|

|

市場調査レポート

商品コード

1567860

北米の上流バイオプロセス市場の2030年予測- 地域別分析- 製品タイプ、ワークフロー、用途タイプ、モード別North America Upstream Bioprocessing Market Forecast to 2030 - Regional analysis - by Product Type, Workflow, Usage Type, and Mode |

||||||

|

|||||||

| 北米の上流バイオプロセス市場の2030年予測- 地域別分析- 製品タイプ、ワークフロー、用途タイプ、モード別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 127 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の上流バイオプロセス市場は、2022年に39億5,862万米ドルと評価され、2030年には106億338万米ドルに達すると予測され、2022年から2030年までのCAGRは13.1%と推定されます。

シングルユース・バイオリアクターの商業利用が北米の上流バイオプロセス市場を活性化します。

バイオ医薬品の商業生産に必要な堅牢な構造と高い性能により、様々なメーカーがシングルユース・バイオリアクター(SUB)を開発しています。バイオフィルム形成、攪拌メカニズム、バイオリアクター設計、センサーシステムなどに関連する技術が組み込まれた結果、実験室や生産規模での使い捨てリアクターの採用が増加しています。シングルユース・バイオリアクターは、次世代細胞・遺伝子治療薬の製造に使用され、連続バイオプロセスに適しています。細胞培養プロセスの進歩により、より高い力価と細胞密度が開発され、SUBの採用が促進されています。シングルユース・バイオリアクターは、コンタミネーションのリスクが低く、生産ターンアラウンドタイムが短く、バリデーション時間が短縮されます。ここ数年、シングルユース・バイオリアクターの使用は、柔軟性の向上、投資の削減、運用コストの抑制を支援する独自の能力により、最新のバイオ医薬品プロセスで増加しています。また、多くの企業が幅広い治療薬を製造するためのシングルユース・バイオリアクターを開発しています。2021年3月、サーモ・フィッシャー・サイエンティフィック社は3,000Lと5,000LのHyPerforma DynaDriveシングルユース・バイオリアクターを発売しました。ザルトリウスAGは幅広いシングルユース・バイオリアクターを提供しています。同社は、10-15mLのマイクロバイオリアクタースケール用のambr 15と50-2000L用のBiostat STRを提供しています。シングルユース・バイオリアクターの使用は、上流のバイオプロセスにおいて増加の一途をたどっています。このように、治療薬の生産にシングルユース・バイオリアクターが受け入れられつつあることが、上流バイオプロセス市場を後押ししています。

北米の上流バイオプロセス市場の概要

北米の上流バイオプロセス市場は、米国、カナダ、メキシコに区分されます。北米の市場成長の背景には、バイオ製薬・バイオテクノロジー企業によるバイオリアクターシステムに対する需要の増加、市場参入企業の存在感、学術・研究機関による研究開発努力の増大があります。また、製薬会社やバイオテクノロジー企業による研究活動が、北米の上流バイオプロセス市場の成長を促進しています。

北米の上流バイオプロセス市場の売上高と2030年までの予測(金額)

北米の上流バイオプロセス市場のセグメンテーション

北米の上流バイオプロセス市場は、製品タイプ、ワークフロー、使用タイプ、モード、国に基づいてセグメント化されます。

製品タイプ別では、北米の上流バイオプロセス市場はバイオリアクター/発酵槽、細胞培養、フィルター、バッグ・容器、その他に区分されます。バイオリアクター/発酵槽サービスは2022年に最大の市場シェアを占めました。

ワークフローに基づき、北米の上流バイオプロセス市場は培地調製、細胞培養、細胞分離に分類されます。細胞分離は2022年に最大の市場シェアを占めました。

使用タイプでは、北米の上流バイオプロセス市場はシングルユースとマルチユースに二分されます。2022年の市場シェアはシングルユースが大きいです。

モード別では、北米の上流バイオプロセス市場はインハウスとアウトソースに二分されます。2022年の市場シェアはインハウスが大きいです。

国別では、北米の上流バイオプロセス市場は米国、カナダ、メキシコに区分されます。2022年の北米の上流バイオプロセス市場シェアは米国が独占。

Thermo Fisher Scientific Inc、Esco Micro Pte Ltd、Sartorius AG、Danaher Corp、Getinge AB、Merck KGaA、Corning Inc、Entegris Inc、PBS Biotech Incは、北米の上流バイオプロセス市場で事業展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブ・サマリー

- 主要な洞察

第3章 調査方法

- 調査範囲

- 二次調査

- 一次調査

第4章 北米の上流バイオプロセス市場展望

- PEST分析

第5章 北米の上流バイオプロセス市場:主要市場ダイナミクス

- 市場促進要因

- シングルユースバイオリアクターの商業利用

- バイオ医薬品製造のアウトソーシング

- 製薬・バイオ産業の急成長

- 市場の阻害要因

- 厳しい規制枠組み

- 市場機会

- 技術の進歩

- 今後の動向

- バイオ医薬品業界における研究開発投資の増加

- 促進要因と抑制要因の影響

第6章 バイオプロセス上流市場:北米分析

第7章 北米の上流バイオプロセス市場分析-製品タイプ別

- バイオリアクター/発酵槽

- 細胞培養

- フィルター

- バッグと容器

- その他

第8章 北米の上流バイオプロセス市場分析:ワークフロー別

- 培地調製

- 細胞培養

- 細胞分離

第9章 北米の上流バイオプロセス市場分析-使用タイプ別

- シングルユース

- マルチユース

第10章 北米の上流バイオプロセス市場分析-モード別

- インハウス

- 外部委託

第11章 北米の上流バイオプロセス市場-国別分析

- 北米市場概要

- 北米

- 米国

- カナダ

- メキシコ

- 北米

第12章 業界概況

- 上流バイオプロセス市場の成長戦略

- 有機的成長戦略

- 無機的成長戦略

第13章 企業プロファイル

- Thermo Fisher Scientific Inc

- Esco Micro Pte. Ltd.

- Sartorius AG

- Danaher Corp

- Getinge AB

- Merck KGaA

- Corning Inc

- Entegris, Inc.

- PBS Biotech, Inc.

第14章 付録

List Of Tables

- Table 1. Upstream Bioprocessing Market Segmentation

- Table 2. Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Product Type

- Table 3. Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Workflow

- Table 4. Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Usage Type

- Table 5. Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million) - by Mode

- Table 6. North America: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 7. US: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Product Type

- Table 8. US: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Workflow

- Table 9. US: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Usage Type

- Table 10. US: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 11. Canada: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Product Type

- Table 12. Canada: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Workflow

- Table 13. Canada: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Usage Type

- Table 14. Canada: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 15. Mexico: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Product Type

- Table 16. Mexico: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Workflow

- Table 17. Mexico: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Usage Type

- Table 18. Mexico: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million) - by Mode

- Table 19. Recent Organic Growth Strategies in Upstream Bioprocessing Market

- Table 20. Recent Inorganic Growth Strategies in the Upstream Bioprocessing Market

- Table 21. Glossary of Terms, Upstream Bioprocessing Market

List Of Figures

- Figure 1. Upstream Bioprocessing Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Upstream Bioprocessing Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Upstream Bioprocessing Market Revenue (US$ Million), 2020-2030

- Figure 6. Upstream Bioprocessing Market Share (%) - by Product Type (2022 and 2030)

- Figure 7. Bioreactors/Fermenters: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Cell Culture: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Filters: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Bags and Containers: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Others: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Upstream Bioprocessing Market Share (%) - by Workflow (2022 and 2030)

- Figure 13. Media Preparation: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Cell Culture: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Cell Separation: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Upstream Bioprocessing Market Share (%) - by Usage Type (2022 and 2030)

- Figure 17. Single-use: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

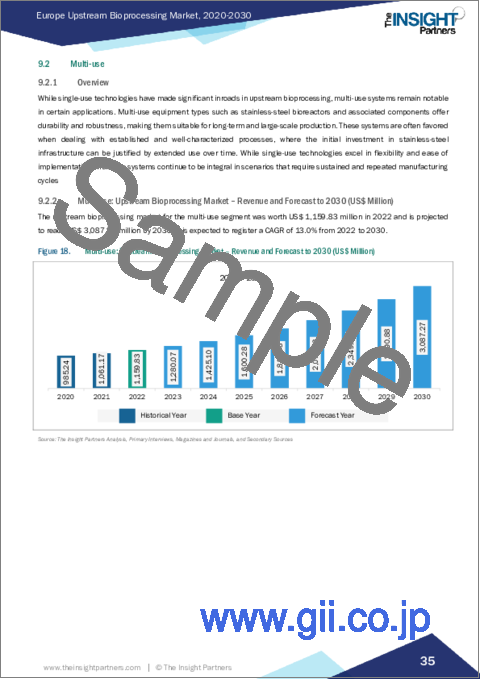

- Figure 18. Multi-use: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Upstream Bioprocessing Market Share (%) - by Mode (2022 and 2030)

- Figure 20. In-house: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Outsourced: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. North America Upstream Bioprocessing Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 23. North America: Upstream Bioprocessing Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 24. US: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million)

- Figure 25. Canada: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million)

- Figure 26. Mexico: Upstream Bioprocessing Market - Revenue and Forecast to 2030(US$ Million)

- Figure 27. Growth Strategies in Upstream Bioprocessing Market

The North America upstream bioprocessing market was valued at US$ 3,958.62 million in 2022 and is expected to reach US$ 10,603.38 million by 2030; it is estimated to grow at a CAGR of 13.1% from 2022 to 2030.

Commercial Use of Single-Use Bioreactors Fuels North America Upstream Bioprocessing Market.

Various manufacturers are developing single-use bioreactors (SUBs) due to their robust build and high performance, which are necessary for the commercial manufacturing of biopharmaceuticals. The incorporation of technologies associated with biofilm formation, stirring mechanisms, bioreactor designs, and sensor systems, among others, have resulted in the increased adoption of disposable reactors at the laboratory and production scales. Single-use bioreactors are operated to manufacture next-generation cell and gene therapies, and they are suitable for continuous bioprocessing. Advancements in cell-culture processes have developed higher titers and cell densities, facilitating the adoption of SUBs. Single-use bioreactors operate with a low risk of contamination, shorter production turnaround times, and reduced validation time. In the last few years, the use of single-use bioreactors has increased in modern biopharmaceutical processes owing to their unique ability to aid enhanced flexibility, reduce investments, and limit operational costs. Also, many companies have developed single-use bioreactors for producing a wide range of therapeutics. In March 2021, Thermo Fischer Scientific launched the 3,000 L and 5,000 L HyPerforma DynaDrive single-use bioreactors. Sartorius AG offers a wide range of single-use bioreactors. The company provides ambr 15 for a 10-15 mL micro bioreactor scale and Biostat STR for 50-2000L. The use of single-use bioreactors is subsequently increasing in upstream bioprocessing. Thus, the increasing acceptance of single-use bioreactors for the production of therapeutics propels the upstream bioprocessing market.

North America Upstream Bioprocessing Market Overview

The upstream bioprocessing market in North America is segmented into the US, Canada, and Mexico. Market growth in North America is attributed to the increasing demand for bioreactor systems from biopharmaceutical and biotechnology companies, the prominent presence of market players, and growing R&D efforts by academic and research institutes. In addition, research activities by pharmaceutical and biotechnology companies propel the upstream bioprocessing market growth in North America.

North America Upstream Bioprocessing Market Revenue and Forecast to 2030 (US$ Million)

North America Upstream Bioprocessing Market Segmentation

The North America upstream bioprocessing market is segmented based on product type, workflow, usage type, mode, and country.

Based on product type, the North America upstream bioprocessing market is segmented into bioreactors/fermenters, cell culture, filters, bags and containers, and others. The bioreactors/fermenters services held the largest market share in 2022.

Based on workflow, the North America upstream bioprocessing market is categorized into media preparation, cell culture, and cell separation. The cell separation held the largest market share in 2022.

In terms of usage type, the North America upstream bioprocessing market is bifurcated into single-use and multi-use. The single-use held a larger market share in 2022

By mode, the North America upstream bioprocessing market is bifurcated into In-house and outsourced. The In-house held a larger market share in 2022.

Based on country, the North America upstream bioprocessing market is segmented into the US, Canada, and Mexico. The US dominated the North America upstream bioprocessing market share in 2022.

Thermo Fisher Scientific Inc, Esco Micro Pte Ltd, Sartorius AG, Danaher Corp, Getinge AB, Merck KGaA, Corning Inc, Entegris Inc, and PBS Biotech Inc are some of the leading companies operating in the North America upstream bioprocessing market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Upstream Bioprocessing Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

5. North America Upstream Bioprocessing Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Commercial Use of Single-Use Bioreactors

- 5.1.2 Outsourcing of Biopharmaceutical Manufacturing

- 5.1.3 Rapid Growth of Pharmaceutical and Biotechnology Industries

- 5.2 Market Restraints

- 5.2.1 Stringent Regulatory Framework

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements

- 5.4 Future Trends

- 5.4.1 Increasing Investments in R&D in Biopharmaceutical Industry

- 5.5 Impact of Drivers and Restraints:

6. Upstream Bioprocessing Market - North America Analysis

7. North America Upstream Bioprocessing Market Analysis - by Product Type

- 7.1 Bioreactors/Fermenters

- 7.1.1 Overview

- 7.1.2 Bioreactors/Fermenters: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Cell Culture

- 7.2.1 Overview

- 7.2.2 Cell Culture: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Filters

- 7.3.1 Overview

- 7.3.2 Filters: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Bags and Containers

- 7.4.1 Overview

- 7.4.2 Bags and Containers: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Upstream Bioprocessing Market Analysis - by Workflow

- 8.1 Media Preparation

- 8.1.1 Overview

- 8.1.2 Media Preparation: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Cell Culture

- 8.2.1 Overview

- 8.2.2 Cell Culture: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Cell Separation

- 8.3.1 Overview

- 8.3.2 Cell Separation: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Upstream Bioprocessing Market Analysis - by Usage Type

- 9.1 Single-use

- 9.1.1 Overview

- 9.1.2 Single-use: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Multi-use

- 9.2.1 Overview

- 9.2.2 Multi-use: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Upstream Bioprocessing Market Analysis - by Mode

- 10.1 In-house

- 10.1.1 Overview

- 10.1.2 In-house: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 10.2 Outsourced

- 10.2.1 Overview

- 10.2.2 Outsourced: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

11. North America Upstream Bioprocessing Market - Country Analysis

- 11.1 North America Market Overview

- 11.1.1 North America: Upstream Bioprocessing Market - Revenue and Forecast Analysis - by Country

- 11.1.1.1 North America: Upstream Bioprocessing Market - Revenue and Forecast Analysis - by Country

- 11.1.1.2 US

- 11.1.1.3 US: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.3.1 US: Upstream Bioprocessing Market Breakdown, by Product Type

- 11.1.1.3.2 US: Upstream Bioprocessing Market Breakdown, by Workflow

- 11.1.1.3.3 US: Upstream Bioprocessing Market Breakdown, by Usage Type

- 11.1.1.3.4 US: Upstream Bioprocessing Market Breakdown, by Mode

- 11.1.1.4 Canada

- 11.1.1.5 Canada: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.5.1 Canada: Upstream Bioprocessing Market Breakdown, by Product Type

- 11.1.1.5.2 Canada: Upstream Bioprocessing Market Breakdown, by Workflow

- 11.1.1.5.3 Canada: Upstream Bioprocessing Market Breakdown, by Usage Type

- 11.1.1.5.4 Canada: Upstream Bioprocessing Market Breakdown, by Mode

- 11.1.1.6 Mexico

- 11.1.1.7 Mexico: Upstream Bioprocessing Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.7.1 Mexico: Upstream Bioprocessing Market Breakdown, by Product Type

- 11.1.1.7.2 Mexico: Upstream Bioprocessing Market Breakdown, by Workflow

- 11.1.1.7.3 Mexico: Upstream Bioprocessing Market Breakdown, by Usage Type

- 11.1.1.7.4 Mexico: Upstream Bioprocessing Market Breakdown, by Mode

- 11.1.1 North America: Upstream Bioprocessing Market - Revenue and Forecast Analysis - by Country

12. Industry Landscape

- 12.1 Overview

- 12.2 Growth Strategies in Upstream Bioprocessing Market

- 12.3 Organic Growth Strategies

- 12.3.1 Overview

- 12.4 Inorganic Growth Strategies

- 12.4.1 Overview

13. Company Profiles

- 13.1 Thermo Fisher Scientific Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Esco Micro Pte. Ltd.

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Sartorius AG

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Danaher Corp

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Getinge AB

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Merck KGaA

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Corning Inc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Entegris, Inc.

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 PBS Biotech, Inc.

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Glossary of Terms