|

|

市場調査レポート

商品コード

1494431

アジア太平洋のEVバッテリー用液浸冷却:2030年市場予測- 地域別分析- タイプ別、冷却液タイプ別Asia Pacific Immersion Cooling for EV Batteries Market Forecast to 2030 - Regional Analysis - By Type (Single-Phase Immersion Cooling and Two-Phase Immersion Cooling) and Cooling Fluid Type (Mineral Oil, Synthetic Oil, and Others) |

||||||

|

|||||||

| アジア太平洋のEVバッテリー用液浸冷却:2030年市場予測- 地域別分析- タイプ別、冷却液タイプ別 |

|

出版日: 2024年03月14日

発行: The Insight Partners

ページ情報: 英文 70 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

アジア太平洋のEVバッテリー用液浸冷却市場は、2026年に156万米ドルと評価され、2030年には2,289万米ドルに達すると予測され、2026年から2030年までのCAGRは95.6%で成長すると予測されています。

電気自動車需要の拡大がアジア太平洋のEVバッテリー用液浸冷却市場を牽引

電気自動車(EV)の販売は、環境保護に関する懸念と、低排出ガス車やゼロ・エミッション車の採用を支持する政府の政策によって急増しています。また、各国政府はEVの普及を促進するため、国民に補助金や税金の払い戻しを提供しています。政府当局は、世界的にEVを普及させるためにさまざまな取り組みを行っています。IEAが毎年発表している「世界電気自動車見通し」によると、2022年には世界で1,000万台以上の電気自動車が販売され、2023年には35%増の1,400万台に達すると予想されています。これは、自動車市場全体における電気自動車のシェアが、2020年の~4%から2022年には14%に上昇し、2023年には18%に達すると予測されていることを示しています。2022年には、世界の電気自動車販売台数の60%が中国で販売されることになります。世界経済フォーラムによると、2022年の中国の新車EV販売台数は、2021年の339万台から618万台へと82%増加しました。また、中国は世界最大のEV生産国で、世界のEV台数の64%を生産しています。このように、EVの販売台数の増加は、自動車の寿命を通じて最高の性能を発揮するために冷却状態を維持するバッテリーの必要性を高めています。この要因がアジア太平洋のEVバッテリー用液浸冷却市場の成長を促進しています。

アジア太平洋のEVバッテリー用液浸冷却市場の概要

アジア太平洋のEVバッテリー用液浸冷却市場は、中国、インド、日本、オーストラリア、韓国、その他アジア太平洋地域に区分されます。アジア太平洋のEVバッテリー用液浸冷却市場を牽引する主な要因の1つは、同地域におけるEVの普及率の上昇です。公害に対する懸念の高まりと、環境に優しい交通手段への嗜好の高まりが、アジア太平洋におけるEV需要の燃料となっています。さらに、EVの導入を促進するため、各国政府はいくつかの政策を策定しています。東南アジア諸国連合(ASEAN)は、EVの導入を奨励するための有利な政策を策定しました。国際再生可能エネルギー機関(IRENA)によると、2025年までに東南アジアの自動車の約20%がEVになり、その中には5,900万台の二輪車と三輪車、890万台の自動車が含まれます。さらに、インド、韓国、台湾、ベトナム、その他のアジア太平洋諸国は、人件費が安いことから、自動車製造施設を上記の国々に移転したいと考える複数の企業の誘致に絶えず取り組んでいます。このため、上記の国々は税制上の優遇措置、資金、補助金を提供し、より多くの製造企業が工場を設立するよう誘致しています。2021年、インド政府は公共交通と共有交通の電化のために4億5,000万米ドルを割り当て、7,090台のEバスを採用しました。また、インドネシア政府は2021年4月、2025年までに国内生産車の20%、40万台をEVにする計画を発表しました。さらに2023年3月には、中国のEVメーカーBYDがタイで新たなEV製造施設の建設を開始し、2024年から年間15万台の乗用車を生産すると発表しました。このように、政府によるEV生産への取り組みや支援規制の増加は、同地域でのEV販売を急増させると予想され、EVの走行距離を伸ばし、バッテリーを熱暴走から安全に保つことができる液浸冷却バッテリーの需要も高め、アジア太平洋のEVバッテリー用液浸冷却市場の成長を後押しします。

アジア太平洋のEVバッテリー用液浸冷却市場の収益と2030年までの予測(金額)

アジア太平洋のEVバッテリー用液浸冷却市場のセグメンテーション

アジア太平洋のEVバッテリー用液浸冷却市場は、タイプ別にセグメント化されています、

タイプ、冷却液タイプ、国によって区分されます。

タイプ別では、アジア太平洋のEVバッテリー用液浸冷却市場は、単相液浸冷却と二相液浸冷却に二分されます。2026年には単相浸漬冷却セグメントがより大きなシェアを占めています。

冷却液タイプ別に見ると、アジア太平洋のEVバッテリー用液浸冷却市場は、鉱物油、合成油、その他に区分されます。2026年には合成油セグメントが最大のシェアを占めました。

国別では、アジア太平洋のEVバッテリー用液浸冷却市場は、中国、インド、日本、韓国、その他アジア太平洋地域に区分されます。2026年のアジア太平洋のEVバッテリー用液浸冷却市場は中国が支配的。

Cargill Inc、Engineered Fluids Inc、M&I Materials Ltd、Mahle GmbH、Ricardo Plc、SAE International、The Lubrizol Corp、XING Mobility Incは、アジア太平洋のEVバッテリー用液浸冷却市場で事業を展開している大手企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋のEVバッテリー用液浸冷却市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 アジア太平洋のEVバッテリー用液浸冷却市場:主要産業力学

- 市場促進要因

- EV走行距離延長のための高容量バッテリー需要の増加

- 電気自動車の需要拡大

- 市場抑制要因

- 液浸冷却に関連する課題

- 市場機会

- 液浸冷却の利点

- 今後の動向

- 路上走行車両への液浸冷却バッテリーの採用拡大

- 促進要因と阻害要因の影響分析

第6章 EVバッテリー用液浸冷却市場:アジア太平洋市場分析

- アジア太平洋のEVバッテリー用液浸冷却市場概要

- アジア太平洋のEVバッテリー用液浸冷却市場の売上実績、2022年~2030年

- EVバッテリー用液浸冷却のアジア太平洋市場予測・分析

第7章 アジア太平洋のEVバッテリー用液浸冷却市場の分析:タイプ

- 単相液浸冷却

- 二相液浸冷却

第8章 アジア太平洋のEVバッテリー用液浸冷却市場分析:冷却液タイプ

- 鉱物油

- 合成油

- その他

第9章 アジア太平洋のEVバッテリー用液浸冷却市場:国別分析

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

第10章 競合情勢

- 主要企業別ヒートマップ分析

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 新規開発

第12章 企業プロファイル

- Ricardo Plc

- Mahle GmbH

- XING Mobility Inc

- The Lubrizol Corp

- SAE International

- Cargill Inc

- Engineered Fluids Inc

- M&I Materials Ltd

第13章 付録

List Of Tables

- Table 1. Asia Pacific Immersion Cooling for EV Batteries Market Segmentation

- Table 2. Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts to 2030 (US$ Million) - Type

- Table 4. Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts to 2030 (US$ Million) - Cooling Fluid Type

- Table 5. Asia Pacific Asia Pacific Immersion Cooling for EV Batteries Market, by Country - Revenue and Forecast to 2030 (USD Million)

- Table 6. China: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Type

- Table 7. China: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Cooling Fluid Type

- Table 8. India: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Type

- Table 9. India: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Cooling Fluid Type

- Table 10. Japan: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Type

- Table 11. Japan: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Cooling Fluid Type

- Table 12. South Korea: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Type

- Table 13. South Korea: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Cooling Fluid Type

- Table 14. Rest of Asia Pacific: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Type

- Table 15. Rest of Asia Pacific: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn) - By Cooling Fluid Type

- Table 16. Company Positioning & Concentration

- Table 17. List of Abbreviation

List Of Figures

- Figure 1. Asia Pacific Immersion Cooling for EV Batteries Market Segmentation, By Country

- Figure 2. Ecosystem: Asia Pacific Immersion Cooling for EV Batteries Market

- Figure 3. Asia Pacific Immersion Cooling for EV Batteries Market - Key Industry Dynamics

- Figure 4. Asia Pacific Immersion Cooling for EV Batteries Market: Impact Analysis of Drivers and Restraints

- Figure 5. Asia Pacific Immersion Cooling for EV Batteries Market Revenue (US$ Million), 2022 & 2030

- Figure 6. Asia Pacific Immersion Cooling for EV Batteries Market Share (%) - Type, 2022 and 2030

- Figure 7. Single-Phase Immersion Cooling Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 8. Two-Phase Immersion Cooling Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. Asia Pacific Immersion Cooling for EV Batteries Market Share (%) - Cooling Fluid Type, 2022 and 2030

- Figure 10. Mineral Oil Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 11. Synthetic Oil Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 12. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 13. Asia Pacific Immersion Cooling for EV Batteries Market by Key Countries - Revenue (2022) (US$ Million)

- Figure 14. Asia Pacific Asia Pacific Immersion Cooling for EV Batteries Market Breakdown By Key Countries, 2022 And 2030 (%)

- Figure 15. China: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 16. India: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 17. Japan: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 18. South Korea: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 19. Rest of Asia Pacific: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 20. Heat Map Analysis By Key Players

The Asia Pacific immersion cooling for EV batteries market was valued at US$ 1.56 million in 2026 and is expected to reach US$ 22.89 million by 2030; it is estimated to grow at a CAGR of 95.6% from 2026 to 2030.

Growing Demand for Electric Vehicles Drive Asia Pacific Immersion Cooling for EV Batteries Market

Electric vehicle (EV) sales are proliferating due to concerns regarding environmental protection and government policies favoring the adoption of low-emission or zero-emission vehicles. Also, governments of different countries are offering subsidies and tax rebates to citizens to increase the adoption of EVs. The government authorities are taking various initiatives to promote EVs globally. According to IEA's annual Global Electric Vehicle Outlook, in 2022, more than 10 million electric cars were sold worldwide, which is expected to grow by 35% in 2023 to reach 14 million units. This shows that the electric cars' share of the overall car market has risen to 14% in 2022 from ~4% in 2020 and is projected to reach 18% in 2023. Overall, in 2022, 60% of global electric car sales occurred in China. Per the World Economic Forum, sales of new EVs increased by 82% in 2022 in China, from 3.39 million in 2021 to 6.18 million in 2022. Also, China is the world's largest EV producer, producing 64% of global EV volume. Thus, the growing sales of EVs are boosting the need for batteries that remain cool to function at peak performance throughout the vehicle's life. This factor is driving the growth of the Asia Pacific immersion cooling for EV batteries market.

Asia Pacific Immersion Cooling for EV Batteries Market Overview

The Asia Pacific immersion cooling for EV batteries market in APAC is segmented into China, India, Japan, Australia, South Korea, and the Rest of APAC. One of the key factors driving the Asia Pacific immersion cooling for EV batteries market is the rising adoption of EVs in the region. Increasing concerns regarding pollution and growing preference for environment-friendly modes of transport fuel the demand for EVs in APAC. Further, to raise the adoption of EVs, the governments of different countries are developing several policies. The Association of Southeast Asian Nations (ASEAN) developed a favorable policy to encourage EV adoption. According to the International Renewable Energy Agency (IRENA), approximately 20% of vehicles in Southeast Asia will be EVs by 2025, including 59 million two-wheelers and three-wheelers and 8.9 million cars. In addition, India, South Korea, Taiwan, Vietnam, and other APAC countries are constantly working on attracting several businesses that want to relocate their car manufacturing facilities to the above countries because of low labor costs. For this, the above countries are offering tax rebates, funds, and subsidies, attracting more manufacturing companies to set up their plants. In 2021, the government of India allocated US$ 450 million for the electrification of public and shared transportation, adopting 7,090 e-buses. Also, in April 2021, the Indonesian government announced its plan for EVs to make 20% of all domestic cars manufactured, equal to 400,000 e-cars, by 2025. In addition, in March 2023, Chinese EV manufacturer BYD announced that it had started the construction of its new EV manufacturing facility in Thailand, which will be producing 150,000 passenger cars per year from 2024. Thus, the increase in initiatives and supportive regulations by governments for the production of EVs is expected to surge the sale of EVs in the region, which will also raise the demand for immersion cooling batteries as they can help increase the driving range of EVs and keep the batteries safe from thermal runaway, propelling the Asia Pacific immersion cooling for EV batteries market growth.

Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Immersion Cooling for EV Batteries Market Segmentation

The Asia Pacific immersion cooling for EV batteries market is segmented based on type,

cooling fluid type, and country.

Based on type, the Asia Pacific immersion cooling for EV batteries market is bifurcated into single-phase immersion cooling and two-phase immersion cooling. The single-phase immersion cooling segment held a larger share in 2026.

By cooling fluid type, the Asia Pacific immersion cooling for EV batteries market is segmented into mineral oil, synthetic oil, and others. The synthetic oil segment held the largest share in 2026.

Based on country, the Asia Pacific immersion cooling for EV batteries market is segmented into China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific immersion cooling for EV batteries market in 2026.

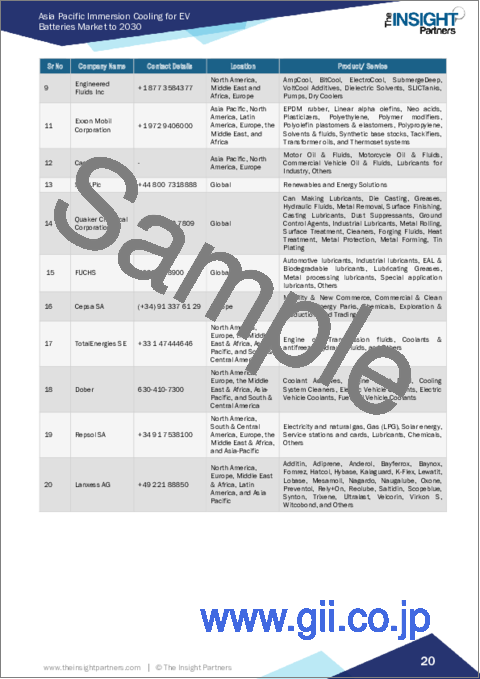

Cargill Inc, Engineered Fluids Inc, M&I Materials Ltd, Mahle GmbH, Ricardo Plc, SAE International, The Lubrizol Corp, and XING Mobility Inc are some of the leading companies operating in the Asia Pacific immersion cooling for EV batteries market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Immersion Cooling for EV Batteries Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in Value Chain:

5. Asia Pacific Immersion Cooling for EV Batteries Market - Key Industry Dynamics

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for High-Capacity Batteries to Extend EV Driving Range

- 5.1.2 Growing Demand for Electric Vehicles

- 5.2 Market Restraints

- 5.2.1 Challenges Associated with Immersion Cooling

- 5.3 Market Opportunities

- 5.3.1 Advantages of Immersion Cooling

- 5.4 Future Trends

- 5.4.1 Growing Incorporation of Immersion-cooled Battery into Road-Going Vehicles

- 5.5 Impact Analysis of Drivers and Restraints

6. Immersion Cooling for EV Batteries Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Immersion Cooling for EV Batteries Market Overview

- 6.2 Asia Pacific Immersion Cooling for EV Batteries Market Revenue (US$ Million), 2022 - 2030

- 6.3 Asia Pacific Immersion Cooling for EV Batteries Market Forecast and Analysis

7. Asia Pacific Immersion Cooling for EV Batteries Market Analysis - Type

- 7.1 Single-Phase Immersion Cooling

- 7.1.1 Overview

- 7.1.2 Single-Phase Immersion Cooling Market Revenue and Forecasts to 2030 (US$ Million)

- 7.2 Two-Phase Immersion Cooling

- 7.2.1 Overview

- 7.2.2 Two-Phase Immersion Cooling Market Revenue and Forecasts to 2030 (US$ Million)

8. Asia Pacific Immersion Cooling for EV Batteries Market Analysis - Cooling Fluid Type

- 8.1 Mineral Oil

- 8.1.1 Overview

- 8.1.2 Mineral Oil Market Revenue and Forecasts to 2030 (US$ Million)

- 8.2 Synthetic Oil

- 8.2.1 Overview

- 8.2.2 Synthetic Oil Market Revenue and Forecasts to 2030 (US$ Million)

- 8.3 Others

- 8.3.1 Overview

- 8.3.2 Others Market Revenue and Forecasts to 2030 (US$ Million)

9. Asia Pacific Immersion Cooling for EV Batteries Market - Country Analysis

- 9.1 Overview

- 9.1.1 Asia Pacific Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Countries

- 9.1.1.1 China: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts to 2030 (US$ Mn)

- 9.1.1.1.1 China: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Type

- 9.1.1.1.2 China: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Cooling Fluid Type

- 9.1.1.2 India: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts to 2030 (US$ Mn)

- 9.1.1.2.1 India: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Type

- 9.1.1.2.2 India: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Cooling Fluid Type

- 9.1.1.3 Japan: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts to 2030 (US$ Mn)

- 9.1.1.3.1 Japan: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Type

- 9.1.1.3.2 Japan: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Cooling Fluid Type

- 9.1.1.4 South Korea: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts to 2030 (US$ Mn)

- 9.1.1.4.1 South Korea: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Type

- 9.1.1.4.2 South Korea: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Cooling Fluid Type

- 9.1.1.5 Rest of Asia Pacific: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts to 2030 (US$ Mn)

- 9.1.1.5.1 Rest of Asia Pacific: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Type

- 9.1.1.5.2 Rest of Asia Pacific: Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Cooling Fluid Type

- 9.1.1.1 China: Asia Pacific Immersion Cooling for EV Batteries Market Revenue and Forecasts to 2030 (US$ Mn)

- 9.1.1 Asia Pacific Asia Pacific Immersion Cooling for EV Batteries Market Breakdown by Countries

10. Competitive Landscape

- 10.1 Heat Map Analysis By Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Market Initiative

- 11.2 New Development

12. Company Profiles

- 12.1 Ricardo Plc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Contribution to Immersion Cooling Technology for EV Batteries

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Mahle GmbH

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Contribution to Immersion Cooling Technology for EV Batteries

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 XING Mobility Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Contribution to Immersion Cooling Technology for EV Batteries

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 The Lubrizol Corp

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Contribution to Immersion Cooling Technology for EV Batteries

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 SAE International

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Contribution to Immersion Cooling Technology for EV Batteries

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Cargill Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Contribution to Immersion Cooling Technology for EV Batteries

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Engineered Fluids Inc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Contribution to Immersion Cooling Technology for EV Batteries

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 M&I Materials Ltd

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Contribution to Immersion Cooling Technology for EV Batteries

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

13. Appendix

- 13.1 Word Index