|

|

市場調査レポート

商品コード

1567888

アジア太平洋の合成開口レーダー:2030年までの市場予測 - 地域分析 - コンポーネント別、周波数帯域別、用途別、プラットフォーム別、モード別Asia Pacific Synthetic Aperture Radar Market Forecast to 2030 - Regional Analysis - by Component, Frequency Band, Application, Platform, and Mode |

||||||

|

|||||||

| アジア太平洋の合成開口レーダー:2030年までの市場予測 - 地域分析 - コンポーネント別、周波数帯域別、用途別、プラットフォーム別、モード別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 120 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の合成開口レーダー市場は、2022年に11億4,044万米ドルとなり、2030年までには28億2,314万米ドルに達すると予測され、2022年から2030年までのCAGRは12.0%と推定されます。

デュアルバンドSARの開発がアジア太平洋の合成開口レーダー市場を後押し

デュアルバンド合成開口レーダー(SAR)技術は、2つの周波数帯域で同時に動作し、シングルバンドSARシステムよりもイメージング能力を高め、画質を向上させます。デュアルバンドSARの使用にはいくつかの利点があります。まず、2つの異なる周波数帯域を組み合わせることで、より詳細で正確な撮像が可能になるため、目標の識別や同定が容易になります。これは、軍事監視、国境管理、海上監視など、物体を識別し、微妙な変化を検出する能力が重要な用途で特に価値があります。

第二に、デュアルバンドSARテクノロジーは、厳しい環境条件下でも物体を透過して検出する能力を高めます。2つの異なる周波数帯を利用することで、SARシステムは、植生、天候、表面の粗さなどの要因による制限を克服することができます。この堅牢性の向上により、悪条件下でも信頼性の高い撮像が可能になり、SAR技術の応用範囲が広がります。さらに、デュアルバンドSARシステムによる画質の向上は、取得したデータの解釈や分析を容易にします。これは、災害管理、環境モニタリング、インフラ計画など、正確で詳細な情報が意思決定に不可欠な用途において特に有益です。このように、デュアルバンド合成開口レーダー(SAR)技術は、合成開口レーダー市場における重要な進歩として登場し、市場の成長と拡大に新たな機会をもたらしています。

アジア太平洋の合成開口レーダー市場概要

アジア太平洋の合成開口レーダー市場は、オーストラリア、中国、インド、日本、韓国、その他のアジア太平洋に区分されます。環境監視、災害管理、海上監視、ターゲット探知などのリモートセンシング用途で合成開口レーダーの用途が拡大しているため、各地域は合成開口レーダーの開発に注力しています。例えば、2023年10月にはインドネシアのバリ島で国際会議「アジア太平洋合成開口レーダー会議(APSAR)」が開催されました。この会議は合成開口レーダーの技術開発と応用をテーマとしていました。この会議は2023 IEEE International Conference on Aerospace Electronics and Remote Sensing Technology(ICARES 2023)と共同開催されました。

合成開口レーダーの開発に向けて、アジア太平洋の複数のプレーヤーがパートナーシップを結んでいます。例えば、2023年10月、Data Patternsは合成開口レーダー(SAR)開発のため、宇宙結節機関IN-SPACeとライセンス供与および技術移転(ToT)契約を締結しました。このパートナーシップは、レーダー開発の取り組みにおいてData Patternsを支援します。

中国はモンスーン気候の影響を大きく受け、気象災害が頻発しています。中国はまた、深刻な地滑り、洪水、その他の地質災害も経験しています。そのため、中国は干渉合成開口レーダー(InSAR)衛星の配備を重視してきました。例えば、中国は2023年3月、中国北部の山西省にある太原衛星発射センターで、中国の民間衛星開発会社GalaxySpaceが開発した4基の干渉合成開口レーダー(InSAR)衛星をCZ-2Dロケットで打ち上げました。このタイプの衛星は、比較的安定したフォーメーション構成と高いマッピング効率を提供します。この衛星は、ミリメートルレベルの変形監視能力を持つため、複雑な地域における主要な地質災害を早期に特定するための強力なツールとなります。探査や地盤沈下、崩壊、地滑り、その他の災害の防止に役立つデータを提供することができます。このような事例が、アジア太平洋の合成開口レーダー市場の成長を後押ししています。

アジア太平洋の合成開口レーダー市場の収益と2030年までの予測(金額)

アジア太平洋の合成開口レーダー市場のセグメンテーション

アジア太平洋の合成開口レーダー市場は、コンポーネント、周波数帯域、用途、プラットフォーム、モード、国に分類されます。

コンポーネントに基づき、アジア太平洋の合成開口レーダー市場は受信機、送信機、アンテナに分類されます。アンテナセグメントは2022年に最大の市場シェアを占めました。

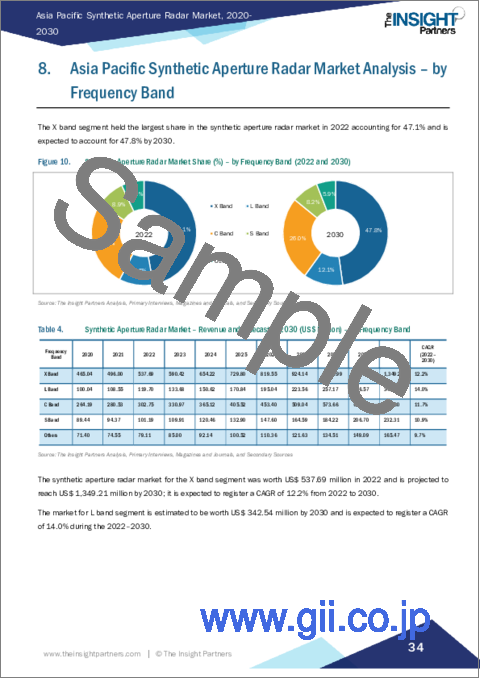

周波数帯では、アジア太平洋の合成開口レーダー市場はxバンド、lバンド、cバンド、sバンド、その他に分類されます。2022年にはxバンドセグメントが最大の市場シェアを占めました。

用途別では、アジア太平洋の合成開口レーダー市場は商業用と防衛用に区分されます。2022年の市場シェアは防衛分野が占めました。

プラットフォーム別では、アジア太平洋の合成開口レーダー市場は地上用と空中用に二分されます。2022年の市場シェアは、航空機セグメントが占めました。

モード別では、アジア太平洋の合成開口レーダー市場はシングルとマルチに二分されます。2022年の市場シェアはマルチの方が大きいです。

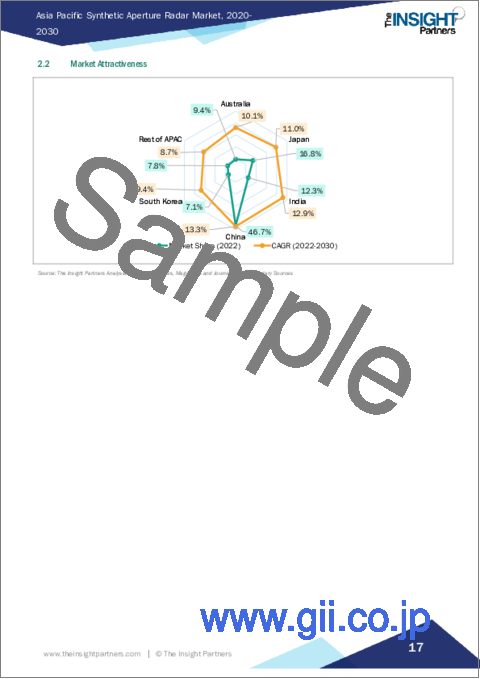

国別では、アジア太平洋の合成開口レーダー市場は、オーストラリア、日本、インド、中国、韓国、その他のアジア太平洋に区分されます。2022年のアジア太平洋合成開口レーダー市場シェアは中国が独占しました。

Northrop Grumman Corp、ASELSAN AS、BAE Systems Plc、Israel Aerospace Industries Ltd、Leonardo SpA、Lockheed Martin Corp、Raytheon Technologies Corp、Thales SA、Saab ABは、アジア太平洋合成開口レーダー市場で事業展開している大手企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査方法

- 調査範囲

- 二次調査

- 一次調査

第4章 アジア太平洋の合成開口レーダー市場展望

- エコシステム分析

第5章 アジア太平洋の合成開口レーダー市場:主要市場ダイナミクス

- 市場促進要因

- 高精度ターゲティング能力確保への志向の高まり

- 統合されたC4ISRエコシステムへの好みの高まり

- 地球観測とリモートセンシング機能に対する需要の高まり

- 市場抑制要因

- 衛星打ち上げの遅れ

- 高い開発コスト

- 市場機会

- デュアルバンドSARの開発台数増加

- 農業分野でのSAR利用の増加

- 今後の動向

- ディープラーニング(DL)との統合

- 促進要因と抑制要因の影響

第6章 合成開口レーダー市場:アジア太平洋市場分析

- アジア太平洋の合成開口レーダー市場収益、2020年~2030年

- 合成開口レーダー市場の予測分析

第7章 アジア太平洋の合成開口レーダー市場分析 - コンポーネント別

- 受信機

- 送信機

- アンテナ

第8章 アジア太平洋の合成開口レーダー市場分析 - 周波数帯別

- Xバンド

- Lバンド

- Cバンド

- Sバンド

- その他

第9章 アジア太平洋の合成開口レーダー市場分析 - 用途別

- 商業

- 防衛

第10章 アジア太平洋の合成開口レーダー市場分析 - プラットフォーム別

- 陸上

- 空挺

第11章 アジア太平洋の合成開口レーダー市場分析 - モード別

- シングル

- マルチ

第12章 アジア太平洋の合成開口レーダー市場 - 国別分析

- アジア太平洋

- オーストラリア

- 日本

- インド

- 中国

- 韓国

- その他のアジア太平洋

第13章 産業展望

- 市場イニシアティブ

- 製品開発

- パートナーシップとコラボレーション

- 事業拡大

- その他

第14章 企業プロファイル

- Northrop Grumman Corp

- ASELSAN AS

- BAE Systems Plc

- Israel Aerospace Industries Ltd

- Leonardo SpA

- Lockheed Martin Corp

- Raytheon Technologies Corp

- Thales SA

- Saab AB

第15章 付録

List Of Tables

- Table 1. Asia Pacific Synthetic Aperture Radar Market Segmentation

- Table 2. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 4. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Frequency Band

- Table 5. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 6. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Platform

- Table 7. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 8. Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 9. Australia: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 10. Australia: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 11. Australia: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 12. Australia: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 13. Australia: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 14. Japan: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 15. Japan: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 16. Japan: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 17. Japan: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 18. Japan: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 19. India: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 20. India: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 21. India: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 22. India: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 23. India: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 24. China: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 25. China: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 26. China: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 27. China: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 28. China: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 29. South Korea: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 30. South Korea: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 31. South Korea: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 32. South Korea: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 33. South Korea: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 34. Rest of Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 35. Rest of Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 36. Rest of Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 37. Rest of Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 38. Rest of Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 39. List of Abbreviation

List Of Figures

- Figure 1. Asia Pacific Synthetic Aperture Radar Market Segmentation, by Country

- Figure 2. Ecosystem Analysis

- Figure 3. Synthetic Aperture Radar Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Synthetic Aperture Radar Market Revenue (US$ Million), 2020-2030

- Figure 6. Synthetic Aperture Radar Market Share (%) - by Component (2022 and 2030)

- Figure 7. Receiver: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Transmitter: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Antenna: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Synthetic Aperture Radar Market Share (%) - by Frequency Band (2022 and 2030)

- Figure 11. X Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. L Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. C Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. S Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Others: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Synthetic Aperture Radar Market Share (%) - by Application (2022 and 2030)

- Figure 17. Commercial: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Defense: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Synthetic Aperture Radar Market Share (%) - by Platform (2022 and 2030)

- Figure 20. Ground: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Airborne: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Synthetic Aperture Radar Market Share (%) - by Mode (2022 and 2030)

- Figure 23. Single: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Multi: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Asia Pacific Synthetic Aperture Radar Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 26. Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 27. Australia: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 28. Japan: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 29. India: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 30. China: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 31. South Korea: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 32. Rest of Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

The Asia Pacific synthetic aperture radar market was valued at US$ 1,140.44 million in 2022 and is expected to reach US$ 2,823.14 million by 2030; it is estimated to register a CAGR of 12.0% from 2022 to 2030.

Rising Development of Dual-Band SAR Boosts Asia Pacific Synthetic Aperture Radar Market

Dual-band synthetic aperture radar (SAR) technology operates in two frequency bands simultaneously, allowing for enhanced imaging capabilities and improved image quality compared to single-band SAR systems. The use of dual-band SAR offers several advantages. Firstly, it enables better target discrimination and identification, as the combination of two different frequency bands provides more detailed and accurate imaging. This is particularly valuable in applications such as military surveillance, border control, and maritime monitoring, where the ability to distinguish between objects and detect subtle changes is crucial.

Secondly, dual-band SAR technology enhances the system's ability to penetrate and detect objects under challenging environmental conditions. Utilizing two different frequency bands, SAR systems can overcome limitations posed by factors such as vegetation cover, weather conditions, and surface roughness. This increased robustness allows for reliable imaging even in adverse conditions, expanding the range of applications for SAR technology. Moreover, the improved image quality offered by dual-band SAR systems facilitates better interpretation and analysis of the acquired data. This is particularly beneficial in applications such as disaster management, environmental monitoring, and infrastructure planning, where accurate and detailed information is vital for decision-making. Thus, dual-band synthetic aperture radar (SAR) technology has emerged as a significant advancement in the synthetic aperture radar market, presenting new opportunities for market growth and expansion.

Asia Pacific Synthetic Aperture Radar Market Overview

The Asia Pacific synthetic aperture radar market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The growing application of synthetic aperture radar in remote sensing applications such as environment monitoring, disaster management, maritime surveillance, and target detection enables regions to focus on the development of synthetic aperture radar. For example, in October 2023, an international conference, the Asia Pacific Conference on Synthetic Aperture Radar (APSAR), was held on Bali Island, Indonesia. The conference was devoted to synthetic aperture radar technology development and applications. This conference was jointly hosted with the 2023 IEEE International Conference on Aerospace Electronics and Remote Sensing Technology (ICARES 2023).

Several players across Asia Pacific are entering into partnerships for the development of synthetic aperture radar. For example, in October 2023, Data Patterns entered into a licensing and transfer of technology (ToT) agreement with space nodal agency IN-SPACe for Synthetic Aperture Radar (SAR) development. The partnership will help Data Patterns in radar development efforts.

China is severely affected by monsoon weather and frequent meteorological disasters. China also has experienced severe landslides, floodwaters, and other geological hazards. Thus, China has emphasized the deployment of interferometric synthetic aperture radar (InSAR) satellites. For example, in March 2023, China launched four interferometric synthetic aperture radar (InSAR) satellites developed by Chinese private satellite developer GalaxySpace using the CZ-2D rocket at the Taiyuan Satellite launch center in North China's Shanxi province. This type of satellite provides comparatively stable formation configuration and high mapping efficiency. The satellites are a powerful tool for the early identification of major geological hazards in complex areas due to their millimeter-level deformation monitoring capability. They can provide data support for exploration and the prevention of land subsidence, collapse, landslides, and other disasters. Thus, such instances drive the growth of the synthetic aperture radar market in Asia Pacific.

Asia Pacific Synthetic Aperture Radar Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Synthetic Aperture Radar Market Segmentation

The Asia Pacific synthetic aperture radar market is categorized into component, frequency band, application, platform, mode, and country.

Based on component, the Asia Pacific synthetic aperture radar market is categorized into receiver, transmitter, and antenna. The antenna segment held the largest market share in 2022.

In terms of frequency band, the Asia Pacific synthetic aperture radar market is categorized into x band, l band, c band, s band, and others. The x band segment held the largest market share in 2022.

By application, the Asia Pacific synthetic aperture radar market is segmented into commercial and defense. The defense segment held a larger market share in 2022.

Based on platform, the Asia Pacific synthetic aperture radar market is bifurcated into ground and airborne. The airborne segment held a larger market share in 2022.

In terms of mode, the Asia Pacific synthetic aperture radar market is bifurcated into single and multi. The multi segment held a larger market share in 2022.

By country, the Asia Pacific synthetic aperture radar market is segmented into Australia, Japan, India, China, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific synthetic aperture radar market share in 2022.

Northrop Grumman Corp, ASELSAN AS, BAE Systems Plc, Israel Aerospace Industries Ltd, Leonardo SpA, Lockheed Martin Corp, Raytheon Technologies Corp, Thales SA, and Saab AB are some of the leading companies operating in the Asia Pacific synthetic aperture radar market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Synthetic Aperture Radar Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

5. Asia Pacific Synthetic Aperture Radar Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Preference for Ensuring Precision Targeting Capability

- 5.1.2 Rising Preference for Integrated C4ISR Ecosystem

- 5.1.3 Growing Demand for Earth Observation and Remote Sensing Capabilities

- 5.2 Market Restraints

- 5.2.1 Satellite Launch Delays

- 5.2.2 High Development Cost

- 5.3 Market Opportunities

- 5.3.1 Rising Development of Dual-Band SAR

- 5.3.2 Increasing Use of SAR in Agriculture Industry

- 5.4 Future Trends

- 5.4.1 Integration with Deep Learning (DL)

- 5.5 Impact of Drivers and Restraints:

6. Synthetic Aperture Radar Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Synthetic Aperture Radar Market Revenue (US$ Million), 2020-2030

- 6.2 Synthetic Aperture Radar Market Forecast Analysis

7. Asia Pacific Synthetic Aperture Radar Market Analysis - by Component

- 7.1 Receiver

- 7.1.1 Overview

- 7.1.2 Receiver: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Transmitter

- 7.2.1 Overview

- 7.2.2 Transmitter: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Antenna

- 7.3.1 Overview

- 7.3.2 Antenna: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Synthetic Aperture Radar Market Analysis - by Frequency Band

- 8.1 X Band

- 8.1.1 Overview

- 8.1.2 X Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 L Band

- 8.2.1 Overview

- 8.2.2 L Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 C Band

- 8.3.1 Overview

- 8.3.2 C Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 S Band

- 8.4.1 Overview

- 8.4.2 S Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Synthetic Aperture Radar Market Analysis - by Application

- 9.1 Commercial

- 9.1.1 Overview

- 9.1.2 Commercial: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Defense

- 9.2.1 Overview

- 9.2.2 Defense: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

10. Asia Pacific Synthetic Aperture Radar Market Analysis - by Platform

- 10.1 Ground

- 10.1.1 Overview

- 10.1.2 Ground: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 10.2 Airborne

- 10.2.1 Overview

- 10.2.2 Airborne: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

11. Asia Pacific Synthetic Aperture Radar Market Analysis - by Mode

- 11.1 Single

- 11.1.1 Overview

- 11.1.2 Single: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 11.2 Multi

- 11.2.1 Overview

- 11.2.2 Multi: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

12. Asia Pacific Synthetic Aperture Radar Market - Country Analysis

- 12.1 Asia Pacific Synthetic Aperture Radar Market - Country Analysis

- 12.1.1 Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast Analysis - by Country

- 12.1.1.1 Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast Analysis - by Country

- 12.1.1.2 Australia: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.2.1 Australia: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.2.2 Australia: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.2.3 Australia: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.2.4 Australia: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.2.5 Australia: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.3 Japan: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.3.1 Japan: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.3.2 Japan: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.3.3 Japan: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.3.4 Japan: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.3.5 Japan: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.4 India: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.4.1 India: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.4.2 India: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.4.3 India: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.4.4 India: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.4.5 India: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.5 China: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.5.1 China: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.5.2 China: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.5.3 China: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.5.4 China: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.5.5 China: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.6 South Korea: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.6.1 South Korea: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.6.2 South Korea: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.6.3 South Korea: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.6.4 South Korea: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.6.5 South Korea: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.7 Rest of Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.7.1 Rest of Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.7.2 Rest of Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.7.3 Rest of Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.7.4 Rest of Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.7.5 Rest of Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1 Asia Pacific: Synthetic Aperture Radar Market - Revenue and Forecast Analysis - by Country

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 Product Development

- 13.4 Partnership & Collaboration

- 13.5 Expansion

- 13.6 Others

14. Company Profiles

- 14.1 Northrop Grumman Corp

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 ASELSAN AS

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 BAE Systems Plc

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Israel Aerospace Industries Ltd

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Leonardo SpA

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Lockheed Martin Corp

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Raytheon Technologies Corp

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Thales SA

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Saab AB

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners

- 15.2 Word Index