|

|

市場調査レポート

商品コード

1533107

北米のVaaS(Video as a Service):2030年市場予測- 地域別分析-展開モード別、業界別North America Video as a Service Market Forecast to 2030 - Regional Analysis - by Deployment Mode and Industry Vertical |

||||||

|

|||||||

| 北米のVaaS(Video as a Service):2030年市場予測- 地域別分析-展開モード別、業界別 |

|

出版日: 2024年06月04日

発行: The Insight Partners

ページ情報: 英文 90 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のVaaS(Video as a Service)市場は、2022年には14億2,248万米ドルとなり、2030年には51億8,743万米ドルに達すると予測され、2022年から2030年までのCAGRは17.6%を記録すると予測されています。

消費者の間でビデオベースのコミュニケーションへの需要が高まり、北米のVideo as a Service市場が活性化

ビデオ会議やコミュニケーション・サービスは近年一貫して成長しています。企業の世界化が進み、消費者の間で費用対効果が高く拡張性の高いコミュニケーション・ソリューションに対するニーズが高まっていることが、VaaSソフトウェアの需要を後押ししています。2023年9月のWebinarCareのデータによると、76%以上の個人がビデオ通話を利用してリモートワークを行っています。これにより、従業員はワークライフバランスを保ちながら、仕事の生産性を高めることができます。ビデオ通話の利用拡大により、消費者の間ではVaaSに対する需要が高まっています。VaaSには、画面共有、カレンダースケジューリング、ファイル共有、クロスプラットフォームメッセージング、パスワード保護、会議録画、待合室、会議リマインダー、コンタクトチャネルなど多くの機能があります。これらの機能は、全体的な業務生産性を向上させ、データプライバシーを維持することで、ユーザーが日々のビジネス活動を処理・管理することをサポートし、VaaSソリューションの需要を促進しています。

Quixy社によると、バーチャルミーティングの需要は2022年から2022年にかけて48%から77%に増加し、従業員間のコラボレーションを効率化するために、消費者の間でVaaSに対する需要が高まっています。このサービスは、個人が上司から与えられたプロジェクトやタスクに集中できるようサポートします。また、VaaSは、ユーザーがビデオ通話で効率的に作業したり、簡単なディスカッションを行ったりするのにも役立ちます。バーチャル会議活動の増加は、日常活動の円滑な流れを維持するために、消費者の間でVaaSに対する需要を高めています。

北米のVaaS(Video as a Service)市場概要

米国、カナダ、メキシコは北米の主要経済国のひとつです。北米は、クラウド技術への高い導入率と投資、および同地域の産業数の増加により、世界のVaaS市場で注目すべきシェアを占めています。VaaSは、異なる場所にいるパートナーやチームメンバー間のコラボレーションを促進することで、企業が遠隔ビデオ会議を実施することを可能にします。北米のVaaS(Video as a Service)市場は、Cisco Systems, Inc.市場の企業は、新規顧客を獲得するため、継続的にサービス・ポートフォリオを開発・拡大しています。2023年10月、Zoom Video Communications, Inc.はSwoogoと提携し、ハイブリッド・イベントを近代化することで、より大規模で熱心な視聴者を獲得します。この提携により、両社はそれぞれの技術を統合し、エンゲージメントと高品質な制作とスケールに重点を置いたバーチャル・プラットフォームとします。この統合は、顧客がプラットフォーム間でビデオデータを共有するためにZoom EventsまたはSwoogoを使用することをサポートすることができ、2024年初めに商業的に利用できるようになる予定です。同地域で事業を展開する市場関係者は、中小企業向けにサービスとしての動画が提供するメリットについて認識を高めており、これが同地域の市場成長を後押ししています。さらに、ビデオ会議やその他のクラウドベースの通信サービスの採用が拡大していることも、北米のVaaS(Video as a Service)市場の成長を後押ししています。さらに、高品質なインターネットとビジュアルミーティングへの継続的なアクセスに対する需要が、この地域の市場成長に寄与しています。

北米のVaaS(Video as a Service)市場の収益と2030年までの予測(金額)

北米のVaaS(Video as a Service)市場セグメンテーション

北米のVaaS(Video as a Service)市場は、展開モード、業界別、国別に区分されます。展開モードに基づいて、北米のVaaS(Video as a Service)市場はパブリッククラウド、プライベートクラウド、ハイブリッドクラウドに分類されます。2022年にはパブリッククラウドセグメントが最大の市場シェアを占めています。

業界別では、北米のVaaS(Video as a Service)市場は、IT&テレコム、ヘルスケア&ライフサイエンス、小売&eコマース、BFSI、教育、メディア&エンターテインメント、政府&公共部門、その他に分類されます。2022年の市場シェアは、IT&テレコム分野が最大でした。

国別に見ると、北米のVaaS(Video as a Service)市場は米国、カナダ、メキシコに区分されます。2022年の北米VaaS市場シェアは米国が独占しました。

Cisco Systems Inc、Zoom Video Communications Inc、Microsoft Corp、Amazon Web Services Inc、Avaya Holdings Corp、Google LLC、Adobe Inc、RingCentral Inc、Dekom AG、BlueJeansは、北米のVaaS(Video as a Service)市場で事業を展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米VaaS(Video as a Service)市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米VaaS(Video as a Service)市場:主要産業力学

- 促進要因

- 消費者の間でのビデオベースのコミュニケーションに対する需要の高まり

- リモートワークモデルの採用増加

- ヘルスケア業界におけるビデオ会議サービスの利用増加

- 市場抑制要因

- データプライバシーとセキュリティに対する懸念の高まり

- 市場機会

- VaaS(Video as a Service)市場を変革する技術の進歩

- 今後の動向

- 拡大する動画マーケティングと販売動向

- 促進要因と抑制要因の影響

第6章 VaaS(Video as a Service)市場:北米市場分析

- VaaS(Video as a Service)市場の収益、2022年~2030年

- VaaS(Video as a Service)市場の予測と分析

第7章 北米のVaaS(Video as a Service)市場分析:展開モード

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

第8章 北米のVaaS(Video as a Service)市場分析:業界別

- IT&テレコム

- ヘルスケア&ライフサイエンス

- 小売・eコマース

- BFSI

- 教育

- メディア・エンターテイメント

- 政府・公共部門

- その他

第9章 北米のVaaS(Video as a Service)市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- 主要企業別ヒートマップ分析

第11章 業界情勢

- 市場イニシアティブ

- 新製品開発

第12章 企業プロファイル

- Cisco Systems Inc

- Zoom Video Communications Inc

- Microsoft Corp

- Amazon Web Services Inc

- Avaya Holdings Corp

- Google LLC

- Adobe Inc

- RingCentral Inc

- Dekom AG

- BlueJeans

第13章 付録

List Of Tables

- Table 1. Video as a Service Market Segmentation

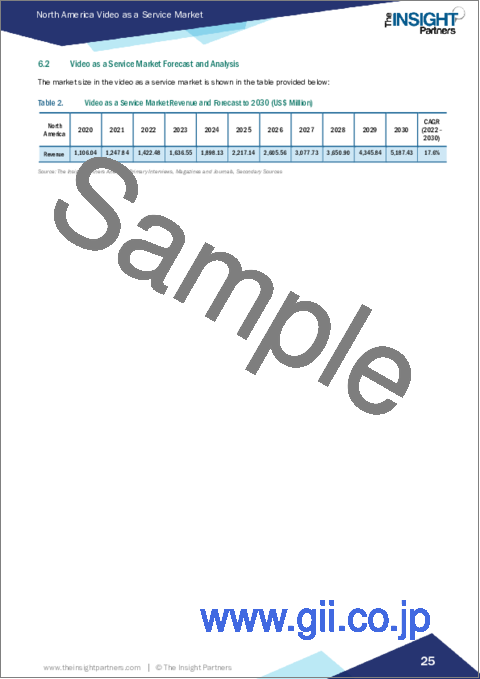

- Table 2. Video as a Service Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. Video as a Service Market Revenue and Forecasts to 2030 (US$ Million) - Deployment Mode

- Table 4. Video as a Service Market Revenue and Forecasts to 2030 (US$ Million) - Industry Vertical

- Table 5. North America Video as a Service Market, by Country - Revenue and Forecast to 2030 (USD Million)

- Table 6. US Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Deployment Mode

- Table 7. US Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Industry Vertical

- Table 8. Canada Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Deployment Mode

- Table 9. Canada Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Industry Vertical

- Table 10. Mexico Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Deployment Mode

- Table 11. Mexico Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Industry Vertical

- Table 12. Heat Map Analysis By Key Players

- Table 13. List of Abbreviation

List Of Figures

- Figure 1. Video as a Service Market Segmentation, By Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Video as a Service Market

- Figure 4. Video as a Service Market - Key Industry Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Video as a Service Market Revenue (US$ Million), 2022 & 2030

- Figure 7. Video as a Service Market Share (%) - Deployment Mode, 2022 and 2030

- Figure 8. Public Cloud Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. Private Cloud Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 10. Hybrid Cloud Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 11. Video as a Service Market Share (%) - Industry Vertical, 2022 and 2030

- Figure 12. IT & Telecom Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 13. Healthcare & Life Sciences Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 14. Retail & E-Commerce Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 15. BFSI Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 16. Education Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 17. Media & Entertainment Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 18. Government & Public Sector Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 19. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 20. North America Video as a Service Market Revenue, By Key Country, (2022) (US$ Million)

- Figure 21. Video as a service market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 22. US Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 23. Canada Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 24. Mexico Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

The North America video as a service market was valued at US$ 1,422.48 million in 2022 and is expected to reach US$ 5,187.43 million by 2030; it is estimated to record a CAGR of 17.6% from 2022 to 2030.

Growing Demand for Video-Based Communications Among Consumers Fuels North America Video as a Service Market

Video conferencing and communication services have grown consistently in recent years. Increasing globalization of companies and growing need for cost-effective and scalable communication solutions among consumers drive demand for video as a service software. WebinarCare data of September 2023 shows that more than 76% of individuals use video calls to work remotely. This allows employees to deliver productivity in their work by maintaining a better work-life balance. Growing use of video calls raise the demand for video as a service among consumers. Video as a service has many features such as screen sharing, calendar scheduling, file sharing, cross-platform messaging, password protection, meeting recordings, waiting rooms, meeting reminders, and contact channels. These features support users to handle and manage daily business activities by increasing overall operational productivity and maintaining data privacy, which is fueling the demand for video as a service solution.

According to Quixy, the demand for virtual meetings grew from 48% to 77% between 2022 and 2022, which increases the demand for video as a service among consumers to streamline the collaboration between employees. This service supports individuals to increase their focus on projects or tasks assigned by their superiors. Video as a service also helps the user to effectively work and conduct a brief discussion over a video call. Rise in virtual meeting activities increases the demand for video as a service among consumers to maintain a smooth flow in their daily activities.

North America Video as a Service Market Overview

The US, Canada, and Mexico are among the major economies in North America. North America contributes a noteworthy share to the global video as a service market owing to high adoption and investments in cloud technology and growing number of industries in the region. Video as a service allows organizations to conduct remote video meetings by fostering collaboration among partners and team members from different locations. The video as a service market in North America is anticipated to expand in the future owing to the presence of a large number of well-established players such as Cisco Systems, Inc.; Zoom Video Communications, Inc.; Microsoft; Google; Adobe; and others. The market players continuously develop and expand their service portfolio to attract new customers. In October 2023, Zoom Video Communications, Inc. partnered with Swoogo to modernize hybrid events by bringing larger and more engaged audiences. Through this partnership, both companies are integrating their technology into a virtual platform that focuses on engagement and high-quality production and scale. The integration can support customers to use Zoom Events or Swoogo for sharing video data between platforms and is expected to be commercially available in early 2024. Market players operating in the region are raising awareness about the benefits provided by video as a service to SMEs, which fuels the market growth in the region. Moreover, the growing adoption of video conferencing and other cloud-based communication services drives the video as a service market growth in North America. In addition, the demand for high-quality internet and continuous access to visual meetings among organizations contributes to regional market growth.

North America Video as a Service Market Revenue and Forecast to 2030 (US$ Million)

North America Video as a Service Market Segmentation

The North America video as a service market is segmented based on deployment mode, industry vertical, and country. Based on deployment mode, the North America video as a service market is categorized into public cloud, private cloud, and hybrid cloud. The public cloud segment held the largest market share in 2022.

In terms of industry vertical, the North America video as a service market is categorized into IT & telecom, healthcare & life sciences, retail & e-commerce, BFSI, education, media & entertainment, government & public sector, and others. The IT & telecom segment held the largest market share in 2022.

Based on country, the North America video as a service market is segmented into the US, Canada, and Mexico. The US dominated the North America video as a service market share in 2022.

Cisco Systems Inc, Zoom Video Communications Inc, Microsoft Corp, Amazon Web Services Inc, Avaya Holdings Corp, Google LLC, Adobe Inc, RingCentral Inc, Dekom AG, and BlueJeans are some of the leading companies operating in the North America video as a service market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Video as a Service Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in Value Chain:

5. North America Video as a Service Market - Key Industry Dynamics

- 5.1 Drivers

- 5.1.1 Growing Demand for Video-Based Communications Among Consumers

- 5.1.2 Increasing Adoption of Remote Working Model

- 5.1.3 Rising Use of Video Conferencing Services in Healthcare Industry

- 5.2 Market Restraints

- 5.2.1 Growing Data Privacy and Security Concerns

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements to Revolutionize Video as a Service Market

- 5.4 Future Trends

- 5.4.1 Growing Video Marketing and Selling Trends

- 5.5 Impact of Drivers and Restraints:

6. Video as a Service Market - North America Market Analysis

- 6.1 Video as a Service Market Revenue (US$ Million), 2022 - 2030

- 6.2 Video as a Service Market Forecast and Analysis

7. North America Video as a Service Market Analysis - Deployment Mode

- 7.1 Public Cloud

- 7.1.1 Overview

- 7.1.2 Public Cloud Market Revenue and Forecasts to 2030 (US$ Million)

- 7.2 Private Cloud

- 7.2.1 Overview

- 7.2.2 Private Cloud Market Revenue and Forecasts to 2030 (US$ Million)

- 7.3 Hybrid Cloud

- 7.3.1 Overview

- 7.3.2 Hybrid Cloud Market Revenue and Forecasts to 2030 (US$ Million)

8. North America Video as a Service Market Analysis - Industry Vertical

- 8.1 IT & Telecom

- 8.1.1 Overview

- 8.1.2 IT & Telecom Market Revenue and Forecasts to 2030 (US$ Million)

- 8.2 Healthcare & Life Sciences

- 8.2.1 Overview

- 8.2.2 Healthcare & Life Sciences Market Revenue and Forecasts to 2030 (US$ Million)

- 8.3 Retail & E-Commerce

- 8.3.1 Overview

- 8.3.2 Retail & E-Commerce Market Revenue and Forecasts to 2030 (US$ Million)

- 8.4 BFSI

- 8.4.1 Overview

- 8.4.2 BFSI Market Revenue and Forecasts to 2030 (US$ Million)

- 8.5 Education

- 8.5.1 Overview

- 8.5.2 Education Market Revenue and Forecasts to 2030 (US$ Million)

- 8.6 Media & Entertainment

- 8.6.1 Overview

- 8.6.2 Media & Entertainment Market Revenue and Forecasts to 2030 (US$ Million)

- 8.7 Government & Public Sector

- 8.7.1 Overview

- 8.7.2 Government & Public Sector Market Revenue and Forecasts to 2030 (US$ Million)

- 8.8 Others

- 8.8.1 Overview

- 8.8.2 Others Market Revenue and Forecasts to 2030 (US$ Million)

9. North America Video as a Service Market - Country Analysis

- 9.1 North America

- 9.1.1 North America Video as a Service Market Overview

- 9.1.2 North America Video as a Service Market Revenue and Forecasts and Analysis - By Countries

- 9.1.2.1 US Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- 9.1.2.1.1 US Video as a Service Market Breakdown by Deployment Mode

- 9.1.2.1.2 US Video as a Service Market Breakdown by Industry Vertical

- 9.1.2.2 Canada Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- 9.1.2.2.1 Canada Video as a Service Market Breakdown by Deployment Mode

- 9.1.2.2.2 Canada Video as a Service Market Breakdown by Industry Vertical

- 9.1.2.3 Mexico Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- 9.1.2.3.1 Mexico Video as a Service Market Breakdown by Deployment Mode

- 9.1.2.3.2 Mexico Video as a Service Market Breakdown by Industry Vertical

- 9.1.2.1 US Video as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

10. Competitive Landscape

- 10.1 Heat Map Analysis By Key Players

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 New Product Development

12. Company Profile

- 12.1 Cisco Systems Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Zoom Video Communications Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Microsoft Corp

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Amazon Web Services Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Avaya Holdings Corp

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Google LLC

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Adobe Inc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 RingCentral Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Dekom AG

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 BlueJeans

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 Word Index