|

|

市場調査レポート

商品コード

1597086

北米の眼科機器市場:2031年までの予測 - 地域別分析 - 製品別、用途別、エンドユーザー別North America Ophthalmology Devices Market Forecast to 2031 - Regional Analysis - by Product, Application, and End User |

||||||

|

|||||||

| 北米の眼科機器市場:2031年までの予測 - 地域別分析 - 製品別、用途別、エンドユーザー別 |

|

出版日: 2024年10月17日

発行: The Insight Partners

ページ情報: 英文 114 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の眼科機器市場は、2023年に172億2,121万米ドルとなり、2031年までには329億5,900万米ドルに達すると予測され、2023年から2031年までのCAGRは8.5%と推定されます。

眼科医療サービスの遠隔医療への注目の高まりが北米の眼科機器市場を活性化

画像キャプチャとデータ伝送の技術的進歩により、眼科は遠隔医療統合を強く受け入れています。遠隔眼科として知られる遠隔眼科医療の提供における技術の採用は、スマートフォンと第5世代(G)ワイヤレス通信の急速な使用とともに急速に進化しています。遠隔眼科は、加齢黄斑変性症、糖尿病網膜症、緑内障、神経眼疾患、未熟児網膜症を含む小児眼疾患などの眼疾患の診断、スクリーニング、モニタリング、治療において、非同期(ストアアンドフォワード)と同期(リアルタイム)の両方で使用することができます。さらに、眼科における遠隔医療の統合は、スクリーニング処置や治療へのアクセスを改善する強い可能性を示しています。このアプローチによって可能になる遠隔患者モニタリングは、眼科医療サービス全体の質を高めます。遠隔医療と遠隔眼科医療はすでに何年も前から実施されていますが、COVID-19の大流行時に重要性を増しました。したがって、先進国と新興諸国の両方における遠隔眼科の採用は、今後数年間で眼科機器市場に大きな成長動向をもたらすと予想されます。

北米の眼科機器市場概要

北米の眼科機器市場は、2023年に172億2,121万米ドルと評なり、2031年までには329億5,900万米ドルに達すると予測されています。また、2023年から2031年の間に8.4%のCAGRを記録すると予想されています。北米における眼科機器市場の成長は、高齢化人口の増加と眼疾患の有病率の増加に起因しています。

人口問題研究所2019によると、米国の65歳以上の高齢者数は2018年の5,200万人(総人口の16%)から倍増し、2060年までには約9,500万人(総人口の23%)になると推定されています。米国眼科学会の2019年の調査によると、米国では2050年までに70歳から75歳の732万人が原発開放隅角緑内障(POAG)に罹患すると推定されています。

視力障害や視力低下といった目の症状は、米国で急増する眼科手術の顕著な原因となっています。Starsurgicalの2023年投資家向けプレゼンテーションによると、米国では毎年約300万件の屈折矯正手術が行われています。眼科機器市場の企業は、有機的・無機的な様々な成長戦略を採用しています。

2023年9月、OCULUS, Inc.はLUVOと提携し、2つの新しい患者治療装置DARWINとLUCENTを米国の検眼・眼科市場に導入しました。LUCENT IPLとDARWIN IPLおよびRF装置は、眼科医に効果的で快適な治療法を提供することを目的としており、患者の症状の根本原因をターゲットにすることができます。

さらに、カナダ統計局の推計によると、高齢者は2036年までにカナダ人口の23%から25%を、2061年までに24%から28%を占めると予想されています。高齢化社会は眼病にかかりやすいため、高齢者人口の増加は眼科機器の普及を促進すると予想されます。

北米の眼科機器市場の収益と2031年までの予測(金額)

北米の眼科機器市場セグメンテーション

北米の眼科機器市場は、製品、用途、エンドユーザー、国によって区分されます。

製品別では、北米の眼科機器市場はビジョンケア製品、手術機器、診断・モニタリング機器に区分されます。ビジョンケア製品セグメントが2023年に最大のシェアを占めています。

用途別では、北米の眼科機器市場は白内障、緑内障、難治性疾患、網膜硝子体疾患、その他の用途に区分されます。2023年には緑内障分野が最大のシェアを占めています。

エンドユーザー別では、北米の眼科機器市場は病院・眼科クリニック、学術・研究所、その他のエンドユーザーに区分されます。病院・眼科クリニックセグメントが2023年に最大シェアを占めました。

国別では、北米の眼科機器市場は米国、カナダ、メキシコに分類されます。米国は2023年に北米の眼科機器市場を独占しました。

北米の眼科機器市場で事業を展開している主要企業には、Johnson &Johnson Vision Care Inc、Alcon AG、Carl Zeiss Meditec、Bausch &Lomb Inc、Essilor Intonational SAS、Nidek Co Ltd、Topcon Corp、Haag-Streit AG、Ziemer Ophthalmic Systems AG、Hoya Corpなどがあります。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 北米の眼科機器市場:主要市場力学

- 北米の眼科機器市場:主要市場力学

- 市場促進要因

- 眼科疾患の発生率の増加

- 製品上市、提携、買収の増加

- 市場抑制要因

- 眼科手術費用の高騰

- 市場機会

- 眼科機器の技術的進歩

- 今後の動向

- 眼科医療サービスにおける遠隔医療への注目の高まり

- 影響分析

第5章 眼科機器市場の北米分析

- 北米の眼科機器市場収益、2021年~2031年

第6章 北米の眼科機器市場分析:製品別

- 北米の眼科機器市場内訳:製品別

- ビジョンケア機器

- 診断・モニタリング機器

- 手術用機器

- 緑内障

- 白内障

- 網膜硝子体疾患

- 難治性疾患

- その他

第7章 北米の眼科機器市場分析:エンドユーザー別

- 病院・眼科クリニック

- 学術・研究機関

- その他

第8章 北米の眼科機器市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第9章 業界情勢

- 眼科機器市場における成長戦略

- 有機的成長戦略

- 無機的成長戦略

第10章 企業プロファイル

- Johnson & Johnson Vision Care, Inc.

- Alcon AG

- Carl Zeiss Meditec

- Bausch & Lomb Inc

- Essilor International SAS

- Nidek Co., Ltd.

- Topcon Corp

- Haag-Streit AG

- Ziemer Ophthalmic Systems AG

- Hoya Corp

第11章 付録

List Of Tables

- Table 1. North America Ophthalmology Devices Market Segmentation

- Table 2. North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 3. North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Vision Care Devices

- Table 4. North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Diagnostic and Monitoring Devices

- Table 5. North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Surgical Devices

- Table 6. United States: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 7. United States: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Vision Care Devices

- Table 8. United States: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Diagnostic and Monitoring Devices

- Table 9. United States: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Surgical Devices

- Table 10. United States: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 11. United States: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 12. Canada: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 13. Canada: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Vision Care Devices

- Table 14. Canada: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Diagnostic and Monitoring Devices

- Table 15. Canada: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Surgical Devices

- Table 16. Canada: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 17. Canada: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 18. Mexico: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 19. Mexico: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Vision Care Devices

- Table 20. Mexico: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Diagnostic and Monitoring Devices

- Table 21. Mexico: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Surgical Devices

- Table 22. Mexico: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 23. Mexico: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 24. Recent Organic Growth Strategies in Ophthalmology Devices Market

- Table 25. Recent Inorganic Growth Strategies in the Ophthalmology Devices Market

- Table 26. Glossary of Terms

List Of Figures

- Figure 1. North America Ophthalmology Devices Market Segmentation, by Country

- Figure 2. Impact Analysis of Drivers and Restraints

- Figure 3. North America Ophthalmology Devices Market Revenue (US$ Million), 2021-2031

- Figure 4. North America Ophthalmology Devices Market Share (%) - by Product (2023 and 2031)

- Figure 5. Vision Care Devices: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 6. Diagnostic and Monitoring Devices: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Surgical Devices: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. North America Ophthalmology Devices Market Share (%) - by Application (2023 and 2031)

- Figure 9. Glaucoma: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Cataract: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

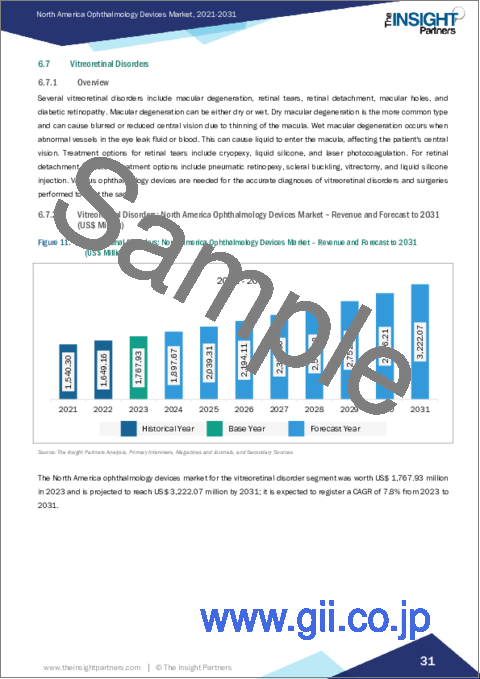

- Figure 11. Vitreoretinal Disorders: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Refractory Disorders: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Others: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. North America Ophthalmology Devices Market Share (%) - by End User (2023 and 2031)

- Figure 15. Hospitals and Eye Clinics: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Academic and Research Laboratory: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Others: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. North America: Ophthalmology Devices Market by Key Countries - Revenue (2023) US$ Million

- Figure 19. North America: Ophthalmology Devices Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 20. United States: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Canada: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Mexico: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Growth Strategies in Ophthalmology Devices Market

The North America ophthalmology devices market was valued at US$ 17,221.21 million in 2023 and is expected to reach US$ 32,959.00 million by 2031; it is estimated to register at a CAGR of 8.5% from 2023 to 2031.

Growing Focus on Telemedicine for Eye Care Services Fuels North America Ophthalmology Devices Market

With technological advancements in image capturing and data transmission, ophthalmology is strongly embracing telehealth integration. The adoption of technology in delivering remote eye care, known as teleophthalmology, has evolved rapidly with the rapid usage of smartphones and 5th generation (G) wireless communications. Teleophthalmology can be used both asynchronously (store-and-forward) and synchronously (real-time) in the diagnosis, screening, monitoring, and treatment of eye diseases such as age-related macular degeneration, diabetic retinopathy, glaucoma, neuro-ophthalmic disorders, and pediatric ocular diseases, including the retinopathy of prematurity. Moreover, the integration of telehealth in ophthalmology presents strong potential to improve access to screening procedures and treatments. Remote patient monitoring, enabled by this approach, enhances the overall quality of eye care services. Telemedicine and teleophthalmology are already in place since many years, but the practices gained significant importance during the COVID-19 pandemic. Hence, the adoption of teleophthalmology, in both developed and developing countries is expected to bring significant growth trends in the ophthalmology devices market in the coming years.

North America Ophthalmology Devices Market Overview

The North America Ophthalmology Devices market was valued at US$ 17,221.21 million in 2023 and is projected to reach US$ 32,959.00 million by 2031; it is expected to register a CAGR of 8.4% during 2023-2031. The ophthalmology devices market growth in North America is attributed to the rising aging population and the increasing prevalence of eye diseases.

As per the Population Reference Bureau 2019, the number of individuals in the US aged 65 and older is estimated to double from 52 million (16% of the total population) in 2018 to nearly 95 million (23% of the total population) by 2060. As per the American Academy of Ophthalmology's 2019 study, an estimated 7.32 million people aged 70-75 would be affected by primary open-angle glaucoma (POAG) in the US by 2050.

Eye conditions such as vision impairment and poor vision are the prominent causes of a surging number of eye surgeries in the US. According to the 2023 investors' presentation of Starsurgical, nearly 3000,000 refractive procedures are performed in the US every year. Companies in the ophthalmology devices market are adopting various organic and inorganic growth strategies; a few of the recent instances are mentioned below.

In September 2023, OCULUS, Inc. partnered with LUVO to introduce two new patient treatment devices-the DARWIN and LUCENT-in the US optometry and ophthalmology market. The LUCENT IPL, and DARWIN IPL and RF devices are intended to offer eye care practitioners effective and comfortable treatment modalities that can target the root causes of patient symptoms.

Furthermore, according to the Statistics Canada estimates, seniors are expected to comprise ~23-25% of the Canadian population by 2036 and ~24-28% of the population by 2061. The rising geriatric population is expected to propel the adoption of ophthalmology devices as the aging population is highly prone to eye diseases.

North America Ophthalmology Devices Market Revenue and Forecast to 2031 (US$ Million)

North America Ophthalmology Devices Market Segmentation

The North America ophthalmology devices market is segmented based on product, application, end user, and country.

Based on product, the North America ophthalmology devices market is segmented into vision care products, surgical devices, and diagnostics and monitoring devices. The vision care products segment held the largest share in 2023.

In terms of application, the North America ophthalmology devices market is segmented into cataract, glaucoma, refractory disorders, vitreoretinal disorders, and other applications. The glaucoma segment held the largest share in 2023.

By end user, the North America ophthalmology devices market is segmented into hospital and eye clinics, academic and research laboratories, and other end users. The hospital and eye clinics segment held the largest share in 2023.

Based on country, the North America ophthalmology devices market is categorized into US, Canada, and Mexico. The US dominated the North America ophthalmology devices market in 2023.

Key players operating in the North America ophthalmology devices market are Johnson & Johnson Vision Care Inc, Alcon AG, Carl Zeiss Meditec, Bausch & Lomb Inc, Essilor Intonational SAS, Nidek Co Ltd, Topcon Corp, Haag-Streit AG, Ziemer Ophthalmic Systems AG, and Hoya Corp are some of the leading companies operating in the North America ophthalmology devices market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Ophthalmology Devices Market - Key Market Dynamics

- 4.1 North America Ophthalmology Devices Market - Key Market Dynamics

- 4.2 Market Drivers

- 4.2.1 Upsurge in Incidence of Ophthalmic Disorders

- 4.2.2 Increasing Number of Product Launches, Collaborations, Acquisitions

- 4.3 Market Restraints

- 4.3.1 High Cost of Ophthalmic Surgeries

- 4.4 Market Opportunities

- 4.4.1 Technological Advancements in Ophthalmic Devices

- 4.5 Future Trends

- 4.5.1 Growing Focus on Telemedicine for Eye Care Services

- 4.6 Impact analysis

5. Ophthalmology Devices Market -North America Analysis

- 5.1 North America Ophthalmology Devices Market Revenue (US$ Million), 2021-2031

6. North America Ophthalmology Devices Market Analysis - by Product

- 6.1 North America Ophthalmology Devices Market Breakdown, by Product

- 6.1.1 North America Ophthalmology Devices Market Breakdown, by Vision Care Devices

- 6.1.2 North America Ophthalmology Devices Market Breakdown, by Diagnostic and Monitoring Devices

- 6.1.3 North America Ophthalmology Devices Market Breakdown, by Surgical Devices

- 6.2 Vision Care Devices

- 6.2.1 Overview

- 6.2.2 Vision Care Devices: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 6.3 Diagnostic and Monitoring Devices

- 6.3.1 Overview

- 6.3.2 Diagnostic and Monitoring Devices: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 6.4 Surgical Devices

- 6.4.1 Overview

- 6.4.2 Surgical Devices: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 6.4.3 North America Ophthalmology Devices Market Analysis - by Application

- 6.5 Glaucoma

- 6.5.1 Overview

- 6.5.2 Glaucoma: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 6.6 Cataract

- 6.6.1 Overview

- 6.6.2 Cataract: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 6.7 Vitreoretinal Disorders

- 6.7.1 Overview

- 6.7.2 Vitreoretinal Disorders: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 6.8 Refractory Disorders

- 6.8.1 Overview

- 6.8.2 Refractory Disorders: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 6.9 Others

- 6.9.1 Overview

- 6.9.2 Others: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

7. North America Ophthalmology Devices Market Analysis - by End User

- 7.1 Hospitals and Eye Clinics

- 7.1.1 Overview

- 7.1.2 Hospitals and Eye Clinics: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Academic and Research Laboratory

- 7.2.1 Overview

- 7.2.2 Academic and Research Laboratory: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Others

- 7.3.1 Overview

- 7.3.2 Others: North America Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Ophthalmology Devices Market -Country Analysis

- 8.1 North America

- 8.1.1 North America: Ophthalmology Devices Market - Revenue and Forecast Analysis - by Country

- 8.1.1.1 United States: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.1.1 United States: Ophthalmology Devices Market Breakdown, by Product

- 8.1.1.1.2 United States: Ophthalmology Devices Market Breakdown, by Vision Care Devices

- 8.1.1.1.3 United States: Ophthalmology Devices Market Breakdown, by Diagnostic and Monitoring Devices

- 8.1.1.1.4 United States: Ophthalmology Devices Market Breakdown, by Surgical Devices

- 8.1.1.1.5 United States: Ophthalmology Devices Market Breakdown, by Application

- 8.1.1.1.6 United States: Ophthalmology Devices Market Breakdown, by End User

- 8.1.1.2 Canada: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.2.1 Canada: Ophthalmology Devices Market Breakdown, by Product

- 8.1.1.2.2 Canada: Ophthalmology Devices Market Breakdown, by Vision Care Devices

- 8.1.1.2.3 Canada: Ophthalmology Devices Market Breakdown, by Diagnostic and Monitoring Devices

- 8.1.1.2.4 Canada: Ophthalmology Devices Market Breakdown, by Surgical Devices

- 8.1.1.2.5 Canada: Ophthalmology Devices Market Breakdown, by Application

- 8.1.1.2.6 Canada: Ophthalmology Devices Market Breakdown, by End User

- 8.1.1.3 Mexico: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.3.1 Mexico: Ophthalmology Devices Market Breakdown, by Product

- 8.1.1.3.2 Mexico: Ophthalmology Devices Market Breakdown, by Vision Care Devices

- 8.1.1.3.3 Mexico: Ophthalmology Devices Market Breakdown, by Diagnostic and Monitoring Devices

- 8.1.1.3.4 Mexico: Ophthalmology Devices Market Breakdown, by Surgical Devices

- 8.1.1.3.5 Mexico: Ophthalmology Devices Market Breakdown, by Application

- 8.1.1.3.6 Mexico: Ophthalmology Devices Market Breakdown, by End User

- 8.1.1.1 United States: Ophthalmology Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1 North America: Ophthalmology Devices Market - Revenue and Forecast Analysis - by Country

9. Industry Landscape

- 9.1 Overview

- 9.2 Growth Strategies in Ophthalmology Devices Market

- 9.3 Organic Growth Strategies

- 9.3.1 Overview

- 9.4 Inorganic Growth Strategies

- 9.4.1 Overview

10. Company Profiles

- 10.1 Johnson & Johnson Vision Care, Inc.

- 10.1.1 Key Facts

- 10.1.2 Business Description

- 10.1.3 Products and Services

- 10.1.4 Financial Overview

- 10.1.5 SWOT Analysis

- 10.1.6 Key Developments

- 10.2 Alcon AG

- 10.2.1 Key Facts

- 10.2.2 Business Description

- 10.2.3 Products and Services

- 10.2.4 Financial Overview

- 10.2.5 SWOT Analysis

- 10.2.6 Key Developments

- 10.3 Carl Zeiss Meditec

- 10.3.1 Key Facts

- 10.3.2 Business Description

- 10.3.3 Products and Services

- 10.3.4 Financial Overview

- 10.3.5 SWOT Analysis

- 10.3.6 Key Developments

- 10.4 Bausch & Lomb Inc

- 10.4.1 Key Facts

- 10.4.2 Business Description

- 10.4.3 Products and Services

- 10.4.4 Financial Overview

- 10.4.5 SWOT Analysis

- 10.4.6 Key Developments

- 10.5 Essilor International SAS

- 10.5.1 Key Facts

- 10.5.2 Business Description

- 10.5.3 Products and Services

- 10.5.4 Financial Overview

- 10.5.5 SWOT Analysis

- 10.5.6 Key Developments

- 10.6 Nidek Co., Ltd.

- 10.6.1 Key Facts

- 10.6.2 Business Description

- 10.6.3 Products and Services

- 10.6.4 Financial Overview

- 10.6.5 SWOT Analysis

- 10.6.6 Key Developments

- 10.7 Topcon Corp

- 10.7.1 Key Facts

- 10.7.2 Business Description

- 10.7.3 Products and Services

- 10.7.4 Financial Overview

- 10.7.5 SWOT Analysis

- 10.7.6 Key Developments

- 10.8 Haag-Streit AG

- 10.8.1 Key Facts

- 10.8.2 Business Description

- 10.8.3 Products and Services

- 10.8.4 Financial Overview

- 10.8.5 SWOT Analysis

- 10.8.6 Key Developments

- 10.9 Ziemer Ophthalmic Systems AG

- 10.9.1 Key Facts

- 10.9.2 Business Description

- 10.9.3 Products and Services

- 10.9.4 Financial Overview

- 10.9.5 SWOT Analysis

- 10.9.6 Key Developments

- 10.10 Hoya Corp

- 10.10.1 Key Facts

- 10.10.2 Business Description

- 10.10.3 Products and Services

- 10.10.4 Financial Overview

- 10.10.5 SWOT Analysis

- 10.10.6 Key Developments

11. Appendix

- 11.1 About The Insight Partners

- 11.2 Glossary of Terms for Ophthalmology Devices Market