|

|

市場調査レポート

商品コード

1567861

アジア太平洋の上流バイオプロセス:2030年までの市場予測 - 地域分析 - 製品タイプ、ワークフロー、用途、モード別Asia Pacific Upstream Bioprocessing Market Forecast to 2030 - Regional analysis - by Product Type, Workflow, Usage Type, and Mode |

||||||

|

|||||||

| アジア太平洋の上流バイオプロセス:2030年までの市場予測 - 地域分析 - 製品タイプ、ワークフロー、用途、モード別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 130 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の上流バイオプロセス市場は、2022年に19億7,610万米ドルと評価され、2030年には56億7,899万米ドルに達すると予測され、2022年から2030年までのCAGRは14.1%で成長すると予測されています。

技術の進歩がアジア太平洋の上流バイオプロセス市場を後押し。

上流バイオプロセス市場には技術的進歩の波が押し寄せており、大きな産業機会をもたらしています。これらの進歩には、細胞培養システム、バイオリアクター設計、プロセスモニタリング、制御、自動化とデジタル化の統合における革新的な開発が含まれます。2023年9月、Repligen CorporationとSartoriusは統合バイオリアクターシステムを発表しました。リプリゲンのXCell Alternating Tangential Flow(ATF)上流強化技術がSartorius Biostat攪拌タンクリアクター(STR)に統合されました。このバイオリアクター技術は、バイオ製薬企業にとって、N灌流と強化シードトレインの適用を容易にするように設計されています。バイオスタットSTRには、統合されたプロセス分析技術と事前に定義された高度な制御レシピを組み合わせたXCell ATFハードウェアおよびソフトウェアモジュールが組み込まれています。このモジュールは、細胞増殖の管理を簡素化し、灌流手順における細胞保持を強化することを目的としており、細胞保持コントロールタワーを別途用意する必要がないです。このような最新の製品は、プロセス効率、拡張性、適応性の向上を特徴としており、バイオ医薬品製造の進化する要求に応えるために極めて重要です。

高度な細胞培養培地製剤と次世代バイオリアクター技術は、上流バイオプロセスの最適化に貢献し、製品収率の向上、製品品質の改善、複雑な生物製剤の効率的な生産を可能にしています。高度な分析とリアルタイムのプロセスモニタリングの継続的な統合は、バイオプロセスにおけるデータ主導の意思決定に革命をもたらし、精度とプロセス最適化の機会を促進しています。バイオテクノロジーの進歩は、柔軟でモジュール化された製造プラットフォームの開発も促進します。さらに、機械学習、人工知能、予測分析の融合は、予測的なバイオプロセスへの道を開き、それによって事前予防的なプロセス制御、品質保証、コスト最適化の機会を引き出しています。このように、上流バイオプロセスの技術的進歩は業界を再形成し、イノベーション、効率性、適応性のための新たな道を提示しています。

アジア太平洋の上流バイオプロセス市場概要

アジア太平洋の上流バイオプロセス市場は、中国、日本、オーストラリア、インド、韓国、その他アジア太平洋地域に区分されます。この地域の市場は2022~2030年に最も高いCAGRで成長すると予測されます。中国、インド、日本はアジア太平洋地域の市場成長に大きく貢献しており、これは主にバイオリアクターの需要増加、研究センターや政府助成金の増加によるものです。さらに、多くの国際的な市場プレーヤーは、地理的拡大やその他の戦略のためにアジア太平洋の国々に焦点を当てています。

アジア太平洋の上流バイオプロセス市場の収益と2030年までの予測(金額)

アジア太平洋の上流バイオプロセス市場のセグメンテーション

アジア太平洋の上流バイオプロセス市場は、製品タイプ、ワークフロー、用途、モード、国別に区分されます。製品タイプ別では、アジア太平洋の上流バイオプロセス市場は、バイオリアクター/発酵槽、細胞培養、フィルター、バッグ・容器、その他に区分されます。バイオリアクター/発酵槽サービスは2022年に最大の市場シェアを占めました。

ワークフロー別では、アジア太平洋の上流バイオプロセス市場は培地調製、細胞培養、細胞分離に分類されます。細胞分離は2022年に最大の市場シェアを占めました。

用途別では、アジア太平洋の上流バイオプロセス市場はシングルユースとマルチユースに二分されます。2022年の市場シェアはシングルユースが大きいです。

モード別では、アジア太平洋の上流バイオプロセス市場はインハウスとアウトソースに二分されます。2022年の市場シェアはインハウスが大きいです。

国別では、アジア太平洋の上流バイオプロセス市場は、中国、日本、インド、オーストラリア、韓国、その他アジア太平洋地域に区分されます。2022年のアジア太平洋の上流バイオプロセス市場シェアは中国が独占。

Thermo Fisher Scientific Inc、Esco Micro Pte Ltd、Sartorius AG、Danaher Corp、Getinge AB、Merck KGaA、Corning Inc、Entegris Incは、アジア太平洋の上流バイオプロセス市場で事業展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブ・サマリー

- 主要な洞察

第3章 調査方法

- 調査範囲

- 二次調査

- 一次調査

第4章 アジア太平洋の上流バイオプロセス市場展望

- PEST分析

第5章 アジア太平洋の上流バイオプロセス市場:主要市場ダイナミクス

- 市場促進要因

- シングルユースバイオリアクターの商業利用

- バイオ医薬品製造のアウトソーシング

- 製薬・バイオ産業の急成長

- 市場の阻害要因

- 厳しい規制枠組み

- 市場機会

- 技術の進歩

- 今後の動向

- バイオ医薬品業界における研究開発投資の増加

- 促進要因と抑制要因の影響

第6章 上流バイオプロセス市場:アジア太平洋分析

第7章 アジア太平洋の上流バイオプロセス市場分析:製品タイプ別

- バイオリアクター/発酵槽

- 細胞培養

- フィルター

- バッグと容器

- その他

第8章 アジア太平洋の上流バイオプロセス市場分析:ワークフロー別

- 培地調製

- 細胞培養

- 細胞分離

第9章 アジア太平洋の上流バイオプロセス市場分析:用途別

- シングルユース

- マルチユース

第10章 アジア太平洋の上流バイオプロセス市場分析:モード別

- インハウス

- アウトソース

第11章 アジア太平洋の上流バイオプロセス市場-:国別分析

- アジア太平洋地域の市場概要

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋地域

- アジア太平洋

第12章 産業展望

- 上流バイオプロセス市場の成長戦略

- 有機的成長戦略

- 無機的成長戦略

第13章 企業プロファイル

- Thermo Fisher Scientific Inc

- Esco Micro Pte Ltd

- Sartorius AG

- Danaher Corp

- Getinge AB

- Merck KGaA

- Corning Inc

- Entegris Inc

第14章 付録

List Of Tables

- Table 1. Upstream Bioprocessing Market Segmentation

- Table 2. Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 3. Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Workflow

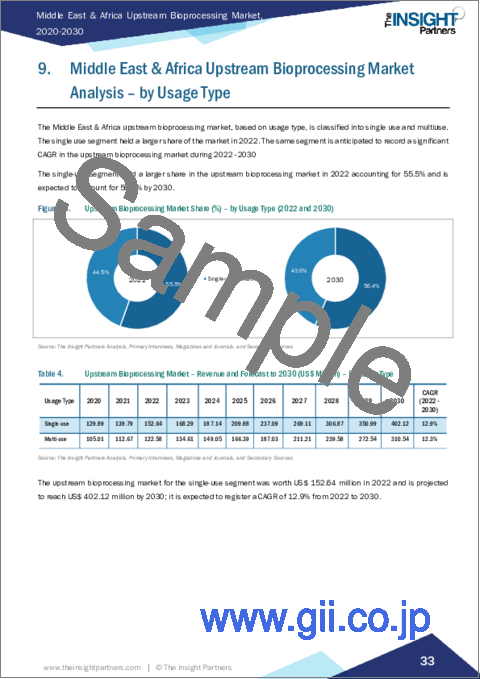

- Table 4. Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Usage Type

- Table 5. Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 6. Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 7. China: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 8. China: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Workflow

- Table 9. China: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Usage Type

- Table 10. China: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 11. Japan: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 12. Japan: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Workflow

- Table 13. Japan: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Usage Type

- Table 14. Japan: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 15. India: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 16. India: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Workflow

- Table 17. India: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Usage Type

- Table 18. India: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 19. Australia: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 20. Australia: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Workflow

- Table 21. Australia: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Usage Type

- Table 22. Australia: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 23. South Korea: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 24. South Korea: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Workflow

- Table 25. South Korea: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Usage Type

- Table 26. South Korea: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 27. Rest of Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 28. Rest of Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Workflow

- Table 29. Rest of Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Usage Type

- Table 30. Rest of Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 31. Recent Organic Growth Strategies in Upstream Bioprocessing Market

- Table 32. Recent Inorganic Growth Strategies in the Upstream Bioprocessing Market

- Table 33. Glossary of Terms, Upstream Bioprocessing Market

List Of Figures

- Figure 1. Upstream Bioprocessing Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Upstream Bioprocessing Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Upstream Bioprocessing Market Revenue (US$ Million), 2020-2030

- Figure 6. Upstream Bioprocessing Market Share (%) - by Product Type (2022 and 2030)

- Figure 7. Bioreactors/Fermenters: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Cell Culture: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Filters: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Bags and Containers: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Others: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Upstream Bioprocessing Market Share (%) - by Workflow (2022 and 2030)

- Figure 13. Media Preparation: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Cell Culture: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Cell Separation: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Upstream Bioprocessing Market Share (%) - by Usage Type (2022 and 2030)

- Figure 17. Single-use: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Multi-use: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Upstream Bioprocessing Market Share (%) - by Mode (2022 and 2030)

- Figure 20. In-house: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Outsourced: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Asia Pacific: Upstream Bioprocessing Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 23. Asia Pacific: Upstream Bioprocessing Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 24. China: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Japan: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. India: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 27. Australia: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 28. South Korea: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 29. Rest of Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 30. Growth Strategies in Upstream Bioprocessing Market

The Asia Pacific upstream bioprocessing market was valued at US$ 1,976.10 million in 2022 and is expected to reach US$ 5,678.99 million by 2030; it is estimated to grow at a CAGR of 14.1% from 2022 to 2030.

Technological Advancements Boost Asia Pacific Upstream Bioprocessing Market.

The upstream bioprocessing market is experiencing a wave of technological advancements, presenting considerable industry opportunities. These advancements include innovative developments in cell culture systems, bioreactor design, process monitoring, and control, as well as the integration of automation and digitalization. In September 2023, Repligen Corporation and Sartorius introduced an integrated bioreactor system. Repligen's XCell Alternating Tangential Flow (ATF) upstream intensification technology has been integrated into the Sartorius Biostat stirred-tank reactor (STR). This bioreactor technology is designed to make the application of N perfusion and intensified seed train easier for biopharmaceutical firms. An embedded XCell ATF hardware and software module that combines integrated process analytical technologies with predefined advanced control recipes is incorporated into Biostat STR. This module is intended to simplify the management of cell growth and enhance cell retention in perfusion procedures, eliminating the need for a separate cell retention control tower. Such modern products feature enhanced process efficiency, scalability, and adaptability, which are crucial for meeting the evolving demands of biopharmaceutical production.

Advanced cell culture media formulations and next-generation bioreactor technologies are contributing to the optimization of upstream bioprocessing, in turn, enabling higher product yields, improved product quality, and the efficient production of complex biologics. The ongoing integration of advanced analytics and real-time process monitoring is revolutionizing data-driven decision-making in bioprocessing, driving precision and process optimization opportunities. Progress in biotechnology also fosters the development of flexible and modular manufacturing platforms. Additionally, the convergence of machine learning, artificial intelligence, and predictive analytics is paving the way for predictive bioprocessing, thereby unlocking proactive process control, quality assurance, and cost optimization opportunities. Thus, technological advancements in upstream bioprocessing are reshaping the industry, presenting new avenues for innovation, efficiency, and adaptability.

Asia Pacific Upstream Bioprocessing Market Overview

The Asia Pacific upstream bioprocessing market is segmented into China, Japan, Australia, India, South Korea, and the Rest of Asia Pacific. The market in this region is expected to grow at the highest CAGR during 2022-2030. China, India, and Japan are three major contributors to the growth of the market in Asia Pacific, which is mainly driven by rising demand for bioreactors as well as an increase in research centers and government funding. Moreover, many international market players are focusing on countries in Asia Pacific for geographic expansion and other strategies.

Asia Pacific Upstream Bioprocessing Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Upstream Bioprocessing Market Segmentation

The Asia Pacific upstream bioprocessing market is segmented based on product type, workflow, usage type, mode, and country. Based on product type, the Asia Pacific upstream bioprocessing market is segmented into bioreactors/fermenters, cell culture, filters, bags and containers, and others. The bioreactors/fermenters services held the largest market share in 2022.

Based on workflow, the Asia Pacific upstream bioprocessing market is categorized into media preparation, cell culture, and cell separation. The cell separation held the largest market share in 2022.

Based on usage type, the Asia Pacific upstream bioprocessing market is bifurcated into single-use and multi-use. The single-use held a larger market share in 2022.

Based on mode, the Asia Pacific upstream bioprocessing market is bifurcated into In-house and outsourced. The In-house held a larger market share in 2022.

Based on country, the Asia Pacific upstream bioprocessing market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific upstream bioprocessing market share in 2022.

Thermo Fisher Scientific Inc, Esco Micro Pte Ltd, Sartorius AG, Danaher Corp, Getinge AB, Merck KGaA, Corning Inc, and Entegris Inc are some of the leading companies operating in the Asia Pacific upstream bioprocessing market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Upstream Bioprocessing Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

5. Asia Pacific Upstream Bioprocessing Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Commercial Use of Single-Use Bioreactors

- 5.1.2 Outsourcing of Biopharmaceutical Manufacturing

- 5.1.3 Rapid Growth of Pharmaceutical and Biotechnology Industries

- 5.2 Market Restraints

- 5.2.1 Stringent Regulatory Framework

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements

- 5.4 Future Trends

- 5.4.1 Increasing Investments in R&D in Biopharmaceutical Industry

- 5.5 Impact of Drivers and Restraints:

6. Upstream Bioprocessing Market - Asia Pacific Analysis

7. Asia Pacific Upstream Bioprocessing Market Analysis - by Product Type

- 7.1 Bioreactors/Fermenters

- 7.1.1 Overview

- 7.1.2 Bioreactors/Fermenters: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Cell Culture

- 7.2.1 Overview

- 7.2.2 Cell Culture: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Filters

- 7.3.1 Overview

- 7.3.2 Filters: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Bags and Containers

- 7.4.1 Overview

- 7.4.2 Bags and Containers: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Upstream Bioprocessing Market Analysis - by Workflow

- 8.1 Media Preparation

- 8.1.1 Overview

- 8.1.2 Media Preparation: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Cell Culture

- 8.2.1 Overview

- 8.2.2 Cell Culture: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Cell Separation

- 8.3.1 Overview

- 8.3.2 Cell Separation: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Upstream Bioprocessing Market Analysis - by Usage Type

- 9.1 Single-use

- 9.1.1 Overview

- 9.1.2 Single-use: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Multi-use

- 9.2.1 Overview

- 9.2.2 Multi-use: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

10. Asia Pacific Upstream Bioprocessing Market Analysis - by Mode

- 10.1 In-house

- 10.1.1 Overview

- 10.1.2 In-house: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 10.2 Outsourced

- 10.2.1 Overview

- 10.2.2 Outsourced: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

11. Asia Pacific Upstream Bioprocessing Market - Country Analysis

- 11.1 Asia Pacific Market Overview

- 11.1.1 Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast Analysis - by Country

- 11.1.1.1 Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast Analysis - by Country

- 11.1.1.2 China

- 11.1.1.3 China: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.3.1 China: Upstream Bioprocessing Market Breakdown, by Product Type

- 11.1.1.3.2 China: Upstream Bioprocessing Market Breakdown, by Workflow

- 11.1.1.3.3 China: Upstream Bioprocessing Market Breakdown, by Usage Type

- 11.1.1.3.4 China: Upstream Bioprocessing Market Breakdown, by Mode

- 11.1.1.4 Japan

- 11.1.1.5 Japan: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.5.1 Japan: Upstream Bioprocessing Market Breakdown, by Product Type

- 11.1.1.5.2 Japan: Upstream Bioprocessing Market Breakdown, by Workflow

- 11.1.1.5.3 Japan: Upstream Bioprocessing Market Breakdown, by Usage Type

- 11.1.1.5.4 Japan: Upstream Bioprocessing Market Breakdown, by Mode

- 11.1.1.6 India

- 11.1.1.7 India: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.7.1 India: Upstream Bioprocessing Market Breakdown, by Product Type

- 11.1.1.7.2 India: Upstream Bioprocessing Market Breakdown, by Workflow

- 11.1.1.7.3 India: Upstream Bioprocessing Market Breakdown, by Usage Type

- 11.1.1.7.4 India: Upstream Bioprocessing Market Breakdown, by Mode

- 11.1.1.8 Australia

- 11.1.1.9 Australia: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.9.1 Australia: Upstream Bioprocessing Market Breakdown, by Product Type

- 11.1.1.9.2 Australia: Upstream Bioprocessing Market Breakdown, by Workflow

- 11.1.1.9.3 Australia: Upstream Bioprocessing Market Breakdown, by Usage Type

- 11.1.1.9.4 Australia: Upstream Bioprocessing Market Breakdown, by Mode

- 11.1.1.10 South Korea

- 11.1.1.11 South Korea: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.11.1 South Korea: Upstream Bioprocessing Market Breakdown, by Product Type

- 11.1.1.11.2 South Korea: Upstream Bioprocessing Market Breakdown, by Workflow

- 11.1.1.11.3 South Korea: Upstream Bioprocessing Market Breakdown, by Usage Type

- 11.1.1.11.4 South Korea: Upstream Bioprocessing Market Breakdown, by Mode

- 11.1.1.12 Rest of Asia Pacific

- 11.1.1.13 Rest of Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.13.1 Rest of Asia Pacific: Upstream Bioprocessing Market Breakdown, by Product Type

- 11.1.1.13.2 Rest of Asia Pacific: Upstream Bioprocessing Market Breakdown, by Workflow

- 11.1.1.13.3 Rest of Asia Pacific: Upstream Bioprocessing Market Breakdown, by Usage Type

- 11.1.1.13.4 Rest of Asia Pacific: Upstream Bioprocessing Market Breakdown, by Mode

- 11.1.1 Asia Pacific: Upstream Bioprocessing Market - Revenue and Forecast Analysis - by Country

12. Industry Landscape

- 12.1 Overview

- 12.2 Growth Strategies in Upstream Bioprocessing Market

- 12.3 Organic Growth Strategies

- 12.3.1 Overview

- 12.4 Inorganic Growth Strategies

- 12.4.1 Overview

13. Company Profiles

- 13.1 Thermo Fisher Scientific Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Esco Micro Pte Ltd

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Sartorius AG

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Danaher Corp

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Getinge AB

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Merck KGaA

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Corning Inc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Entegris Inc

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Glossary of Terms