|

|

市場調査レポート

商品コード

1567862

北米のトウモロコシと小麦ベースの飼料:2030年までの市場予測 - 地域分析 - 製品タイプ別、家畜別North America Corn and Wheat-Based Feed Market Forecast to 2030 - Regional Analysis - by Product Type and Livestock (Poultry, Ruminants, Swine, Aquaculture, and Others) |

||||||

|

|||||||

| 北米のトウモロコシと小麦ベースの飼料:2030年までの市場予測 - 地域分析 - 製品タイプ別、家畜別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 78 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のトウモロコシと小麦ベースの飼料市場は、2022年に532億1,134万米ドルと評価され、2030年には768億4,254万米ドルに達すると予測され、2022年から2030年までのCAGRは4.7%と推定されます。

有機飼料への嗜好の高まりが北米のトウモロコシと小麦ベースの飼料市場を牽引

有機食品を摂取する動物は、栄養価の高い肉を提供します。有機ミルクと肉には、酵素、バイオフラボノイド、抗酸化物質などの栄養素が豊富に含まれています。そのため、健康志向の消費者は、農薬を使用していない従来の食品よりも有機食品や有機肉を好みます。オーガニック肉と乳製品に対する需要の高まりを受けて、畜産農場、養鶏部門、畜産業は、消費者にオーガニック肉を供給するため、高品質のオーガニック・コーンと小麦ベースの飼料の購入に力を入れています。従来の飼料には、動物が摂取すると肉質を損なう化学物質が多量に含まれていることが多いです。そのような肉を長期的に摂取すると、さまざまな健康障害を引き起こします。この問題を克服するため、メーカーは有機成分で生産されたトウモロコシや小麦ベースの飼料製品に多額の投資を行っています。また、化学添加物を含まない有機製品の開発も進んでいます。これらすべての要因から、有機飼料への嗜好の高まりは、予測期間中、北米のトウモロコシと小麦ベースの飼料市場の重要な動向になると予想されます。

北米のトウモロコシと小麦ベースの飼料市場概要

北米のトウモロコシと小麦ベースの飼料需要の急増は、家畜生産の増加に起因しています。米国農務省の全米農業統計局(NASS)が発表したCattle Reportによると、2024年1月1日現在、米国の農場で飼育されている牛と子牛の頭数は8,720万頭です。北米では、人口増加、都市化、タンパク質が豊富な食事への嗜好の変化により、肉の消費量が増加しています。その結果、食肉生産のために飼育される家畜の数を維持するために、家畜飼料の需要が増加しています。トウモロコシと小麦は、その栄養価の高さと手頃な価格から、動物用飼料の主原料となっています。

飼料におけるトウモロコシの利点に対する認識の高まりが、市場の成長をさらに後押ししています。トウモロコシはエネルギーとして消化性の高い炭水化物です。健康な皮膚と被毛のための脂肪酸、ベータカロチン、ビタミンE、ルテイン、天然の抗酸化物質、筋肉と組織の成長のための高品質のタンパク質が含まれています。また、トウモロコシは鶏にとって入手しやすく安価なエネルギー源であり、タンパク質でもあるため、市販の鶏用飼料によく使われています。豚と同じように、鶏も炭水化物を多く含むことで恩恵を受ける。炭水化物は良質なタンパク質源であり、体温を維持・成長させるためのエネルギーや、筋肉組織の成長と維持に必要な必須アミノ酸を供給します。さらに、米国は世界でもトップクラスのトウモロコシ生産国です。米国農務省(USDA)によると、2023年の同国のトウモロコシ生産量は153億ブッシェルを占める。また、メキシコとカナダでもトウモロコシが大量に生産されています。このように、この地域ではトウモロコシの入手が容易であり、トウモロコシベースの飼料を使用する利点に対する認識が高まっていることが、この地域の市場成長に寄与しています。

北米のトウモロコシと小麦ベースの飼料市場の収益と2030年までの予測(US$Million)

北米のトウモロコシと小麦ベースの飼料市場セグメンテーション

北米のトウモロコシと小麦ベースの飼料市場は、製品タイプ、家畜、国に分類されます。

製品タイプ別では、北米のトウモロコシと小麦ベースの飼料市場はトウモロコシベースと小麦ベースに二分されます。2022年の市場シェアはトウモロコシベースが大きいです。トウモロコシベースのセグメントはさらに、コーングルテンミール、コーングルテンフィード、その他のトウモロコシベースの飼料に細分化されます。小麦ベースのセグメントはさらに小麦グルテン、小麦ふすま、その他の小麦ベースの飼料に細分化されます。

家畜別では、北米のトウモロコシと小麦ベースの飼料市場は家禽、反芻動物、豚、養殖、その他に分類されます。2022年には反芻動物セグメントが最大の市場シェアを占めています。

国別では、北米のトウモロコシと小麦ベースの飼料市場は米国、カナダ、メキシコに区分されます。米国が2022年の北米のトウモロコシと小麦ベースの飼料市場シェアを独占しました。

Associated British Foods Plc、Jungbunzlauer Suisse AG、Roquette Freres SA、BENEO GmbH、International Nutritionals Ltd、Agrana Beteiligungs AG、Grain St Laurent Inc、Archer Daniels Midland Companyなどが北米のトウモロコシと小麦ベースの飼料市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

- 限界と前提条件

第4章 北米のトウモロコシと小麦ベースの飼料市場情勢

- 市場概要

- ポーター分析ファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造プロセス

- 流通業者または供給業者

- エンドユーザー

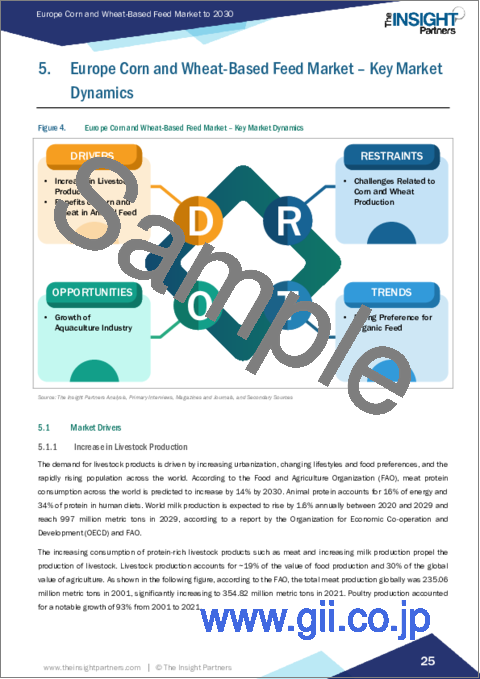

第5章 北米のトウモロコシと小麦ベースの飼料の市場:主要市場力学

- 市場促進要因

- 家畜生産の増加

- 動物飼料におけるトウモロコシと小麦の利点

- 市場抑制要因

- トウモロコシと小麦の生産に関する課題

- 市場機会

- 水産養殖産業の成長

- 今後の動向

- 有機飼料への嗜好の高まり

- 促進要因と抑制要因の影響

第6章 トウモロコシと小麦ベースの飼料市場:北米市場分析

- 北米のトウモロコシと小麦ベースの飼料市場収入, 2020-2030

- 北米のトウモロコシと小麦ベースの飼料市場予測分析

第7章 北米のトウモロコシと小麦ベースの飼料市場:製品タイプ別

- トウモロコシベース

- 小麦ベース

第8章 北米のトウモロコシと小麦ベースの飼料市場:家畜別

- 家禽

- 反芻動物

- 豚

- 水産養殖

- その他

第9章 北米のトウモロコシと小麦ベースの飼料市場:国別分析

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第11章 企業プロファイル

- Associated British Foods Plc

- Jungbunzlauer Suisse AG

- Roquette Freres SA

- BENEO GmbH

- International Nutritionals Ltd

- Agrana Beteiligungs AG

- Grain St Laurent Inc

- Archer Daniels Midland Company

第12章 付録

List Of Tables

- Table 1. North America Corn and Wheat-Based Feed Market Segmentation

- Table 2. North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 4. North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million) - by Livestock

- Table 5. North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 6. US: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 7. US: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million) - by Livestock

- Table 8. Canada: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 9. Canada: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million) - by Livestock

- Table 10. Mexico: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 11. Mexico: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million) - by Livestock

- Table 12. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. North America Corn and Wheat-Based Feed Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem Analysis: Corn and Wheat-Based Feed Market

- Figure 4. North America Corn and Wheat-Based Feed Market - Key Market Dynamics

- Figure 5. Global Meat Production by Livestock Type (2001-2021)

- Figure 6. World Aquaculture Production, 1091-2020

- Figure 7. Impact Analysis of Drivers and Restraints

- Figure 8. North America Corn and Wheat-Based Feed Market Revenue (US$ Million), 2020-2030

- Figure 9. North America Corn and Wheat-Based Feed Market Share (%) - by Product Type (2022 and 2030)

- Figure 10. Corn-Based: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Corn Gluten Meal: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Corn Gluten Feed: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Other Corn-Based Feed: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Wheat-Based: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Wheat Gluten: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Wheat Bran: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Other Wheat-Based Feed: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. North America Corn and Wheat-Based Feed Market Share (%) - by Livestock (2022 and 2030)

- Figure 19. Poultry: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Ruminants: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Swine: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Aquaculture: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Others: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. North America Corn and Wheat-Based Feed Market Breakdown, by Key Countries - Revenue (2022) (US$ Million)

- Figure 25. North America Corn and Wheat-Based Feed Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 26. US: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 27. Canada: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 28. Mexico: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 29. Company Positioning & Concentration

The North America corn and wheat-based feed market was valued at US$ 53,211.34 million in 2022 and is expected to reach US$ 76,842.54 million by 2030; it is estimated to register a CAGR of 4.7% from 2022 to 2030.

Rising Preference for Organic Feed Fuel North America Corn and Wheat-Based Feed Market

Animals who consume organic food offer meat that has high nutritional value. Organic milk and meat are rich in nutrients such as enzymes, bioflavonoids, and antioxidants. Hence, health-conscious consumers prefer organic food and organic meat over conventional food as it does not contain pesticides. Due to the growing demand for organic meat and dairy products, livestock farms, the poultry sector, and animal husbandry have focused on purchasing high-quality organic corn and wheat-based feed to supply organic meat to consumers. Conventional feed often contains high amounts of chemicals that hamper meat quality when consumed by animals. Long-term consumption of such meat results in various health disorders. To overcome this issue, manufacturers are investing heavily in corn and wheat-based feed products produced with organic constituents. Also, they are developing organic products that contain no chemical additives. Owing to all these factors, the rising preference for organic feed is expected to become a significant trend in the North America corn and wheat-based feed market during the forecast period.

North America Corn and Wheat-Based Feed Market Overview

The surge in demand for corn and wheat-based feed in North America can be attributed to the rise in livestock production. There were 87.2 million head of cattle and calves on the US farms as of January 1, 2024, according to the Cattle Report published by the US Department of Agriculture's National Agricultural Statistics Service (NASS). North America has seen increased meat consumption, driven by population growth, urbanization, and changing dietary preferences toward protein-rich diets. As a result, the demand for animal feed is rising to sustain the growing number of livestock raised for meat production. Corn and wheat are staple ingredients in animal feed formulations due to their nutritional value and affordability.

The increasing awareness of the advantages of corn in feed is further bolstering the market growth. Corn is a highly digestible carbohydrate for energy. It contains fatty acids for healthy skin and coat, beta-carotene, vitamin E, lutein, natural antioxidants, and high-quality proteins for muscle and tissue growth. Also, corn is a commonly used ingredient in commercial chicken feed because it's a readily available and inexpensive energy source and protein for chickens. Much like pigs, chickens benefit from the high carbohydrate content as it is a good source of protein and provides energy to maintain and grow their body temperature and essential amino acids for the growth and maintenance of muscle tissue. Additionally, the US is one of the top producers of corn in the world. According to United States Department of Agriculture (USDA), the corn production in the country in 2023 accounted for 15.3 billion bushels. Also, in Mexico and Canada there is huge production of corn. Thus, the easy availability of corn in the region and the rising awareness of benefits of using corn-based feed is contributing to the market growth in the region.

North America Corn and Wheat-Based Feed Market Revenue and Forecast to 2030 (US$ Million)

North America Corn and Wheat-Based Feed Market Segmentation

The North America corn and wheat-based feed market is categorized into product type, livestock, and country.

Based on product type, the North America corn and wheat-based feed market is bifurcated corn-based and wheat-based. The corn-based segment held a larger market share in 2022. The corn-based segment is further sub segmented into corn gluten meal, corn gluten feed, and other corn-based feed. The wheat-based segment is further sub segmented into wheat gluten, wheat bran, and other wheat-based feed.

In terms of livestock, the North America corn and wheat-based feed market is categorized into poultry, ruminants, swine, aquaculture, and others. The ruminants segment held the largest market share in 2022.

By country, the North America corn and wheat-based feed market is segmented into the US, Canada, and Mexico. The US dominated the North America corn and wheat-based feed market share in 2022.

Associated British Foods Plc, Jungbunzlauer Suisse AG, Roquette Freres SA, BENEO GmbH, International Nutritionals Ltd, Agrana Beteiligungs AG, Grain St Laurent Inc, and Archer Daniels Midland Company are some of the leading companies operating in the North America corn and wheat-based feed market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

- 3.4 Limitations and Assumptions

4. North America Corn and Wheat-Based Feed Market Landscape

- 4.1 Market Overview

- 4.2 Porter's Analysis Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturing Process

- 4.3.3 Distributors or Suppliers

- 4.3.4 End User

5. North America Corn and Wheat-Based Feed Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increase in Livestock Production

- 5.1.2 Benefits of Corn and Wheat in Animal Feed

- 5.2 Market Restraints

- 5.2.1 Challenges Related to Corn and Wheat Production

- 5.3 Market Opportunities

- 5.3.1 Growth of Aquaculture Industry

- 5.4 Future Trends

- 5.4.1 Rising Preference for Organic Feed

- 5.5 Impact of Drivers and Restraints:

6. Corn and Wheat-Based Feed Market - North America Market Analysis

- 6.1 North America Corn and Wheat-Based Feed Market Revenue (US$ Million), 2020-2030

- 6.2 North America Corn and Wheat-Based Feed Market Forecast Analysis

7. North America Corn and Wheat-Based Feed Market Analysis - by Product Type

- 7.1 Corn-Based

- 7.1.1 Overview

- 7.1.2 Corn-Based: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 7.1.3 Corn Gluten Meal

- 7.1.3.1 Overview

- 7.1.3.2 Corn Gluten Meal: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 7.1.4 Corn Gluten Feed

- 7.1.4.1 Overview

- 7.1.4.2 Corn Gluten Feed: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 7.1.5 Other Corn-Based Feed

- 7.1.5.1 Overview

- 7.1.5.2 Other Corn-Based Feed: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Wheat-Based

- 7.2.1 Overview

- 7.2.2 Wheat-Based: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2.3 Wheat Gluten

- 7.2.3.1 Overview

- 7.2.3.2 Wheat Gluten: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2.4 Wheat Bran

- 7.2.4.1 Overview

- 7.2.4.2 Wheat Bran: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2.5 Other Wheat-Based Feed

- 7.2.5.1 Overview

- 7.2.5.2 Other Wheat-Based Feed: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Corn and Wheat-Based Feed Market Analysis - by Livestock

- 8.1 Poultry

- 8.1.1 Overview

- 8.1.2 Poultry: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Ruminants

- 8.2.1 Overview

- 8.2.2 Ruminants: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Swine

- 8.3.1 Overview

- 8.3.2 Swine: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Aquaculture

- 8.4.1 Overview

- 8.4.2 Aquaculture: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Corn and Wheat-Based Feed Market - Country Analysis

- 9.1 North America Corn and Wheat-Based Feed Market Breakdown, by Key Countries, 2022 and 2030 (%)

- 9.1.1 North America Corn and Wheat-Based Feed Market - Revenue and Forecast Analysis - by Country

- 9.1.2 US: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.1 US: North America Corn and Wheat-Based Feed Market Breakdown, by Product Type

- 9.1.2.2 US: North America Corn and Wheat-Based Feed Market Breakdown, by Livestock

- 9.1.3 Canada: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.3.1 Canada: North America Corn and Wheat-Based Feed Market Breakdown, by Product Type

- 9.1.3.2 Canada: North America Corn and Wheat-Based Feed Market Breakdown, by Livestock

- 9.1.4 Mexico: North America Corn and Wheat-Based Feed Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.4.1 Mexico: North America Corn and Wheat-Based Feed Market Breakdown, by Product Type

- 9.1.4.2 Mexico: North America Corn and Wheat-Based Feed Market Breakdown, by Livestock

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning & Concentration

11. Company Profiles

- 11.1 Associated British Foods Plc

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 Jungbunzlauer Suisse AG

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 Roquette Freres SA

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 BENEO GmbH

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 International Nutritionals Ltd

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 Agrana Beteiligungs AG

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 Grain St Laurent Inc

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

- 11.8 Archer Daniels Midland Company

- 11.8.1 Key Facts

- 11.8.2 Business Description

- 11.8.3 Products and Services

- 11.8.4 Financial Overview

- 11.8.5 SWOT Analysis

- 11.8.6 Key Developments

12. Appendix

- 12.1 About The Insight Partners