|

|

市場調査レポート

商品コード

1494293

北米の凝固:2030年市場予測-地域別分析-適応疾患別、タイプ別、提供品目別、技術別、エンドユーザー別North America Coagulation Market Forecast to 2030 - Regional Analysis - by Disease Indications, Type, Offering, Technology, and End User |

||||||

|

|||||||

| 北米の凝固:2030年市場予測-地域別分析-適応疾患別、タイプ別、提供品目別、技術別、エンドユーザー別 |

|

出版日: 2024年03月14日

発行: The Insight Partners

ページ情報: 英文 102 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の凝固市場は、2022年に27億1,264万米ドルと評価され、2030年には46億3,326万米ドルに達すると予測され、2022年から2030年までのCAGRは6.9%と推定されます。

血液疾患の有病率の増加が北米凝固市場を牽引

血友病Aは一般的なX連鎖性劣性疾患の一つであり、全米希少疾患機構によると、フォンヴィレブランド病病に次いで2番目に多い遺伝性凝固因子欠損症です。また、米国では男児の5,000人に1人が血友病Aを患っています。Global Hemophilia Care 2020の調査によると、世界中で393,658例の出血性疾患が認められ、その内訳は血友病241,535例、フォンヴィレブランド病87,729例、その他の出血性疾患64,394例です。米国国立医学図書館(NLM)によると、2020年には米国で30,000~33,000人の男性が血友病に罹患しています。

米国がん協会(CLL)の報告によると、米国では2021年に~21,250人の慢性リンパ性白血病の新規症例が記録されました。米国疾病予防管理センター(CDC)の2020年2月の最新情報によると、米国で深部静脈血栓症に罹患する人の数は90万人(1,000人に1~2人)に達する可能性があります。同じ情報源によると、米国では年間6万~10万人の米国人が静脈血栓塞栓症で死亡していると推定されています。

米国保健社会福祉省によると、2020年には10万人の米国人が鎌状赤血球症(SCD)と診断され、これは最も一般的な遺伝性血液疾患の一つです。さらに、2050年までに鎌状赤血球症を患う人の数は30%増加すると予想されています。全米希少疾患機構は、自己免疫性出血性疾患である免疫性血小板減少症(ITP)は、2022年には米国で毎年100万人当たり66人の成人が罹患すると述べています。したがって、血液疾患の有病率の上昇が凝固市場の成長を後押ししています。

北米の凝固市場概要

北米の凝固市場は米国、カナダ、メキシコに区分されます。北米は、血液疾患の発生率の増加、心房細動(AFib)などの心血管疾患の発生率の増加、新規および既存の製品開拓に取り組む大手市場企業の存在により、大きな市場シェアを占めています。北米の凝固市場で最大のシェアを占めるのは米国です。血液疾患患者の急増、心血管疾患の有病率の増加、血液疾患予防のための政府支援などが、2022~2030年の北米凝固市場の成長を後押しすると予想されます。

北米の凝固市場の収益と2030年までの予測(金額)

北米の凝固市場のセグメンテーション

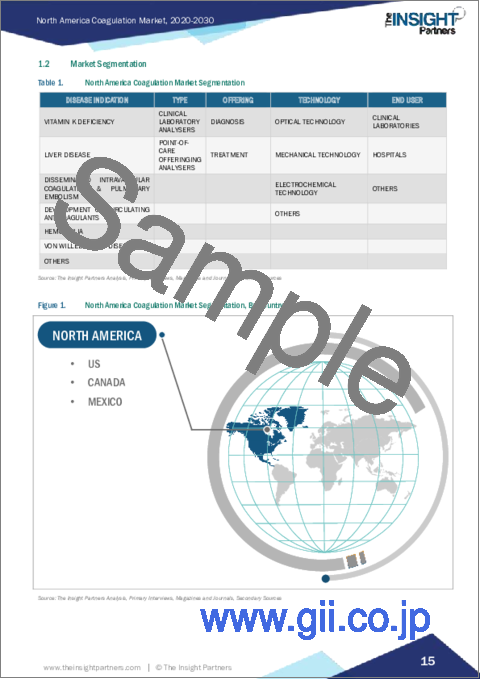

北米の凝固市場は、疾患適応症、タイプ、提供、技術、エンドユーザー、国によって区分されます。

疾患適応症に基づき、北米の凝固市場はビタミンK欠乏症、肝疾患、播種性血管内凝固・肺塞栓症、循環性抗凝固薬の開発、血友病、フォンヴィレブランド病、その他に区分されます。2022年の北米の凝固市場シェアは、肝疾患分野が最大でした。

北米の凝固市場はタイプ別に、臨床検査用分析装置とポイントオブケア検査用分析装置に二分されます。2022年の北米凝固市場シェアは臨床検査分析装置部門が大きいです。臨床検査分析装置セグメントはさらに、コントロール&キャリブレーター、アッセイ&試薬、機器/システム、凝固因子、その他に細分化されます。

提供サービスの観点から、北米の凝固市場は診断と治療に二分されます。2022年の北米凝固市場シェアは、診断部門が大きいです。診断セグメントはさらに、プロトロンビン時間検査、フィブリノゲン検査、活性化凝固時間検査、活性化部分トロンボプラスチン時間検査、dダイマー検査、血小板機能検査、その他の活動に細分化されます。治療分野はさらに、抗線溶薬、避妊薬、デスモプレシン&免疫抑制薬、ビタミンkサプリメント、血液希釈薬、トロンビン阻害薬または血栓溶解薬、補充療法、カテーテル補助血栓除去、その他に細分化されます。

技術別では、北米の凝固市場は光学技術、機械技術、電気化学技術、その他に区分されます。2022年の北米凝固市場シェアは、光学技術分野が最大でした。

エンドユーザー別では、北米の凝固市場は臨床検査室、病院、その他に区分されます。臨床検査室セグメントが2022年の北米凝固市場シェアで最大を占めました。

国別に見ると、北米の凝固市場は米国、カナダ、メキシコに分類されます。2022年の北米凝固市場は米国が支配的でした。

Diagnostica Stago Inc、F Hoffmann-La Roche Ltd、Genrui Biotech Co, Ltd、Helena Laboratories Corporation、Horiba Ltd、ImproGen Diagnostik Kimya San. &Tic.Ltd.、Siemens Healthineers AG、Sysmex Corp、Transasia Bio-Medicals Ltd.などが北米の凝固市場で事業を展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米凝固市場- 主要産業力学

- 主な市場促進要因

- 血液疾患の有病率の増加

- 心血管疾患の有病率の上昇

- 市場抑制要因

- 凝固分析装置に関連する高コスト

- 市場機会

- 主要市場企業による有機的・無機的戦略の成長

- 今後の動向

- ポイントオブケア(POC)凝固分析装置の発展

- 影響分析

第5章 凝固市場:北米市場分析

- 北米の凝固市場売上高、2022年~2030年

第6章 北米凝固市場-2030年に至る収益と予測:適応疾患別

- 北米の凝固市場:2022年および2030年の疾患別売上シェア(%)

- ビタミンK欠乏症

- 肝疾患

- 播種性血管内凝固症候群と肺塞栓症

- 循環型抗凝固薬の開発

- 血友病

- フォンヴィレブランド病

- その他

第7章 北米の凝固市場:タイプ別収益と2030年までの予測

- 北米の凝固市場2022年および2030年タイプ別売上高シェア(%)

- 臨床検査分析装置

- ポイントオブケア検査分析装置

第8章 北米の凝固市場-2030年に至る収益と予測-オファリング別

- 北米の凝固市場:2022年および2030年の収入シェア(提供品目別)

- 診断

- 治療

第9章 北米の凝固市場-2030年に至る収益と予測-技術別

- 北米の凝固市場:2022年および2030年の技術別売上高シェア(%)

- 光学技術

- 機械技術

- 電気化学技術

- その他

第10章 北米の凝固市場:エンドユーザー別収益と2030年までの予測

- 北米の凝固市場:2022年および2030年のエンドユーザー別売上高シェア(%)

- 臨床検査室

- 病院

- その他

第11章 北米の凝固市場:国別分析

- 北米の凝固市場:2030年までの収益と予測

- 北米の凝固市場:国別

- 米国

- カナダ

- メキシコ

第12章 凝固市場-業界情勢

- 凝固市場の成長戦略

- 無機的成長戦略

- 無機的成長戦略

- 有機的成長戦略

第13章 企業プロファイル

- Siemens Healthineers AG

- Diagnostica Stago, Inc

- ImproGen Diagnostik Kimya San. & Tic. Ltd.Sti.

- Sysmex Corp

- Helena Laboratories Corporation

- F. Hoffmann-La Roche Ltd

- Genrui Biotech Co., Ltd.

- Transasia Bio-Medicals Ltd

- Horiba Ltd.

第14章 付録

List Of Tables

- Table 1. North America Coagulation Market Segmentation

- Table 2. North America Coagulation Market Revenue and Forecast to 2030 (US$ million) - Clinical Laboratory Analyzers

- Table 3. North America Coagulation Market Revenue and Forecast to 2030 (US$ million) - Diagnosis

- Table 4. North America Coagulation Market Revenue and Forecast to 2030 (US$ million) - Treatment

- Table 5. Optical Technologies and Their Applications

- Table 6. Mechanical Technologies and Their Applications

- Table 7. US Coagulation Market Revenue and Forecast to 2030 (US$ million) - Disease Indication

- Table 8. US Coagulation Market Revenue and Forecast to 2030 (US$ million) - Type

- Table 9. US Coagulation Market Revenue and Forecast to 2030 (US$ million) - Clinical Laboratory Analyzers

- Table 10. US Coagulation Market Revenue and Forecast To 2030 (US$ million) - Offering

- Table 11. US Coagulation Market Revenue and Forecast to 2030 (US$ million) - Diagnosis

- Table 12. US Coagulation Market Revenue and Forecast to 2030 (US$ million) - Treatment

- Table 13. US Coagulation Market Revenue and Forecast To 2030 (US$ million) - Technology

- Table 14. US Coagulation Market Revenue and Forecast To 2030 (US$ million) - End User

- Table 15. Canada Coagulation Market Revenue and Forecast to 2030 (US$ million) - Disease Indication

- Table 16. Canada Coagulation Market Revenue and Forecast to 2030 (US$ million) - Type

- Table 17. Canada Coagulation Market Revenue and Forecast to 2030 (US$ million) - Clinical Laboratory Analyzers

- Table 18. Canada Coagulation Market Revenue and Forecast To 2030 (US$ million) - Offering

- Table 19. Canada Coagulation Market Revenue and Forecast to 2030 (US$ million) - Diagnosis

- Table 20. Canada Coagulation Market Revenue and Forecast to 2030 (US$ million) - Treatment

- Table 21. Canada Coagulation Market Revenue and Forecast To 2030 (US$ million) - Technology

- Table 22. Canada Coagulation Market Revenue and Forecast To 2030 (US$ million) - End User

- Table 23. Mexico Coagulation Market Revenue and Forecast to 2030 (US$ million) - Disease Indication

- Table 24. Mexico Coagulation Market Revenue and Forecast to 2030 (US$ million) - Type

- Table 25. Mexico Coagulation Market Revenue and Forecast to 2030 (US$ million) - Clinical Laboratory Analyzers

- Table 26. Mexico Coagulation Market Revenue and Forecast To 2030 (US$ million) - Offering

- Table 27. Mexico Coagulation Market Revenue and Forecast to 2030 (US$ million) - Diagnosis

- Table 28. US Coagulation Market Revenue and Forecast to 2030 (US$ million) - Treatment

- Table 29. Mexico Coagulation Market Revenue and Forecast To 2030 (US$ million) - Technology

- Table 30. Mexico Coagulation Market Revenue and Forecast To 2030 (US$ million) - End User

- Table 31. Recent Inorganic Growth Strategies in the Coagulation Market

- Table 32. Recent Organic Growth Strategies in the Coagulation Market

- Table 33. Glossary of Terms, Coagulation Market

List Of Figures

- Figure 1. North America Coagulation Market Segmentation, By Country

- Figure 2. North America Coagulation Market - Key Industry Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Coagulation Market Revenue (US$ million), 2020 - 2030

- Figure 5. North America Coagulation Market Revenue Share, by Disease Indication 2022 & 2030 (%)

- Figure 6. Vitamin K Deficiency: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 7. Liver Disease: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

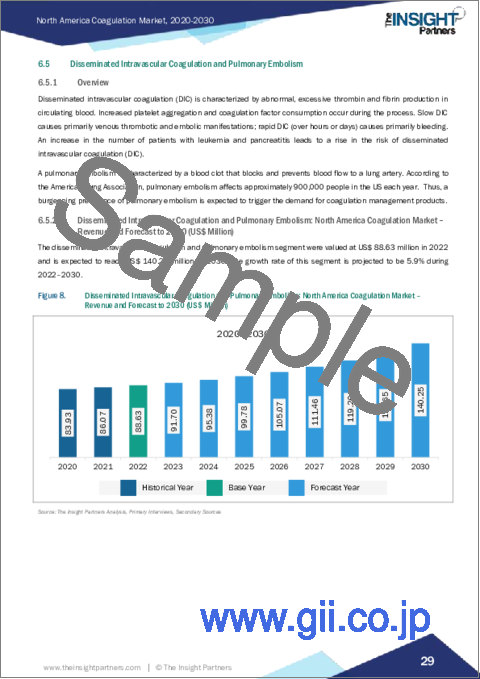

- Figure 8. Disseminated Intravascular Coagulation and Pulmonary Embolism: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Development of Circulating Anticoagulant: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Hemophilia: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Von Willebrand's Disease: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Others: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. North America Coagulation Market Revenue Share, by Type 2022 & 2030 (%)

- Figure 14. Clinical Laboratory Analyzers: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Point-of-Care Testing Analyzers: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. North America Coagulation Market Revenue Share, by Offering 2022 & 2030 (%)

- Figure 17. Diagnosis: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Treatment: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. North America Coagulation Market Revenue Share, by Technology 2022 & 2030 (%)

- Figure 20. Optical Technology: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Mechanical Technology: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Electrochemical Technology: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Others: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. North America Coagulation Market Revenue Share, by End User 2022 & 2030 (%)

- Figure 25. Clinical Laboratories: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Hospitals: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 27. Others: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 28. North America Coagulation Market, 2022 (US$)(million)

- Figure 29. North America Coagulation Market, By Key Countries, 2022 and 2030 (%)

- Figure 30. US Coagulation Market Revenue and Forecast to 2030 (US$ million)

- Figure 31. Canada Coagulation Market Revenue and Forecast to 2030 (US$ million)

- Figure 32. Mexico Coagulation Market Revenue and Forecast to 2030 (US$ million)

- Figure 33. Growth Strategies in the Coagulation Market

The North America coagulation market was valued at US$ 2,712.64 million in 2022 and is expected to reach US$ 4,633.26 million by 2030; it is estimated to grow at a CAGR of 6.9% from 2022 to 2030.

Increasing Prevalence of Blood Disorders Fuel North America Coagulation Market

Hemophilia A is one of the common X-linked recessive disorders and the second most common inherited clotting factor deficiency after von Willebrand disease, according to the National Organization of Rare Disorders. Also, ~1 in 5,000 male infants suffers from hemophilia A in the US. According to the Global Hemophilia Care 2020 study, 393,658 bleeding disorders cases have been recognized and documented worldwide over time, including 241,535 hemophilia cases, 87,729 von Willebrand disease cases, and 64,394 other bleeding disorder cases. According to the National Library of Medicine (NLM), ~30,000-33,000 men were affected by hemophilia in the US in 2020.

As per the reports from the American Cancer Society (CLL), the US recorded ~21,250 new cases of chronic lymphocytic leukemia in 2021. A February 2020 update from the Centers for Disease Control and Prevention (CDC) states that the number of people in the US affected by deep vein thrombosis could reach 900,000 (1 to 2 per 1,000). The same source estimates that in the US 60,000-100,000 Americans die yearly from venous thromboembolism.

According to the US Department of Health & Human Services, ~100,000 Americans were diagnosed with sickle cell disease (SCD) in 2020, which is one of the most commonly inherited blood disorders. In addition, the number of people suffering from SCD is expected to grow by ~30% by 2050. The National Organization for Rare Disorders stated that immune thrombocytopenia (ITP), an autoimmune bleeding disorder, affected ~66 adults per 1 million in the US each year in 2022. Therefore, the rising prevalence of blood disorders drives the coagulation market growth.

North America Coagulation Market Overview

The North America coagulation market is segmented into the US, Canada, and Mexico. North America accounts for a significant market share owing to the growing incidences of blood disorders, increasing occurrence of cardiovascular diseases such as atrial fibrillation (AFib), and the presence of major market players engaged in new and existing product developments. The US holds the largest share of the coagulation market in North America. The burgeoning cases of blood disorders, growing prevalence of cardiovascular diseases, and government support for preventing blood disorders are anticipated to boost the North America coagulation market growth during 2022-2030.

North America Coagulation Market Revenue and Forecast to 2030 (US$ Million)

North America Coagulation Market Segmentation

The North America coagulation market is segmented based on disease indication, type, offering, technology, end user, and country.

Based on disease indication, the North America coagulation market is segmented into vitamin k deficiency, liver disease, disseminated intravascular coagulation and pulmonary embolism, development of circulating anticoagulants, hemophilia, von willebrand's disease, and others. The liver disease segment held the largest North America coagulation market share in 2022.

Based on type, the North America coagulation market is bifurcated into clinical laboratory analysers and point-of-care testing analyzers. The clinical laboratory analysers segment held a larger North America coagulation market share in 2022. Clinical laboratory analysers segment is further subsegmented into controls & calibrators, assays & reagents, instruments/systems, coagulation factors, and others.

In terms of offering, the North America coagulation market is bifurcated into diagnosis and treatment. The diagnosis segment held a larger North America coagulation market share in 2022. Diagnosis segment is further subsegmented into prothrombin time testing, fibrinogen testing, activated clotting time testing, activated partial thromboplastin time testing, d-dimmer testing, platelets function testing, and others. Treatment segment is further subsegmented into anti-fibrinolytic drugs, birth control pills, desmopressin & immunosuppressive medicines, vitamin k supplements, blood thinners, thrombin inhibitors or thrombolytics, replacement therapy, catheter-assisted thrombus removal, and others.

By technology, the North America coagulation market is segmented into optical technology, mechanical technology, electrochemical technology, and others. The optical technology segment held the largest North America coagulation market share in 2022.

By end user, the North America coagulation market is segmented into clinical laboratories, hospitals, and others. The clinical laboratories segment held the largest North America coagulation market share in 2022.

Based on country, the North America coagulation market is categorized into the US, Canada, and Mexico. The US dominated the North America coagulation market in 2022.

Diagnostica Stago Inc, F Hoffmann-La Roche Ltd, Genrui Biotech Co, Ltd, Helena Laboratories Corporation, Horiba Ltd, ImproGen Diagnostik Kimya San. & Tic. Ltd.Sti., Siemens Healthineers AG, Sysmex Corp, and Transasia Bio-Medicals Ltd are some of the leading companies operating in the North America coagulation market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Coagulation Market - Key Industry Dynamics

- 4.1 Key Market Drivers:

- 4.1.1 Increasing Prevalence of Blood Disorders

- 4.1.2 Rising Prevalence of Cardiovascular Diseases

- 4.2 Market Restraints

- 4.2.1 High Costs Associated with Coagulation Analyzers

- 4.3 Market Opportunities

- 4.3.1 Growing Organic and Inorganic Strategies by Key Market Players

- 4.4 Future Trends

- 4.4.1 Development of Point-of-Care (POC) Coagulation Analyzers

- 4.5 Impact Analysis

5. Coagulation Market - North America Market Analysis

- 5.1 North America Coagulation Market Revenue (US$ million), 2022 - 2030

6. North America Coagulation Market - Revenue and Forecast to 2030 - by Disease Indication

- 6.1 Overview

- 6.2 North America Coagulation Market Revenue Share, by Disease Indication 2022 & 2030 (%)

- 6.3 Vitamin K Deficiency

- 6.3.1 Overview

- 6.3.2 Vitamin K Deficiency: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 6.4 Liver Disease

- 6.4.1 Overview

- 6.4.2 Liver Disease: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 6.5 Disseminated Intravascular Coagulation and Pulmonary Embolism

- 6.5.1 Overview

- 6.5.2 Disseminated Intravascular Coagulation and Pulmonary Embolism: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 6.6 Development of Circulating Anticoagulant

- 6.6.1 Overview

- 6.6.2 Development of Circulating Anticoagulant: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 6.7 Hemophilia

- 6.7.1 Overview

- 6.7.2 Hemophilia: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 6.8 Von Willebrand's Disease

- 6.8.1 Overview

- 6.8.2 Von Willebrand's Disease: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 6.9 Others

- 6.9.1 Overview

- 6.9.2 Others: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

7. North America Coagulation Market - Revenue and Forecast to 2030 - by Type

- 7.1 Overview

- 7.2 North America Coagulation Market Revenue Share, by Type 2022 & 2030 (%)

- 7.3 Clinical Laboratory Analyzers

- 7.3.1 Overview

- 7.3.2 Clinical Laboratory Analyzers: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3.2.1 North America Coagulation Market, by Clinical Laboratory Analyzers

- 7.4 Point-of-Care Testing Analyzers

- 7.4.1 Overview

- 7.4.2 Point-of-Care Testing Analyzers: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Coagulation Market - Revenue and Forecast to 2030 - by Offering

- 8.1 Overview

- 8.2 North America Coagulation Market Revenue Share, by Offering 2022 & 2030 (%)

- 8.3 Diagnosis

- 8.3.1 Overview

- 8.3.2 Diagnosis: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3.2.1 North America Coagulation Market, by Diagnosis

- 8.4 Treatment

- 8.4.1 Overview

- 8.4.2 Treatment: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4.2.1 North America Coagulation Market, by Treatment

9. North America Coagulation Market - Revenue and Forecast to 2030 - by Technology

- 9.1 Overview

- 9.2 North America Coagulation Market Revenue Share, by Technology 2022 & 2030 (%)

- 9.3 Optical Technology

- 9.3.1 Overview

- 9.3.2 Optical Technology: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Mechanical Technology

- 9.4.1 Overview

- 9.4.2 Mechanical Technology: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 Electrochemical Technology

- 9.5.1 Overview

- 9.5.2 Electrochemical Technology: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Coagulation Market - Revenue and Forecast to 2030 - by End User

- 10.1 Overview

- 10.2 North America Coagulation Market Revenue Share, by End User 2022 & 2030 (%)

- 10.3 Clinical Laboratories

- 10.3.1 Overview

- 10.3.2 Clinical Laboratories: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 10.4 Hospitals

- 10.4.1 Overview

- 10.4.2 Hospitals: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

- 10.5 Others

- 10.5.1 Overview

- 10.5.2 Others: North America Coagulation Market - Revenue and Forecast to 2030 (US$ Million)

11. North America Coagulation Market - Country Analysis

- 11.1 North America Coagulation Market, Revenue and Forecast to 2030

- 11.1.1.1 North America Coagulation Market, by Country

- 11.1.1.2 US

- 11.1.1.2.1 Overview

- 11.1.1.2.2 US Coagulation Market Revenue and Forecast to 2030 (US$ million)

- 11.1.1.2.3 US Coagulation Market, by Disease Indication

- 11.1.1.2.4 US Coagulation Market, by Type

- 11.1.1.2.4.1 US Coagulation Market, by Clinical Laboratory Analyzers

- 11.1.1.2.5 US Coagulation Market, by Offering

- 11.1.1.2.5.1 US Coagulation Market, by Diagnosis

- 11.1.1.2.5.2 US Coagulation Market, by Treatment

- 11.1.1.2.6 US Coagulation Market, by Technology

- 11.1.1.2.7 US Coagulation Market, by End User

- 11.1.1.3 Canada

- 11.1.1.3.1 Overview

- 11.1.1.3.2 Canada Coagulation Market Revenue and Forecast to 2030 (US$ million)

- 11.1.1.3.3 Canada Coagulation Market, by Disease Indication

- 11.1.1.3.4 Canada Coagulation Market, by Type

- 11.1.1.3.4.1 Canada Coagulation Market, by Clinical Laboratory Analyzers

- 11.1.1.3.5 Canada Coagulation Market, by Offering

- 11.1.1.3.5.1 Canada Coagulation Market, by Diagnosis

- 11.1.1.3.5.2 Canada Coagulation Market, by Treatment

- 11.1.1.3.6 Canada Coagulation Market, by Technology

- 11.1.1.3.7 Canada Coagulation Market, by End User

- 11.1.1.4 Mexico

- 11.1.1.4.1 Overview

- 11.1.1.4.2 Mexico Coagulation Market Revenue and Forecast to 2030 (US$ million)

- 11.1.1.4.3 Mexico Coagulation Market, by Disease Indication

- 11.1.1.4.4 Mexico Coagulation Market, by Type

- 11.1.1.4.4.1 Mexico Coagulation Market, by Clinical Laboratory Analyzers

- 11.1.1.4.5 Mexico Coagulation Market, by Offering

- 11.1.1.4.5.1 Mexico Coagulation Market, by Diagnosis

- 11.1.1.4.5.2 US Coagulation Market, by Treatment

- 11.1.1.4.6 Mexico Coagulation Market, by Technology

- 11.1.1.4.7 Mexico Coagulation Market, by End User

12. Coagulation Market-Industry Landscape

- 12.1 Overview

- 12.2 Growth Strategies in the Coagulation Market

- 12.3 Inorganic Growth Strategies

- 12.3.1 Overview

- 12.4 Organic Growth Strategies

- 12.4.1 Overview

13. Company Profiles

- 13.1 Siemens Healthineers AG

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Diagnostica Stago, Inc

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 ImproGen Diagnostik Kimya San. & Tic. Ltd.Sti.

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Sysmex Corp

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Helena Laboratories Corporation

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 F. Hoffmann-La Roche Ltd

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Genrui Biotech Co., Ltd.

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Transasia Bio-Medicals Ltd

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Horiba Ltd.

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

14. Appendix

- 14.1 About Us

- 14.2 Glossary of Terms