|

|

市場調査レポート

商品コード

1597073

アジア太平洋の潤滑グリース市場の将来予測 (2030年まで) - 地域別分析:基油別、増ちょう剤の種類別、最終用途産業別Asia Pacific Lubricating Grease Market Forecast to 2030 - Regional Analysis - by Base Oil, Thickener Type, and End-Use Industry |

||||||

|

|||||||

| アジア太平洋の潤滑グリース市場の将来予測 (2030年まで) - 地域別分析:基油別、増ちょう剤の種類別、最終用途産業別 |

|

出版日: 2024年10月17日

発行: The Insight Partners

ページ情報: 英文 177 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の潤滑グリース市場は、2022年に18億2,581万米ドルと評価され、2030年には25億9,813万米ドルに達すると予測され、2022年から2030年までのCAGRは4.5%と推定されます。

新興国における急速な工業化がアジア太平洋の潤滑グリース市場を後押し

潤滑グリースは産業分野で使用される主要部品の一つであり、機器の効率的な稼働と最大限の信頼性を提供するのに役立っています。自動車、石油・ガス、繊維、ガラス、発電、紙・パルプ、化学、石油化学、農業、海洋、工業製造、飲食品、医薬品など様々な産業で使用されています。新興経済諸国が製造業、建設業、工業部門の急成長によって大きな変貌を遂げるにつれて、潤滑ソリューションへの依存が最も重要になっています。この急速な工業化に伴い、潤滑グリースは産業機器の最適な性能と長寿命を確保するために需要が高まっています。潤滑グリースは、製造機械のシームレスな操作に対応し、工業生産の勢いを維持します。これと並行して,工業化の要である建設業も潤滑グリースの需要に大きな影響を与えています。インドは世界的に最も重要な建設市場の一つです。インドにおける建設活動の成長は、継続的な工業化、急増する人口、中間所得層の増加、インフラ整備によって促進されています。インド・ブランド・エクイティ財団 (IBEF) によると、2023~2024年度予算では、インフラ整備のための設備投資支出は33%増の1,220億米ドル (1兆インドルピー) となり、これはGDPの3.3%に相当します。インド政府は、特に道路、空港、工業団地、高速道路、高等教育、技能開発の分野で、民間投資を誘致するための様々な形式を導入しています。

建設産業はインドネシアにとって最も有望な産業です。2024年予算の一環として、インドネシアは新首都開発のために27億米国ドル (40兆6,000億ルピア) を投資しました。重機や土木車両を含む建設に使用される機械は、厳しい条件下で稼働します。潤滑グリースは,新興経済諸国におけるインフラ・プロジェクトの急速な拡大に合わせ,これらの機械の適切な機能と耐久性を確保する上で極めて重要な役割を果たしています。産業部門への投資の増加は、潤滑グリースの需要を大幅に増加させています。生産活動の急増に伴い、製造工程で使用される機械は、摩擦を緩和し、摩耗や損傷を減らし、動作寿命を延ばすために効率的な潤滑を必要としています。潤滑グリースは、これらの特定のニーズに対応し、製造機械のシームレスな動作に貢献し、工業生産の勢いを維持します。

トレーディング・エコノミクスが2021年10月に発表したデータによると、中国の工業生産は3.5%増加しました。さらに2021年10月、アジア開発銀行 (ADB) はインドの国家産業回廊開発プログラム (NICDP) を支援するため、2億5,000万米ドル相当の融資を承認しました。このプロジェクトでは、インドの17州にまたがる11の産業回廊が開発されます。このように、パンデミック後のシナリオにおける大きな投資見通しとビジネスモデルの再構築が、潤滑グリースの需要を増大させている主な要因です。

電力セクターのサブセグメントである再生可能エネルギー産業も、潤滑グリースの顕著な消費者として台頭してきています。この業界では主にタービンと変圧器にグリースが使用されています。近年、再生可能エネルギーへの需要の高まりにより、世界中で風力タービンの設置が急増しています。世界中の発展途上諸国は、風力タービンの設置を通じて再生可能エネルギーの容量を増やす取り組みを行っています。鉱業、農業、化学、石油化学部門の成長は、潤滑グリースの需要を増大させています。鉱業では、過酷な運転条件に耐えるために頑丈な潤滑が必要であり、農業機械はスムーズで信頼性の高い性能を発揮するために効率的なグリースに依存しています。経済が産業と製造能力を拡大するにつれて,潤滑グリースは成長を維持し,運転効率を高め,機械や装置の寿命を確保するために不可欠なものとなっています。このように、新興経済諸国における急速な工業化は、様々な分野における潤滑グリースの需要を促進しています。

アジア太平洋の潤滑グリース市場概要

アジア太平洋の市場は、自動車産業、風力エネルギー産業、海洋産業、航空宇宙産業、建設産業の加速により成長しています。アジア太平洋は自動車製造の中心地であり、国内外から多くの企業が進出しています。中国乗用車協会が発表した報告書によると、2022年にTesla Inc.は8万3,135台の中国製電気自動車を納入しており、2021年と比較して電気自動車の販売が伸びていることを示しています。国際自動車製造機構 (OICA) によると、アジア・オセアニアの自動車生産台数は2021年の4,680万台から2022年には5,000万台に増加しました。潤滑グリースは、耐食性と酸化抑制を付与し、エンジン性能を向上させ、部品寿命を延ばすために、自動車ギアの製造に使用されます。

造船分野では中国、日本、韓国が主要国です。中華人民共和国国務院によると、2022年の中国の造船生産量は961万重量トン (dwt) で、前年比2.8ポイント増加し、世界全体の46.2%を占めました。造船用グリースは、元素や腐食性海水への耐性、高圧への耐性、船舶部品の寿命延長などの特性を与えます。さらに、米国地質調査所が2022年に発表した報告書によると、中国は2021年、他の数カ国に対する25品目の非燃料鉱物の最大の供給国でした。リストアップされた25種類の鉱物のうち、中国は16種類の重要鉱物を生産していました。このように、風力発電、航空宇宙、自動車、造船などの最終用途産業の成長は、アジア太平洋の潤滑グリース市場に有利な機会をもたらします。

アジア太平洋の潤滑グリース市場の収益と2030年までの予測 (単位:100万米ドル)

アジア太平洋の潤滑グリース市場セグメンテーション

アジア太平洋の潤滑グリース市場は、基油、増ちょう剤の種類、最終用途産業、国に分類されます。

基油別では、アジア太平洋の潤滑グリース市場は鉱物油、合成油、バイオベースに区分されます。鉱物油セグメントは2022年に最大の市場シェアを占めました。合成油セグメントはさらにポリアルキレングリコール、ポリアルファオレフィン、エステルに細分化されます。

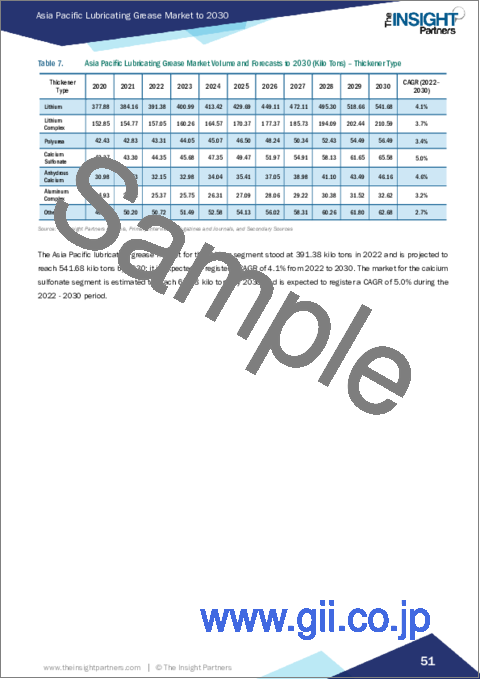

増ちょう剤の種類別では、アジア太平洋の潤滑グリース市場はリチウム、リチウムコンプレックス、ポリウレア、カルシウムスルホネート、無水カルシウム、アルミニウムコンプレックス、その他に分類されます。2022年にはリチウムセグメントが最大の市場シェアを占めました。

最終用途産業別では、アジア太平洋の潤滑グリース市場は、従来型自動車、電気自動車、建築・建設、鉱業、船舶、食品、エネルギー・電力、その他に区分されます。2022年には、従来型自動車セグメントが最大の市場シェアを占めています。

国別では、アジア太平洋の潤滑グリース市場はオーストラリア、中国、インド、日本、韓国、その他アジア太平洋に区分されます。2022年のアジア太平洋潤滑グリース市場シェアは中国が独占しました。

BP Plc、Chevron Corp、Exxon Mobil Corp、Fuchs SE、Kluber Lubrication GmbH &Co KG、Petroliam Nasional Bhd、Shell Plc、TotalEnergies SE、Valvoline Incなどが、アジア太平洋の潤滑グリース市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 アジア太平洋の潤滑グリースの市場情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 代替品の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 競争企業間の敵対関係

- エコシステム分析

- 原材料サプライヤー

- 製造業者

- 流通業者または供給業者

- 最終用途産業

- バリューチェーンのベンダー一覧

第5章 アジア太平洋の潤滑グリース市場:主要な市場力学

- 市場促進要因

- 自動車産業からの潤滑グリース需要の急増

- 急速な工業化

- 市場抑制要因

- 厳しい政府政策

- 市場機会

- バイオベースグリースの採用増加

- 今後の動向

- グリース開発の進歩

- 促進要因と抑制要因の影響

第6章 アジア太平洋の潤滑グリース市場の分析

- アジア太平洋の潤滑グリースの市場収益 (2020~2030年)

- アジア太平洋の潤滑グリースの市場規模 (単位:キロトン、2020~2030年)

- アジア太平洋の潤滑グリース市場の予測分析

第7章 アジア太平洋の潤滑グリース市場の分析:ベースオイル別

- 鉱物油

- 鉱物油の市場収益と将来予測 (2030年まで)

- 鉱物油の市場規模と将来予測 (単位:キロトン、2030年まで)

- 合成油

- 合成油の市場収益と将来予測 (2030年まで)

- 合成油の市場規模と将来予測 (単位:キロトン、2030年まで)

- ポリアルキレングリコール (PAG)

- ポリアルファオレフィン (PAO)

- エステル

- バイオベース

- バイオベースの市場収益と将来予測 (2030年まで)

- バイオベースの市場規模と将来予測 (単位:キロトン、2030年まで)

第8章 アジア太平洋の潤滑グリース市場の分析:増ちょう剤の種類別

- リチウム

- リチウムの市場収益と将来予測 (2030年まで)

- リチウムの市場規模と将来予測 (単位:キロトン、2030年まで)

- リチウムコンプレックス

- リチウムコンプレックスの概要

- リチウムコンプレックスの市場収益と将来予測 (2030年まで)

- リチウムコンプレックスの市場規模と将来予測 (単位:キロトン、2030年まで)

- ポリウレア

- ポリウレアの概要

- ポリウレアの市場収益と将来予測 (2030年まで)

- ポリウレアの市場規模と将来予測 (単位:キロトン、2030年まで)

- スルホン酸カルシウム

- スルホン酸カルシウムの市場収益と将来予測 (2030年まで)

- スルホン酸カルシウムの市場規模と将来予測 (単位:キロトン、2030年まで)

- 無水カルシウム

- 無水カルシウムの概要

- 無水カルシウムの市場収益と将来予測 (2030年まで)

- 無水カルシウムの市場規模と将来予測 (単位:キロトン、2030年まで)

- アルミニウムコンプレックス

- アルミニウムコンプレックスの概要

- アルミニウムコンプレックスの市場収益と将来予測 (2030年まで)

- アルミニウムコンプレックスの市場規模と将来予測 (単位:キロトン、2030年まで)

- その他

- その他の概要

- その他の市場収益と将来予測 (2030年まで)

- その他の市場規模と将来予測 (単位:キロトン、2030年まで)

第9章 アジア太平洋の潤滑グリース市場の分析:最終用途産業別

- 従来型自動車

- 従来型自動車の市場収益と将来予測 (2030年まで)

- 従来型自動車の市場規模と将来予測 (単位:キロトン、2030年まで)

- 電気自動車

- 電気自動車の市場収益と将来予測 (2030年まで)

- 電気自動車の市場規模と将来予測 (単位:キロトン、2030年まで)

- 建築・建設

- 建築・建設の市場収益と将来予測 (2030年まで)

- 建築・建設の市場規模と将来予測 (単位:キロトン、2030年まで)

- 鉱業

- 鉱業の概要

- 鉱業の市場収益と将来予測 (2030年まで)

- 鉱業の市場規模と将来予測 (単位:キロトン、2030年まで)

- 船舶

- 船舶の市場収益と将来予測 (2030年まで)

- 船舶の市場規模と将来予測 (単位:キロトン、2030年まで)

- 食品

- 食品の市場収益と将来予測 (2030年まで)

- 食品の市場規模と将来予測 (単位:キロトン、2030年まで)

- エネルギー・電力

- エネルギー・電力の市場収益と将来予測 (2030年まで)

- エネルギー・電力の市場規模と将来予測 (単位:キロトン、2030年まで)

- その他

- その他の概要

- その他の市場収益と将来予測 (2030年まで)

- その他の市場規模と将来予測 (単位:キロトン、2030年まで)

第10章 アジア太平洋の潤滑グリース市場:国別分析

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他のアジア

第11章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 事業拡大

- 新製品開発

- 企業合併・買収 (M&A)

- 事業提携

- その他の事業戦略

第13章 企業プロファイル

- Exxon Mobil Corp

- Fuchs SE

- Petroliam Nasional Bhd

- Shell Plc

- Kluber Lubrication GmbH & Co KG

- TotalEnergies SE

- BP Plc

- Chevron Corp

- Valvoline Inc

第14章 付録

List Of Tables

- Table 1. Asia Pacific Lubricating Grease Market Segmentation

- Table 2. Asia Pacific Lubricating Grease Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Asia Pacific Lubricating Grease Market - Volume and Forecast to 2030 (Kilo Tons)

- Table 4. Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - Base Oil

- Table 5. Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - Base Oil

- Table 6. Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - Thickener Type

- Table 7. Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - Thickener Type

- Table 8. Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - End Use Industry

- Table 9. Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - End Use Industry

- Table 10. Australia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Base Oil

- Table 11. Australia: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Base Oil

- Table 12. Australia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Thickener Type

- Table 13. Australia: Asia Pacific Lubricating Grease Market Volume and Forecasts To 2030 (US$ Million) - by Thickener Type

- Table 14. Australia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by End Use Industry

- Table 15. Australia: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by End Use Industry

- Table 16. China: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Base Oil

- Table 17. China: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Base Oil

- Table 18. China: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Thickener Type

- Table 19. China: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Thickener Type

- Table 20. China: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by End Use Industry

- Table 21. China: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by End Use Industry

- Table 22. India: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Base Oil

- Table 23. India: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Base Oil

- Table 24. India: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Thickener Type

- Table 25. India: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Thickener Type

- Table 26. India: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by End Use Industry

- Table 27. India: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by End Use Industry

- Table 28. Japan: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Base Oil

- Table 29. Japan: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Base Oil

- Table 30. Japan: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Thickener Type

- Table 31. Japan: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Thickener Type

- Table 32. Japan: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by End Use Industry

- Table 33. Japan: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by End Use Industry

- Table 34. South Korea: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Base Oil

- Table 35. South Korea: Asia Pacific Lubricating Grease Market Revenue and Forecasts To 2030 (Kilo Ton) - by Base Oil

- Table 36. South Korea: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Thickener Type

- Table 37. South Korea: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Thickener Type

- Table 38. South Korea: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by End Use Industry

- Table 39. South Korea: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by End Use Industry

- Table 40. Rest of Asia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Base Oil

- Table 41. Rest of Asia: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Base Oil

- Table 42. Rest of Asia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by Thickener Type

- Table 43. Rest of Asia: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by Thickener Type

- Table 44. Rest of Asia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million) - by End Use Industry

- Table 45. Rest of Asia: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons) - by End Use Industry

- Table 46. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. Asia Pacific Lubricating Grease Market Segmentation, by Country

- Figure 2. Lubricating Grease Market - Porter's Analysis

- Figure 3. Ecosystem: Lubricating Grease Market

- Figure 4. Asia Pacific Lubricating Grease Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Asia Pacific Lubricating Grease Market Revenue (US$ Million), 2020-2030

- Figure 7. Asia Pacific Lubricating Grease Market Volume (Kilo Tons), 2020-2030

- Figure 8. Asia Pacific Lubricating Grease Market Share (%) - Base Oil, 2022 and 2030

- Figure 9. Mineral Oil Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 10. Mineral Oil Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 11. Synthetic Oil Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 12. Synthetic Oil Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 13. Polyalkylene Glycol (PAG) Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 14. Polyalkylene Glycol (PAG) Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 15. Polyalphaolefin (PAO) Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 16. Polyalphaolefin (PAO) Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 17. Esters Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 18. Esters Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 19. Bio-based Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 20. Bio-based Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 21. Asia Pacific Lubricating Grease Market Share (%) - Thickener Type, 2022 and 2030

- Figure 22. Lithium Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 23. Lithium Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 24. Lithium Complex Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 25. Lithium Complex Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 26. Polyurea Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 27. Polyurea Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 28. Calcium Sulfonate Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 29. Calcium Sulfonate Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 30. Anhydrous Calcium Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 31. Anhydrous Calcium Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 32. Aluminum Complex Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 33. Aluminum Complex Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 34. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 35. Others Market Volume and Forecasts to 2030 (Kilo Tons))

- Figure 36. Asia Pacific Lubricating Grease Market Share (%) - End Use Industry, 2022 and 2030

- Figure 37. Conventional Vehicles Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 38. Conventional Vehicles Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 39. Electric Vehicles Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 40. Electric Vehicles Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 41. Building and Construction Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 42. Building and Construction Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 43. Mining Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 44. Mining Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 45. Marine Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 46. Marine Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 47. Food Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 48. Food Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 49. Energy and Power Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 50. Energy and Power Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 51. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 52. Others Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 53. Asia Pacific Lubricating Grease Market Breakdown by Key Countries - Revenue (2022) (US$ Million)

- Figure 54. Asia Pacific Lubricating Grease Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 55. Australia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 56. Australia: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 57. China: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 58. China: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 59. India: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 60. India: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 61. Japan: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 62. Japan: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 63. South Korea: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 64. South Korea: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 65. Rest of Asia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 66. Rest of Asia: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 67. Company Positioning & Concentration

The Asia Pacific lubricating grease market was valued at US$ 1,825.81 million in 2022 and is expected to reach US$ 2,598.13 million by 2030; it is estimated to register a CAGR of 4.5% from 2022 to 2030.

Rapid Industrialization in Developing Economies Boosts Asia Pacific Lubricating Grease Market

Lubricating grease is one of the key components used in the industrial sector, which helps the equipment to run efficiently and offer maximum reliability. It is used in various industries, such as automotive, oil & gas, textile, glass, power generation, paper & pulp, chemicals, petrochemicals, agriculture, marine, industrial manufacturing, food & beverages, and pharmaceuticals. As developing economies undergo significant transformation, with burgeoning manufacturing, construction, and industrial sectors, the reliance on lubrication solutions becomes paramount. In the wake of this rapid industrialization, lubricating grease is experiencing heightened demand to ensure the optimal performance and longevity of industrial equipment. Lubricating grease caters to the seamless operation of manufacturing machinery and sustains industrial production momentum. In parallel, the construction industry, a cornerstone of industrialization, significantly influences the demand for lubricating grease. India is one of the most significant construction markets globally. The growth in construction activities in India is fueled by continuous industrialization, burgeoning population, increasing middle-class income, and infrastructure development. According to the India Brand Equity Foundation (IBEF), in Budget 2023-2024, capital investment outlay for infrastructure is being increased by 33% to US$ 122 billion (INR 10 lakh crore), which would be 3.3% of the GDP. The Indian government has introduced various formats to attract private investments, particularly in roads, airports, industrial parks, highways, and higher education and skill development areas.

The construction industry is the best prospective industry for Indonesia. As part of its 2024 budget, Indonesia has invested US$ 2.7 billion (IDR 40.6 trillion) to develop its new capital city. The machinery used in construction, including heavy equipment and earth-moving vehicles, operates under challenging conditions. Lubricating grease plays a pivotal role in ensuring the proper functioning and durability of these machines, aligning with the rapid expansion of infrastructure projects in developing economies. Increasing investment in the industrial sector is significantly increasing the demand for lubricating greases. With a surge in production activities, the machinery utilized in manufacturing processes requires efficient lubrication to mitigate friction, reduce wear and tear, and extend operational lifespan. Lubricating grease caters to these specific needs, contributing to the seamless operation of manufacturing machinery and sustaining industrial production momentum.

As per the data published by Trading Economics in October 2021, industrial production in China increased by 3.5%. In addition, in October 2021, the Asian Development Bank (ADB) approved a loan worth US$ 250 million to support India's National Industrial Corridor Development Program (NICDP). Under this project, 11 industrial corridors spanning across 17 states in India will be developed. Thus, significant investment prospects and restructured business models in post-pandemic scenarios are the main factors that have augmented the demand for lubricating grease.

The renewable energy industry, a subsegment of the power sector, is also emerging as a prominent consumer of lubricating grease. Grease is primarily used in turbines and transformers in this industry. In recent years, the increasing demand for renewable energy has led to an upsurge in wind turbine installations worldwide. Developing countries across the world are taking initiatives to increase their renewable energy capacities through wind turbine installations. The growth of mining, agriculture, chemicals, and petrochemical sectors amplifies the demand for lubricating grease. In mining, heavy-duty equipment requires robust lubrication to withstand harsh operating conditions, while agricultural machinery relies on efficient greases for smooth and reliable performance. As economies expand their industrial and manufacturing capacities, lubricating grease becomes integral to sustaining growth, enhancing operational efficiency, and ensuring the longevity of machinery and equipment. Thus, the rapid industrialization in developing economies is driving the demand for lubricating grease across diverse sectors.

Asia Pacific Lubricating Grease Market Overview

The market in Asia Pacific is growing owing to the accelerating automotive, wind energy, marine, aerospace, and construction industries. Asia Pacific is a hub for automotive manufacturing with a large presence of international and domestic players operating in the region. According to a report published by the China Passenger Car Association, in 2022, Tesla Inc delivered 83,135 made-in-China electric vehicles, indicating growth in sales of electric vehicles compared to 2021. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), Asia-Oceania's vehicle production increased from 46.8 million in 2021 to 50 million in 2022. Lubricating grease is used in manufacturing automotive gears to confer corrosion resistance and oxidation inhibition, enhance engine performance, and extend the component life span.

China, Japan, and South Korea are leading countries in the shipbuilding sector. According to the States Council of the People's Republic of China, the shipbuilding output of China was 9.61 million deadweight tons (dwt) in 2022, i.e., up by 2.8 percentage points year-on-year, accounting for 46.2% of the global total. Shipbuilding grease confers properties such as resistance to elements and corrosive saltwater, resistance to high pressure, and increased lifespans for ship components. Furthermore, according to the report published by the US Geological Survey in 2022, China was the largest supplier of twenty-five non-fuel mineral commodities to several other countries in 2021. Out of twenty-five listed minerals, China produced sixteen critical minerals. Thus, the growth of end-use industries such as wind power, aerospace, automotive, and shipbuilding presents favorable opportunities for the Asia Pacific lubricating grease market.

Asia Pacific Lubricating Grease Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Lubricating Grease Market Segmentation

The Asia Pacific lubricating grease market is categorized into base oil, thickener type, end-use industry, and country.

Based on base oil, the Asia Pacific lubricating grease market is segmented mineral oil, synthetic oil, and bio-based. The mineral oil segment held the largest market share in 2022. The synthetic oil segment is further sub segmented into polyalkylene glycol, polyalphaolefin, and esters.

In terms of thickener type, the Asia Pacific lubricating grease market is categorized into lithium, lithium complex, polyurea, calcium sulfonate, anhydrous calcium, aluminum complex, and others. The lithium segment held the largest market share in 2022.

By end-use industry, the Asia Pacific lubricating grease market is segmented into conventional vehicles, electric vehicles, building & construction, mining, marine, food, energy & power, and others. The conventional vehicles segment held the largest market share in 2022.

By country, the Asia Pacific lubricating grease market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific lubricating grease market share in 2022.

BP Plc, Chevron Corp, Exxon Mobil Corp, Fuchs SE, Kluber Lubrication GmbH & Co KG, Petroliam Nasional Bhd, Shell Plc, TotalEnergies SE, and Valvoline Inc are some of the leading companies operating in the Asia Pacific lubricating grease market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

- 1.3 Limitations and Assumptions

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Lubricating Grease Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Threat of Substitutes

- 4.2.3 Bargaining Power of Buyers

- 4.2.4 Bargaining Power of Suppliers

- 4.2.5 Competitive Rivalry

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors or Suppliers

- 4.3.4 End-use Industry

5. Asia Pacific Lubricating Grease Market - Key Market Dynamics

- 5.1 Drivers

- 5.1.1 Soaring Demand for Lubricating Grease from the Automotive Industry

- 5.1.2 Rapid Industrialization in Developing Economies

- 5.2 Market Restraints

- 5.2.1 Stringent Government Policies

- 5.3 Market Opportunities

- 5.3.1 Rising Adoption of Bio-based Greases

- 5.4 Future Trends

- 5.4.1 Advancements in Grease Development

- 5.5 Impact of Drivers and Restraints:

6. Lubricating Grease Market - Asia Pacific Analysis

- 6.1 Asia Pacific Lubricating Grease Market Revenue (US$ Million) 2020-2030

- 6.2 Asia Pacific Lubricating Grease Market Volume (Kilo Tons), 2020-2030

- 6.3 Asia Pacific Lubricating Grease Market Forecast Analysis

7. Asia Pacific Lubricating Grease Market Analysis - Base Oil

- 7.1 Mineral Oil

- 7.1.1 Overview

- 7.1.2 Mineral Oil Market Revenue and Forecast to 2030 (US$ Million)

- 7.1.3 Mineral Oil Market Volume and Forecast to 2030 (Kilo Tons)

- 7.2 Synthetic Oil

- 7.2.1 Overview

- 7.2.2 Synthetic Oil Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.3 Synthetic Oil Market Volume and Forecast to 2030 (Kilo Tons)

- 7.2.4 Polyalkylene Glycol (PAG)

- 7.2.5 Polyalphaolefin (PAO)

- 7.2.6 Esters

- 7.3 Bio-based

- 7.3.1 Overview

- 7.3.2 Bio-based Market Revenue and Forecast to 2030 (US$ Million)

- 7.3.3 Bio-based Market Volume and Forecast to 2030 (Kilo Tons)

8. Asia Pacific Lubricating Grease Market Analysis - Thickener Type

- 8.1 Lithium

- 8.1.1 Overview

- 8.1.2 Lithium Market Revenue and Forecast to 2030 (US$ Million)

- 8.1.3 Lithium Market Volume and Forecast to 2030 (Kilo Tons)

- 8.2 Lithium Complex

- 8.2.1 Overview

- 8.2.2 Lithium Complex Market Revenue and Forecast to 2030 (US$ Million)

- 8.2.3 Lithium Complex Market Volume and Forecast to 2030 (Kilo Tons)

- 8.3 Polyurea

- 8.3.1 Overview

- 8.3.2 Polyurea Market Volume and Forecast to 2030 (US$ Million)

- 8.3.3 Polyurea Market Volume and Forecast to 2030 (Kilo Tons)

- 8.4 Calcium Sulfonate

- 8.4.1 Overview

- 8.4.2 Calcium Sulfonate Market Revenue and Forecast to 2030 (US$ Million)

- 8.4.3 Calcium Sulfonate Market Volume and Forecast to 2030 (Kilo Tons)

- 8.5 Anhydrous Calcium

- 8.5.1 Overview

- 8.5.2 Anhydrous Calcium Market Revenue and Forecast to 2030 (US$ Million)

- 8.5.3 Anhydrous Calcium Market Volume and Forecast to 2030 (Kilo Tons)

- 8.6 Aluminum Complex

- 8.6.1 Overview

- 8.6.2 Aluminum Complex Market Revenue and Forecast to 2030 (US$ Million)

- 8.6.3 Aluminum Complex Market Volume and Forecast to 2030 (Kilo Tons)

- 8.7 Others

- 8.7.1 Overview

- 8.7.2 Others Market Revenue and Forecast to 2030 (US$ Million)

- 8.7.3 Others Market Volume and Forecast to 2030 (Kilo Tons)

9. Asia Pacific Lubricating Grease Market Analysis - End Use Industry

- 9.1 Conventional Vehicles

- 9.1.1 Overview

- 9.1.2 Conventional Vehicles Market Revenue and Forecast to 2030 (US$ Million)

- 9.1.3 Conventional Vehicles Market Volume and Forecast to 2030 (Kilo Tons)

- 9.2 Electric Vehicles

- 9.2.1 Overview

- 9.2.2 Electric Vehicles Market Revenue and Forecast to 2030 (US$ Million)

- 9.2.3 Electric Vehicles Market Volume and Forecast to 2030 (Kilo Tons)

- 9.3 Building and Construction

- 9.3.1 Overview

- 9.3.2 Building and Construction Market Revenue and Forecast to 2030 (US$ Million)

- 9.3.3 Building and Construction Market Volume and Forecast to 2030 (Kilo Tons)

- 9.4 Mining

- 9.4.1 Overview

- 9.4.2 Mining Market Revenue and Forecast to 2030 (US$ Million)

- 9.4.3 Mining Market Volume and Forecast to 2030 (Kilo Tons)

- 9.5 Marine

- 9.5.1 Overview

- 9.5.2 Marine Market Revenue and Forecast to 2030 (US$ Million)

- 9.5.3 Marine Market Volume and Forecast to 2030 (Kilo Tons)

- 9.6 Food

- 9.6.1 Overview

- 9.6.2 Food Market Revenue and Forecast to 2030 (US$ Million)

- 9.6.3 Food Market Volume and Forecast to 2030 (Kilo Tons)

- 9.7 Energy and Power

- 9.7.1 Overview

- 9.7.2 Energy and Power Market Revenue and Forecast to 2030 (US$ Million)

- 9.7.3 Energy and Power Market Volume and Forecast to 2030 (Kilo Tons)

- 9.8 Others

- 9.8.1 Overview

- 9.8.2 Others Market Revenue and Forecast to 2030 (US$ Million)

- 9.8.3 Others Market Volume and Forecast to 2030 (Kilo Tons)

10. Asia Pacific Lubricating Grease Market - Country Analysis

- 10.1 Asia Pacific

- 10.1.1 Asia Pacific Lubricating Grease Market Breakdown by Country

- 10.1.1.1 Australia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.2 Australia: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.1.2.1 Australia: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.2.2 Australia: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.2.3 Australia: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.2.4 Australia: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.2.5 Australia: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.2.6 Australia: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.3 China: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.4 China: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.1.4.1 China: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.4.2 China: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.4.3 China: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.4.4 China: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.4.5 China: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.4.6 China: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.5 India: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.6 India: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.1.6.1 India: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.6.2 India: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.6.3 India: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.6.4 India: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.6.5 India: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.6.6 India: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.7 Japan: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.8 Japan: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.1.8.1 Japan: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.8.2 Japan: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.8.3 Japan: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.8.4 Japan: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.8.5 Japan: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.8.6 Japan: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.9 South Korea: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.10 South Korea: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.1.10.1 South Korea: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.10.2 South Korea: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.10.3 South Korea: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.10.4 South Korea: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.10.5 South Korea: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.10.6 South Korea: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.11 Rest of Asia: Asia Pacific Lubricating Grease Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.12 Rest of Asia: Asia Pacific Lubricating Grease Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.1.12.1 Rest of Asia: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.12.2 Rest of Asia: Asia Pacific Lubricating Grease Market Breakdown by Base Oil

- 10.1.1.12.3 Rest of Asia: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.12.4 Rest of Asia: Asia Pacific Lubricating Grease Market Breakdown by Thickener Type

- 10.1.1.12.5 Rest of Asia: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1.12.6 Rest of Asia: Asia Pacific Lubricating Grease Market Breakdown by End Use Industry

- 10.1.1 Asia Pacific Lubricating Grease Market Breakdown by Country

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Expansion

- 12.3 New Product Development

- 12.4 Merger and Acquisition

- 12.5 Partnerships

- 12.6 Other Business Strategies

13. Company Profiles

- 13.1 Exxon Mobil Corp

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Fuchs SE

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Petroliam Nasional Bhd

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Shell Plc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Kluber Lubrication GmbH & Co KG

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 TotalEnergies SE

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 BP Plc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Chevron Corp

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Valvoline Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners