|

|

市場調査レポート

商品コード

1481959

北米の薬局自動化システム:2030年までの市場予測 - 地域分析 - タイプ別、エンドユーザー別North America Pharmacy Automation Systems Market Forecast to 2030 - Regional Analysis - by Type and End User (Hospital Pharmacy, Retail Pharmacy, and Others) |

||||||

|

|||||||

| 北米の薬局自動化システム:2030年までの市場予測 - 地域分析 - タイプ別、エンドユーザー別 |

|

出版日: 2024年02月28日

発行: The Insight Partners

ページ情報: 英文 89 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の薬局自動化システム市場は、2022年に55億3,842万米ドルと評価され、2030年には109億6,300万米ドルに達すると予測され、2022年から2030年までのCAGRは8.9%で成長すると予測されています。

ロボット薬局の普及が北米の薬局自動化システム市場を後押し

ヘルスケア分野では、自動化システムがさまざまなプロセスに組み込まれ、在庫や在庫に関する情報を提供し、トレーサビリティや合理化された保管を支援しています。このように、自動化は薬剤師を労働集約的な流通機能から解放し、薬局のワークフロー効率を高めます。さらに、ロボットや自動化システムの採用は発展途上地域の薬局で増加しています。2023年、Oak Lawn Pharmacyはフェニックスを拠点とするMedAvail Holdingsと提携し、テキサス州全域に10台のM4 MedCenterキオスクを配備しました。また2022年、米国の製薬会社ウォルグリーンは、薬剤師や薬剤師技師が全国的に不足しているため、薬局の処方箋記入にロボットを使用することを発表しました。

大手薬局自動化システムベンダーは、継続的にイノベーションの開発とイントロダクション注力しています。2021年2月、オムニセル社はメディマットシステムの発売を発表しました。メディマットは小売薬局向けの次世代自動調剤システムです。メディマットは、患者の安全性向上、効率的な時間利用、経済的節約のために構築されています。同様に、2021年8月、ソフトウェア対応薬局フルフィルメントと自動化ソリューションの商用プロバイダーであるinnovativeAspirations(iA)は、処方された医薬品のフルフィルメントを一元管理するために、メディマットのNEXiAテクノロジーと統合された3つのソリューションを発表しました。SmartPodにより、薬局プロバイダーは集中フルフィルメント・ソリューションの調整と拡張が可能になります。このように、次世代自動化システムのイントロダクションよるロボット薬局の採用拡大が、薬局自動化システム市場の成長を促進しています。

北米の薬局自動化システム市場概要

北米は薬局自動化システム市場で最大のシェアを占めています。この地域の市場は米国、カナダ、メキシコに分かれています。同地域の市場成長は、自動化技術に対する一般市民の意識の高まりや、政府や薬局自動化システムベンダーによる戦略的な動きの高まりといった要因によるものです。米国は、北米および世界の薬局自動化システム市場の最大の貢献者です。米国の市場成長は、主に投薬ミスの増加と医薬品需要の急増に起因しています。2020年6月にStatPearlsに掲載された研究「Medication Errors」によると、米国では投薬ミスにより年間7,000~9,000人が死亡しています。そのため、ヘルスケア機関は投薬ミスを避けるために薬局自動化システムの開発を増やしています。2023年7月、米国を拠点とするプレイヤーの1つであるCapsaヘルスケアは、MASSメディカルストレージを買収しました。MASS Medical Storageの買収により、Capsaは医療用ストレージと内視鏡キャビネット乾燥システムの専門知識を得た。さらに、この買収は世界市場におけるCapsaヘルスケアの地位強化に役立ち、病院、診療所、外来手術センターなどのエンドユーザーへの様々な薬局自動化システムのリーチを拡大します。

北米の薬局自動化システム市場の収益と2030年までの予測(金額)

北米の薬局自動化システム市場セグメンテーション

北米の薬局自動化システム市場は、タイプ、エンドユーザー、国に基づいてセグメント化されます。

タイプ別では、北米の薬局自動化システム市場は、自動調剤システム(製品タイプおよび操作)、自動包装・ラベリングシステム、自動テーブルトップカウンター、自動保管・検索システム、その他のタイプに区分されます。自動投薬システムセグメントが2022年に最大の市場シェアを占めました。

エンドユーザーに基づき、北米の薬局自動化システム市場は病院薬局、小売薬局、その他に区分されます。病院薬局セグメントが2022年に最大の市場シェアを占めました。

国別では、北米の薬局自動化システム市場は、米国、カナダ、メキシコにセグメント化されます。2022年の北米の薬局自動化システム市場シェアは米国が独占しています。

McKesson Corp、Becton Dickinson and Co、Capsa Solutions LLC、Omnicell Inc、Oracle Corp、ScriptPro LLC、Veradigm LLC、Innovation Associates、YUYAMA Manufacturing Co Ltd、Swisslog Healthcare AGは、北米の薬局自動化システム市場で事業を展開する大手企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 調査手法

- 対象範囲

- 2次調査

- 1次調査

第4章 北米の薬局自動化システム市場:主要産業力学

- 主な市場促進要因

- ロボット薬局の採用拡大

- 投薬ミスのリスク増大

- 主な市場抑制要因

- 高い設備投資コストと薬局自動化システムに関連する問題

- 主な市場機会

- 人口の高齢化

- 今後の動向

- 薬局分野における人工知能(AI)

- 影響分析

第5章 薬局自動化システム市場:北米市場分析

- 北米の薬局自動化システム市場収益、2022年~2030年

第6章 北米の薬局自動化システム市場 - 収益と2030年までの予測:タイプ別

- 市場収益シェア、2022年および2030年

- 自動調剤システム-製品タイプ

- 自動調剤システム-オペレーション

- 自動包装・ラベリングシステム

- 自動テーブルトップカウンター

- 自動保管・検索システム

- その他のタイプ

第7章 北米の薬局自動化システム市場 - 収益と2030年までの予測:エンドユーザー別

- 市場収益シェア、2022年および2030年

- 病院薬局

- 小売薬局

- その他

第8章 北米の薬局自動化システム市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第9章 薬局自動化システム市場-業界情勢

- 有機的成長戦略

- 無機的成長戦略

第10章 企業プロファイル

- McKesson Corp

- Becton Dickinson and Co

- Capsa Solutions LLC

- Omnicell Inc

- Oracle Corp

- ScriptPro LLC

- Veradigm LLC

- Innovation Associates

- YUYAMA Manufacturing Co Ltd

- Swisslog Healthcare AG

第11章 付録

List Of Tables

- Table 1. Pharmacy Automation Systems Market Segmentation

- Table 2. US: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn) - Type

- Table 3. US: Automated Medication Dispensing Systems Market Revenue and Forecast to 2030 (US$ Mn) - Product Type

- Table 4. US: Automated Medication Dispensing Systems Market Revenue and Forecast to 2030 (US$ Mn) - Operation

- Table 5. US: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn) - End User

- Table 6. Canada: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn) - Type

- Table 7. Canada: Automated Medication Dispensing Systems Market Revenue and Forecast to 2030 (US$ Mn) - Product Type

- Table 8. Canada: Automated Medication Dispensing Systems Market Revenue and Forecast to 2030 (US$ Mn) - Operation

- Table 9. Canada: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn) - End User

- Table 10. Mexico: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn) - Type

- Table 11. Mexico: Automated Medication Dispensing Systems Market Revenue and Forecast to 2030 (US$ Mn) - Product Type

- Table 12. Mexico: Automated Medication Dispensing Systems Market Revenue and Forecast to 2030 (US$ Mn) - Operation

- Table 13. Mexico: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn) - End User

- Table 14. Recent Organic Growth Strategies in Pharmacy Automation Systems Market

- Table 15. Recent Inorganic Growth Strategies in the Pharmacy Automation Systems Market

- Table 16. Glossary of Terms, North America Pharmacy Automation Systems Market

List Of Figures

- Figure 1. Pharmacy Automation Systems Market Segmentation, By Country

- Figure 2. Key Insights

- Figure 3. Pharmacy Automation Systems Market - Key Industry Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. North America Pharmacy Automation Systems Market Revenue (US$ Mn), 2022 - 2030

- Figure 6. North America Pharmacy Automation Systems Market Revenue Share, by Type 2022 & 2030 (%)

- Figure 7. Automated Medication Dispensing Systems: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Robotics Automated Systems: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

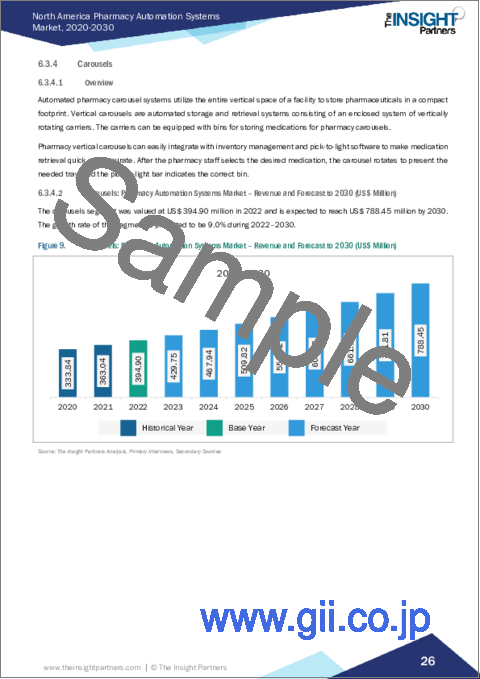

- Figure 9. Carousels: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Automated Dispensing Cabinets: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Centralized Prescription Fulfilment: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Decentralized Prescription Fulfilment: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Automated Packaging and Labelling Systems: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Automated Table-top Counters: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Automated Storage and Retrieval Systems: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Other Types: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. North America Pharmacy Automation Systems Market Revenue Share, by End User 2022 & 2030 (%)

- Figure 18. Hospital Pharmacy: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Retail Pharmacy: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Others: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. North America Pharmacy Automation Systems Market, 2022 ($Mn)

- Figure 22. North America: Pharmacy Automation Systems Market, By Key Countries, 2022 And 2030 (%)

- Figure 23. US: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn)

- Figure 24. Canada: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn)

- Figure 25. Mexico: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn)

The North America pharmacy automation systems market was valued at US$ 5,538.42 million in 2022 and is expected to reach US$ 10,963.00 million by 2030; it is estimated to grow at a CAGR of 8.9% from 2022 to 2030.

Growing Adoption of Robotic Pharmacy Fuels the North America Pharmacy Automation Systems Market

In the healthcare sector, automated systems are incorporated into different processes to provide information about stock and inventory, and aid in traceability and streamlined storage. Thus, automation relieves pharmacists from labor-intensive distributive functions and enhances workflow efficiency in pharmacies. Moreover, the adoption of robotics and automated systems is rising in pharmacies in developing regions. In 2023, Oak Lawn Pharmacy partnered with Phoenix-based MedAvail Holdings to deploy 10 M4 MedCenter kiosks across Texas. Also, in 2022, the US pharmaceutical operator Walgreens announced using robots to fill prescriptions for pharmacies as there is a national lack of pharmacists and pharmacy technicians.

Leading pharmacy automation system vendors continuously focus on developments and introduction of their innovations. In February 2021, Omnicell Inc. announced the launch of its Medimat system. Medimat is a next-generation, automated dispensing system for retail pharmacies. Medimat has been built for improved patient safety, efficient time utilization, and financial savings. Similarly, in August 2021, innovativeAspirations (iA), a commercial provider of software-enabled pharmacy fulfillment and automation solutions, launched three solutions that are integrated with Medimat's NEXiA technology to manage the fulfillment of prescribed medicines centrally. iA has also introduced SmartPod, a next-generation robot with a modular autofill unit. SmartPod allows pharmacy providers to adjust and scale their centralized fulfillment solutions. Thus, the growing adoption of robotic pharmacies with the introduction of next-generation automated systems fuels growth of the pharmacy automation systems market.

North America Pharmacy Automation Systems Market Overview

North America holds the largest share of the pharmacy automation systems market. The market in this region is split into the US, Canada, and Mexico. The growth of the market in the region is attributed to factors such as growing public awareness about automated technologies and rising strategic moves by governments and pharmacy automation system vendors. The US is the largest contributor to the pharmacy automation systems market in North America and the world. Market growth in the US is mainly attributed to the rise in medication errors and a surge in demand for pharmaceutical products. According to the study "Medication Errors," published in StatPearls in June 2020, medication errors result in 7,000-9,000 deaths annually in the US. Thus, healthcare organizations have increased developments in pharmacy automation systems to avoid medication errors. In July 2023, Capsa Healthcare, one of the US-based players, acquired MASS Medical Storage. The acquisition of MASS Medical Storage provided Capsa with expertise in making medical storage and endoscope cabinet drying systems. Additionally, the acquisition would help strengthen Capsa Healthcare's position in the global market, expanding the reach of its various pharmacy automation systems to end users such as hospitals, clinics, and ambulatory surgical centers.

North America Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Million)

North America Pharmacy Automation Systems Market Segmentation

The North America pharmacy automation systems market is segmented based on type, end user, and country.

Based on type, the North America pharmacy automation systems market is segmented into automation medication dispensing systems (product type and operation), automated packaging and labelling systems, automated table-top counters, automated storage and retrieval systems, and other types. The automation medication dispensing systems segment held the largest market share in 2022.

Based on end user, the North America pharmacy automation systems market is segmented into hospital pharmacy, retail pharmacy, and others. The hospital pharmacy segment held the largest market share in 2022.

Based on country, the North America pharmacy automation systems market is segmented into the US, Canada, and Mexico. The US dominated the North America pharmacy automation systems market share in 2022.

McKesson Corp, Becton Dickinson and Co, Capsa Solutions LLC, Omnicell Inc, Oracle Corp, ScriptPro LLC, Veradigm LLC, Innovation Associates, YUYAMA Manufacturing Co Ltd, and Swisslog Healthcare AG are some of the leading companies operating in the North America pharmacy automation systems market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Pharmacy Automation Systems Market - Key Industry Dynamics

- 4.1 Key Market Drivers:

- 4.1.1 Growing Adoption of Robotic Pharmacy

- 4.1.2 Growing Risks of Medication Errors

- 4.2 Key Market Restraints:

- 4.2.1 High Capitalization Cost and Problems Associated with Pharmacy Automation Systems

- 4.3 Key Market Opportunities:

- 4.3.1 Aging Population

- 4.4 Future Trends

- 4.4.1 Artificial Intelligence (AI) in the Pharmacy Sector

- 4.5 Impact Analysis:

5. Pharmacy Automation Systems Market - North America Market Analysis

- 5.1 Overview

- 5.2 North America Pharmacy Automation Systems Market Revenue (US$ Mn), 2022 - 2030

6. North America Pharmacy Automation Systems Market - Revenue and Forecast to 2030 - by Type

- 6.1 Overview

- 6.2 North America Pharmacy Automation Systems Market Revenue Share, by Type 2022 & 2030 (%)

- 6.3 Automated Medication Dispensing Systems-Product Type

- 6.3.1 Overview

- 6.3.2 Automated Medication Dispensing Systems: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 6.3.3 Robotics Automated Systems

- 6.3.3.1 Overview

- 6.3.3.2 Robotics Automated Systems: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 6.3.4 Carousels

- 6.3.4.1 Overview

- 6.3.4.2 Carousels: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 6.3.5 Automated Dispensing Cabinets

- 6.3.5.1 Overview

- 6.3.5.2 Automated Dispensing Cabinets: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 6.4 Automated Medication Dispensing Systems-Operation

- 6.4.1 Overview

- 6.4.2 Centralized Prescription Fulfilment

- 6.4.2.1 Overview

- 6.4.2.2 Centralized Prescription Fulfilment: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 6.4.3 Decentralized Prescription Fulfilment

- 6.4.3.1 Overview

- 6.4.3.2 Decentralized Prescription Fulfilment: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 6.5 Automated Packaging and Labelling Systems

- 6.5.1 Overview

- 6.5.2 Automated Packaging and Labelling Systems: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 6.6 Automated Table-top Counters

- 6.6.1 Overview

- 6.6.2 Automated Table-top Counters: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 6.7 Automated Storage and Retrieval Systems

- 6.7.1 Overview

- 6.7.2 Automated Storage and Retrieval Systems: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 6.8 Other Types

- 6.8.1 Overview

- 6.8.2 Other Types: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

7. North America Pharmacy Automation Systems Market - Revenue and Forecast to 2030 - by End User

- 7.1 Overview

- 7.2 North America Pharmacy Automation Systems Market Revenue Share, by End User 2022 & 2030 (%)

- 7.3 Hospital Pharmacy

- 7.3.1 Overview

- 7.3.2 Hospital Pharmacy: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Retail Pharmacy

- 7.4.1 Overview

- 7.4.2 Retail Pharmacy: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Pharmacy Automation Systems Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Pharmacy Automation Systems Market - Country Analysis

- 8.1 North America Pharmacy Automation Systems Market, Revenue and Forecast to 2030

- 8.1.1 Overview

- 8.1.2 North America: Pharmacy Automation Systems Market, by Country

- 8.1.2.1 US

- 8.1.2.1.1 US: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn)

- 8.1.2.1.2 US: Pharmacy Automation Systems Market, by Type

- 8.1.2.1.2.1 US: Automated Medication Dispensing Systems Market, by Product Type

- 8.1.2.1.2.2 US: Automated Medication Dispensing Systems Market, by Operation

- 8.1.2.1.3 US: Pharmacy Automation Systems Market, by End User

- 8.1.2.2 Canada

- 8.1.2.2.1 Canada: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn)

- 8.1.2.2.2 Canada: Pharmacy Automation Systems Market, by Type

- 8.1.2.2.2.1 Canada: Automated Medication Dispensing Systems Market, by Product Type

- 8.1.2.2.2.2 Canada: Automated Medication Dispensing Systems Market, by Operation

- 8.1.2.2.3 Canada: Pharmacy Automation Systems Market, by End User

- 8.1.2.3 Mexico

- 8.1.2.3.1 Mexico: Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Mn)

- 8.1.2.3.2 Mexico: Pharmacy Automation Systems Market, by Type

- 8.1.2.3.2.1 Mexico: Automated Medication Dispensing Systems Market, by Product Type

- 8.1.2.3.2.2 Mexico: Automated Medication Dispensing Systems Market, by Operation

- 8.1.2.3.3 Mexico: Pharmacy Automation Systems Market, by End User

- 8.1.2.1 US

9. Pharmacy Automation Systems Market-Industry Landscape

- 9.1 Overview

- 9.2 Organic Growth Strategies

- 9.2.1 Overview

- 9.3 Inorganic Growth Strategies

- 9.3.1 Overview

10. Company Profiles

- 10.1 McKesson Corp

- 10.1.1 Key Facts

- 10.1.2 Business Description

- 10.1.3 Products and Services

- 10.1.4 Financial Overview

- 10.1.5 SWOT Analysis

- 10.1.6 Key Developments

- 10.2 Becton Dickinson and Co

- 10.2.1 Key Facts

- 10.2.2 Business Description

- 10.2.3 Products and Services

- 10.2.4 Financial Overview

- 10.2.5 SWOT Analysis

- 10.2.6 Key Developments

- 10.3 Capsa Solutions LLC

- 10.3.1 Key Facts

- 10.3.2 Business Description

- 10.3.3 Products and Services

- 10.3.4 Financial Overview

- 10.3.5 SWOT Analysis

- 10.3.6 Key Developments

- 10.4 Omnicell Inc

- 10.4.1 Key Facts

- 10.4.2 Business Description

- 10.4.3 Products and Services

- 10.4.4 Financial Overview

- 10.4.5 SWOT Analysis

- 10.4.6 Key Developments

- 10.5 Oracle Corp

- 10.5.1 Key Facts

- 10.5.2 Business Description

- 10.5.3 Products and Services

- 10.5.4 Financial Overview

- 10.5.5 SWOT Analysis

- 10.5.6 Key Developments

- 10.6 ScriptPro LLC

- 10.6.1 Key Facts

- 10.6.2 Business Description

- 10.6.3 Products and Services

- 10.6.4 Financial Overview

- 10.6.5 SWOT Analysis

- 10.6.6 Key Developments

- 10.7 Veradigm LLC

- 10.7.1 Key Facts

- 10.7.2 Business Description

- 10.7.3 Products and Services

- 10.7.4 Financial Overview

- 10.7.5 SWOT Analysis

- 10.7.6 Key Developments

- 10.8 Innovation Associates

- 10.8.1 Key Facts

- 10.8.2 Business Description

- 10.8.3 Products and Services

- 10.8.4 Financial Overview

- 10.8.5 SWOT Analysis

- 10.8.6 Key Developments

- 10.9 YUYAMA Manufacturing Co Ltd

- 10.9.1 Key Facts

- 10.9.2 Business Description

- 10.9.3 Products and Services

- 10.9.4 Financial Overview

- 10.9.5 SWOT Analysis

- 10.9.6 Key Developments

- 10.10 Swisslog Healthcare AG

- 10.10.1 Key Facts

- 10.10.2 Business Description

- 10.10.3 Products and Services

- 10.10.4 Financial Overview

- 10.10.5 SWOT Analysis

- 10.10.6 Key Developments

11. Appendix

- 11.1 About Us

- 11.2 Glossary of Terms