|

|

市場調査レポート

商品コード

1567887

北米の合成開口レーダー:2030年までの市場予測 - 地域分析 - コンポーネント別、周波数帯域別、用途別、プラットフォーム別、モード別North America Synthetic Aperture Radar Market Forecast to 2030 - Regional Analysis - by Component, Frequency Band, Application, Platform, and Mode |

||||||

|

|||||||

| 北米の合成開口レーダー:2030年までの市場予測 - 地域分析 - コンポーネント別、周波数帯域別、用途別、プラットフォーム別、モード別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 105 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の合成開口レーダー市場は、2022年に20億6,403万米ドルとなり、2030年までには47億934万米ドルに達すると予測され、2022年から2030年までのCAGRは10.9%と推定されます。

高精度ターゲティング能力確保への志向の高まりが北米の合成開口レーダー市場を後押し

新世代の航空機と先進電子走査アレイ(AESA)レーダーが統合され、複数の帯域幅で情報を送受信できるようになったことで、精密な照準能力を確保することへの選好が高まっています。SARの大きな特徴のひとつは、逆SAR(ISAR)画像によって目標情報を提供できることです。ISAR技術は、レーダー画像を使って目標の動きを追跡し、高解像度の二次元画像を生成します。この能力は、SAR/ISARレーダー画像を使ったターゲットの検出と追跡を可能にするため、精密ターゲティングにとって特に価値があります。

精密ターゲティングは、現代の戦争や監視活動において最も重要です。ターゲットを正確に識別し追跡する能力は、軍事・防衛組織にとって極めて重要です。SARは、正確な目標検出のための高解像度画像処理能力を提供することで、このニーズを満たす上で重要な役割を果たしています。精密な標的探知能力の開発が進んでいることから、SARの需要が高まり、市場成長にプラスの影響を与えると予想されます。アクティブ電子走査アレイ(AESA)レーダーの統合は、XバンドとKuバンドレーダーの使用とともに、より細かいターゲット検出を可能にし、精密ターゲティングの全体的な効果を高めます。さらに、ISARレーダーは海上哨戒機で重要な役割を果たしており、あらゆる気象条件下で水上艦船やその他の物体の探知、画像化、分類を可能にしています。この能力は目標認識目的には極めて重要であり、SARシステムの需要に寄与しています。

北米の合成開口レーダー市場概要

北米の合成開口レーダー(SAR)市場は、米国、カナダ、メキシコに区分されます。国境警備、監視、環境モニタリング、政府支出の増加が、予測期間中に合成開口レーダーの需要を生み出すと予測されています。気候危機は気温を上昇させ、世界最大の氷床である東南極の融解の原因となっており、海面を何メートルも押し上げる可能性があります。そのため、氷床、氷河、海氷を含む地球の凍結地域の変化を監視する合成開口レーダーを開発するため、北米中の組織が協力しています。例えば、2024年1月、アメリカ航空宇宙局(NASA)とインド宇宙研究機関(ISRO)は共同で、NASA-ISRO合成開口レーダー(NISAR)を開発しました。NISARは先進的なレーダー技術を採用し、地球の陸地と氷の表面の変化を監視し、主に極地の棚氷の動態に焦点を当てます。この構想は、東南極大陸からの衛星画像が著しい氷河の崩壊を示し、詳細なモニタリングの緊急の必要性を浮き彫りにしていることから、重要な時期を迎えています。

政府投資の拡大と軍事・防衛費の増加は、合成開口レーダーの成長を後押ししています。さらに、商業投資と政府投資は、地球観測衛星とリモートセンシングデータの急成長に先行しています。例えば、2022年3月現在、米軍の研究者は、合成開口レーダー画像における自動物体認識を改善することを目的としたFiddlerプログラム(DARPA-SN-22-23)を発表しています。SARのユニークな画像処理能力は、自然災害後の変化検知や違法漁業の特定など、一刻を争う用途に特に有用です。さらに、いくつかの主要企業は、商業用リモート・センシング・システムのために合併や買収などの戦略的イニシアチブをとっています。例えば、2023年11月、NASAはICEYEの合成開口レーダーデータを取得し、NASAの地球科学研究目標を推進するための適切性を判断するため、科学界や学術界による評価を行っています。このような買収や開発が北米の合成開口レーダー市場シェアの成長を後押ししています。

北米の合成開口レーダー市場の収益と2030年までの予測(金額)

北米の合成開口レーダー市場セグメンテーション

北米の合成開口レーダー市場は、コンポーネント、周波数帯域、用途、プラットフォーム、モード、国に分類されます。

コンポーネント別では、北米の合成開口レーダー市場は受信機、送信機、アンテナに分類されます。アンテナセグメントは2022年に最大の市場シェアを占めました。

周波数帯では、北米の合成開口レーダー市場はxバンド、lバンド、cバンド、sバンド、その他に分類されます。2022年にはxバンドセグメントが最大の市場シェアを占めました。

用途別では、北米の合成開口レーダー市場は商業用と防衛用に区分されます。2022年の市場シェアは防衛分野が占めました。

プラットフォーム別では、北米の合成開口レーダー市場は地上用と空中用に二分されます。2022年の市場シェアは、航空機セグメントが占めました。

モード別では、北米の合成開口レーダー市場はシングルとマルチに二分されます。2022年の市場シェアはマルチの方が大きいです。

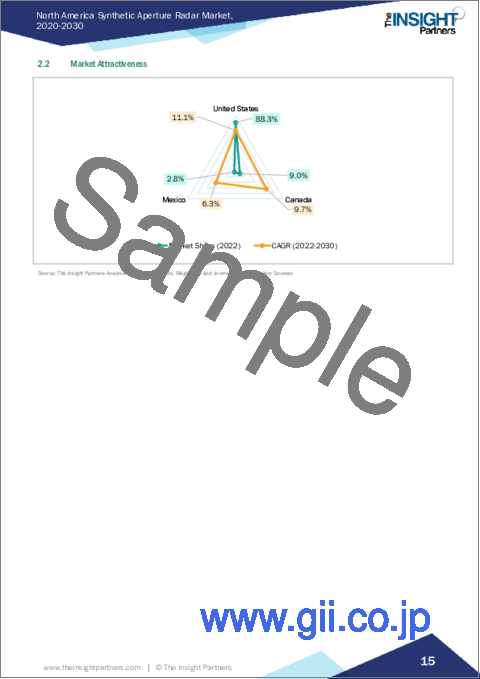

国別では、北米の合成開口レーダー市場は米国、カナダ、メキシコに区分されます。2022年の北米の合成開口レーダー市場シェアは米国が独占しました。

Northrop Grumman Corp、BAE Systems Plc、Leonardo SpA、Lockheed Martin Corp、Raytheon Technologies Corp、Thales SA、General Atomics Aeronautical Systems Inc、Saab ABは、北米の合成開口レーダー市場で事業展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブ・サマリー

- 主要洞察

- 市場の魅力

第3章 調査方法

- 調査範囲

- 二次調査

- 一次調査

第4章 北米の合成開口レーダー市場展望

- エコシステム分析

第5章 北米の合成開口レーダー市場:主要市場ダイナミクス

- 市場促進要因

- 高精度ターゲティング能力確保への志向の高まり

- 統合されたC4ISRエコシステムへの好みの高まり

- 地球観測およびリモートセンシング機能に対する需要の高まり

- 市場抑制要因

- 衛星打ち上げの遅れ

- 高い開発コスト

- 市場機会

- デュアルバンドSARの開発台数増加

- 農業分野でのSAR利用の増加

- 今後の動向

- ディープラーニング(DL)との統合

- 促進要因と抑制要因の影響

第6章 合成開口レーダー市場:北米市場分析

- 北米の合成開口レーダー市場収益、2020年~2030年

- 合成開口レーダーの市場予測分析

第7章 北米の合成開口レーダー市場分析 - コンポーネント別

- 受信機

- 送信機

- アンテナ

第8章 北米の合成開口レーダー市場分析 - 周波数帯別

- Xバンド

- Lバンド

- Cバンド

- Sバンド

- その他

第9章 北米の合成開口レーダー市場分析 - 用途別

- 商業

- 防衛

第10章 北米の合成開口レーダー市場の分析 - プラットフォーム別

- 地上

- 空挺

第11章 北米の合成開口レーダー市場分析 - モード別

- シングル

- マルチ

第12章 北米の合成開口レーダー市場 - 国別分析

- 北米市場の概要

- 北米

- 米国

- カナダ

- メキシコ

- 北米

第13章 業界概況

- 市場イニシアティブ

- 製品開発

- パートナーシップとコラボレーション

- 事業拡大

- その他

第14章 企業プロファイル

- Northrop Grumman Corp

- BAE Systems Plc

- Leonardo SpA

- Lockheed Martin Corp

- Raytheon Technologies Corp

- Thales SA

- General Atomics Aeronautical Systems Inc

- Saab AB

第15章 付録

List Of Tables

- Table 1. Synthetic Aperture Radar Market Segmentation

- Table 2. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 4. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Frequency Band

- Table 5. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 6. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Platform

- Table 7. Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 8. North America: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 9. United States: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 10. United States: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 11. United States: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 12. United States: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 13. United States: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 14. Canada: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 15. Canada: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 16. Canada: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 17. Canada: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 18. Canada: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 19. Mexico: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 20. Mexico: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Frequency Band

- Table 21. Mexico: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 22. Mexico: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Platform

- Table 23. Mexico: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 24. List of Abbreviation

List Of Figures

- Figure 1. Synthetic Aperture Radar Market Segmentation, by Country

- Figure 2. Ecosystem Analysis

- Figure 3. Synthetic Aperture Radar Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Synthetic Aperture Radar Market Revenue (US$ Million), 2020-2030

- Figure 6. Synthetic Aperture Radar Market Share (%) - by Component (2022 and 2030)

- Figure 7. Receiver: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Transmitter: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Antenna: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Synthetic Aperture Radar Market Share (%) - by Frequency Band (2022 and 2030)

- Figure 11. X Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. L Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. C Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. S Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Others: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Synthetic Aperture Radar Market Share (%) - by Application (2022 and 2030)

- Figure 17. Commercial: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Defense: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Synthetic Aperture Radar Market Share (%) - by Platform (2022 and 2030)

- Figure 20. Ground: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Airborne: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Synthetic Aperture Radar Market Share (%) - by Mode (2022 and 2030)

- Figure 23. Single: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Multi: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. North America Synthetic Aperture Radar Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 26. North America: Synthetic Aperture Radar Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 27. United States: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 28. Canada: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

- Figure 29. Mexico: Synthetic Aperture Radar Market - Revenue and Forecast to 2030(US$ Million)

The North America synthetic aperture radar market was valued at US$ 2,064.03 million in 2022 and is expected to reach US$ 4,709.34 million by 2030; it is estimated to register a CAGR of 10.9% from 2022 to 2030.

Increasing Preference for Ensuring Precision Targeting Capability Fuels North America Synthetic Aperture Radar Market

The increasing preference for ensuring precision targeting capability is driven by the integration of newer-generation aircraft with advanced electronically scanned array (AESA) radars, which enable the transmission and reception of information on multiple bandwidths. One of the major features of SAR is its ability to provide target information through inverse SAR (ISAR) images. ISAR technology uses radar imaging to generate high-resolution two-dimensional images of a target by tracking its movement. This capability is particularly valuable for precision targeting, as it allows for the detection and tracking of targets using SAR/ISAR radar images.

Precision targeting is of utmost importance in modern warfare and surveillance operations. The ability to accurately identify and track targets is crucial for military and defense organizations. SAR plays a crucial role in fulfilling this need by providing high-resolution imaging capabilities for precise target detection. The rising developments in precision targeting capability are expected to drive the demand for SAR and positively impact market growth. The integration of active electronically scanned array (AESA) radars, along with the use of X-band and Ku-band radars, enables finer target detection and enhances the overall effectiveness of precision targeting. Furthermore, ISAR radars play a significant role in maritime patrol aircraft, allowing for the detection, imaging, and classification of surface ships and other objects in all weather conditions. This capability is crucial for target recognition purposes and contributes to the demand for SAR systems.

North America Synthetic Aperture Radar Market Overview

The North America synthetic aperture radar (SAR) market is segmented into the US, Canada, and Mexico. The increasing border security, surveillance, environmental monitoring, and government spending are anticipated to create demand for synthetic aperture radar during the forecast period. The climate crisis is driving temperatures higher and being the reason for the melting of the world's biggest ice sheet-the East Antarctic, could drive up sea level by many meters. Thus, organizations across North America are collaborating to create synthetic aperture radar to monitor changes in Earth's frozen regions, including ice sheets, glaciers, and sea ice. For instance, in January 2024, the US National Aeronautics and Space Administration (NASA) and the Indian Space Research Organization (ISRO) collaborated to develop the NASA-ISRO Synthetic Aperture Radar (NISAR). NISAR will employ advanced radar technology to monitor changes across Earth's land and ice surfaces, primarily focusing on the dynamics of ice shelves in polar regions. This initiative comes at a crucial time, as satellite imagery from East Antarctica has shown significant glacial collapse, highlighting the urgent need for detailed monitoring.

The growing government investment and increasing military & defense spending empower the growth of synthetic aperture radar. Moreover, commercial and government investments are preceding rapid growth in Earth-observation satellites and remote-sensing data. For instance, as of March 2022, the US military researchers announced the Fiddler program (DARPA-SN-22-23), intended to improve automatic object recognition in synthetic aperture radar images. The unique imaging capability of SAR makes it particularly useful for time-critical applications such as change detection after natural disasters and identifying illegal fishing operations. Further, several key players are taking strategic initiatives such as mergers and acquisitions for commercial remote sensing systems. For instance, in November 2023, NASA acquired ICEYE's synthetic-aperture radar data for evaluation by scientific and academic communities to determine the rightness for advancing NASA's Earth Science research objectives. Thus, such acquisitions and developments propel the growth of the synthetic aperture radar market share in North America.

North America Synthetic Aperture Radar Market Revenue and Forecast to 2030 (US$ Million)

North America Synthetic Aperture Radar Market Segmentation

The North America synthetic aperture radar market is categorized into component, frequency band, application, platform, mode, and country.

Based on component, the North America synthetic aperture radar market is categorized into receiver, transmitter, and antenna. The antenna segment held the largest market share in 2022.

In terms of frequency band, the North America synthetic aperture radar market is categorized into x band, l band, c band, s band, and others. The x band segment held the largest market share in 2022.

By application, the North America synthetic aperture radar market is segmented into commercial and defense. The defense segment held a larger market share in 2022.

Based on platform, the North America synthetic aperture radar market is bifurcated into ground and airborne. The airborne segment held a larger market share in 2022.

In terms of mode, the North America synthetic aperture radar market is bifurcated into single and multi. The multi segment held a larger market share in 2022.

By country, the North America synthetic aperture radar market is segmented into the US, Canada, and Mexico. The US dominated the North America synthetic aperture radar market share in 2022.

Northrop Grumman Corp, BAE Systems Plc, Leonardo SpA, Lockheed Martin Corp, Raytheon Technologies Corp, Thales SA, General Atomics Aeronautical Systems Inc, and Saab AB are some of the leading companies operating in the North America synthetic aperture radar market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Synthetic Aperture Radar Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

5. North America Synthetic Aperture Radar Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Preference for Ensuring Precision Targeting Capability

- 5.1.2 Rising Preference for Integrated C4ISR Ecosystem

- 5.1.3 Growing Demand for Earth Observation and Remote Sensing Capabilities

- 5.2 Market Restraints

- 5.2.1 Satellite Launch Delays

- 5.2.2 High Development Cost

- 5.3 Market Opportunities

- 5.3.1 Rising Development of Dual-Band SAR

- 5.3.2 Increasing Use of SAR in Agriculture Industry

- 5.4 Future Trends

- 5.4.1 Integration with Deep Learning (DL)

- 5.5 Impact of Drivers and Restraints:

6. Synthetic Aperture Radar Market - North America Market Analysis

- 6.1 North America Synthetic Aperture Radar Market Revenue (US$ Million), 2020-2030

- 6.2 Synthetic Aperture Radar Market Forecast Analysis

7. North America Synthetic Aperture Radar Market Analysis - by Component

- 7.1 Receiver

- 7.1.1 Overview

- 7.1.2 Receiver: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

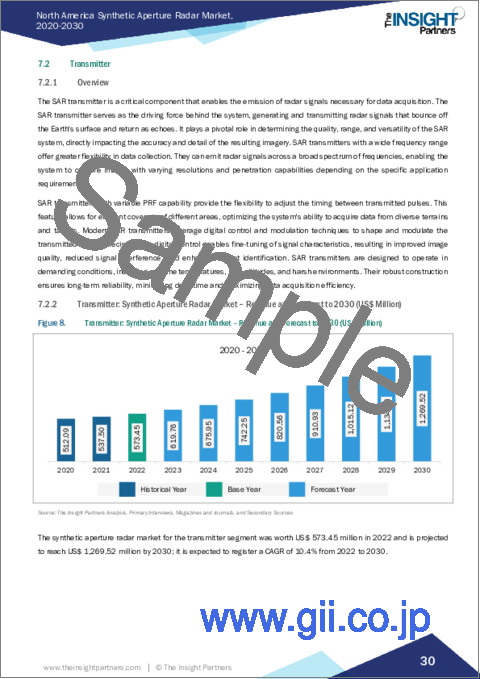

- 7.2 Transmitter

- 7.2.1 Overview

- 7.2.2 Transmitter: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Antenna

- 7.3.1 Overview

- 7.3.2 Antenna: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Synthetic Aperture Radar Market Analysis - by Frequency Band

- 8.1 X Band

- 8.1.1 Overview

- 8.1.2 X Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 L Band

- 8.2.1 Overview

- 8.2.2 L Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 C Band

- 8.3.1 Overview

- 8.3.2 C Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 S Band

- 8.4.1 Overview

- 8.4.2 S Band: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Synthetic Aperture Radar Market Analysis - by Application

- 9.1 Commercial

- 9.1.1 Overview

- 9.1.2 Commercial: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Defense

- 9.2.1 Overview

- 9.2.2 Defense: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Synthetic Aperture Radar Market Analysis - by Platform

- 10.1 Ground

- 10.1.1 Overview

- 10.1.2 Ground: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 10.2 Airborne

- 10.2.1 Overview

- 10.2.2 Airborne: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

11. North America Synthetic Aperture Radar Market Analysis - by Mode

- 11.1 Single

- 11.1.1 Overview

- 11.1.2 Single: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 11.2 Multi

- 11.2.1 Overview

- 11.2.2 Multi: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

12. North America Synthetic Aperture Radar Market - Country Analysis

- 12.1 North America Market Overview

- 12.1.1 North America: Synthetic Aperture Radar Market - Revenue and Forecast Analysis - by Country

- 12.1.1.1 North America: Synthetic Aperture Radar Market - Revenue and Forecast Analysis - by Country

- 12.1.1.2 United States: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.2.1 United States: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.2.2 United States: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.2.3 United States: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.2.4 United States: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.2.5 United States: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.3 Canada: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.3.1 Canada: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.3.2 Canada: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.3.3 Canada: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.3.4 Canada: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.3.5 Canada: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1.4 Mexico: Synthetic Aperture Radar Market - Revenue and Forecast to 2030 (US$ Million)

- 12.1.1.4.1 Mexico: Synthetic Aperture Radar Market Breakdown, by Component

- 12.1.1.4.2 Mexico: Synthetic Aperture Radar Market Breakdown, by Frequency Band

- 12.1.1.4.3 Mexico: Synthetic Aperture Radar Market Breakdown, by Application

- 12.1.1.4.4 Mexico: Synthetic Aperture Radar Market Breakdown, by Platform

- 12.1.1.4.5 Mexico: Synthetic Aperture Radar Market Breakdown, by Mode

- 12.1.1 North America: Synthetic Aperture Radar Market - Revenue and Forecast Analysis - by Country

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 Product Development

- 13.4 Partnership & Collaboration

- 13.5 Expansion

- 13.6 Others

14. Company Profiles

- 14.1 Northrop Grumman Corp

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 BAE Systems Plc

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Leonardo SpA

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Lockheed Martin Corp

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Raytheon Technologies Corp

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Thales SA

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 General Atomics Aeronautical Systems Inc

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Saab AB

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners

- 15.2 Word Index