|

|

市場調査レポート

商品コード

1482342

米国の下水道・排水管清掃サービス市場規模・予測、地域シェア、動向、成長機会分析レポート範囲:清掃タイプ別、パイプタイプ別、エンドユーザー別、国別US Sewer and Drain Cleaning Services Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Cleaning Type, Pipe Type, End User, and Country |

||||||

|

|||||||

| 米国の下水道・排水管清掃サービス市場規模・予測、地域シェア、動向、成長機会分析レポート範囲:清掃タイプ別、パイプタイプ別、エンドユーザー別、国別 |

|

出版日: 2024年04月29日

発行: The Insight Partners

ページ情報: 英文 74 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

米国の下水道・排水管清掃サービス市場は、2023年に15億米ドルと評価され、2031年には24億9,000万米ドルに達すると予測され、2023~2031年にかけてのCAGRは6.5%を記録すると予測されています。

ファットバーグ形成による脅威の増大が米国の下水道・排水管清掃サービス市場の成長を後押し

ファットバーグは油脂の塊を含みます。ファットバーグは、使い捨てワイパー、ペーパータオル、タンポン、フェイシャルティッシュ、生理用タオル、その他下水システムに流される廃棄物から構成されることもあります。ファットバーグの堆積が進むと石灰化が進み、詰まりの原因となります。2020年、アイオワ州デモイン市は、COVID-19の大流行が始まって以来、ファットバーグの形成が少なくとも~50%増加していると述べています。台所から排水溝への家庭用油の廃棄の増加とともに、衛生ティッシュの洗浄が増加していることが、ファットバーグの形成と排水の閉塞の脅威を高めています。埋立機構は2020年、30カ所以上の詰まりを処理するために10万米ドル以上を費やしました。

ファットバーグの形成は、詰まった水道施設の運営上の大きな課題のひとつです。都市化の進展は、ファットバーグの形成がもたらす排水管の詰まりの課題を悪化させています。下水道・排水管清掃サービスは、下水道・排水インフラに存在するファットバーグを管理する上で重要な役割を果たしています。したがって、ファットバーグの形成増加による下水道・排水インフラへの脅威の増大は、米国における下水道・排水管清掃サービスの需要を強化し、ひいては米国の下水道・排水管清掃サービス市場の成長を促進します。

絶え間ない技術開発は、多くの下水道や排水管の清掃、保守、試験サービスを支援する先進的な機器の開発を推進することができます。プッシュ・ロケーティング装置、ロッド・カメラ、ハイエンド試験カメラ、高度なパッチ除去装置、その他の下水道・排水管試験ツールなど、技術主導型の排水管清掃装置や製品は、従来の手順に比べて排水管清掃活動を簡素化します。さらに、廃水の流れ状態や、パッチや損傷の正確な位置を特定するために必要なパラメータを決定するためのソフトウェアなどのハイエンド技術の統合が進んでいます。さらに、様々な市場参入企業が革新的で改良された排水管清掃機器を開発しており、持続可能な競争優位性を提供しています。2023年4月、RidgidはTruSense技術搭載のSeeSnake Mini Pro試験カメラを発売しました。この種のリールとしては初めて、可動部品のないデジタルセルフレベリングを実現しました。これは、RIDGIDの試験・排水管清掃製品コレクションの最新リールです。ミニプロは、ミッドフレックスプッシュケーブルで最大200フィートの1.5~8インチパイプを試験し、90度の急な曲がりにも対応します。画期的な25mmデジタルセルフレベリング・カメラにより、管内画像は直立を保ち、一般的な25mmカメラヘッドよりも短いです。このような技術的進歩は、予測期間中、米国の下水道・排水管清掃サービス市場の動向として浮上すると予想されます。

Modern Plumbing Industries, Inc.、Drains By James Inc.、Mr.Rooter、Mr.Drain Inc.、Bob Oates、ZOOM DRAIN、Top Notch Sewer &Drain Cleaning, Inc.、Roto-Rooter Group Inc.、Haller Enterprises、Neptune Plumbing、Augusta Industrial Services、Frank's Repair Plumbing, Inc.は、市場調査中にプロファイルされた米国の下水道・排水管清掃サービス市場の主要企業です。これらの企業に加えて、いくつかの他の重要な企業は、米国の下水道・排水管清掃サービス市場の全体像を得るために、この市場調査中に調査・分析されました。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

- 清掃タイプ別

- パイプタイプ別

- エンドユーザー別

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 米国の下水道・排水管清掃サービス市場情勢

- イントロダクション

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 米国の下水道・排水管清掃サービス市場:主要市場力学

- 米国の下水道・排水管清掃サービス市場-主要市場力学

- 市場促進要因

- 効率的な下水道・排水管インフラへの政府投資の拡大

- 人口増加と都市化の進展

- ファットバーグ形成による脅威の増大

- 市場抑制要因

- 不安定な原材料価格とマクロ経済要因の影響

- 市場機会

- 地方における上下水道インフラプロジェクトの増加

- 今後の動向

- 下水道・排水管清掃サービスにおける技術進歩の高まり

- 促進要因と阻害要因の影響

第6章 米国の下水道・排水管清掃サービス市場分析

- 米国の下水道・排水管清掃サービス市場売上高(2023~2031年)

- 米国の下水道・排水管清掃サービス市場の予測・分析

第7章 米国の下水道・排水管清掃サービス市場分析-清掃タイプ別

- ケーブルマシン

- 高速軟質シャフト

- 高圧ウォータージェット

- カメラ試験

- パイプパッチ

- その他

第8章 米国の下水道・排水管清掃サービス市場分析-パイプタイプ別

- 3インチ以下

- 4~8インチ

- 9~11インチ

- 12インチ以上

第9章 米国の下水道・排水管清掃サービス市場分析-エンドユーザー別

- 住宅用

- 商業用

- 工業用

- 自治体

第10章 競合情勢

- 主要参入企業によるヒートマップ分析

- 企業のポジショニングと集中度

第11章 業界情勢

- イントロダクション

- 市場イニシアティブ

第12章 企業プロファイル

- Modern Plumbing Industries, Inc.

- Drains By James Inc

- Mr. Rooter

- Mr. Drain Inc

- Bob Oates

- ZOOM DRAIN

- Top Notch Sewer & Drain Cleaning, Inc.

- Roto-Rooter Group Inc

- Haller Enterprises

- Neptune Plumbing

- Augusta Industrial Services

- Frank's Repair Plumbing, Inc.

第13章 付録

List Of Tables

- Table 1. US Sewer and Drain Cleaning Services Market Segmentation

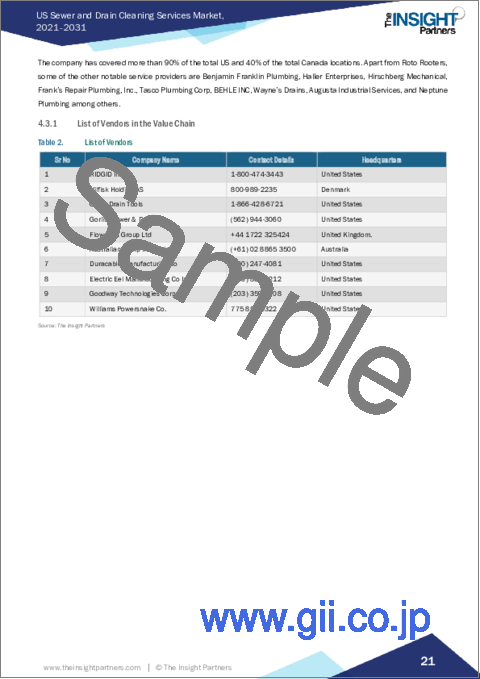

- Table 2. List of Vendors

- Table 3. US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million) - by Cleaning Type

- Table 5. US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million) - by Pipe Type

- Table 6. US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 7. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. PEST Analysis

- Figure 2. Impact Analysis of Drivers and Restraints

- Figure 3. US Sewer and Drain Cleaning Services Market Revenue (US$ Million), 2023-2031

- Figure 4. US Sewer and Drain Cleaning Services Market Share (%) - by Cleaning Type, 2023 and 2031

- Figure 5. Cable Machines: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 6. High Speed Flexible Shafts: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 7. High Pressure Water Jetting: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Camera Inspection: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Pipe Patch: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Others: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 11. US Sewer and Drain Cleaning Services Market Share (%) - by Pipe Type, 2023 and 2031

- Figure 12. Less than 3 Inch: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 13. -8 Inch: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 14. -11 Inch: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Above 12 Inch: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 16. US Sewer and Drain Cleaning Services Market Share (%) - by End User, 2023 and 2031

- Figure 17. Residential: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Commercial: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Industrial: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Municipal: US Sewer and Drain Cleaning Services Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Company Positioning and Concentration

The US sewer and drain cleaning services market was valued at US$ 1.50 billion in 2023 and is projected to reach US$ 2.49 billion by 2031; the market is expected to register a CAGR of 6.5% during 2023-2031.

Increasing Threat from Fatberg Formation is Bolstering the US Sewer and Drain Cleaning Services Market Growth

Fatbergs contain clumps of fats, oils, and grease. Fatbergs can also consist of disposable wipes, paper towels, tampons, facial tissues, sanitary towels, and other wastes flushed into the sanitary sewer system. Growing collection of fatbergs can result in calcification, transforming the blockage. In 2020, the City of Des Moines, Iowa, stated an increase in fatberg formations of at least ~50% since the COVID-19 pandemic began. The increase in the flushing of sanitary wipes along with the growing household oil disposal down the drains from kitchens are increasing the threat of fatberg formation and drainage blockages. The Reclamation Authority spent over US$ 100,000 in 2020 to manage more than 30 blockages.

Fatberg formation is one of the major operational challenges for clogging water utilities. The rising urbanization is exacerbating the drain-clogging challenges posed by fatberg formation. Sewer and drain cleaning services play a crucial role in managing the fatbergs present in the sewer and drainage infrastructure. Thus, the growing threat to sewer and drainage infrastructure from increasing formations of fatbergs bolsters the demand for sewer and drain cleaning services in the US, which in turn drive the US sewer and drain cleaning services market growth.

Constant technological developments can propel the development of advanced devices that assist in numerous sewers and drain cleaning, maintenance, and inspection services. Technology-driven drain cleaning equipment and products such as push locating equipment, rod cameras, high-end inspection cameras, advanced patch removing equipment, and other sewer and drain inspection tools simplify drain cleaning activities compared to conventional procedures. Moreover, the integration of high-end technologies such as software for determining wastewater flow conditions and the parameters required to locate the exact location of patch or damage is growing. Additionally, various market players are developing innovative and improved drain-cleaning equipment, which offers them a sustainable competitive advantage. In April 2023, Ridgid launched the SeeSnake Mini Pro Inspection Camera with TruSense Technology, the first reel of its kind to offer digital self-levelling without any moving parts. It is the newest reel in the RIDGID collection of inspection and drain cleaning products. The Mini Pro inspects up to 200 feet of 1.5-8-inch pipe with its mid-flex push cable, which can handle steep 90-degree bends. Its revolutionary 25 mm digital self-levelling camera ensures that the in-pipe image remains upright and is shorter than the typical 25 mm camera head. Such technological advancement is anticipated to emerge as trends in the US sewer and drain cleaning services market during the forecast period.

Modern Plumbing Industries, Inc.; Drains By James Inc; Mr. Rooter; Mr. Drain Inc; Bob Oates; ZOOM DRAIN; Top Notch Sewer & Drain Cleaning, Inc.; Roto-Rooter Group Inc; Haller Enterprises; Neptune Plumbing; Augusta Industrial Services; and Frank's Repair Plumbing, Inc. are the key US sewer and drain cleaning services market players profiled during the market study. In addition to these players, several other important companies were studied and analyzed during this market research study to get a holistic overview of the US sewer and drain cleaning services market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

- 2.2.1 By Machine Type

- 2.2.2 By Pipe Type

- 2.2.3 By End User

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. US Sewer and Drain Cleaning Services Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. US Sewer and Drain Cleaning Services Market - Key Market Dynamics

- 5.1 US Sewer and Drain Cleaning Services Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Growing Government Investments in Efficient Sewer and Drain Infrastructure

- 5.2.2 Increasing Population and Rising Urbanization

- 5.2.3 Increasing Threat from Fatberg Formation

- 5.3 Market Restraints

- 5.3.1 Volatile Raw Material Prices and Impact of Macroeconomic Factors

- 5.4 Market Opportunities

- 5.4.1 Rising Number of Water, Wastewater, and Sewer Infrastructure Projects in Rural Parts

- 5.5 Future Trends

- 5.5.1 Growing Technological Advancements in Sewer and Drain Cleaning Services

- 5.6 Impact of Drivers and Restraints:

6. US Sewer and Drain Cleaning Services Market Analysis

- 6.1 US Sewer and Drain Cleaning Services Market Revenue (US$ Million), 2023-2031

- 6.2 US Sewer and Drain Cleaning Services Market Forecast and Analysis

7. US Sewer and Drain Cleaning Services Market Analysis - by Cleaning Type

- 7.1 Cable Machines

- 7.1.1 Overview

- 7.1.2 Cable Machines: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 High Speed Flexible Shafts

- 7.2.1 Overview

- 7.2.2 High Speed Flexible Shafts: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 High Pressure Water Jetting

- 7.3.1 Overview

- 7.3.2 High Pressure Water Jetting: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Camera Inspection

- 7.4.1 Overview

- 7.4.2 Camera Inspection: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Pipe Patch

- 7.5.1 Overview

- 7.5.2 Pipe Patch: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

8. US Sewer and Drain Cleaning Services Market Analysis - by Pipe Type

- 8.1 Less than 3 Inch

- 8.1.1 Overview

- 8.1.2 Less than 3 Inch: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2-8 Inch

- 8.2.1 Overview

- 8.2.2-8 Inch: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3-11 Inch

- 8.3.1 Overview

- 8.3.2-11 Inch: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Above 12 Inch

- 8.4.1 Overview

- 8.4.2 Above 12 Inch: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

9. US Sewer and Drain Cleaning Services Market Analysis - by End User

- 9.1 Residential

- 9.1.1 Overview

- 9.1.2 Residential: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Commercial

- 9.2.1 Overview

- 9.2.2 Commercial: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Industrial

- 9.3.1 Overview

- 9.3.2 Industrial: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Municipal

- 9.4.1 Overview

- 9.4.2 Municipal: US Sewer and Drain Cleaning Services Market - Revenue and Forecast to 2031 (US$ Million)

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning and Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

12. Company Profiles

- 12.1 Modern Plumbing Industries, Inc.

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Drains By James Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Mr. Rooter

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Mr. Drain Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Bob Oates

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 ZOOM DRAIN

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Top Notch Sewer & Drain Cleaning, Inc.

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Roto-Rooter Group Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Haller Enterprises

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Neptune Plumbing

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Financial Overview

- 12.10.4 SWOT Analysis

- 12.10.5 Key Developments

- 12.11 Augusta Industrial Services

- 12.11.1 Key Facts

- 12.11.2 Business Description

- 12.11.3 Products and Services

- 12.11.4 Financial Overview

- 12.11.5 SWOT Analysis

- 12.11.6 Key Developments

- 12.12 Frank's Repair Plumbing, Inc.

- 12.12.1 Key Facts

- 12.12.2 Business Description

- 12.12.3 Products and Services

- 12.12.4 Financial Overview

- 12.12.5 SWOT Analysis

- 12.12.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners