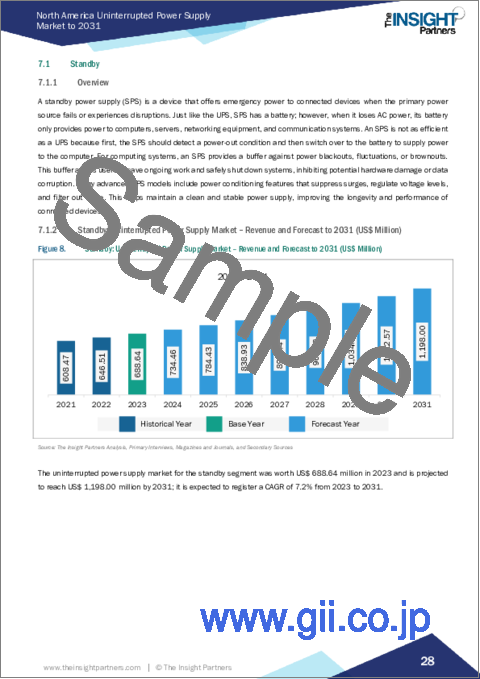

タイプ別では、北米の無停電電源装置市場はスタンバイ、ラインインタラクティブ、オンラインに区分されます。オンラインセグメントが2023年に最大の市場シェアを占めました。

定格では、北米の無停電電源装置市場は50kVAまで、50~100kVA、100kVA以上に分類されます。100kVA以上のセグメントが2023年に最大の市場シェアを占めました。

エンドユーザー別では、北米の無停電電源装置市場はデータセンター、通信、ヘルスケア、産業、その他に区分されます。データセンターセグメントが2023年に最大の市場シェアを占めました。

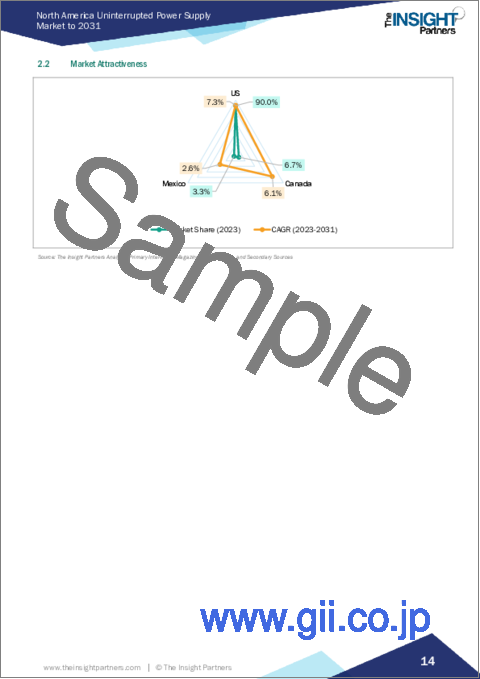

国別では、北米の無停電電源装置市場は米国、カナダ、メキシコに区分されます。2023年の北米の無停電電源装置市場シェアは米国が独占しました。

Schneider Electric SE、ABB Ltd、Toshiba Corp、Cyber Power Systems(USA)Inc、Eaton Corp Plc、Emerson Electric Co、Delta Electronics Inc、Legrand SA、Mitsubishi Electric Corp、Kehua Data Co Ltd.は北米の無停電電源装置市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の無停電電源装置市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の無停電電源装置市場:主要市場力学

- 市場促進要因

- スマートビルにおけるUPS要件の増加

- データセンターにおけるエネルギー効率の重視

- 市場抑制要因

- 高コスト

- 市場機会

- IoTがUPSシステムを可能にする

- ダイナミックグリッドサポート技術

- 今後の動向

- スマートUPSシステム

- 促進要因と抑制要因の影響

第6章 無停電電源装置市場-北米分析

- 北米の無停電電源装置市場概要

- 無停電電源装置市場の収益、2021年~2031年

- 無停電電源装置市場の予測分析

第7章 北米の無停電電源装置市場分析:タイプ別

- スタンバイ

- ラインインタラクティブ

- オンライン

第8章 北米の無停電電源装置市場分析:定格別

- 50kVA以下

- 50~100kVA間

- 100kVA以上

第9章 北米の無停電電源装置市場分析:エンドユーザー別

- データセンター

- 通信

- ヘルスケア

- 産業用

- その他

第10章 北米の無停電電源装置市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品ニュース・企業ニュース

- コラボレーション・M&A

第13章 企業プロファイル

- Schneider Electric SE

- ABB Ltd

- Toshiba Corp

- Cyber Power Systems(USA)Inc

- Eaton Corp Plc

- Emerson Electric Co

- Delta Electronics Inc

- Legrand SA

- Mitsubishi Electric Corp

- Kehua Data Co Ltd

第14章 付録

List Of Tables

- Table 1. North America Uninterrupted Power Supply Market Segmentation

- Table 2. List of Vendors

- Table 3. Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)- by Type

- Table 5. Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)- by Rating

- Table 6. Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)- by End User

- Table 7. North America: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 8. United States: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 9. United States: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by Rating

- Table 10. United States: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 11. Canada: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 12. Canada: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by Rating

- Table 13. Canada: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 14. Mexico: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 15. Mexico: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by Rating

- Table 16. Mexico: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 17. List of Abbreviation

List Of Figures

- Figure 1. North America Uninterrupted Power Supply Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Uninterrupted Power Supply Market

- Figure 4. North America Uninterrupted Power Supply Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Uninterrupted Power Supply Market Revenue 2021-2031 (US$ Million)

- Figure 7. Uninterrupted Power Supply Market Share (%) - by Type (2023 and 2031)

- Figure 8. Standby: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Line Interactive: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Online: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Uninterrupted Power Supply Market Share (%) - by Rating (2023 and 2031)

- Figure 12. Upto 50 kVA: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. between 50 to 100 kVA: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Above 100 kVA: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Uninterrupted Power Supply Market Share (%) - by End User (2023 and 2031)

- Figure 16. Data Centers: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Telecom: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Healthcare: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Industrial: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Others: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. North America Uninterrupted Power Supply Market, by Key Country - Revenue, (2023 US$ Million)

- Figure 22. North America: Uninterrupted Power Supply Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 23. United States: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Canada: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Mexico: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Heat Map Analysis by Key Players

- Figure 27. Company Positioning & Concentration

The North America uninterrupted power supply market was valued at US$ 3,192.11 million in 2023 and is expected to reach US$ 5,509.98 million by 2031; it is estimated to register a CAGR of 7.1% from 2023 to 2031.

Increase in Requirement for UPS in Smart Buildings Fuels North America Uninterrupted Power Supply Market

Smart buildings are equipped with technologically advanced products to ensure efficient use of the building's resources. This aims to create a safe and comfortable environment for its residents. Internet of Things (IoT) sensors, building management, artificial intelligence (AI) systems, and robots are among the technologies used in smart buildings, all of which are integrated and enhanced by power saving solutions. Automation is critical in a smart building because of the high level of connection between many activities, for example, between data sent by real-time motion sensors connected to the Internet of Things and building management systems. This automation extends to HVAC, lighting, and security systems, among other areas. All equipment and systems that comprise a smart building must have a dependable, consistent, and high-quality electricity supply. Uninterruptible power supply (UPS) systems can protect the hardware and software infrastructure of any building, whether commercial, business, educational, or residential. If the power supply is interrupted, the UPS will continue to provide the required power so that the computer equipment installed in the building has enough time to turn off and reboot properly, as well as store data and produce backup copies. UPS systems protect connected devices from power fluctuations that could cause major data loss or hardware damage. They provide an uninterrupted power source, giving the connected device enough time to turn off during a power loss. Thus, the rising number of UPS in smart buildings is driving the market growth.

North America Uninterrupted Power Supply Market Overview

The North America uninterrupted power supply market is segmented into the US, Canada, and Mexico. North America is an industrially and economically advanced region. The region has established a significant number of data centers, which are expected to grow in the coming years. For instance, in 2023, Microsoft announced its plan to invest US$ 500 million in developing a hyperscale cloud computing and AI infrastructure in Quebec. The investment was made to fulfill the goal of strengthening the region's innovation economy, creating high-value jobs, and preparing the province for the future AI economy. In 2024, Amazon subsidiary AWS announced its plan to invest US$ 5 billion to establish multiple data centers in Mexico to cater to the growing demand for cloud computing services. According to Reuters, Ruben Mugartegui, the CEO of AWS Mexico, stated that the new data centers will be established in the Mexican state of Queretaro. Mugartegui also stated that the company has been working on the project for more than five years and intends to divide the investment over a period of 15 years. Also, the rise in investment in smart grids in the region contributes to the increased demand for uninterrupted power supply. In 2023, the Department of Energy announced US$ 3.5 billion in grants to increase wind and solar power capacity, fortify power lines against extreme weather, integrate batteries and electric vehicles, and develop microgrids to keep lights operational during power outages. The report highlighted 58 projects in 44 states in the US as eligible for federal financing. The investment amount will reach more than US$ 8 billion with funding from state and local governments, utilities, and industry partners. This government initiative will drive the market growth in the region.

North America Uninterrupted Power Supply Market Revenue and Forecast to 2031 (US$ Million)

North America Uninterrupted Power Supply Market Segmentation

The North America uninterrupted power supply market is categorized into type, rating, end user, and country.

Based on type, the North America uninterrupted power supply market is segmented into standby, line interactive, and online. The online segment held the largest market share in 2023.

In terms of rating, the North America uninterrupted power supply market is categorized into upto 50 kVA, between 50 to 100 kVA, and above 100 kVA. The above 100 kVA segment held the largest market share in 2023.

By end user, the North America uninterrupted power supply market is segmented into data centers, telecom, healthcare, industrial, and others. The data centers segment held the largest market share in 2023.

Based on country, the North America uninterrupted power supply market is segmented into the US, Canada, and Mexico. The US dominated the North America uninterrupted power supply market share in 2023.

Schneider Electric SE, ABB Ltd, Toshiba Corp, Cyber Power Systems (USA) Inc, Eaton Corp Plc, Emerson Electric Co, Delta Electronics Inc, Legrand SA, Mitsubishi Electric Corp, and Kehua Data Co Ltd. are some of the leading companies operating in the North America uninterrupted power supply market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Uninterrupted Power Supply Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. North America Uninterrupted Power Supply Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increase in Requirement for UPS in Smart Buildings

- 5.1.2 Focus on Energy Efficiency in Data Centers

- 5.2 Market Restraints

- 5.2.1 High Costs

- 5.3 Market Opportunities

- 5.3.1 IoT Enables UPS Systems

- 5.3.2 Dynamic Grid Support Technology

- 5.4 Future Trends

- 5.4.1 Smart UPS Systems

- 5.5 Impact of Drivers and Restraints:

6. Uninterrupted Power Supply Market - North America Analysis

- 6.1 North America Uninterrupted Power Supply Market Overview

- 6.2 Uninterrupted Power Supply Market Revenue, 2021-2031 (US$ Million)

- 6.3 Uninterrupted Power Supply Market Forecast Analysis

7. North America Uninterrupted Power Supply Market Analysis - by Type

- 7.1 Standby

- 7.1.1 Overview

- 7.1.2 Standby: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Line Interactive

- 7.2.1 Overview

- 7.2.2 Line Interactive: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Online

- 7.3.1 Overview

- 7.3.2 Online: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Uninterrupted Power Supply Market Analysis - by Rating

- 8.1 Upto 50 kVA

- 8.1.1 Overview

- 8.1.2 Upto 50 kVA: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Between 50 to 100 kVA

- 8.2.1 Overview

- 8.2.2 between 50 to 100 kVA: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Above 100 kVA

- 8.3.1 Overview

- 8.3.2 Above 100 kVA: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Uninterrupted Power Supply Market Analysis - by End User

- 9.1 Data Centers

- 9.1.1 Overview

- 9.1.2 Data Centers: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Telecom

- 9.2.1 Overview

- 9.2.2 Telecom: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Healthcare

- 9.3.1 Overview

- 9.3.2 Healthcare: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Industrial

- 9.4.1 Overview

- 9.4.2 Industrial: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Uninterrupted Power Supply Market - Country Analysis

- 10.1 North America

- 10.1.1 North America: Uninterrupted Power Supply Market Breakdown, by Key Country, 2023 and 2031 (%)

- 10.1.1.1 North America: Uninterrupted Power Supply Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 United States: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.2.1 United States: Uninterrupted Power Supply Market Breakdown, by Type

- 10.1.1.2.2 United States: Uninterrupted Power Supply Market Breakdown, by Rating

- 10.1.1.2.3 United States: Uninterrupted Power Supply Market Breakdown, by End User

- 10.1.1.3 Canada: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.3.1 Canada: Uninterrupted Power Supply Market Breakdown, by Type

- 10.1.1.3.2 Canada: Uninterrupted Power Supply Market Breakdown, by Rating

- 10.1.1.3.3 Canada: Uninterrupted Power Supply Market Breakdown, by End User

- 10.1.1.4 Mexico: Uninterrupted Power Supply Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.4.1 Mexico: Uninterrupted Power Supply Market Breakdown, by Type

- 10.1.1.4.2 Mexico: Uninterrupted Power Supply Market Breakdown, by Rating

- 10.1.1.4.3 Mexico: Uninterrupted Power Supply Market Breakdown, by End User

- 10.1.1 North America: Uninterrupted Power Supply Market Breakdown, by Key Country, 2023 and 2031 (%)

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product News & Company News

- 12.4 Collaboration and Mergers & Acquisitions

13. Company Profiles

- 13.1 Schneider Electric SE

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 ABB Ltd

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Toshiba Corp

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Cyber Power Systems (USA) Inc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Eaton Corp Plc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Emerson Electric Co

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Delta Electronics Inc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Legrand SA

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Mitsubishi Electric Corp

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Kehua Data Co Ltd

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index