|

|

市場調査レポート

商品コード

1597058

北米のベジタリアンカプセル市場の将来予測 (2031年まで) - 地域別分析:製品別、用途別、機能別、エンドユーザー別North America Vegetarian Capsules Market Forecast to 2031 - Regional Analysis - by Product, Application, Functionality, and End User |

||||||

|

|||||||

| 北米のベジタリアンカプセル市場の将来予測 (2031年まで) - 地域別分析:製品別、用途別、機能別、エンドユーザー別 |

|

出版日: 2024年10月17日

発行: The Insight Partners

ページ情報: 英文 90 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のベジタリアンカプセル市場は2023年に5億363万米ドルと評価され、2031年には9億7,633万米ドルに達すると予測され、2023年から2031年までのCAGRは8.6%と推定されます。

ゼラチンベースのカプセルに対するビーガンカプセルの人気の増大が、北米のベジタリアンカプセル市場を後押し

ベジタリアンカプセルは水分が少なく、吸湿性化合物の安定性が高いため、製薬会社の大半は動物由来カプセルよりもベジタリアンカプセルを調達しています。長年にわたり、医薬品のカプセルコーティングや製剤に動物性物質を添加することについて、医学的、宗教的、文化的、倫理的な懸念があった。また、一部の消費者は、関連する医療リスクのために、動物由来の医薬品の使用に懸念を表明していました。2023年7月、疾病管理予防センター (CDC) は、アルファ・ガール症候群 (AGS) 患者に対し、これらの医薬品の75%に動物由来成分が含まれているとして、動物由来の医薬品やサプリメントの摂取を制限するよう報告書を発表しました。また、AGS患者が哺乳類由来成分を含む医薬品やサプリメントを摂取した後、重篤なアレルギー反応を起こしたことが明らかになりました。このような事例から、動物由来の成分を含まない医薬品やサプリメントを製造することに、製造者の関心が高まっています。

ゼラチンカプセルとベジタリアンカプセルの比較分析

要因

ゼラチンカプセル

ベジタリアンカプセル

由来

牛、皮、牛、豚

植物

対象者

菜食主義者および非菜食主義者

ビーガンまたはベジタリアン

アレルギー

牛・豚由来成分によるアレルギー

アレルギーなし

交差結合成分

他の医薬品-医薬品誘導体との相互リンク

架橋なし

外部成分

防腐剤

防腐剤なし

現在、市場に出回っている医薬品カプセルの多くはゼラチンで構成されています。しかし、ゼラチンの架橋による薬物不適合や、動物由来のゼラチンの使用に関する厳しい規制により、製薬メーカーはゼラチン成分を植物由来の成分に置き換えるよう促しています。製薬メーカーは、ヒドロキシプロピルメチルセルロース (HPMC) 由来のベジタリアンカプセルが、植物由来であることからゼラチンの代替品として適していることを確認しました。Vegicapsソフトカプセルは、動物を含まないカプセルの最良の例です。殻は海藻エキスとグルテンフリーのデンプンで構成され、改質糖や人工着色料は含まれていません。Vegicapsソフトカプセルの利点は、動物由来成分を含まず、飲み込みやすく、柔らかく、自然で、より健康的な製品であることです。ゼラチンをベースとするカプセルの場合、腸溶性ポリマー水分散液を噴霧するとシェルが軟化してべたついたり、乾燥時に水分が蒸発して脆くなり、最終的に機械的安定性を失うことがあります。しかし、HPMC由来のベジタリアンカプセルでは、水性コーティングの影響を受けにくく、カプセルの殻が硬いため、成分の漏れを防ぐことができます。

したがって、ベジタリアン医薬品への嗜好の高まりは、ベジタリアンカプセルの生産を加速させるメーカーにとって有利であることを証明し、北米のベジタリアンカプセル市場の成長を促進します。

北米ベジタリアンカプセル市場概要

2024年に米国オステオパシー協会 (AOA) の報告書で発表されたデータによると、米国では成人の5人に4人以上 (86%) がビタミンや栄養補助食品を摂取しています。同レポートによると、米国の成人がビタミン剤や栄養補助食品を摂取するのは、個人的なニーズや医師・友人・家族からの勧めによるものであることが明らかになっています。また、ビタミン欠乏症の有病率が上昇していることから、米国ではカプセルなどの栄養補助食品の消費量が多いです。2023 CRN Consumer Survey on Dietary Supplements (栄養補助食品に関する2023年CRN消費者調査) によると、米国では成人のほぼ74%が栄養補助食品を消費しており、そのうち55%が定期的に消費しています。米国人口の一部は菜食主義に移行しています。健康志向のビーガン消費者は、栄養補助食品やその他の栄養補助食品を購入する際に「ビーガン商標」を探しています。

米国では、栄養補助食品業界は、消費者の需要の高まりと、動物性食品を含まない栄養補助食品への消費者の多様な摂取シフトに対応するため、革新的なビーガン製品を提供しています。2023年4月、IFFは「VERDIGEL SC」の発売を発表しました。VERDIGEL SC」のイントロダクションより、ビーガンソフトジェルのメーカーは、いくつかの市場で需要の高いカラギーナンフリーの製品を提供できるようになります。ソフトジェルは栄養やサプリメントの分野で高い人気を集めており、IFFが開発したこの新製品は、メーカーに、既存の製造工程を中断したり性能や品質を損なったりすることなく、植物由来のカラギーナンフリー代替品に切り替えるための適切な選択肢を提供します。

北米のベジタリアンカプセル市場の収益と2031年までの予測 (単位:100万米ドル)

北米のベジタリアンカプセル市場の内訳

北米のベジタリアンカプセル市場は、製品別、用途別、機能別、エンドユーザー別、国別に分類されます。

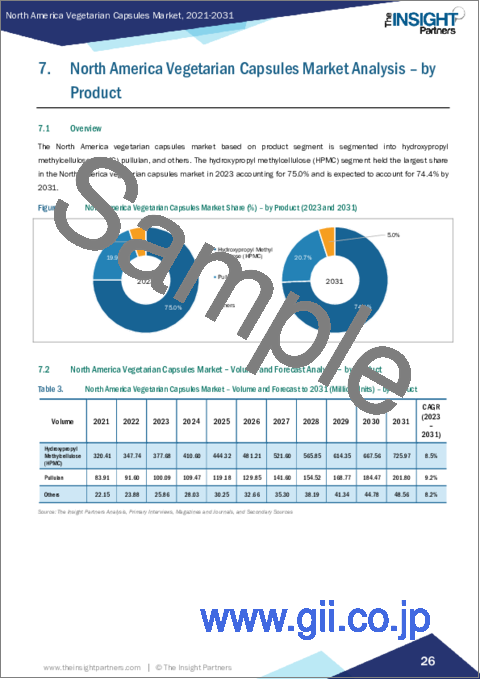

製品別では、北米のベジタリアンカプセル市場は、ヒドロキシプロピルメチルセルロース (HPMC)、プルラン、その他に区分されます。2023年にはHPMCセグメントが最大の市場シェアを占めています。

用途別では、北米のベジタリアンカプセル市場は、抗生物質・抗菌薬、ビタミン・栄養補助食品、抗炎症薬、心血管治療薬、制酸剤・整腸剤、その他に分類されます。抗生物質・抗菌薬セグメントは2023年に最大の市場シェアを占めました。

機能別では、北米のベジタリアンカプセル市場は、即時放出型カプセル、持続放出型カプセル、遅延放出型カプセルに区分されます。2023年には、即時放出型カプセルのセグメントがより大きな市場シェアを占めました。

エンドユーザー別では、北米のベジタリアンカプセル市場は製薬企業、栄養補助食品企業、CMO、化粧品企業に区分されます。2023年には製薬企業セグメントが最大の市場シェアを占めました。

国別では、北米のベジタリアンカプセル市場は米国、カナダ、メキシコに区分されます。2023年の北米ベジタリアンカプセル市場シェアは米国が独占しました。

ACG、CapsCanada、Capsugel, Inc (A subsidiary of Lonza Group AG) 、HealthCaps India、Lefancaps、NATURAL CAPSULES LIMITED、QUALICAPS、Shanxi Guangsheng Medicinal Capsules Co (GS Capsules) 、Sunil Healthcare Limited、Yasin、Zhejiang Huili Capsules Co., Ltd.などが、北米のベジタリアンカプセル市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 分析手法

第4章 北米のベジタリアンカプセル市場の情勢

- 原材料サプライヤーの一覧

- プルランの原材料サプライヤーの一覧

- 製剤におけるHPMCの使用バリエーション

第5章 北米のベジタリアンカプセル市場:主な市場力学

- 市場促進要因

- ゼラチン系カプセルに対するビーガンカプセルの嗜好の高まり

- 高コストにもかかわらず高い野菜カプセルの需要

- 市場抑制要因

- 製品回収のリスク

- 市場機会

- ベジタリアンカプセルの革新的な製品発売

- 今後の動向

- ベジタリアンカプセルのアウトソーシング

- 促進要因と抑制要因の影響

第6章 北米のベジタリアンカプセル市場の分析

- 北米のベジタリアンカプセル市場の売上高 (2021~2031年)

第7章 北米のベジタリアンカプセル市場分析:製品別

- 北米のベジタリアンカプセルの市場規模と予測分析:製品別

- ヒドロキシプロピルメチルセルロース (HPMC)

- プルラン

- その他

第8章 北米のベジタリアンカプセル市場分析:用途別

- 抗生物質・抗菌剤

- ビタミン・栄養補助食品

- 抗炎症薬

- 心血管治療薬

- 制酸剤・整腸剤

- その他

第9章 北米ベジタリアンカプセル市場分析:機能別

- 即時放出型カプセル

- 持続放出型カプセル (徐放性カプセル)

- 遅延放出型カプセル

第10章 北米のベジタリアンカプセル市場の分析:エンドユーザー別

- 製薬会社

- 栄養補助食品企業

- CMO (医薬品製造業務受託機関)

- 化粧品企業

第11章 北米のベジタリアンカプセル市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 企業プロファイル

- Shanxi Guangsheng Medicinal Capsules Co (GS Capsules)

- Lefancaps

- ACG

- Capsugel, Inc (A subsidiary of Lonza Group AG)

- HealthCaps India

- NATURAL CAPSULES LIMITED

- Sunil Healthcare Limited

- QUALICAPS

- CapsCanada

- Zhejiang Huili Capsules Co., Ltd.

- Yasin

- Zhejiang Honghui Capsule Co., Ltd

第13章 付録

List Of Tables

- Table 1. North America Vegetarian Capsules Market Segmentation

- Table 2. Comparative Analysis Between Gelatin Capsules and Vegetarian Capsules

- Table 3. North America Vegetarian Capsules Market - Volume and Forecast to 2031 (Million Units) - by Product

- Table 4. United States: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 5. United States: North America Vegetarian Capsules Market - Volume and Forecast to 2031 (Million Units) - by Product

- Table 6. United States: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 7. United States: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by Functionality

- Table 8. United States: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 9. Canada: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 10. Canada: North America Vegetarian Capsules Market - Volume and Forecast to 2031 (Million Units) - by Product

- Table 11. Canada: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 12. Canada: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by Functionality

- Table 13. Canada: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 14. Mexico: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 15. Mexico: North America Vegetarian Capsules Market - Volume and Forecast to 2031 (Million Units) - by Product

- Table 16. Mexico: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 17. Mexico: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by Functionality

- Table 18. Mexico: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 19. Glossary of Terms, Vegetarian Capsules Market

List Of Figures

- Figure 1. North America Vegetarian Capsules Market Segmentation, by Country

- Figure 2. North America Vegetarian Capsules Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Vegetarian Capsules Market Revenue (US$ Million), 2021-2031

- Figure 5. North America Vegetarian Capsules Market Share (%) - by Product (2023 and 2031)

- Figure 6. Hydroxypropyl Methylcellulose (HPMC): North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Pullulan: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Others: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. North America Vegetarian Capsules Market Share (%) - by Application (2023 and 2031)

- Figure 10. Antibiotic and Antibacterial Drug: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Vitamin and Dietary Supplement: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Anti Inflammatory Drugs: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Cardiovascular Therapy Drugs: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Antacid and Antiflatulent Preparation: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Others: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. North America Vegetarian Capsules Market Share (%) - by Functionality (2023 and 2031)

- Figure 17. Immediate Release Capsules: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Sustained Release Capsules: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Delayed Release Capsules: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. North America Vegetarian Capsules Market Share (%) - by End User (2023 and 2031)

- Figure 21. Pharmaceutical Companies: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Nutraceutical Companies: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Contract Manufacturing Organizations (CMOs): North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Cosmeceutical Companies: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. North America Vegetarian Capsules Market by Key Countries - Revenue 2023 (US$ Million)

- Figure 26. North America Vegetarian Capsules Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 27. United States: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Canada: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Mexico: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

The North America vegetarian capsules market was valued at US$ 503.63 million in 2023 and is expected to reach US$ 976.33 million by 2031; it is estimated to register a CAGR of 8.6% from 2023 to 2031.

Rising Preference for Vegan Capsules Over Gelatin-Based Capsules Fuels North America Vegetarian Capsules Market

The majority of pharmaceutical companies are procuring vegetarian capsules over animal-derived capsules as they have low moisture content and better stability for hygroscopic compounds. For many years, there have been medical, religious, cultural, and ethical concerns about adding animal substances to capsule coatings or formulations in pharmaceutical medicines. Also, some consumers expressed concerns over the use of animal-derived pharmaceutical medicines due to the associated healthcare risks. In July 2023, the Center for Disease Control and Prevention (CDC) published a report for Alpha-gal syndrome (AGS) patients to limit the consumption of animal-derived medicines and supplements, as 75% of these medications contain animal-sourced ingredients. Also, AGS patients revealed serious allergic reactions after consuming medications or supplements that include mammalian-derived ingredients. Such instances have raised interest among the manufacturers to produce animal-free medications and supplements.

Comparative Analysis Between Gelatin Capsules and Vegetarian Capsules

Factors

Gelatin Capsules

Vegetarian Capsules

Source

Bovine, Skin, Cow, and Pigs

Plants

Target Audience

Vegan and Nonvegetarian Population

Vegan or Vegetarian Population

Allergy

Allergy Due to Cow and Pig-Based Ingredient

No Allergies

Cross Linking Ingredients

Cross Linking with Other Drug-Drug Derivatives

No Cross Linking

External Ingredients

Preservatives

No Preservatives

Currently, the high volume of pharmaceutical capsules available in the market are composed of gelatin. However, the crosslinking of gelatin with drug incompatibilities and strict regulations on the use of animal-derived gelatin have encouraged pharmaceutical manufacturers to replace gelatin components with vegetable-based ingredients. Pharmaceutical manufacturers identified that Hydroxypropyl Methylcellulose (HPMC)-derived vegetarian capsules are a good alternative to gelatin due to its vegetable derived source. Vegicaps soft capsules are the best example of animal-free capsules. The shell is composed of seaweed extract and gluten-free starch containing no modified sugars and artificial colors. Advantages of Vegicaps soft capsules are that they are free from animal derivatives, easy to swallow, soft, natural, and healthier products. In the case of gelatin-based capsules, the shell may get soft and become sticky upon spraying aqueous enteric polymer dispersions or may become brittle due to water evaporation during drying, ultimately losing mechanical stability. However, in HPMC-derived vegetarian capsules, it is less sensitive to aqueous coating, and the capsule shell is hard that avoids leakage of the ingredients.

Therefore, rising preference toward vegetarian medicines proves advantageous for the manufacturers to accelerate the production of vegetarian capsules, which drives the North America vegetarian capsules market growth.

North America Vegetarian Capsules Market Overview

According to data published in the American Osteopathic Association (AOA) report in 2024, in the US more than 4 in 5 American adults (86%) consume vitamins or dietary supplements. The report reveals that American adults consume vitamins or nutraceuticals due to personal needs or recommendations by physicians, friends, or family members. Also, with the rising prevalence of vitamin deficiency, the consumption of nutraceutical supplements such as capsules is high among the US population. The 2023 CRN Consumer Survey on Dietary Supplements shows that almost 74% of adults in the US consume dietary supplements, among which 55% are regular consumers. Some US population is shifting toward vegan diet. Health-conscious vegan consumers look for the "Vegan Trademark" while purchasing nutraceuticals and other dietary supplement products.

In the US, the nutraceutical industry provides innovative vegan products to meet rising consumer demand and diverse consumer intake shift toward animal-free dietary supplements. In April 2023, IFF announced the launch of "VERDIGEL SC". The introduction of "VERDIGEL SC" enables manufacturers of vegan soft gels to offer carrageenan-free products that are in high demand in several markets. Softgels are gaining high popularity in the nutritional and supplement sectors, and this new product developed by the IFF offers manufacturers a suitable option to switch to plant-based, carrageenan-free alternatives without disrupting existing production processes and compromising performance and quality.

North America Vegetarian Capsules Market Revenue and Forecast to 2031 (US$ Million)

North America Vegetarian Capsules Market Segmentation

The North America vegetarian capsules market is categorized into product, application, functionality, end user, and country.

Based on product, the North America vegetarian capsules market is segmented hydroxypropyl methylcellulose (HPMC), pullulan, and others. The hydroxypropyl methylcellulose (HPMC) segment held the largest market share in 2023.

In terms of application, the North America vegetarian capsules market is categorized into antibiotic and antibacterial drug, vitamin and dietary supplement, anti-inflammatory drugs, cardiovascular therapy drugs, antacid and antiflatulent preparation, and others. The antibiotic and antibacterial drug segment held the largest market share in 2023.

By functionality, the North America vegetarian capsules market is segmented into immediate release capsules, sustained release capsules, and delayed release capsules. The immediate release capsules segment held the larger market share in 2023.

By end user, the North America vegetarian capsules market is segmented into pharmaceutical companies, nutraceutical companies, contract manufacturing organizations (CMOS), and cosmeceutical companies. The pharmaceutical companies segment held the largest market share in 2023.

By country, the North America vegetarian capsules market is segmented into the US, Canada, and Mexico. The US dominated the North America vegetarian capsules market share in 2023.

ACG; CapsCanada; Capsugel, Inc (A subsidiary of Lonza Group AG); HealthCaps India; Lefancaps; NATURAL CAPSULES LIMITED; QUALICAPS; Shanxi Guangsheng Medicinal Capsules Co (GS Capsules); Sunil Healthcare Limited; Yasin; and Zhejiang Huili Capsules Co., Ltd. are some of the leading companies operating in the North America vegetarian capsules market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Vegetarian Capsules Market Landscape

- 4.1 List of Raw Material Suppliers

- 4.1.1 List of Raw Material Suppliers for Pullulan

- 4.1.2 Variant types of HPMC Use in Formulation

5. North America Vegetarian Capsules Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rising Preference for Vegan Capsules Over Gelatin-Based Capsules

- 5.1.2 Growing Demand for Vegetable Capsules Despite Their High Cost

- 5.2 Market Restraints

- 5.2.1 Risks of Product Recalls

- 5.3 Market Opportunities

- 5.3.1 Innovative Product Launches of Vegetarian Capsules

- 5.4 Future Trends

- 5.4.1 Outsourcing of Vegetarian Capsules

- 5.5 Impact of Drivers and Restraints:

6. Vegetarian Capsules Market - North America Analysis

- 6.1 North America Vegetarian Capsules Market Revenue (US$ Million), 2021-2031

7. North America Vegetarian Capsules Market Analysis - by Product

- 7.1 Overview

- 7.2 North America Vegetarian Capsules Market - Volume and Forecast Analysis - by Product

- 7.3 Hydroxypropyl Methylcellulose (HPMC)

- 7.3.1 Overview

- 7.3.2 Hydroxypropyl Methylcellulose (HPMC): North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Pullulan

- 7.4.1 Overview

- 7.4.2 Pullulan: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Vegetarian Capsules Market Analysis - by Application

- 8.1 Overview

- 8.2 Antibiotic and Antibacterial Drug

- 8.2.1 Overview

- 8.2.2 Antibiotic and Antibacterial Drug: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Vitamin and Dietary Supplement

- 8.3.1 Overview

- 8.3.2 Vitamin and Dietary Supplement: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Anti Inflammatory Drugs

- 8.4.1 Overview

- 8.4.2 Anti Inflammatory Drugs: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Cardiovascular Therapy Drugs

- 8.5.1 Overview

- 8.5.2 Cardiovascular Therapy Drugs: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Antacid and Antiflatulent Preparation

- 8.6.1 Overview

- 8.6.2 Antacid and Antiflatulent Preparation: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 8.7 Others

- 8.7.1 Overview

- 8.7.2 Others: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Vegetarian Capsules Market Analysis - by Functionality

- 9.1 Overview

- 9.2 Immediate Release Capsules

- 9.2.1 Overview

- 9.2.2 Immediate Release Capsules: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Sustained Release Capsules

- 9.3.1 Overview

- 9.3.2 Sustained Release Capsules: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Delayed Release Capsules

- 9.4.1 Overview

- 9.4.2 Delayed Release Capsules: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Vegetarian Capsules Market Analysis - by End User

- 10.1 Overview

- 10.2 Pharmaceutical Companies

- 10.2.1 Overview

- 10.2.2 Pharmaceutical Companies: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Nutraceutical Companies

- 10.3.1 Overview

- 10.3.2 Nutraceutical Companies: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Contract Manufacturing Organizations (CMOs)

- 10.4.1 Overview

- 10.4.2 Contract Manufacturing Organizations (CMOs): North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5 Cosmeceutical Companies

- 10.5.1 Overview

- 10.5.2 Cosmeceutical Companies: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Vegetarian Capsules Market - Country Analysis

- 11.1 North America

- 11.1.1 North America Vegetarian Capsules Market Breakdown, by Key Countries, 2023 and 2031 (%)

- 11.1.1.1 United States: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.1.1 Overview

- 11.1.1.2 United States: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.2.1 United States: North America Vegetarian Capsules Market Breakdown, by Product

- 11.1.1.2.2 United States: North America Vegetarian Capsules Market - Volume and Forecast Analysis - by Product

- 11.1.1.2.3 United States: North America Vegetarian Capsules Market Breakdown, by Application

- 11.1.1.2.4 United States: North America Vegetarian Capsules Market Breakdown, by Functionality

- 11.1.1.2.5 United States: North America Vegetarian Capsules Market Breakdown, by End User

- 11.1.1.3 Canada: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.3.1 Overview

- 11.1.1.4 Canada: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.4.1 Canada: North America Vegetarian Capsules Market Breakdown, by Product

- 11.1.1.4.2 Canada: North America Vegetarian Capsules Market - Volume and Forecast Analysis - by Product

- 11.1.1.4.3 Canada: North America Vegetarian Capsules Market Breakdown, by Application

- 11.1.1.4.4 Canada: North America Vegetarian Capsules Market Breakdown, by Functionality

- 11.1.1.4.5 Canada: North America Vegetarian Capsules Market Breakdown, by End User

- 11.1.1.5 Mexico: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.5.1 Overview

- 11.1.1.6 Mexico: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.6.1 Mexico: North America Vegetarian Capsules Market Breakdown, by Product

- 11.1.1.6.2 Mexico: North America Vegetarian Capsules Market - Volume and Forecast Analysis - by Product

- 11.1.1.6.3 Mexico: North America Vegetarian Capsules Market Breakdown, by Application

- 11.1.1.6.4 Mexico: North America Vegetarian Capsules Market Breakdown, by Functionality

- 11.1.1.6.5 Mexico: North America Vegetarian Capsules Market Breakdown, by End User

- 11.1.1.1 United States: North America Vegetarian Capsules Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1 North America Vegetarian Capsules Market Breakdown, by Key Countries, 2023 and 2031 (%)

12. Company Profiles

- 12.1 Shanxi Guangsheng Medicinal Capsules Co (GS Capsules)

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Lefancaps

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 ACG

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Capsugel, Inc (A subsidiary of Lonza Group AG)

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 HealthCaps India

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 NATURAL CAPSULES LIMITED

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Sunil Healthcare Limited

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 QUALICAPS

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 CapsCanada

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Zhejiang Huili Capsules Co., Ltd.

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

- 12.11 Yasin

- 12.11.1 Key Facts

- 12.11.2 Business Description

- 12.11.3 Products and Services

- 12.11.4 Financial Overview

- 12.11.5 SWOT Analysis

- 12.11.6 Key Developments

- 12.12 Zhejiang Honghui Capsule Co., Ltd

- 12.12.1 Key Facts

- 12.12.2 Business Description

- 12.12.3 Products and Services

- 12.12.4 Financial Overview

- 12.12.5 SWOT Analysis

- 12.12.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Glossary of Terms