|

|

市場調査レポート

商品コード

1567890

欧州の合成開口レーダー:2030年までの市場予測 - 地域分析 - コンポーネント別、周波数帯域別、用途別、プラットフォーム別、モード別Europe Synthetic Aperture Radar Market Forecast to 2030 - Regional Analysis - by Component, Frequency Band, Application, Platform, and Mode |

||||||

|

|||||||

| 欧州の合成開口レーダー:2030年までの市場予測 - 地域分析 - コンポーネント別、周波数帯域別、用途別、プラットフォーム別、モード別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 120 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州の合成開口レーダー市場は、2022年に14億9,808万米ドルと評価され、2030年には36億4,912万米ドルに達すると予測され、2022年から2030年までのCAGRは11.8%と推定されます。

統合C4ISRエコシステムに対する好みの高まりが欧州の合成開口レーダー市場を牽引

合成開口レーダー市場は、統合されたコマンド、制御、通信、コンピュータ、インテリジェンス、監視、偵察(C4ISR)エコシステムに対する選好の高まりによって牽引されています。従来、C4ISRシステムは、それぞれが特定の機能と任務要件用に装備された個別の独立ユニットに依存していました。このアプローチでは、情報の収集と分析に別々のシステムやディスプレイを使用することが多く、その結果、厳格で時間のかかるプロセスが発生します。こうした課題に対処するため、防衛機関は現在、エンタープライズ・インテグレーション・アプローチの採用に傾きつつあります。このアプローチは、安全で相互運用可能なC4ISRネットワークとシステムの統合を提唱し、プロセス全体を合理化するものです。この統合C4ISRアプローチでは、政府はエンタープライズ設計図とシステム間インターフェイスの設計に責任を持っています。同時にベンダーは、全体的なC4ISR環境にシームレスに統合できる個々のシステムやサブコンポーネントを提供します。

統合C4ISRアプローチの採用には、いくつかの利点があります。まず、OEM(相手先ブランド製造)やプライムインテグレーターにとっては、既存のシステムをアップグレードする必要がないため、プロセスが簡素化されます。この結果、これらの利害関係者にとって、コスト面でのメリットとプロセスの簡素化がもたらされます。第二に、C4ISRネットワークとシステムの統合は、並列的なプランニングと意思決定能力を可能にし、状況認識を強化し、加速する作戦環境において敵の先を行くことで、作戦効率を高めます。この傾向は、従来の取得アプローチからのパラダイムシフトを意味し、合成開口レーダー市場に好影響を与えると予想されます。C4ISRシステムの統合は、軍事作戦の全体的な効率と効果を向上させ、コスト削減とプロセスの簡素化に貢献します。その結果、統合されたC4ISRエコシステムにおいて重要な役割を果たすSARシステムの需要が高まり、市場にプラスの影響を与えます。

欧州の合成開口レーダー市場概要

欧州の合成開口レーダー市場は、ドイツ、フランス、イタリア、英国、ロシア、その他欧州に区分されます。欧州の海上防衛、安全保障、監視分野は、技術革新と軍事・民生用用途によって重要性を増し、拡大しています。フランスと英国が欧州の防衛研究開発費全体の40%を占め、ドイツ、イタリア、スペイン、スウェーデンがこれに続きます。このように、様々なプレーヤーがAIと最先端のソフトウェアでSARを進めています。例えば、2023年8月、ポーランドのSatimは最新の投資家ラウンドで220万米ドルを確保しました。同社はこの資金で、衛星の合成開口レーダー画像を使って、いつでもどこでも自動物体検出、識別、分類ができるAIベースの最先端ソフトウェアを開発する計画です。

この地域のいくつかの企業は、無人航空機に合成開口レーダーを追加しています。例えば2023年4月、無人航空機システム(UAV)とIaaSソリューションの欧州市場リーダーであるTEKEVERは、同社のAR5 UASにGAMASARを事実上追加したと発表しました。GAMASARはTEKEVERが設計・開発した合成開口レーダーで、航空・宇宙ベースの地球観測をサポートします。現在、AR5とAR3の両システムで利用可能で、最も要求の厳しい陸上・海上ミッションをサポートしています。合成開口レーダーペイロードの統合は、特に小型のUASプラットフォームでは、通常、運用能力において大きなトレードオフをもたらします。

欧州諸国は、車両の排ガス検知、地球観測、その他いくつかの理由でリモートセンシングを利用しています。欧州中の様々なプレーヤーが、リモートセンシング・アプリケーションを提供するために、パートナーシップのような戦略的イニシアチブをとっています。例えば、UmbraはEuropean Space Imaging(EUSI)との戦略的パートナーシップを発表しました。このパートナーシップ契約により、EUSIは、Umbraの先進的な衛星コンステレーションとタスキング・プラットフォームを使用して、顧客のためにSAR画像の世界なタスキングと配信を監督する能力を得ることになります。この提携により、欧州全域のリモートセンシングデータユーザーは、世界最高解像度の宇宙ベースの光学および合成開口レーダー画像を、それぞれ30cmおよび25cmの解像度で取得できるようになり、大きなメリットを享受できます。このような合成開口レーダーとUASの統合や合成開口レーダーの進歩は、合成開口レーダー市場の成長を後押ししています。

欧州の合成開口レーダー市場の収益と2030年までの予測(金額)

欧州の合成開口レーダー市場のセグメンテーション

欧州の合成開口レーダー市場は、コンポーネント、周波数帯域、用途、プラットフォーム、モード、国に分類されます。

コンポーネントに基づき、欧州の合成開口レーダー市場は受信機、送信機、アンテナに分類されます。アンテナセグメントは2022年に最大の市場シェアを占めました。

周波数帯では、欧州の合成開口レーダー市場はxバンド、lバンド、cバンド、sバンド、その他に分類されます。2022年にはxバンドセグメントが最大の市場シェアを占めました。

用途別では、欧州の合成開口レーダー市場は商業用と防衛用に区分されます。2022年の市場シェアは防衛分野が占めました。

プラットフォーム別では、欧州の合成開口レーダー市場は地上用と空中用に二分されます。2022年の市場シェアは、航空機セグメントが大きいです。

モード別では、欧州の合成開口レーダー市場はシングルとマルチに二分されます。2022年の市場シェアはマルチの方が大きいです。

国別では、欧州の合成開口レーダー市場はドイツ、英国、フランス、イタリア、ロシア、その他欧州に区分されます。2022年の欧州の合成開口レーダー市場シェアは英国が独占しました。

Northrop Grumman Corp、ASELSAN AS、BAE Systems Plc、Israel Aerospace Industries Ltd、Leonardo SpA、Lockheed Martin Corp、Raytheon Technologies Corp、Thales SA、Saab ABは、欧州の合成開口レーダー市場で事業展開している大手企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブ・サマリー

- 主要洞察

- 市場の魅力

第3章 調査方法

- 調査範囲

- 二次調査

- 一次調査

第4章 欧州の合成開口レーダー市場展望

- エコシステム分析

第5章 欧州の合成開口レーダー市場:主要市場ダイナミクス

- 市場促進要因

- 高精度なターゲティング能力確保への志向の高まり

- 統合されたC4ISRエコシステムへの好みの高まり

- 地球観測およびリモートセンシング機能に対する需要の高まり

- 市場抑制要因

- 衛星打ち上げの遅れ

- 高い開発コスト

- 市場機会

- デュアルバンドSARの開発台数増加

- 農業分野でのSAR利用の増加

- 今後の動向

- ディープラーニング(DL)との統合

- 促進要因と抑制要因の影響

第6章 合成開口レーダー市場:欧州市場概観

- 合成開口レーダー市場の収益、2020年~2030年

- 合成開口レーダー市場の予測分析

第7章 欧州の合成開口レーダーの市場分析 - コンポーネント別

- 受信機

- 送信機

- アンテナ

第8章 欧州の合成開口レーダーの市場分析 - 周波数帯域別

- Xバンド

- Lバンド

- Cバンド

- Sバンド

- その他

第9章 欧州の合成開口レーダー市場分析 - 用途別

- 商業

- 防衛

第10章 欧州の合成開口レーダー市場分析 - プラットフォーム別

- 地上

- 航空機

第11章 欧州の合成開口レーダー市場分析 - モード別

- シングル

- マルチ

第12章 欧州の合成開口レーダー市場分析 - 国別分析

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア連邦

- その他の欧州

第13章 業界の展望

- 市場イニシアティブ

- 製品開発

- パートナーシップとコラボレーション

- 事業拡大

- その他

第14章 企業プロファイル

- Northrop Grumman Corp

- ASELSAN AS

- BAE Systems Plc

- Israel Aerospace Industries Ltd

- Leonardo SpA

- Lockheed Martin Corp

- Raytheon Technologies Corp

- Thales SA

- Saab AB

第15章 付録

List Of Tables

- Table 1. Europe Synthetic Aperture Radar Market Segmentation

- Table 2. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 4. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Frequency Band

- Table 5. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 6. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Platform

- Table 7. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 8. Europe: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 9. Germany: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 10. Germany: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 11. Germany: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 12. Germany: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 13. Germany: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 14. United Kingdom: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 15. United Kingdom: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 16. United Kingdom: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 17. United Kingdom: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 18. United Kingdom: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 19. France: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 20. France: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 21. France: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 22. France: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 23. France: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 24. Italy: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 25. Italy: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 26. Italy: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 27. Italy: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 28. Italy: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 29. Russian Federation: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 30. Russian Federation: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 31. Russian Federation: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 32. Russian Federation: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 33. Russian Federation: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 34. Rest of Europe: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 35. Rest of Europe: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 36. Rest of Europe: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 37. Rest of Europe: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 38. Rest of Europe: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 39. List of Abbreviation

List Of Figures

- Figure 1. Europe Synthetic Aperture Radar Market Segmentation, by Country

- Figure 2. Ecosystem Analysis

- Figure 3. Europe Synthetic Aperture Radar Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Synthetic Aperture Radar Market Revenue (US$ Million), 2020-2030

- Figure 6. Synthetic Aperture Radar Market Share (%) - by Component (2022 and 2030)

- Figure 7. Receiver: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Transmitter: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Antenna: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Synthetic Aperture Radar Market Share (%) - by Frequency Band (2022 and 2030)

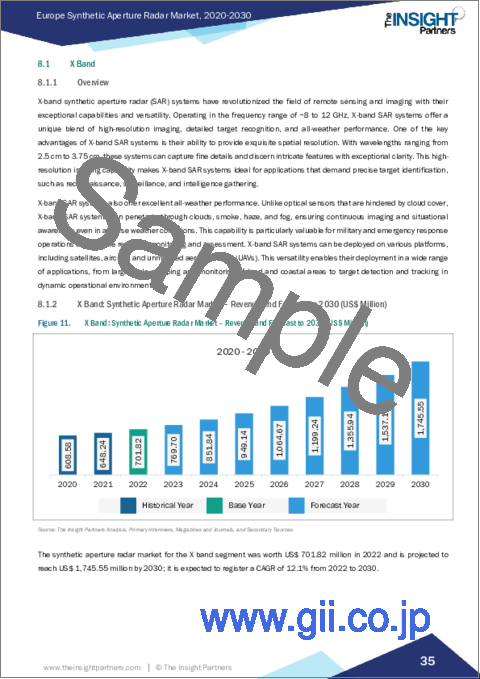

- Figure 11. X Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. L Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. C Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. S Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Others: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Synthetic Aperture Radar Market Share (%) - by Application (2022 and 2030)

- Figure 17. Commercial: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Defense: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Synthetic Aperture Radar Market Share (%) - by Platform (2022 and 2030)

- Figure 20. Ground: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Airborne: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Synthetic Aperture Radar Market Share (%) - by Mode (2022 and 2030)

- Figure 23. Single: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Multi: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Europe Synthetic Aperture Radar Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 26. Europe: Synthetic Aperture Radar Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 27. Germany: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 28. United Kingdom: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 29. France: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 30. Italy: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 31. Russian Federation: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 32. Rest of Europe: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

The Europe synthetic aperture radar market was valued at US$ 1,498.08 million in 2022 and is expected to reach US$ 3,649.12 million by 2030; it is estimated to register a CAGR of 11.8% from 2022 to 2030.

Rising Preference for Integrated C4ISR Ecosystem Drives Europe Synthetic Aperture Radar Market

The synthetic aperture radar market is driven by the increasing preference for an integrated Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) ecosystem. Traditionally, C4ISR systems have relied on separate stand-alone units, each equipped for specific functions and mission requirements. This approach often leads to the use of separate systems and displays for collecting and analyzing information, resulting in a rigorous and time-consuming process. To address these challenges, defense agencies are now leaning toward adopting an enterprise integration approach. This approach advocates for the integration of secure and interoperable C4ISR networks and systems, streamlining the entire process. In this integrated C4ISR approach, governments take responsibility for designing enterprise blueprints and intersystem interfaces. At the same time, vendors deliver individual systems and sub-components that can be seamlessly integrated into the overall C4ISR environment.

The adoption of an integrated C4ISR approach offers several benefits. Firstly, it simplifies the process for Original Equipment Manufacturers (OEMs) and prime integrators, as they do not have to upgrade existing systems. This results in cost advantages and process simplifications for these stakeholders. Secondly, the integration of C4ISR networks and systems enhances operational efficiency by enabling parallel planning and decision-making abilities, enhancing situational awareness, and staying ahead of adversaries in accelerated operational environments. This trend represents a paradigm shift from the traditional acquisition approach and is expected to have a positive impact on the synthetic aperture radar market. The integration of C4ISR systems improves the overall efficiency and effectiveness of military operations and contributes to cost savings and process simplifications. As a result, the demand for SAR systems, which play a crucial role in the integrated C4ISR ecosystem, grows, thereby positively favoring the market.

Europe Synthetic Aperture Radar Market Overview

The Europe synthetic aperture radar market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Maritime Defense, Security, and Surveillance sectors in Europe are gaining significance and expanding with technological innovations and applications for military and civil use. France and the UK account for 40% of the total Defense R&D spending in Europe, followed by Germany, Italy, Spain, and Sweden. Thus, various players are advancing SAR with AI and cutting-edge software. For instance, in August 2023, Polish company Satim secured US$ 2.2 million in their latest investor round. The firm plans to use these funds to advance its AI-based, cutting-edge software for automatic object detection, identification, and classification capabilities anytime, anywhere, using satellite synthetic aperture radar imagery.

Several players across the region are adding synthetic aperture radar to unmanned aerial vehicles. For example, in April 2023, the European market leader in unmanned aerial systems (UAV) and intelligence-as-a-service solutions, TEKEVER, announced that it has effectively added GAMASAR to its AR5 UAS. GAMASAR is a synthetic aperture radar designed and developed by TEKEVER to support aerial and space-based Earth observation. It is now available on both AR5 and AR3 systems to support the most demanding land and maritime missions. The integration of synthetic aperture radar payloads typically imposes a significant tradeoff in operational capabilities, especially in smaller UAS platforms.

European countries are using remote sensing for the detection of vehicle emissions, earth observation, and several other reasons. Various players across Europe are taking strategic initiatives, such as partnerships, to provide remote sensing applications. For example, Umbra announced a strategic partnership with European Space Imaging (EUSI). With this partnership agreement, EUSI will gain the ability to oversee global tasking and delivery of SAR imagery for its customers using Umbra's advanced satellite constellation and tasking platform. This collaboration will offer a significant benefit to remote sensing data users across Europe, as they can now acquire the world's highest resolution space-based optical and synthetic aperture radar imagery 30 cm and 25cm resolutions, respectively. Such integration of a synthetic aperture radar with UAS and advancement in synthetic aperture radar propels the growth of the synthetic aperture radar market.

Europe Synthetic Aperture Radar Market Revenue and Forecast to 2030 (US$ Million)

Europe Synthetic Aperture Radar Market Segmentation

The Europe synthetic aperture radar market is categorized into component, frequency band, application, platform, mode, and country.

Based on component, the Europe synthetic aperture radar market is categorized into receiver, transmitter, and antenna. The antenna segment held the largest market share in 2022.

In terms of frequency band, the Europe synthetic aperture radar market is categorized into x band, l band, c band, s band, and others. The x band segment held the largest market share in 2022.

By application, the Europe synthetic aperture radar market is segmented into commercial and defense. The defense segment held a larger market share in 2022.

Based on platform, the Europe synthetic aperture radar market is bifurcated into ground and airborne. The airborne segment held a larger market share in 2022.

In terms of mode, the Europe synthetic aperture radar market is bifurcated into single and multi. The multi segment held a larger market share in 2022.

By country, the Europe synthetic aperture radar market is segmented into Germany, the UK, France, Italy, Russia, and the Rest of Europe. The UK dominated the Europe synthetic aperture radar market share in 2022.

Northrop Grumman Corp, ASELSAN AS, BAE Systems Plc, Israel Aerospace Industries Ltd, Leonardo SpA, Lockheed Martin Corp, Raytheon Technologies Corp, Thales SA, and Saab AB are some of the leading companies operating in the Europe synthetic aperture radar market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Europe Synthetic Aperture Radar Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

5. Europe Synthetic Aperture Radar Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Preference for Ensuring Precision Targeting Capability

- 5.1.2 Rising Preference for Integrated C4ISR Ecosystem

- 5.1.3 Growing Demand for Earth Observation and Remote Sensing Capabilities

- 5.2 Market Restraints

- 5.2.1 Satellite Launch Delays

- 5.2.2 High Development Cost

- 5.3 Market Opportunities

- 5.3.1 Rising Development of Dual-Band SAR

- 5.3.2 Increasing Use of SAR in Agriculture Industry

- 5.4 Future Trends

- 5.4.1 Integration with Deep Learning (DL)

- 5.5 Impact of Drivers and Restraints:

6. Synthetic Aperture Radar Market - Europe Market Overview

- 6.1 Synthetic Aperture Radar Market Revenue (US$ Million), 2020-2030

- 6.2 Synthetic Aperture Radar Market Forecast Analysis

7. Europe Synthetic Aperture Radar Market Analysis - by Component

- 7.1 Receiver

- 7.1.1 Overview

- 7.1.2 Receiver: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Transmitter

- 7.2.1 Overview

- 7.2.2 Transmitter: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Antenna

- 7.3.1 Overview

- 7.3.2 Antenna: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

8. Europe Synthetic Aperture Radar Market Analysis - by Frequency Band

- 8.1 X Band

- 8.1.1 Overview

- 8.1.2 X Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 L Band

- 8.2.1 Overview

- 8.2.2 L Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 C Band

- 8.3.1 Overview

- 8.3.2 C Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 S Band

- 8.4.1 Overview

- 8.4.2 S Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

9. Europe Synthetic Aperture Radar Market Analysis - by Application

- 9.1 Commercial

- 9.1.1 Overview

- 9.1.2 Commercial: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Defense

- 9.2.1 Overview

- 9.2.2 Defense: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

10. Europe Synthetic Aperture Radar Market Analysis - by Platform

- 10.1 Ground

- 10.1.1 Overview

- 10.1.2 Ground: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 10.2 Airborne

- 10.2.1 Overview

- 10.2.2 Airborne: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

11. Europe Synthetic Aperture Radar Market Analysis - by Mode

- 11.1 Single

- 11.1.1 Overview

- 11.1.2 Single: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 11.2 Multi

- 11.2.1 Overview

- 11.2.2 Multi: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

12. Europe Synthetic Aperture Radar Market - Country Analysis

- 12.1 Europe Synthetic Aperture Radar Market - Country Analysis

- 12.1.1 Europe: Synthetic Aperture Radar Market - Revenue and Forecast Analysis - by Country

- 12.1.1.1 Europe: Synthetic Aperture Radar Market - Revenue and Forecast Analysis - by Country

- 12.1.1.2 Germany: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.2.1 Germany: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.2.2 Germany: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.2.3 Germany: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.2.4 Germany: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.2.5 Germany: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.3 United Kingdom: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.3.1 United Kingdom: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.3.2 United Kingdom: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.3.3 United Kingdom: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.3.4 United Kingdom: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.3.5 United Kingdom: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.4 France: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.4.1 France: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.4.2 France: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.4.3 France: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.4.4 France: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.4.5 France: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.5 Italy: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.5.1 Italy: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.5.2 Italy: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.5.3 Italy: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.5.4 Italy: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.5.5 Italy: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.6 Russian Federation: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.6.1 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.6.2 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.6.3 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.6.4 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.6.5 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.7 Rest of Europe: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.7.1 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.7.2 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.7.3 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.7.4 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.7.5 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1 Europe: Synthetic Aperture Radar Market - Revenue and Forecast Analysis - by Country

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 Product Development

- 13.4 Partnership & Collaboration

- 13.5 Expansion

- 13.6 Others

14. Company Profiles

- 14.1 Northrop Grumman Corp

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 ASELSAN AS

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 BAE Systems Plc

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Israel Aerospace Industries Ltd

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Leonardo SpA

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Lockheed Martin Corp

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Raytheon Technologies Corp

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Thales SA

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Saab AB

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners

- 15.2 Word Index